Crypto Options Analytics: November 30th,2025

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

tastytrade, Inc. (“tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. Although affiliated with tastylive, Inc. and tastycrypto, a product provided solely by tasty Software Solutions, LLC, each entity operates independently and is not responsible for one another’s services, products, and policies.

Monday 8:00pm - Fed Powell Speaks (in the evening)

Wednesday 8:15am - ADP Employment situation

Friday 8:30am - PCE

*Various Fed Governors Speak during the week*

MACRO

The markets for crypto and overall risk-assets found a bid as the NY Fed President said that a rate cut would be the path of least regret.

This occurred on Friday Nov. 21st.

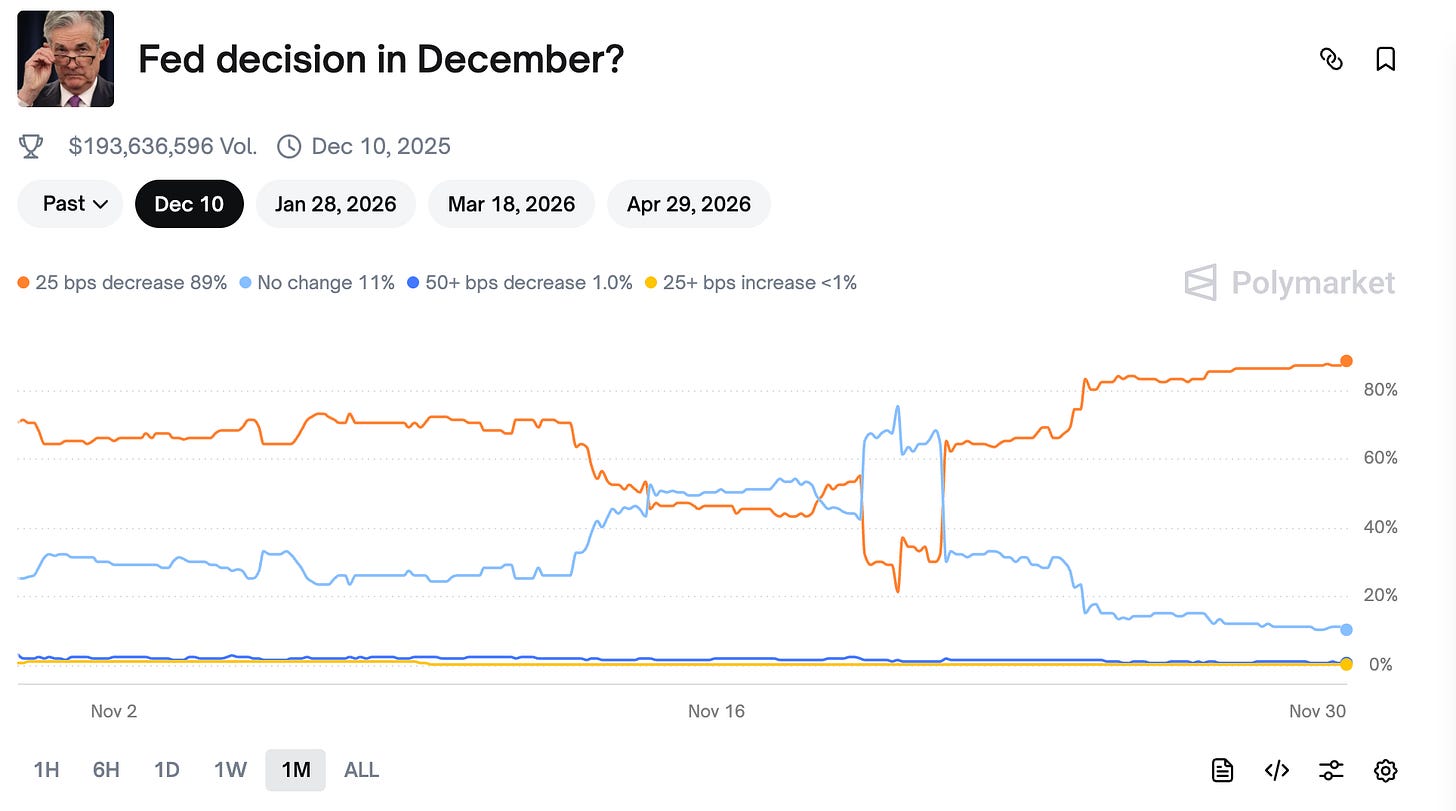

We can see the Polymarket odds instantly reacted to these comments.

