Crypto Options Analytics, Sept. 11th, 2022

Deribit, SSVI Fits, Paradigm Block, Opyn Squeeth, LYRA

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Weekly EVENTS:

Tuesday CPI 8:30am ET

THE BIG PICTURE THEMES:

The bearish theme I was so sure about last week played on great on Tuesday… only to be annihilated the rest of the week, with a massive relief rally.

Hopefully shorts were able to cover some of their positions Tuesday.

Wednesday, the Fed released the Beige Book and there was some “softness” in the economy that suggests the Fed might be less hawkish.

The Fed remains hawkish however and another 75bps hike is expected at the next FOMC.

Let’s see how CPI come in this week… This rally may defy macro fundamentals if it’s positioning related.

Crypto:

Like the rest of the risk complex, cryptos saw a massive rally this week and crypto vol. went into positive territory for short-term risk-reversals.

BTC: $21,657 +10.14%

ETH :$1,750 +22.21%

SOL: $34.76 +9.41%

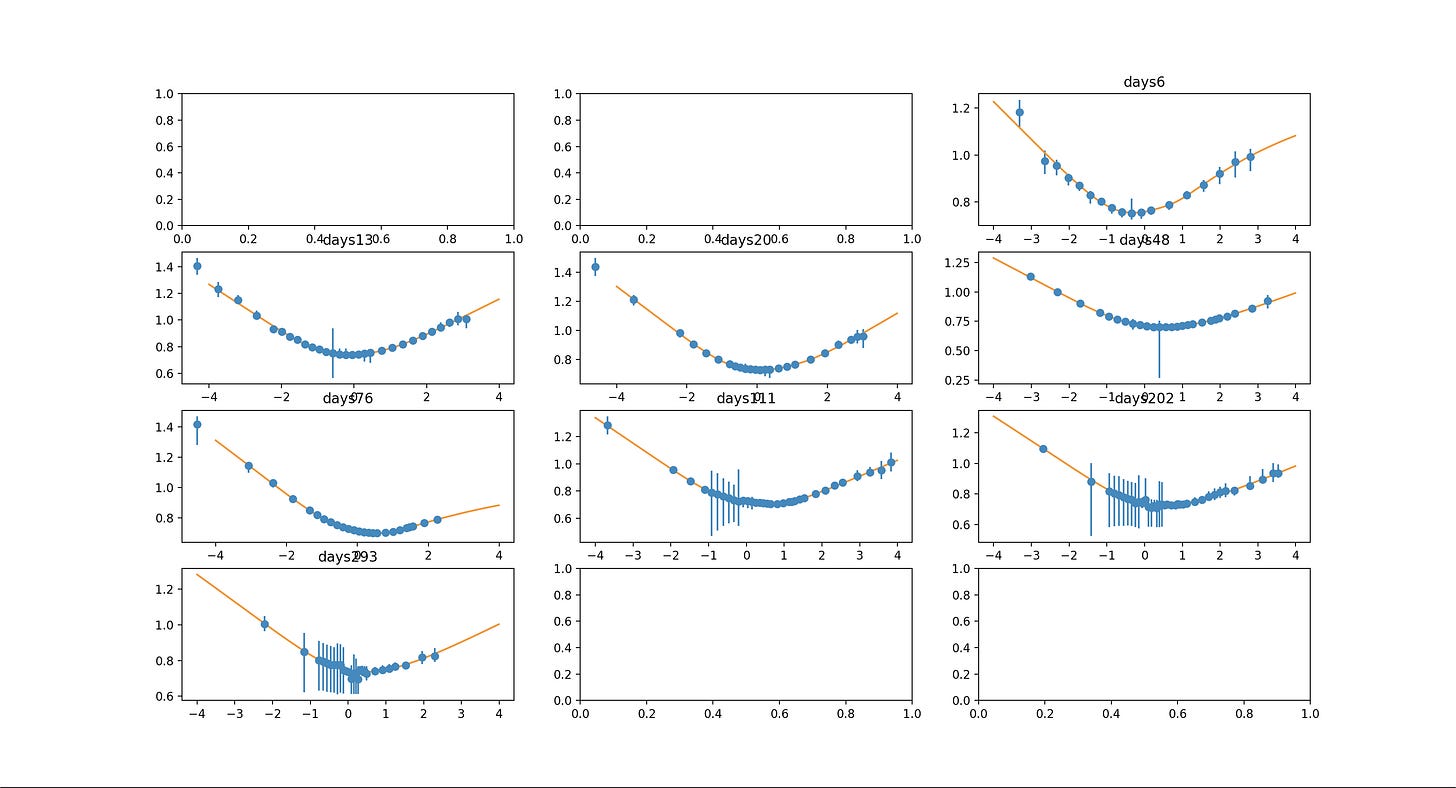

SSVI/S3 (click for more info) Deribit Fitting

BTC - Mark Price SSVI/S3 (Normalized Strike)

BTC - Probability Density Function (Normalized Strike)

ETH - Mark Price SSVI/S3 (Normalized Strike)

ETH - Probability Density Function (Normalized Strike)

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

Spot prices rallied with a viciousness this week and the DVol index barely budged.

