Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Week Ahead:

Wednesday 8:15am ET: ADP employment report (level change)

Wednesday 2pm ET: FOMC Announcement

Friday 8:30am ET: Non-farm payrolls

THE BIG PICTURE THEMES:

This week is a MONSTER week in terms of economics events.

Wednesday afternoon we have an FOMC rate decision, combined with an ADP employment report earlier in the morning.

The FOMC rate decision is expected to be a 75bps hike but the forward guidance for future hikes is going to be the big “unknown”. Global central banks are starting to soften their hawkish tone, but Powell may not follow-suit.

All this is followed by an employment report on Friday that could set the tone for the direction of future guidance.

Last week markets, including crypto, saw a decent relief rally.

Although this may be a “bear rally”, it seems clear that positioning in the market might be too bearish, causing a squeeze higher.

Should positioning diverge from fundamentals, we could see counter-intuitive price action… In my mind, that bodes well for trading.

Here’s a “GOLDEN SET-UP” that I’d look for.

FOMC rate decision comes in at 75bps, with middle-hawkish guidance… This leads to a “Dip” in risk-assets.

Because of extended short-positioning, this is essentially an “OUT” opportunity for those that need it and creates an opportunity to buy-the-dip, as a trade idea.

Wednesday close, Thursday trading, and Thursday night market rallies the rest of the time into NFP. (Scale out longs here).

If NFP comes in “Soft” in any shape or form, this is a massive long signal for traders, because that affords Powell the opportunity to reduce a hawkish tilt (essentially joining the other global central banks).

Something like that…

There’s a lot of other “IF-THEN” statements to add, but this is a rough idea of my trading mindset this week.

A short-term trade set-up I’m looking for.

BTC: $20,636 +7.22%

ETH :$1,584 +21.50%

SOL: $32.50 +7.6%

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

Earlier in the week, the DVOL rallied on the back of a spot rally.

The problem with this Vol. rally, is that the term structure and the VRP remained super steep and elevated. We saw a modest pickup in RV but not enough to close the RV-IV gap.

As markets later realized a lack of follow-through in spot, IV quickly melted away its gains and dropped back down to 12-month lows.

Spot prices DO INDEED look constructively bullish… but that said, Q4-22 doesn’t resemble the Q4-20 environment, where buying call exposure was the right move to make.

A short-term trade in this environment seeks to get long Delta, but not long outright Vega.

TERM STRUCTURE

(Oct. 30th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

We can see the term structure attempt to reach a “flat” shape, only to be quickly rebuffed.

Although the term structure is back into Contango, the steepness isn’t as extreme as last Sunday’s.

BTC (Term Structure - API chart)

ETH (Term Structure - API chart)

Here’s something fascinating however: the vol. term-structure for ETH has found a massive footing higher. We can see that short-term options increase +10-15pts higher, bringing the term-structure into a “flat shape”.

You can see here that ATM IV for EOY options has diverged a lot from Oct.25th, for ETH and for BTC.

BTC is lower than 10/25 while ETH is higher.

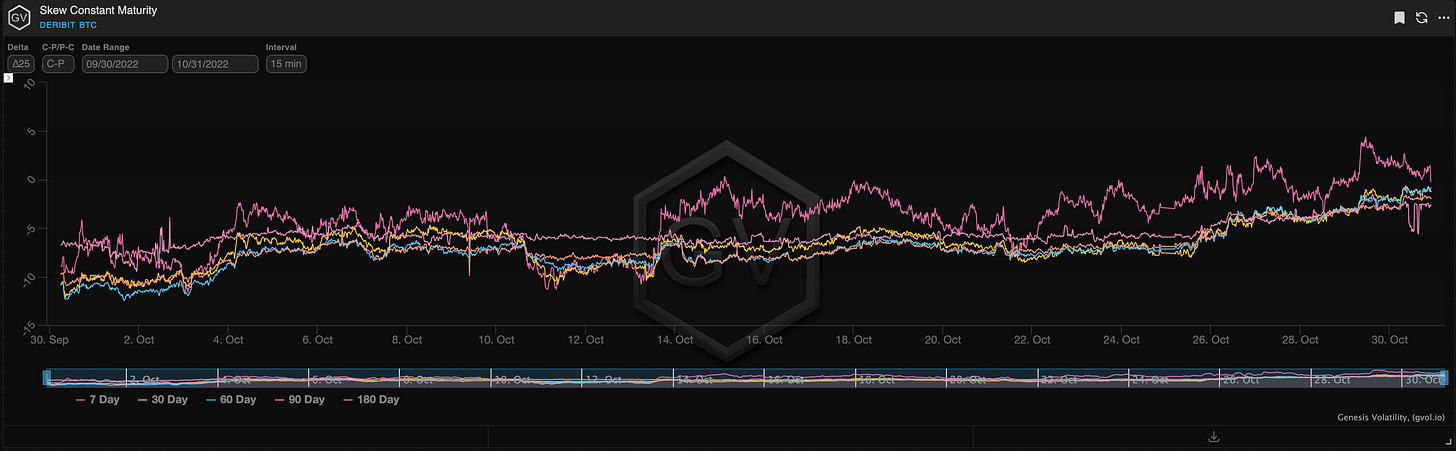

SKEWS

(Oct. 30th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

It’s no surprise to see BTC RR-Skew move higher after the last bullish price action.

