Crypto Options Analytics, October 31st, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

LIVE October 18th, 2021

GVol has officially integrated with Deribit via the new Deribit UI.

Check out the awesome new Deribit upgrades! We’re excited to be part of the picture.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$60,266

DVOL: Deribit’s volatility index

(1 month, hourly)

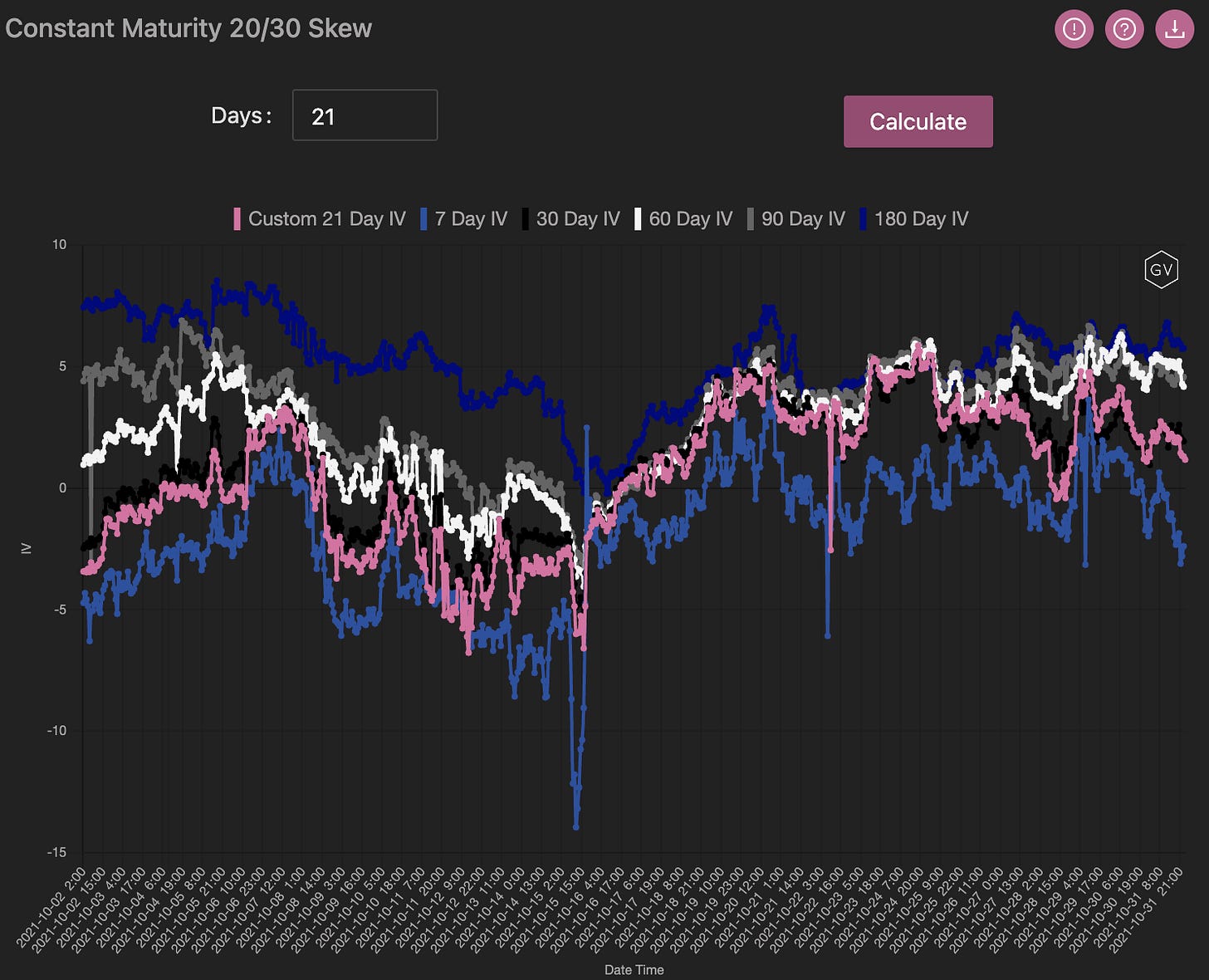

SKEWS

(Oct. 31st, 2021 - Short-term and Medium-term BTC Skews - Deribit)

Bitcoin spot prices have lost momentum, at least temporarily.

