Crypto Options Analytics, November 28th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$57,302

DVOL: Deribit’s volatility index

(1 month, hourly)

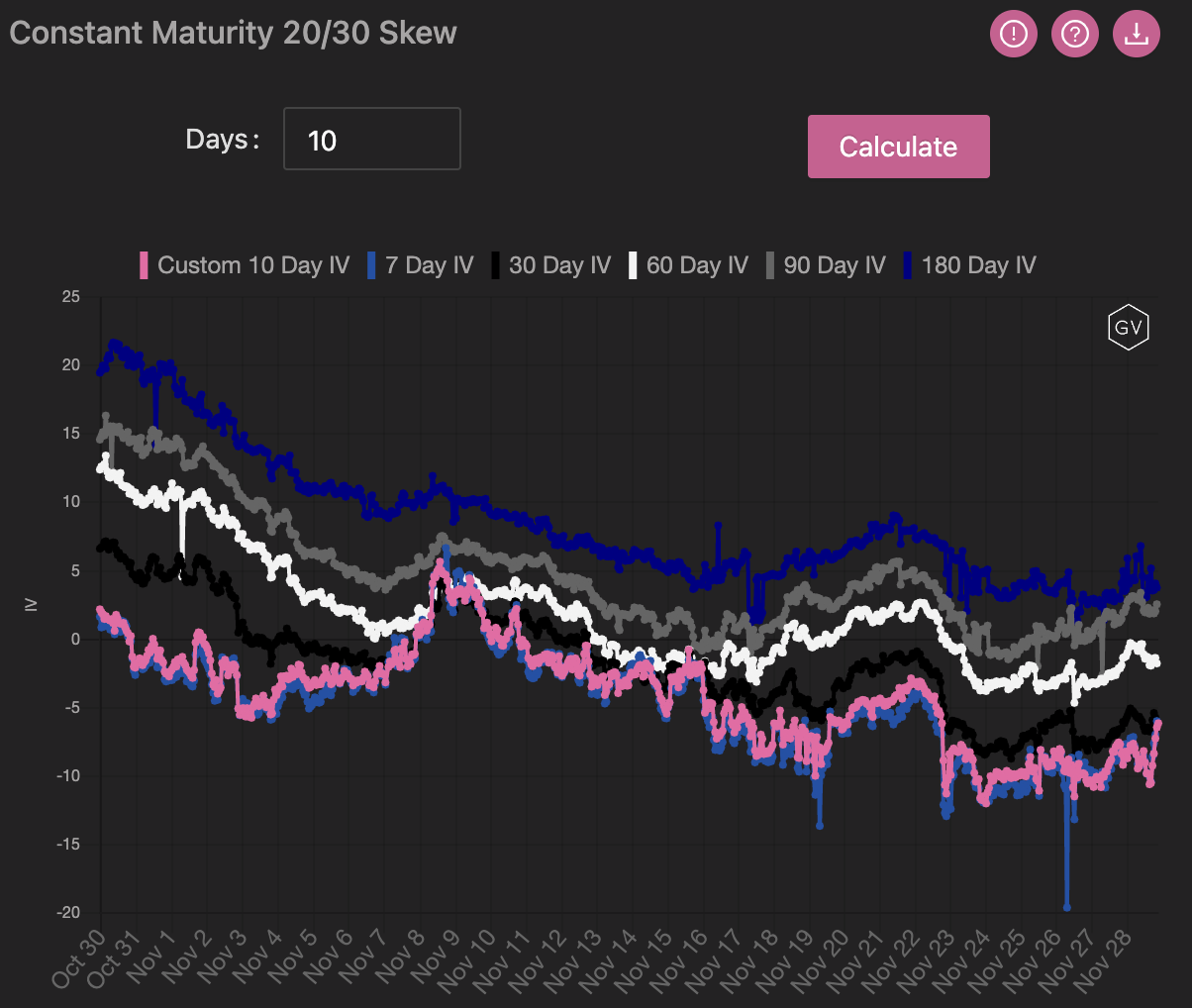

SKEWS

(Nov. 28th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

BTC option skews became very negative this week as spot-prices dipped, due to new Covid concerns.

After the March 2020 Covid flash-crash, traders are weary of a similar event unfolding… Therefore, put demand increased this week, dragging skews lower as a result.

Short-term options lead the pack by a large margin.

