Crypto Options Analytics, Oct. 24th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Week Ahead:

Tuesday 9:00a ET - S&P Case Shiller (Home Prices)

Thursday 8:30a ET - Q3 GDP

Friday 8:30a ET - PCE

THE BIG PICTURE THEMES:

Global rates continue to go higher, weighting down growth. Next week, Wednesday Nov. 2nd, the Fed will release is latest interest rate decision.

The Fed’s fight against inflation has caused a major rally in the USD, which is nearing multi-decade highs and dragging assets prices lower.

Crypto prices are holding a low volatility regime despite higher VIX levels.

The DVOL/VIX is currently slight under 2x, this same time last year it was above nearly 5x.

We’re likely headed into another rate hike of 75bps next week limiting any sort of relief rally in risk-assets.

BTC: $19,248 -0.23%

ETH :$1,304 +2.38%

SOL: $30.2 -6.26%

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

DVOL is currently holding 12-month lows. There’s an even bigger drop in realized vol. that suggests that selling IV at these lows isn’t a bad idea.

As noted in the “MisFits” podcast episode, I do believe there’s more crypto spot price downside, but for now IV remains a sale.

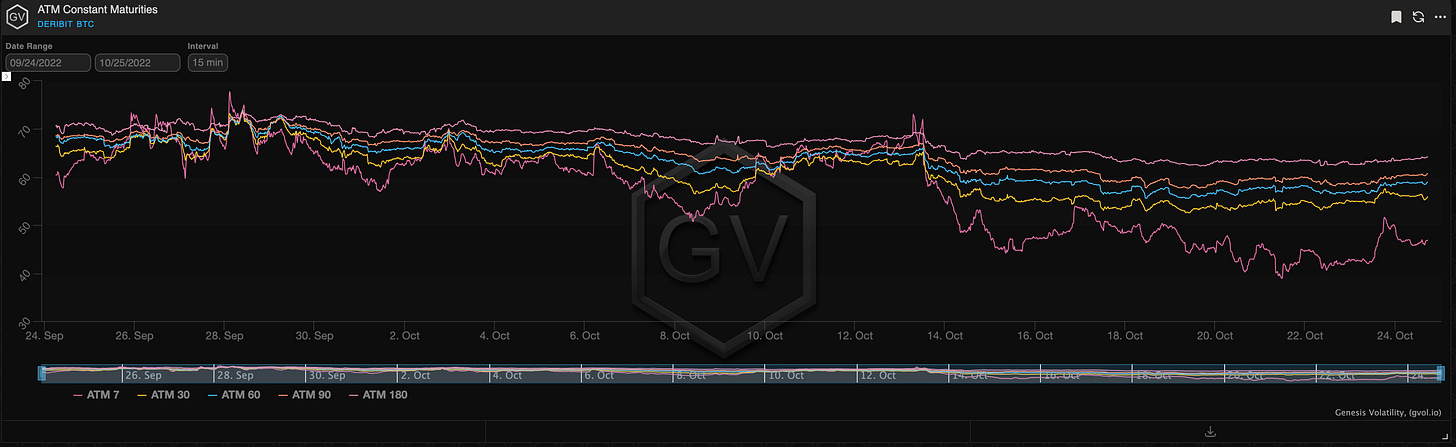

TERM STRUCTURE

(Oct. 24th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

Over the past week BTC’s term structure has fallen into a steep Contango lead by 7-day IV.

We continue to be in a favorable environment for vol. sellers. Contango term-structure IV “roll-down” + a rather large persistent VRP + IV shifts lower.

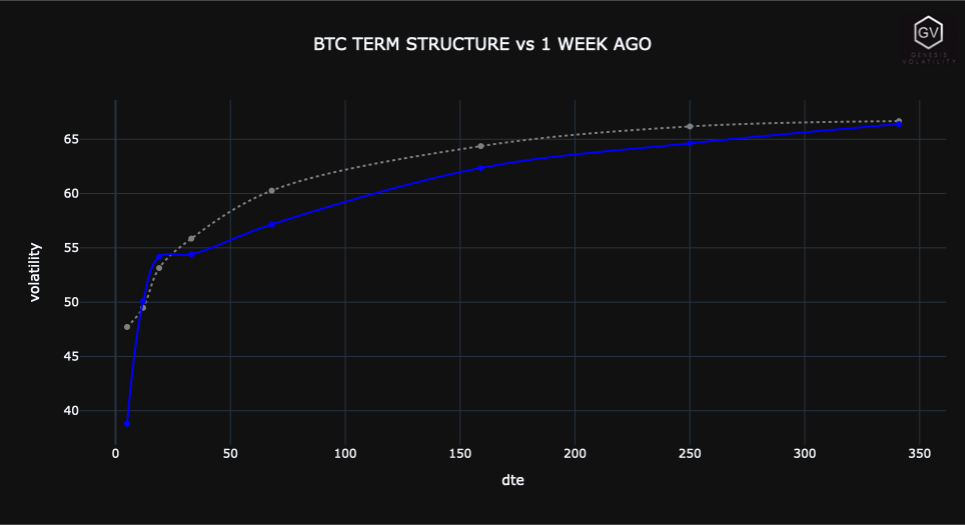

BTC (Term Structure - API chart)

ETH (Term Structure - API chart)

BTC’s term structure was steady compared to this time last week but the ETH term structure has Continued to shift lower, a consistent trade since the ETH 2.0 merge event.

