Crypto Options Analytics, May 8th, 2022

Deribit launches SOL options! Check here

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$34,499

DOV auctions [Ribbon, Friktion, Katana, Thetanuts, PsyFinance]

*note: Protocols have different auction times & calculated vols. are estimates

DVOL: Deribit’s volatility index

(1 month, hourly)

What a crazy week we had!

On Wednesday (May 4th @ 2pm ET) Jerome Powell and the FOMC brought a 50bps hike to the Fed Funds rate, while at the same time “dovishly” signaling that 75bps hikes were “off-the-table”.

The initial reaction was a substantial rally in risk-assets (crypto included).

This optimism quickly turned sour the next day, as markets retraced the entire move higher and took out the previous day’s lows.

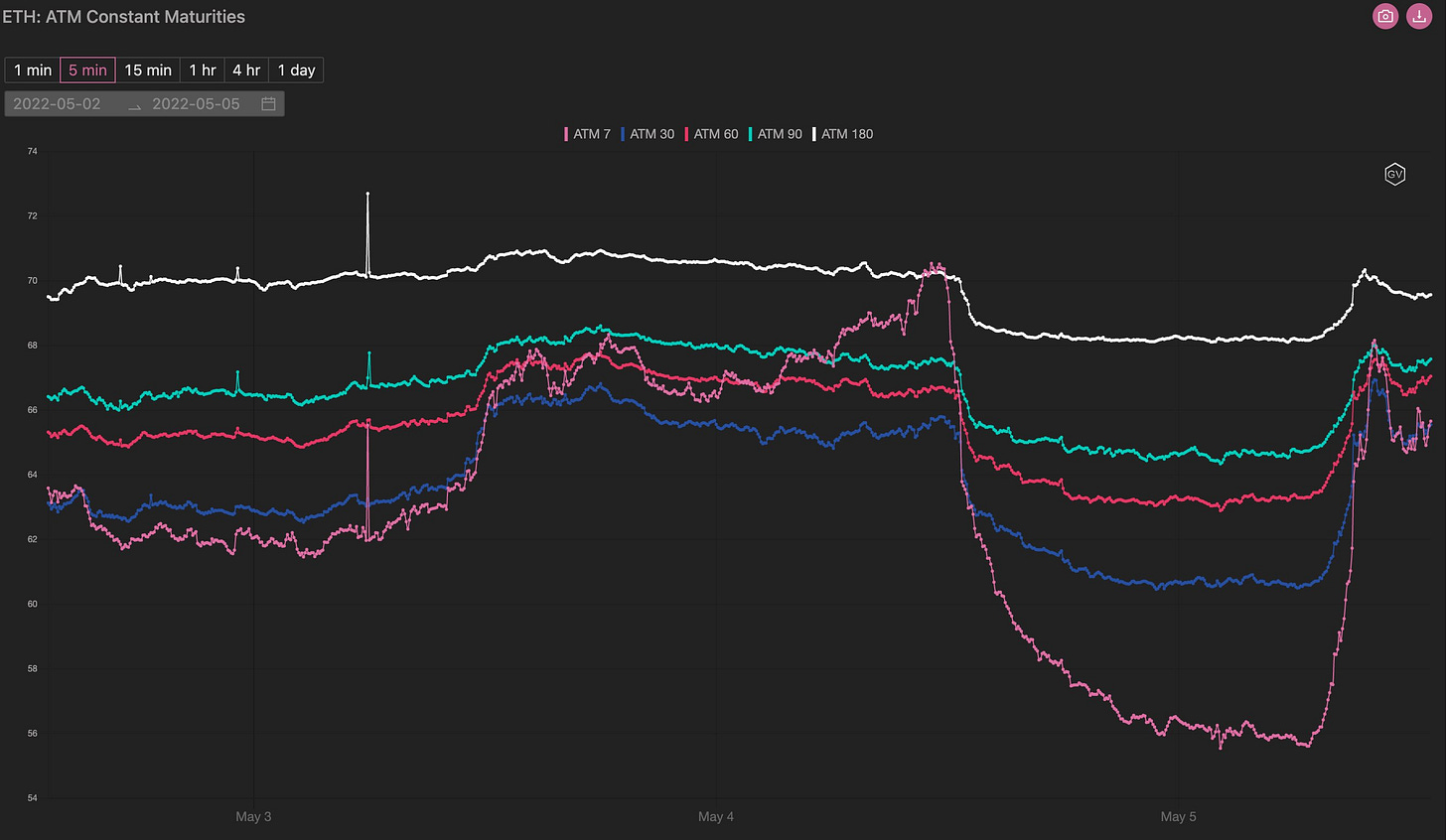

Something extremely fascinating to see in the crypto volatility space, is that vol. markets are clearly reacting to FOMC.

Notice the IV ramp higher (especially in the 7-day maturity) going into the announcement and the quick subsequent drop lower in IV, post announcement (and final rally back).

This shows us that macro players and institutional folks are trading crypto vol. and that US macro events are considered significant in the crypto vol. space.

TERM STRUCTURE

(May 8th, 2022 - BTC’s Term Structure - Deribit)

(gvol API python module, pre-built notebook charts )

So, where are we now?

Well despite crypto crashing, TradFi crashing and IV ramping higher… Both IV and RV are relatively low historically speaking… We still haven’t seen the type of PANIC crypto traders are used too.

Buying vol here… (again, using smart structures… ) HAS to be the play here… I don’t see how we’re out-of-the-woods with volatility in the bigger picture.

(Tony Stewart @PelionCap)

SKEWS

(May 8th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Option skews have been consistently negative these past few weeks… pricing in a ton of this move already.

Skew have been a good gauge of “sentiment” but the pricing has remained stable despite BTC hitting $34.5k as of this writing.

Bear markets are often peppered with vicious counter-trend rallies…

This means that monitoring the bearish skew to find tactical bullish bets, is the play here.

We also continue to like the long-term calls in combination with short-futures for the bigger picture long-vol. structure.

(May 8th, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