(Nov. 28th, 2021 - Long-Dated BTC Skews - Deribit)

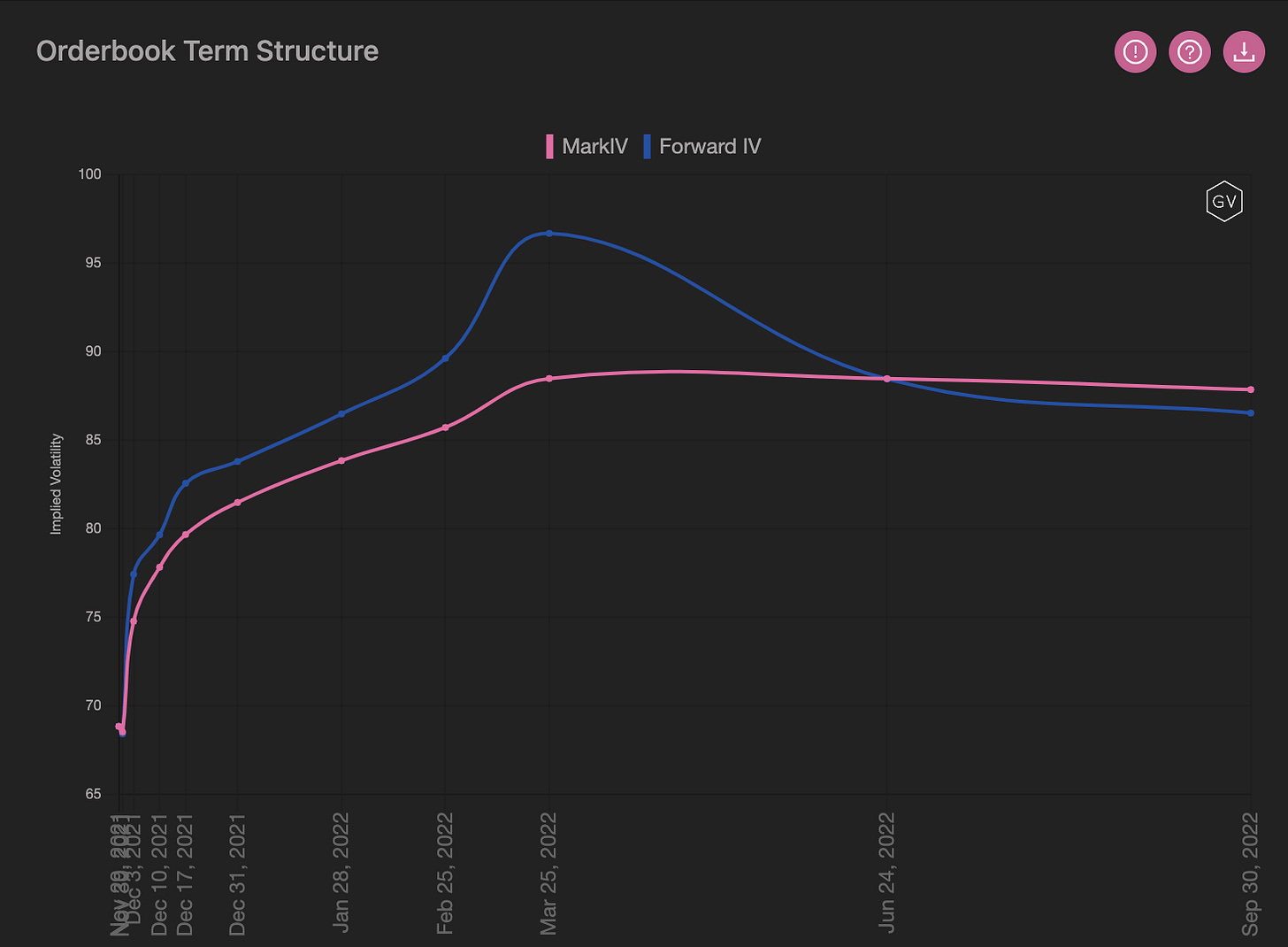

TERM STRUCTURE

(Nov. 28th, 2021 - BTC’s Term Structure - Deribit)

ATM IV remained rather stable despite the increased fear around spot-prices.

We can see that the term structure briefly flattened during the week but the Contango shape persisted overall.

RV increased on the back of the spot price sell-off, but not enough to change the term structure shape.

The now (VS) EOY differential currently sits slightly above +10pts.

ATM/SKEW

(Nov. 28th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) continues to hold a consistent 10pt range. Overall IV remains practically unchanged. The increase in RV had already been priced-in and there lacks solid follow-through to change this phenomenon.

SKEW (right) moved drastically. The skew profile has been very reactive the past few months and seems to provide the most interesting tradeable opportunities, exhibiting nearly a 12pt range this past month.

Open Interest - @fb_gravitysucks

BTC

Up to $2.6 billions in notional traded on Friday expiry. Put/call ratio showed a clear preference of calls; however, dollar premium has gone to puts, balancing the rewards.

From now on, all eyes are on 31 Dec.

(Nov 26th , 2021 – BTC Notional – Deribit)

(Nov 26th , 2021 – BTC Dollar premium – Deribit)

(Dec 31st , 2021 – BTC Dollar premium – Deribit)

Top trades of the week:

1. Risk reversal: almost $3.5mil of premium traded, with clips of 50-contracts blocked each time. This is an interesting trade from both a protection and vol/skew perspective. Same interest showed on Mar22 40k-100k strikes.

