Crypto Options Analytics, November 14th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$64,316

DVOL: Deribit’s volatility index

(1 month, hourly)

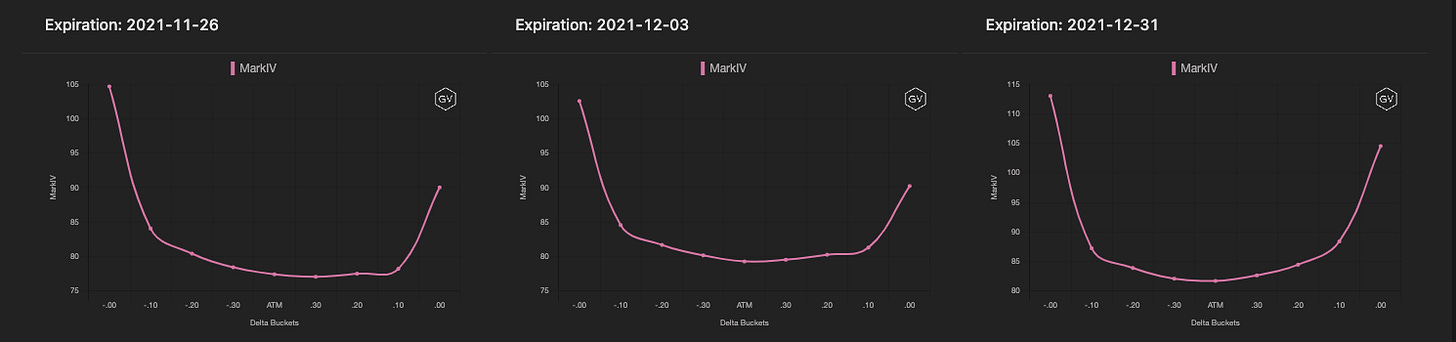

SKEWS

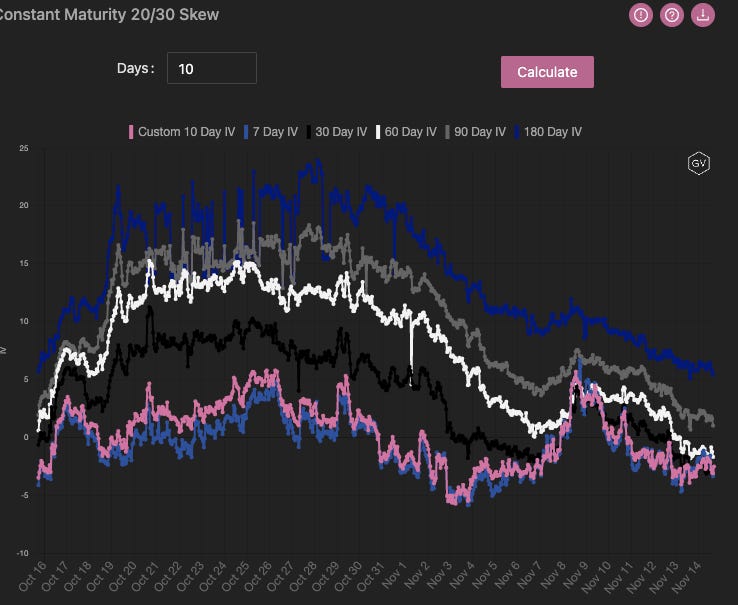

(Nov. 14th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

Spot/skew moved with tight correlation this week, especially with respect to short-term expirations.

BTC spot prices tested new all-time highs early in the week, then ended the week backing away from those ATHs.

Short-term expiration skews displayed a nearly identical chart to spot prices, rallying into positive territory then backing off, ending the week with negative skew.

Traders have a preference for puts in the short-term but beyond 30-days, calls become relatively more expensive.

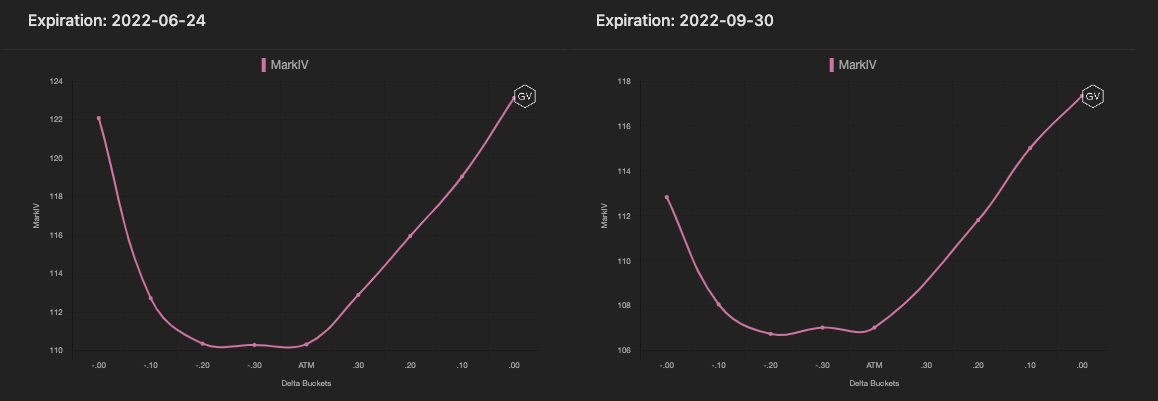

(Nov. 14th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Nov. 14th, 2021 - BTC’s Term Structure - Deribit)

The term structure end the week slightly flatter than this time last week, although Contango remains strong.