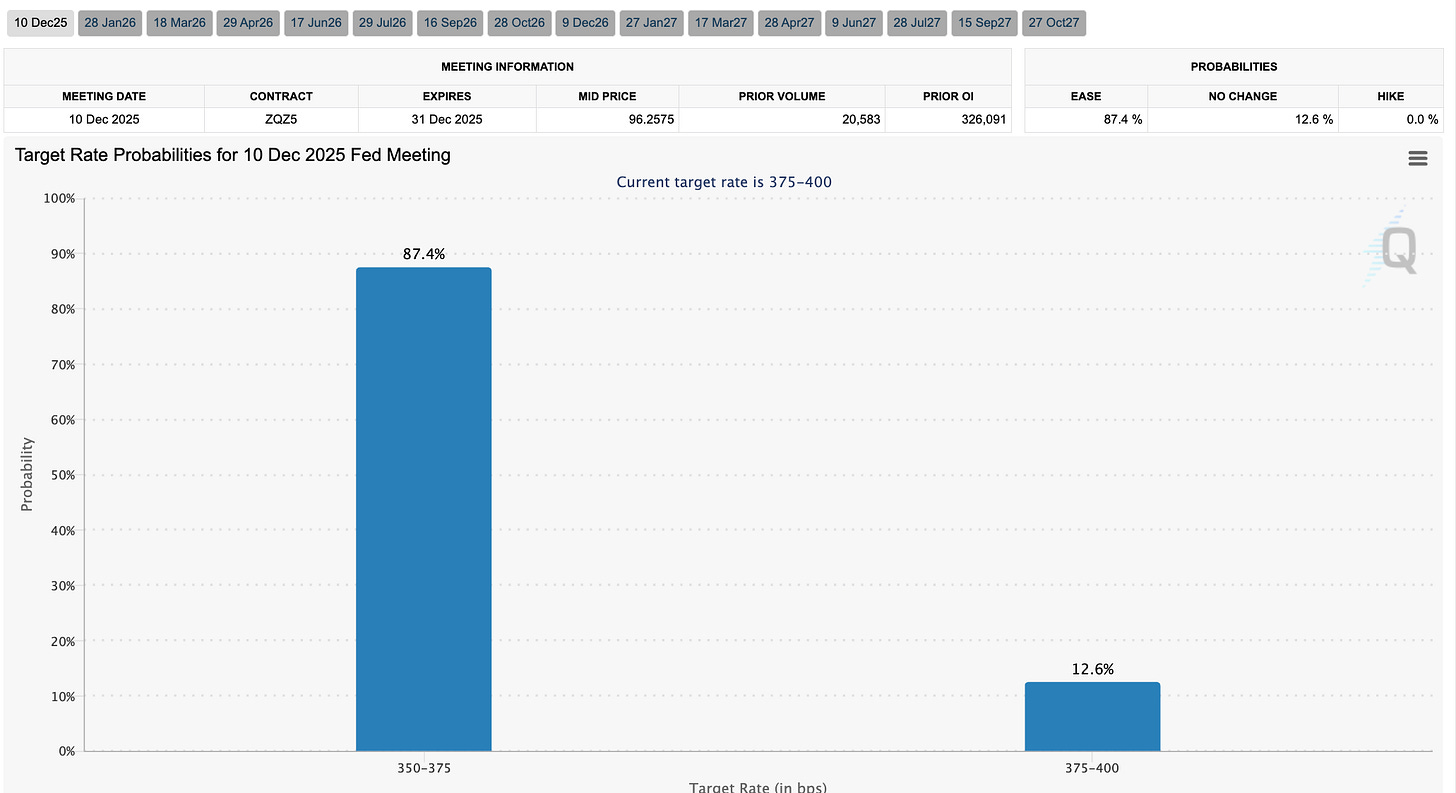

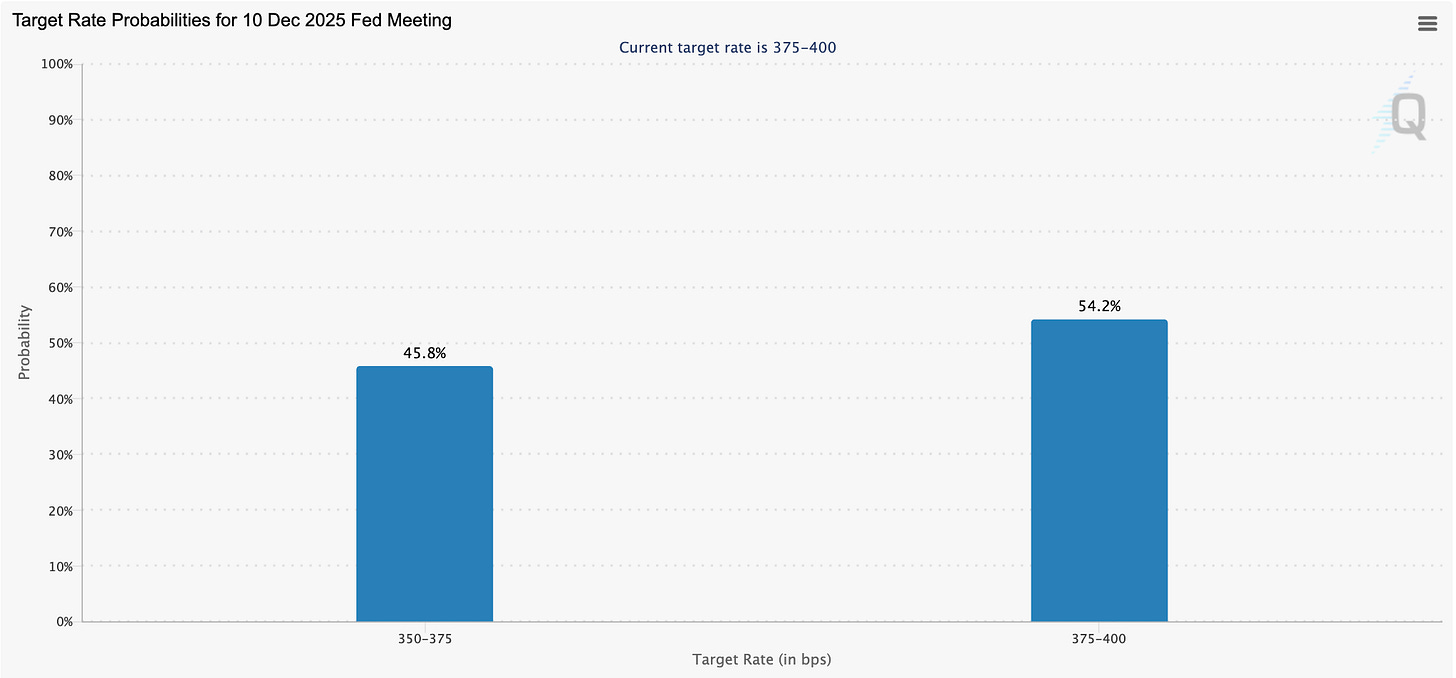

The CME Fed Funds futures odds also reacted as the probability of a December 10th rate cut jumped to 87.4% (now) versus 45.8% (nov 16th)

This momentum brought us higher into Thanksgiving trading, which is typically a thin market. Which means markets can easily “trend” on one-way flow (buyers react, while sellers are on vacation).

