Crypto Options Analytics, October 3rd, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$47,894

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 3rd, 2021 - Short-term and Medium-term BTC Skews - Deribit)

Spot-prices ended the week significantly higher, after friendlier than anticipated Jerome Powell noises.

Short-term option skews, which began the week with the most negative readings, rallied back substantially from -13pts to -3pts.

Medium-term 30-day options are now back to par, thanks to a +10pt skew rally.

Long-term options have remained rather stable, 90-day options rallied about +3pts and 180-day options budged about +1pt.

(Oct. 3rd, 2021 - Long-Dated BTC Skews - Deribit)

All this activity is welcome news to the space.

TERM STRUCTURE

(Oct. 3rd, 2021 - BTC’s Term Structure - Deribit)

The term structure is back to peak steepness.

The Contango shape seems to be de-facto in a positive spot environment for the time being.

Without a rally above the recent highs of $52k, we are not likely to see a flat or backwardated term structure on the back of a spot-price rally.

The term structure shape is still more responsive to downward price drops.

This type of structure and environment remains constructive for yield enhancement covered call strategies, especially in the NOV and DEC expirations.

ATM/SKEW

(Oct. 3rd, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has held true to the inverse spot price correlation this week. ATM IV is now back near monthly lows as spot prices climb towards recent highs. That being said, the IV and RV relationship is now inline.

SKEW (right) seems to finally be climbing out of the recent rut. Short-term and medium-term option positioning is turning more optimistic towards upside vol.

VOLUME

(Oct. 3rd, 2021 - BTC Premium Traded - Deribit)

(Oct. 3rd, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (27 Sep - 3 Oct) - Patrick Chu

In BTC, there was optimism throughout the multiple tests of the 40k key pivot, in contrast to the caution seen last week.

Amidst the positivity, we saw short-dated skew recovering 10 handles to close the week around -3 from -13 at the lows.

We continued to see significant interest for topside calls, with calls hitting a high of 81% of overall Paradigm volumes.

(Sept. 27th - Oct. 3rd - Volume Profile - Deribit & Paradigm)

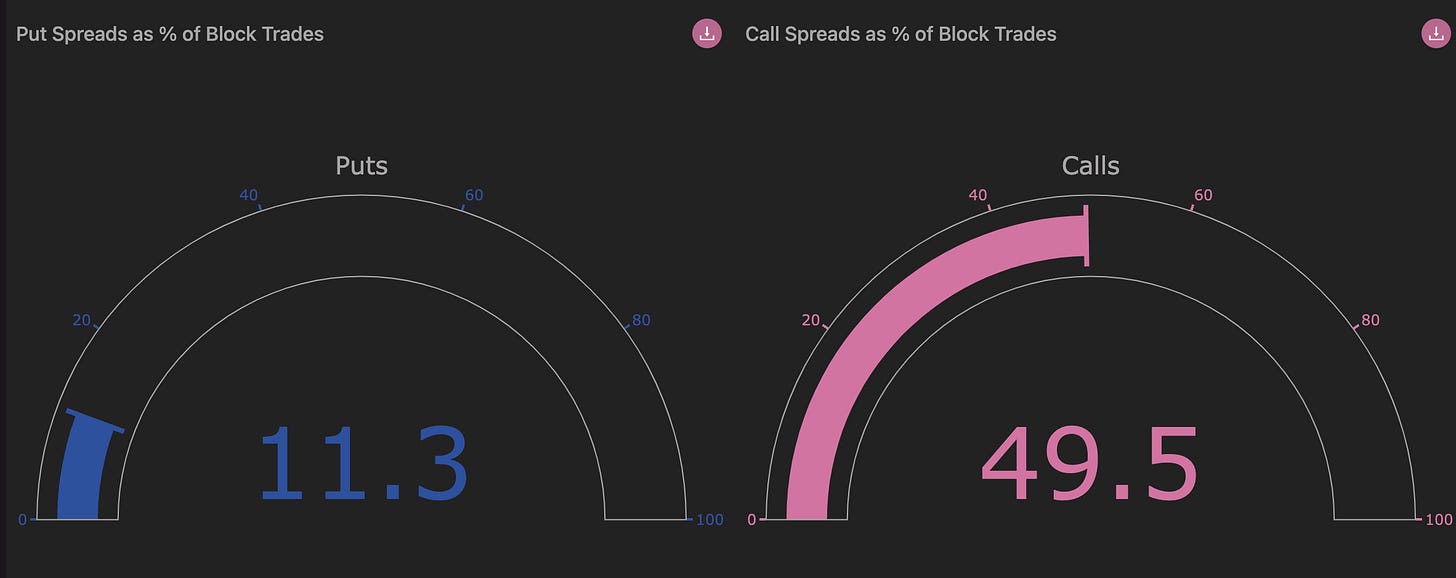

Call spreads continued to drive activity, representing 46% of total volumes. Popular call spreads included strikes centered around 45k / 60k, as well as 70k / 100k.

