Crypto Options Analytics, November 7th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

LIVE October 18th, 2021

GVol has officially integrated with Deribit via the new Deribit UI.

Check out the awesome new Deribit upgrades! We’re excited to be part of the picture.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$62,316

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

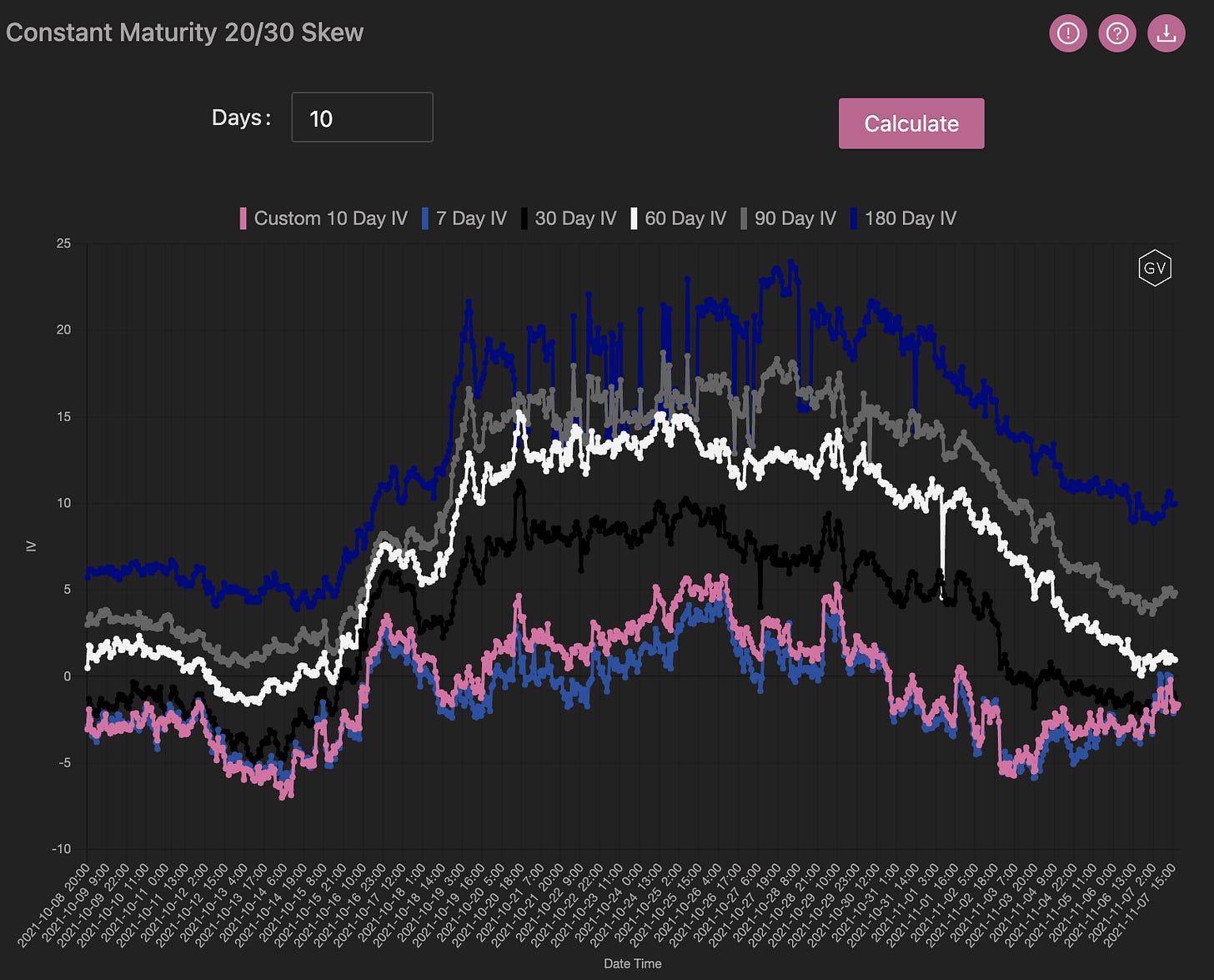

(Nov. 7th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

The skew profile for BTC is rather mixed when comparing short-term skews versus longer-term skews.

Short-dated option skews are negative about -5 vol. points as traders buy puts to hedge ATH rejection.

Long-dated option skews are about +5 vol. points positive.

Although skew isn’t expensive compared to levels seen in the past, overall IV is rather expensive.