Notice the “cliff-like” shape of the current term structure.

The combination of low RV and strong December EOY IV (likely due to MM inventory) is causing the term structure to resemble a “cliff-structure” as 12/31 approaches.

We continue to maintain that 12/31 presents an interesting short-vol opportunity.

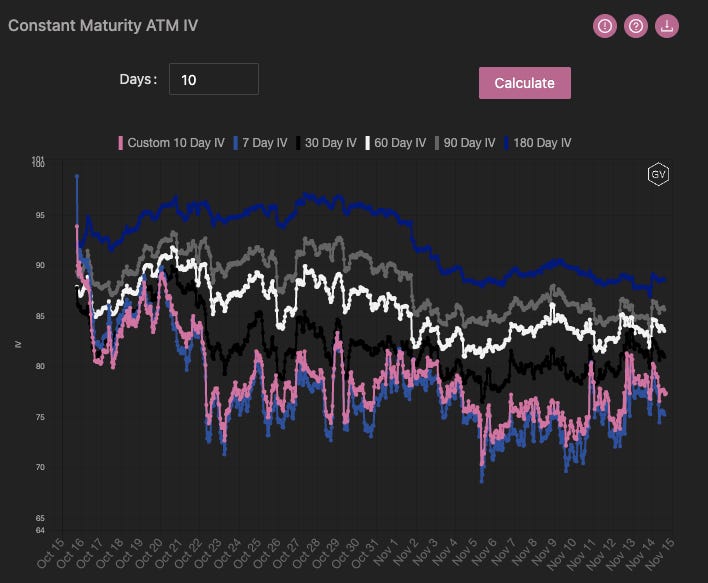

ATM/SKEW

(Nov. 14th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is holding strong. This trend has been interesting considering the RV path lower we have been consistently witnessing.

Option positioning (or FOMO enthusiasm) is continuing to create large RV and IV divergences.

SKEW (right) has been much more logical. As previously mentioned, this past week displayed skew profiles that greatly mimicked spot price activity.

Open Interest - @fb_gravitysucks

BTC

We saw another low volume weekly expiry with around 17k contracts and a delivery price of $64,495.

Premium paid to call holders.

(Nov 12th , 2021 – BTC Open Interest profile – Deribit)

(Nov 12th , 2021 – BTC Dollar premium – Deribit)

Despite Wednesday’s new ATH, options’ market participants haven’t showed interest in trading with size.

We witnessed some interest in puts for protection demand when spot retraced under $68k this week.

On Friday morning we saw December $85k-$100k call buying… This may have been due to speculation around the spot BTC ETF approval (denied few hours later).

(8th – 14th Nov, 2021 – BTC Options scanner - Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

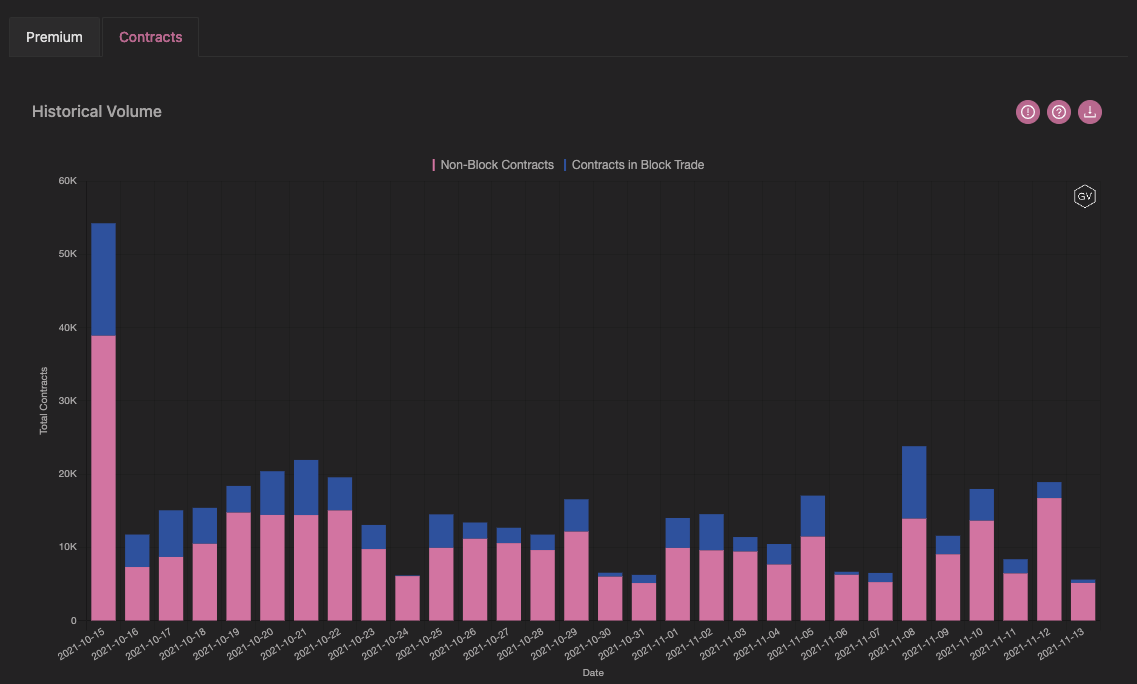

VOLUME

(Nov. 14th, 2021 - BTC Premium Traded - Deribit)