Last week there was insight from the Fed’s “Beige Book” release, this showed only a bit of inflation pressures (modest) while the business growth from consumer spending softened a little bit.

Overall it seems that things are somewhat steady but on balance a rate cut next Wednesday (Dec 10th) would remain the prudent path for the Fed.

This upcoming week we have the ADP employment numbers on Wednesday, PCE Friday (the Fed’s favourite inflation measure) and Powell speaking on Monday evening.

BTC: $91,027 (+4.0% / 7-day)

ETH: $3,018 (+6.9% / 7-day)

SOL: $136.89 (+3.4% / 7-day)

Crypto Options Overview

Bitcoin is well placed for a continued move higher in an EOY “Santa Rally” move.

Given the rate cut narrative, the potential Ukraine/Russia peace deal, the dovish May 2026 Fed Chairman pick… I could see markets having a relief rally into EOY.

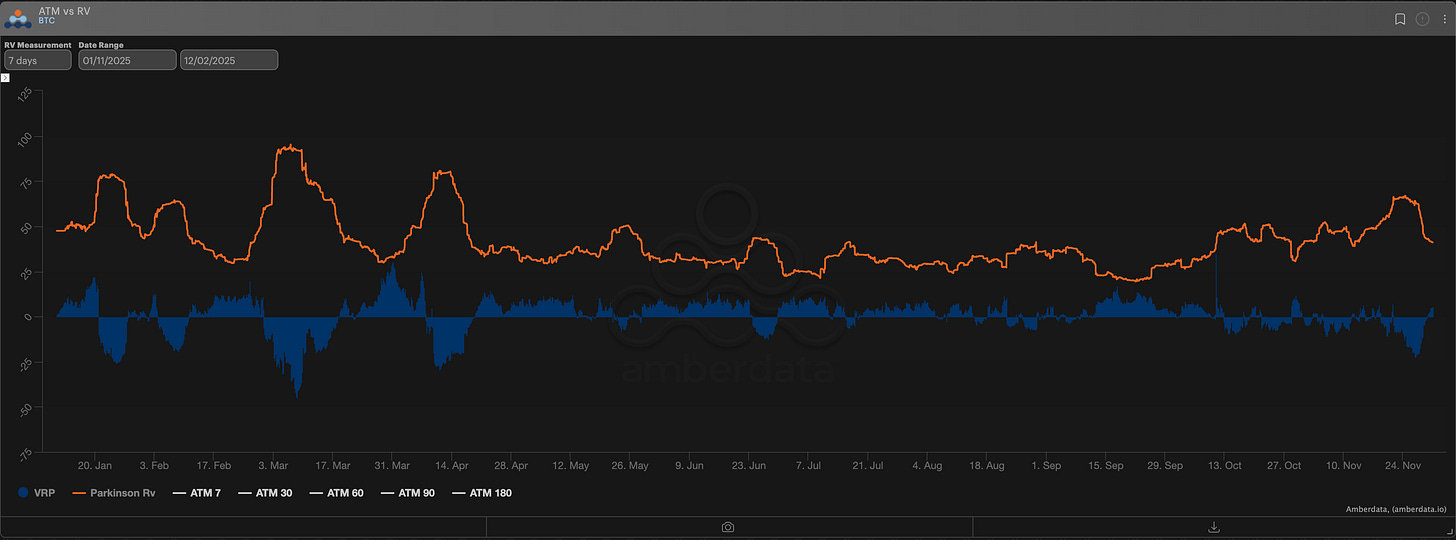

Volatility is currently relatively high, given the recent BTC selloff from $120k → $85k.

The current negative spot/vol correlation likely continues to hold and therefor grabbing exposure via a BTC +1/-2 Call spread is my favourite setup here.

If markets crash… then “no-harm, no-foul”.

If markets pick-up… I expect IV to drop and markets to recover back towards the $100k+ level.

We can see both the DVol index and the Realized Volatility measures for BTC are coming down from near YTD high zones.

