Crypto Options Analytics, September 26th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$43,456

DVOL: Deribit’s volatility index

(1 month, hourly)

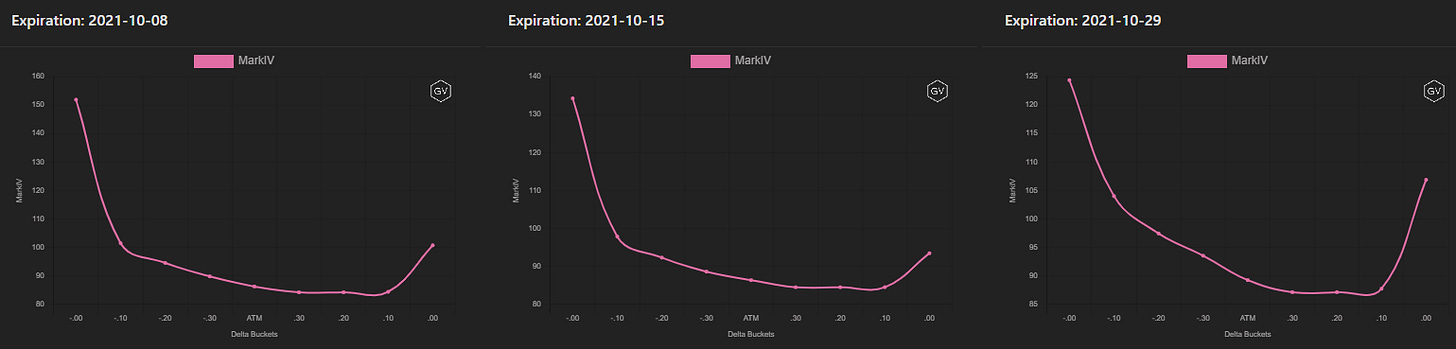

SKEWS

(Sept. 26th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

This week spot prices dropped and tested support levels.

Short-term skews responded quickly, becoming more negative as put demand grew.

Medium-term options had a muted, but similar, reaction.

The long-dated options were unfazed and barely budged, actually to our surprise, 180+ expiration skews actually became slightly more positive, while the shorter-term skews headed in the other direction.

(Sept. 26th, 2021 - Long-Dated BTC Skews - Deribit)

Deribit listed the new quarterly expiration of 9/30/22, the Nike “swoosh” skew is most pronounced in this long-term contract.

TERM STRUCTURE

(Sept. 26th, 2021 - BTC’s Term Structure - Deribit)

The term structure flattened this week.

During the week, as spot prices tested $40k support, IV jumped significantly higher, lead by the short-end of the term structure.

The term structure briefly became flat but quickly returned to Contango as $40k support proved to hold.

The theme of “higher volatility if lower spot prices” is likely still in play, as all markets are focused on China economic woes.

ATM/SKEW

(Sept. 26th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

As previously mentioned, ATM IV (left) jumped significantly higher as spot prices dipped. IV reached peak levels for the month, but was unable to hold those levels and quickly returned to monthly low levels.

SKEW (right) is now fixed to a lower range. Despite IV coming down, skew is unable to return to the upper bound, as traders hedge holdings.

