Crypto Options Analytics, November 21st, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$59,446

DVOL: Deribit’s volatility index

(1 month, hourly)

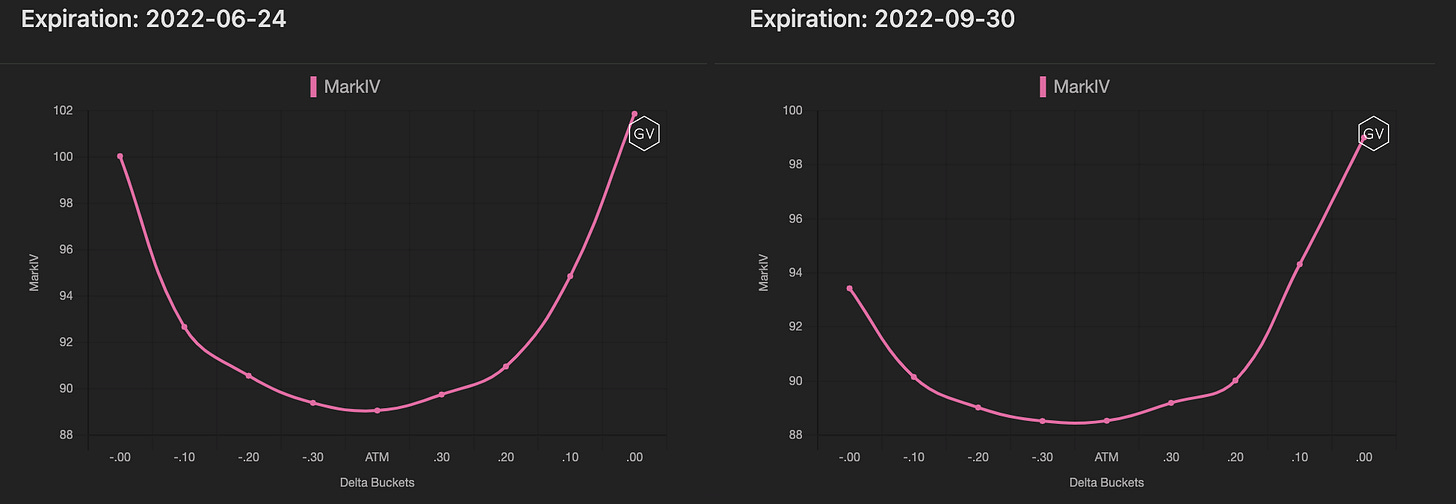

SKEWS

(Nov. 21st, 2021 - Short-term and Medium-term BTC Skews - Deribit)

Early in the week spot prices took a brief dive lower.

This caused option traders to quickly buy put protection, causing implied volatility to spike higher and short-term option skews to drop aggressively lower.

Without follow-through for BTC prices to go lower, implied volatility dropped, and option skew climbed back towards par by the end of the week.

Currently, most expirations are pricing skew at par, except for short-term expirations which are -4 pts negative.

(Nov. 21st, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Nov. 21st, 2021 - BTC’s Term Structure - Deribit)

Similar to skew activity, the ATM term-structure saw action early in the week.

The term-structure briefly flattened early this week as BTC spot prices dropped lower.

Short-term IV rallied +20pts to around 90% Implied vol.

As BTC prices stabilized, implied levels lost all their gains and short-term IV dropped back down to ~72%.

We are now back into a steep Contango structure with Dec. 31st expiration trading +25pts above immediate expiration.

