Crypto Options Analytics, Oct. 2nd, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Weekly EVENTS:

(Friday 8:30am ET) Non-Farm Payrolls

THE BIG PICTURE THEMES:

This week has been quiet in crypto assets, but crazy in other corners of finance.

Volatility has trickled into the UK Gilts market in a way never witnessed in my lifetime.

US Stocks are also down a lot this week, taking out June lows and making new lows for the year.

We’re also seeing FX markets have their moment, as the USD dollar index (DXY) reaches a nearly +20% gain on the year.

All this news makes Friday’s NFP jobs number super important.

Powell signaled rate raises until things break… The question remains, have things broken yet?

I believe Powell is concerned about the psychological components of inflation expectations and trying to avoid a wage-price spiral. Meaning, if Friday’s Jobs report is strong (good for the economy) the markets will react negatively, because Powell is going to keep hiking.

The opposite is true, if Friday’s jobs report finally begins to show weakness.

BTC: $19,261 +2.44%

ETH :$1,304 +0%

SOL: $32.69 +0%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

Both implied vol. and spot prices are currently moving sideways. This week could be a catalyst to “pick a direction” on the back of NFP.

Should risk-assets rally post job’s number, implied vols. are expected to go lower.

Going INTO the number, betting on sideways movement is an interesting play. There’s likely some decent premium to grab, given the relative strength crypto displayed last week.

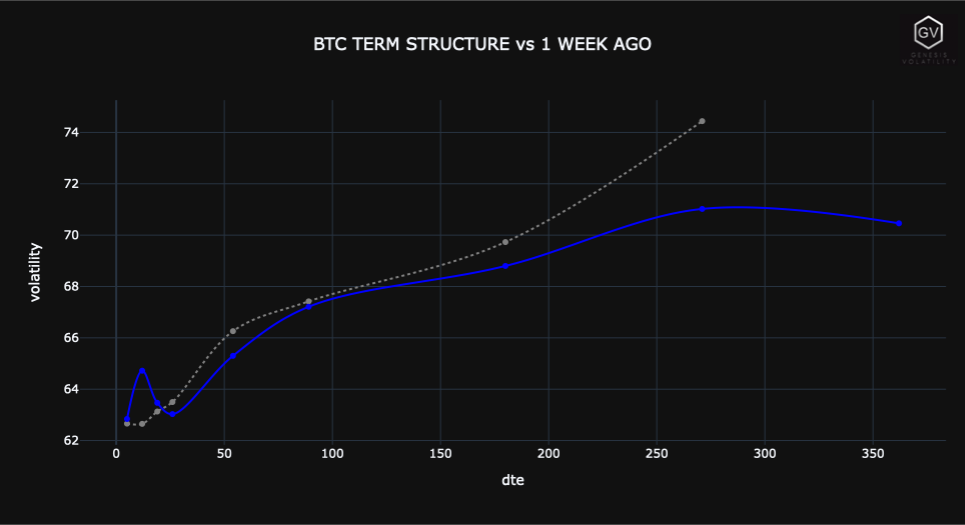

TERM STRUCTURE

(Oct. 2nd, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

Notice the steady slide lower in weekly BTC implied vol. and the steepening Contango.

BTC (Term Structure - API chart)

ETH (Term Structure - API chart)

ETH’s term structure has had a bigger W/W drop. We see about -5pts lower in the back-end of the curve.

SKEWS

(Oct. 2nd, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

Given the relative strength, BTC RR-skew climbed throughout the week but remains near the -10% level.

In early Sept. the pre-CPI release enthusiasm caused BTC RR-skew to rally beyond the ZERO-LINE. I don’t expect another drastic move like that anytime soon, but a weak NFP number could quickly send RR-Skew from -10% → -3% (or so).

Going into the NFP number, selling vol. using downside put structures makes the most sense, assuming you share the consolidation thesis.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

Week characterized by calendars and diagonals traded in clips, and by a persistent directional uncertainty highlighted by many pure volatility trades (delta hedged) and delta-neutral structures.

The closure of call spreads on Ethereum opened pre-merge should be noted.

Bitcoin trades: Call spread sold 28OCT $19k/$22k (delta hedged), strangle bought 28OCT $18k/$22k, diagonal bought 28OCT/25NOV $23k/$28k, calls sold 28OCT $20k, call bought 7OCT $20.5 (delta hedged), put bought 7OCT $18k (delta hedged)

Ethereum trades: Call spread sold 30DEC $2k/$3k (closing oi), put bought 14OCT $1.25k, calendar bought 7OCT/14OCT $1.3k, call spreads sold MAR23 $3k/$4k-$4.5k (closing oi), put sold JUN23 $0.7k (delta hedged), calendar bought 14OCT/28OCT $1.35k

(26th Sep - 2nd Oct, 2022 - BTC GVOL Gravity charts)

(26th Sept - 2nd Oct, 2022 - ETH GVOL Gravity charts)

Paradigm Block Insights (26th Sept – 2nd Oct.)

A rangebound week, though crypto majors slightly outperformed equities.

BTC +1% / ETH +1% / SOL -1% / NDX -3%

One-way taker bid for gamma with dealer reluctance to sell.

BTC 🌊

Gamma buying dominated the tape. Dealers are reluctant to sell, given the macro outlook and the increasing vol buyers flooding the market.

1000x 7Oct 18k Put bot

1000x 7Oct 20.5k Call bot

500x 7Oct 21k Call bot

ETH 🌊

7Oct ETH topside gamma lifted in size 🔥.

Makers hesitant to sell, given the level of vols and a strong rates bid sparked by the BoE QE decision.

8250x 7Oct 1450 Call bot

5000x 7Oct 1500 Call bot

4200x 7Oct 1400 Call bot

Amidst the 7Oct ETH call buying flurry, there was natural 7Oct / 28Oct call calendar buying which allowed market makers to recycle the gamma. 🔥

10250x 7Oct 1300 / 28Oct 1300 Call Calendar bot

🌊Call Flies

Call fly buying in BTC, but closing fly risk in ETH via 1x2 call ratios (lower wing and belly). 👀

1750x BTC Dec 30k/35k/40k CFly bot

10k ETH Mar 3000/4000 1x2 CSpd sold

BTC

ETH

SOL

VOLATILITY PREMIUM

(Oct. 2nd, 2022 - BTC IV-RV)

Although BTC spot prices are consolidating below the $20k level - showing relative strength compared to macro risk-assets - realized volatility has risen enough to meet implied vol.

The August summer lull is behind us and I do expect BTC to trade along with risk-assets.

European winter, US mid-terms and geopolitical tensions are all catalysts to create haywire volatility in risk-assets.

Squeeth Weekly Review

While spot markets were relatively quiet this week, vol markets were active. ETH spot markets ended the week +.14%, oSQTH ended the week -1.29%.

Volatility

This week, oSQTH saw slow declines in IV, starting the week at roughly 80% and ending the week at 72%. oSQTH presented many opportunities this week to trade ETH vol and remains a cheap route to buy ETH exposure.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $9.02m. September 26th saw the most volume, with a daily total of $1.88m traded.

Crab Strategy

Crab strategy continues to see deposits with roughly 4,573ETH in the vault. This week, Crab returned roughly 1.5% in USD terms.

This week, Crab performed 3 hedges equating to 166.86ETH.

For more on Crab check out: squeeth.opyn.co/strategies?2_1_1

For all things Opyn, join us in Discord: https://discord.gg/opyn?2_1_1