Crypto Options Analytics, September 5th, 2021

Great Covered Call environment! The spot rally excitement is causing options to be expensive... although long vol. in ETH is more justified.

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$50,907

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Sept. 5th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

The Bitcoin rally has continued over the past week.

As spot prices climb higher, implied vol. has seen a slight uptick but the realized volatility landscape continues to trade below IV.

Option skews have converged near the zero-line (0% skew) for most expiration buckets, with the exception of long-dated options.

(Sept. 5th, 2021 - Long-Dated BTC Skews - Deribit)

Despite long-dated options holding their premium for call IV vs put IV, even long-dated options have seen a decrease in skew levels.

Surprisingly, the rally higher isn’t being met with higher call option demand, despite option volatility holding a premium to realized volatility overall.

TERM STRUCTURE

(Sept. 5th, 2021 - BTC’s Term Structure - Deribit)

The BTC term structure continues to display a steep slope with DEC. 31st expiration being the most expensive forward volatility.

The option market continues to price an “event” in either direction, yet this trade is rather expensive to hold, given the term structure and variance premium.

ATM/SKEW

(Sept. 5th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) saw a spike higher as BTC traded through the $50k mark. Breaching this price point caused a significant reaction in the option market as traders were quick to buy options, expecting follow-through volatility.

Despite the spike in IV being quickly faded back lower, the confluence of activity dignified the importance of the $50k price level.

Skew (right): surprisingly, skew has been heading lower despite the increase in spot prices… In the equity space, traditional fund managers tend to buy puts to hedge their underlying spot holdings… this type of TradFi flow could explain the spot/skew inverse correlation… but it’s too early to make this call.

Crypto options have displayed a positive spot/skew correlation historically.