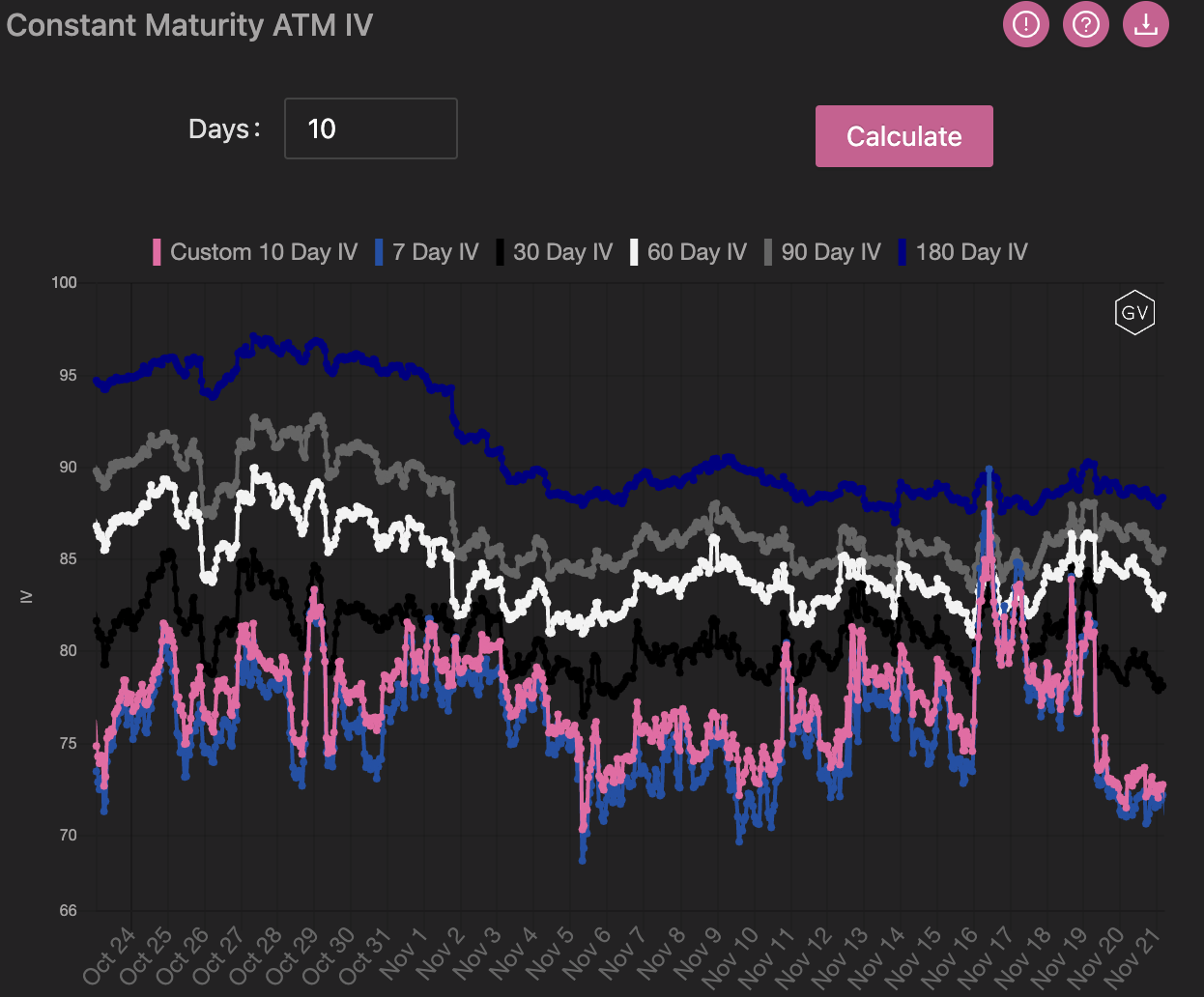

ATM/SKEW

(Nov. 21st, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has been “whippy” but “trendless” for the past month. IV has been consistently pricing higher future RV, but to no avail. This weekend IV has been able to break into the lower end of the monthly range.

If BTC prices can rally or continue to stabilize, we can’t help but continue to call for lower IV levels.

SKEW (right) has actually had direction this past month. Testing ATH’s brought skew into positive territory but as momentum failed to materialize higher prices, skew has been consistently pulled down this month.

Open Interest - @fb_gravitysucks

BTC

P/C ratio this week has been a warning bell after new ATHs were reached. Dollar premium has reversed the open interest distribution.