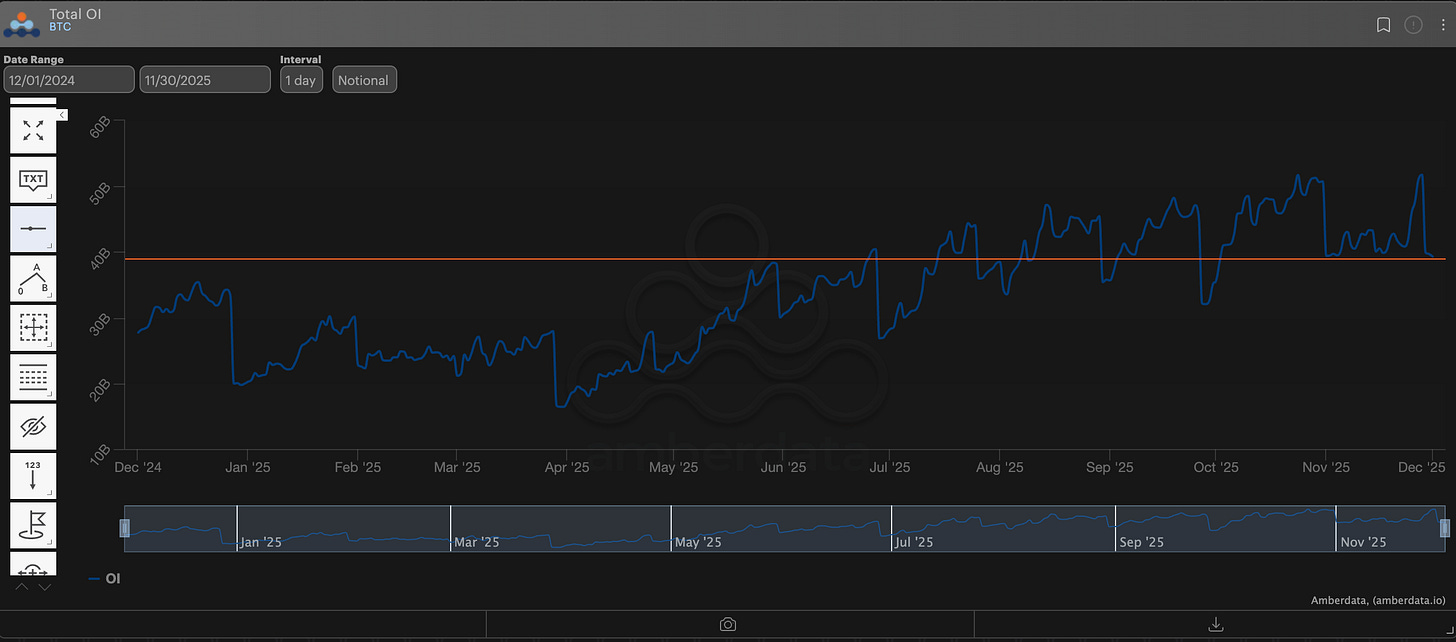

The options outstanding open interest is also on the lighter side for Deribit. After a recent expiration cycle, we’re seeing mid-summer open interest exposure levels.

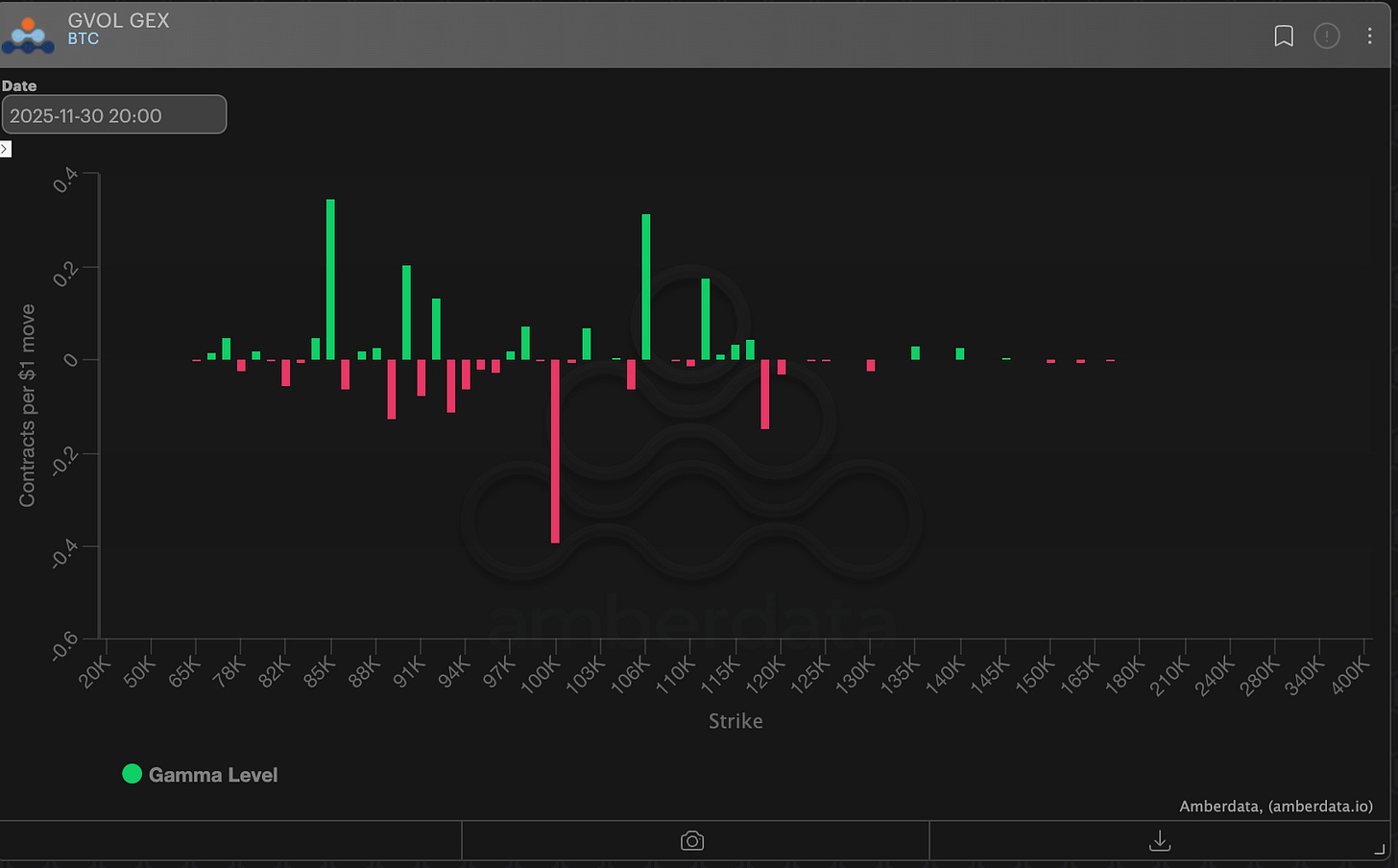

If we backout the GEX expsoure on Deribit, we see that the street (traders) are long a lot of the $100k paper.

$100k is a psychological technical spot level but also an important inflection point for the options market.

As we approach $100k, dealers gamma rebalancing will accelerate the move higher, unless spot seller look to unload at $100k.

We’ll need to see how the level holds as support or resistance, but getting back to $100k for a market “test” is a good opportunity for the EOY Santa rally imo.

Especially given the volatility surface opportunity.

