Crypto Options Analytics, October 24th, 2021

Interesting Vol. Activity? Last week was BTC this week ETH

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

LIVE October 18th, 2021

GVol has officially integrated with Deribit via the new Deribit UI.

Check out the awesome new Deribit upgrades! We’re excited to be part of the picture.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$60,166

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 24th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

“Buy the rumor, sell the news”

Now that the BTC ETF has started trading (along with ETF options), Bitcoin volatility has quickly deflated and returned to normal levels.

Option skew is marginally positive across expirations, floating around +5pts to the calls.

Short-dated options are the exception, with option skew hovering around par.

(Oct. 24th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Oct. 24th, 2021 - BTC’s Term Structure - Deribit)

After the volatility squeeze witnessed last week, the bitcoin volatility term structure is now back into Contango.

Long-term implied volatility has remained stable, while the front-end of the curve has led the way lower.

The term-structure has returned near the higher steepness witnessed previously in the month.

ATM/SKEW

(Oct. 24th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has dropped lower, along with a drop in spot-prices. Volatility and spot-prices are now in positive correlation.

SKEW (right) during these drops, skews have been able to climb higher and reach monthly highs.

Overall, option traders view BTC prices and volatility as continuing to be positively correlated and therefore are pricing skew to the calls.

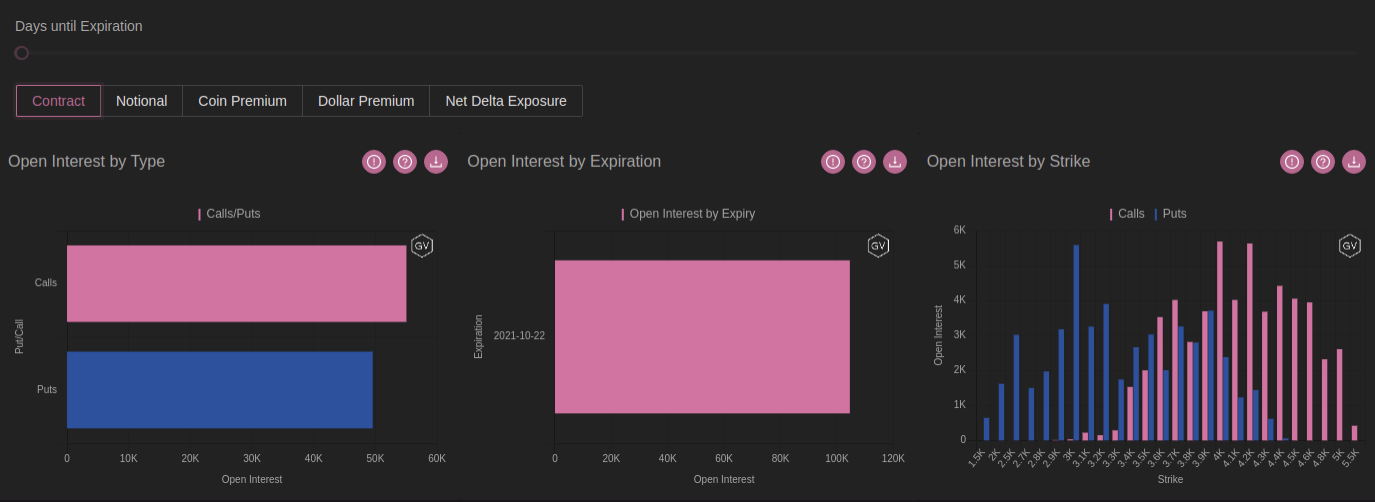

Open Interest - @fb_gravitysucks

The weekly expiration (delivery price 63,413$) gave again max pleasure to CALL holders: around 45% of total open interest expired ITM. Statistically a tail event, the second in a row considering the last weekly expiry.

(Oct 22nd, 2021 – BTC Weekly expiration - Deribit)

Open interest profile shows a major interest towards CALL, with next week 29th expiry influencing the short term view. Monthly expirations usually have an impact on traders’ psychology, creating an expectation of “pinned price” and “suppressed volatility”. Considering the dollar premium in ITM, this could be a scenario to monitor in the next days.