(Nov 19th , 2021 – BTC Open Interest profile – Deribit)

(Nov 19th , 2021 – BTC Dollar premium – Deribit)

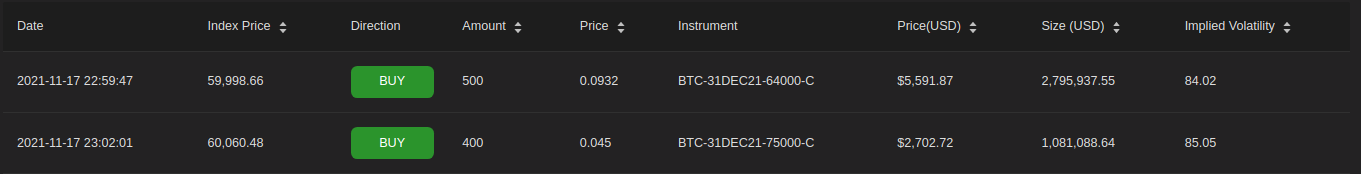

Top trades of the week:

1. On Wednesday we saw a huge trade blocked, reported as buy, for around $4M of premium, for DEC21 calls.

(Nov 17th , 2021 – Time and Sales, Historical Top Trades – Deribit)

2. On Thursday, as spot drops mid $56k, a smart trader took profit on 65k puts and rolled down to 60k. This was a no-cost trade as both legs had the same premium.

(Nov 17th , 2021 – Time and Sales, Historical Top Trades – Deribit)

3. On Friday, a refined risk reversal took place. Zero premium paid suggests an experienced desk.

(Nov 19th , 2021 – Time and Sales, Historical Top Trades – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

