Crypto Options Analytics, May 9th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

DVOL: Deribit’s volatility index

(1 month, hourly)

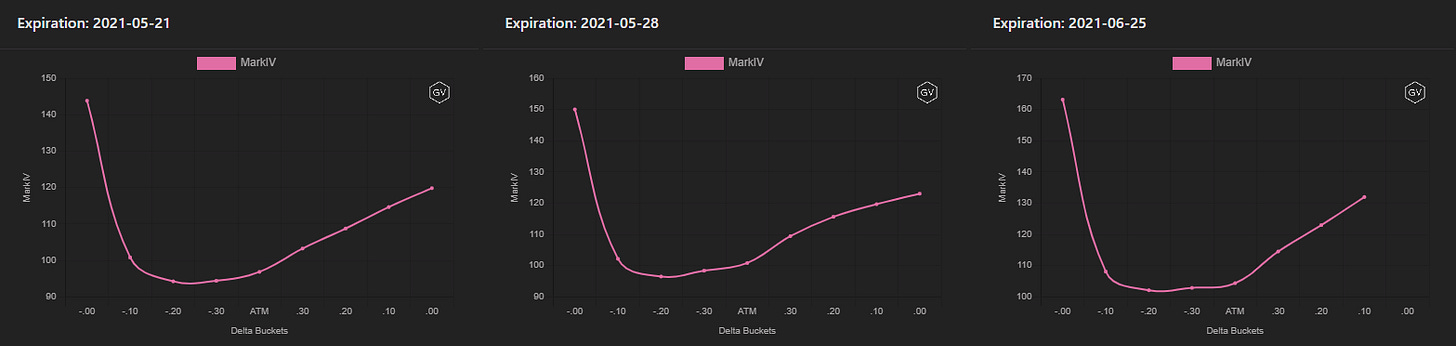

SKEWS

(May 9th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Although Ethereum has greatly outperformed BTC over the past week, BTC was able to find its footing.

As BTC prices rallied higher this past week, skews moved into positive territory as well.

Skews for all expiration cycles are now positive.

(May 9th, 2021 - Long-Dated BTC Skews - Deribit)

The longest-dated skews are still the most positive but as expiration approaches, the relative bid for calls diminishes.

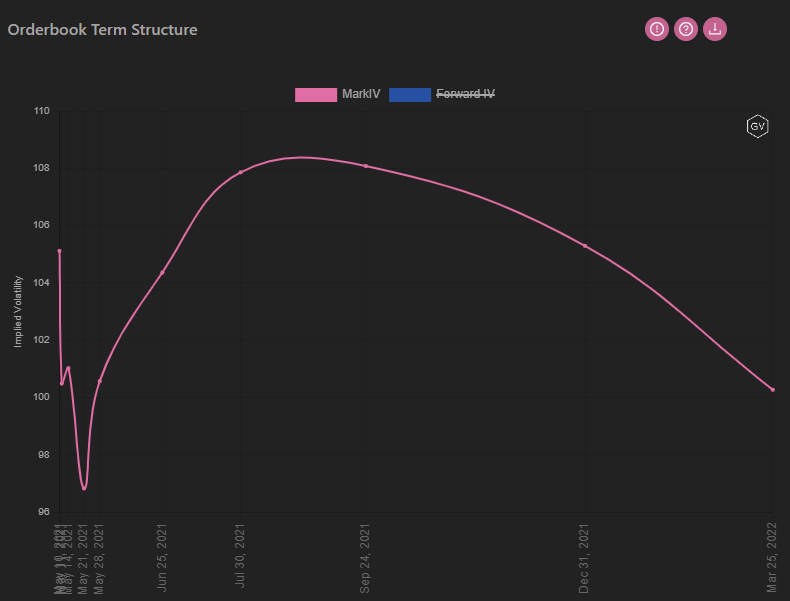

TERM STRUCTURE

(May 9th, 2021 - BTC’s Term Structure - Deribit)

Last week, we had a relatively flat term structure.

