Crypto Options Analytics, October 17th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

LIVE October 18th, 2021

GVol has officially integrated with Deribit via the new Deribit UI.

Check out the awesome new Deribit upgrades! We’re excited to be part of the picture.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$60,866

DVOL: Deribit’s volatility index

(1 month, hourly)

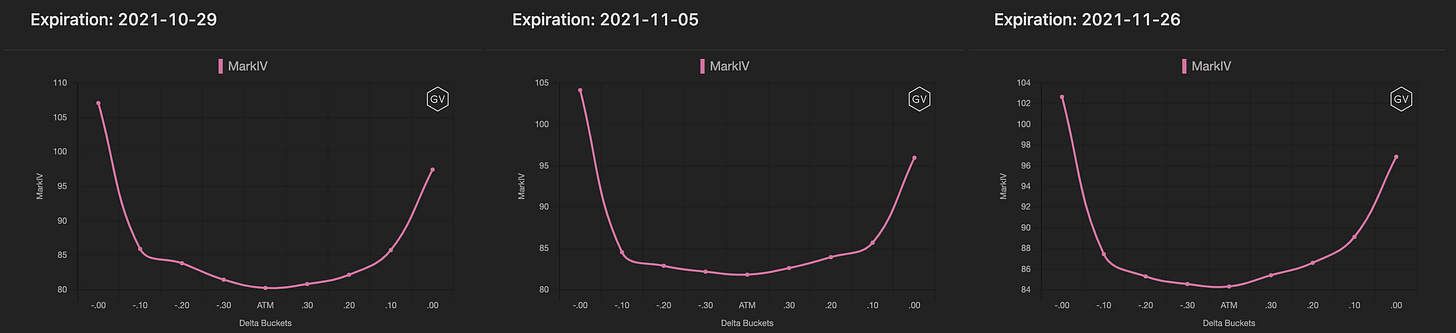

SKEWS

(Oct. 17th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

BTC spot prices rallied another +$5k this week, trading as high as $62k. The continued catalyst for this move has been the continuous drip of optimistic BTC ETF approval data throughout the week.

A Nasdaq approval, followed by a telling SEC tweet, finally culminated this weekend with an approval (or non-disapproval).

Although spot prices moved smoothly higher, option vols saw fireworks.

While short-dated vol. levels exploded, higher option skews moved lower.

We saw heavy $60k strike trading cause the skew to become very negative late in the week, as traders hedged BTC spot gains, only to later find skew near unchanged.

(Oct. 17th, 2021 - Long-Dated BTC Skews - Deribit)

Short-dated options moved the most, although long-dated options reacted as well.

We even saw skews for all maturities briefly meet near par for a quick “get-together”, before all moving higher over the weekend.

