Crypto Options Analytics, Sept. 5th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Weekly EVENTS:

1)Fed Speakers Wednesday, Thursday (Powell), Friday.

2)ECB rate decision on Thursday.

THE BIG PICTURE THEMES:

Jerome Powell is determined not to ignore the problem of taming inflation. He understands that raising rates breaks stuff.

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

-JP

I expect this week to continue to be bearish for risk assets. There’s a great opportunity in downside trades this week and the USD rally to continue.

As long as inflation is at a 40-year HIGH

ANDDDDD……

Unemployment is at a 50-yeah LOW

there’s no other moves to make, but raise rates until either inflation breaks or the markets and economy break.

What breaks first?

How could it be inflation?

The European gas situation, other global supply chain threats via geopolitical fractures AND government fiscal spending? Supply side inflation isn’t going away unless we crush demand.

Jobs

Last Friday we had the NFP payroll number (PDF HERE)

Unemployment rose to 3.7% (from 3.5%)

Yet, participation rose from 62.4% (from 62.1%)

+315k payroll jobs added (remember about +150k is maintenance)

Even interest rate sensitive sectors like construction, (think housing and mortgage costs) are seeing continued growth.

There’s a ton of potential hiring left in leisure and hospitality post Covid.

Again, the Fed has no other move besides hawkishness, until things break.

Crypto:

Crypto prices aren’t an inflation hedge right now. They’re still behaving like risk-assets highly correlated to tech stocks.

Like other risk assets, I see large downside potential in the short/medium term.

BTC prices are consolidating below the $20k level, support has become resistance, this isn’t a bullish sign.

Overall volatility levels have subdued a lot compared to May.

This makes long-vol, negative delta structures interesting.

ETH has the only potential counter-narrative with the merge to POS progress and the Sept.6th Bellatrix upgrade.

I love ETH, but I’m likely fading any “significant” ETH price uptick.

I could see ETH move higher initially, but then become dragged down by the rest of markets and Macro environment.

In my opinion we are now beyond the summer relief-rally and August vol. crush.

BTC: $19,663 +0.45%

ETH :$1,432 +10.75%

SOL: $31.79 +4.43%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

We’re seeing DVol hold a firm level here around 80% IV.

As spot prices drop, DVol is getting a slight bid from hedgers but the “explosive” upside in vol. isn’t likely to occur unless spot prices take out May lows, about $17.8k.

Even then, I don’t think DVol reaches that May/June 140% level, unless we start seeing BTC in the $10k-$12.5k spot range.

Overall, I think vol. is a buy here, but this is a function of my delta bias. Keep that in mind… my vol. bias is currently Texas-hedging itself (aka doubling down).

TERM STRUCTURE

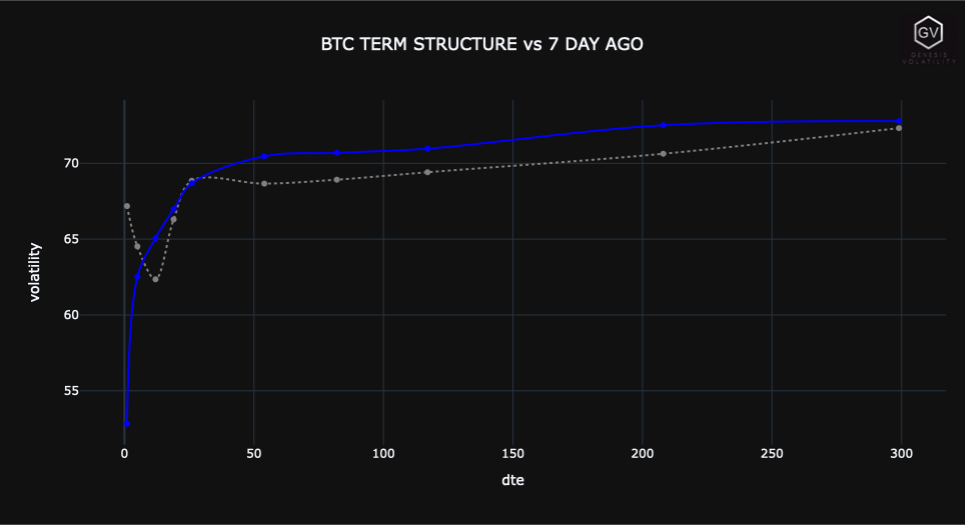

(SEPT.5th, 2022 - BTC Term Structure - Deribit)

BTC (Term Structure)

ETH (Term Structure)

The BTC term structure is in a Contango with little change week-over-week.