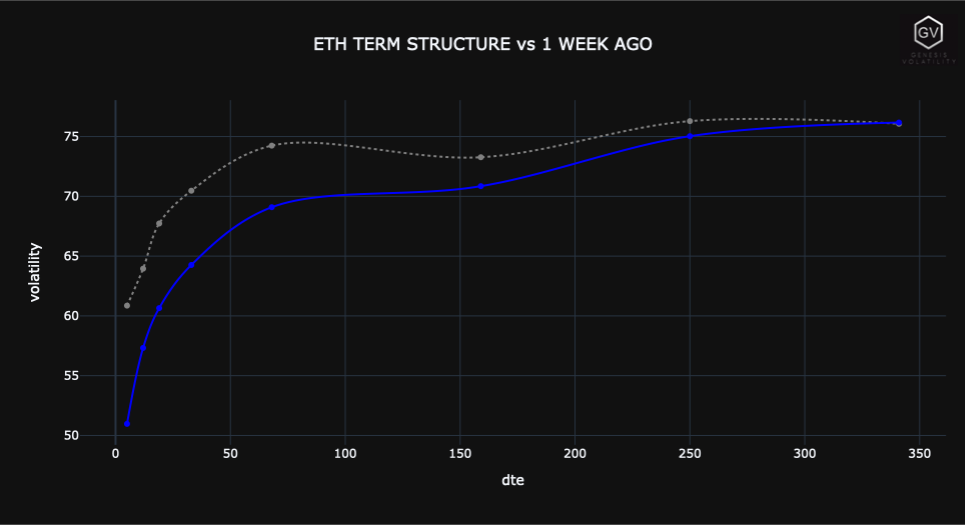

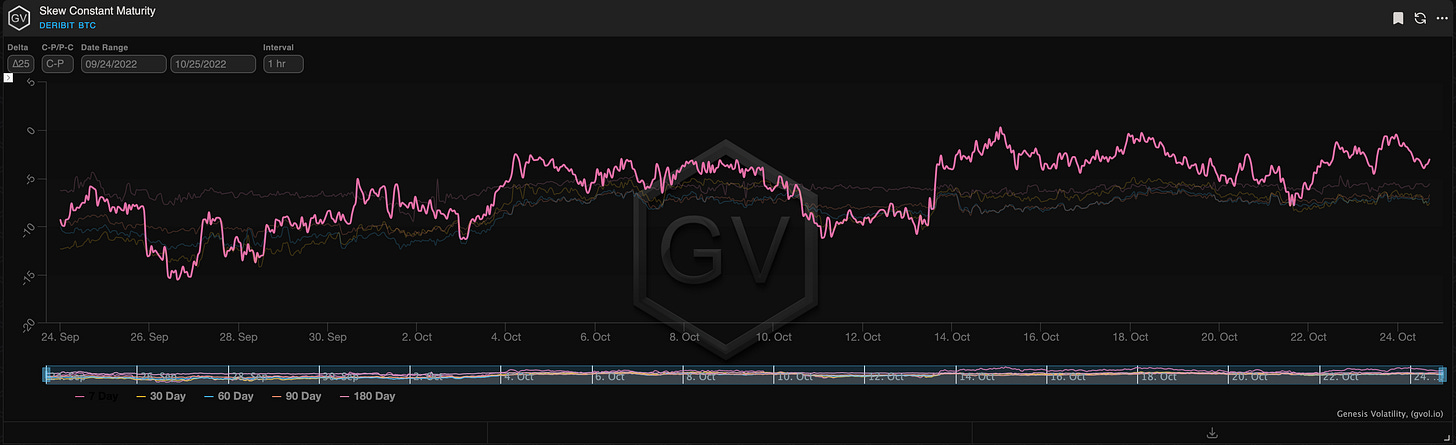

SKEWS

(Oct. 24th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

We can see that BTC RR-skew remains elevated compared to a month earlier.

As vol. comes down, the need for massive put protection purchases are coming down as well. This causes the the BTC RR to shift higher.

Any positive RR-skew is a good fade in my opinion, given my bias for new lows on the year at some point.