As BTC backs off the ATH the volatility space has reacted by softening a well.

BTC skews have dipped lower for short-term maturities while longer maturities remain mostly unchanged compared to last week.

(Oct. 31st, 2021 - Long-Dated BTC Skews - Deribit)

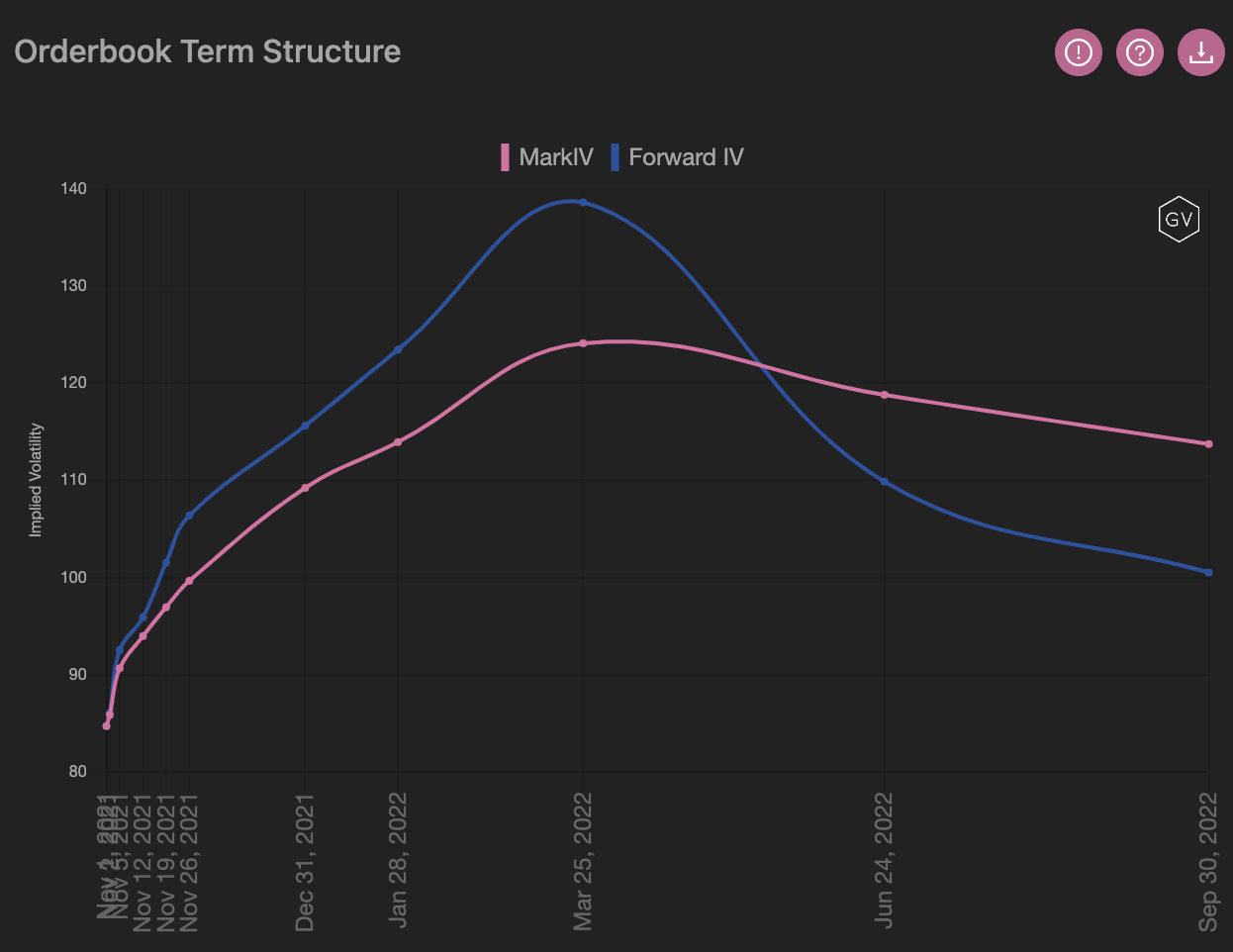

TERM STRUCTURE

(Oct. 31st, 2021 - BTC’s Term Structure - Deribit)

The term structure remains rather steep and continues to hold a Contango shape punctuated by March 2022.

March forward vol is nearly 10pts higher than any other expiration, while anything beyond March is flat on the curve.

ATM/SKEW

(Oct. 31st, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has held rather consistent this week.

SKEW (right) highlights much of the softening for BTC vol. coming from skew losing steam and retracing down to par.

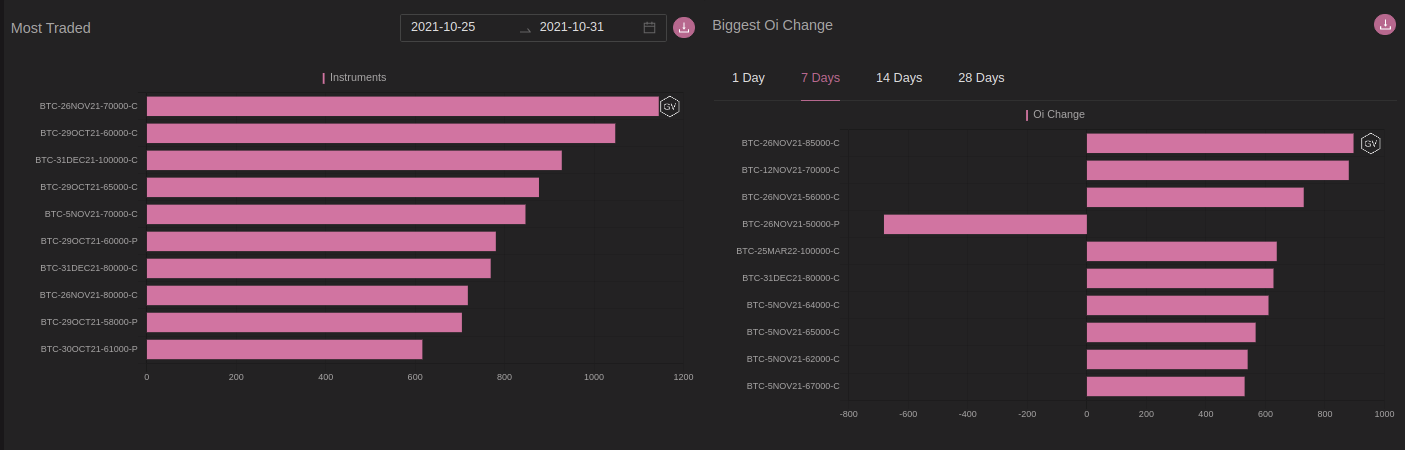

Open Interest - @fb_gravitysucks

On Friday we saw a moderate monthly expiry (delivery price of $60,544) with around 51k contracts expiring.

This was not a monthly historical record for options traders on Deribit.

“Max-Pleasure” went to $45k-$50k calls holders but around 70% of contracts expired worthless.

(Oct 29th, 2021 – BTC Weekly expiration - Deribit)

Now that October has cleared, the open interest profile shows the greatness of the December expiry.

EOY will start to influence traders’ behaviour, and attention will shift from monthly to yearly in my opinion.

Current set-up displays a clear call preference with $70k and $100k strikes.

(Oct 31st, 2021 – BTC Open Interest profile – Deribit)

As expected monthly expiration catalyzed traders’ views with no big trade to highlight for the week. Persistence was found on $70k calls.