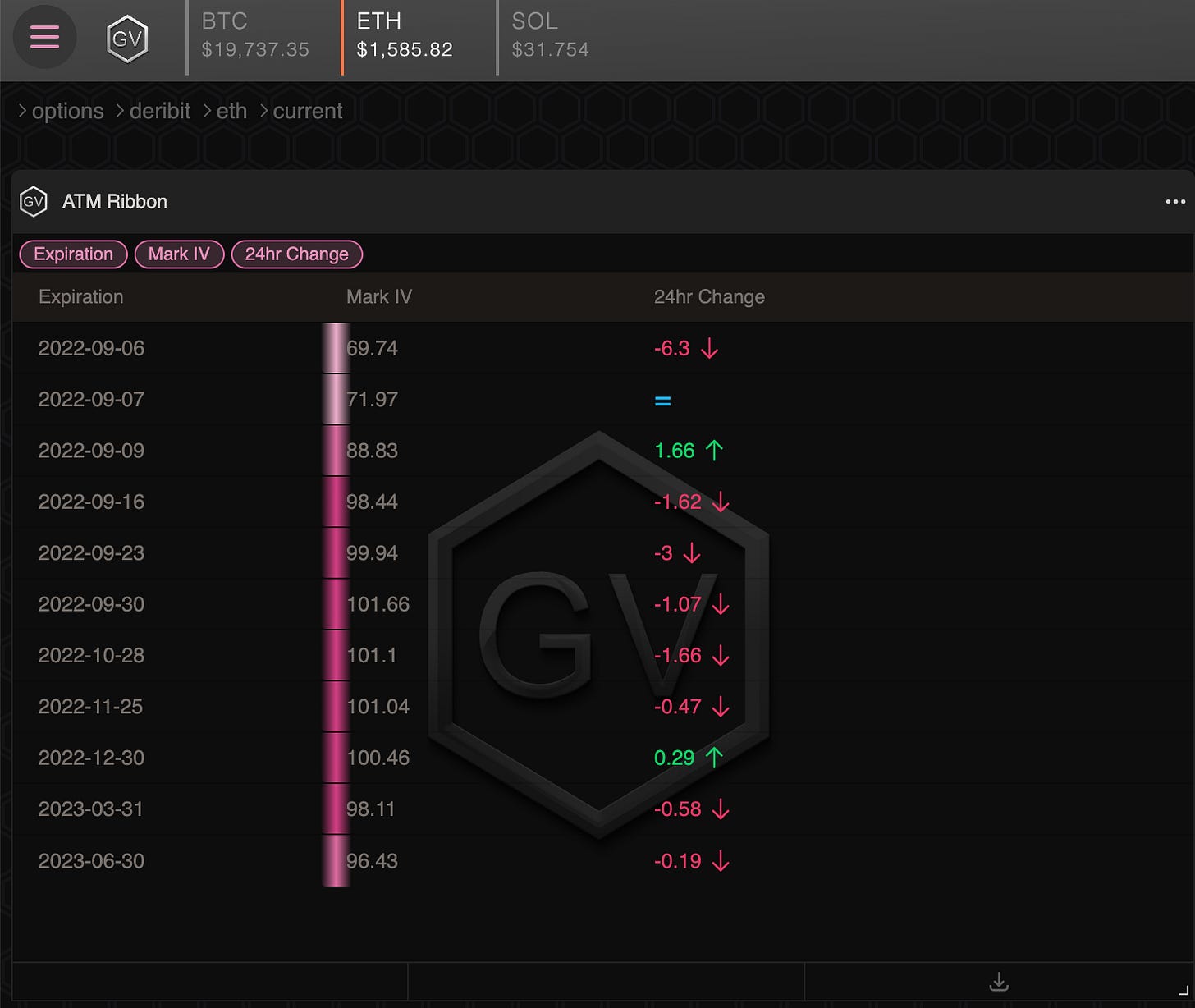

The ETH term structure is mixed, with a kink around the ETH 2.0 merge event. (See ATM Ribbon below).