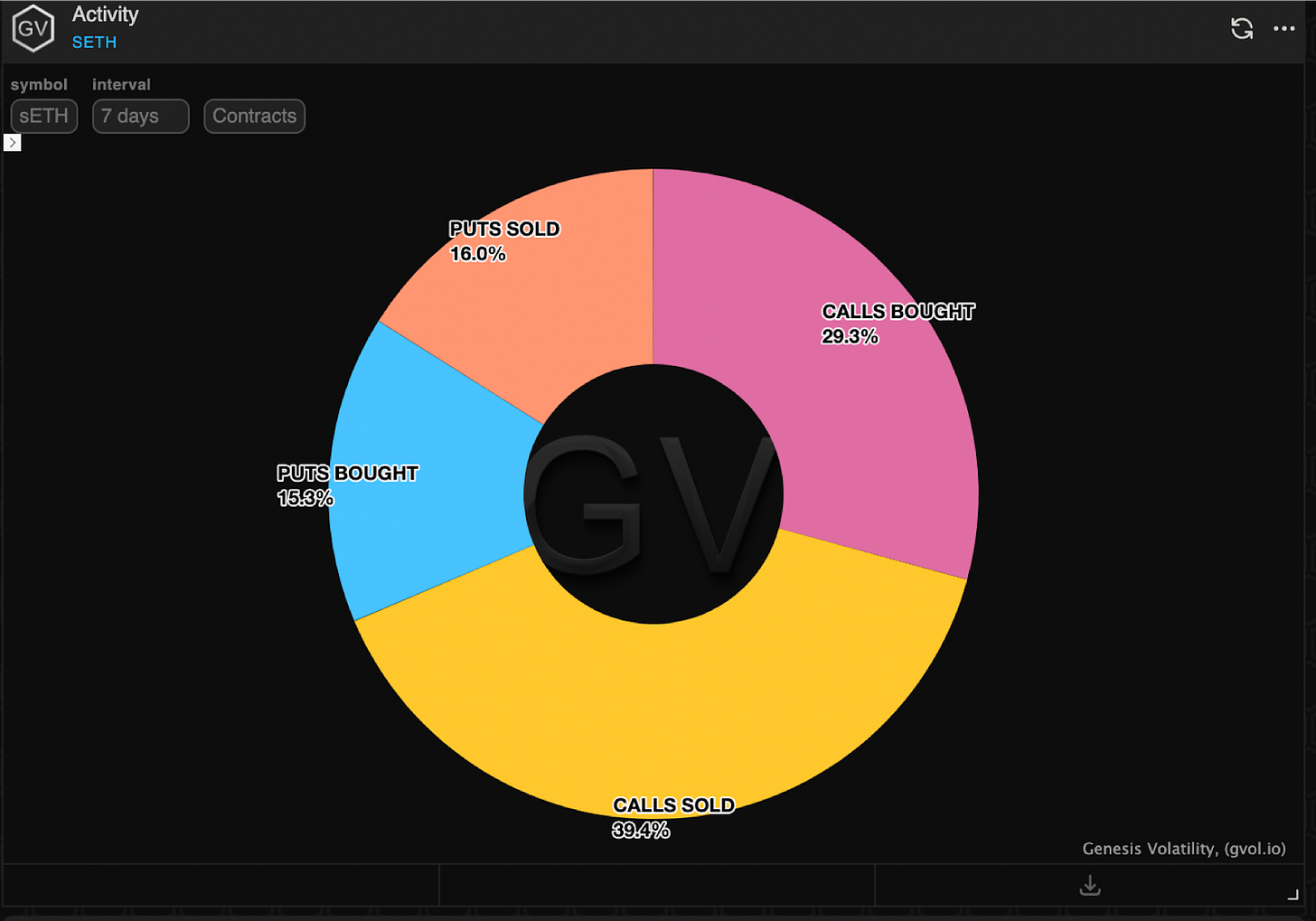

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

The overall level of iv at historic lows and the relatively flat skew, allowed traders to express their ideas without too much constraints.

And in fact the week is difficult to read with many strike-levels traded 2-way and with both short and long volatility positions. The term structure in strong contango, however, influenced the tone of the flow (short front + neutral/long back).

Although there is a lack of a clear distinct theme (nor bullish or bearish), some trades have caught attention:

BITCOIN

BTC-19NOV22-19000 straddle bought

BTC-4NOV22-18000-P bought

BTC-29SEP23-22000-C bought (65.6% iv delta hedged)

BTC-30DEC22-23000-C sold on screen

ETHEREUM

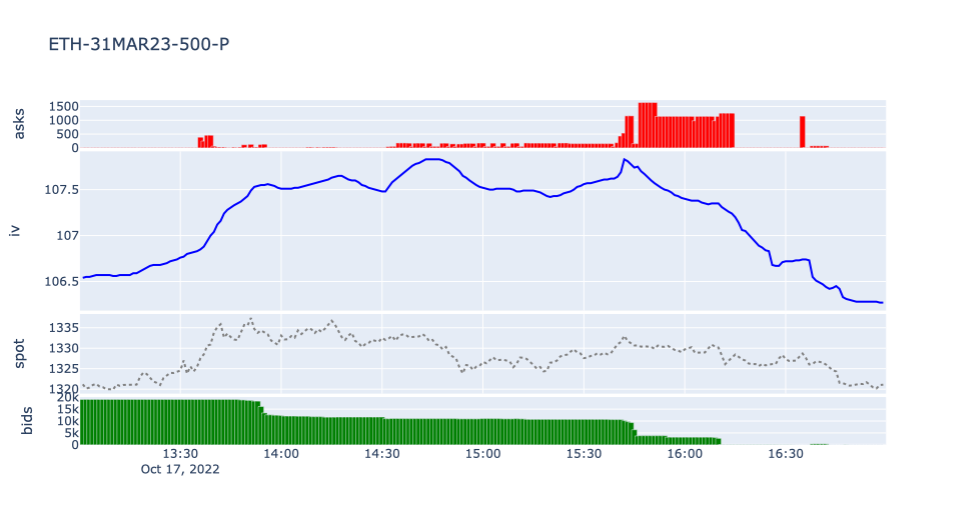

- ETH-31MAR23-500-P bought x20000 on screen

This last trade was a bid in the deribit orderbook for a few days before being hit by MMs and was the subject of some controversy on twitter:

(GVOL orderbook 1minute detail | ETH 31MAR23 500 Put)

