Strategy Backtest

ETH Implied Volatility Term Structure + Futures Basis Trading System

ETH Implied Volatility Term Structure + Futures Basis Trading System

Similar to the strategy that I developed a few weeks ago, this week’s strategy is a long/short ETH system that analyzes momentum on the ETH implied volatility term structure & futures basis spreads on hourly granularity.

Hypothesis: If the short-term momentum of ETH implied volatility is “stable”, then ETH is likely to remain stable or increase in value. Additionally, if the short-term momentum of ETH implied volatility is “unstable” & futures basis is unstable, then ETH is likely to destabilize and decrease in value.

The system longs spot ETH when a specified ratio of the ETH implied volatility term structure crosses a moving average of the specified ETH implied volatility term structure ratio.

Signal: ATM-60/ATM-90 Ratio less than Ratio SMA.

On the contrary, the system shorts ETH on the inverse of the conditions mentioned above with an additional noise reducer: futures basis. The system will only short ETH when short-term futures basis yields are below longer-term basis yields.

Signal: ATM-60/ATM-90 Ratio Greater than Ratio SMA + Basis30< Basis60< Basis90 (in order to reduce high vol. environment noise)

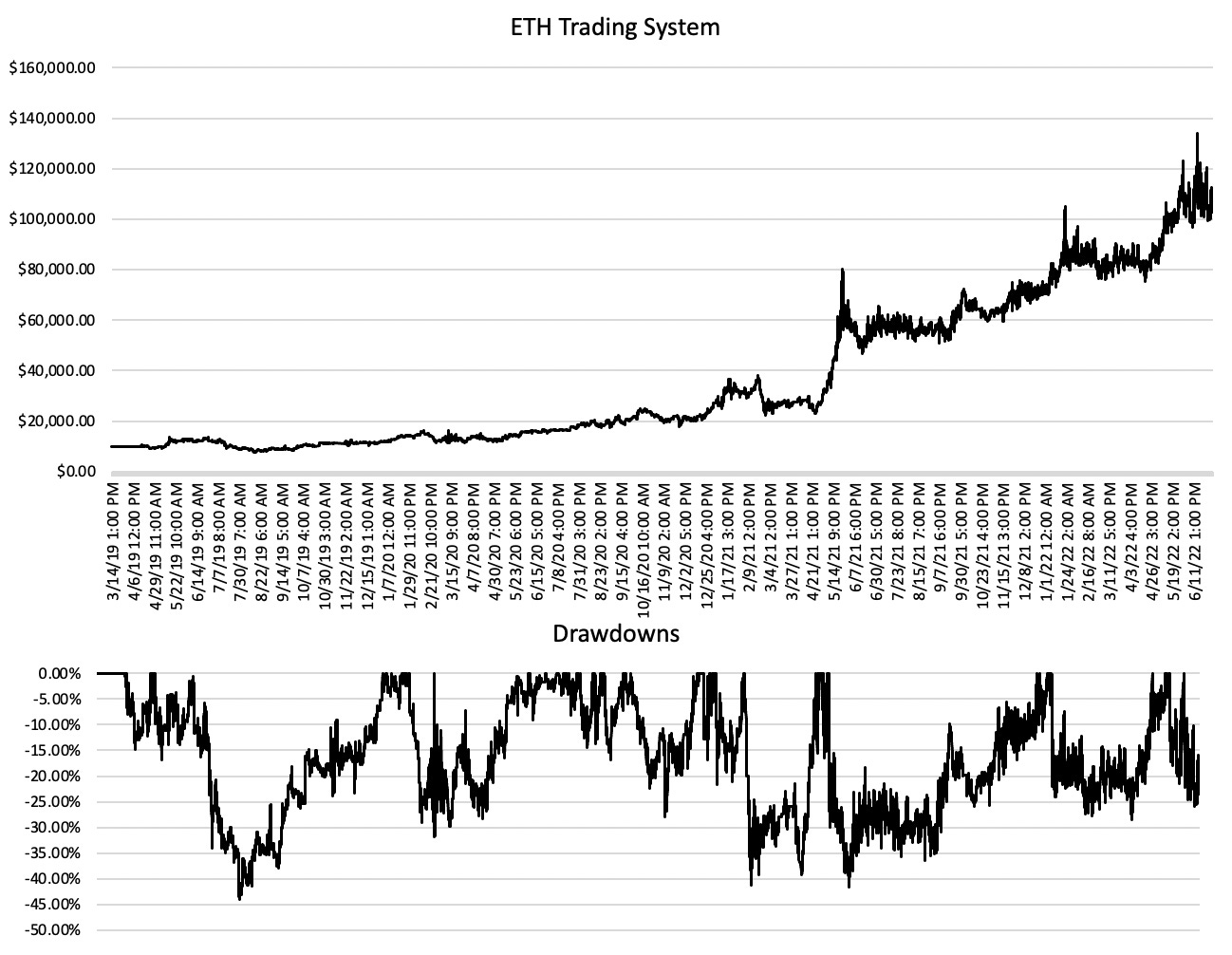

Below is a generic backtest replicating the stated conditions in response to spot ETH with an initial account balance of $10,000 on 3/4/2019 (trading in full position sizes). The ending account balance on 7/02/2022 is $103,256.78. The total CAGR for the trading period is 101.53% with a max drawdown of -42.93%.

Compared to buy/hold spot ETH, plotted below, the hypothesized system drastically yields a better risk-adjusted return due to the differences in max drawdown and consistency over time. Regardless of buy/hold spot ETH yielding a more extensive account balance through the duration of the holding period, buy/hold spot ETH is clearly less consistent with far larger drawdowns than the hypothesized system. The correlation coefficient from the trading strategy’s returns relative to buy/hold spot ETH is .7813.

Got any questions? Should me a DM on Twitter

@TPrahm

Where can I find hourly options data to reproduce this?