Crypto Options Analytics, Sept. 25th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Weekly EVENTS:

Monday:5-fed presidents talk throughout the day (8:30a-4pm ET)

Tuesday: 7:30am ET- Powell speaks about digital finance

Friday: 8:30am PCE numbers

THE BIG PICTURE THEMES:

Last week the Fed raised rates by 75bps, in-line with expectations, but signaled they would hold rates higher, longer… allowing higher rates to trickle into the back-end of the yield curve too.

Hiking rates to fight inflation is a global theme.

The UK, Canada, ECB, Switzerland and Sweden are all raising rates. This is causing traders to discount risk-assets and triggers lower prices.

The one central bank that hasn’t raised rates, and CANNOT, is the BOJ.

Here’s a twitter thread I wrote to describe the Japanese situation. I think $/¥-200 is in the cards.

The BOJ got directly involved in currency intervention last week too. Let’s remember that Japanese $ reserves are indeed a couple trillion, but this number isn’t infinity.

Crypto:

Crypto suffered a little bit this week, but held up relatively well, considering it’s a high beta asset class.

SOL actually rallied WoW. Same with a few other quality alt-coins such as LYRA (Disclaimer: I have bags in this).

This type of mixed activity could be interesting for long-short trade ideas… “Long quality ERC20s, short ETH” or “Long ETH, short BTC on a volatility adjusted basis"

BTC: $18,802 -3.6%

ETH :$1,292 -4%

SOL: $32.32 +3%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

BTC Vol. was rather steady, given this big week.

Even in TradFi, equity vol. isn’t seeing an explosive VIX!

Markets are “grinding lower” as opposed to violently crashing.

This may be because the Fed is using a approach of “holding rates higher longer”, as opposed to making a massive “surprise Hike”.

However, there are MANY external variables that could cause violent vol. spikes (China/Taiwan, Mid-terms, Russia/Ukraine stuff, Japanese rates, etc).

TERM STRUCTURE

(SEP 25th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

The BTC term structure is right back to being basically flat. When we highlight 7-day only, we can see BTC vol. likely head either direction here.

We’re in a bit of a no-man’s land, as BTC vol. is pretty stable as of late.

ETH is where all the action has been this past month.

BTC (Term Structure - API chart)

ETH (Term Structure - API chart)

Relative Vol. ETH-BTC (API chart)

The massive relative vol. convergence is interesting. This trade is still coming-in, long after the ETH 2.0 merge proved itself to be a non-event.

As we’ve stated before, relative vol. trades are a bit more complicated due to the attention needed for “collateral management”; that said, it’s great to know this type of trade has a “window of reaction” for potential trades.

Let’s note this set-up for the future opportunities.

(Gvol → Deribit→ Currency Relative Vol.)

SKEWS

(SEPT.25th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

Fading the CPI RR-skew optimism, a couple weeks ago, was a golden opportunity, given how much enthusiasm was priced in… This week, looking at 7-day expirations, the ∆25 BTC-RR is at recent lows.

Maybe Fed officials will “walk-back” some rhetoric this week during their Monday and Tuesday dialogue, or maybe PCE number will surprise and lead to relief.

That’s a “potential” short-term trade idea… Not something I have huge conviction in, but something to consider, given market positioning.

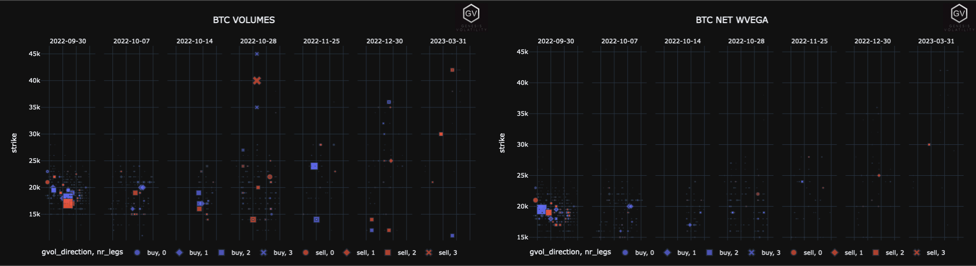

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

Trades of the week to be quickly forgotten - with below-average volumes, mild stances, and with conflicting directional bias.

Bitcoin trades: Call calendar NOV/MAR23 +$24k/-$30k, put spread bought 30SEP $18k/$17k, calls bought 14OCT $20k, puts bought 7OCT $17k

Ethereum trades: call spread sold 30DEC $2k/$3k, call spread sold MAR23 $3.5k/$4k, call spread bought 30DEC $2.8k/$3.2k, calls bought 28OCT $1.8k, strangle bought 28OCT $0.8k/$2k, put bought 30DEC $0.9k

Lacking a “new narrative" and with an increasingly dominant macro scenario, participants seem to be waiting for a signal for a more marked positioning.

We are entering the last week of the month, where about $3.8B of notional will expire. The gamma exposure of dealers is at the lowest levels on Bitcoin and a moderate price action near expiration could bring an accentuation of volatility.