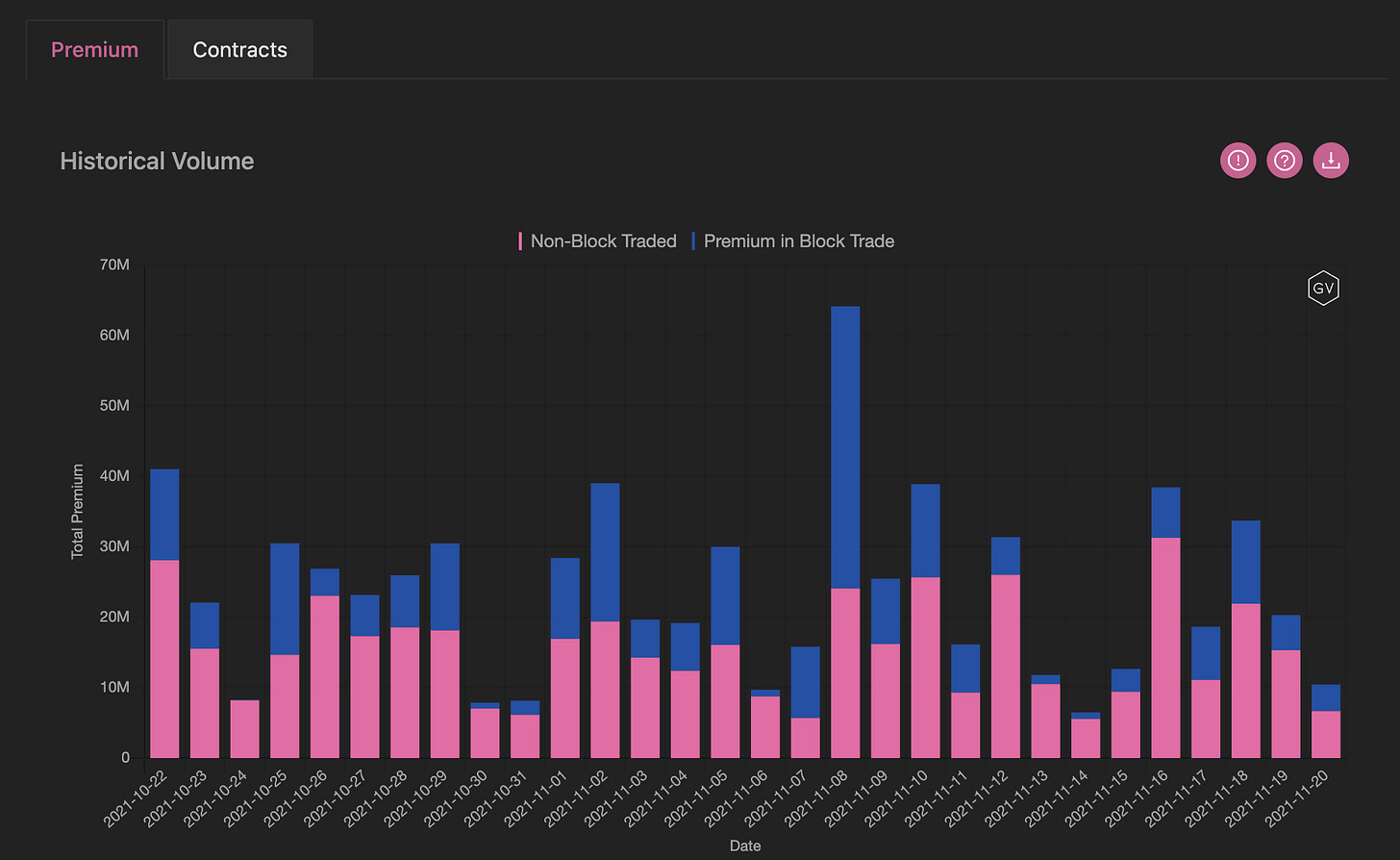

(Nov. 21st, 2021 - BTC Premium Traded - Deribit)

(Nov. 21st, 2021 - BTC’s Contracts Traded - Deribit)