This Skew repricing is led by short-term maturities, but longer-term options remain in the negative territory.

It remains an open question whether crypto skew is secularly going to mimic equity skew, or if this current negative RR-Skew is merely cyclical, given the bear market this year.

Paradigm Block Insights (24 October – 30 October)

Finally a constructive week on an absolute basis and also relative to equities. ETH : the clear outperformer. 🔥

ETH +22% / SOL +16% / BTC +8% / NDX +2%

Upside strikes in focus with BTC C/P ratio of 3.

Strong spot moves usually mean strong volumes on Paradigm! 📈Two days this week of ATHs!

44.1K BTC traded on Wednesday, surpassed by a new ATH of 44.3K on Friday where we were 50% of Deribit volume! 🚀

BTC 🌊

The largest BTC prints skewed towards buyers of Nov upside on Friday in various formats. 📈

2000x 25Nov 24k / 30Dec 30k call calendar sold

1255x 18Nov 22k / 23k call spread bot

750x 4Nov 21k calls bot

BTC Nov vols rallied with spot, but the bid didn’t last long, as spot momentum slowed.

7D ATM hit 45v post-expiry, falling from 63v on Wednesday. 📉

Term structure in steep contango and interesting to see no significant 4Nov bid, despite the FOMC meeting on 2Nov.😬

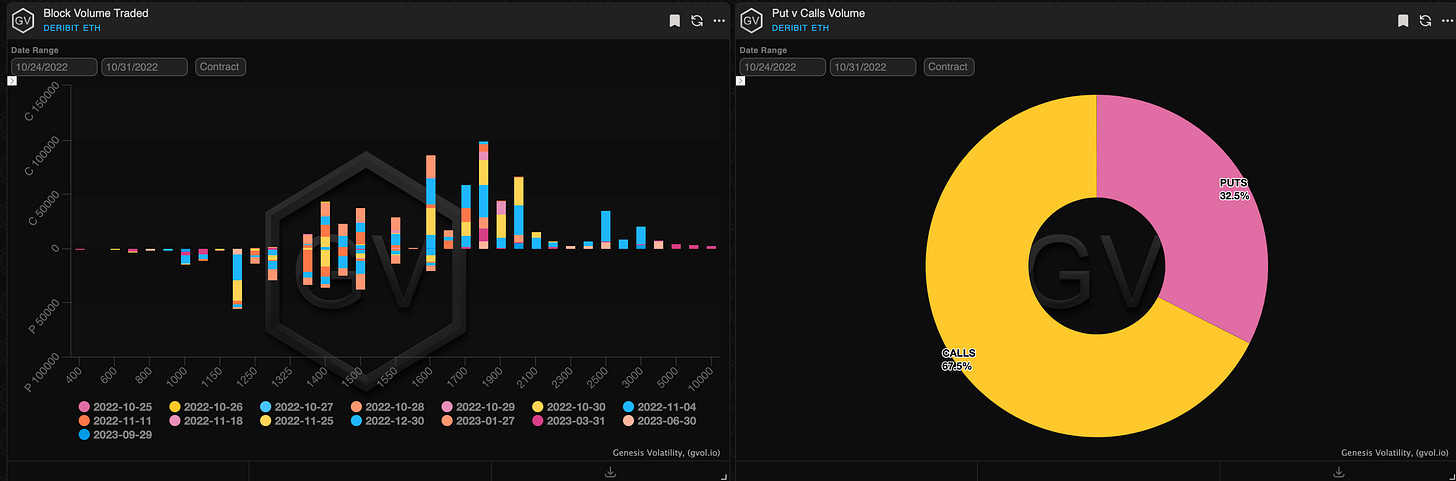

ETH 🌊

Flows consisted of rolling upside strikes and new call spreads. Light protection buying outside one large 11Nov buyer.

