Crypto Options Analytics, October 10th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$55,155

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 10th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

While Ethereum spot prices remained relatively stable this week, BTC saw a continued rally higher to $55k.

The enthusiasm around a US Bitcoin ETF approval, which could lead to a series of approvals, has gotten the market excited about BTC again.

This excitement briefly rallied spot, IV, and skew higher together, although most of the option skews remained unchanged on the week, as skews retraced lower going into the the weekend.

Short-dated weekly options are negative, while 30-day options and longer are all in positive territory.

(Oct. 10th, 2021 - Long-Dated BTC Skews - Deribit)

Calls remain the most bid for 25-delta skews in the longest expiration months.

TERM STRUCTURE

(Oct. 10th, 2021 - BTC’s Term Structure - Deribit)

The term structure remains in a relatively steep Contango.

The option market seems to be discounting the potential for a melt-up rally higher, which could materialize on the back of a friendly US regulatory environment.

Short-dated options remain the cheapest, combined with negative call skew.

All this, despite BTC cutting right through $50k and beyond.

Call gamma plays could be interesting here.

ATM/SKEW

(Oct. 10th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) displays a sharp move higher combined with the BTC spot-price rally.

SKEW (right) retraced lower as spot-price activity calmed down.

VOLUME

(Oct. 10th, 2021 - BTC Premium Traded - Deribit)

(Oct. 10th, 2021 - BTC’s Contracts Traded - Deribit)

Overall volumes saw a nice bump higher this week. Especially when considering the option $ premium being blocked on Oct. 6th, 7th, and 8th.

Paradigm Block Insights (4 Oct - 10 Oct) - Patrick Chu

As BTC continued to consolidate above the 52000 level, this week’s trading highlights in BTC included a tug of war between two distinct categories of interest as the 1m skew fluctuated between +3 & -3 while 1m IV remained stable around 82%.

(Oct. 4th - Oct. 10th - Volume Profile - Deribit & Paradigm)

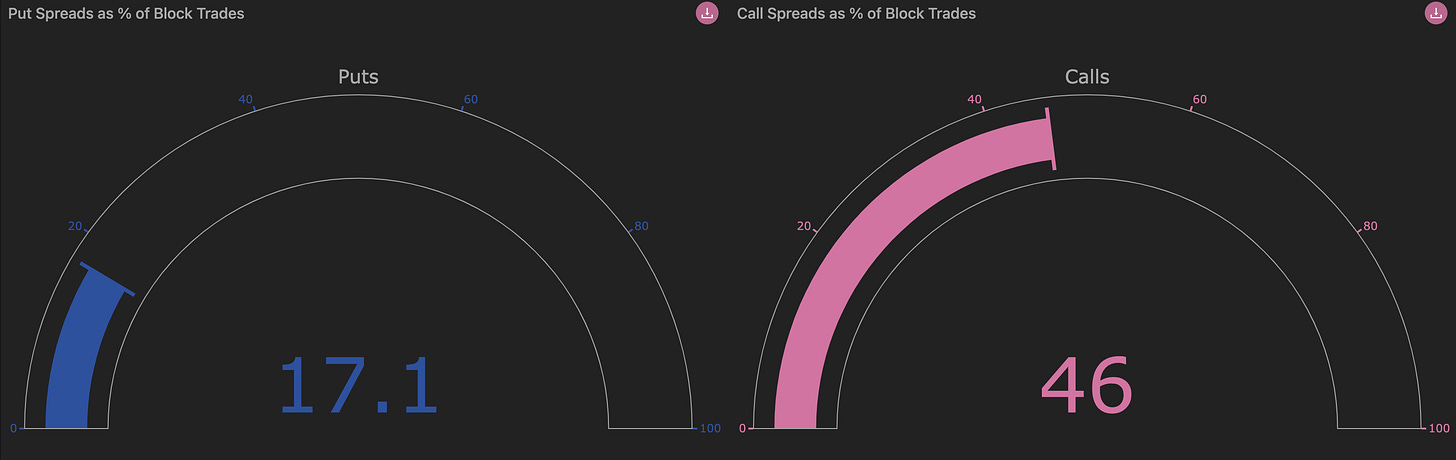

This move in skew was mainly driven first by continued persistent demand for year-end call spreads, with 48k/70k being one of the more popular variants. Call spreads continued to dominate the tape, accounting for 43% of overall volumes for the week.