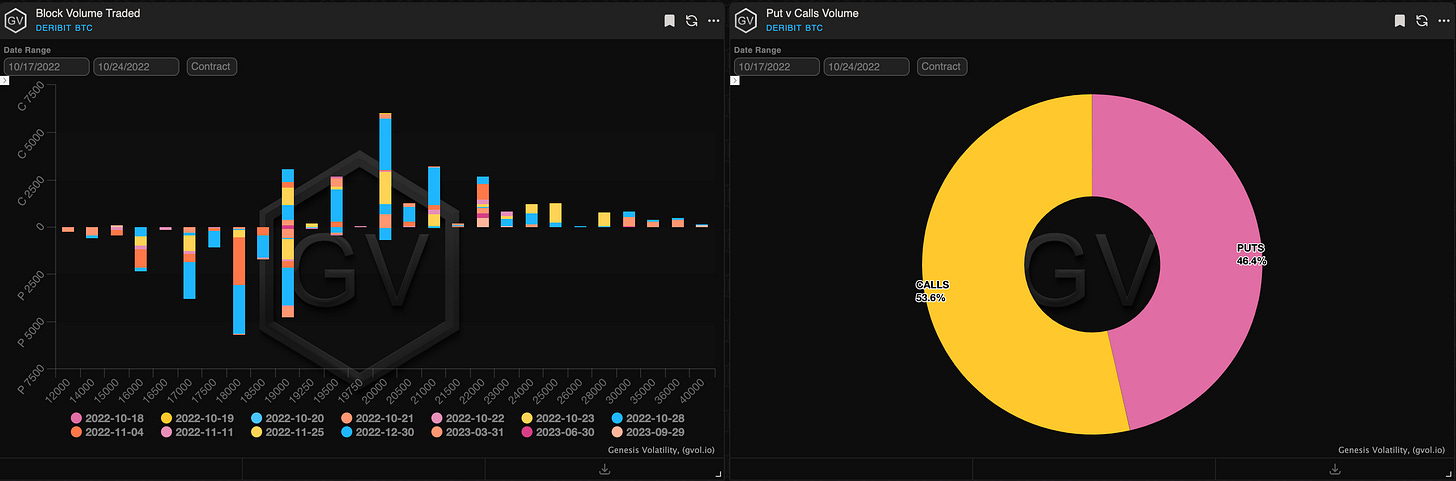

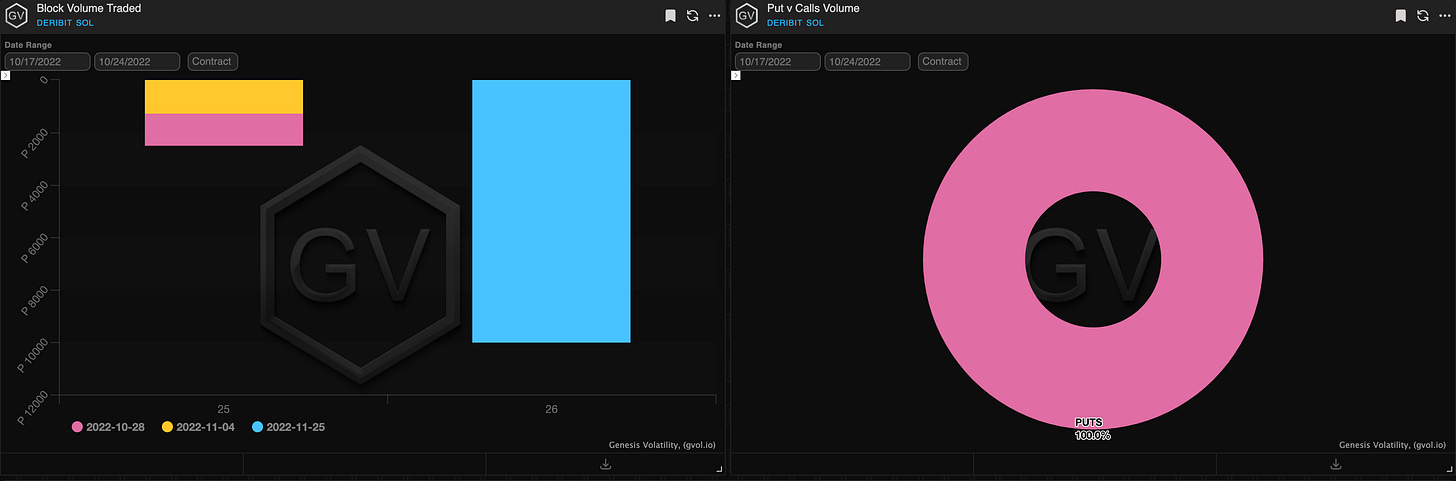

Paradigm Block Insights (17 October – 23 October)

Calm spot action drove volatility lower this week. Takers bought downside in SIZE.

📢First @friktion_labs auction on Paradigm📢

BTC Unch. / ETH +1% / SOL -7% / NDX +3%

BTC Flows 🌊

SIZE outright options were blocked on Paradigm this week. Takers are getting long vol to capture the depressed implied levels.

2000x 4-Nov-22 18000 Put bot 🔥

1575x 28-Oct-22 20000 Call bot

550x 28-Oct-22 20000 Put bot

🌊

We noted in our weekly commentary that the 4Nov bucket (capturing the Fed’s meeting on 2Nov) is getting bid as takers play for a vol surge 🫡

2000x 4Nov 18k Put bot

450x 28Oct 17k / 4Nov 16k PCal bot

250x 4Nov 18k / 25Nov 17k PCal sold

Term structure in contango 👀

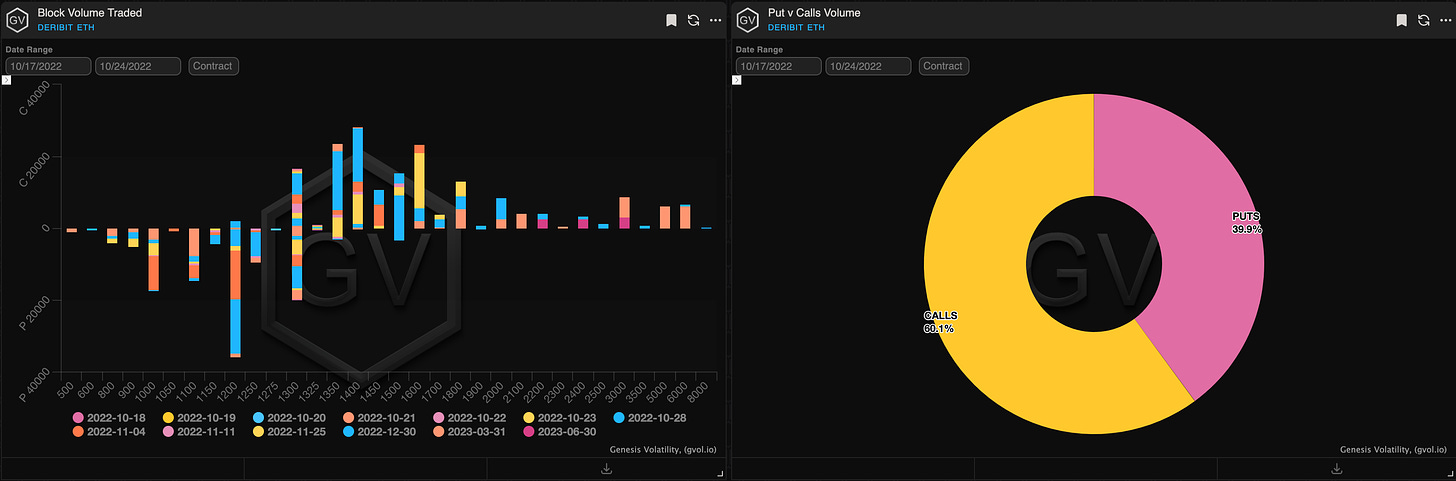

🌊ETH

Size outright vol lifted capturing 2Nov Fed meeting in ETH. ATM vols trading CHEAP.

