Crypto Options Analytics, May 2nd, 2021

Crypto prices drop like beach balls, get submerged in water!

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Crypto prices drop like beach balls, get submerged in water!

DVOL: Deribit’s volatility index

(1 month, hourly)

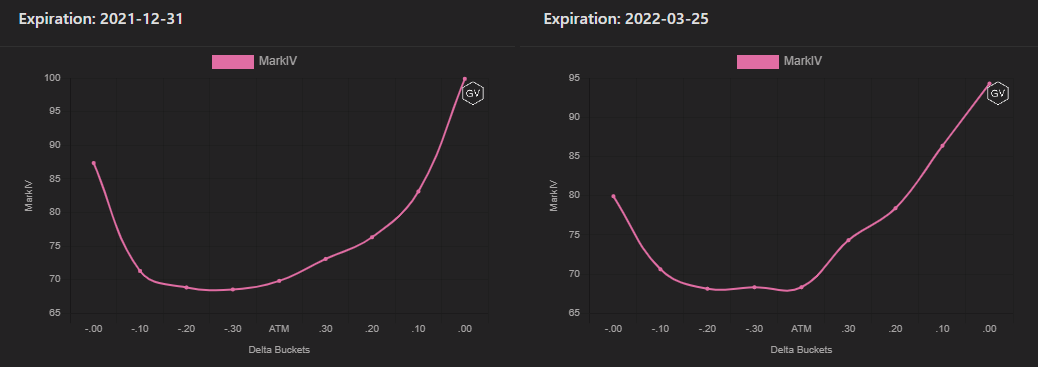

SKEWS

(May 2nd, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Interestingly enough, despite BTC prices unable to remain lower for any extended amount of time, option skews have had trouble finding positive territory.

This divergences in option skews and BTC spot prices, indicate that traders are cautious in the short- and medium-term.

(May 2nd, 2021 - Long-Dated BTC Skews - Deribit)

Unsurprisingly, long-term options once again display a decidedly positive skew.

TERM STRUCTURE

(May 2nd, 2021 - BTC’s Term Structure - Deribit)

The term structure is now very flat.

Implied volatility has dropped significantly, about ~18pts, versus last week.

As volatility has dropped, the term structure has lost its “Backwardation” shape and now assumed a flat shape.

ATM/SKEW

(May 2nd, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

This chart reiterates the above points nicely.

1) IV has whipped around a lot over the past month, dropping nearly 20pts versus last week.

2) Although BTC spot price rallying has eased the negative option skew, we are not quite yet in positive territory for the short-term and medium-term maturities.

VOLUME

(May 2nd, 2021 - BTC Premium Traded - Deribit)

(May 2nd, 2021 - BTC’s Contracts Traded - Deribit)

Option trading activity has remained strong and steady over the past week.

No outliers immediately jump out.

VOLATILITY CONE

(May 2nd, 2021 - BTC’s Volatility Cone)

7-day and 30-day realized volatility continues to hold above the upper 75th percentile.

This high volatility environment should be noted for price direction traders… There’s room.

