Crypto Options Analytics, September 19th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$47,456

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Sept. 19th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

This week implied volatility, along with realized volatility, softened.

Option skews remained the same this week versus last week, with little movement in between. Short-dated option have a bias towards puts, while options with about 60-days-until-expiration are at par. Option skews beyond 60-days become more positive as the expirations extend.

(Sept. 19th, 2021 - Long-Dated BTC Skews - Deribit)

This kind of put-bias in the option skew signals a cautionary tone.

The recent sell-off in spot prices has found support but if we retest that support and prices fail to hold, we could easily see volatility ramp higher as prices fall. Option traders are paying up for this protection.

TERM STRUCTURE

(Sept. 19th, 2021 - BTC’s Term Structure - Deribit)

The term structure is extremely steep.

The differential between short-dated IV and DEC is 57% to 89%, meaning the “roll-down” decay is nearly 0.35% points.

Together, roll-down and theta create a hefty cost to owning premium.

@JSterz and @PelionCap provided interesting insight into this phenomenon in the Paradigm<>GVol Telegram “Vol Pit”. (The commentary was originally around ETH but the logic holds true for the BTC term structure too)

Follow these two on twitter.

ATM/SKEW

(Sept. 19th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) volatility has seen a substantial softening versus last week. Given the SKEW (right), we believe that the risk of a volatility increase remains in the realm of lower spot prices.

If spot prices do not drop below recently formed lows, volatility will likely drop further as BTC prices continue to consolidate below the $50k key level.

VOLUME

(Sept. 19th, 2021 - BTC Premium Traded - Deribit)

(Sept. 19th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (13 Sept. - 19 Sept.)

The week's trading highlights in BTC include a shift in demand towards 1 to 3 month options as volumes of Oct 29 & Dec 31 expiries accounted for 40% of total volumes. We also saw very strong two-way interest for <1month calls in the 48-50k strike range as realized vols continued to remain suppressed.

A slightly more cautious stance was adopted by market participants as volumes for put spreads ticked upward, accounting for 25% of total volumes in BTC and puts representing almost 35% of total volumes, up from 24% last week. Protection in the 40k-46k strike range being particularly in demand in the 1wk - 1m expiry range.

VOLATILITY CONE

(Sept. 19th, 2021 - BTC’s Volatility Cone)

Realized volatility has softened this week.

As long as spot prices remain in the $45k-50k range, realized volatility has room to run lower, especially if we hold the support.