(Oct 24th, 2021 – BTC Open Interest profile – Deribit)

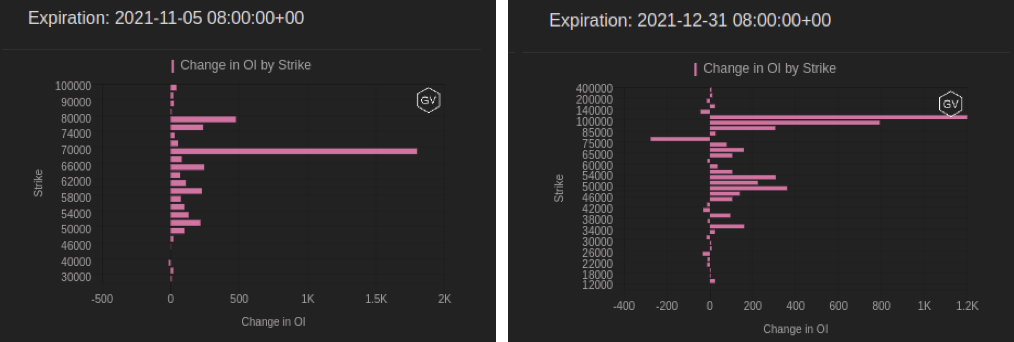

The continuation of interest for calendars dominated the trading week: 5NOV $70k CALL bought, financed by selling 31DEC $100k/$120k CALL.

(Oct 18th - 24th, 2021 – BTC Change in OI – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Oct. 24th, 2021 - BTC Premium Traded - Deribit)

(Oct. 24th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (18 Oct. - 24 Oct.) - Patrick Chu

As the market consolidated after digesting the first week of BTC ETFs going live, BTC IV ground lower throughout the week - especially in the front end of the curve - with 1w IV down to a low of 72 from the peaks above 120 last week, closing the week around 77 and 1M following suit, grinding more than 10 vol. points lower to close the week just above 80.

(Oct. 18th - Oct. 24th - Volume Profile - Deribit & Paradigm)

Flow-wise, two distinct groups of activity dominated: (1) interest in wing topside in BTC covering a range between 70k up to 120k via both outright calls and call spreads, (2) protection via <1 month put spreads covering a range between 60k/50k.

Both call and put spreads remained the most popular structures, with call spreads accounting for 37% and put spreads accounting for 24% of total volumes respectively.

(Oct. 18th - Oct. 24th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 24th, 2021 - BTC’s Volatility Cone)

Realized volatility is calm.

RV’s are trading near the lower 25th percentile for nearly all measurement windows.

REALIZED & IMPLIED

(Oct. 24th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The IV to RV premium continues to hold, with the volatility squeeze seen 2 weeks ago being the peak divergence.

$4,009

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 24th, 2021 - ETH’s Skews - Deribit)

This week, the Ethereum vol. space was met with distinct purchasing flows.

Since the BTC ETF is built using CME futures, there is likely speculation that an ETH ETF could soon follow, since ETH futures are also live on CME. This has caused traders to speculate on higher ETH prices using options.

The ETH option market is much thinner than BTC and therefore, any meaningful flows can quickly move the vol. space.

All skews are above par, with longer maturities reaching +20pts for calls vs puts.

(Oct. 24th, 2021 - ETH’s Skews - Deribit)

Notice the lack of variability between maturities. Skews moved higher, in lock-step, for all expirations.

