Crypto Options Analytics, May 31st, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 31st, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Although volatility has dropped over the past week, the option market is still more interested in buying put protection instead of call exposure.

The markets are still reeling from the recent selling.

Trader’s are reluctant to shed put protection and skews are very negative providing interesting opportunity for “dip buyers”.

(May 31st, 2021 - Long-Dated BTC Skews - Deribit)

Even the longterm options are seeing negative skews. This type of longterm skew structure has proved to be extremely rare in the past.

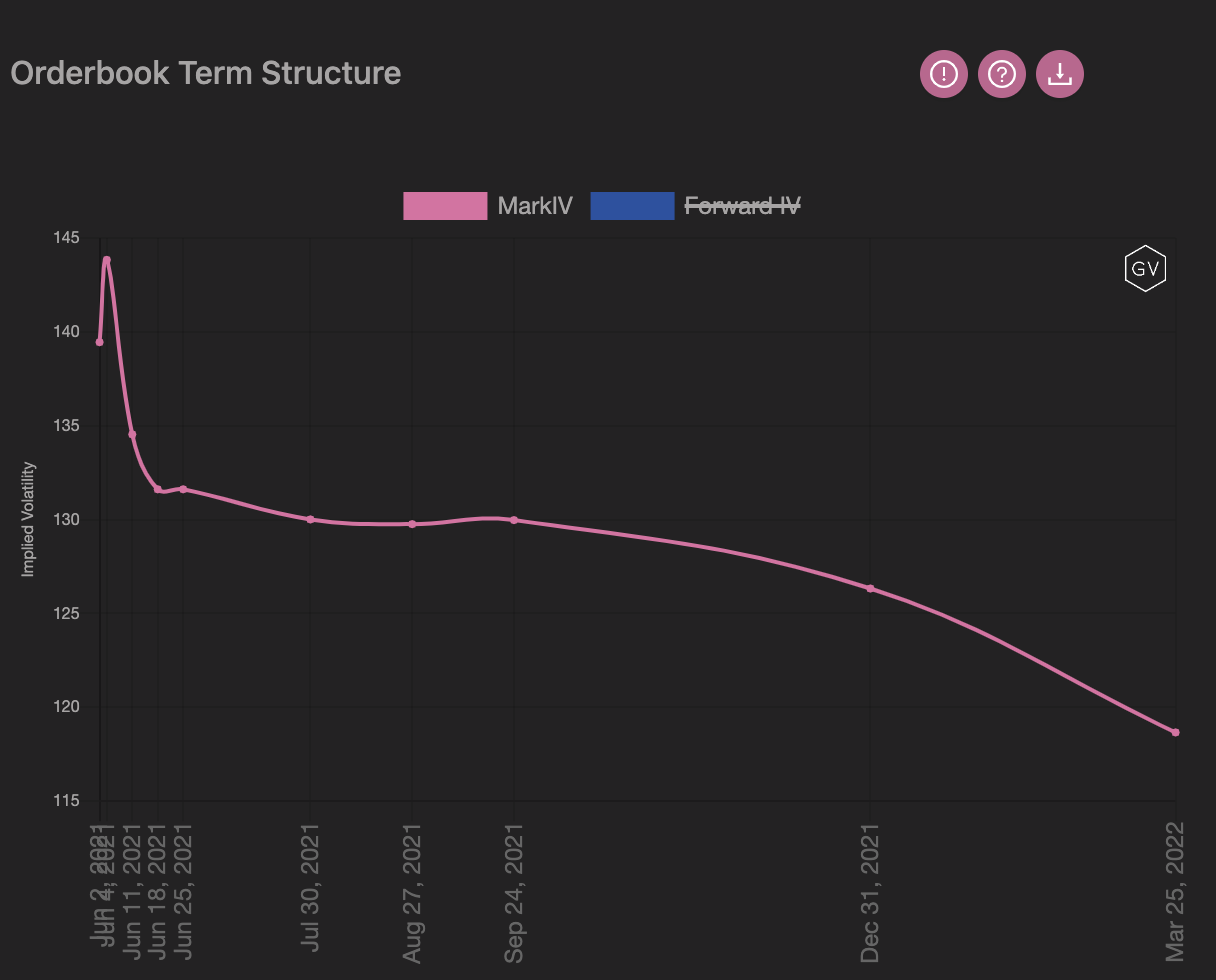

TERM STRUCTURE

(May 31st, 2021 - BTC’s Term Structure - Deribit)

The term structure is nearly flat here. Option markets have calmed down a lot and the strong Backwardation seen last week is no longer present.