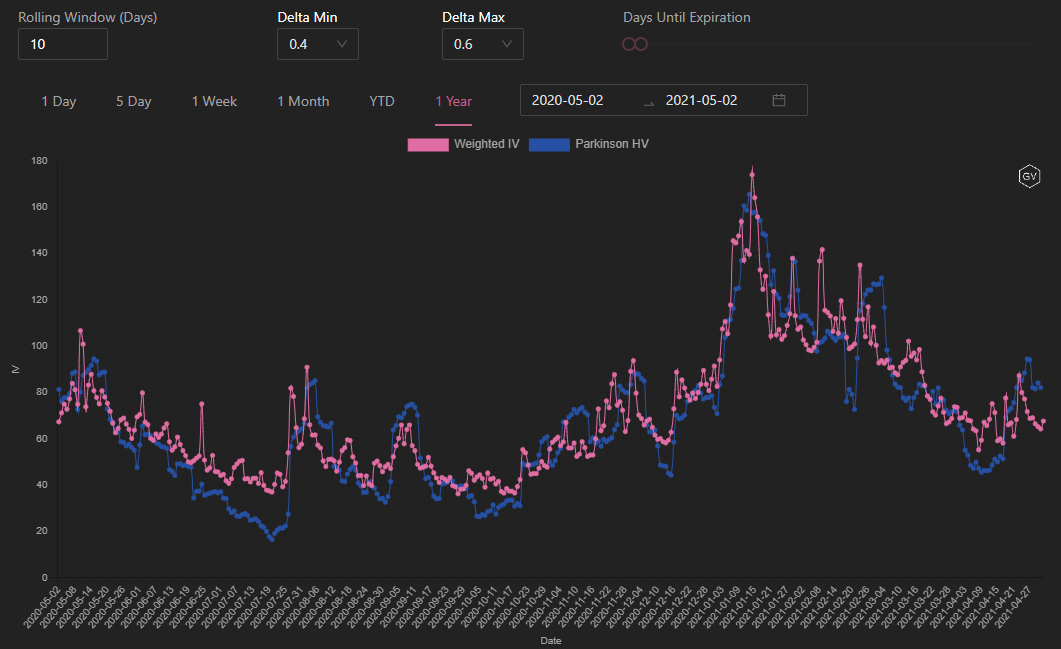

REALIZED & IMPLIED

(May 2nd, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Short dated option IV is trading below RV… There are opportunities in buying volatility in this type of environment.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 2nd, 2021 - ETH’s Skews - Deribit)

The ETH option market is very bullish, especially compared to BTC as a benchmark.

All option expirations have a decidedly positive skew.

This indicates that option traders are enthusiastically paying a premium for calls, versus puts, on ETH.

(May 2nd, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(May 2nd, 2021 - ETH’s Term Structure - Deribit)

Like BTC, the term structure resembles a nearly flat structure.

This flat structure can easily flip to Contango or Backwardation, depending on the volatility environment going forward.

ATM/SKEW

(May 2nd, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV has also dropped versus last week, but skew has become so bullish that we are nearly at the highs for the past 90days.

VOLUME

(May 2nd, 2021 - ETH’s Premium Traded - Deribit)

(May 2nd, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are very strong, especially in terms of dollars (premium) being traded.

This is a good development for ETH: it shows growing interest and participation.

This desire to participate in the ETH options market is an indication of bullish ETH sentiment.

VOLATILITY CONE

(May 2nd, 2021 - ETH’s Volatility Cone)

Although ETH RV has dropped slightly since last week, the 14-day, 30-day and 90-day are still elevated near the upper 75th percentile.

Things have not stopped moving here.

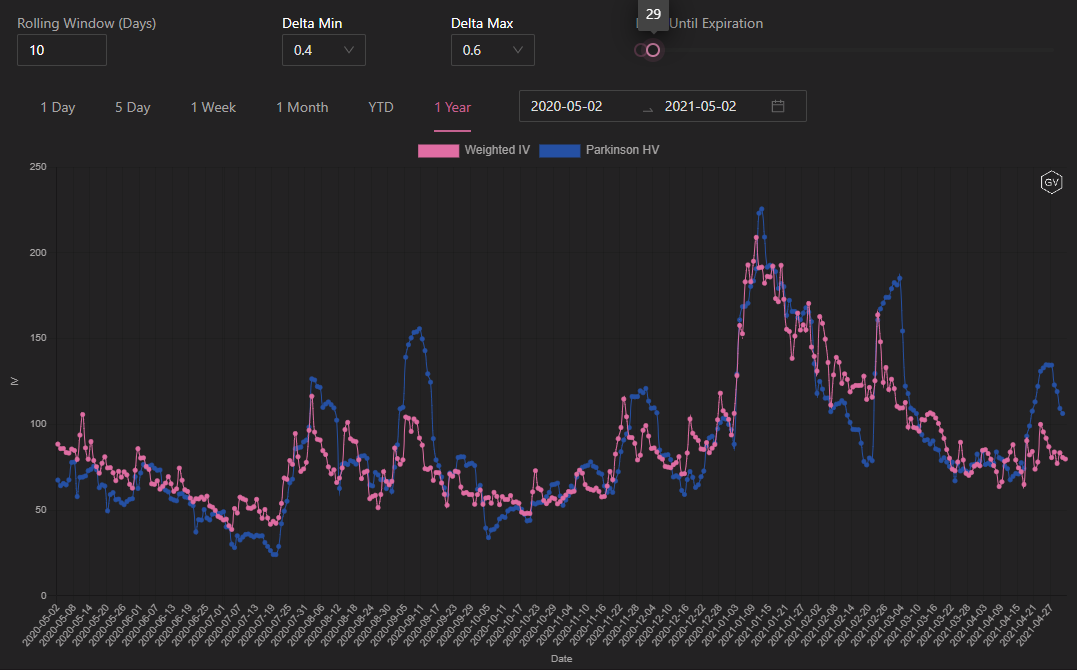

REALIZED & IMPLIED

(May 2nd, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is trading at a HUGE discount to RV… buying options in this environment is extremely interesting… especially as ETH is making new ATHs.