(Nov. 7th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Nov. 7th, 2021 - BTC’s Term Structure - Deribit)

The BTC term structure is rather steep and the relationship between RV and IV is expensive as well.

Overall, the options market is too enthusiastic around the potential for explosive BTC vol.

ATM/SKEW

(Nov. 7th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is holding rather steady, despite the potential for lower IV.

SKEW (right) has soften a lot this past week.

Now that the Bitcoin ETF excitement is behind us and that BTC battles to make new ATH’s, option skew remains undecided and hovers around par.

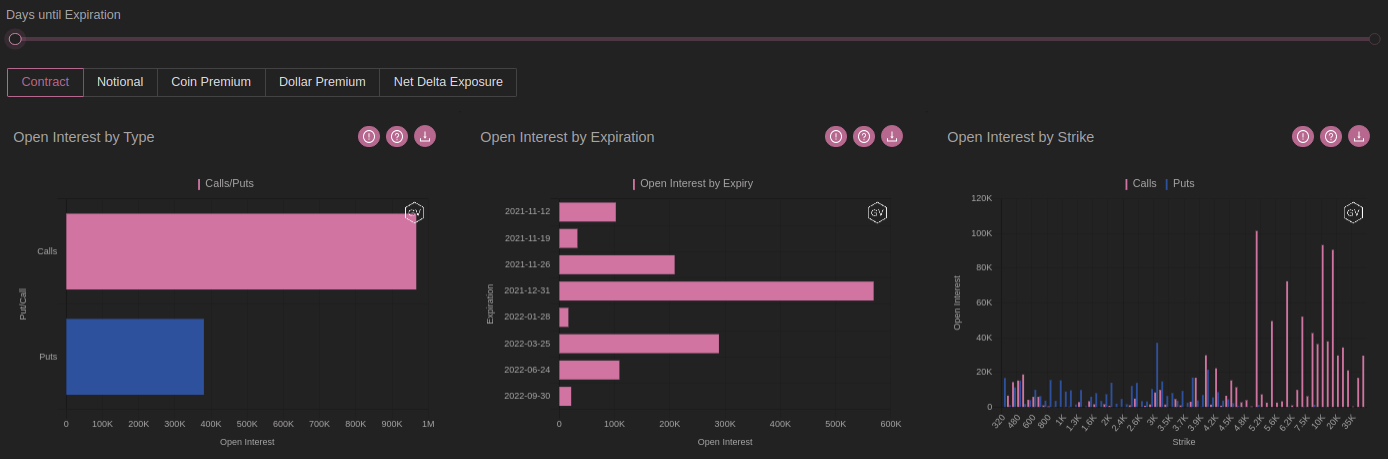

Open Interest - @fb_gravitysucks

BTC

Weekly RV at historical minimum levels has made the case for options sellers.

With 16k contracts and a delivery price of $62,175, around 88% of options expired worthless.

Open interest profile remains pretty consistent compared to last week, with low trading volumes. Participants are not eager to take position during this non-directional price action.

Levels to watch are $60k and $64k where they could resume volatility trades.

(Nov 7th , 2021 – BTC Open Interest profile – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Nov. 7th, 2021 - BTC Premium Traded - Deribit)

(Nov. 7th, 2021 - BTC’s Contracts Traded - Deribit)

