Crypto Options Analytics: November 3rd, 2024

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

Tuesday - US PRESIDENTIAL ELECTION

Thursday 2/2:30p - FOMC Rate Decision & Powell Press Conference

MACRO

Obviously this upcoming we is going to be dominated by the US Election, followed by the FOMC rate decision and Powell press conference on Thursday.

Last week we saw the market run bullish early in the week, only to reverse along with polls and prediction markets. Giving us good insights on how to trade the election.

We also had interesting economic numbers last week. Employment, GDP and the Fed’s favourite inflation indicator, the PCE.

The Federal Reserve is expected to cut interest rates by a quarter-point at its Thursday meeting, following a half-point cut in September, as inflation approaches the Fed’s 2% target.

Officials are cautiously optimistic about inflation trends, yet the labor market shows signs of cooling, with lower job growth and a slight uptick in layoffs.

The low October number is likely distorted by factors like the Boeing strike and two hurricanes, making it unreliable as a sole gauge of economic health.

Other signs point to economic resilience. GDP grew at 2.8% in the third quarter.

BTC: $68,818 (+1.6% / 7-day)

ETH :$2,461 (-1.2% / 7-day)

SOL :$161.90 (-8.4% / 7-day)

Crypto

The election polls and market pricing continue to show us how to trade BTC post election.

As the Trump odds rallied higher earlier last week, we saw BTC test all-time-highs again.

As the election betting markets began to retrace towards 50/50, BTC pulled away, along with the for related stock DJT.

Now that we see the direction of polls and BTC trends, this leaves us with how to trade the election itself.

The option market is pricing in a substantial volatility premium. As we can see the 7-day VRP is currently at +34% points.

Traders are expecting the election reaction will make-up for the large volatility premium gap.

Let’s translate this into an expected spot move!

With the newly listed November 6th contract, we can compare the ATM implied vol for 11/5 (48%) → 11/6 (81%) to get us a forward volatility of 112%.

Meaning the current pricing of the US election has the standard deviation of BTC spot +/- $4,000.

Because the odds are back near 50/50, I take that information as meaning neither outcome will be a “Surprise” +3-Sigma move.

That said there’s also no “we saw this coming” outcome either… Therefore I don’t see a scenario that produces a sub <1-Sigma reaction.

Therefore I expect a +1.5-Sigma ($6k to $8k price range) as a result of the post election price reaction.

Therefor major price levels are $60k (A Kamala win dip) or a $75k/$77k a Trump win that brings spot right back to the ATHs then THROUGH them, as election enthusiasm breaks the high seen last week.

Looking at the fixed strike volatility, we can see a larger negative skew with 60k Nov Puts around 102% IV and 80k at 91%.

The NOV29 upside contract could be an interesting selection for reacting to a Trump win.

+80k is only price at 15% while +90k is price at 5%

Trading the 80k/90k Call spread pays 10-to-1, costing a debit of about $1,000 on Deribit

