Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Weekly EVENTS:

FOMC Rate Decision: Wednesday 2pm ET

THE BIG PICTURE THEMES:

Last week, we had a CPI # that’s surprised to the upside. Core CPI rose 0.6% (M/M). All measures of the CPI number were above their median forecast.

This CPI number was being closely watched by traders to gauge whether inflation is truly structural or merely transitory.

An upside surprise hurt the “transitory” argument and will likely help push the FOMC towards continued hawkishness.

World economies are starting to worry about dollar strength and some expect a Fed pivot.

I don’t think we’re there yet. The Fed has TWO mandates only. World economies dollar-denominated debt isn’t a mandate.

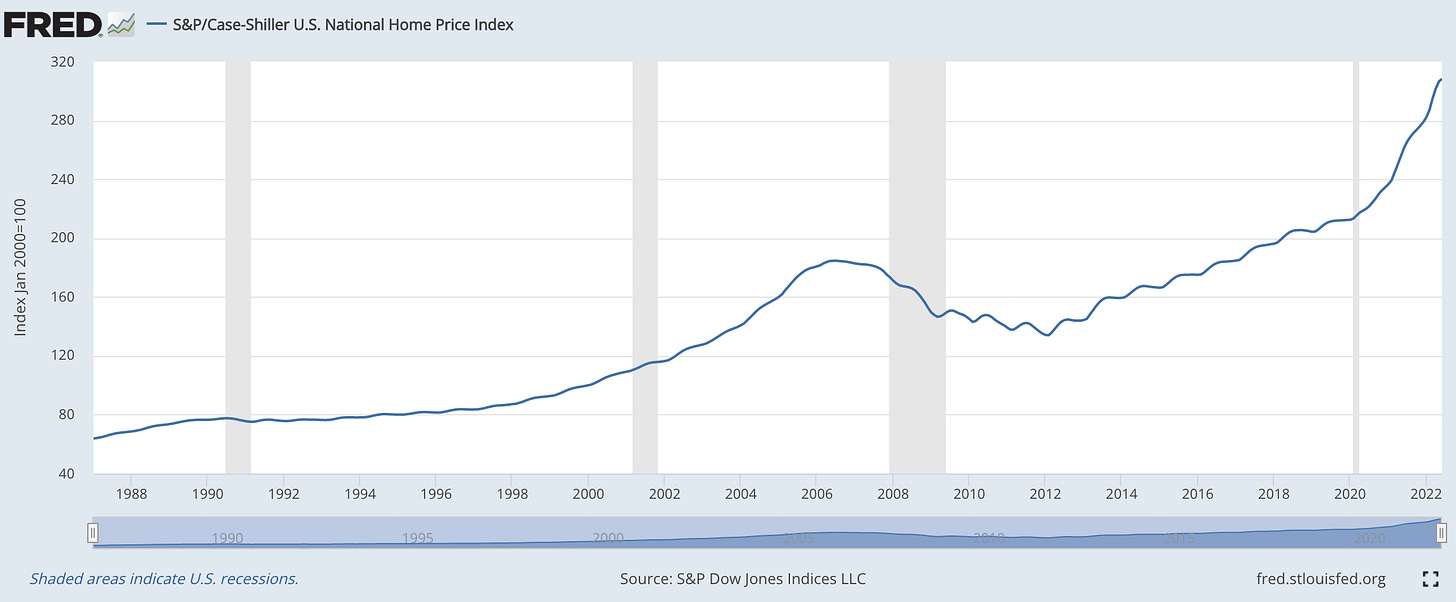

This is the US housing market… Since 2012, house prices have increased 229% nationally. That’s not really a good thing!

I expect the Fed to remain hawkish… A 1% rate hike, merely an extra 25bps, is a “cheap” way to surprise the markets and show some backbone.

I think risk-assets trade weak into FOMC.

Implied volatilities rise.

A decent trade is to be long vol. short-delta… from now until pre-FOMC announcement release.

Crypto:

The ETH 2.0 merge had a massive IV rally going into the event… Yet the event was truly a non-event from a price perspective… I almost say, literally 0 RV.

That said, ETH and the rest of the crypto-complex was brought lower as risk assets softened.

BTC: $19,500 -9.96%

ETH :$1,346 -23.21%

SOL: $31.39 -9.70%

SSVI/S3 (click for more info) Deribit Fitting

BTC - Mark Price SSVI/S3 (Normalized Strike)

BTC - Mark Price SSVI/S3 (Strike)

ETH - Mark Price SSVI/S3 (Normalized Strike)

ETH - Mark Price SSVI/S3 (Strike)

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

ETH - (180-days w/ spot line chart)

DVol moved a lot lower this week for ETH, after the merge non-event. 30-day options lost about 15 IV points in ETH, while BTC’s DVol also dropped a bit at the same time.