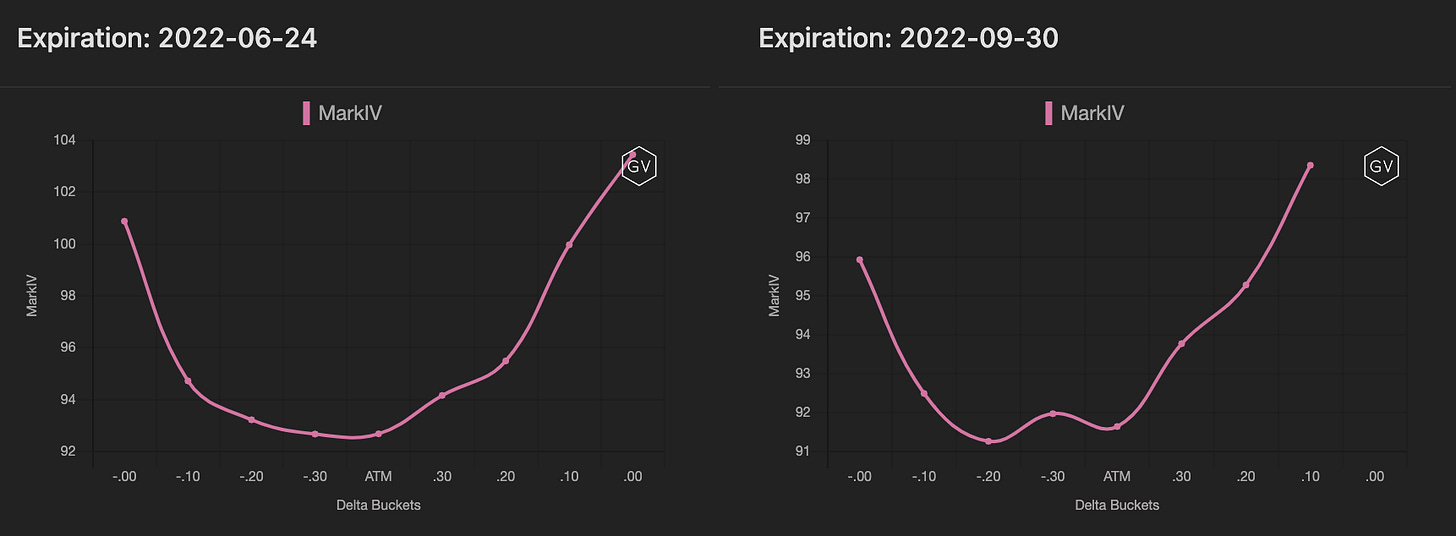

TERM STRUCTURE

(Oct. 17th, 2021 - BTC’s Term Structure - Deribit)

The term structure finally repriced higher and jumped briefly into Backwardation.

This week was marked with heavy trading activity in the $60k strikes. Vol squeezed higher as $400k of short-term paper went through the screens at 196% implied vol.

This peak vol heavily outpaced anything going on in the realized space.

Now that the decision event is behind us, the IV term structure has resumed a Contango shape, although not nearly as steep.

ATM/SKEW

(Oct. 17th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) completely squeezed higher this week, peaking nearly +30points compared to last week.

SKEW (right) gave traders a nice opportunity late in the week, as it dipped heavily to about -6% only to retrace back to par. This ETF catalyst could be a catalyst for skew to become more positive as the possibility of a Q4 EOY rally materializes.

VOLUME

(Oct. 17th, 2021 - BTC Premium Traded - Deribit)

(Oct. 17th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (11 Oct. - 17 Oct.) - Patrick Chu

