Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

USA Week Ahead:

Fed members speaking all week

Tuesday: Midterm Elections

Thursday 8:30a ET: CPI

THE BIG PICTURE THEMES:

Last week we had FOMC and NFP numbers. FOMC came in with +75bps hike and a strongly hawkish press conference after. Powell isn’t going to shy away from more hikes.

NFP came in middle-to-soft.

We saw +261k payrolls added, the lowest since Dec2020, but also still above the pre-pandemic jobs gain rate.

Post NFP, we saw yield curves steepen; copper, cryptos and precious metals rally. Stocks were soft.

This type of mixed reaction makes me think the market priced-in a recession in the short-term, but the fed unable to tackle inflation in the long-term. (Although one day of price action is too little to conclude much.)

China is rumored to ease COVID lockdowns and this could be another bullish catalyst.

BIG themes to look for in 2023 are more hikes BUT an inflation target adjustment from 2% → 3%: this would be huge.

Lastly, Q4 seasonality has me leaning more bullish Cryptos in the short and medium term. Think now until EOY.

Long-term however, these weekly charts still look broken for BTC/ETH AND the S&P 500.

BTC: $21,224 +2.86%

ETH :$1,609 +1.58%

SOL: $34.57 +6.37%

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

Lower IV seems like a SOLID Trend (don’t fight the trend outside very short-term gamma plays).

We can see that DVol is making new lows for the year and the 30-day RV is much lower than IV and also trending down.

TERM STRUCTURE

(Nov. 6th, 2022 - BTC Term Structure - Deribit)

(7-day highlight)

Term structures have likely to stay in a steep trend. I would assume that outside a bearish break lower, any bullish spot activity is going to be accompanied by lower RV and IV.

I love the idea of Jan 1X2 Call ratio spread here.

+1 Jan 22k Call

-2 Jan 25k Call

Total Premium $0

(OR the Dec. expirations for a $300 cost)

I just can’t see many scenarios that get BTC to melt-up in a massive rally… blowing past, say, $30k (Obviously, position sizing and risk management are important, as always)

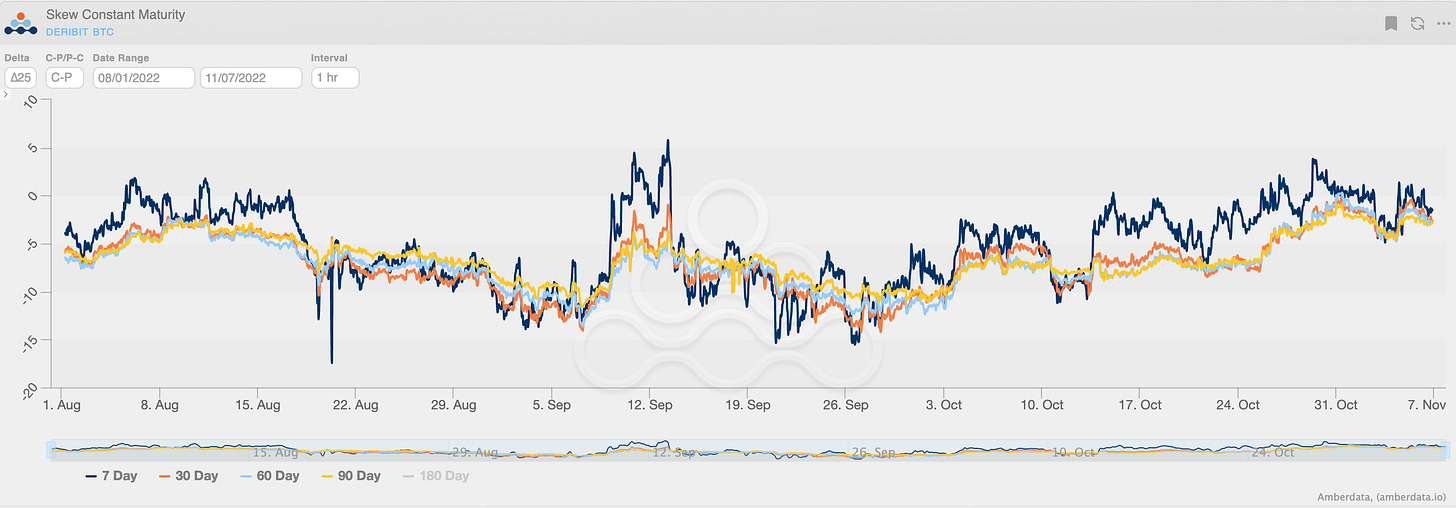

SKEWS

(Nov. 6th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(7-day highlight)

Piggy-backing on the previous 1x2 call spread idea, beyond VRP and Term Structure “Roll-down” the current RR-Skew is priced near recent highs.

