Crypto Options Analytics, Oct. 16th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Week Ahead:

Tuesday 10AM ET: NAHB home builders' index

Wednesday 8:30am ET: Housing Starts and Builders Permits

Thursday 10AM ET: Existing home sales (SAAR)

THE BIG PICTURE THEMES:

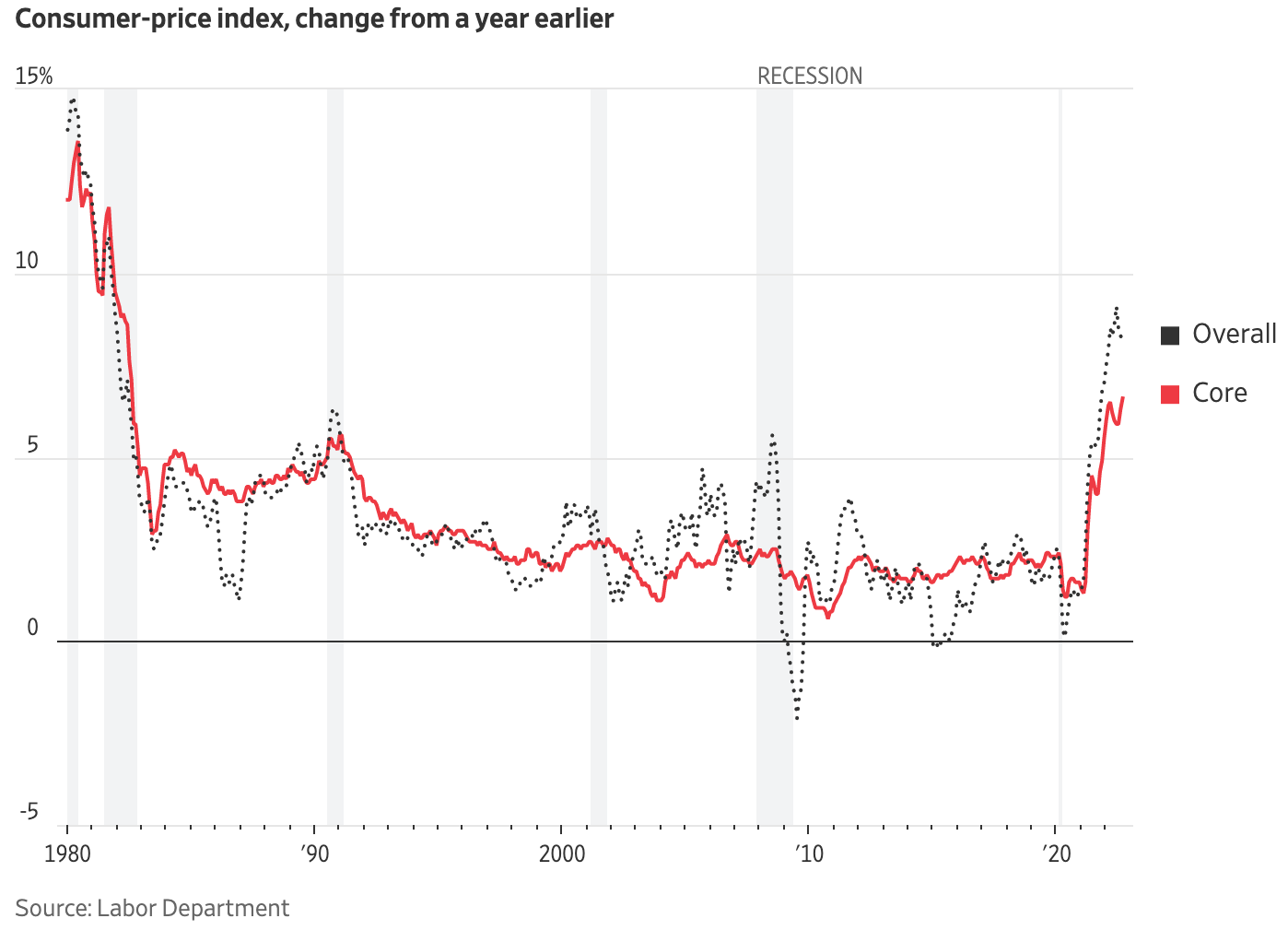

Core CPI hit its biggest level since 1982 last week, marking another big CPI surprise.