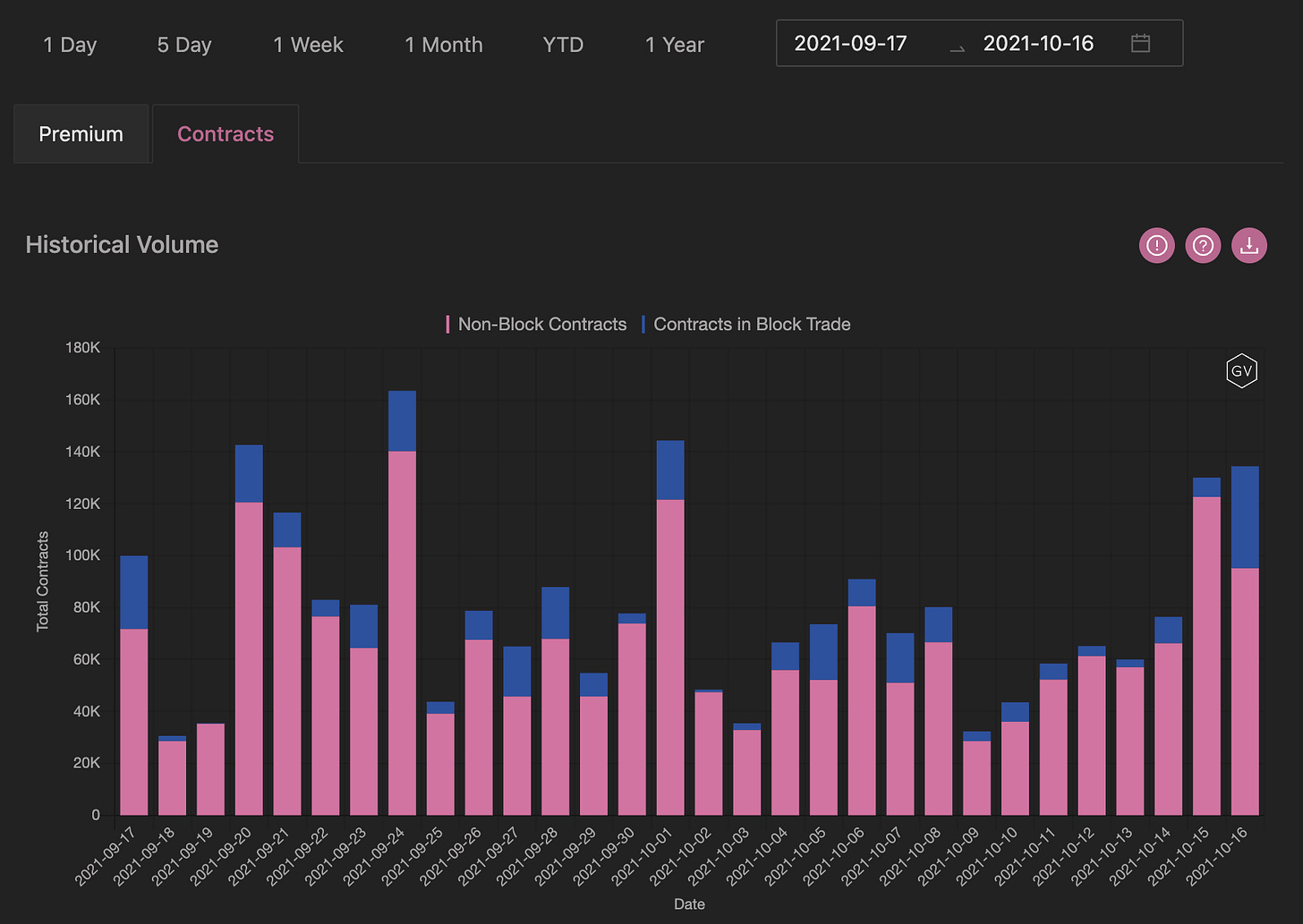

BTC grinded higher throughout the week, breaking above both the 56k & 58k resistances & posting a high above 62k as the market continued to digest the approval of the first US based ETFs. With this move came an uptick in option interest as global weekly volumes surged to the highest since May.

On October 16th, we surpassed the 1B threshold for total daily volumes with 950M of it coming from BTC options, marking our second highest daily volume on record.

