Crypto Options Analytics: May 4th, 2025

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

Monday 10a - ISM

Tuesday 8:30a - US Trade Deficit

Wednesday 2p - FOMC Rate Decision

Friday - Various Fed Governors Speaking

MACRO

There was a lot of US economic data and developments last week.

The 12-month rate of inflation, measured by the PCE index, slowed to 2.3% from 2.7%

This inflation data is further supported by a jobs report that beat expectations +177k (vs +133k) while hourly wages rose at an annualized rate of +2.4% (vs +3.8% trailing 12-month rate).

The unemployment rate from the household survey remained steady at +4.2%.

Next Wednesday we have the FOMC rate decision, which is expected to remain unchanged. Powell is likely going to signal a wait-and-see approach going forward and overall I think the rate decision will be a quiet event.

The CME FedWatch Tool shows the market is only pricing 2.8% probability for a rate cut. This probability was 10.4% only last week.

Risk-assets moved higher last week given the signed US/Ukraine deal and willingness for trade-war talks between China/US appearing.

The markets have now erased all the trade tariff losses experienced in early April.

BTC: $95,508 (+1.6% / 7-day)

ETH :$1,829 (+1.7% / 7-day)

SOL :$146.59 (-1.5% / 7-day)

Crypto

As Bitcoin approaches $100k once again, a growing theme is for private companies to add more BTC to their balance sheet, there are currently about 70 companies doing this worldwide. Combine this theme with returning inflows into Bitcoin ETFs and now new ATHs are back in sight.

During last week’s MSTR earnings call, Saylor suggested that MSTR would double it’s acquisition plans from 21/21 to 42/42, planning to raise $84B for BTC purchases over the next two yers.

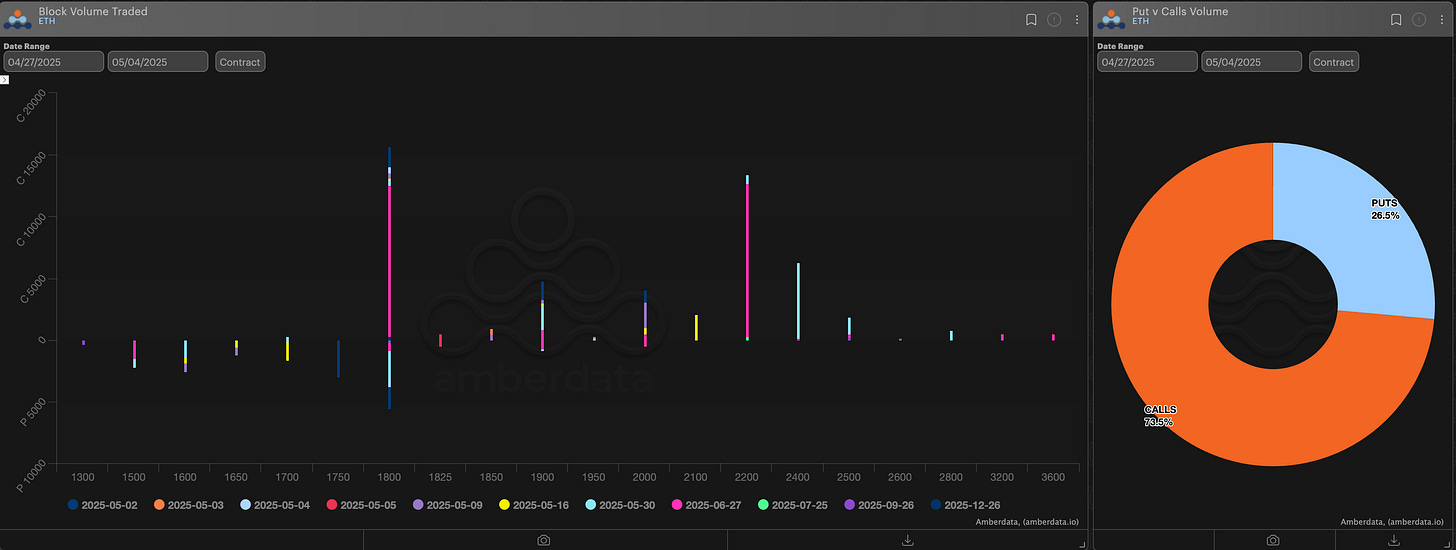

Block flows were mostly bullish last week as the top trades were call purchases and put selling for June expiration.

On-screen trades were also bullish as traders bought short-dated upside < 30-dte.

We can see the volatility surface skew is ambitiously pricing these bullish flows. The 60-dte call wing is back to highs against ATM vol. while the ∆25 put wing is trading negative to ATM.

60-dte put ratios are a decent buy here (sell 1x, buy 2x). This is a good hedge against BTC longs. This also shows that selling the ∆25 Put wing isn’t very attractive from a skew perspective right now.

Overall volatility continues to be decent here for buyers, but given the shift in skew, long the put-ratio + long spot would be my preferred 60-dte structure.