I can understand this RR-Skew from a perspective of “delta” flows… but the idea that potential upside vol. will have the same magnitude as potential downside vol. right now… doesn’t make sense to me.

Who knows for sure, but it seems like a RR-Skew I’d like to sell.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

“GVOL-DIRECTION” FLOWS

There was certainly no shortage of major macro events, but it was with the upside breakout of the monthly spot range that the flow gained clarity, with a more marked directional exposure.

We note the feeling that there is a scenario with limited expectations, given the many sales (especially onscreen aka DSOB), even if, with BTC breaking $21k, we saw buying calls $22k-$23k Nov/Dec.

BITCOIN

Sold 1x2 Put ratio 30DEC $19k/$16k

Sold straddles 30DEC $20k

Sold strangles 30DEC $20k-$22k

BTC-30DEC22-24000/25000-C sold (DSOB)

ETHEREUM

Sold 1x2 Call ratio MAR23 $2.6k/$4k

ETH-25NOV22-1300-P bought (DSOB)

ETH-25NOV22-1700-C bought (DSOB)

Call spread bought 30DEC $1.6k/$2.1k

Although the total “dealer gamma” (gvol_gex) is quite modest, we are at the beginning of a strikes region with a negative exposure.

Should the positive price momentum continue, the hedging activity by the dealers could sustain and accentuate the swing.

(GVOL GEX - BTC)

(GVOL GEX - ETH)

Paradigm Block Insights (31 Oct – 06 Nov)

Second consecutive week of strong crypto outperformance vs equities, with ETH leading the way again. Will the decoupling last after earnings season?

ETH +9% / SOL +7.5% / BTC +4% / NDX -6%

ETH Flows🌊

Largest ETH blocks consisted of buying short-dated Nov upside that screened low, given a busy macro week of FOMC/NFP, and buying upside wings via call ratios.

15k Mar 2600 / 4000 1x2 call ratio sold

10k Nov 1800 / 2000 1x3 call ratio sold

8k 11Nov 1750 Calls bought

6.4k 18Nov 1750 / 2000 / 2200 call fly bought

BTC Flows 🌊

Largest flows in BTC leaned towards protection buying in the 1W to Dec buckets in spread formats. Remember, we’ve mentioned we previously saw outrights dominate the largest BTC blocks.

1.3k 11Nov 15k / 16k put spread bought

1k Dec 16k / 19k 1x2 put ratio sold

750x Dec 10k / 15k put spread bought

500x 11Nov 22000 calls bought

Given the low level of absolute implieds, albeit not so great realized, we’ve seen 1M 25D skew (put - call) move to roughly flat, the lowest levels since January.

If BTC breaks out higher, we could perhaps see implieds reset higher with spot.

We’ve officially launched automated tools for our clients to check on @ftx cash-carry basis opportunities, based off of current funding and borrow/lend rates. We will update these opportunities regularly to Twitter.

Disclaimer to do your own research - assuming constant funding is not advised!

Short Basis Opportunities on FTX FSPD!

(Short Coin, Long Perp)

$BCH : 13.35% APR

24hr borrowed volume = $4.8M

$APT : 10.48% APR

24hr borrowed volume = $1.0M

$AXS : 7.22% APR

24hr borrowed volume = $2.2M

Long @FTX Basis Opportunities on Paradigm FSPD!