The reason we still see DVOL being firm, despite an expected negative correlation between spot/vol, is due to the magnitude of this move.

Notice the nearly 4-std daily return.

This was one of the biggest up-moves in almost 3-years!!

TERM STRUCTURE

(SEP 11th, 2022 - BTC Term Structure - Deribit)

BTC (Term Structure)

ETH (Term Structure)

Term-Structure activity was focused on the front-end, with nearly no changes in longer expirations.

Event-driven plays in ETH are likely still interesting, given the stubborn long-term options.

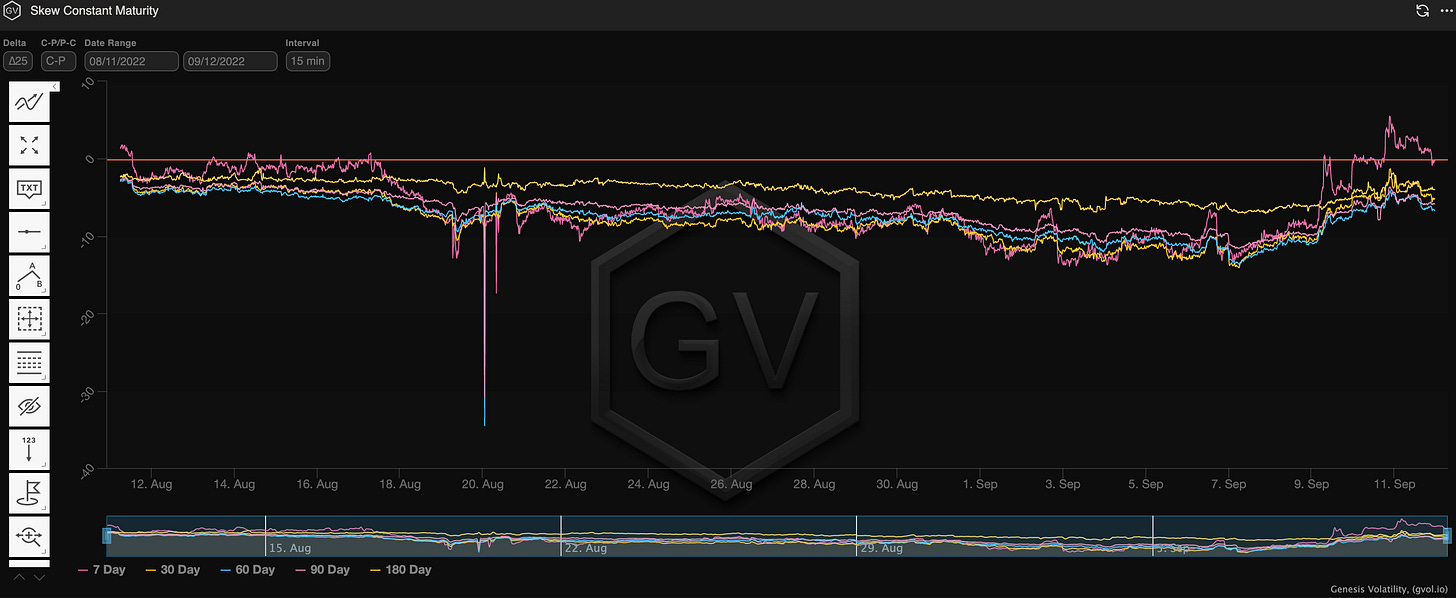

SKEWS

(SEPT.11th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

The week had quite a big swing both ways in BTC spot prices.

Tuesday saw a further meltdown across risk-assets, bringing BTC spot prices to $18.8k - about $1k away from June lows of $17.8k.

Then, we ended the week higher at $21.5k.

That’s a massive swing in both directions, finally paying vol. buyers and pushing up the 7-day RR-skew into positive territory.

Let’s not step in front of any trains, but we finally have a decent opportunity to sell the RR above the 0-line.

We’ve been below the 0-line nearly the entire year!

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

In the previous newsletter we talked about how last Friday’s price action dictated the moods of trades; this Friday after the Bitcoin’s break up, the same thing happened but with opposite signs, and the resulting bullish flow dominated the volumes of the week.