Later on October 7th, a second group of interest in downside protection for end October, in the form of both outright and put spreads, pushed skew lower. Multiple outright clips of larger than 1000x BTC printed for 22 Oct expiry 46000 & 48000 Puts, and 37% of Deribit market share traded over Paradigm.

(Oct. 4th - Oct. 10th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

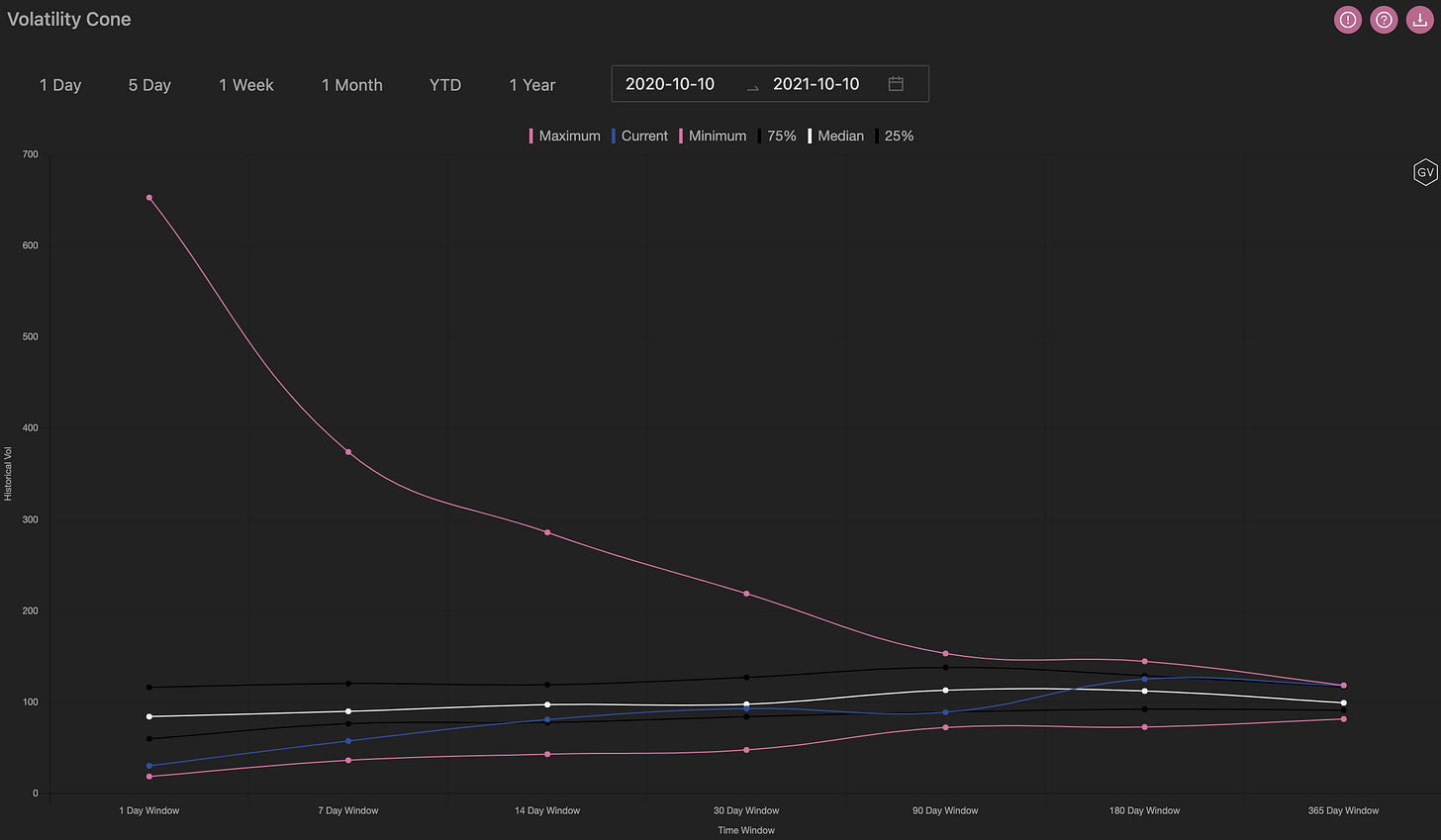

VOLATILITY CONE

(Oct. 10th, 2021 - BTC’s Volatility Cone)

Realized volatility remains stubbornly lower, justifying the current term structure and lower short-term option IV.

That being said, Q4 2020 proved (once again) that crypto prices can move higher with velocity, never looking back.

Therefor Q4 2021 still holds the potential for a melt-up rally.

Although, once again… Ethereum might be the crypto to truly surprise the market… a thesis that wasn’t supported this week.