This week, despite volatility levels increasing, we see a Contango term structure with Dec. 31 being the richest point on the curve.

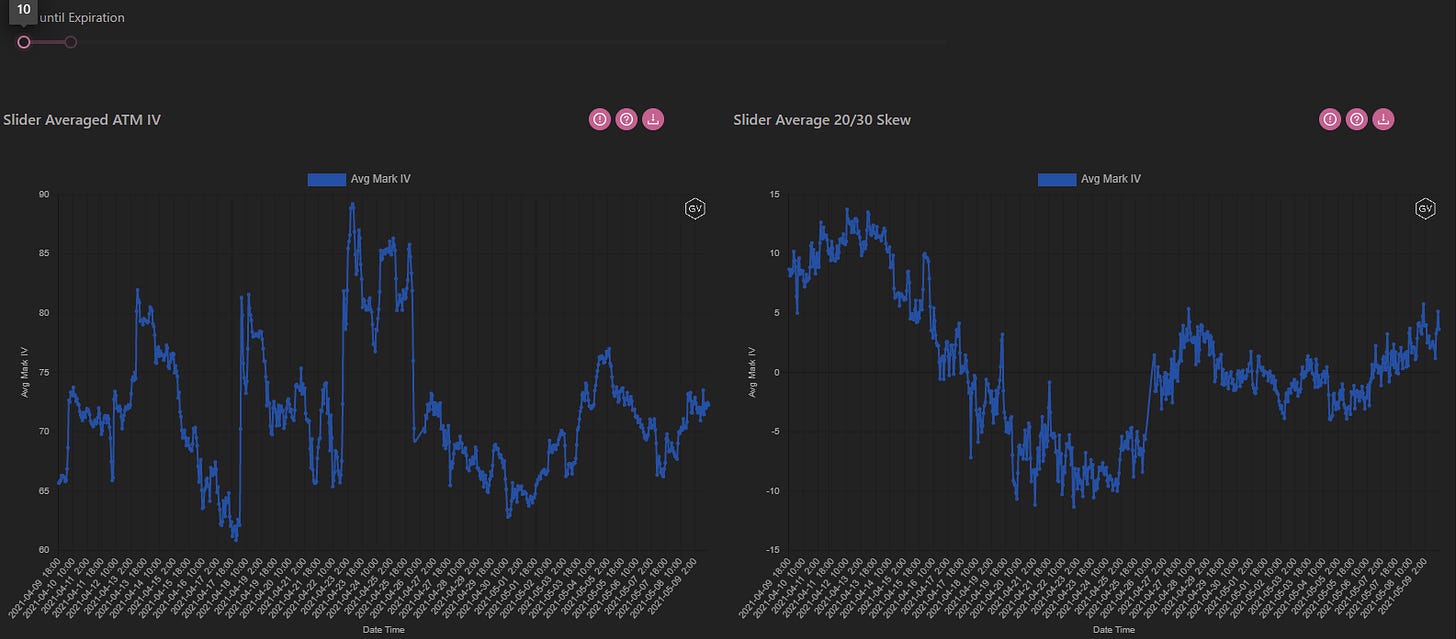

ATM/SKEW

(May 9th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV has increased, compared to last week.

It’s interesting to note that although ATM IV increased, ATM IV also seems less erratic, when compared to this past month.

As noted earlier, skew has now become positive.