The first weekly deadline in May started with a bang with spot losing over 8% in the previous 24 hours and with a delivery price of $36.3k (to find a lower value we have to go back to February 24…).

The open interest profile shows a homogeneous distribution between the different strikes, a sign of a lack of certainty for traders in recent weeks.

Among the largest trades influencing the distribution profile are shorts found in the $36k put, $42k call and $44k call, and a two-way interest in the $40k strike (long call and short straddle).

Despite the sharp spot movement, 81% of contracts expired worthless with premium distributed over the notional of 1%.

(May 6th, 2022 - BTC Contracts - Deribit)

(May 6th, 2022 - BTC Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

“Sometimes a chart is worth a thousand words,” this seems to us to be the case. Take a look at the “blue tide” in the options scanner!

(2nd - 8th May, 2022 - Options scanner BTC - Deribit)

The trading week can be summarized in two phases: the first with the spot in the $38k-$39.5k range that saw moderate flow, with balanced bullish/bearish views. And the second, with high volumes that have not been noticed in a long time with puts absolute protagonists.

Among the trades worthy of mention, the purchase of 500x puts on the May 13th with spot at $39.5k a few hours before the drop to $37k. What a timing!

In the following hours we recorded some of the biggest trades of 2022 with the purchase of over 1300x $35k puts in September and over 1000x $35k puts in June, for total premiums of over $8.5M.

The end of the week was marked by the relentless purchase of $30k puts in June, and the opening of positions in $32k puts on May 27th.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 8th, 2022 - BTC Premium Traded - Deribit)

(May 8th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (2 May - 8 May) BTC

Wega (Weighted Vega standardized to 30-day)

Quite the roller coaster this week. Short-term vols increased 4 points towards the Fed meeting, to drop 5 points in the post-FOMC relief rally, and reversed again on Thursday with world markets dropping. DOV vol selling put a damper on the vols for Friday, with realized volatility also declining.

The week started with short-term Wega being bought, mostly in BTC with sentiment being neutral in the beginning, turning bearish with $30 million of delta selling on Thursday, mainly in June and Sept expiries (put buying).