(Sept. 27th - Oct. 3rd - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 3rd, 2021 - BTC’s Volatility Cone)

Realized volatility continues to hover around the median for most measurement windows.

Although RV seems to be holding a “typical range”, a resumed rally into year-end could prove explosive.

Recent highs and lows will be key levels to observe; until then, assuming “typical RV” is likely sound.

REALIZED & IMPLIED

(Oct. 3rd, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is stable and near YTD lows.

IV is now fairly priced, assuming these RV levels hold.

In this fair environment, vol. buyers can likely find opportunity in short-term gamma plays, while vol. sellers can likely find opportunity in the term structure plays.

$3,419

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Oct. 3rd, 2021 - ETH’s Skews - Deribit)

Short-term skews saw a steep recovery with this week’s spot price rally.

We witnessed short-term skews move up from -16pts to -5pts.

Medium-term skews are still more negative for ETH than BTC.

Not until 60-days out does ETH option skew finally hit par.

(Oct. 3rd, 2021 - ETH’s Skews - Deribit)

Longer-term skews are more stable. That being said, 90-day ETH skews have steadily climbed to +5pts, from par in mid-September.

TERM STRUCTURE

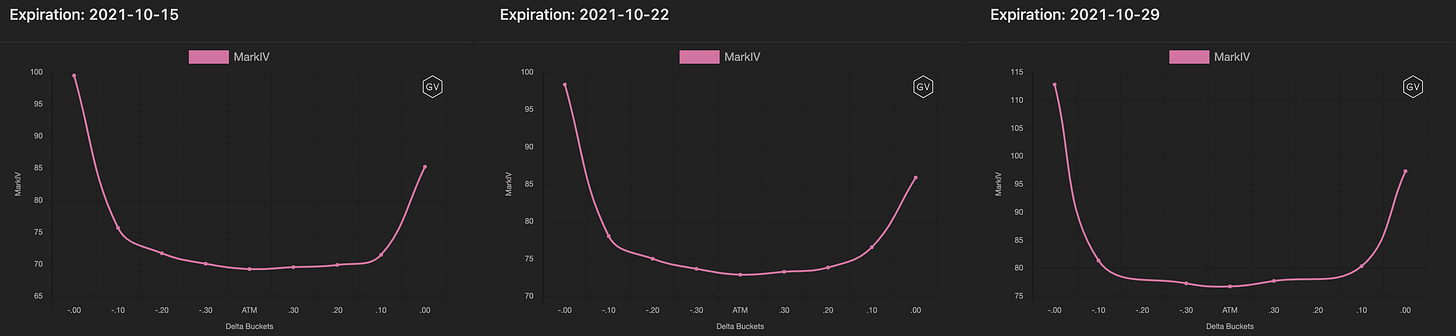

(Oct. 3rd, 2021 - ETH’s Term Structure - Deribit)

The term structure in ETH is also in a steep Contango.

The short-term vol. seems to have found a floor around 80%, the monthly lows.

This steepness is punctuated by the relatively expensive DEC expiration that we continue to witness.

Again, CC yield enhancement strategies can be lucrative here going into year-end, given the current term structure shape.

ATM/SKEW

(Oct. 3rd, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) dropped significantly with this week’s spot rally. IV is now back to monthly lows. This inverse correlation could break if ETH is able to find buyers beyond $4k.

SKEW (right) has finally broken the relentless grind lower. We’re happy to see ETH skew climb back towards par for these select maturities.

VOLUME

(Oct. 3rd, 2021 - ETH’s Premium Traded - Deribit)

(Oct. 3rd, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (27 Sep - 3 Oct) - Patrick Chu

In ETH, we started the week with caution as the market was heavily paid on the Sept. 28 Asia open, where more than 13,000 contracts of Oct 8 expiry focused on the 2600, 2700 and 2800 strikes traded. The aggressive put buying on the three strikes continued throughout the week with more than 30,000 contracts traded, marking the first time since May that the top 3 traded ETH options over Paradigm were all puts.

(Sept. 27th - Oct. 3rd - Volume Profile - Deribit & Paradigm)

Overall for the week, puts accounted for 53% over total volume. Similarly to BTC, ETH 1w & 1m skew also recovered dramatically as we bounced off of the key 2650/2700 support.

(Sept. 27th - Oct. 3rd - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Oct. 3rd, 2021 - ETH’s Volatility Cone)

Realized volatility is actually rather high. Medium-term measurement windows are between the median and 75th percentile. Meaning things are most definitely not sleepy at the moment.

REALIZED & IMPLIED

(Oct. 3rd, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

As mentioned above, the RV environment is nothing to overlook in ETH.

We can see that IV is currently trading at a discount to RV.

If ETH’s enthusiasm continues and spot prices can get above $4k, long vol gamma plays will likely be rewarded.

Like BTC, we see opportunities for both sides of the vol. market in ETH, based on selected maturities.