12.5x 4Nov 1200 Put bot

9000x 28Oct 1200 / 4Nov 1000 PCal sold

8300x 28Oct 1400 Call bot

7000x 25Nov 1400/1600 CSpd sold

🌊

Important to note that SPX realized vol is now higher than ETH!!.ETH a ATM implied still around 30 point higher (vol 57 vs 25 in Nov).

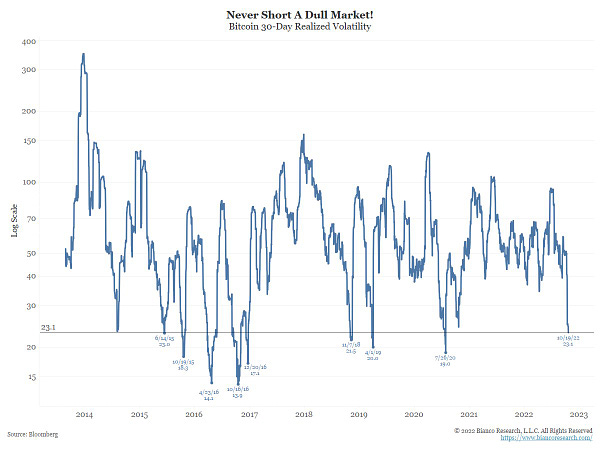

H/T @biancoresearch The old trader adage "never short a dull market,"

Read this 👉

FTX FSPD🔥🔥🔥. Talking about liquidity.. TOB in ETH Spot/Perp showing 22,000 ETH😲 with 0.10 wide bid-ask spread!! Screen showing 0.2 wide for 50 only….

@tradeparadigm if you like tight markets with size 💪

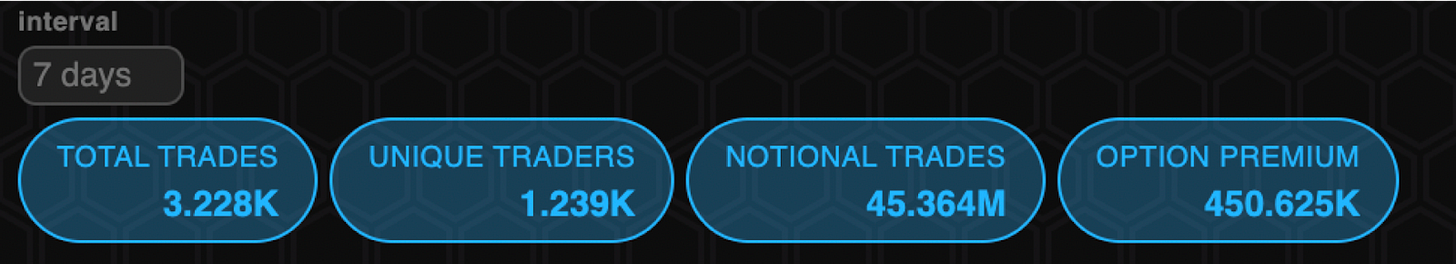

More FSPD trades in the last 7 days then the last 2 months combined. 71K trades💥. AXS taking the lead…

Top 3 structures (# trades):