BTC

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 8th, 2022 - BTC’s Volatility Cone)

Last week RV was around the lower 25th percentile with aspirations for the median. Today we’re around the median, but this isn’t a “Median” environment, so to speak.

Again, we’ve got-to find long vol. structures and set-ups in the bigger picture.

Crypto traders have see spot prices do crazy things many times before… and this feels like a “crazy things” environment.

“Crazy things” RV is marked by that top pink line… meaning 7-day RV “CAN” hit ~250+.

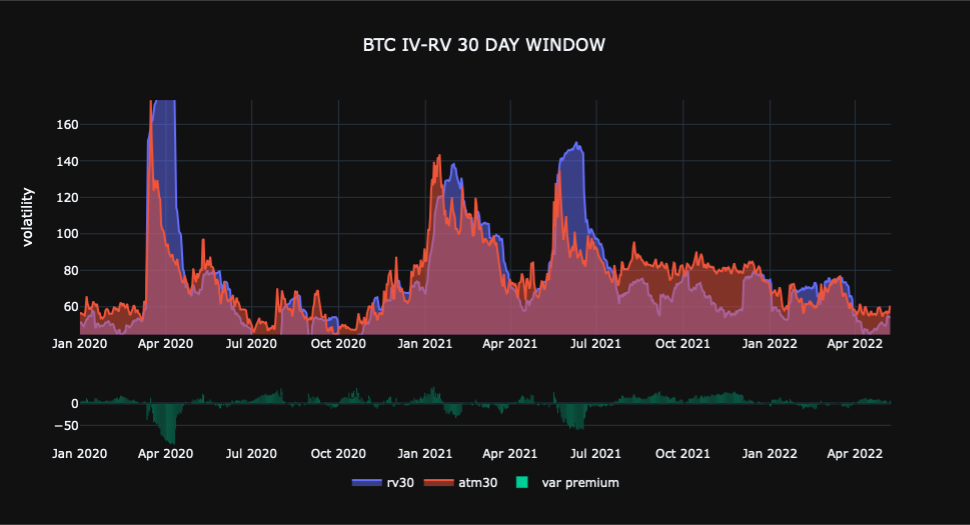

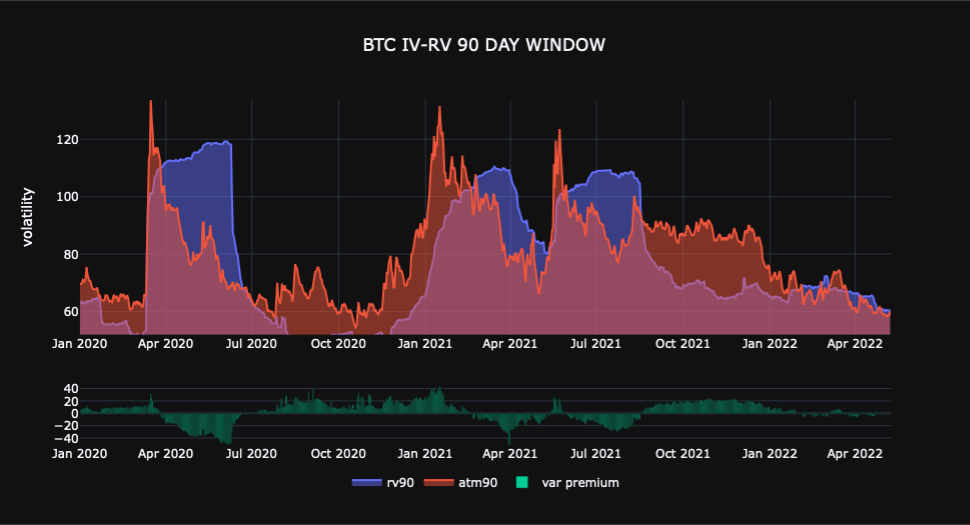

REALIZED & IMPLIED

(gvol API python module, pre-built notebook charts)

Short-term 30-day IV continues to display a slight var. premium while 90-day IV trades around 90-day RV.

$2,535

DOV auctions [Ribbon, Friktion, Katana, Thetanuts, PsyFinance]

*note: Protocols have different auction times & calculated vols. are estimates

DVOL: Deribit’s volatility index

(1 month, hourly)

ETH IV has risen, in reaction to a spot price drop.