Bitcoin trades: buy 30SEP $25k call, long calendar 30SEP/28OCT +$24k/-$28k-$29k call, buy 30SEP $24k call, buy JUN23 $40k/$45k/$50k call, buy 16SEP $23k call (on screen).

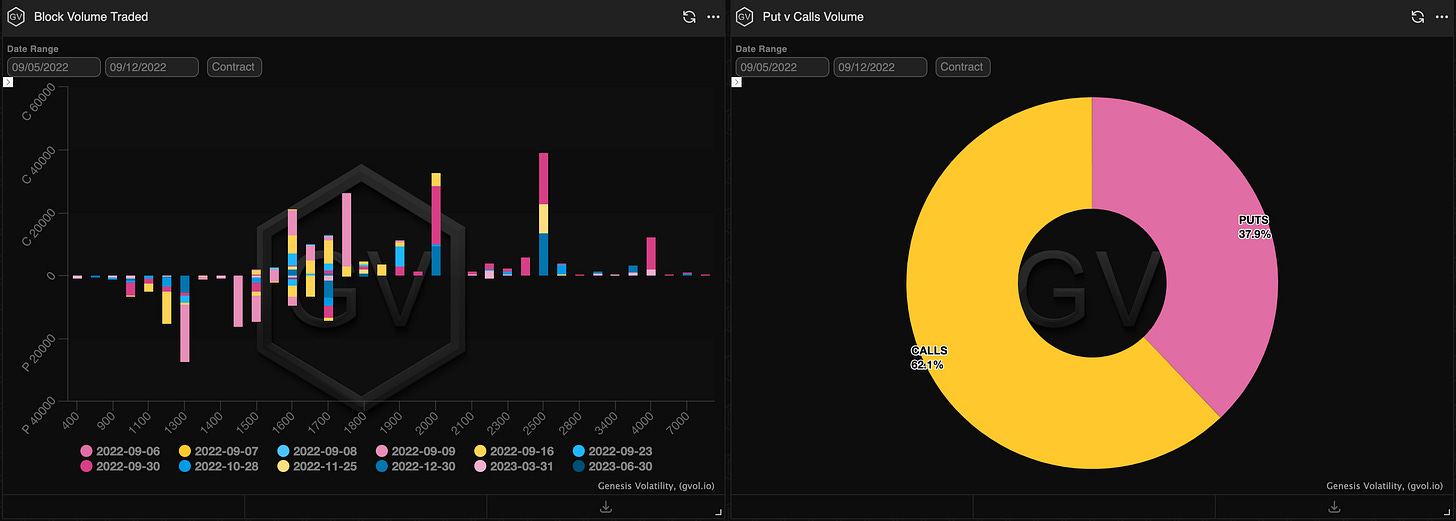

Ethereum trades: sell 16SEP $1.2k put, long 30SEP $2.5k/$4.0 call spread, short 30DEC $2.0k/$2.5k call spread, buy 25NOV $2.5k call, sell 30SEP $2.0 call, short straddle 23SEP $1.6k

If for Bitcoin we report the prevalence of directional trades, on Ethereum we begin to see the first profit-taking and delta neutral trades to anticipate the unwind of post-merge positions and possibly exploiting anomalies in the volatility curves (e.g. December).

This week will be to be followed carefully.

(5th - 11th Sep, 2022 - BTC GVOL Gravity charts)

(5th - 11th Sep, 2022 - ETH GVOL Gravity charts)