(Nov. 14th, 2021 - BTC’s Contracts Traded - Deribit)

Option volumes have been rather tame these past few weeks, following the lead of RV much more closely than the still elevated IV profile.

Paradigm Block Insights (Nov. 8th - Nov. 14th) - Patrick Chu

In BTC this week, both IV & skew continued to consolidate as BTC failed to sustain a close above the previous all time highs at 67k, resulting in subdued realized volatility.

Over Paradigm we witnessed continued interest in calls via spreads, with 48% of our overall flow for the week coming from diagonal and vertical call spreads.

(Nov. 8th - Nov. 14th - Volume Profile - Deribit & Paradigm)

For vertical spreads, the majority of the action was focused around 65k & 70k on <1 m expiries, while for diagonal spreads, Dec-Jan expiries and strikes between 80k and 140k were of interest.

We also saw some defensive flows after the retracement on Nov 10th, with outright puts with strikes between 60-65k dominating the flow.

(Nov. 8th - Nov. 14th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 14th, 2021 - BTC’s Volatility Cone)

Notice here that RV is on a path of its own.

Constantly grinding lower week after week and hanging below the 25th percentile for nearly all measurement windows.

REALIZED & IMPLIED

(Nov. 14th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

This IV/RV gap is extremely wide.

Playing short-volatility strategies, especially around December contracts, seems like that layup trade.

We recommend using hedged structures that prevent the potential for getting squeezed out, given the (likely) crowded market positioning.

$4,564

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Nov. 14th, 2021 - ETH’s Skews - Deribit)

A few weeks ago we noted an unusual “parallel shift” higher in ETH skews across all maturities, in nearly an identical manner.

This type of unusual move was likely the result of a large amount of order flow going in the same direction.

Now that this flow has dissipated we see ETH option skews continue to retrace lower to previous levels.

Notice option skews have ground lower across the board, with the small exception of short-term options spiking higher earlier this week, as ETH tested new all-time highs.

(Nov. 14th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Nov. 14th, 2021 - ETH’s Term Structure - Deribit)

The ETH term structure continues to display a steep contango form, although the “cliff-like” structure isn’t acutely present.

ETH March options stand-out at the relatively expensive expiration.

We’ve noted on twitter the flow for March 2022 options. There seems to be a lot of non-block buying going on in the 15k strikes.

ATM/SKEW

(Nov. 14th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has inched lower this past week, especially as prices moved back from ATH territory.

As noted last week, these IV levels are very elevated compared to RV and present the potential to move much lower from here.

ETH option skew have steadily moved lower this week. The combined effects of ATH retracing and one-way flow dissipating have allowed option skews to drop lower.

Open Interest - @fb_gravitysucks

ETH

We saw an interesting weekly expiry, with over 150k contracts going out and a delivery price of $4,709, puts dominating the profile.

Participants showed bullish conviction, selling $3k-$4k strikes.

(Nov 12th , 2021 – ETH Open Interest profile – Deribit)

(Nov 12th , 2021 – ETH Dollar premium – Deribit)

This week also showed a two-way interest for puts in general.

We also noted a large OTC buyer of Mar 2022 $3k contract accumulating positions on Thursday/Friday.

(8th – 14th Nov, 2021 – ETH Options scanner - Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Nov. 14th, 2021 - ETH’s Premium Traded - Deribit)

(Nov. 14th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (Nov. 8th - Nov. 14th) - Patrick Chu

In ETH, with interest in puts continuing to rise, skew ground lower as the whole curve shifted down by 3-4 handles. We saw a good amount of long-dated downside protection trading, with the 25Mar22 3000P being the most traded contract of the week (11650x) and being included in many strategies including outright, risk reversals and put spreads.

(Nov. 8th - Nov. 14th - Volume Profile - Deribit & Paradigm)

We also continued to see good interest in short date calls, with 4600 & 5000 strikes for end Nov being popular.

(Nov. 8th - Nov. 14th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 14th, 2021 - ETH’s Volatility Cone)

The RV profile is absolutely dismal.

We are actively witnessing new RV annual lows and maintain that IV is sure to follow, or steadily bleed theta from higher levels until expiration.

REALIZED & IMPLIED

(Nov. 14th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The ETH IV/RV profile is persistently wide and provides a lot of juice for volatility sellers.

Spot prices haven’t exhibited volatile FOMO above new ATHs and therefore provide a clear risk measurement for vol. sellers, should new ATH FOMO present itself.