Even though energy and other commodities are lower compared to earlier this year, inflation isn’t coming down yet. Housing is a big part of the reason.

This implied more rate hikes by the US Central Bank but crypto prices actually held-up nicely and closed the week essentially unchanged.

This week we have a couple housing related economics releases that could move TradFi markets.

BTC: $19,248 -0.5%

ETH :$1,304 +0.0%

SOL: $30.2 -7.2%

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

It’s been 3-weeks in a row of nearly 0% movement in BTC and ETH spot markets.

We’re seeing a drop in RV, relative strength in crypto (VS) TradFi risk-assets and a turn towards a more bullish volatility surface.

DVol is now flirting with 12-month lows yet the VRP continues to grow larger.

TERM STRUCTURE

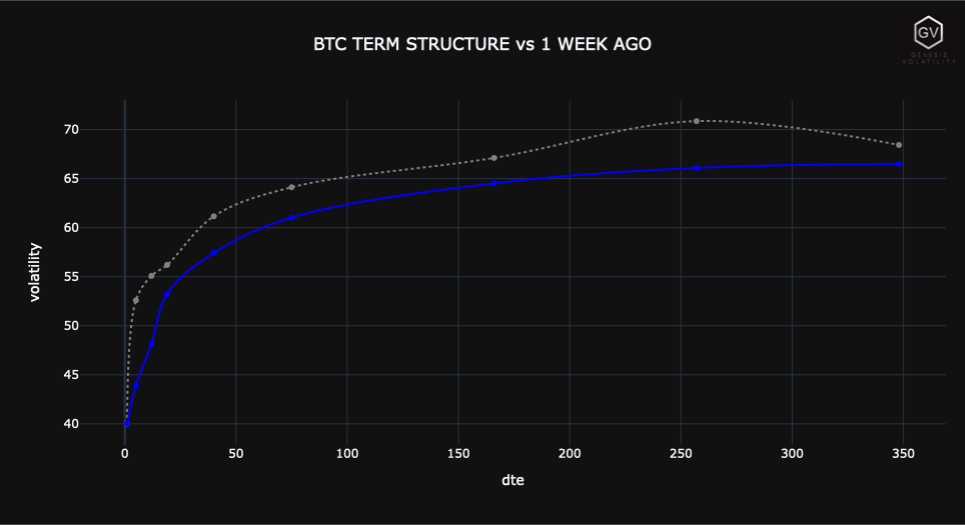

(Oct. 16th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

When you look at the term structure, you can see the 7-day ATM vol. leading the TS into a very STEEP Contango.

Option markets are reflecting a confidence in continued spot-price consolidation.

Vol. sellers aren’t only enjoying a large VRP but also a term-structure “roll-down”.

If everything holds constant, this is one of the best vol. selling environments for BTC.

BTC (Term Structure - API chart)

ETH (Term Structure - API chart)

ETH also as a steep term-structure especially in the front-end.

We’re also seeing big parallel drops in long-term options, about -5% pts in both ETH and BTC.

SKEWS

(Oct. 16th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

BTC RR-Skew is “almost” back above the 0-line.

This is fascinating because macro sentiment is still uncertain and bearish, but crypto vol. is now showing strong divergence.

For context, 7-day RR-Skew was briefly above the 0-line going into Sept. CPI. That trade didn’t work and RR-skew was instantly sold back down.

Today we’re coming off another bad CPI print last week, risk-assets are down but BTC skew is climbing steadily higher.

7-day RR-skew has been negative nearly the entire past 12-months.

This divergence is very interesting to note, especially combined with the relative strength vs TradFi.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

Week as expected: gamma bid until the release of the CPI with the prevalence of puts dominating the flow (skew deteriorated), with unwind of positions in the following moments the event. Sales continued, bloodbath of iv (at minimum levels of 2022).

The price action of 13th/14th October with a 10% swing justified purchases at >100iv, but gamma buyers were caught off guard…

Very dynamic trading week on-screen, both with several prominent orders placed in the book as “resting orders” traded subsequently near-mark, and with aggressive buyers/sellers who have paid the whole bid-ask spread.