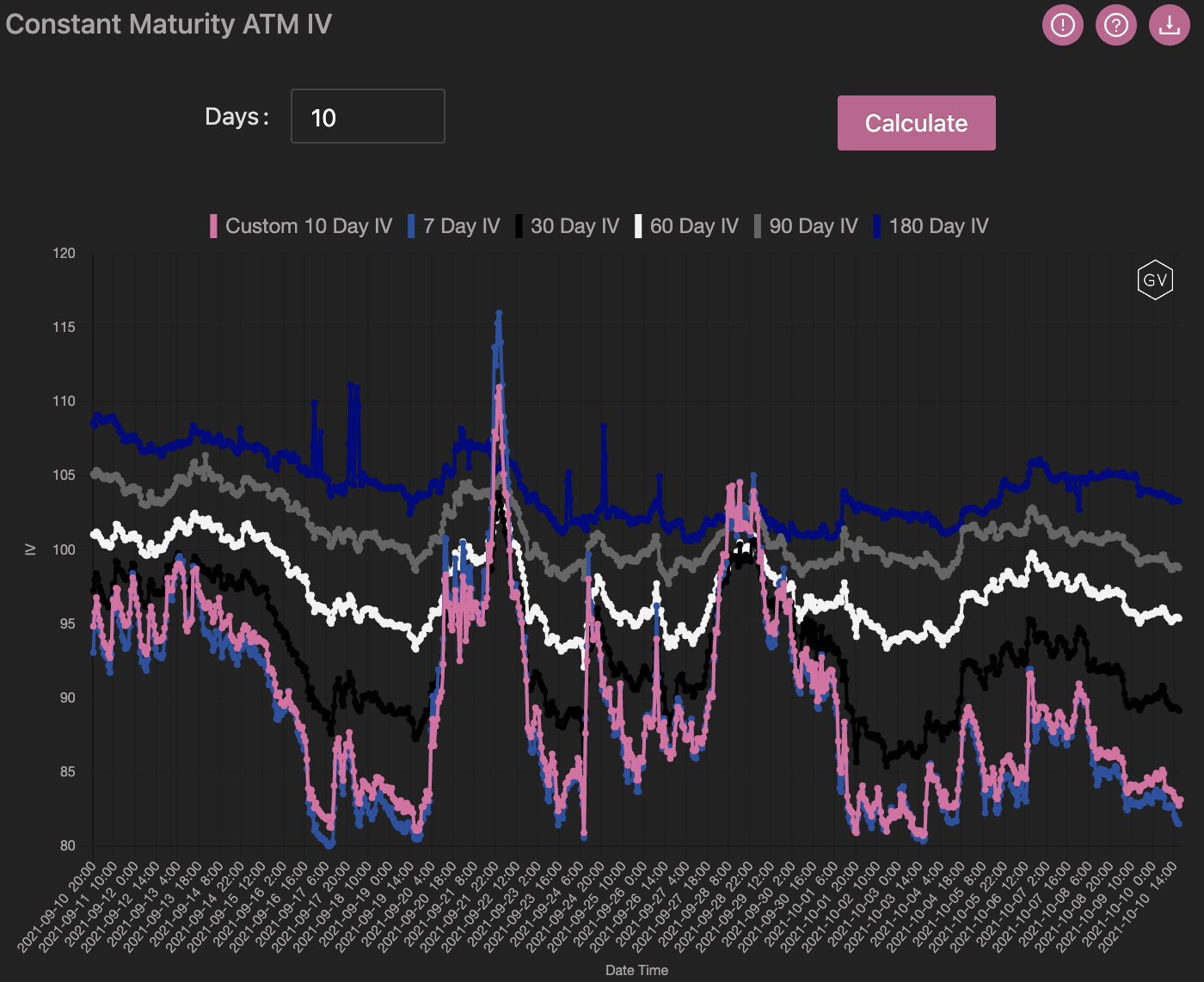

REALIZED & IMPLIED

(Oct. 10th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RV are married together this week and joined at the hip.

Nothing exciting to be said here.

$3,569

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 10th, 2021 - ETH’s Skews - Deribit)

Unlike BTC, ETH has been relatively stable this week, both in terms of spot-prices and volatility structures.

Option skews saw very little variation this week.

Short-dated options and medium-term options (think 30-days or less) remain the most negative, with skews around -5%.

Not until 60-days out do skews hit par.

(Oct. 10th, 2021 - ETH’s Skews - Deribit)

As usual, longer dated options remain the most positive with 180-day skews hovering around +5%.

TERM STRUCTURE

(Oct. 10th, 2021 - ETH’s Term Structure - Deribit)

The ETH term structure remains rather steep, with only a brief (and dismal) flattening attempt early in the week.

Again, we can’t help but think Ethereum holds the most potential for “upside” surprises as corporate balance sheet allocations and flippening narratives are potential to materialize.

ATM/SKEW

(Oct. 10th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) nearly gave back all gains seen early in the week. This is to be expected given that ETH spot prices are nearly unchanged versus this time last week.

SKEW (right) displays a more positive and rosier picture as a steady climb higher to par materialized this week for selected expirations.