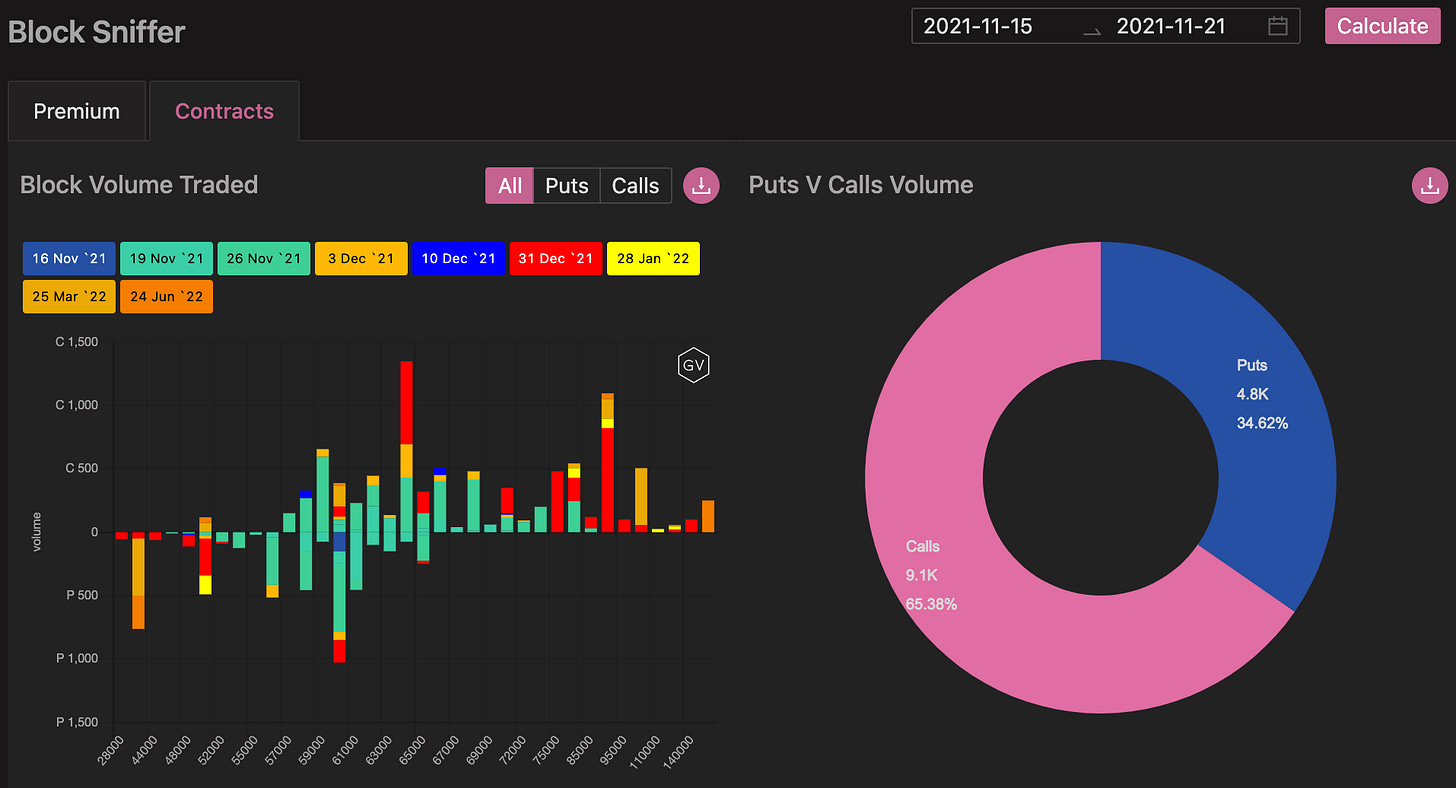

Paradigm Block Insights (Nov. 15th - Nov. 21st) - Patrick Chu

In BTC, we initially saw better demand for outright puts, in particular for the <1m 60k strike and demand for puts via risk reversals with the 40k Mar/Jun 22 dominating volumes. As BTC stabilized off the lows, we saw strong demand for outright calls & call spreads in particular for the Nov 26, Dec 3 & Dec 31 expiries.

(Nov. 15th - Nov. 21st - Volume Profile - Deribit & Paradigm)

Call spreads remained the most popular structure of the week, accounting for 29% of total volumes.

(Nov. 15th - Nov. 21st - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 21st, 2021 - BTC’s Volatility Cone)

Short-term RV measurements lifted off their lows thanks to the BTC spot selling.

Assuming we don’t see lower prices, we expect RV to drop back into annual lows.

REALIZED & IMPLIED

(Nov. 21st, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The IV/RV GAP couldn’t even close this week, despite the spot bearish RV rise.

Crypto options are having difficulty finding natural sellers, therefore IV is pricing a heavy premium.

We continue to prefer the short-vol. side here.

$4,358

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Nov. 21st, 2021 - ETH’s Skews - Deribit)

ETH skews continued to drop lower this week, giving back their abnormal shift higher seen in Mid-October.

All skews with expirations shorter than 90-days flipped into the negative earlier this week as ETH prices dropped alongside BTC.

ETH is now finding support and seems relatively stronger than BTC.

Despite the stop in price bleed, ETH option skews are negative for expirations shorter than 30-days.

(Nov. 21st, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Nov. 21st, 2021 - ETH’s Term Structure - Deribit)

The term structure continues to be extremely steep.

DEC 31st expiration bleeds nearly 1pt implied volatility per day, in addition to regular theta decay.

Even with the bearish rise in vol. seen this week, the ETH term structure maintained a Contango shape.

The 7-day to 90-day IV spread is 35pts. Very Steep! Vol. buyers need some fireworks to justify current premiums.