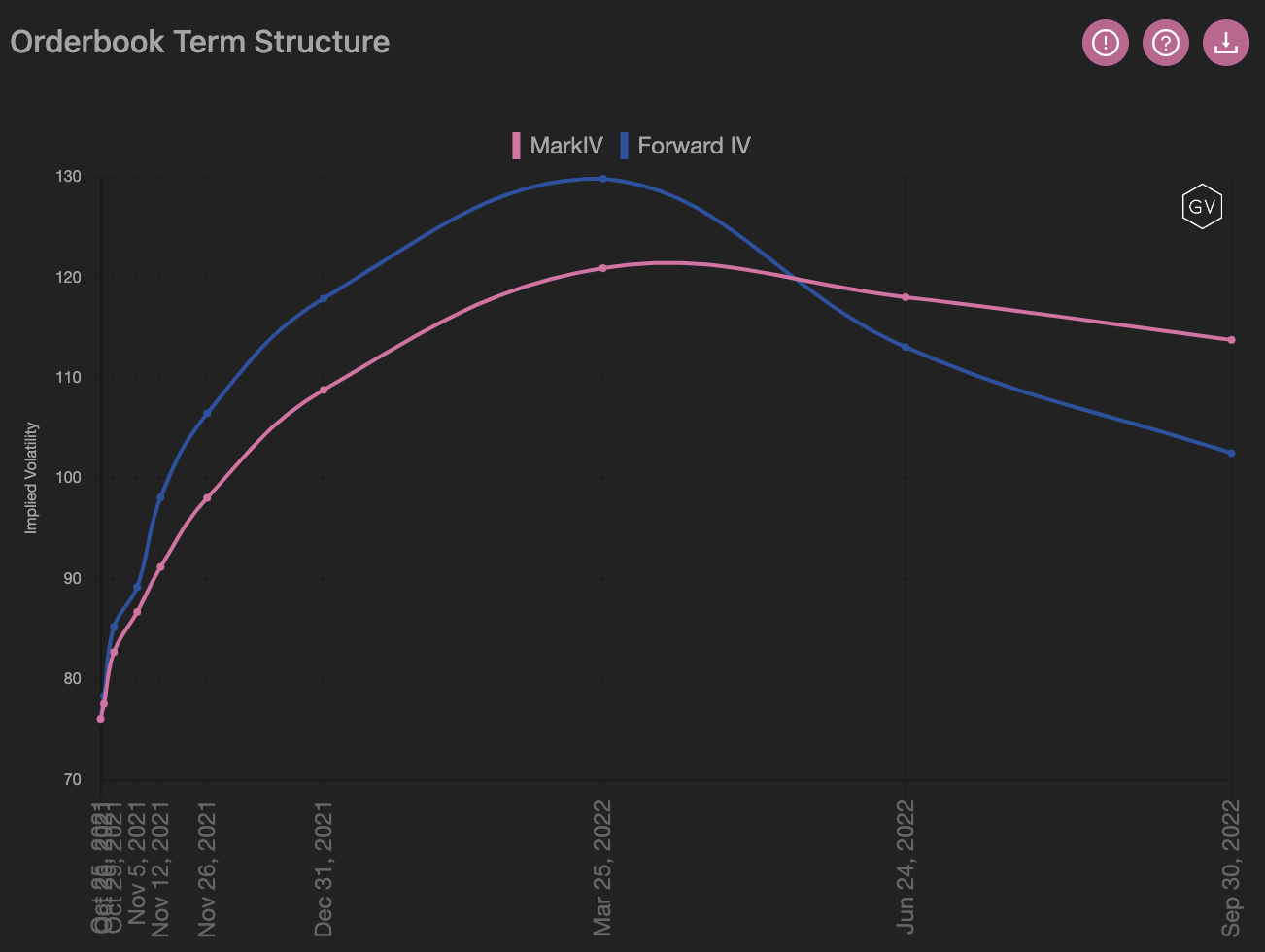

TERM STRUCTURE

(Oct. 24th, 2021 - ETH’s Term Structure - Deribit)

The term structure has steepened enormously!

The steep Contango is punctuated with the March 2022 expiration being the most expensive.

Short-dated volatility is near monthly lows, while long-term expirations are at monthly highs.

There’s a ton of incentive to write covered calls against ETH holdings or trade interesting structures such as “Back-Ratio” 1x2s.