AXS Spot / Perp 29K

ETH Spot / Perp: 21K

ETH Dec / March 12 K

BTC

ETH

SOL

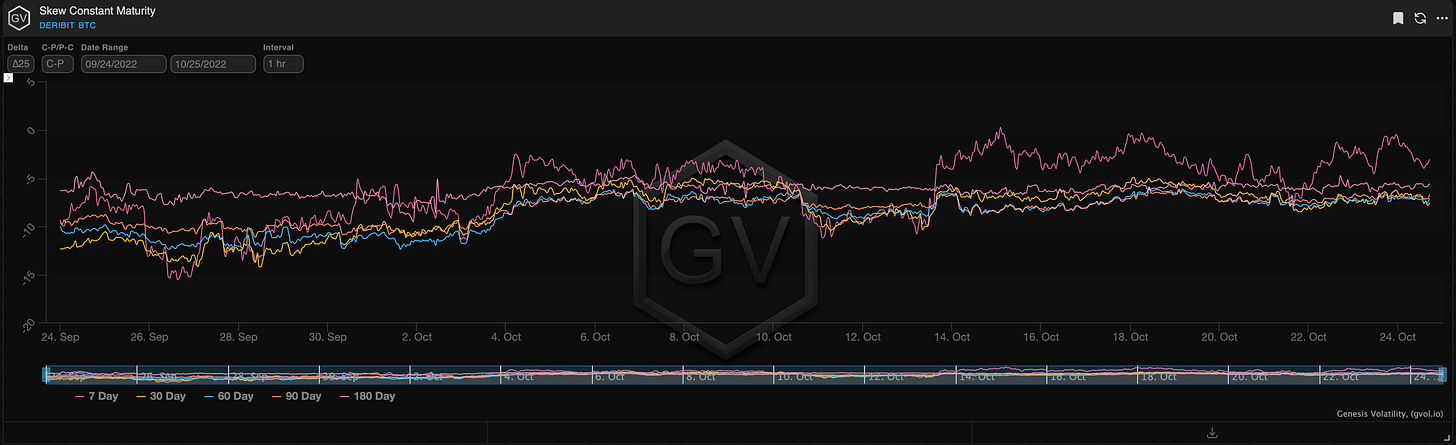

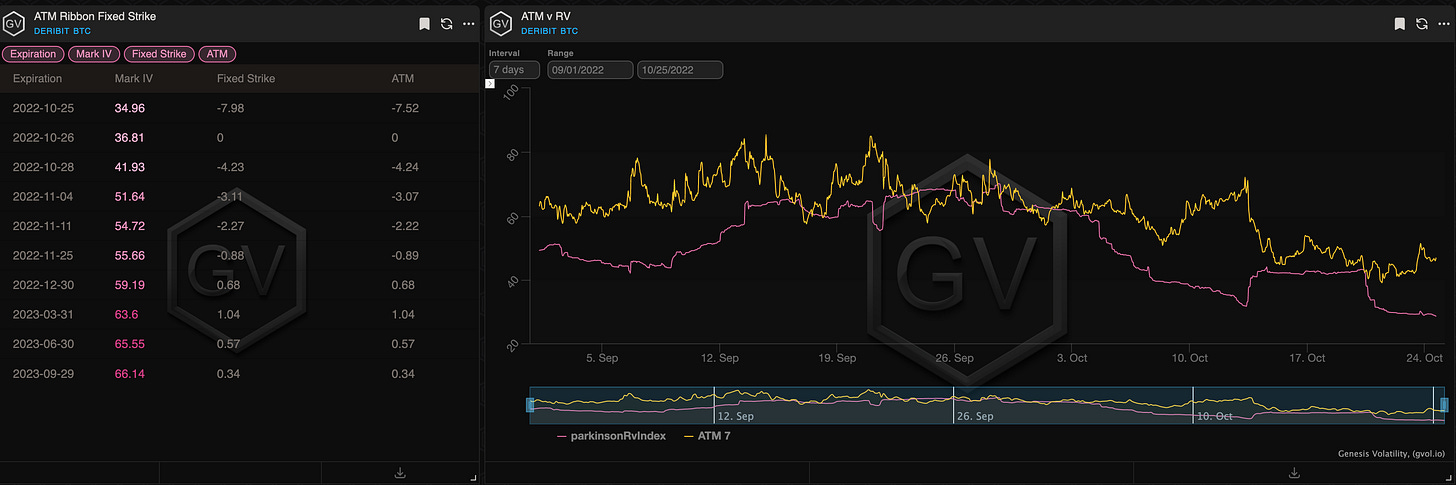

VOLATILITY PREMIUM

(Oct. 24th, 2022 - BTC IV-RV)

As mentioned last week, once the CPI day has dropped out of the RV calculation, we return to a massive VRP.

What’s even more important to note, is that this wide VRP is present EVEN using the 7-day time frame (the lowest IV on the fixed term structure charts).

Squeeth Weekly Review - 8/16/2022 - 8/22/2022

Markets remain quiet as the bottom of this range continues to hold support. ETH finished the week +.93% and oSQTH ended the week +.73%.

Volatility

Volatility slowly sold off over the week to end in the 50s. oSQTH remains a cheap product for buying ETH exposure.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $5.05m. October 18th saw the most volume, with a daily total of $984.82k traded.