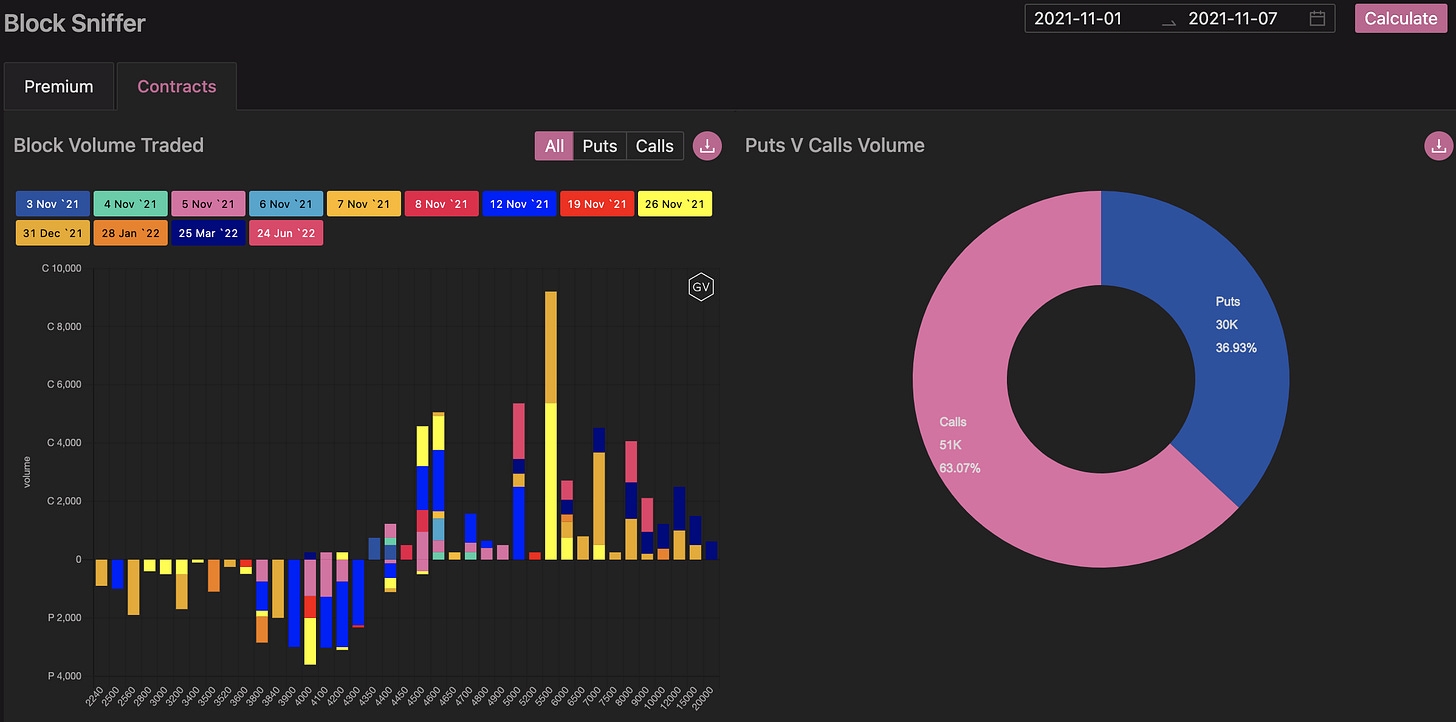

Paradigm Block Insights (Nov. 1st - Nov. 7th) - Patrick Chu

In BTC this week IV edged lower across all tenors as RV remained subdued as we entered the third week of trading within a tight 58k/64k range. Skew on the shorter dates such as 1w & 1m drifted back into negative territory, with 1w closing at -5 & 1m closing at -2.

(Nov. 1st - Nov. 7th - Volume Profile - Deribit & Paradigm)

Over Paradigm, we saw more defensive flows as increased demand for puts in the form of put spreads was seen versus the prior week. Of particular interest, decent amounts of end-of-month Nov 60k/55k put spreads & diagonal spreads rolling downside protection further out in both tenor and strike were seen.

For calls, persistent two way flow was seen for the 66k, 68k, 70k and 74k strike. Finally, good amounts of 100k, 120k & 140k strikes continued to trade this week as part of risk reversals / call spreads structures.

(Nov. 1st - Nov. 7th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 7th, 2021 - BTC’s Volatility Cone)

RV is materializing around lows for the year.

This RV profile, combined with elevated IV, is perfect for short-vol. structures going forward.

REALIZED & IMPLIED

(Nov. 7th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Notice the extremely wide RV/IV gap.

Not only is the gap wide but RV is also headed lower, near annual lows.

Again, short-vol. trades are rather interesting here.

$4,609

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Nov. 7th, 2021 - ETH’s Skews - Deribit)

The volatility surface is starting to converge in the ETH landscape.

ETH spot prices are on a strong uptrend, but in a form that is controlled and slower than the option markets would have hoped.

This uptrend has caused short-term skews to flip from negative to par as calls regain some favor.

All while longer-dated skews dropped significantly lower, being disappointed with the lack of explosive upside moves through new all time highs.

(Nov. 7th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Nov. 7th, 2021 - ETH’s Term Structure - Deribit)

The ETH term structure continues to remain expensive.

Not only are the various expirations in a steep Contango but the RV to IV relationship also has an expensive relationship.

Like option skews this week, we expect IV to drop lower going forward.

Spot prices remain bullish but the option market is 2 - 3 steps ahead of price action and options are trading much too expensive.

ATM/SKEW

(Nov. 7th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV was able to soften a little this past week, but overall IV remains elevated compared to RV and could easily drop much lower.