Going forward, bearish spot activity or an FOMC rate “shock” are the likely candidates for higher vol.

TERM STRUCTURE

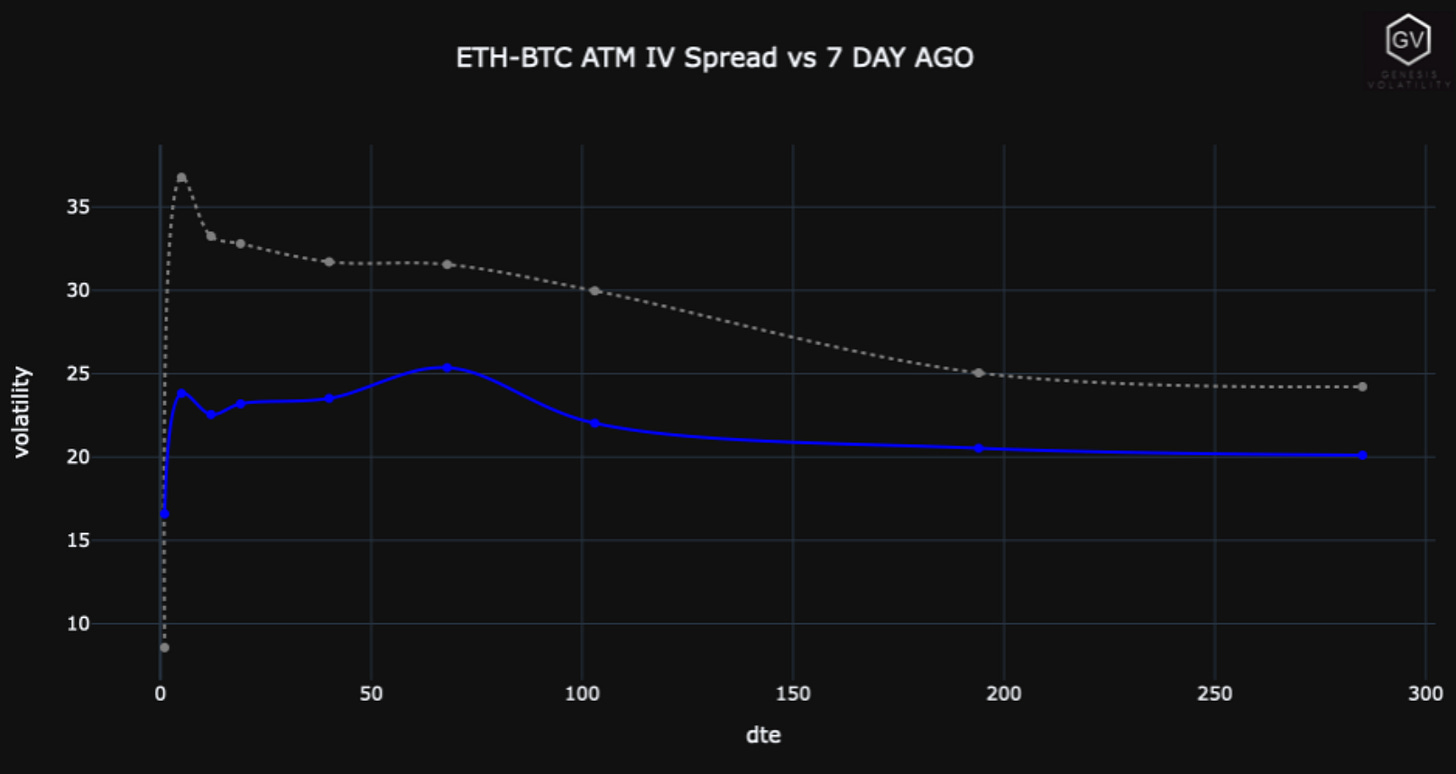

All the term-structures dropped into Contango.

The ETH-BTC IV spread dropped across the term-structure as well.

The BTC IV drop this week is the most surprising because spot prices did swing a lot during the week ($3k range / 13.35%) which shows that traders had priced “Some” ETH vol-event IV into BTC as well.

The relative volatility between BTC & ETH remains large but I could see a scenario where crypto and risk-assets “sell-off” but an increased appetite for ETH offsets its downside “beta”. (something like that).

SKEWS

(SEPT.18th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(SEPT.18th, 2022 - ETH RR SKEW (C-P) ∆25 - Deribit)

What’s interesting here is the outlier RR-skew that BTC displayed in the weekly options, versus ETH from 9/9 to 9/13.