(Long Coin, Short Perp)

$ETHW : 13.94% APR

24hr borrowed volume = $0.3M

$HT : 12.41% APR

24hr borrowed volume = $7.6M

$SOL : 5.42% APR

24hr borrowed volume = $65.3M

🎀Another successful week of @ribbonfinance auction on @tradeparadigm 🎉

Congrats to this weeks winners 🥳

🥇@GenesisTrading

🥇@BastionTrading

🥇@QCPCapital

🥇Various ANON 🤫

🧵8/11

Another successful week of @friktion_labs auctions on @tradeparadigm with 2 vaults trading

This time, the prices beat the screen by an average of 4%, so vault owners continue to win!

Congrats to the two winners this week:

🥇@ledger_prime

🥇Mysterious ANON 🤫

Episode 3 of The Shift by Paradigm is out now!

@sohan_sen1 speaks with @Darley_Tech CEO Clément Florentin on the life and pitfalls of being an options market maker

Listen here https://pdgm.co/3fteOYX

Hit us up on Telegram! 🙏

Daily Commentary✍️ http://pdgm.co/cmmntry

24/7 Support: http://pdgm.co/tgsupport

🔥@FTX_Official Trade Tape: https://pdgm.co/3qmav3n

Sign up now! 👉 https://pdgm.co/3BLEw1Y

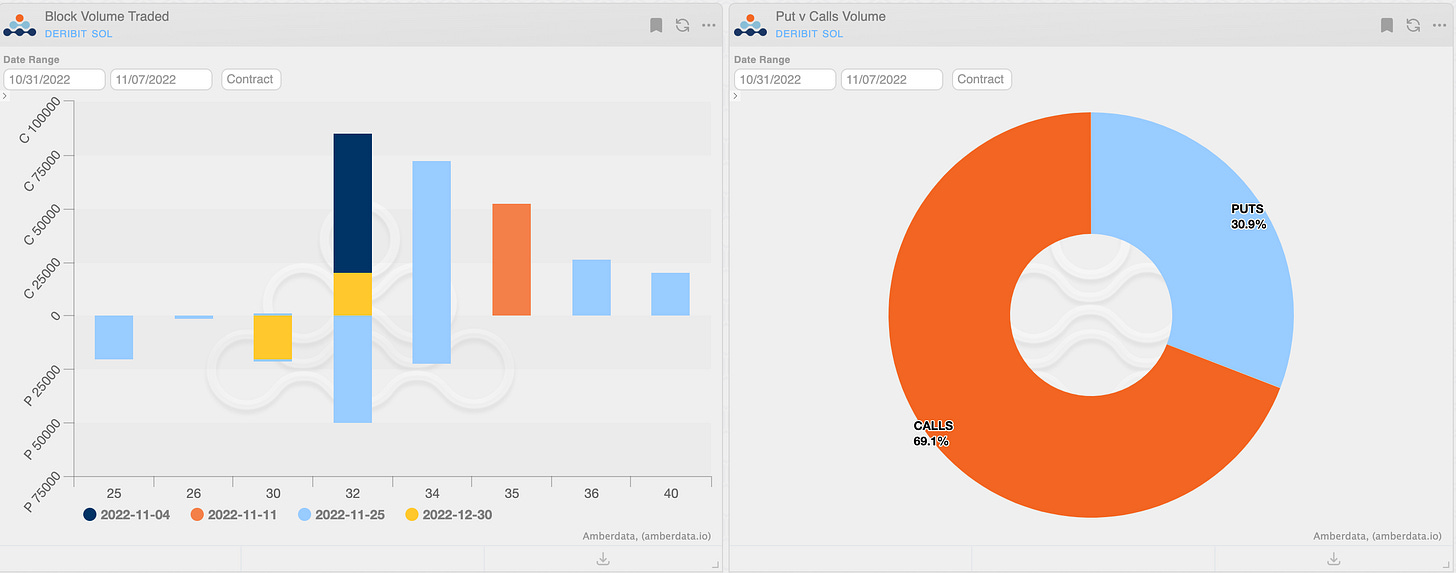

BTC

ETH

SOL

VOLATILITY PREMIUM

(Nov. 6th, 2022 - BTC IV-RV)

Short-term option VRP is priced better today.

There’s a slight VRP but nothing you can hang your hat on.

I’d rather play the VRP in longer term maturities - like 30-day or 60-day.