20k 25Nov 1800 / 2000 1x2 call ratio sold

15k 11Nov 1350 put bot

9k Dec 2000 / 2500 call spread bot

6k Nov 1700 / 1900 call spread sold

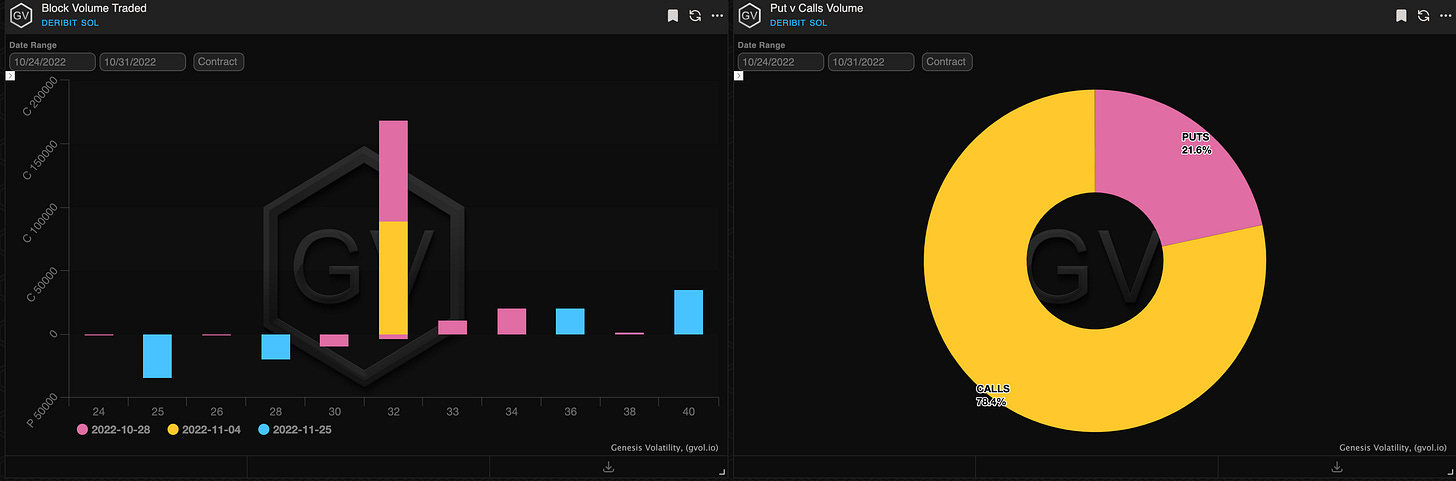

SOL 🌊

Paradigm is the only place to trade size in SOL…over 80% market share on Wed!

Per the usual, most SOL blocks are selling vol, but see a large 1-week roll from 28Oct to 4Nov.

75k 28Oct /4Nov 32 call cal bot

15k 25Nov 25/40 strangle sold

20k 25Nov 28 put sold

BTC

ETH

SOL

VOLATILITY PREMIUM

(Oct. 30th, 2022 - BTC IV-RV)

We can see that the BTC increase in realized vol. wasn’t enough to close the VRP.

We continue to have a VRP of about 10pts, making outright options still relatively expensive to hold.

Squeeth Weekly Review

Finally we have found some movement in spot markets. With an explosion in buying to start the week, ETH quickly ripped over $1,500. ETH ended the week +20.8% and oSQTH +46%.

Volatility

Opyn is excited to announce the launch of our “reference volatility” metric on https://go.squeeth.com/ReferenceVol

This metric was created to help traders understand if Squeeth is cheap (good time to buy) or expensive (good time to sell / deposit in Crab). The equivalent bundle of options on Deribit has an ETH^2 payoff, which makes it a good reference vol.

IV started the week in the 50s and quickly peaked around 90% on October 27th, just to end the week back in the 50s. At the time of writing, reference vol is 81.27%, while implied vol for oSQTH is 63.90%.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $15.46m. October 26th saw the most volume, with a daily total of $4.54m traded.