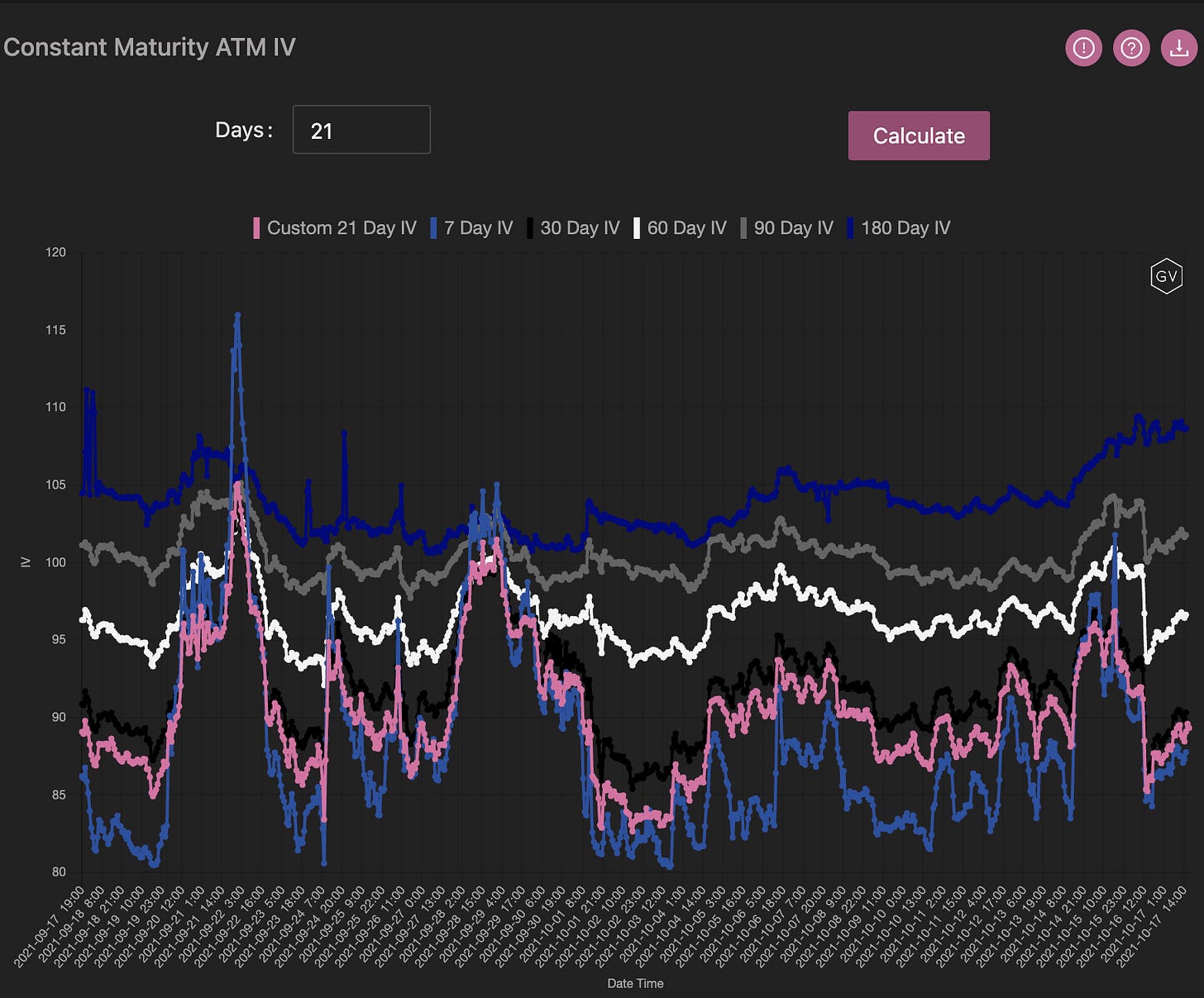

On the vol front, IV steadily ground higher throughout the week across the curve. Moves were particularly sharp in the front end of the curve where 1W spiked to a high of 120+ after starting the week around 80.

(Oct. 11th - Oct. 17th - Volume Profile - Deribit & Paradigm)

Core flow over Paradigm came from (1) continuous interest for topside calls/call spreads, particularly with a focus on strikes between 70k to 120k & (2) two-way flow for month end 46-48k puts and put spreads focused on the 60k/50k range. Strong volumes in calls were offset by interest in puts towards the end of the week, and 53% of our volume for the week traded in calls vs 47% in puts.