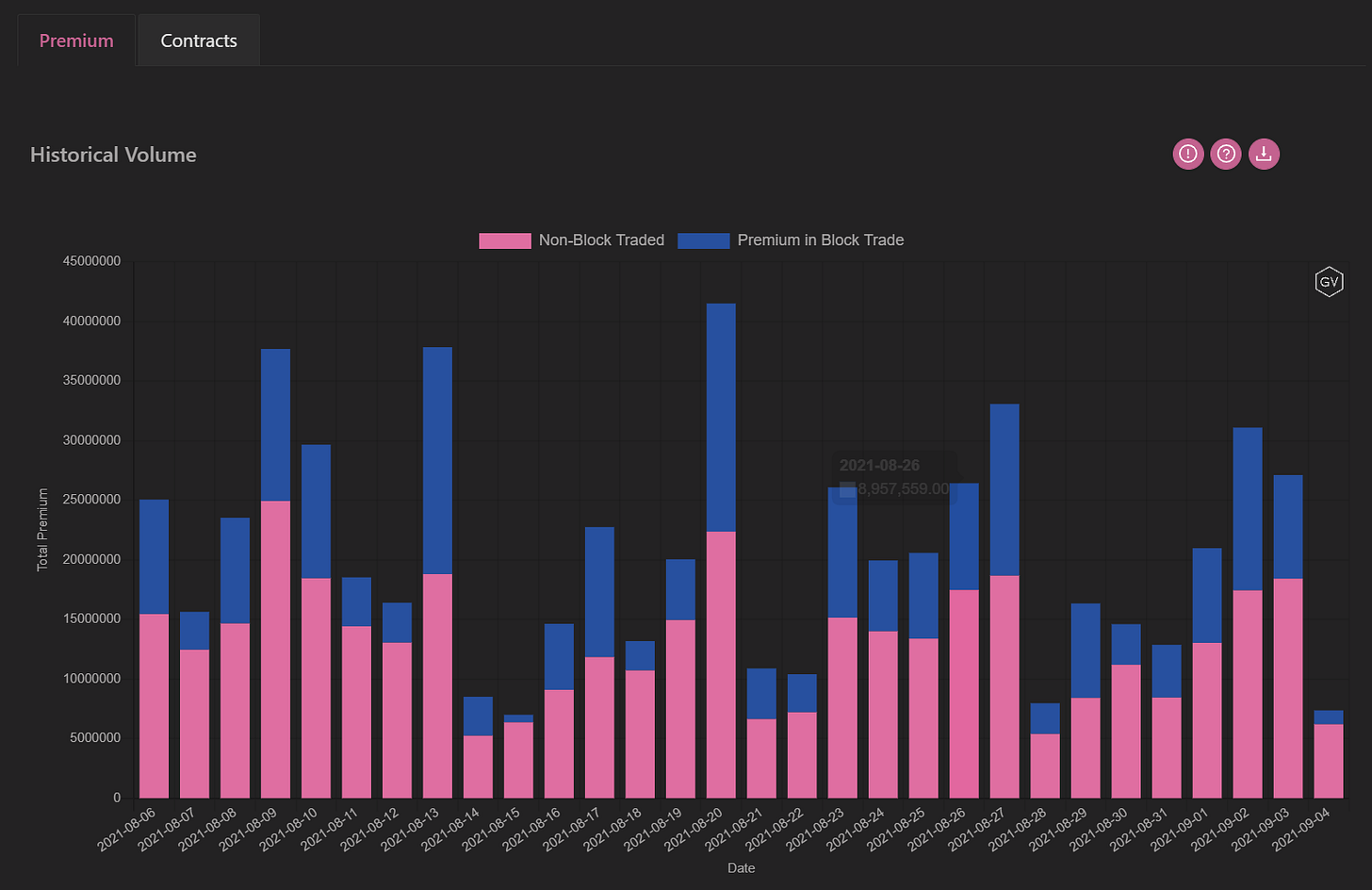

VOLUME

(Sept. 5th, 2021 - BTC Premium Traded - Deribit)

(Sept. 5th, 2021 - BTC’s Contracts Traded - Deribit)

Overall, volumes were similar to last week. There was no explosive volume profiles that significantly stood out.

PARADIGM FLOW HIGHLIGHTS - Patrick Chu @Paradigm

(Aug. 30th <-> Sept. 5th, 2021)

The week's trading highlights included calls continuing to dominate volumes with 25 delta risk reversals continuing to shift in favor of calls with 1wk trading above par and 1m & 3m all grinding towards par.

Volume for calls continued to outstrip demand for puts with 76% of BTC block interest.

We continued to see strong two way interest for calls on the 10 Sep & 24 Sep expiries, with 50k, 60k & 64k strikes in BTC