Notable on-screen trades:

Bitcoin trades:

BTC-4NOV22-20000-C sold

BTC-25NOV22-22000-C sold

BTC-30DEC22-20000/21000/23000-C sold

BTC-31MAR23-25000/26000-C sold

BTC-30DEC22-19000/18000/17000-P bought

Ethereum trades:

ETH-30DEC22-1600-C sold

ETH-31MAR23-1800/1900-C sold

ETH-30DEC22-2000-C bought

Paradigm Block Insights (10 Oct – 16 Oct)

Another week of poor realized, but turbulent intraday action around the US CPI release.

Large puts bought ahead of the data, but unwinding downside after the print.

BTC -1% / ETH -3% / SOL -9% / NDX -3%

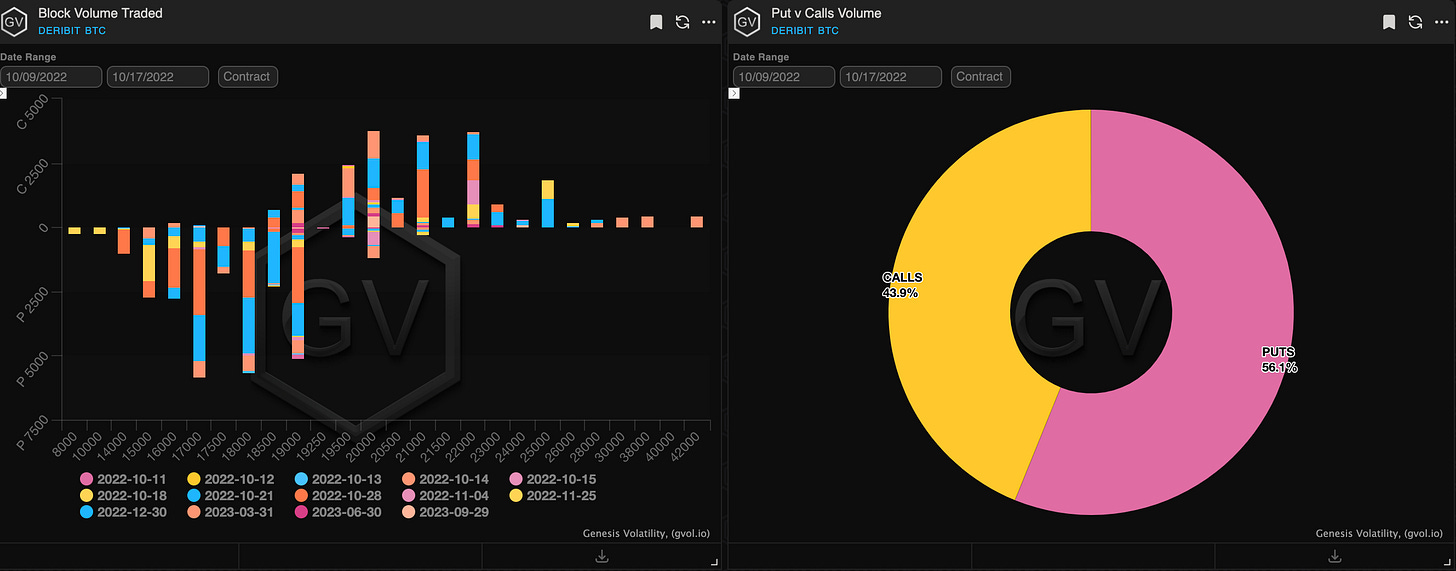

BTC Flows 🌊

Put buying into CPI was the theme with short-dated implieds at the lows.

Some of our clients believed realized this poor is a contrarian signal to own vol (BTC <40v historically doesn’t last), with CPI as a potential catalyst.😮💨

Is this time different?🤔

BTC Put Buying Before CPI

1500x 28Oct 17000 Put bot

1000x 21Oct 18500 Put bot

500x 28Oct 17500 Put bot

500x 21Oct 18000 Put bot

500x 21Oct 17500 Put bot

Immediately after CPI, takers unloaded BTC short-dated downside and bought upside. 📈

Dealers reluctant to bid downside as vols fell off a cliff.