(Oct. 11th - Oct. 17th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

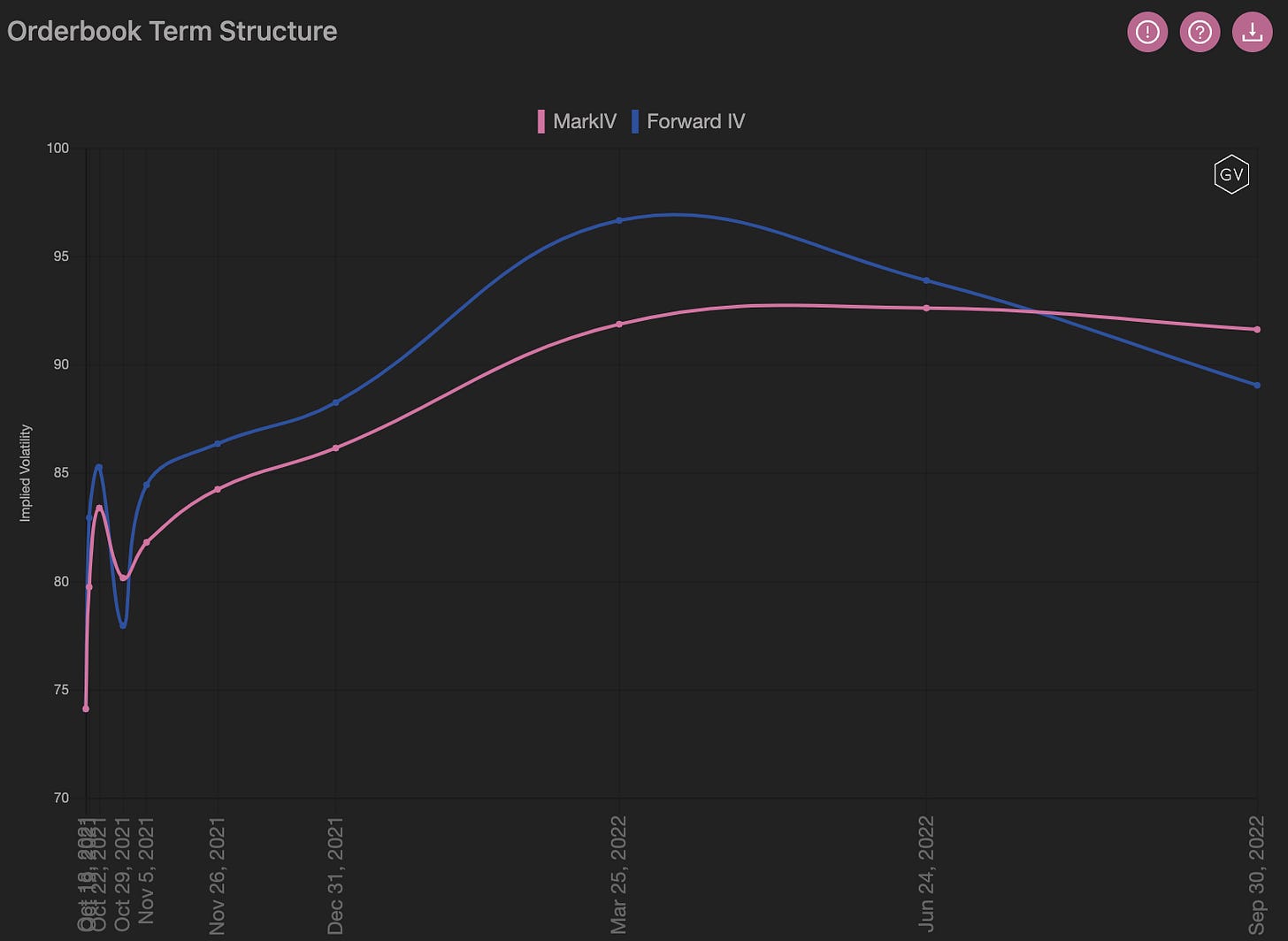

VOLATILITY CONE

(Oct. 17th, 2021 - BTC’s Volatility Cone)

Like we noted earlier, the disconnection between RV and IV this week was especially wide.

IV had a mind of its own as the market had trouble finding any natural sellers of vol.

Although spot prices moved higher, by thousands of dollars, the momentum was controlled and didn’t justify IV on its own.

REALIZED & IMPLIED

(Oct. 17th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

This chart especially highlights the divergence between IV and RV.

While RV is holding still (even resting slightly lower), IV is spiking higher to levels not seen since May.

$3,809

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 17th, 2021 - ETH’s Skews - Deribit)

Ethereum is a sleeper this week compared to the activity around BTC.

Without a blatant catalyst, such as an ETF, the BTC vol. space grabbed all the limelight this week.

That being said, ETH skews are telling an optimistic story.

We’re seeing a rally in skews, pushing relative call bids higher, for nearly all expiration months.

(Oct. 17th, 2021 - ETH’s Skews - Deribit)

This time last week, only options beyond 60-days until maturity had positive skews.

We now see all skews above par, lead by the longest expirations.

Nearly all skews moved higher in unison, while overall IV levels barely moved.