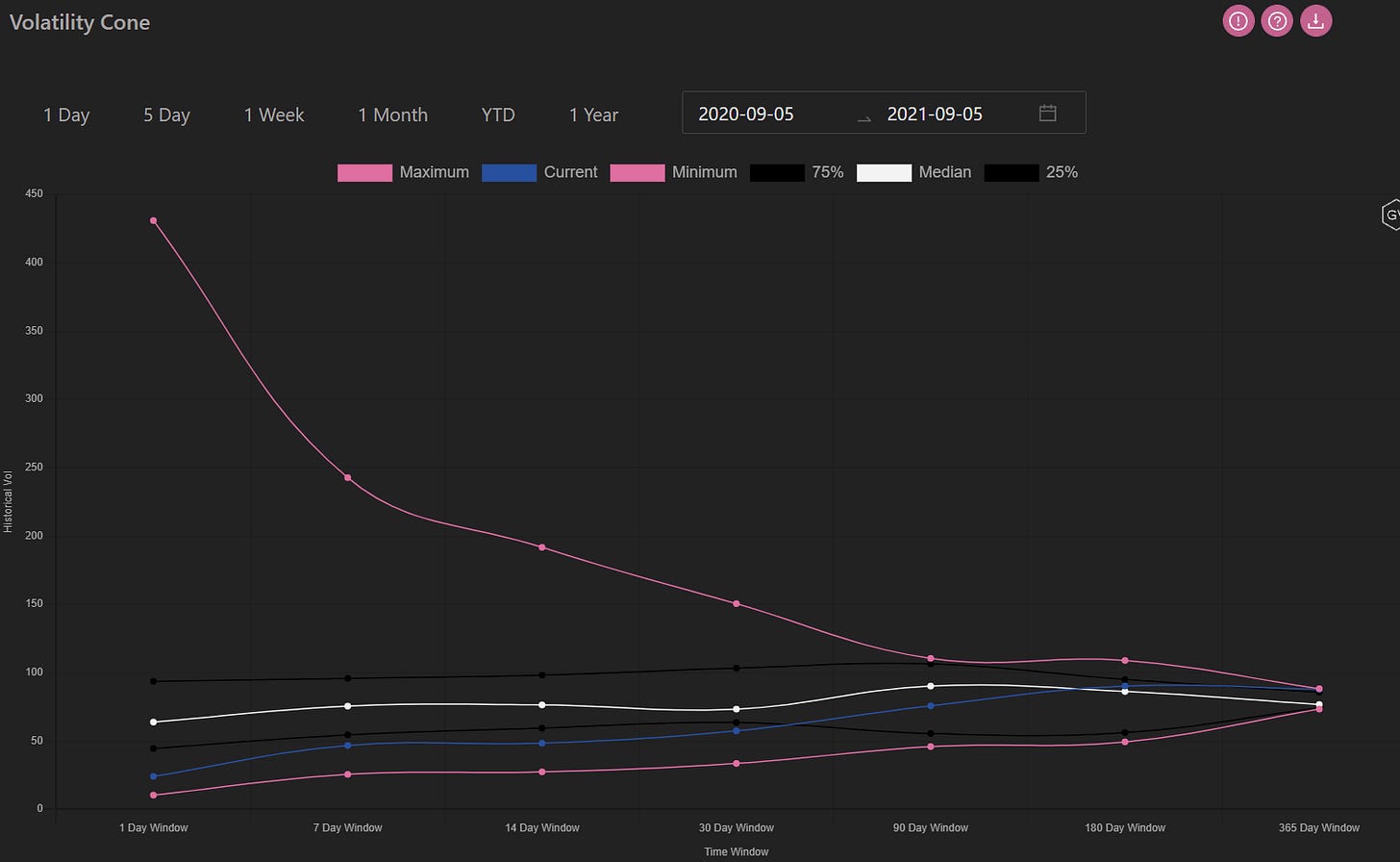

VOLATILITY CONE

(Sept. 5th, 2021 - BTC’s Volatility Cone)

Although IV saw a spike higher as prices crept above $50k on Thursday, RV continued to drop EVEN lower during this past week.

There’s a real dislocation between the volatility being priced in the options market and the underlying realized volatility.

REALIZED & IMPLIED

(Sept. 5th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The LARGE IV to RV premium, which has been present lately, continued to get even larger.

Without a significant “catch-up” move in the underlying, buying options here is a tough trade. There’s a lot of activity already priced in.

The current volatility might be overestimated here due to the enthusiasm around the current rally (a good analogy is bets favoring Pacquiao vs Mayweather in 2015)… The market WANTS exposure to the rally… but the excitement is causing bets to be too expensive.

$3,930

DVOL: Deribit’s volatility index

(1 month, hourly)

I’m convinced the ETH / BTC market capitalization “flippening” is going to happen, at least at some point.

When that trend does really get going, the IV/RV premium could actually dissipate.

Until then, holding long vol. positions in ETH continues to have expensive carry costs.

SKEWS

(Sept. 5th, 2021 - ETH’s Skews - Deribit)

Option skews have dropped significantly in the ETH vol. landscape.

Like BTC, ETH skews are nearly at par for all short-term and medium-term expirations.

Longer-dated options continue to hold a positive skew (favoring calls) but the premium has dropped significantly over the past week.

(Sept. 5th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Sept. 5th, 2021 - ETH’s Term Structure - Deribit)

The term-structure is still very steep.

DEC. 31st remains the most expensive point on the forward volatility curve and holding costs continue to decay long volatility positions due to both “roll-down” and variance premium effects.

ATM/SKEW

(Sept. 5th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) the major difference between BTC volatility and ETH volatility seen last week is that ETH IV actually ended the week higher, along with higher RV.

The IV / RV premium remains for both pairs, but ETH volatility positions enjoyed a nice “offset”.

SKEW (right) has dropped a lot over the past week. Like BTC, ETH option skew currently hovers around the ~0 line for selected maturities.

We believe there’s a good opportunity to trade the skew here, buying the call leg and selling the put leg. There’s significant momentum behind ETH.