(19th - 25th Sep, 2022 - BTC GVOL Gravity charts)

(19th - 25th Sep, 2022 - ETH GVOL Gravity charts)

(25th Sep, 2022 - BTC GVOL GEX charts)

Paradigm Block Insights (19th Sept – 25th Sept)

BTC and ETH round trip to ~flat this week, with a busy Wednesday Fed 75bps rate hike. Paradigm saw directional flows around the print. Majors outperform Equities on the week!

BTC +1% / ETH +0% / SOL +7% / NDX -4%

FTX FSpds continue to take off 🚀 Another week of record volumes! Total notional now tallying $1.4bn with $500mm recorded this week!

Most traded strategies this week were ETH and BTC spot vs perp, with BTC perp vs BTC 30 dec in third place.

New coins added this week! NEAR, ADA, AAVE, DOT, AXS, ATOM, XRP, EOS are now available for trading 🔥🔥🔥

No. of trades continues to increase as new takers onboard to Paradigm daily! Join Paradigm now and trade pairs in over 20 different coins.

https://www.paradigm.co/join

🌊Fed flows

Heading into the Fed announcement, risk assets rallied with vols. 🌊

Right before the announcement, a SIZE downside buyer came in and swept up the market in 23Sep BTC and ETH OTM Puts. ✍️

BTC

475x 18k Put bot

450x 17.5k Put bot

ETH

4000x 1200 Put bot

3000x 1300 Put bot

Immediately after the widely anticipated 75 bps hike, we saw a taker chasing the move down. As spot and vols puked, a downside buyer lifted 1000x BTC 30Sep 18000/17000 Put Spreads. 👀 🌊

🌊ETH

Takers lift SIZE topside!🔥 Makes sense given vol reset lower:

28Oct ~88v 30Dec ~91v

19k Oct 1800 Call bot

15k Dec 2800/3200 CSpd bot

11k Dec 2500 Call bot

Post-merge call spread unwinds continue as spot trades range-bound:

10k Mar 3500/4000

10k Dec 2000/3000

🎀Another successful @ribbonfinance auction on @tradeparadigm this week 🎉

💥5% average beats to screen price and competition is 🔥🔥, with 7 different winners across the auctions🥳

Winners:🥇 @QCPCapital 🥇 @GenesisTrading 🥇 @BastionTrading 🥇 Various ANON

We put out daily commentary at the Telegram link below. 👇

http://pdgm.co/cmmntry

Follow all @FTX_Official spread trades on @tradeparadigm 👇

https://pdgm.co/3qmav3n

BTC

ETH

SOL

VOLATILITY PREMIUM

(Sept. 25th, 2022 - BTC IV-RV)

VRP gap closed.

RV is finally picking up some steam!

Note that IV has held steady most of the time (in the chart above) while RV did its own thing - meaning expectation have been steady, regardless of spot gyrations.

Squeeth Weekly Review

This week provided opportunities for traders on both sides of the tape. Spot declines started early with a hopeful bid into turnaround Tuesday, just to have the recovery dream wiped away on the back of the FOMC. ETH closed the week down -8.96%, oSQTH ended the week down -10.4%.

Volatility

Despite the harsh declines, oSQTH presented many opportunities for traders to take advantage of with this week’s range. oSQTH was an expensive way to gain exposure to ETH to begin the week, and quickly became cheap relative to DVOL. Current readings: oSQTH 80.60% IV vs. DVOL 97.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $9.99m. September 21st saw the most volume, with a daily total of $2.12m traded.

Crab Strategy

Crab outperformed ETH spot-markets by 12.42%, to end the week +3.46%, returning 17.4% more ETH to depositors.

Since its inception (July 28th, 2022), Crab has hit a new ATH with returns of +9.61%.

Crab v2 performed 3 hedges this week, equating to 379.45 ETH.

For more information on Squeeth and Crab Strategy, hop in our Discord and ask us questions: https://discord.gg/opyn

Lyra Weekly Review

ETH 7-Day Stats:

Weekly Change:

Trades +1,869

Unique Traders +850

Notional Trades +1.646M

Option Premium +186.684K

Volatility

ETH Implied Volatility has continued lower this week, as some structured products built on Lyra have resumed execution post-merge and arbitragers have picked up on the opportunity to sell higher vols on Lyra. Current ATM IV is sitting at ~92% with the near-term calls being some of the lowest on the board.

Trading

Lyra has seen a massive increase in trading volume and users over the last week. 30-day trading fees for the ETH MMV are ~109K! All trading fees go directly to liquidity providers in Lyra’s MMVs. Along with the increased trading volumes, Lyra has reached a new all-time high in Open interest of over 10K contracts!

ETH Market-Making Vault

The ETH MMV has returned 3.95% since its inception (June 28th, 2022) representing a weekly change of -0.02%. Vault performance had a slight drawdown this week, given that the vault was long delta and short gamma for the sell-off: from near $1400 to $1245.

The 30-day performance is +7.38% annualized. Depositors earn an additional 4.59% rewards APY (boosted up to 9.18% for LYRA Stakers)

Net MMV Exposure:

BTC Market-Making Vault

Lyra’s BTC MMV returns continue to grind higher at 0.659% since its inception (August 16th, 2022). This represents a weekly change of +0.098%.

The 30-day performance is +7.51% annualized. Depositors earn an additional 5.38% rewards APY (boosted up to 10.76% for LYRA Stakers)

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here