(Oct 25th - 31st, 2021 – BTC Change in OI – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

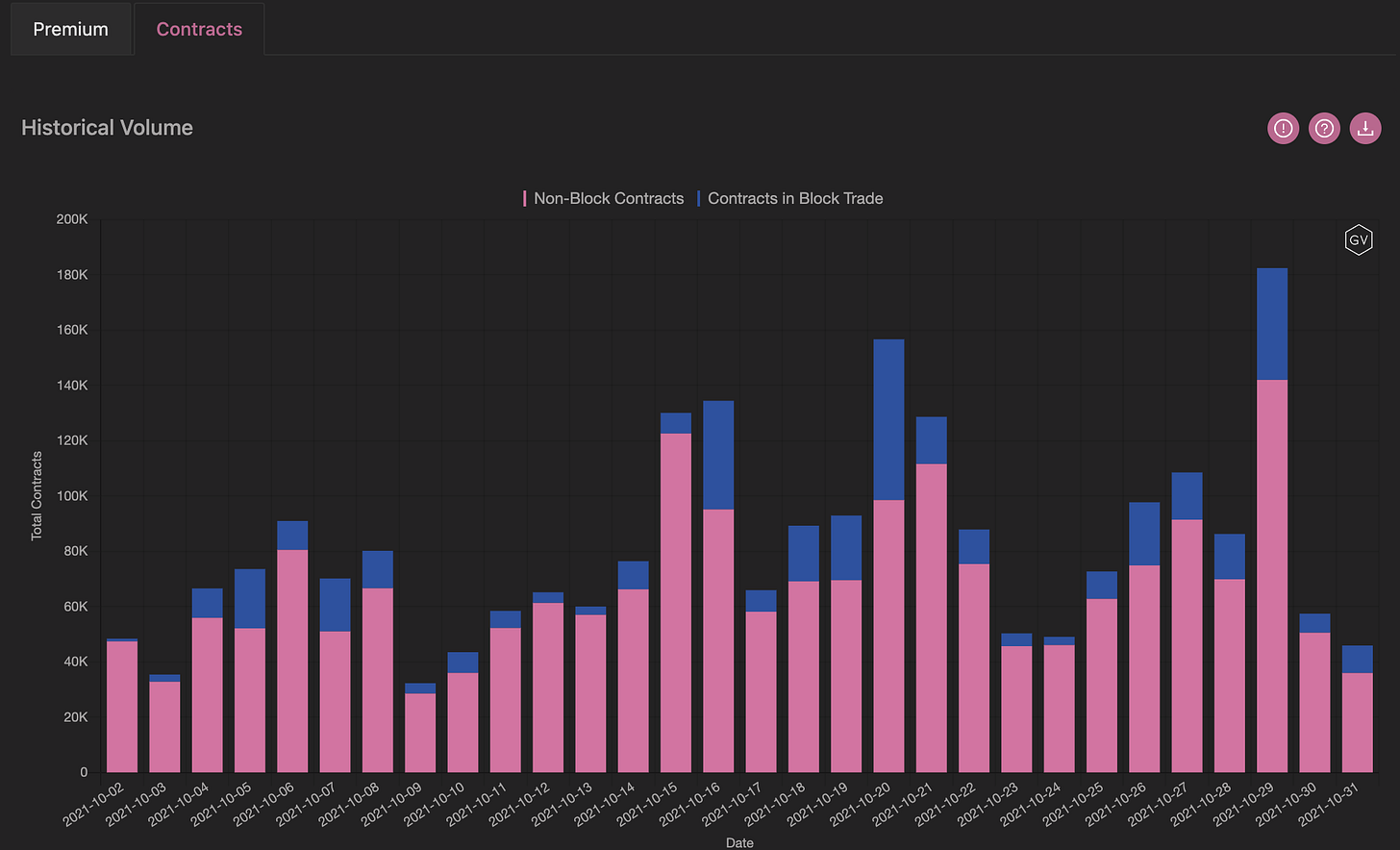

VOLUME

(Oct. 31st, 2021 - BTC Premium Traded - Deribit)

(Oct. 31st, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (25 Oct. - 31 Oct.) - Patrick Chu

In BTC this week, we saw strong interest for both calls and puts on the 60k strike as more than 2k contracts traded making it the most popular expiry of the week.