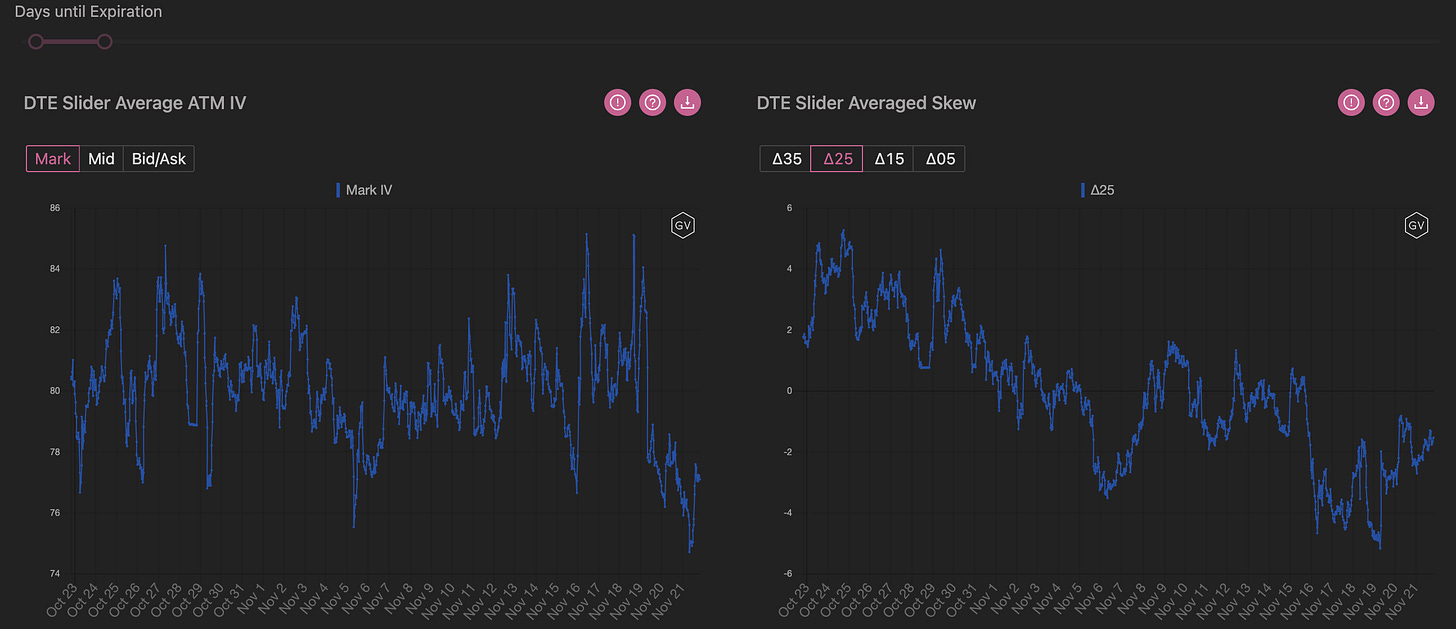

ATM/SKEW

(Nov. 21st, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) IV continues to hold a range, although it’s a rather large 20pt range.

Skew (right) has consistently dropped lower this month with a few brief rallies in-between.

The parallel shift higher in mid-October was unusual and this skew activity is a “normalizing” event as opposed to a change of sentiment, in our opinion.

Open Interest - @fb_gravitysucks

ETH

Currently, ETH options flow seems more instructive for assessing what is happening in the market.

Notional on ETH gained huge traction over last months.

This week: P/C ratio of about 1, and a massive amount of dollar premium paid to puts holders compared to calls. Eyes on ETH for the weeks forward.

(Nov 19th , 2021 – ETH Open Interest profile – Deribit)

(Nov 19th , 2021 – ETH Dollar premium – Deribit)

Top trades of the week:

1. On Wednesday, the biggest trade of the week on Deribit, both considering ETH and BTC.

$5Mil premium paid. Buyers are expecting a “Santa rally”.

2. Monday, institutions bought large sizes of Mar 22 puts 3k-4k and sold calls 8k-10k. Very sharp flow.

3. Tuesday saw buying of 31Dec x 2500 call spreads.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Nov. 21st, 2021 - ETH’s Premium Traded - Deribit)