(Nov 22nd , 2021 – Time and Sales, Historical Top Trades – Deribit)

2. Call spread: almost $4mil of premium traded for a bullish view on 10 December expiration. Considering the sell-off on Friday, the timing has not been the best but this structure will easily gain if prices bounce from here.

(Nov 22nd , 2021 – Time and Sales, Historical Top Trades – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Nov. 28th, 2021 - BTC Premium Traded - Deribit)

(Nov. 28th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Nov. 22nd - Nov. 28th) - Patrick Chu

In BTC, we saw a strong shift in sentiment as demand for puts soared and skew dropped significantly, especially in the front end of the curve.

1wk skew traded as low as -18 on Nov 26 as demand for puts, through outright and risk reversals structures, dominated volumes for the week.

(Nov. 22nd - Nov. 28th - Volume Profile - Deribit & Paradigm)

Over Paradigm, demand for puts was particularly strong on the 50k strike with more than 1770 contracts exchanging hands. Elsewhere, we also saw strong demand for the 60k and 48k puts expiring EOY.

Interestingly enough, amidst the sell-off, call spreads remained in demand, representing 35% of total volumes. For call spreads, the 31 Dec 60k was a popular front leg against the 70, 75 & 80k strikes.

(Nov. 22nd - Nov. 28th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 28th, 2021 - BTC’s Volatility Cone)

Realized vol. moved slightly higher over the 7-day measurement window, but beyond that the RV profiled appears nearly untouched compared to last week.

Without solid RV, follow-through options are going to remain overpriced.

A sharp sell-off is likely the only catalyst for sharply higher RV, justifying current option skews; otherwise, we expect muted RV reactions to the up-side.

REALIZED & IMPLIED

(Nov. 28th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The IV/RV gap persists, although narrowed week on week.

We continue to think IV is overpriced… specifically upside IV.

$4,238

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Nov. 28th, 2021 - ETH’s Skews - Deribit)

ETH skews have finally given back all their gains, dipping negative for all maturities 60-days and under.

Short-term option skews dropped the lowest, testing -10 pts.

Sunday showed a sign of relief as $4k spot-prices proved to hold, causing skews to inch higher.

(Nov. 28th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Nov. 28th, 2021 - ETH’s Term Structure - Deribit)

The term structure has remained persistent throughout the week, with little attempts at flattening.

The Contango structure remains very steep. The now (VS) EOY differential is nearly 25pts!!

ATM/SKEW

(Nov. 28th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is displaying a strong trendless range similar to BTC, although the range is nearly 20pts of vol!

Skew (right) has continued its monster downward trend. Traders are aware of the negative spot/vol correlation and are hedging any potential ETH crash.

Skew has moved nearly 14pts over the past month!

Open Interest - @fb_gravitysucks

ETH

The stable rise in Ethereum spot-prices seen over the last few weeks paid off call holders for November monthly expiration.

With ETH having almost half of the notional open interest of Bitcoin, the market continues to pay more and more attention to ETH options. There are massive bets on $5k calls for Dec 31st expiration.

(Nov 26th , 2021 – ETH Notional – Deribit)

(Nov 26th , 2021 – ETH Dollar premium – Deribit)

(Dec 31st , 2021 – ETH Dollar premium – Deribit)

Top trades of the week:

1. Risk reversal: selling upside volatility on Mar22 keeps on. The premium was used to buy protection in -0.20 delta zone. The “Raoul effect” so far has created more volatility opportunity than all the rest. Dislocations are where pros come into play.

2. With almost $6mil premium traded, this could be a pure volatility trade: selling the rich and buying the cheap parts of the curve. Perfect timing as spot prices reached a local top.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Nov. 28th, 2021 - ETH’s Premium Traded - Deribit)

(Nov. 28th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (Nov. 22nd - Nov. 28th) - Patrick Chu

In ETH, 1wk (81 -> 98) & 1m (97 -> 103) IV awoke from their slumber on Nov 26 as ETH abruptly turned lower on the back of technical selling and Covid concerns, before the whole curve sold off into the weekend. Over Paradigm, we saw demand for puts in particular for the 4000/3800 & 3500 strikes.

(Nov. 22nd - Nov. 28th - Volume Profile - Deribit & Paradigm)

Interestingly, call spreads continued to drive overall volumes throughout the week, as the largest trades of the week were for 31 Dec 5000/6000 1x2 call spreads, where 5 separate trades of 2000 x 4000 contracts were executed.

(Nov. 22nd - Nov. 28th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 28th, 2021 - ETH’s Volatility Cone)

ETH RV saw a more pronounced rise than BTC RV.

Both 7-day and 14-day were able to increase enough to reach the annual median.

A break of $4k could spike RV higher.

REALIZED & IMPLIED

(Nov. 28th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

ETH IV/RV continued to hold par this week.

We are actually witnessing ETH RV “peeking its head” slightly above IV.

Downside vol. carries the vol. risk in our opinion, while upside vol will likely be subdued.