(Oct. 25th - Oct. 31st - Volume Profile - Deribit & Paradigm)

Similarly to last week, we continued to see two distinct groups of activity dominate:

(1) outright & spread interest in calls covering a range between 70k to 120k

(2) downside protection via <1 month outrights with strikes between 50k to 56k being popular.

(Oct. 25th - Oct. 31st - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 31st, 2021 - BTC’s Volatility Cone)

RV heads into this week from and even lower point.

Given that spot prices are nearly identical today to this time last week, it’s no surprise to see RV now solidly below the 25th percentile for short & medium measurement windows.

REALIZED & IMPLIED

(Oct. 31st, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The IV to RV divergence continues.

Option flow continues to be strong given fundamental developments and year-end narratives, continuing the decoupling from RV.

$4,239

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 31st, 2021 - ETH’s Skews - Deribit)

ETH spot prices were relatively strong this past week.

Despite and unchanged BTC price, ETH was able to test ATH’s and close the week around +5%.

Most option skews remain firmly positive after the parallel shift higher seen last week.

Short-term skews, the exception, dropped to par as ETH backed off its ATH.

(Oct. 31st, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Oct. 31st, 2021 - ETH’s Term Structure - Deribit)

The ETH term structure continues to be very steep.

The spread between the front-end and March 2022 is nearly 35pts!!

March 2022 stands out as particularly expensive volatility on the forward, even more so for ETH than BTC.

There’s strong opportunity here for sellers.

ATM/SKEW

(Oct. 31st, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV was able to hold the higher end of it’s range, while skew slowly dropped lower, for select maturities.

Open Interest - @fb_gravitysucks

This monthly expiration occurred with more than 200k contracts (delivery price $4,307) and payouts were skewed towards calls.

We saw big chunks of calls delivered with profits between the $3k-$4k strikes.

In total, around 77% of total contracts expired worthless.

(Oct 22nd, 2021 – ETH Weekly expiration - Deribit)

The Open Interest profile is on “calls only” mode.

Although this doesn’t express necessary a bullish view, participants are inclined to be exposed to upside convexity (see last newsletter for details).

Different from bitcoin, MAR22 is a more important tenure in ETH with traders betting on a strong Q1 (ETF rumors), as opposed to year-end flows.

(Oct 31st, 2021 – BTC Open Interest profile – Deribit)

Incoming activity for $15k-MAR22-Calls continues but overall there was no heavy flow for the past week.

(Oct 25th - 31st, 2021 – ETH Change in OI – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Oct. 31st, 2021 - ETH’s Premium Traded - Deribit)

(Oct. 31st, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (25 Oct. - 31 Oct.) - Patrick Chu

In ETH this week, IV & Skew remained relatively stable as we retraced after printing a fresh ATH amidst rumors of an ETH ETF making the rounds.

Flows over Paradigm leaned net bullish for ETH with calls & call spreads as the preferred topside expression, although some caution was seen given a good amount of puts in the 3800 to 4100 strike range traded.

(Oct. 25th - Oct. 31st - Volume Profile - Deribit & Paradigm)

Particularly high volumes continued to trade for the Nov21, Dec21, and Mar22 expiries in the form of both outright and call spreads with 5000, 6000 & 10000 being the most popular strikes this week.

(Oct. 25th - Oct. 31st - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 31st, 2021 - ETH’s Volatility Cone)

RV actually held steady compared to last week.

ETH holding above ATH prices could invite sparks back into the market.

REALIZED & IMPLIED

(Oct. 31st, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The IV/RV relationship is holding tighter for ETH than BTC.