There’s a sharp divergence in ETH ATM vol. between post-merge options and pre-merge options.

Is the ETH 2.0 merge really going to be a 100% IV event? Is there opportunity between medium-term and long-term post-merge options, given the flat term-structure in the post-merge environment?

That could be an interesting gamma trade.

There could also be a “non-event” vol. trade here too.

Anyone following the merge dynamics in detail probably has edge here.

SKEWS

(SEPT.5th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

BTC option RR-skew is near the lower-end of the “things are fine” range. That said, should fear return to the markets (even via a Macro related push lower) we could easily BTC RR-skew head much lower.

Should things stay “as-is” and spot prices float around… long ATM puts, short ∆25 puts (via put spreads) creates a decent hedge to bear bets.

We still want the bearish scenario if we structure our book this way, but the 30-day ∆25 put sell is elevated right now and therefore a good hedge.

Should prices drop… we can roll-down put-spreads.

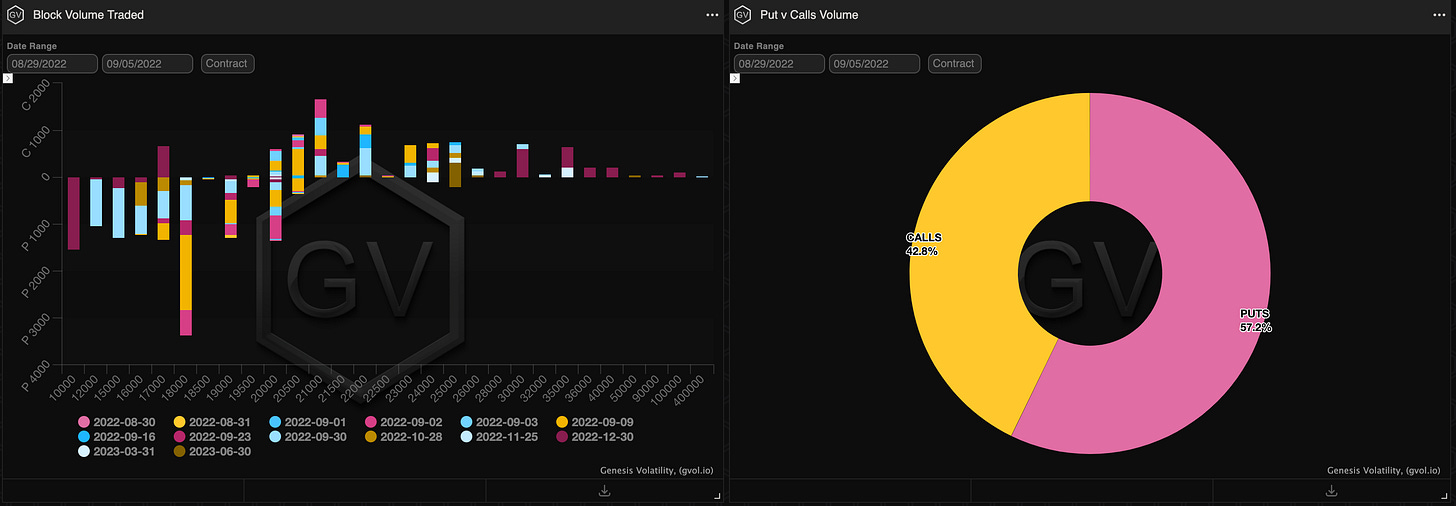

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

First week of the month undertone, with most of the volumes focused on Ethereum (although not with the usual conviction); on the end of the week some sharper takes of positions with puts buying and calls selling, dictated by Friday's price action.

Bitcoin trades: puts bought 9SEP $18k, puts bought 30DEC $10k, put spreads bought 30SEP $15k/$12k, short straddle 9SEP $20.5k

Ethereum trades: strangle bought 28OCT $0.8k/$2.5k, calls sold 9SEP $1.6k/$1.7k

The merge is approaching and from a technical point of view only positive confirmations arrive suggesting transition without repercussions, at least in the short term.

The last two weeks of September will overlay the merge to the usual market-attentive macro appointments (CPI and FOMC meeting) and it will be interesting to note the positioning of participants in the coming days.