REALIZED & IMPLIED

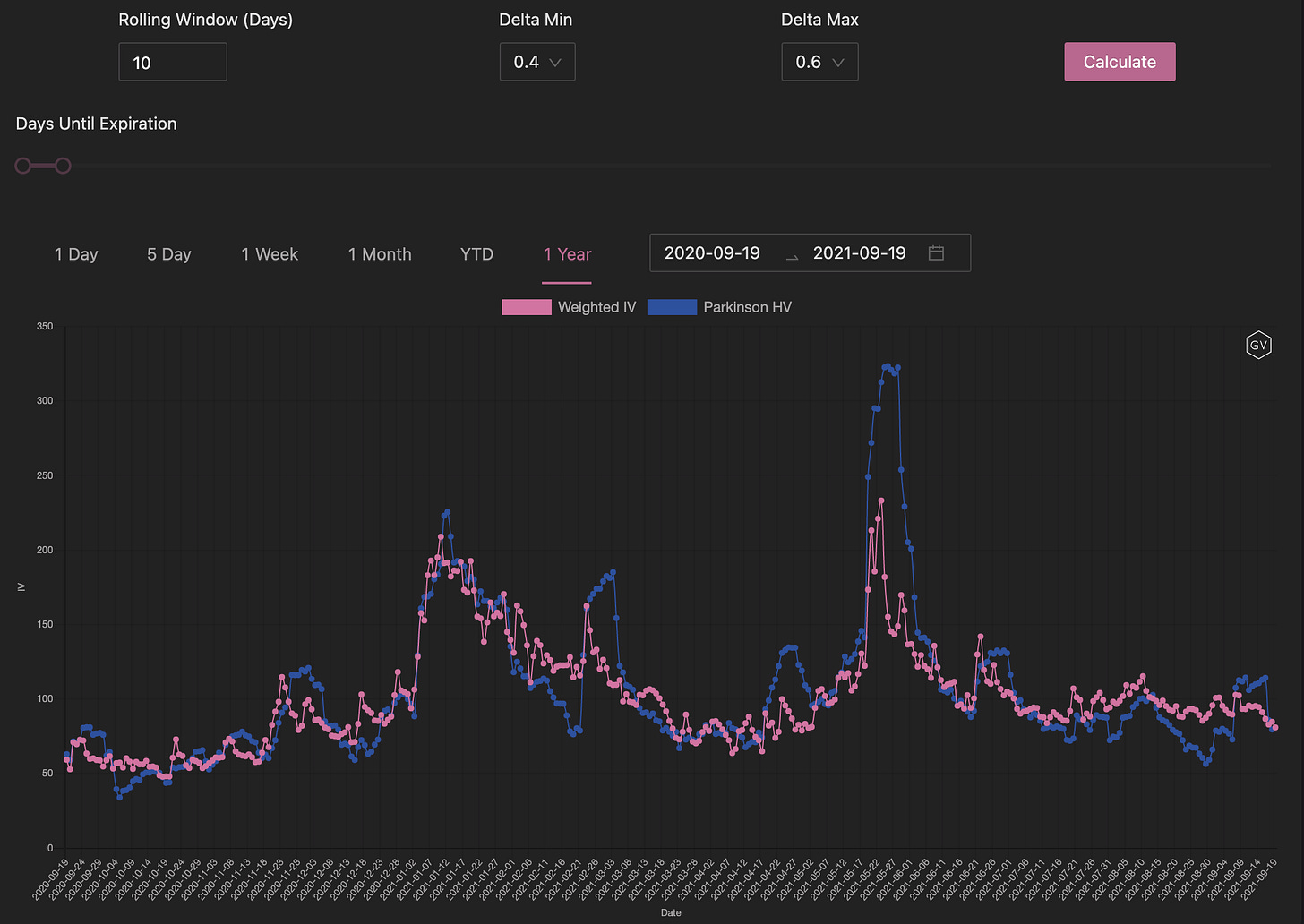

(Sept. 19th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The 10-day realized volatility measurement window has just dropped the spot price crash out of sample.

Realized volatility is now printing much lower than IV and will likely drag IV lower.

$3,330

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Sept. 19th, 2021 - ETH’s Skews - Deribit)

The Ethereum volatility space has also seen a softening this week.

ETH option skews are negative for everything shorter than 90-days until expiration. Late in the week, short-dated and medium-term ETH skews saw a brief push higher, moving from -7% to -3%.

(Sept. 19th, 2021 - ETH’s Skews - Deribit)

The same cautious approach is being taken by option traders in the ETH landscape.

Volatility bias returns to positive for longer expirations, with 180-day expirations trading about +5%.

TERM STRUCTURE

(Sept. 19th, 2021 - ETH’s Term Structure - Deribit)

There’s a steep term structure for ETH as well, but not quite as steep as BTC.

December remains relatively expensive. The differential between short-term and DEC IV is 80% to 103%, about a .25% daily roll down the term structure.

ATM/SKEW

(Sept. 19th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) this week saw a substantial drop in IV of nearly 10pts. This was enough to make a new low for the month. SKEW (right) tried to push even lower during the week but was unable too.

VOLUME

(Sept. 19th, 2021 - ETH’s Premium Traded - Deribit)

(Sept. 19th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volume have been very tame this past week, a congruent behavior to the volatility space.

Paradigm Block Insights (13 Sept. - 19 Sept.)

ETH flow was one-dimensional, with interest for short-dated topside calls continuing to dominate, accounting for 77% of total volumes. The only deviation from the persistent topside interest was the strong demand for 3200 strike puts in the <2wk tenor, making it the third most traded strike of the week, accounting for 10.5% of overall volumes.

VOLATILITY CONE

(Sept. 19th, 2021 - ETH’s Volatility Cone)

Realized volatility headed back towards the 25th percentile.

Although we see vol risk coming from a drop in spot prices for BTC, we do think there’s actually 2-way vol risk for ETH… ETH above $5k would be a whole different volatility profile than the current 3200-4000 range.

REALIZED & IMPLIED

(Sept. 19th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The IV / RV relationship is inline this week.

RV has traded above and below IV in the past month, while IV has remained the anchor.