Last week, we even saw complacent vol. sellers trade nearly 0 VRP in the “daily” option market.

This type of environment is great for Calendar and Diagonal hedges/trade ideas.

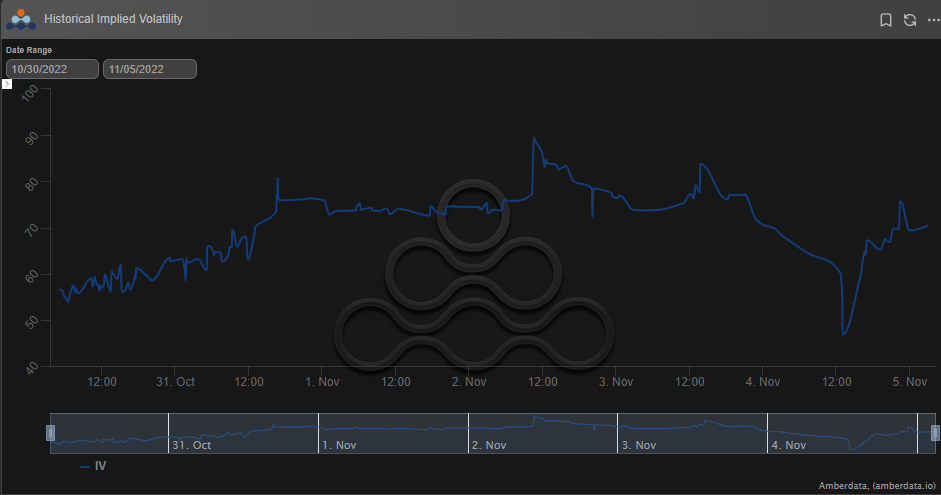

Squeeth a Week in Review (10/30/22 - 11/5/22)

What an interesting week: with traders focusing on the FOMC announcement, many overlooked the possibilities for fireworks to end the week. ETH ended the week up 1.5% and oSQTH ended the week up 3.32%, with most of the gains coming on Friday.

Volatility

oSQTH slowly saw IV incline throughout the week up until the NFP announcement. IV has found its way lower in the last few sessions of the week. Currently, IV is trading at 65.63% compared to its reference vol of 73.71%.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $7.84m. November 2nd saw the most volume, with a daily total of $2.21m traded.

Crab Strategy (10/29/22 - 11/4/22)

Crab had a great week, ending up 2.34% in USD terms. IV selling off into the weekend helped Crab, with most of the gains coming in the second half of the week.

Crab performed 3 hedges this week equating to 373.73ETH.

Twitter: https://twitter.com/opyn_

Discord: discord.gg/opyn

ETH 7-Day Stats:

Volatility

ETH Implied Volatility took a 20-point dive after Thursday's FOMC but rebounded into the weekend. The current ATM IV is sitting at ~75%, unchanged on the week.

Trading

30-day trading fees for the ETH MMV are ~147K!

66% of volume this week was call trading

OI is heavily skewed toward puts

ETH Market-Making Vault

The ETH MMV has returned 3.88% since its inception (June 28th, 2022), representing a weekly change of +0.21%. After struggling the last few weeks on long gamma, ETH realized vol finally caught up.

The 30-day performance annualized is +2.1%, annualized performance since inception is +10.4%. Depositors earn an additional 13.38% rewards APY (boosted up to 26.77% for LYRA Stakers).

Net MMV Exposure:

BTC Market-Making Vault

Lyra’s BTC MMV has returned .913% since its inception (August 16th, 2022). This represents a weekly change of +0.192%. The BTC vaults have also struggled with the recent decline in IV but the BTC realized vol has not been able to close the realized/IV gap as well as ETH.

The 30-day performance is -2.134% annualized. Depositors earn an additional 12.13% rewards APY (boosted up to 24.27% for LYRA Stakers)

Net MMV Exposure:

SOL Market-Making Vault

Lyra’s SOL MMV has returned +.704% since inception (September 27th, 2022).

The 30-day performance is +13.58% annualized. Depositors earn an additional 22.35% rewards APY (boosted up to 44.7% for LYRA Stakers)

Net MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here