(

)

(29th Aug -4th Sep, 2022 - BTC GVOL Gravity charts)

(29th Aug -4th Sep, 2022 - ETH GVOL Gravity charts)

Paradigm Block Insights (28 Aug – 5th Sept)

ETH the outperformer this week +5.5%, compared to BTC and SOL relatively flat. Worth noting ETH’s significant outperformance vs. equities with NDX -4% WoW.

@FTX spreads on Paradigm are heating up since our launch in July. Fourth consecutive week of higher volumes!

Full list of FTX coins include: BTC, ETH, SOL, AVAX, APE, DOGE, LINK, LTC FTM, MATIC,BNB and BCH! ✍️

More coins are coming soon!

FTX spreads on Paradigm don’t rest on weekends! From Friday to Saturday evening, we printed $13M with notable prints in ETH/SOL/AVAX!

(S/B) 3.5k ETH Sep/Dec

(B/S) 10k SOL Spot / Perp

(B/S) 10k AVAX Spot/Perp

BTC options were more defensive this week with two large outright positions initiated, the largest being quite short-dated.

A shift in tone from the large call buying we saw a few weeks ago in Mar and Jun buckets. All bought on Paradigm:

1.6k DO 9-Sep-22 18000 Put

1.5k DO 30-Dec-22 10000 Put

1k 30-Sep-22 12000/15000 Put Spread

In ETH options, upside continues to dominate the narrative with continued buying of longer-dated spreads ahead of the merge.

10k 30-Dec-22 3500/4000 Call Spread

7.5k 30-Dec-22 1800/2500/7000 Call Fly

7.5k 30-Sep-22 3500/5000 Call Spread

Given healthy ETH multileg activity, worth noting Deribit now has up to 50% off fees when trading multi-leg option blocks on Paradigm!! 🔥

Never been cheaper for you to trade option strategies on Paradigm, cleared via Deribit 🍾.

Reach out below if you have any questions!

https://t.me/para_client_support

🎀Another milestone auction on @tradeparadigm as our partners and friends at

@ribbonfinance turn on the fee switch💥

⚡️The auctions continue to be🔥with average price beat to screen over 10% 🙌

Winners:

🥇 @BastionTrading

🥇 @GenesisTrading

🥇 @QCPCapital

🥇Various ANON

We put out daily commentary at the Telegram link below. 👇

https://t.me/para_client_support

Follow all @FTX_Official spread trades on @tradeparadigm here

https://t.me/paradigm_ftx_trades

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

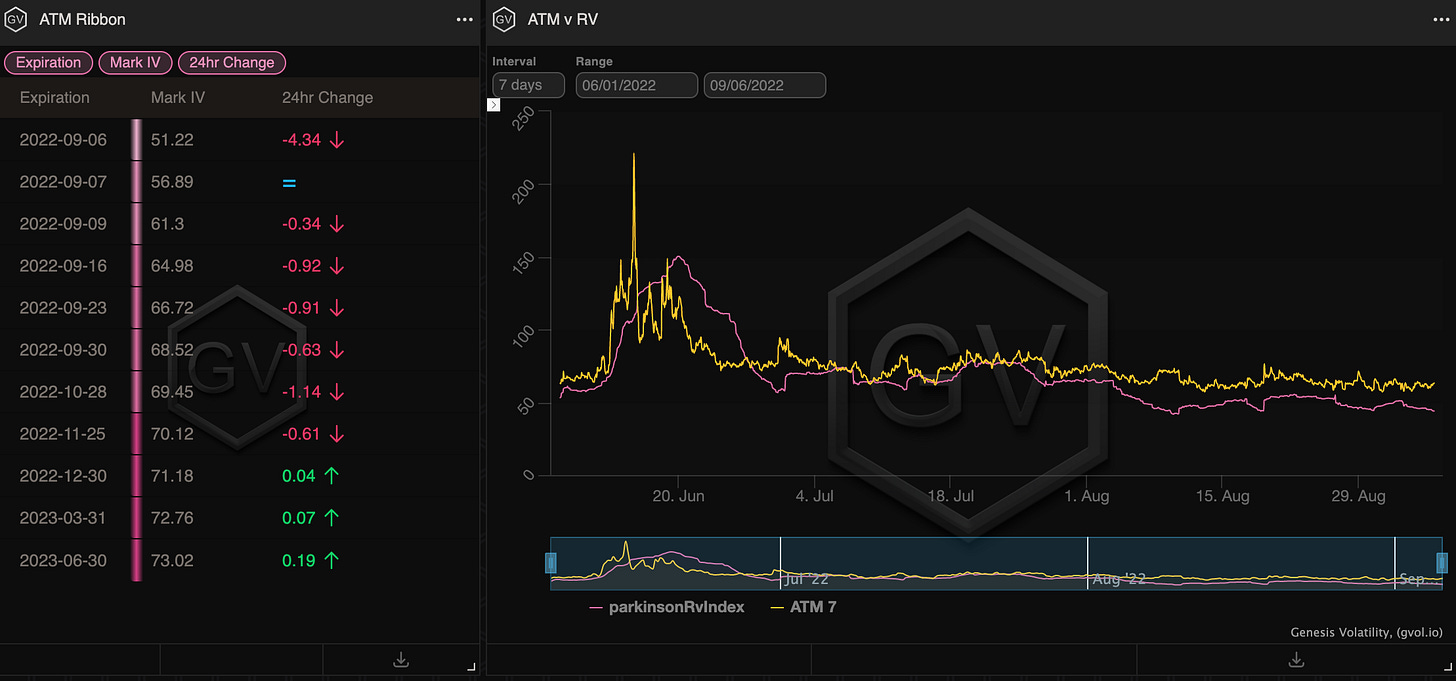

BTC

ETH

SOL

VOLATILITY PREMIUM

(Sept. 5th, 2022 - BTC IV-RV)

The one caveat to my theme this week is the VRP.

The BTC VRP is still elevated.

When you’re buying vol. here, you’re overpaying if things stay “as-is”. Instead, you’re hoping realized volatility spikes higher as BTC breakdown along with the Macro environment.

This is something to keep in mind as we structure trades.

Think, put-spreads instead of Puts, which also have a favorable skew right now.

(NOTE: To a certain extent this is common to all vol. trading… You’re overpaying for fire insurance, until a fire happens.)

Squeeth Weekly Review

Spot markets found a bid early into the holiday weekend where markets have remained relatively calm. ETH ended the week +4.91% and oSQTH ended the week +6.87%.

Volatility

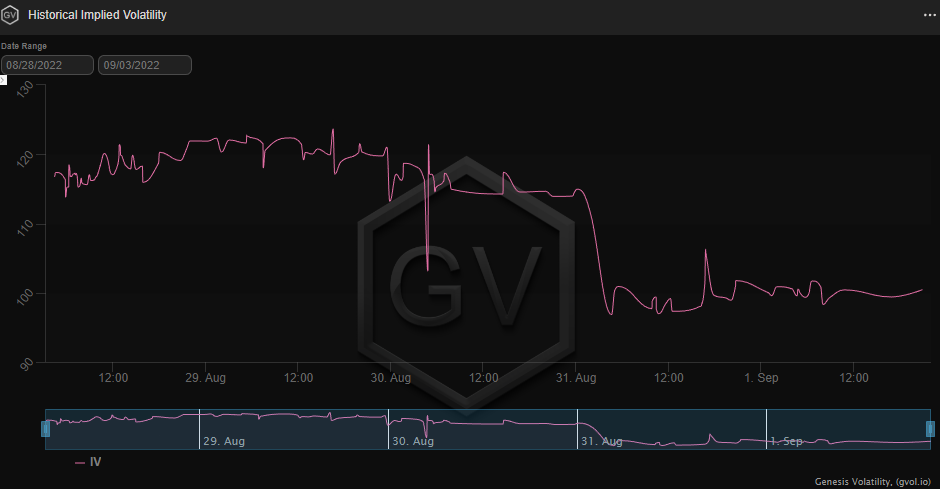

oSQTH IV found its way lower on the back of ETH spot markets rallying. IV started the week around 116 and ended the week around 106. oSQTH remained a great place to buy cheap ETH during parts of the week.

Volume

The 7-day total for oSQTH via Uniswap oSQTH/ETH pool was $5.90m. September 2nd saw the most volume, with a daily total of $1.17m being traded.

Crab Strategy

Crab v2 has returned 5.34% since its inception (July 28th, 2022).

Crab v2 performed multiple hedges equating to 267.88 ETH