VOLUME

(Oct. 10th, 2021 - ETH’s Premium Traded - Deribit)

(Oct. 10th, 2021 - ETH’s Contracts Traded - Deribit)

Overall volumes in the ETH landscape were…. average.

Nothing special to write home about.

That being said, some interesting - and quite positive- flows were seen in block trades this week.

Paradigm Block Insights (27 Sep - 3 Oct) - Patrick Chu

For ETH, we saw the exact opposite of last week as pessimism was replaced with optimism. Call activity dominated the tape with 90% of overall volumes and call spreads & flies accounting for almost 50% of overall volumes.

Call calendars were also of interest with rotations between the Dec 21 & Mar 22 contracts attracting a lot of attention with 5000, 6000 & 7000 being the most traded strikes for the week.

(Oct. 4th - Oct. 10th - Volume Profile - Deribit & Paradigm)

(Oct. 4th - Oct. 10th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 10th, 2021 - ETH’s Volatility Cone)

Realized volatility is LOW!

7-day RV is significantly below the 25th percentile, while longer measurement windows are nearly on the 25th percentile right through to the 90-day measurement.

REALIZED & IMPLIED

(Oct. 10th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Notice both RV and IV heading lower together.

RV is leading the way lower, especially given this stable “you can hear a pin-drop” week in spot prices.

Buying vol. here is a trend fade but as expressed above we can’t help but think ETH holds the potential for surprise catalysts.