Volatility traders have been quick discount future realized volatility and seem to be pricing in spot price consolidation as the next most likely outcome.

ATM/SKEW

(May 31st, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

Notice the drop lower in ATM volatility combined by a relief rally in the option skew.

Despite these corrections skew is still negative, as mentioned before, this skew pricing has bled into the longterm options as well.

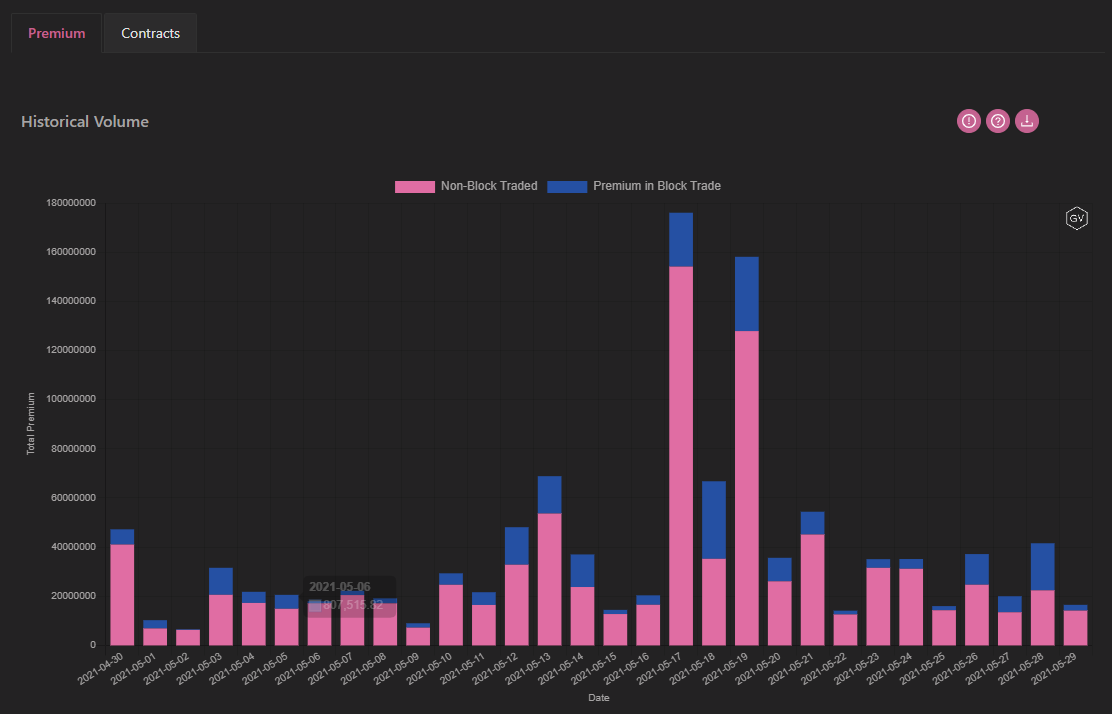

VOLUME

(May 31st, 2021 - BTC Premium Traded - Deribit)

(May 31st, 2021 - BTC’s Contracts Traded - Deribit)

Option volume have been light over the past week compared to the rest of the month.

This type of “calm” is congruent with implied volatility subsiding.