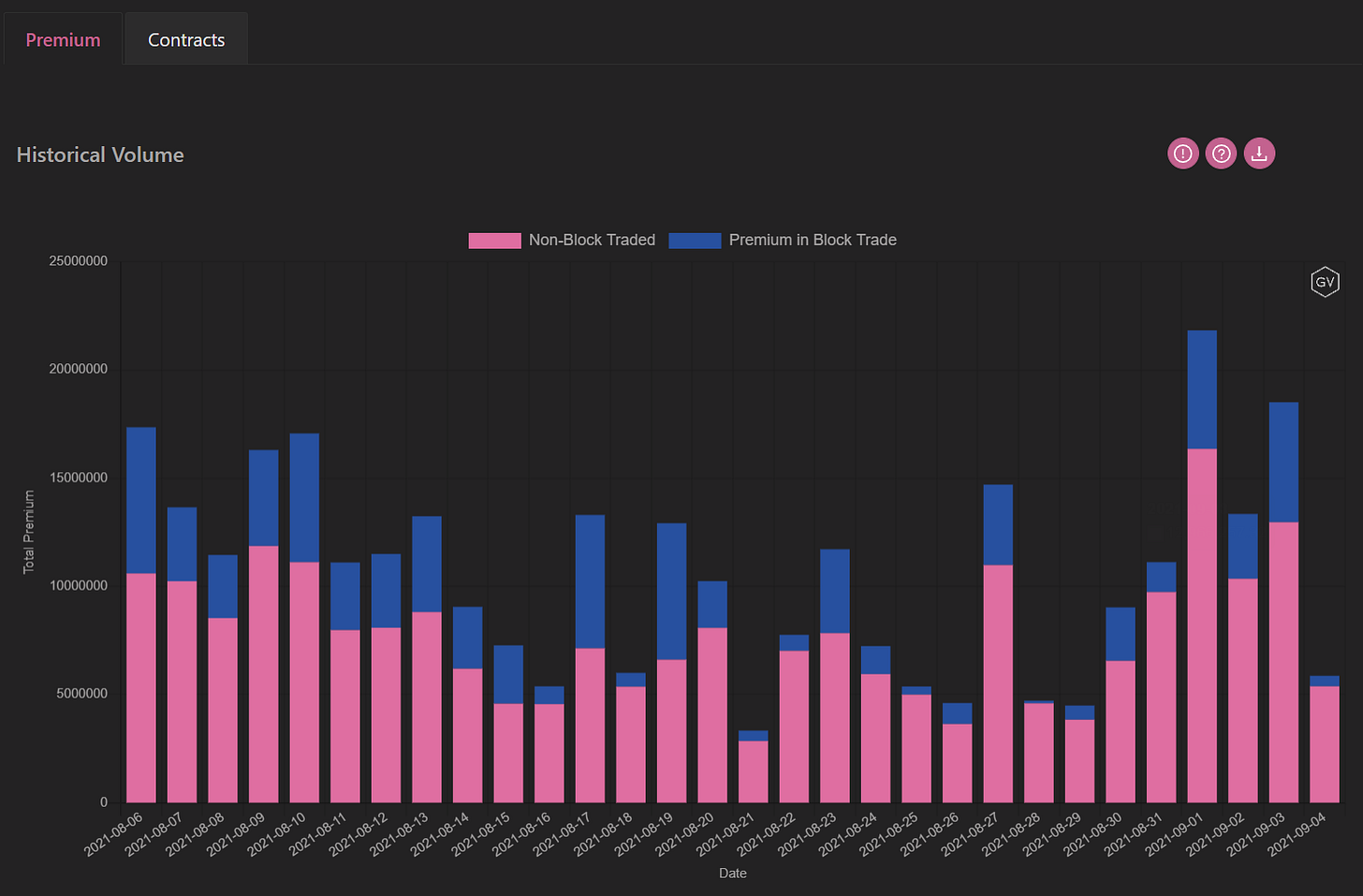

VOLUME

(Sept. 5th, 2021 - ETH’s Premium Traded - Deribit)

(Sept. 5th, 2021 - ETH’s Contracts Traded - Deribit)

ETH did see more explosive volumes last week. Both 9/1 and 9/2 recorded some of the highest volume readings all month.

This volume divergence supports the relatively strong ETH enthusiasm. It’s worth taking note.

PARADIGM FLOW HIGHLIGHTS - Patrick Chu @Paradigm

(Aug. 30th <-> Sept. 5th, 2021)

We continued to see rising volumes especially in ETH this week with ~$230M traded on September 1st over Paradigm, accounting for ~37% of total volume.

Volume for calls continued to outstrip demand for puts with ~70% of ETH block interest. Strike selection of 3600 / 4000 in ETH comprised the bulk of the action.

In ETH, we also continued to see very strong interest in the 6k & 7k strikes for the Dec, March and June expiries.

VOLATILITY CONE

(Sept. 5th, 2021 - ETH’s Volatility Cone)

7-day ETH RV is leading the volatility cone, back higher towards the median.

REALIZED & IMPLIED

(Sept. 5th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The IV / RV variance premium is still present but RV was able to climb higher, narrowing the gap.

ETH is relatively strong here and there is more explosive option volume activity being seen, relatively speaking.

Overall, if you want to buy volatility, ETH vol. seems more justified than BTC.