Traders positioned themselves heavily long-calls going into the CPI number, hoping for a “transitory” narrative.

This was only the second time that BTC RR-Skew hit positive levels this year…

In ETH, we see that the lack of a spot price rally post-merge caused weekly skew to quickly drop lower, but that move was short-lived.

Overall, RR-skew is back within recent ranges - potentially providing some FOMC “shock” hedging opportunity.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

Week marked by CPI data and the Ethereum merge.

Initially, with BTC and ETH stably above the threshold levels of $20k/$1.6k, the participants tried to anticipate a positive release for Tuesday.

The negative number and the subsequent price action dictated some short-term protection on September, and the focus turned to the expected merge. No interest on the part of LPs to increase negative-gamma-inventories, resulting in IV remaining firmly high until the “no event” - with a sudden unwind in the immediately following hours.

Bitcoin trades: bought put ratio $17k-$15k 30SEP, bought calls $20.5k/$23k 23SEP, bought call $25k 30SEP, bought call $36k MAR23, bought calls $40k/$45k JUN23, RR -$24k+$18k 28OCT

Ethereum trades: bought call $6k MAR23, sold call spread $3.5k/$4k 30DEC, sol call spread $4.5k/$5.5k MAR23

There does not seem to be a new narrative on the horizon that can support the market and in this situation, the macro context will continue to dominate the flow.

(12th - 18th Sep, 2022 - BTC GVOL Gravity charts)

(12th - 18th Sep, 2022 - ETH GVOL Gravity charts)

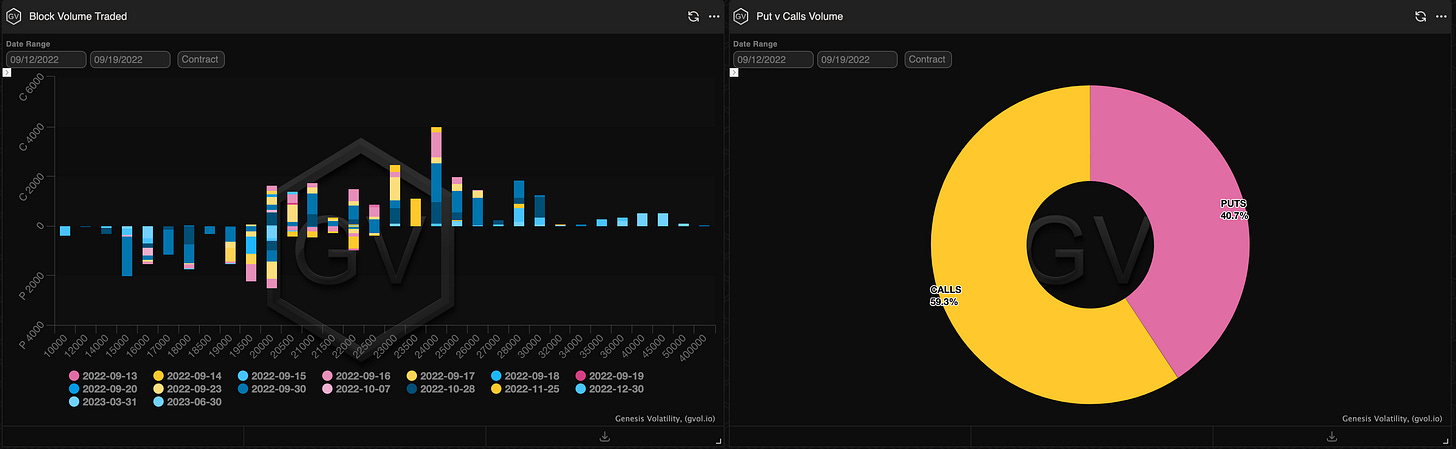

Paradigm Block Insights (12th Sept – 18th Sept)

Dramatic spot down / vol down action in ETH with 1M ATMs trading from 110v to 90v.

While quite an extreme vol reset, given ETH -15% post-merge, 1M ATM of 110v traded ~30v over 7D realized before the event!

These parameters now trading roughly in-line.

BTC Flows

Large buyer of short-dated BTC calls leading into CPI.

Safe to say, the market was surprised by the hawkish print and these options expired worthless.

950x 14Sep 23500 Call bot

760x 16Sep 24000 Call bot

We continue to see outright interest in June, as vols reset lower post-merge.

There seems to be a persistent bid for June outright vega when implieds approach high 60s / low 70s.