Paradigm's Week In Review

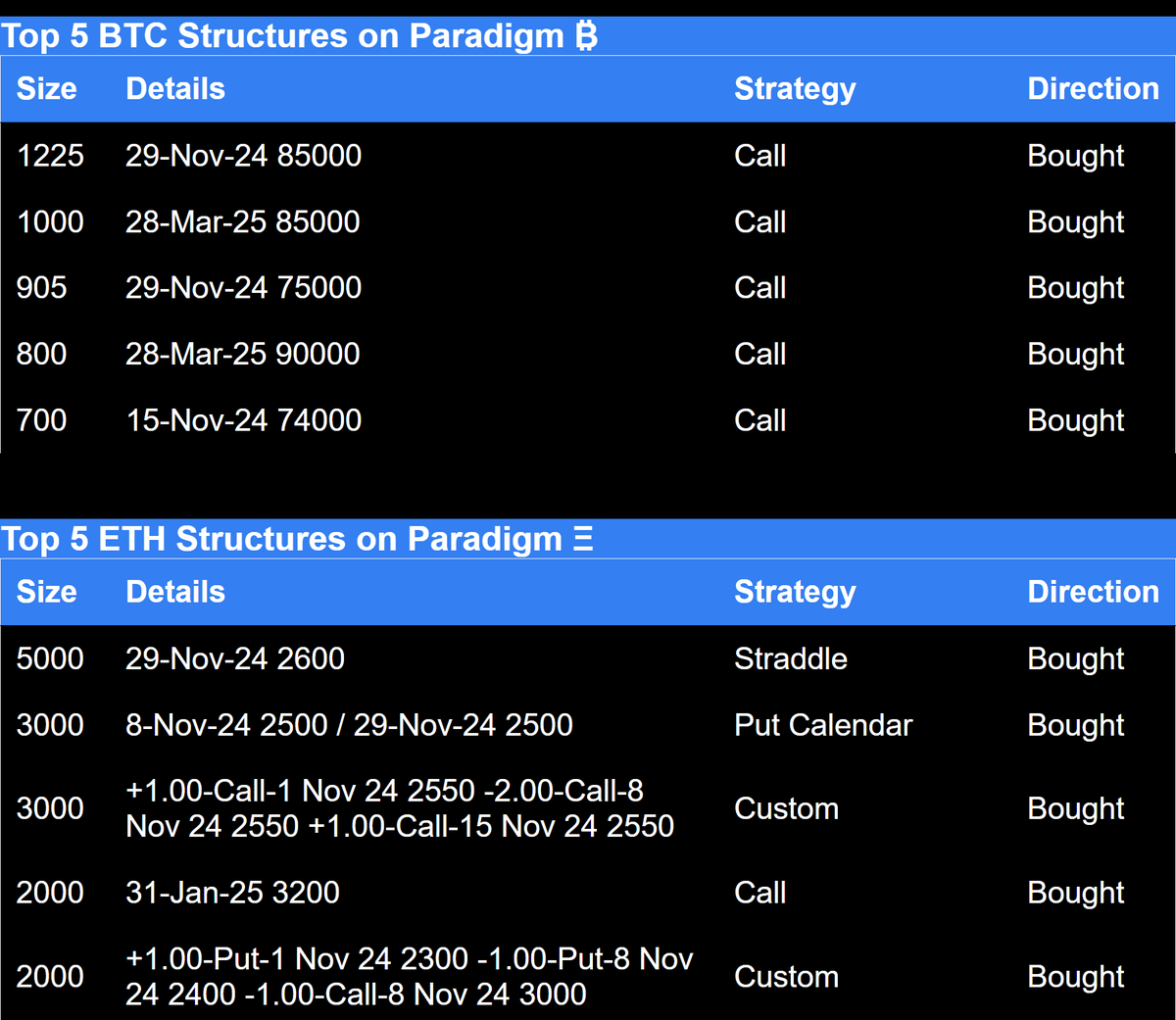

Paradigm Top Trades This Week

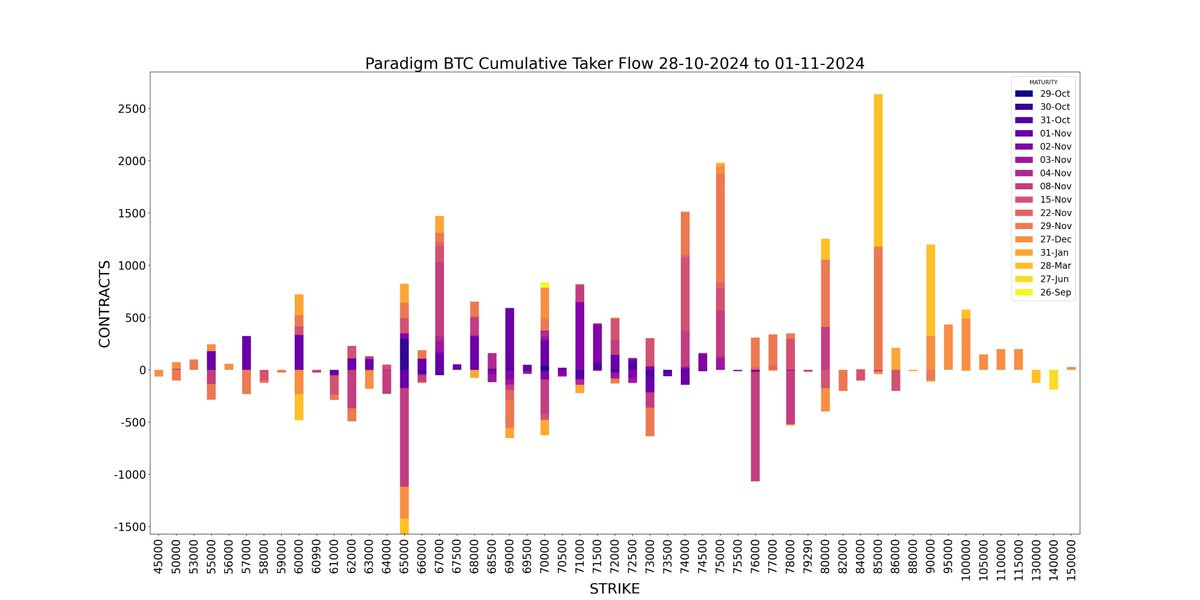

Weekly BTC Cumulative Taker Flow

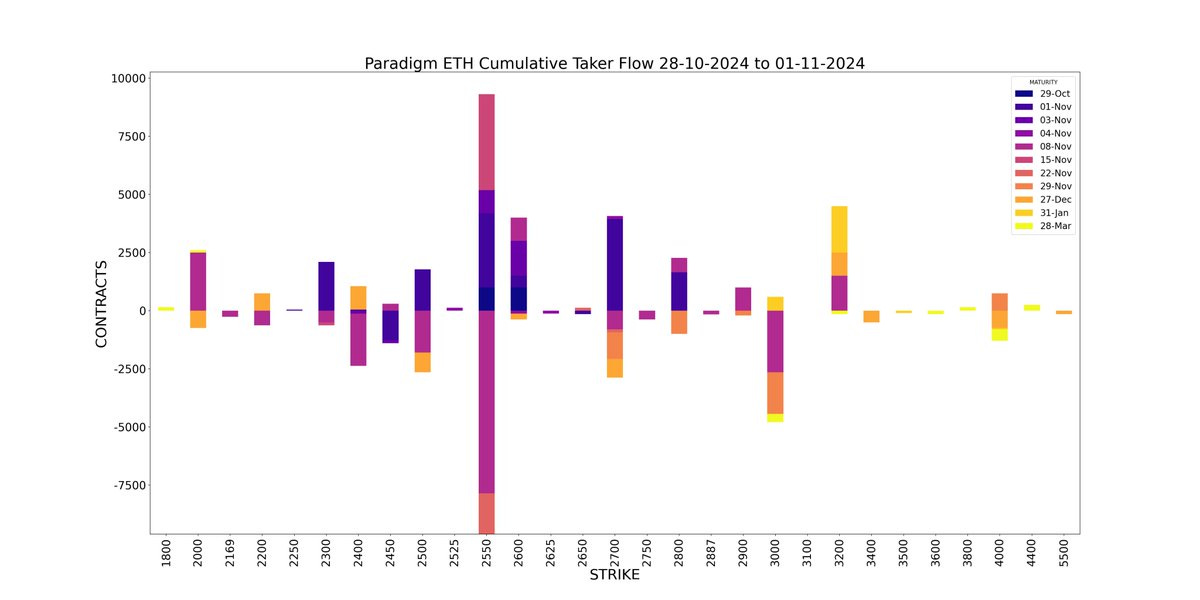

Weekly ETH Cumulative Taker Flow

BTC Cumulative OI

ETH Cumulative OI

BTC

ETH

The Squeethcosystem Report

This is the last week of Squeeth before it shut down to gear up for Opyn Markets launch. Crypto markets looked promising and had a positive first half of the week before closing red. ETH ended the week at -1.6% and oSQTH ended the week at -5.25%.

Volatility

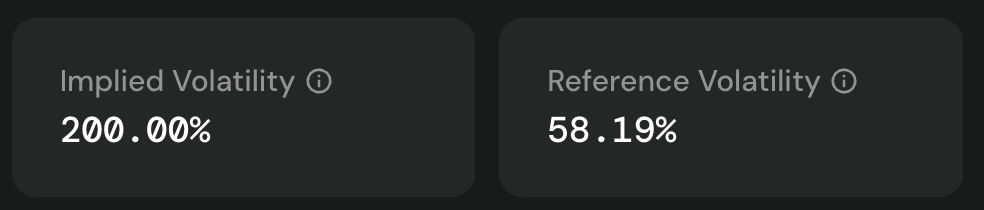

During its last week, oSQTH IV was 200% vs. its ref vol. closed at 58.19%.

Crab Strategy

Crab, also in its last week before shutdown, ended at -0.04%.

Twitter: https://twitter.com/opyn_

Discord: https://discord.gg/46PCtAS2

In the Markets

BTC 7 dte IV has surged from 51% to 74.5% in the last week (56% to 77.7% for ETH) as the market prices in heightened volatility ahead of the US election.

On Derive, there is a moderate difference in BTC put and call OI (896 to 1184) while for ETH the difference is 4609 to 11,165 - likely the result of yield generation from the LRT vaults.

25 delta BTC skew is slightly positive at 2% while that for ETH is -3%, indicating puts trading at a premium for the latter. This indicates mild bullish sentiment for the former.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.