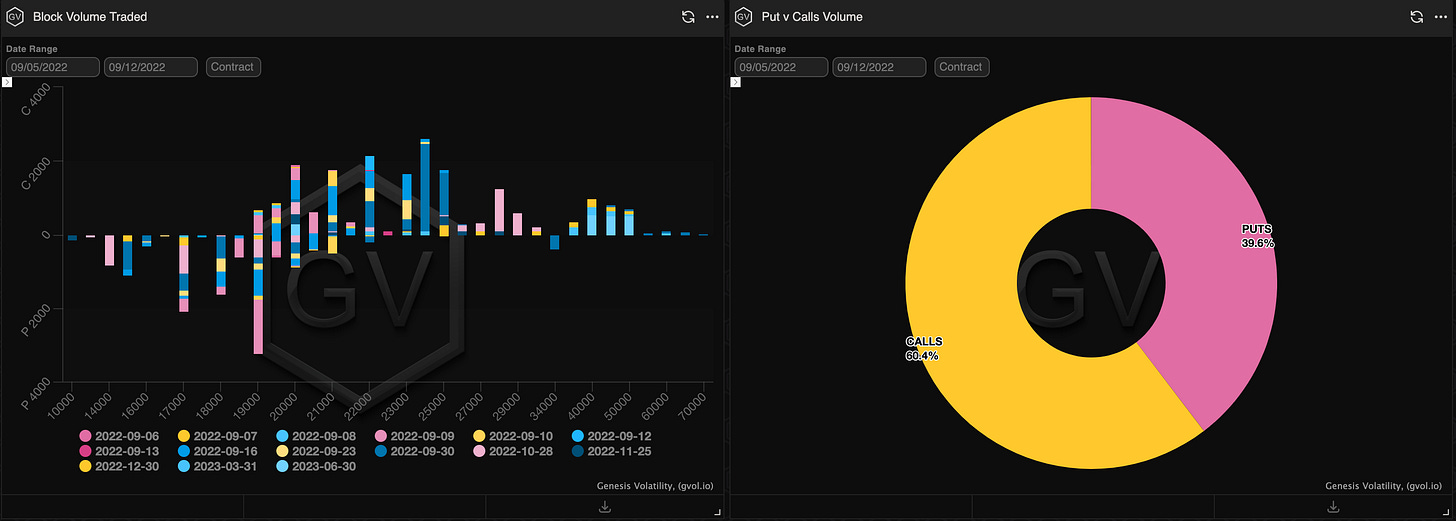

Paradigm Block Insights (5th Sept – 11th Sept)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

BTC

ETH

SOL

VOLATILITY PREMIUM

(Sept. 11th, 2022 - BTC IV-RV)

Given the massive rally (nearly 4 STD daily return) seen at the end of the week, BTC option IV has climbed higher, along with RV and RR-skew.

Goldman Sachs currently believes the risk-asset pain trade is for higher prices.

Squeeth Weekly Review

With the expected merge date around the corner, this week did not disappoint traders. ETH spot markets found a bid shortly after early weakness to end the week +12.3%. oSQTH ended the week +30%.

Volatility

While the market continues to price-in the risks of the upcoming merge, vol remained bid. oSQTH became an expensive alternative for ETH exposure this week, with IV (at the time of writing 132%) to ETH DVOL reading of 113.05. This should set up a unique trading environment after the dust settles.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $9.05m. September 9th saw the most volume, with a daily total of $2.33m traded.

Crab Strategy

Crab struggled this week to close the week -2.83%.

Crab performed its biggest hedge to date on September 9th, equating to a USD value of roughly $561,000 at the time. Multiple participants offered to the vault shown below.

For more on the Crab auction history, check out: https://www.squeethportal.xyz/auctionHistory

Lyra Weekly Review

ETH 7-Day Stats:

Volatility

ETH Implied Volatility continues to rise as traders position themselves for the Merge - with current ATM IV sitting at ~125%. Lyra continues to have some of the highest observed IV in the Defi option space, particularly in OTM options.

Trading

You can now earn token rewards for trading on Lyra:

Trading Rewards - 20% reward on all trading fees, up to 60% rewards when you stake your LYRA

Trading The Merge Competition: 30,000 $OP ($34,200) in prizes!!

Short Collateral Rewards: Receive an extra $.10-$.20 per contract per day on short-option positions. Sept 16th: + $.70 - $1.40 Oct 28th: + $4.90 - $9.80

ETH Market-Making Vault Strategy

Lyra’s MMV has returned 3.80% since its inception (June 28th, 2022). This is in addition to the current 6.64% rewards APY (up to 13.28% for LYRA Stakers) Lyra LPs receive in stkLYRA and OP incentives.

Net MMV Exposure:

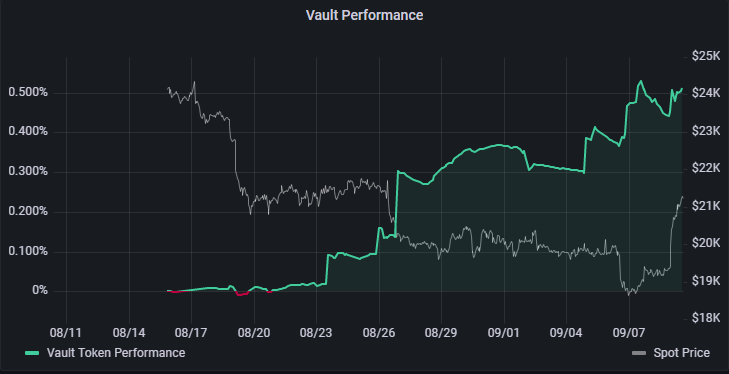

BTC Market-Making Vault Strategy

Lyra’s MMV has returned 0.518% since its inception (August 16th, 2022) in addition to the current 6.92% rewards APY (up to 13.84% for LYRA Stakers) Lyra LPs receive.

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol geek out about options here

*** Lyra will be paused for trading 14 hours prior to the expected merge block