(Nov. 21st, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

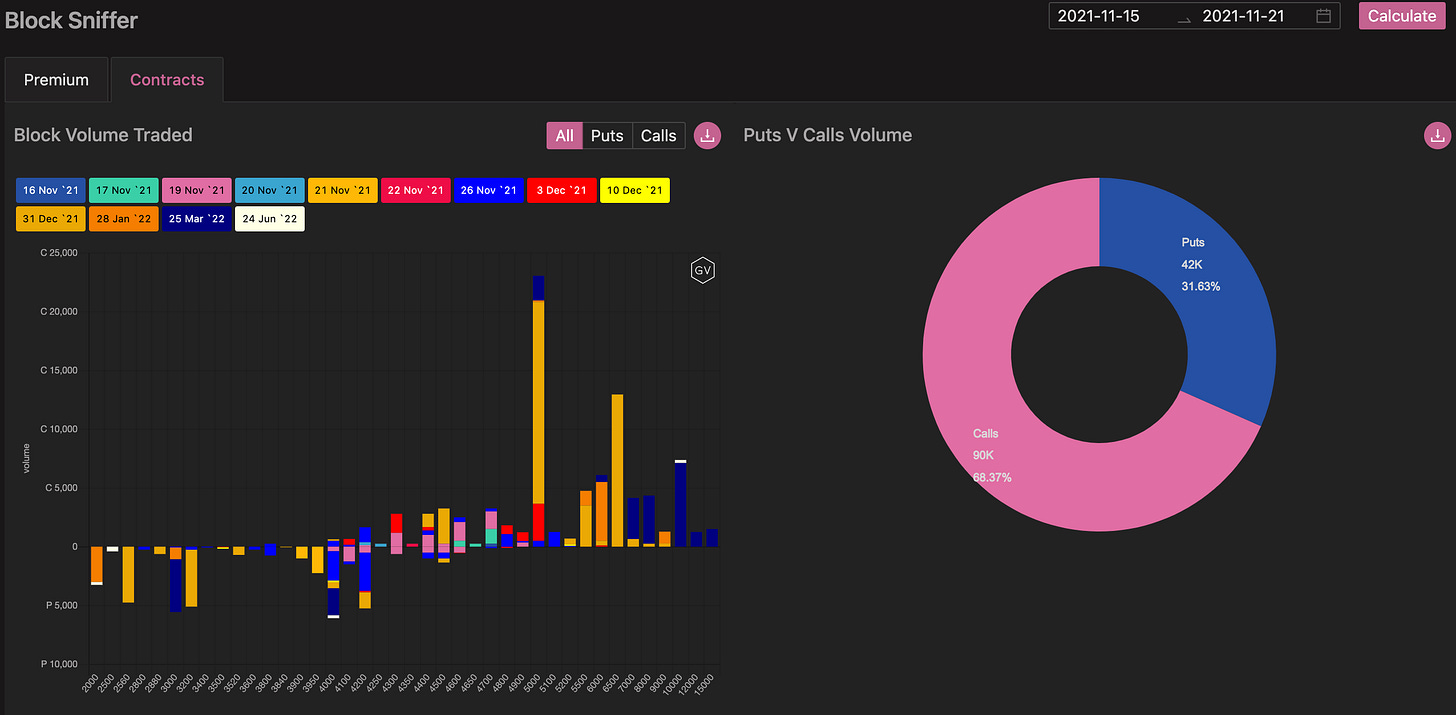

Paradigm Block Insights (Nov. 15th - Nov. 21st) - Patrick Chu

In ETH, skew initially moved in favor of puts, as we saw demand for short-dated puts via outrights and spreads on the 4200, 4000, 3200 & 3000 strikes, before recovering on the back of strong demand for year-end calls.

(Nov. 15th - Nov. 21st - Volume Profile - Deribit & Paradigm)

Dec 31 5000C (17175x) & 6500C (12950x) were the top two traded contracts this week as we continue to see bullish interest for a move higher by Dec & March expressed via outrights & call spreads.

(Nov. 15th - Nov. 21st - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 21st, 2021 - ETH’s Volatility Cone)

RV rose slightly on the back of spot-selling.

Stability or a sustained rise in spot-prices will likely send RV back to annual lows, unless explosive new momentum arrives as prices break all-time-highs.

REALIZED & IMPLIED

(Nov. 21st, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

ETH IV/RV were actually able to meet.

The stability in prices will likely send RV lower this week and reintroduce an IV to RV premium.