ETH is currently hanging out around $2,500 and experienced similar FOMC swings as BTC.

Squeeth IV levels continue to float at substantial premiums to vanilla options.

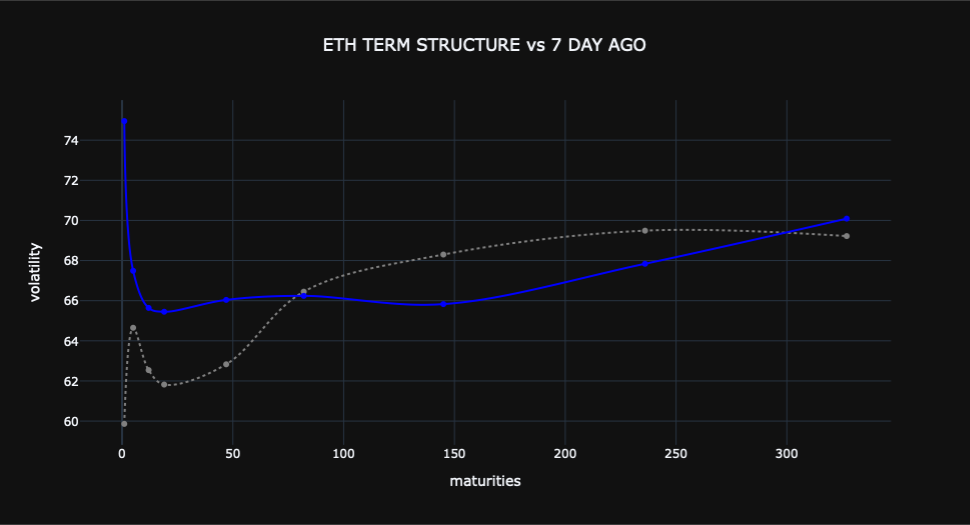

TERM STRUCTURE

(May 8th, 2022 - ETH’s Term Structure - Deribit)

The term structure is currently inverted along the front-end but overall levels are historically meek.

We can see substantially higher vol. moves in the near future.

Compared to 30-days ago, ETH IV isn’t higher on a parallel basis… merely flatter from a term structure shape. The long-end is lower and the short-end is higher.

SKEWS

(May 8th, 2022 - ETH’s Skews - Deribit)

Month-over-month skew is more negative, but week-over-week basically unchanged.

(May 8th, 2022 - ETH’s Skews - Deribit)

Open Interest - @fb_gravitysucks

ETH

The first weekly deadline in May for Ethereum brought some thrills for DOV investors with the delivery price of $2.7k right near one of the best-selling strikes.

Despite the lack of clear-cut positions, open interest profile highlights the levels most affected by DOV with strikes $2.7k/$2.8k puts and $3.2k/$3.3k calls.

Also for this reason, open contracts expired worthless at 88% with a premium distributed over the notional of only 0.4%.

(May 6th, 2022 - ETH Contracts - Deribit)

(May 6th, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

Compared to that of Bitcoin, the week of Ethereum was relatively “calm”, with the absence of protection at any cost.

(2nd - 8th May, 2022 - Options scanner ETH - Deribit)

The start of the week featured $3.5k call sales in July and $3.2k in May (often in combo with $2.5k put to form a short strangle) and the purchase of $2.5k put on the December deadline.

Mid-week with spot firmly above $2.85k and the FOMC meeting closed, the participants must have thought that uncertainty was behind because we only recorded sales (short straddle the preferred strategy) and some call spreads in the September deadline and call ratio (-$6k/+$10k) in December.

But it’s on end of the week with spot at $2.7k that the flow surprised us, not seeking protection as we’ve seen on bitcoin, but focusing mainly on selling short-term volatility. Among the trades to highlight, the further sale of call $3.2k 27th May, a very interesting diagonal put -$2.5k/+$2.2k -27May/+24Jun (exploiting of the most inclined part of the term structure) and the sale of straddle $2.7k 27th May.