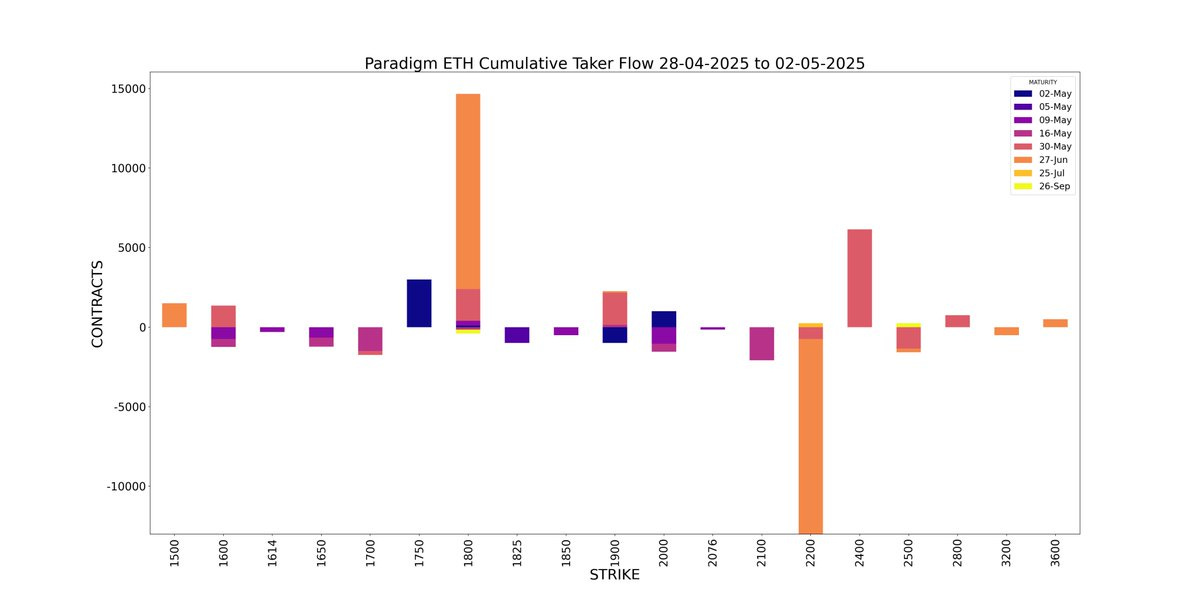

Ethereum is also getting some love right now as the biggest block trades were Call Spread buying, strike were 1800/2200 for 60-DTE out.

This is a good trade. I like this. There’s potential for a snap-back rally in the ETH/BTC ratio and ETH could easily relief rally above $2,200 in the medium term as risk-assets rebound everywhere.

ETH ATM IV isn’t elevated here either, it’s arguably low compared to the past 12-months of data (above), making the timing of Call spread purchases more interesting.

Paradigm Top Trades This Week

Weekly BTC Cumulative Taker Flow

ETH Cumulative Taker Flow

BTC Cumulative OI

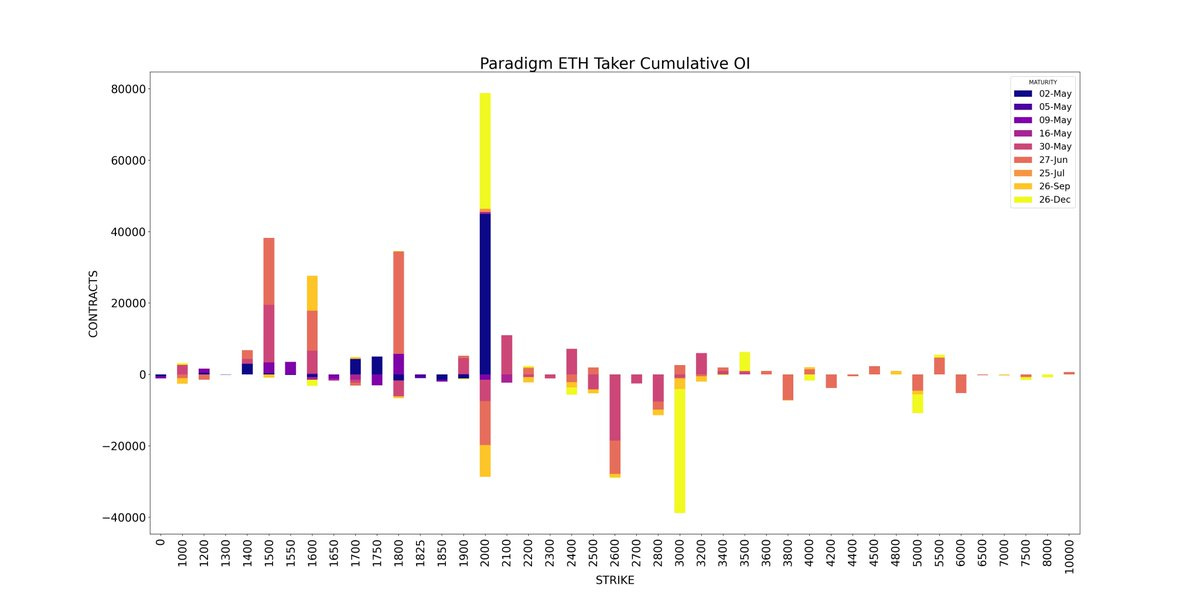

ETH Cumulative OI

BTC

ETH

IV remains low on Derive. BTC IV remains near monthly lows of 38% (7 DTE) and 43% for 30 DTE. Similarly, ETH IV has also fallen to 55% (7 DTE) and 60% (30 DTE).

We’ve seen a large increase in OI for the DEC 26 expiry for calls but mostly puts. This suggests traders are stacking up long dated insurance with the worries of a recession on the horizon.

Borrow rates on USDC remain low at 4.4%

Big week ahead with Fed FOMC meeting, along with ETH Pectra upgrade and Coinbase earnings call.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.