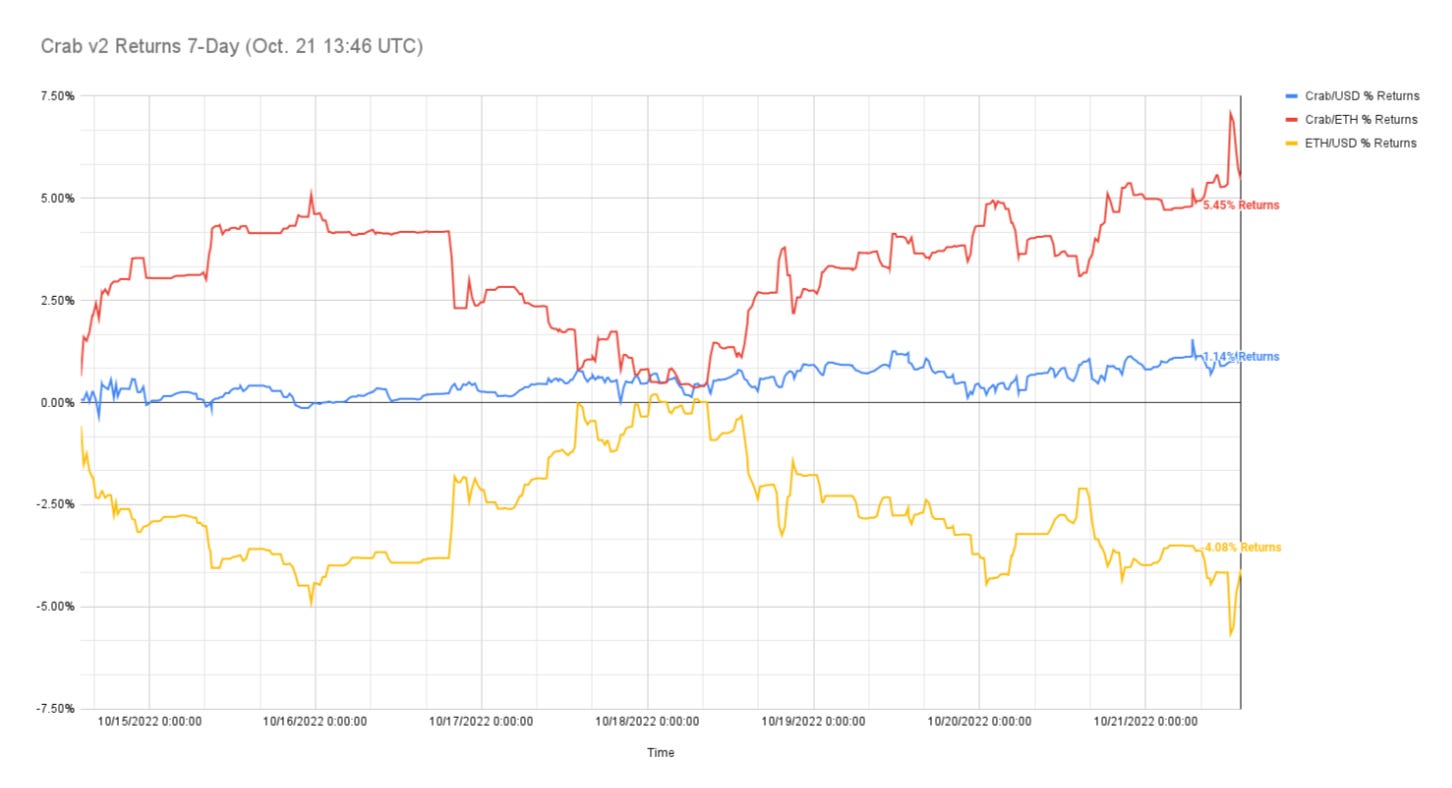

Crab Strategy

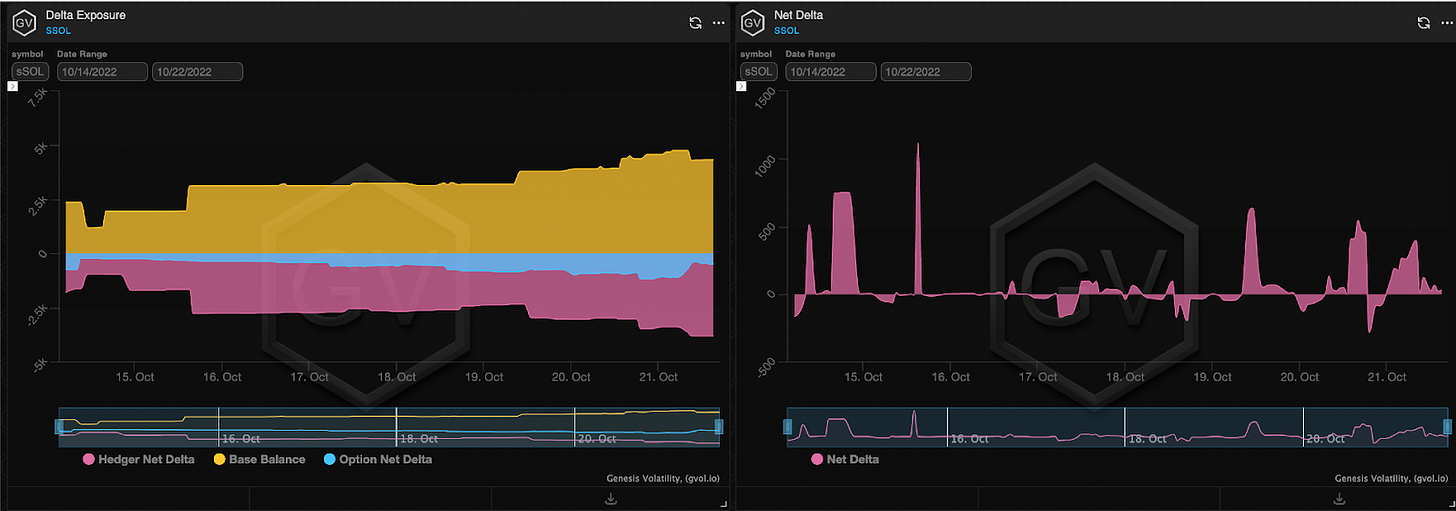

Crab finished the dates of October 15th - October 21st with a 1.14% return in terms of USD, and a 5.45% return in terms of ETH.

Crab performed 3 hedges this week equating to 266.729 ETH.

Join us in Discord for all things Opyn: https://discord.gg/opyn

ETH 7-Day Stats:

Volatility

ETH Implied Volatility has continued lower this week on a stagnant market. Current ATM IV is sitting at ~50% with most defi option term structures in steep contango. IV is down near 28 points in one week. Longer-dated options are trading at a premium to near-term options with IV ~ 68%

Trading

30-day trading fees for the ETH MMV are ~140K!

Vol hammering continues with ~56% of all order flow being option sellers.

The Lyra ecosystem continues to grow with the launch of new integrations!

Lyra users can now trade with Advanced Mode!