ETH option skew has been awakened by the reality of a dismal RV profile and has dropped consistently lower.

Open Interest - @fb_gravitysucks

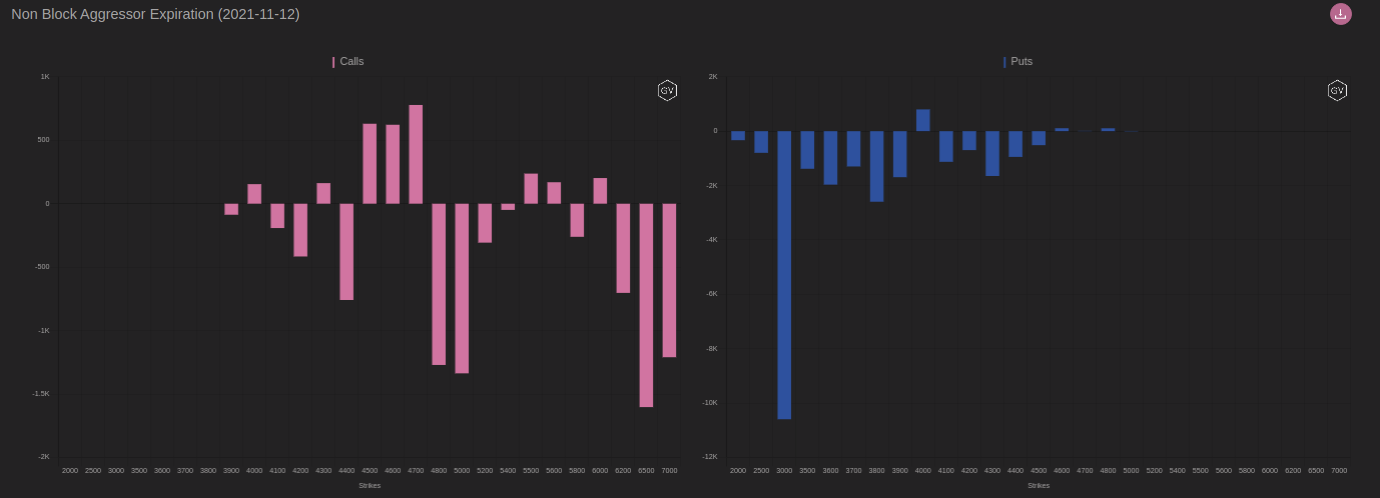

ETH

Although ETH is making new ATHs, the RV drifting lower isn’t helping those who bought weekly expirations.

Going into expiration, there was 126k contracts and a delivery price of $4,532, causing 90% of options to expire worthless.

Week over week, there hasn’t been any large changes in the open interest profile.

The most traded contract: 12NOV $3k PUT, mostly sold on screen (non blocked).

(Nov 7th , 2021 – ETH Open Interest profile – Deribit)

(1st Nov - Nov 7th, 2021 – ETH Non Block aggressor exp 12NOV21 – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Nov. 7th, 2021 - ETH’s Premium Traded - Deribit)

(Nov. 7th, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (Nov. 1st - Nov. 7th) - Patrick Chu

In ETH this week, IV & Skew remained relatively stable as we retraced after printing a fresh ATH amidst rumors of an ETH ETF making the rounds.

Flows over Paradigm leaned net bullish for ETH, with calls & call spreads as the preferred topside expression, although some caution was seen given a good amount of puts in the 3800 to 4100 strike range traded.

(Nov. 1st - Nov. 7th - Volume Profile - Deribit & Paradigm)

In ETH the up move thus far in spot has come in a slow grinding fashion rather than via explosive price discovery, causing ETH IV to grind lower throughout the week. ETH Skew has also normalized as the whole curve corrected lower, with tenors out to 2 months trading close to or below par (2M dropped 10 handles from +11 to +1) and as persistent demand for low delta topside waned in comparison to prior weeks.

Over Paradigm, we witnessed significant two-way action on the short dated 4.5k, 4.6k, 5k and 5.5k outright calls, & protection sought out via put spreads in the 3800-4300 strike range.

(Nov. 1st - Nov. 7th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Nov. 7th, 2021 - ETH’s Volatility Cone)

RV is nearly resting on the minimum levels for the year.

Although a sad event for option premium buyers, this sort of controlled “grind” higher in spot prices feels like a solid foundation for high prices… ETH isn’t running on FOMO fumes, so to speak.

REALIZED & IMPLIED

(Nov. 7th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

ETH is flirting with annual lows, while IV seems to only be modestly lower.