At the time of writing the ETH/BTC pair (0.074) it is performing relatively well despite the price drop and this seems consistent with the activity we have shown in the volatility market.

We believe this interconnection between the two markets is set to grow further in the future.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 8th, 2022 - ETH’s Premium Traded - Deribit)

(May 8th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (2 May - May 8) ETH

Wega (Weighted Vega standardized to 30-day)

For ETH, aggressive selling occurred after the FED. Interestingly the Wega flows were completely neutral on Thursday.

Overall sentiment in ETH was bullish at the beginning of the week, with Call and Call spread buying on Monday, totaling +10 million of $delta buying, and neutral end of the week.

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 8th, 2022 - ETH’s Volatility Cone)

Unlike BTC, ETH RV is sitting tight on the lower 25th percentile.

Median RV seems like an easy target should things continue to remain uncertain.

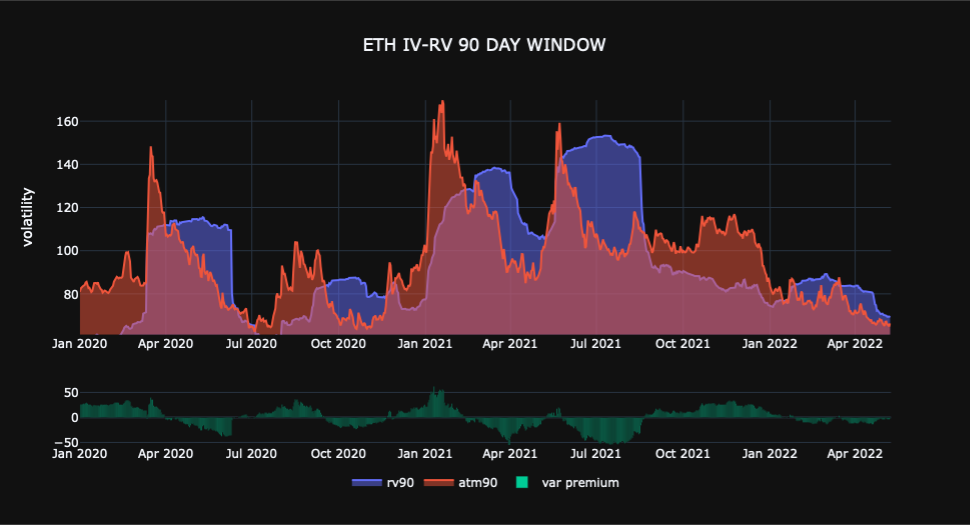

REALIZED & IMPLIED

(Gvol API python module, pre-built notebook charts)

90-day IV/RV is still at a discount, although narrowing, while 30-day IV/RV is pretty much at par.

$77.92

DOV auctions [Ribbon, Friktion, Katana, Thetanuts, PsyFinance]