400x 21Oct 16000/18000 Put Spread sold

400x 28Oct 17000 Put sold

374.3x 28Oct 18500/21000 Call Spread bot

ETH Flows 🌊

Takers played for upside in ETH all week. A SIZE Nov call spread buyer lit up market makers mid-week. playing for a 30% move over the next 6 weeks. 👇

36k 25-Nov-22 1700/1900 Call Spread bot

Additional topside flows:

13k 30Dec 1700 Call bot

12k 21Oct 1400 Call bot

9k 21Oct 1350 Call bot

BTC

ETH

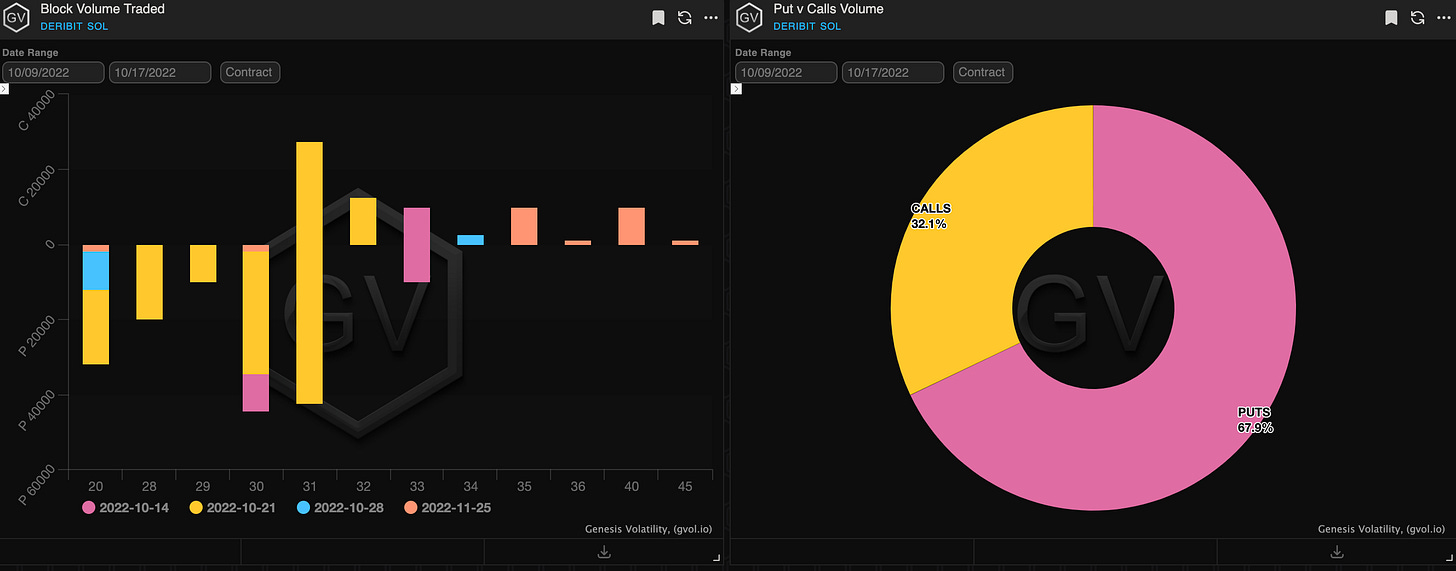

SOL

VOLATILITY PREMIUM

(Oct. 16th, 2022 - BTC IV-RV)

Notice the VRP closed a little this week, but I think this will be short-lived.

RV jumped higher on the CPI number but I expect that data-point to “Drop out” of the 7-day RV calculation.

This means that the likely “true” VRP reflects current IV and RV seen around Oct. 10th.

With most expecting fireworks on the back of the CPI print this week remained relatively flat. ETH ended the week +1.44%, oSQTH ended the week +3.45%.

Volatility

This week oSQTH volatility remained range bound. oSQTH presented interesting trades pre-CPI relative to DVOL short dated IV.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $6.03m. October 14th saw the most volume, with a daily total of $1.31m traded.

Crab Strategy

Crab strategy continues to see deposits with roughly 4,985 ETH in the vault. This week Crab returned roughly 1.6% in USD terms.

This week Crab performed 3 hedges equating to 222.33 ETH.

For more on Crab check out: squeeth.opyn.co/strategies

For all things Opyn, join us in Discord: http://discord.gg/opyn