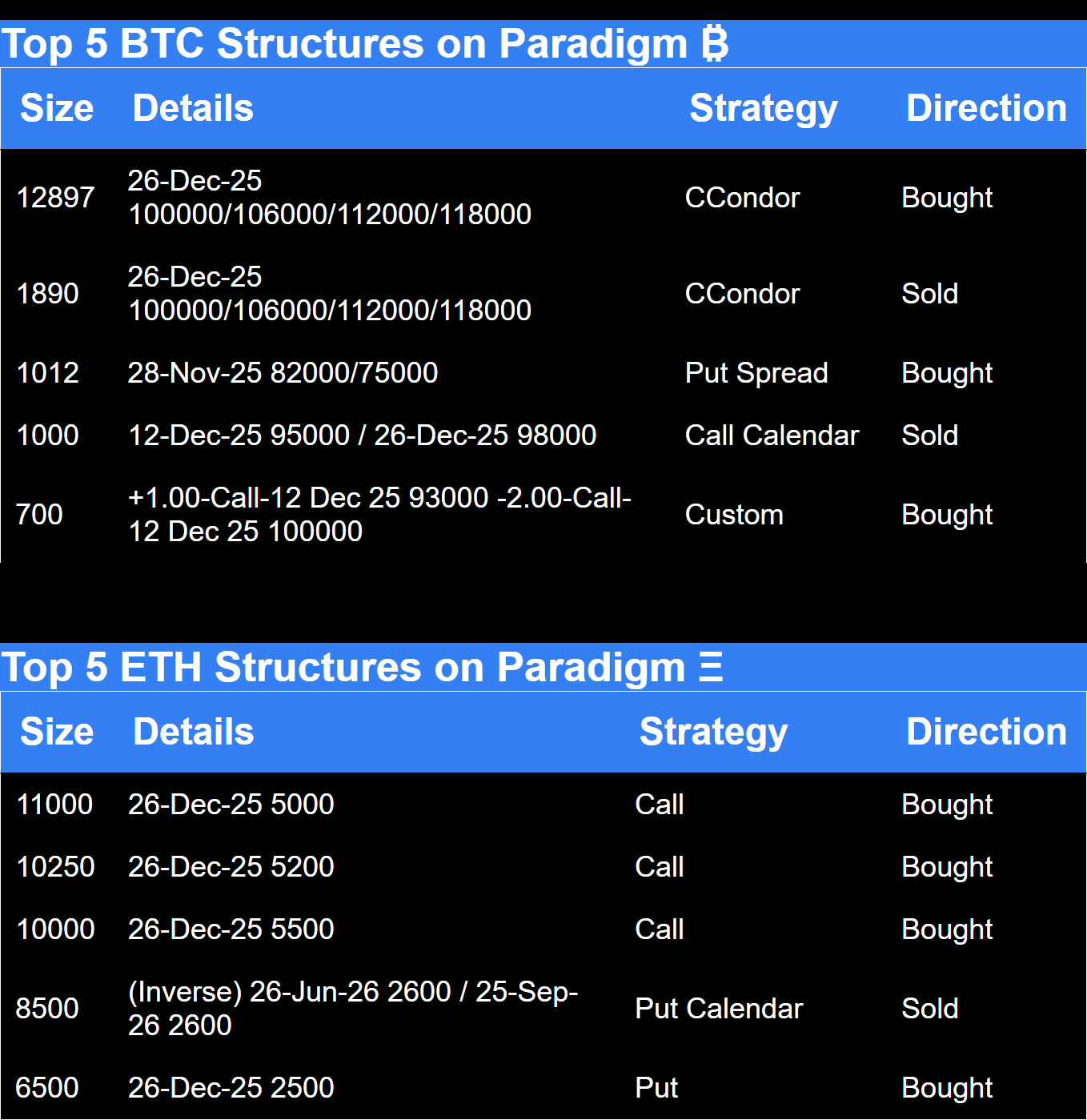

Paradigm Top Trades this Week

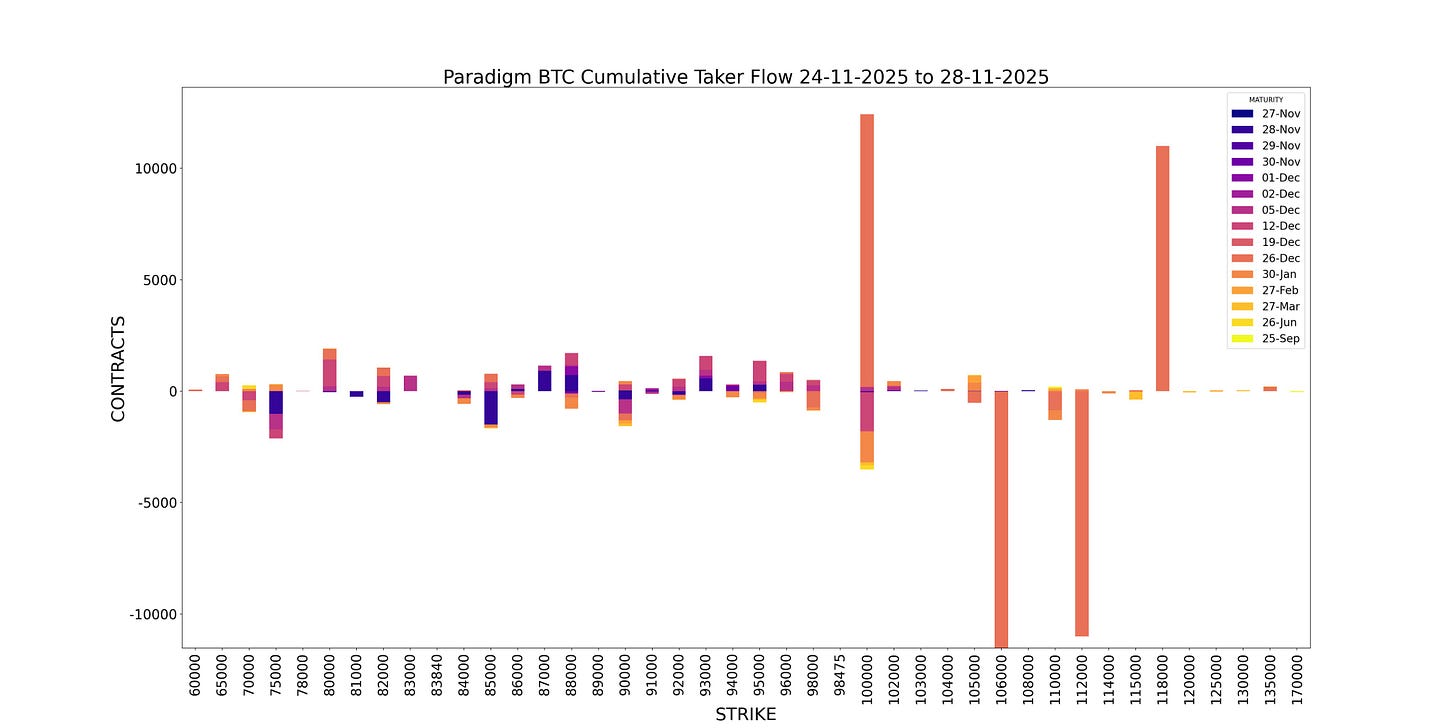

BTC Cumulative Taker Flow

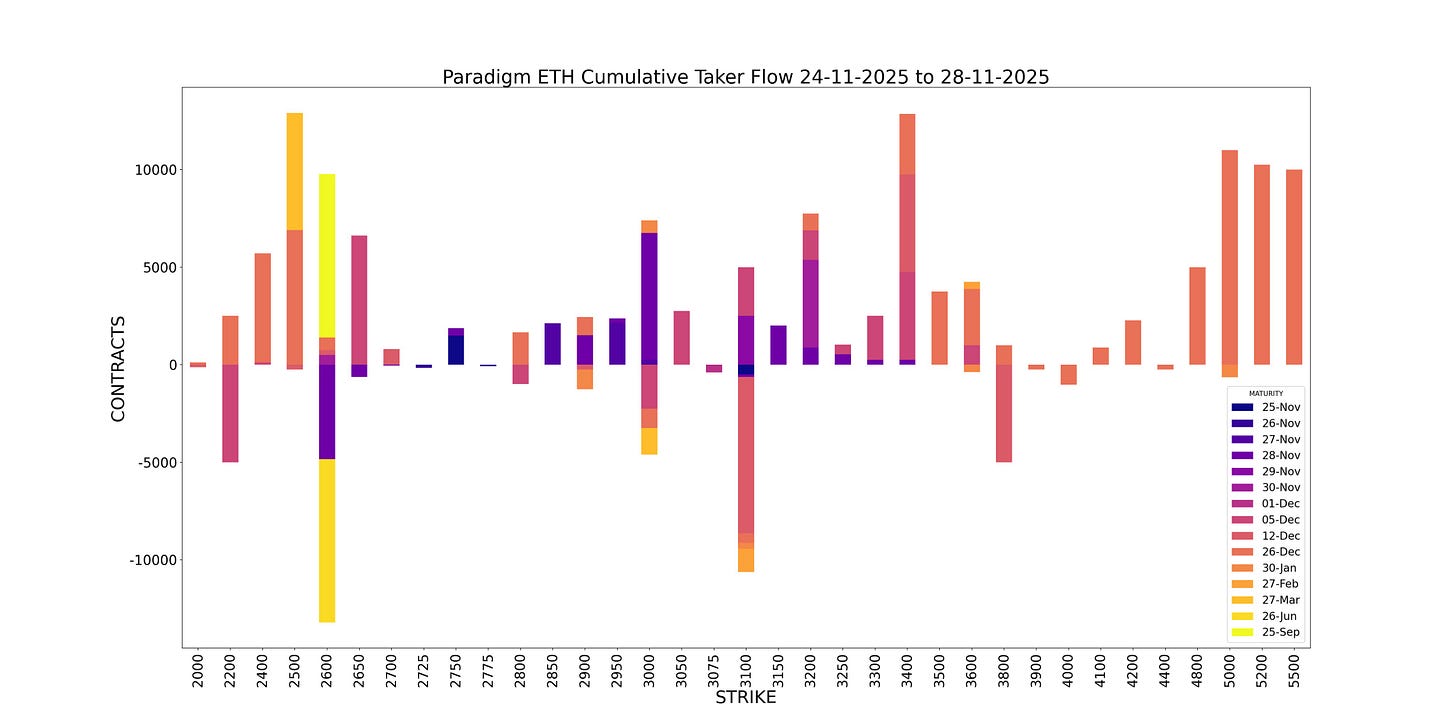

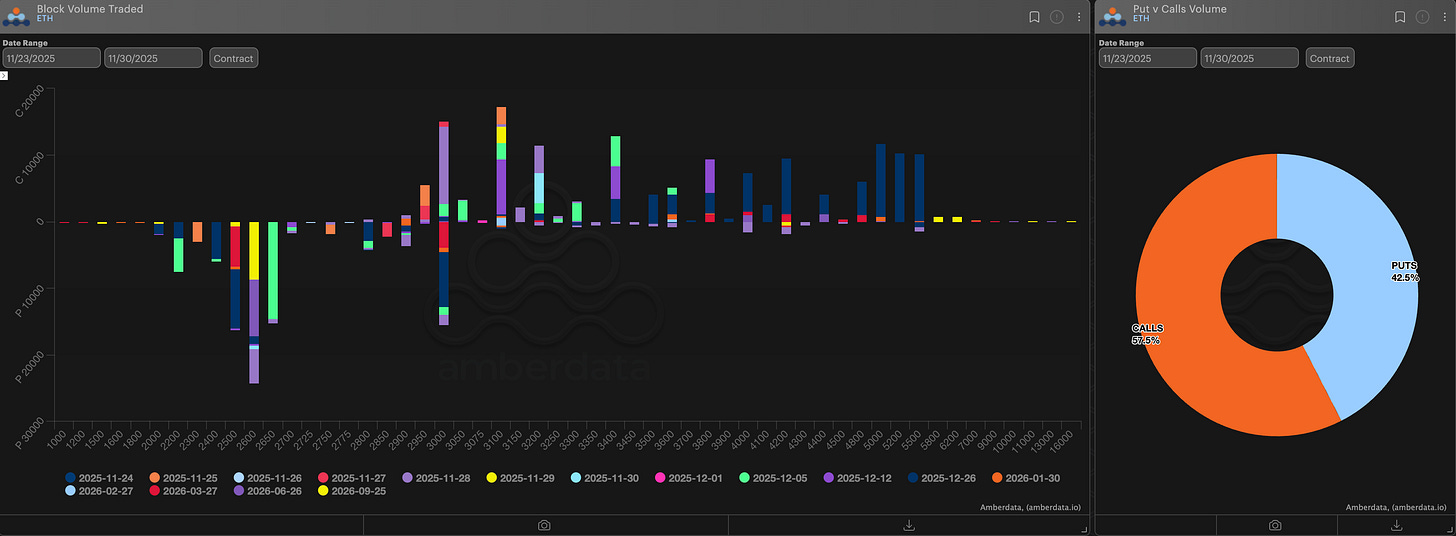

ETH Cumulative Taker Flow