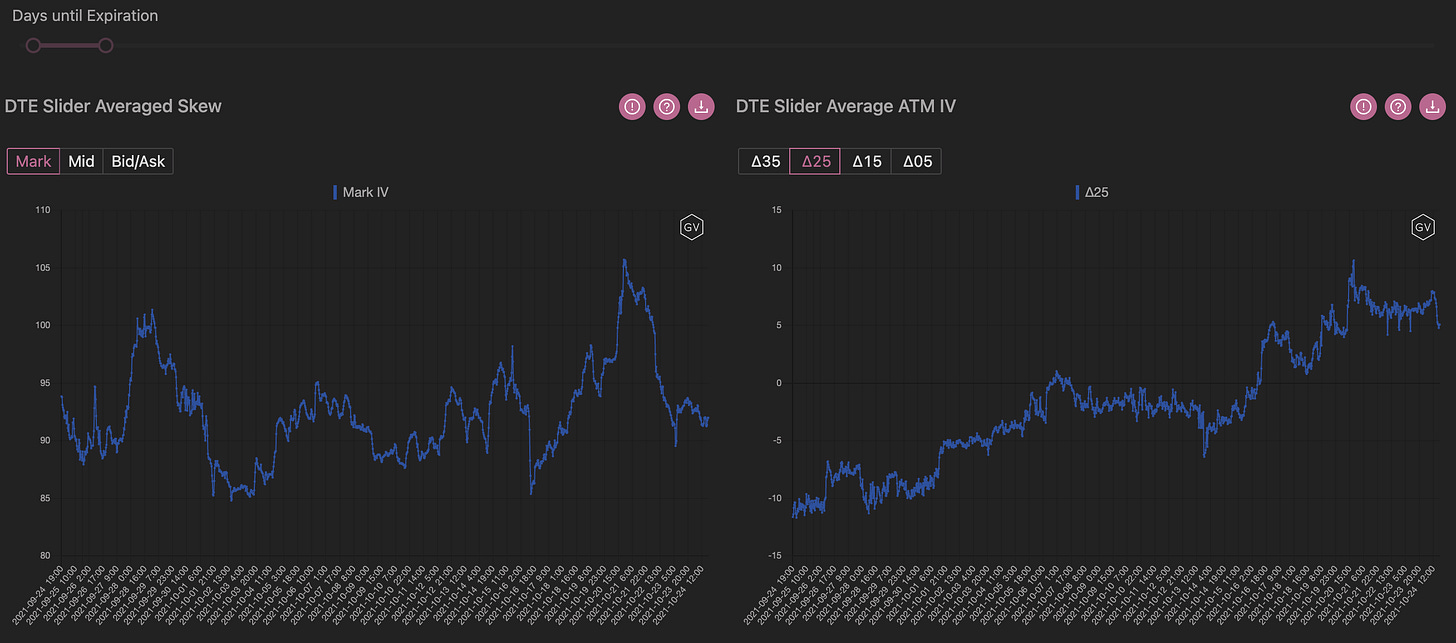

ATM/SKEW

(Oct. 24th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is back in normal range for select expirations (0-31 days) but the option skew is quickly climbing higher as Call purchases exceed available supply.

Open Interest - @fb_gravitysucks

Open interest of the weekly expiration (delivery price 4,142$) showed a cautious distribution, with a decent amount of PUT expiring worthless.

(Oct 22nd, 2021 – ETH Weekly expiration - Deribit)

Open interest profile shows a terrific bullishness for ETH. Participants are betting prices will move higher. Huge CALL concentration in the $5k-$15k range, with traders expecting prices above $5k at end of November, above $10k at end of December and above $15k in March 2022!

(Oct 24th, 2021 – BTC Open Interest profile – Deribit)

Massive attention for the MAR22 $15k CALL which has definitely been THE trade of the week in crypto options. Action took place on Tuesday the 19th, with big impact on IV curve (lifted up).

(Oct 18th - 24th, 2021 – ETH Change in OI – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Oct. 24th, 2021 - ETH’s Premium Traded - Deribit)

(Oct. 24th, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (18 Oct. - 24 Oct.) - Patrick Chu

In ETH this week, flows over Paradigm continued to lean bullish for ETH, with call spreads being the preferred topside expression. Particularly high volumes were traded for the Nov21, Dec21, and Mar22 expiries in the form of both outright and call spreads, with a focus on strikes between 5000 & 10000.

(Oct. 18th - Oct. 24th - Volume Profile - Deribit & Paradigm)

(Oct. 18th - Oct. 24th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

82% of overall volumes traded for calls, with call spreads making up 64% of overall volumes.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 24th, 2021 - ETH’s Volatility Cone)

Realized volatility remains low.

Nearly all measurement windows are trading on the lower 25th percentile.

Implied volatility has decoupled from realized, and option prices are currently being dominated by flows, as opposed to following RV pricing.

REALIZED & IMPLIED

(Oct. 24th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

ATM implied volatility is trading significantly above realized volatility.

This chart captures traded IV for 0-31 days-until-Expiration.

Longer-dated options are trading even higher, while long-dated RV remains around similar levels.

Option flows are “Paying up”, essentially betting that ETH moves explosively higher in the future.

hi .. am i right in seeing that options on FTX trade at much higher prices than the same contracts on Deribit? Or am I missing something in the contract specs?

great work, as always ... thanks!