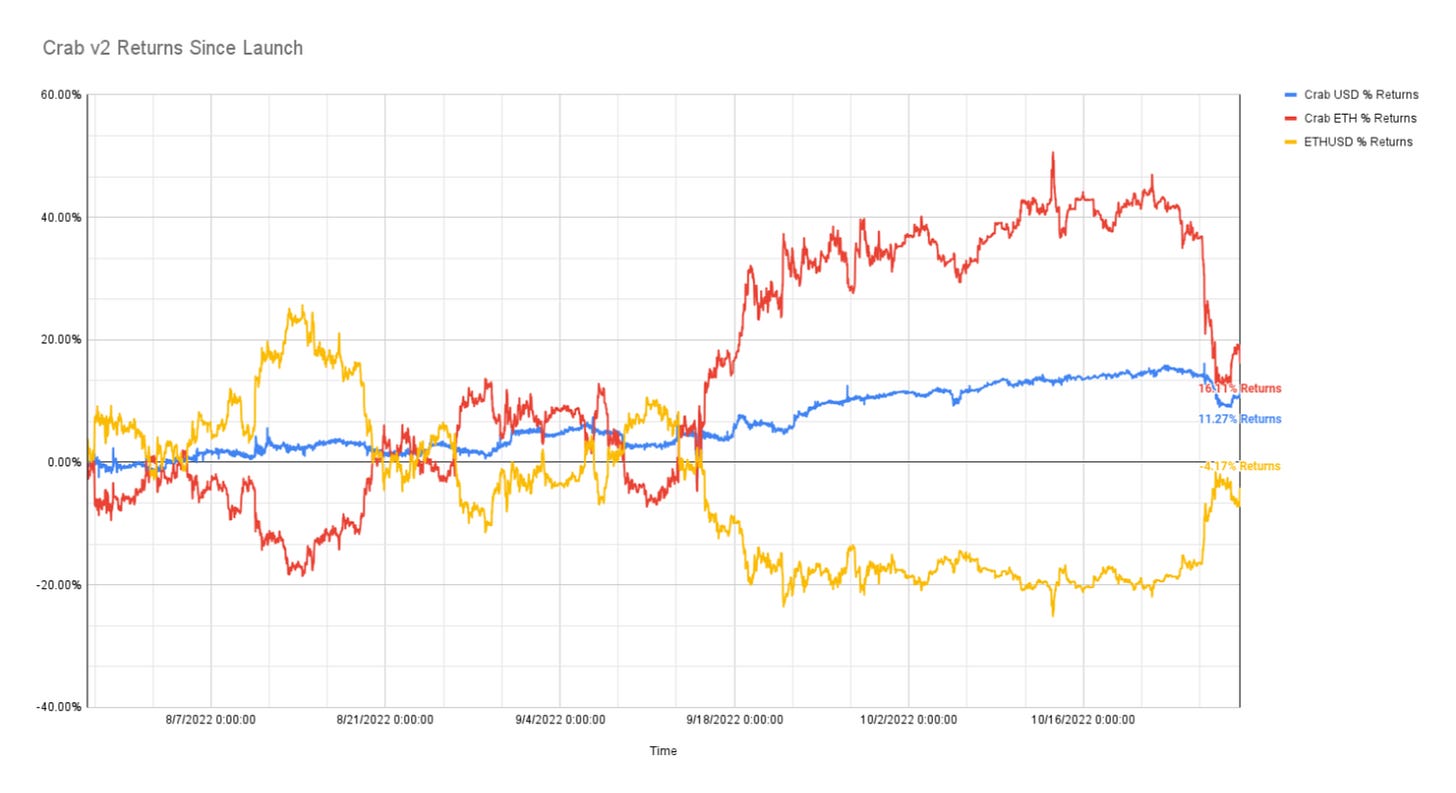

Crab Strategy (10/22/22 - 10/28/22)

Crab declined this week with the increase in volatility. Crab lost 3.16% during this period in USD terms. Since inception (07/28/22), Crab still remains +11.27% in USD terms.

7-Day ROI

Since Inception ROI

For all things Opyn, join us in Discord: https://discord.gg/opyn

ETH 7-Day Stats:

Volatility

ETH Implied Volatility saw a spike this week after Tuesday's rally. Near-term skews moved into backwardation, with downside puts catching the most bid. Current ATM IV is sitting at ~75%. IV is up nearly 25 points this week, off the lows for the year. Longer-dated options are trading at a discount with IV ~ 72%, up marginally on the week.

Trading

30-day trading fees for the ETH MMV are ~140K!

The majority of OI is traders’ long puts against the Lyra MMV

ETH Market-Making Vault

The ETH MMV has returned 3.67% since its inception (June 28th, 2022), representing a weekly change of +0.38%. After struggling the last few weeks on long gamma, the MMV finally caught a move and was able to realize some of its theoretical edge. With the recent rally, the MMV position is relatively flat, paying just $26 per day in theta.

The 30-day performance, annualized, is -1.816%; annualized performance since inception is +10.3%. Depositors earn an additional 10.60% rewards APY (boosted up to 21.20% for LYRA Stakers)

Net MMV Exposure:

BTC Market-Making Vault

Lyra’s BTC MMV has returned .721% since its inception (August 16th, 2022). This represents a weekly change of +0.111%.

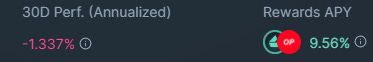

The 30-day performance is -1.33% annualized. Depositors earn an additional 9.56% rewards APY (boosted up to 19.12% for LYRA Stakers)

Net MMV Exposure:

SOL Market-Making Vault

Lyra’s SOL MMV has returned +.704% since inception (September 27th, 2022).

The 30-day performance is +8.66% annualized. Rewards APY for vault deposits are currently 19.03% (boosted up to 38.06% for LYRA Stakers)

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here