500x 30Jun 40000 Call bot

500x 30Jun 45000 Call bot

ETH Flows

Signs of loss of conviction? Post-merge call spread unwinds after the disappointing spot reaction. 📉

20000x 30Dec 3500/4000 Call Spread sold

16491x 30Sep 2500/3000 Call Spread sold

14000x 16Sep 1800/2000 Call Spread sold

10000x 31Mar 4500/5500 Call Spread sold

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

BTC

ETH

SOL

VOLATILITY PREMIUM

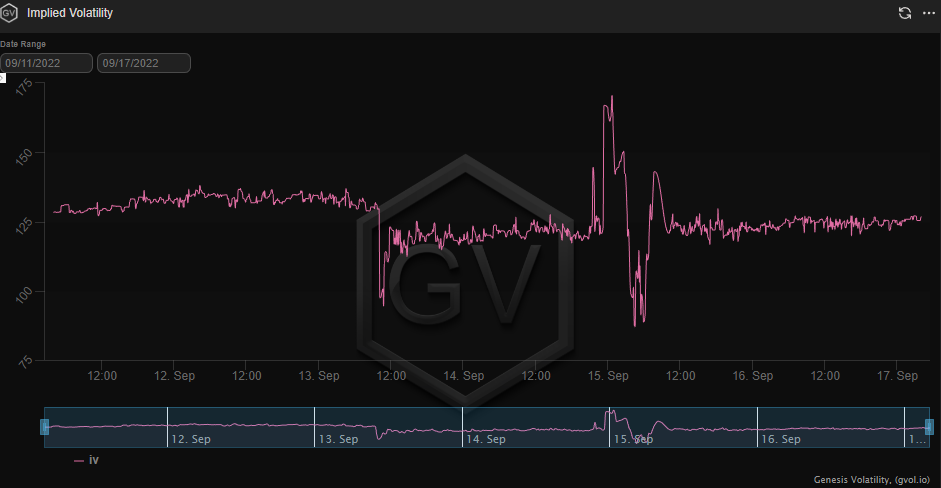

(Sept. 18th, 2022 - ETH IV-RV)

This week, looking at the ETH VRP, we see how much traders overpaid for ETH IV.

At the peak (Flag #A), IV was 141% versus 82% RV… nearly 60-points of VRP.

There are two big themes here to glean.

Option markets are paying attention. Traders are looking to price “vol-events”… This isn’t apathy!

Because crypto vol. is such a young space, the market is still figuring out what constitutes a true “Vol-event”. Sharp traders can find REAL EDGE in this market.

Squeeth Weekly Review

One of the most anticipated weeks in ETH history has come and gone, and what a week it was! While the returns were less than optimal, this week provided traders with very interesting ways to approach the volatility markets. ETH ended the week down -17.79%, with oSQTH down -35.2%.

Volatility

With the anticipation of the merge, markets priced-in the risk factor early in the week. oSQTH saw a slow IV bid from the beginning of last week, starting the week with around 127 IV and seeing as high as 160% into the event. oSQTH remains a great place to be a seller of vol in ETH relative to DVOL.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $11.72m. September 14th saw the most volume, with a daily total of $2.71m traded.

Crab Strategy

Crab bounced back after last week’s struggles, to trade back to its highs of roughly +7.33% since inception (July 28th, 2022). Intra-week swings in oSQTH IV lead to PnL swings in the strategy.

During the dates of 9/11 - 9/15 Crab has acquired 23% more ETH for depositors.

Crab v2 performed multiple hedges this week equating to 459.19 ETH.

Lyra Weekly Review

ETH 7-Day Stats:

Weekly Change:

Trades +361

Unique Traders +105

Notional Trades +10.268M

Option Premium +229.488K

Volatility

ETH Implied Volatility had a massive decline on a relatively uneventful merge. Current ATM IV is sitting at ~105% with the near-term options seeing the most significant decline. Lyra continues to have some of the highest IVs in the defi options space.

Trading

30-day trading fees for the ETH MMV just broke 100K! All trading fees go directly to liquidity providers in Lyra’s MMVs.

ETH Market-Making Vault

The ETH MMV has returned 3.97% since its inception (June 28th, 2022) representing a weekly change of +0.17%. Vault performance has been consistently grinding higher generating market-neutral returns for LPs despite volatile market conditions.

The 30-day performance is +6.03% annualized. Depositors earn an additional 5.61% rewards APY (boosted up to 11.22% for LYRA Stakers)

Net MMV Exposure:

The ETH vault has flipped to net long vega this week, from short ~$2,500 in the post-merge IV purge.

BTC Market-Making Vault

Lyra’s BTC MMV has returned 0.561% since its inception (August 16th, 2022). This represents a weekly change of +0.043%.

The 30-day performance is +6.7% annualized. Depositors earn an additional 6.48% rewards APY (boosted up to 12.96% for LYRA Stakers)

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here