*note: Protocols have different auction times & calculated vols. are estimates

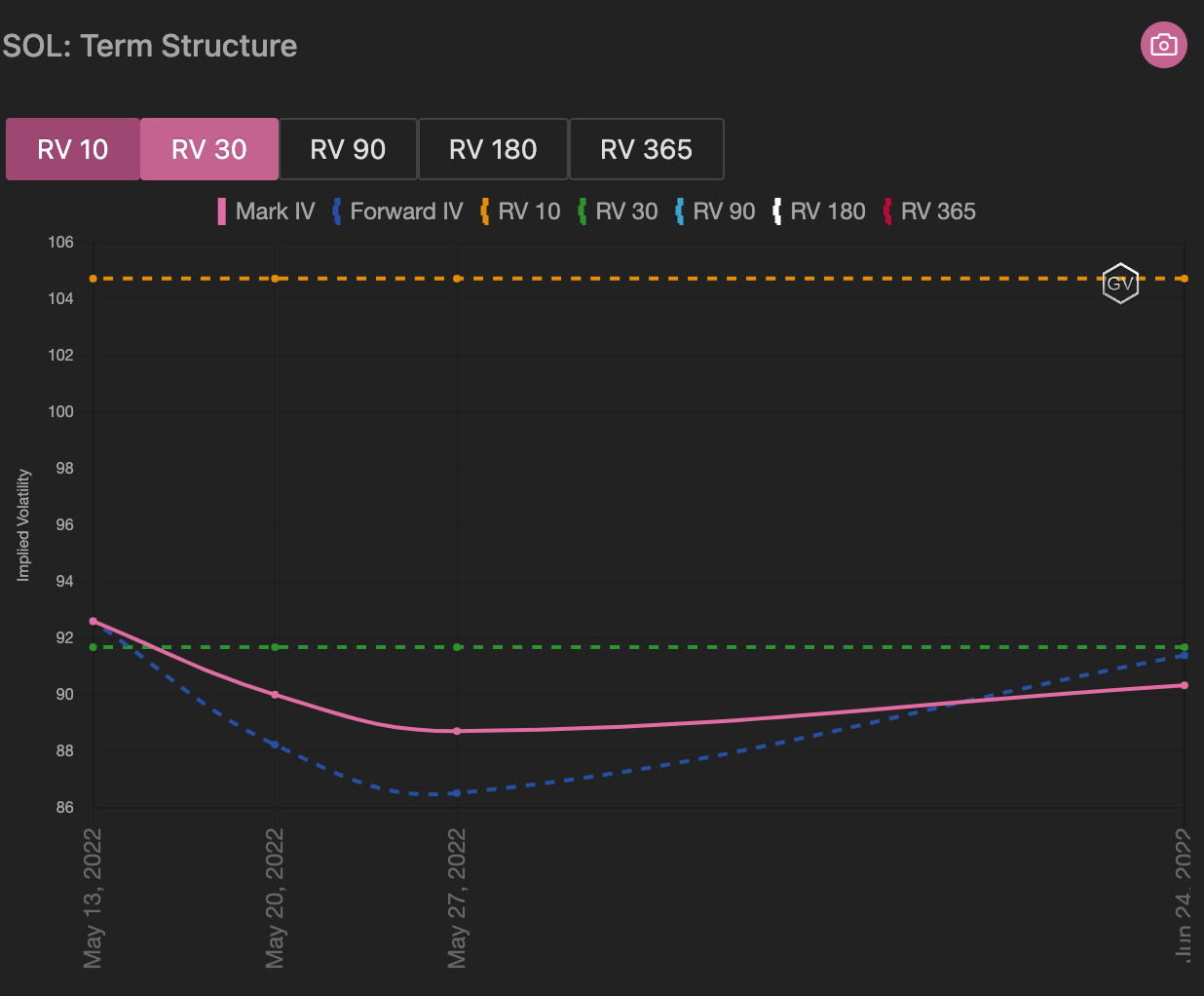

We’re super excited to see Solana options being launched on Deribit.

Not only does this bode well for crypto vol. traders, but this is another healthy addition to the Solana ecosystem, which is continuously gaining traction and popularity.

TERM STRUCTURE

(May 8th, 2022 - SOL’s Term Structure - Deribit)

Sol. vol is much higher than both BTC and ETH… hanging out in the +90% handles for both IV and RV.

This is an exciting coin with a lot of beta risk and much smaller market cap. $25b compared BTC’s/$658B & ETH’s/$309B.

SKEWS

(May 8th, 2022 - Short-term and Medium-term SOL Skews - Deribit)

Option skew went crazy during the FOMC announcement, but this is also due to the fact SOL options launched on the same day.

As traders made markets and prices found equilibrium, we saw big swings.

Skew has stabilized and is now negative along with BTC and ETH counter parts.

(May 8th, 2022 - Long-Dated SOL Skews - Deribit)

VOLUME & OI

(May 8th, 2022 - SOL OI Profile - Deribit)

(May 8th, 2022 - SOL Premium Traded - Deribit)

(May 8th, 2022 - SOL’s Contracts Traded - Deribit)

VOLATILITY CONE

(May 8th, 2022 - SOL’s Volatility Cone)

The 12-month distribution of RV for SOL is MUCH wider.

90% RV is on the “LOWER” 25th percentile and in crazy times 7-day SOL RV has reached a near 500% peak.

Wow!