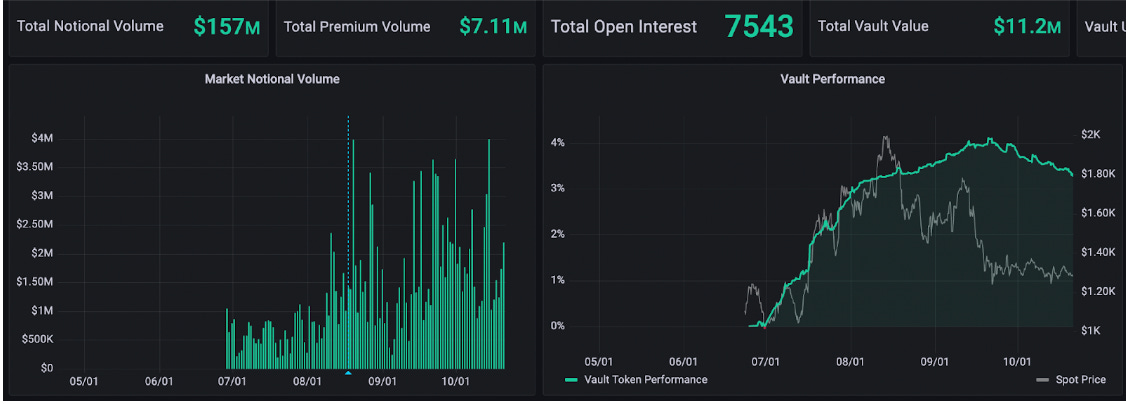

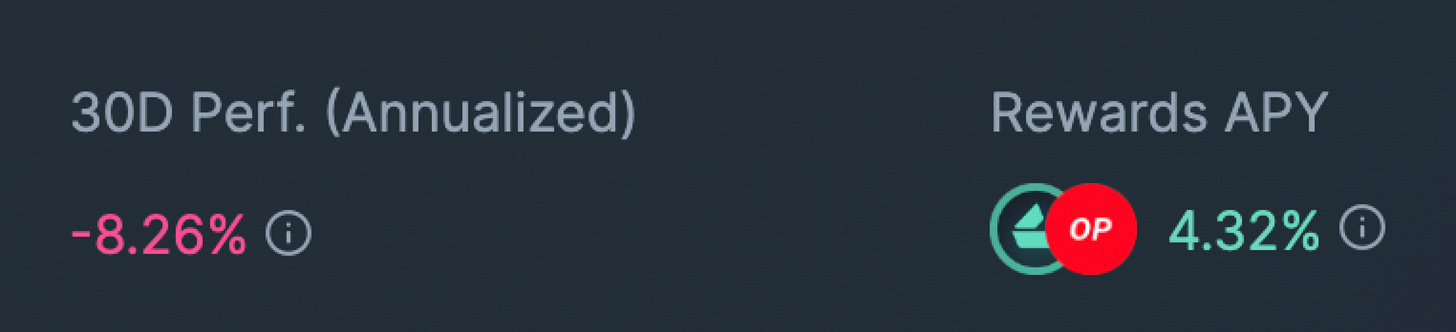

ETH Market-Making Vault

The ETH MMV has returned 3.29% since its inception (June 28th, 2022) representing a weekly change of -0.20%. Over the last few weeks, the MMVs have flipped from a short vega to a long vega position. Long gamma and short theta positions are expected to decay over time and capture profits on large market moves.

The 30-day performance is -8.26%, annualized performance since inception is +9.96%. Depositors earn an additional 4.32% rewards APY (boosted up to 8.64% for LYRA Stakers)

Net MMV Exposure:

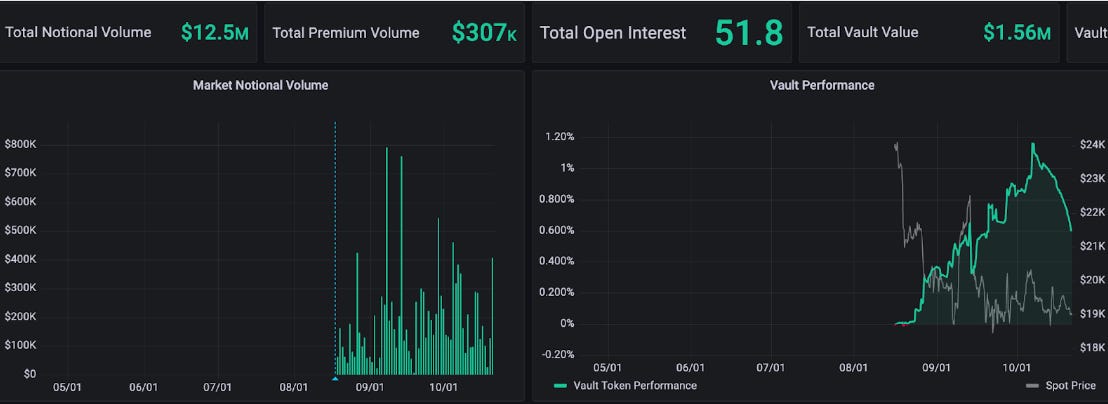

BTC Market-Making Vault

Lyra’s BTC MMV has returned .61% since its inception (August 16th, 2022). This represents a weekly change of -0.33%.

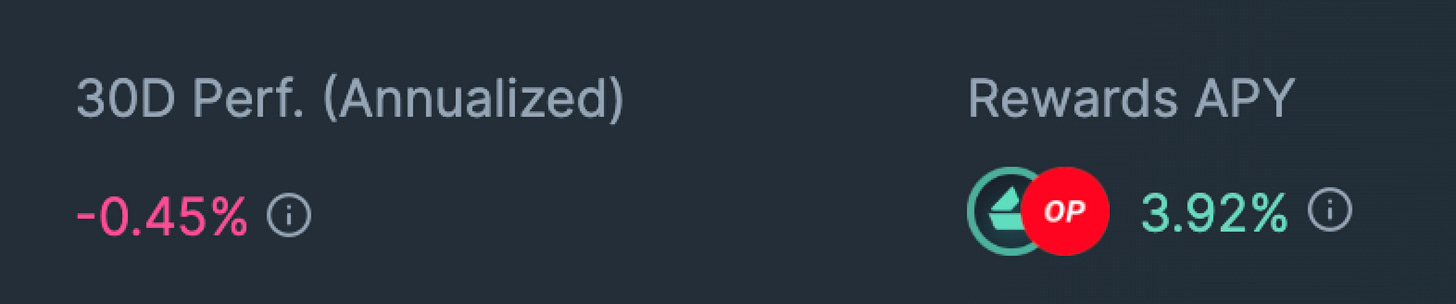

The 30-day performance is -0.45% annualized. Depositors earn an additional 3.92% rewards APY (boosted up to 7.84% for LYRA Stakers)

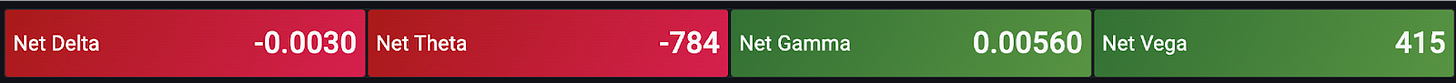

Net MMV Exposure:

SOL Market-Making Vault

SOL options are live on Lyra! Rewards APY for vault deposits are currently 9.33% (boosted up to 18.66% for LYRA Stakers)

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here