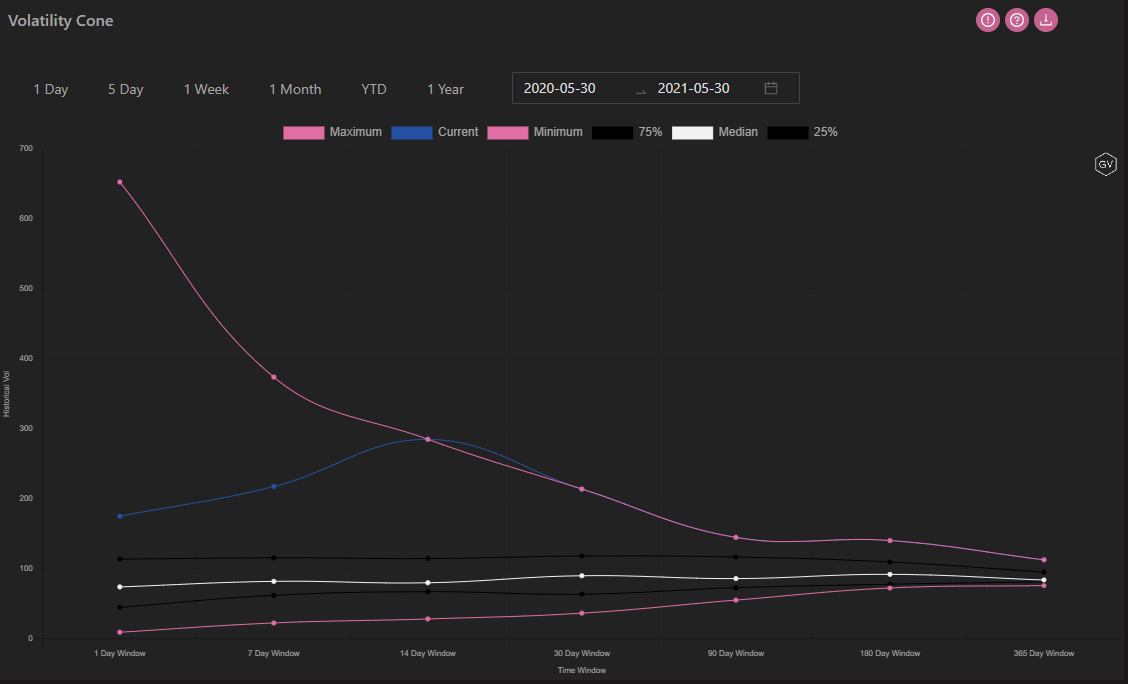

VOLATILITY CONE

(May 31st, 2021 - BTC’s Volatility Cone)

Realized volatility measures are still near annual highs.

The long measurement windows haven’t experienced enough time nor drop in RV to be affected… Short measurement windows have dropped significantly but are still above the 75% percentile.

REALIZED & IMPLIED

(May 31st, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is HEAVILY discounting future RV.

Even though volatility is high historically speaking, IV may very well prove to be relatively cheap right now.

Should spot markets break down lower or experience a sharp relief rally, buying IV here may provide good opportunity.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 31st, 2021 - ETH’s Skews - Deribit)

ETH options are displaying a similar skew structure to BTC for the short and medium-term options.

The market is still offering a premium for put options in these shorter expirations.

(May 31st, 2021 - ETH’s Skews - Deribit)

Longterm options are displaying a positive skew for ETH.

This is consistent with typical crypto skews and the relatively bullish outlook for ETH over BTC is interesting.

TERM STRUCTURE

(May 31st, 2021 - ETH’s Term Structure - Deribit)

ETH’s term structure is still in Backwardation.

Not only does ETH have a higher overall implied volatility but the term structure is also pricing in outsized volatility in the near term.

The market isn’t ready to discount the possibility of a large corporation potentially announcing balance sheet allocation to ETH.

(Think GME)

ATM/SKEW

(May 31st, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV has started to come down.

Skew is still largely negative for the selected maturities.

VOLUME

(May 31st, 2021 - ETH’s Premium Traded - Deribit)

(May 31st, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes have been quiet over the past week.

Again, this lack of activity is congruent with IV heading lower.

VOLATILITY CONE

(May 31st, 2021 - ETH’s Volatility Cone)

ETH realized volatility remains very high.

All the measurement windows are near their highs for the past 12 months.

REALIZED & IMPLIED

(May 31st, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

Similar to BTC, ETH IV is heavily discounting future RV.

Relatively speaking ETH options could prove to be cheap.