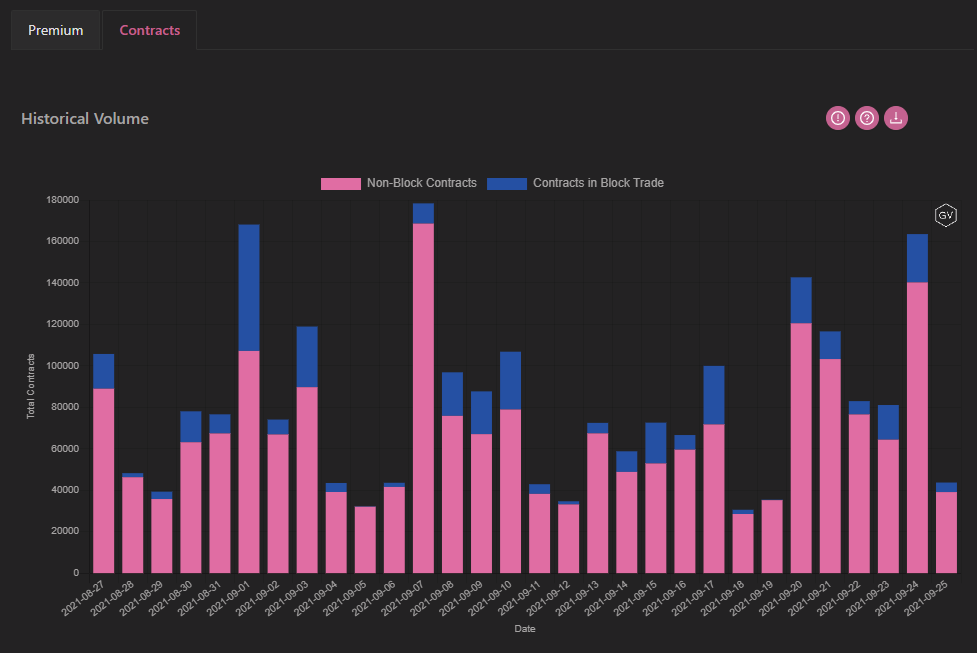

VOLUME

(Sept. 26th, 2021 - BTC Premium Traded - Deribit)

(Sept. 26th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (20 Sep - 26 Sep)

The week's trading highlights in BTC included significant volumes going through on the year end expiries where more than 6100 contracts were executed, making it the most active expiry of the week and the first time in months that the most actively traded tenor was greater than 1 month. Volumes were driven by (1) continued bullish expressions via call spreads (2) strong two-way outright activity in both calls and puts, and (3) increased interest in risk reversals.

Elsewhere, interest in puts over Paradigm spiked as short-dated IV jumped on 22 Sept. & 24 Sept. & skew drifted in favor of puts. Total volumes for puts accounted for ~40% of our flow, up from 35% last week & 28% two weeks ago with the 20000 (~1800 contracts), 40000 (~1400 contracts) & 42000 (~1200 contracts) being the most popular for the week.

VOLATILITY CONE

(Sept. 26th, 2021 - BTC’s Volatility Cone)

Realized volatility moved back to the median over this week.

RV is likely going to continue to depend on spot-price direction for the near term.

REALIZED & IMPLIED

(Sept. 26th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Implied volatility saw a modest spike higher for select options, but IV continues to act as an anchor as RV swings around back-and-forth.

RV is now back to IV after being at a discount last week.

$3,050

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Sept. 26th, 2021 - ETH’s Skews - Deribit)

Implied volatility saw even more erratic spikes this week for ETH than for BTC.

Short-term skews dipped incredibly low as ETH spot-prices dropped, weeklies were nearly -15%.

Like BTC, medium-term skews were similar but muted, while the long-term options saw nearly no variations in skew.

(Sept. 26th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Sept. 26th, 2021 - ETH’s Term Structure - Deribit)

The term structure is now similarly shaped to that of last week, but in the interim the term structure briefly hit backwardation.

Now that another week has gone by and DEC is priced similarly, the FWD pricing for the DEC expiration has gotten even more rich.

The back-end of the TS is rather stable and nearly flat.

ATM/SKEW

(Sept. 26th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) saw a sharp spike higher to nearly the monthly peaks; this was quickly given back.

SKEW (right) is in a strong and relentless down trend, for the exception of the past couple of data points, where skew edged higher.

VOLUME

(Sept. 26th, 2021 - ETH’s Premium Traded - Deribit)

(Sept. 26th, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (20 Sept. - 26 Sept.)

In ETH, we continued to see very strong interest in topside expressions via call spreads, as more than 35% of overall volumes for the week came from such structures, with strikes around 3500 (6400 contracts), 4000 (~6000 contracts), and 5500 (~6750 contracts) dominating action.

The continued demand for topside structures was offset by increased put activity in the form of both outrights and put spreads, as demand for puts jumped, especially in the 1-wk to 1-month tenors. IV & skew moved in favor of puts, with interest rather evenly distributed for strikes between 2000 & 3000. Total volumes for puts accounted for ~40% of our flow, up significantly from 23% last week, and put spreads accounted for 20% of overall block trades.

VOLATILITY CONE

(Sept. 26th, 2021 - ETH’s Volatility Cone)

Realized volatility moved much higher than BTC’s, relatively speaking. ETH is actually flirting with the upper 75th percentile for weekly RV.

There might be more in the works for ETH going forward.

We continue to think that ETH vol. could climb higher on a spot price rally too; the potential is there with ETH due to an increasingly vocal flippening narrative.

REALIZED & IMPLIED

(Sept. 26th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Last week IV and RV were equal, now RV is trading above IV.