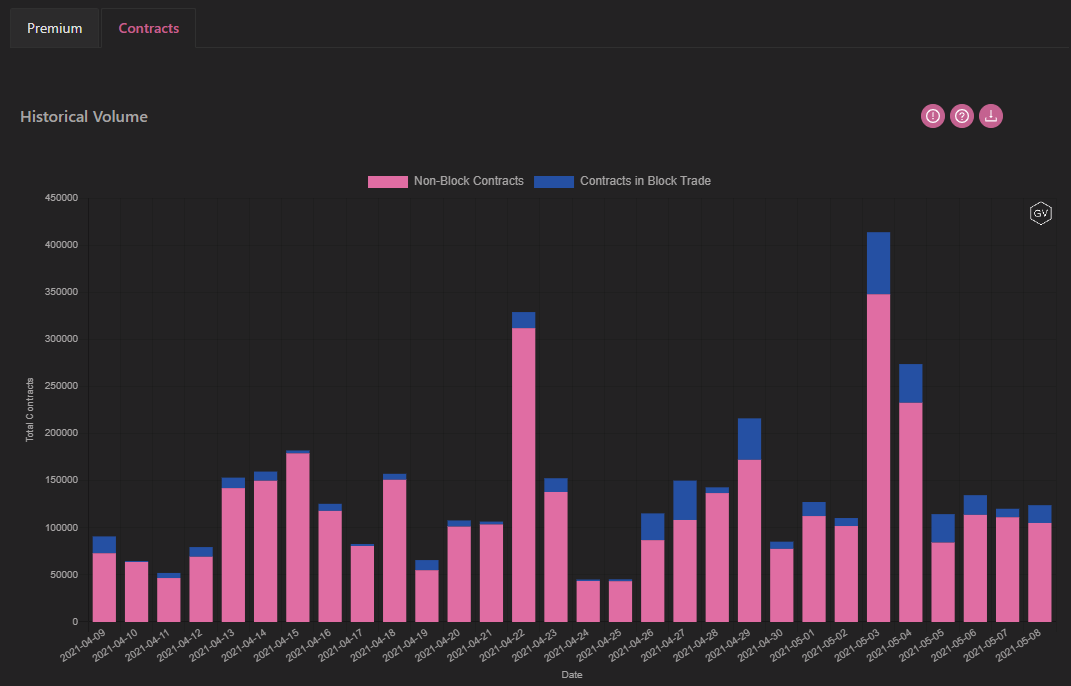

VOLUME

(May 9th, 2021 - BTC Premium Traded - Deribit)

(May 9th, 2021 - BTC’s Contracts Traded - Deribit)

Option trading activity has remained steady over the past week, although diminished by about -15% compared to the previous week.

VOLATILITY CONE

(May 9th, 2021 - BTC’s Volatility Cone)

It’s very interesting to see that RV has dropped compared to last week, given that IV has actually moved higher.

Now most RV measurement windows lie around the median; while last week, we saw the 7-day and 14-day near the upper 75th percentile.

REALIZED & IMPLIED

(May 9th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Last week, RV was clearly higher than IV; now that differential is gone.

Both IV and RV are at the same levels. This is due to both: IV increasing, AND RV decreasing.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 9th, 2021 - ETH’s Skews - Deribit)

Ethereum has had an explosive move higher, which has continued well into the weekend.

This spot-price appreciation has caused both implied volatility and option skews to be extended even higher.

(May 9th, 2021 - ETH’s Skews - Deribit)

These option skews are more positive for longer-dated options, but short-dated option skews have seen a larger shift higher over the past week.

TERM STRUCTURE

(May 9th, 2021 - ETH’s Term Structure - Deribit)

While BTC’s term structure is in Contango, ETH’s term structure resembles more of a flat shape.

Although the term structure has a hump in the June and Sept expirations, the overall range of IV for the various expiration months is pretty tight.

ATM/SKEW

(May 9th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Notice that ATM IV has extended to its highest point over the past month.

Skew has also extended to its 30-day high.

The option market is pricing strong upside volatility.

VOLUME

(May 9th, 2021 - ETH’s Premium Traded - Deribit)

(May 9th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volume is very strong, and especially apparent for premiums traded this past week.

This strong demand for ETH options continues to support the idea of a growing ETH adoption.

VOLATILITY CONE

(May 9th, 2021 - ETH’s Volatility Cone)

Realized Volatility continues to move higher.

ETH is now around the 75th percentile for all measurement windows.

REALIZED & IMPLIED

(May 9th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

Last week, IV was trading at a significant discount to RV: we found this peculiar.

This phenomenon is now corrected, due to IV now being priced much higher.