TERM STRUCTURE

(Oct. 17th, 2021 - ETH’s Term Structure - Deribit)

The term structure is still holding a relatively steep Contango shape, which only saw meager flattening attempts during the BTC IV squeeze.

ATM/SKEW

(Oct. 17th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) was much more stable in ETH than BTC this week. Relative volatility trades could be interesting here.

SKEW (right) has climbed significantly higher compared to this time last week. This is something to keep in mind as traders reprice the potential for ETH upside volatility.

VOLUME

(Oct. 17th, 2021 - ETH’s Premium Traded - Deribit)

(Oct. 17th, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (11 Oct. - 17 Oct.) - Patrick Chu

With all eyes on BTC & the ETF headlines, ETH initially followed suit with IVs moving higher across the curve, before tapering off towards the end of the week back to original levels with both 1wk & 1m returning to <90 levels. Skew continued to drift in favor of calls as both 1w & 1m ended the week above par and sentiment remained strong.

(Oct. 11th - Oct. 17th - Volume Profile - Deribit & Paradigm)

(Oct. 11th - Oct. 17th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

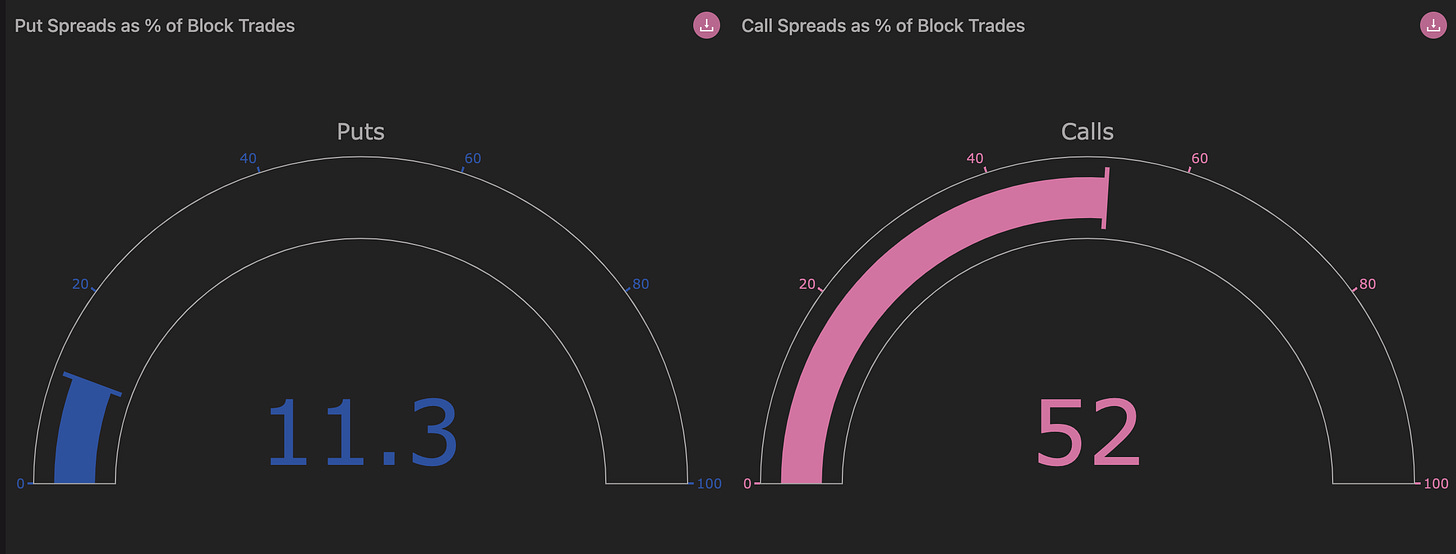

Over Paradigm, ETH call activity dominated the tape once again with 81% of overall volumes and call spreads accounting for 52% of overall volumes. Interest was particularly high for the 4200 & 5000 strikes.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