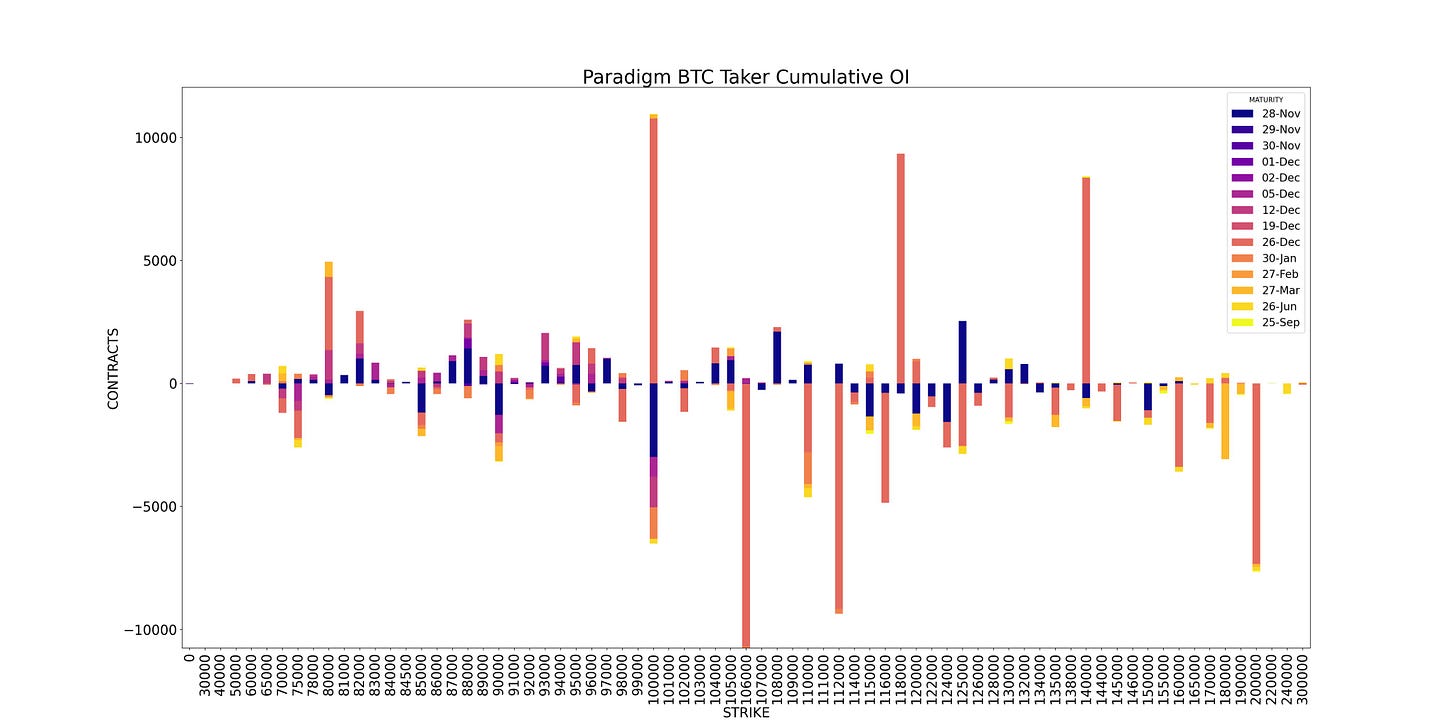

BTC Cumulative OI

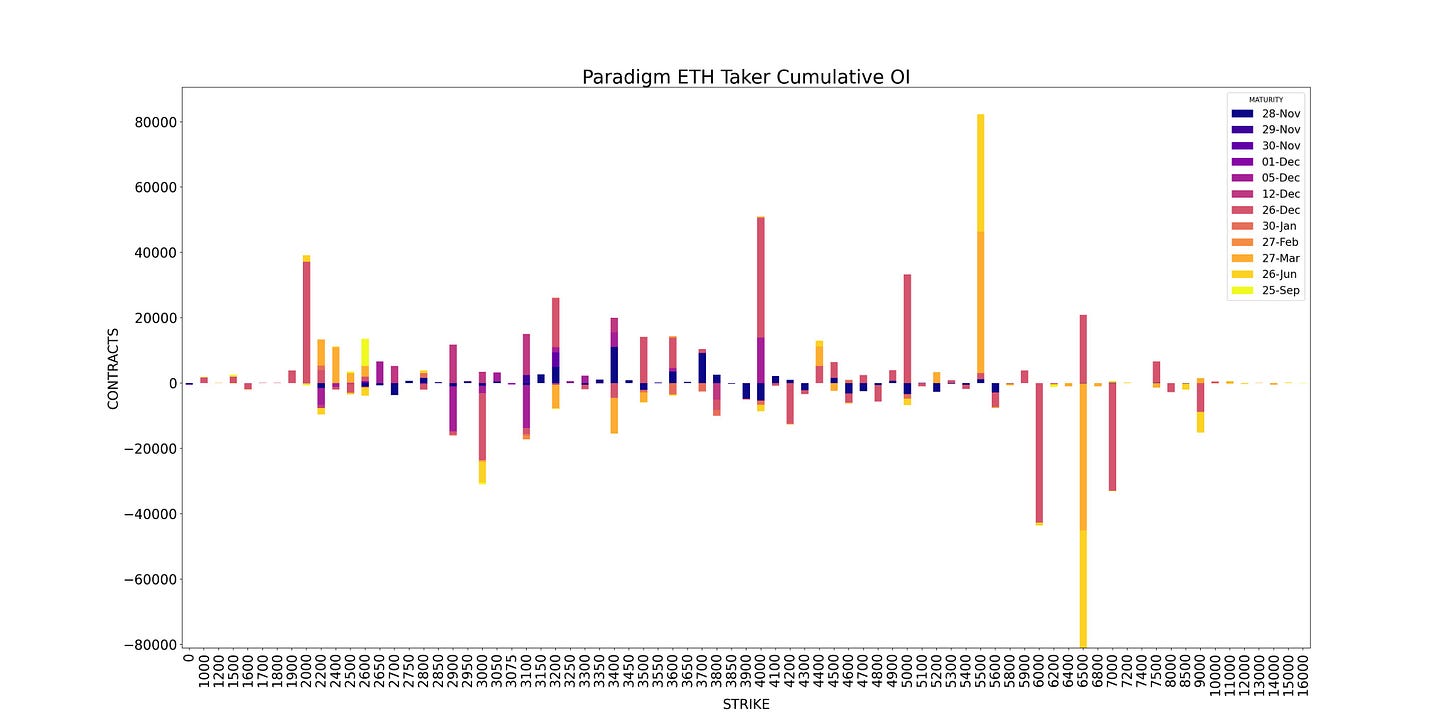

ETH Cumulative OI

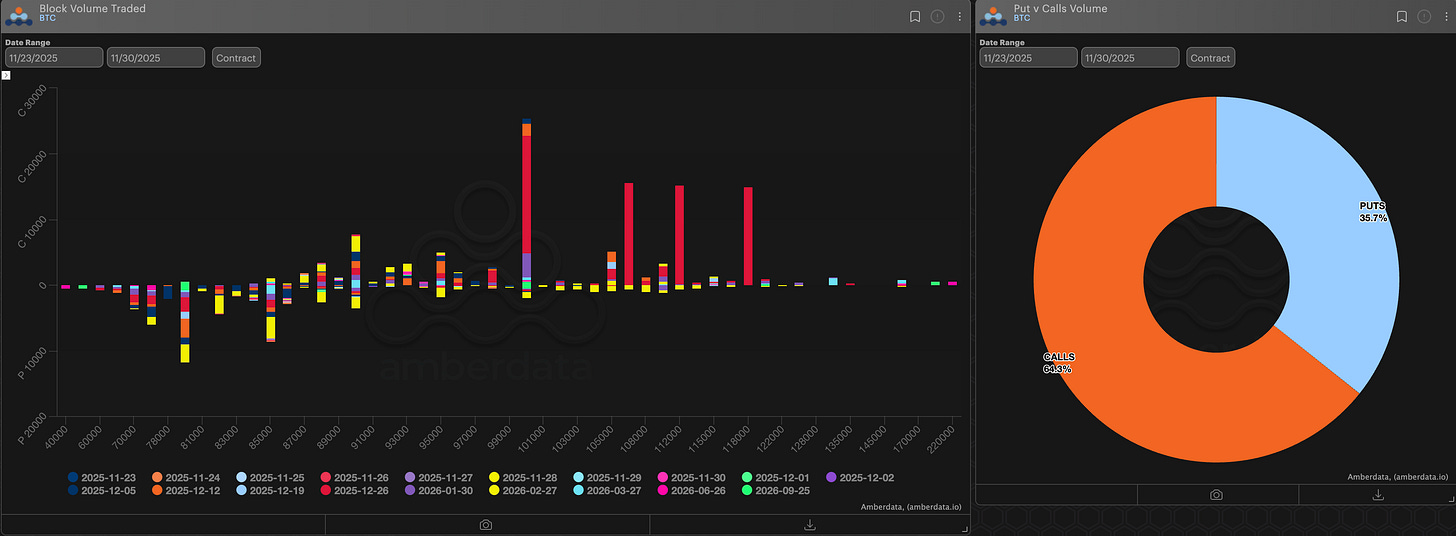

BTC

ETH

Derive is live on HyperEVM.

HYPE holders can now use their tokens as collateral to trade options and perps on Derive. TVL stays on @HyperliquidX while users generate yield on Derive. HYPE becomes a yield-bearing collateral.

Derive has also integrated SpiceNet - a DeFi brokerage network!

Unified trading engine lets traders access Derive’s options and perps from any network, through a single API account.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don’t invest more than what you can afford to lose.

Thanks for reading AD Derivatives Newsletter! Subscribe for free to receive new posts and support my work.