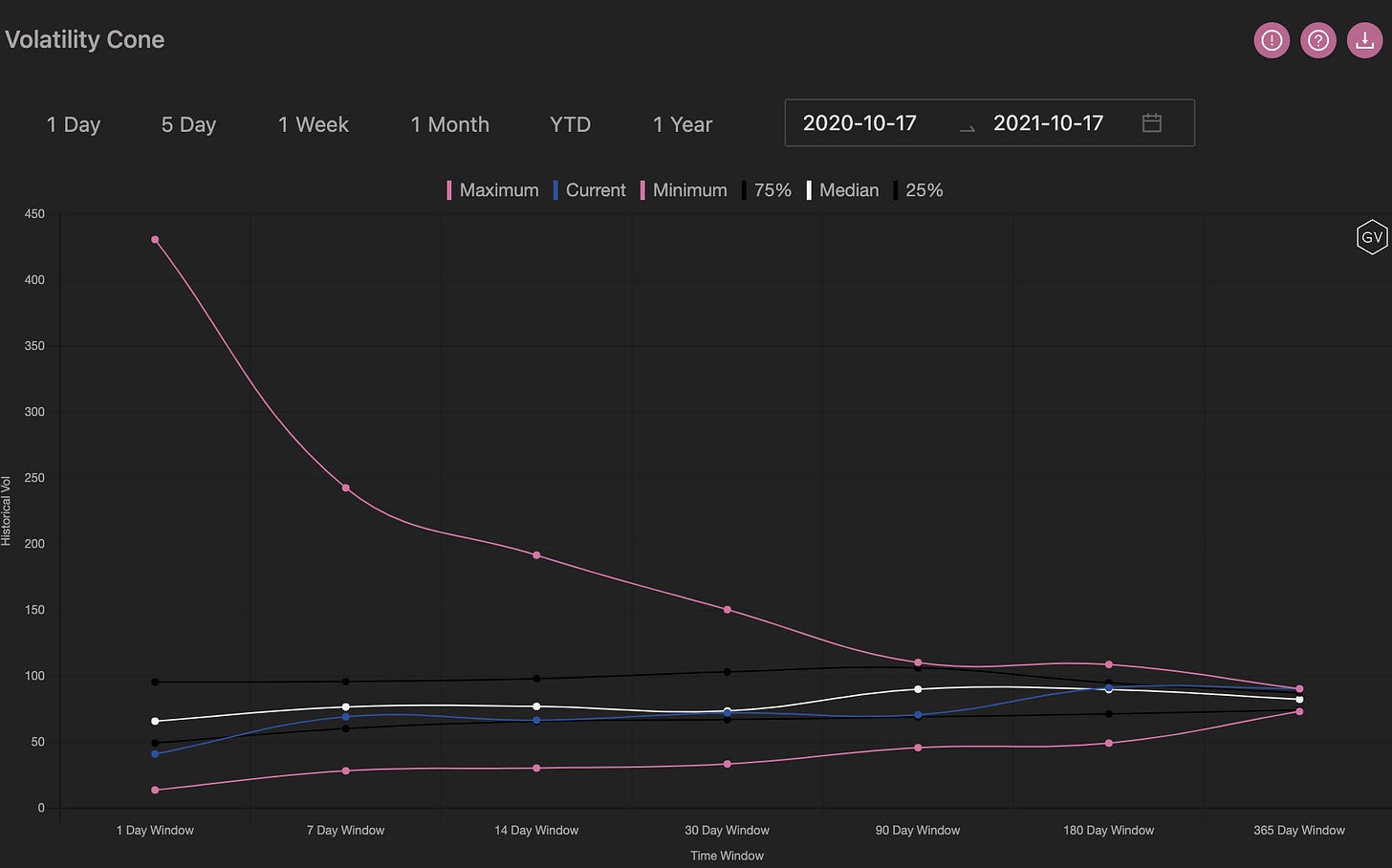

VOLATILITY CONE

(Oct. 17th, 2021 - ETH’s Volatility Cone)

Realized volatility continues to be low.

Even though IV was stable this week, RV continued to head lower.

REALIZED & IMPLIED

(Oct. 17th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

We’re seeing one of the largest discounts to IV in recent memory.

ETH IV remains very stable, likely being propped higher by spot enthusiasm and BTC neighboring activity, but ETH RV continues to head steadily lower.