Crypto Options Analytics, May 29th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

Weekly Theme - Relief Rally and Lower Vol.

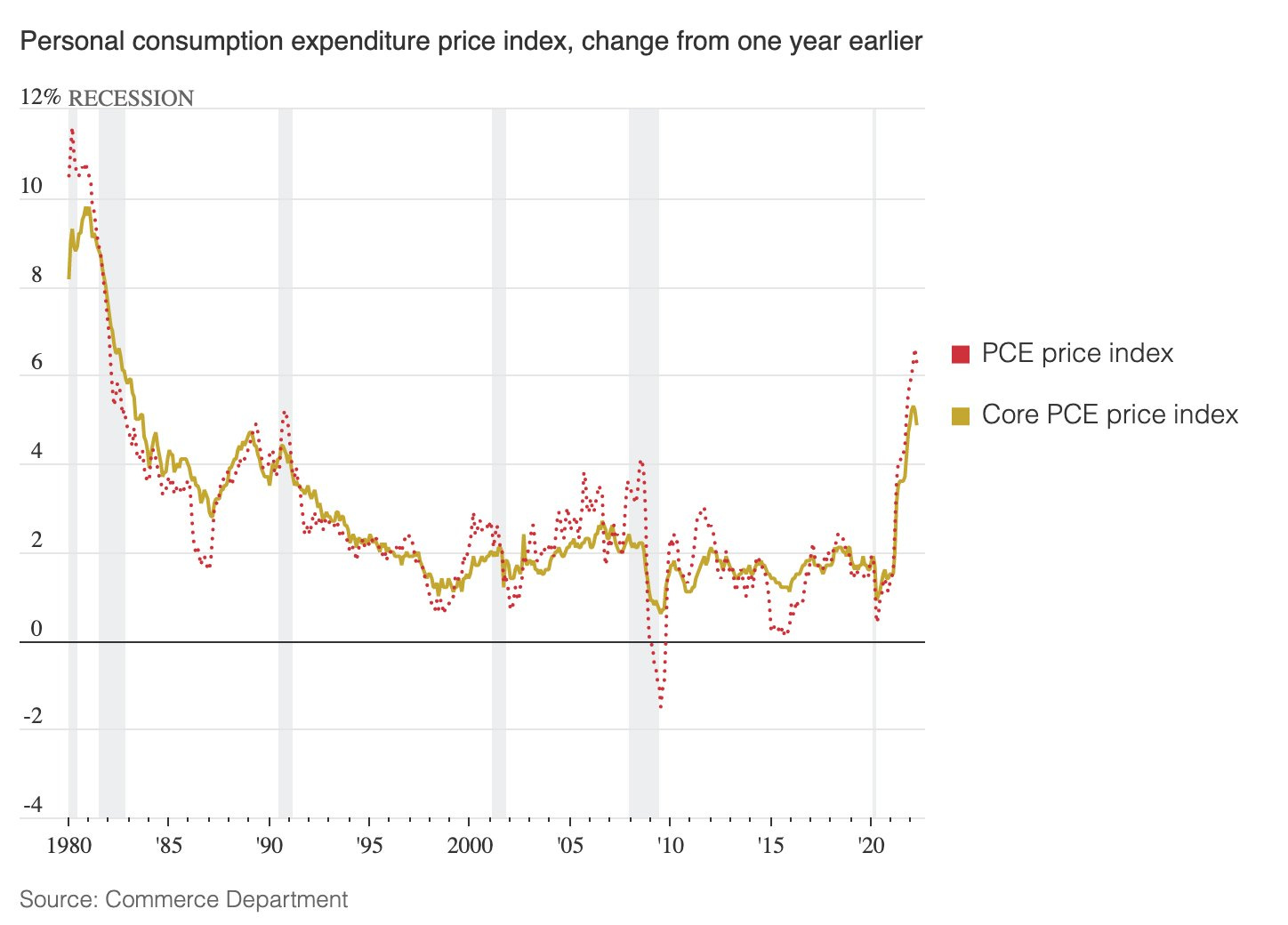

Friday, we saw a sharp rally in US equities as the rate of inflation slowed down slightly.

(WSJ - PCE numbers released at 8:30 am ET)

This is an excuse for a relief rally, given that the Fed is reacting to inflation.

Crypto and TradFi assets have had a high correlation as of late and therefore our weekly theme is based on activity currently found in TradFi.

The VIX futures term structure in now in Contango, suggesting IV is likely headed lower.

Cash-VIX is near monthly lows as SPX option vol. is sold lower… and fear leaves the market.

VVIX is the BIG story here!

VVIX (Vix of VIX options) is now making new lows since the START of the COVID-19 pandemic.

The vol. market is likely leading the way for higher S&P prices… If S&P heads higher, most likely crypto follows and crypto vol. heads much lower.

Medium term, the pain-train is likely not over… but short-term it looks like asset prices will be experiencing a relief rally.

$29,159

DVOL: Deribit’s volatility index

(1 month, hourly)

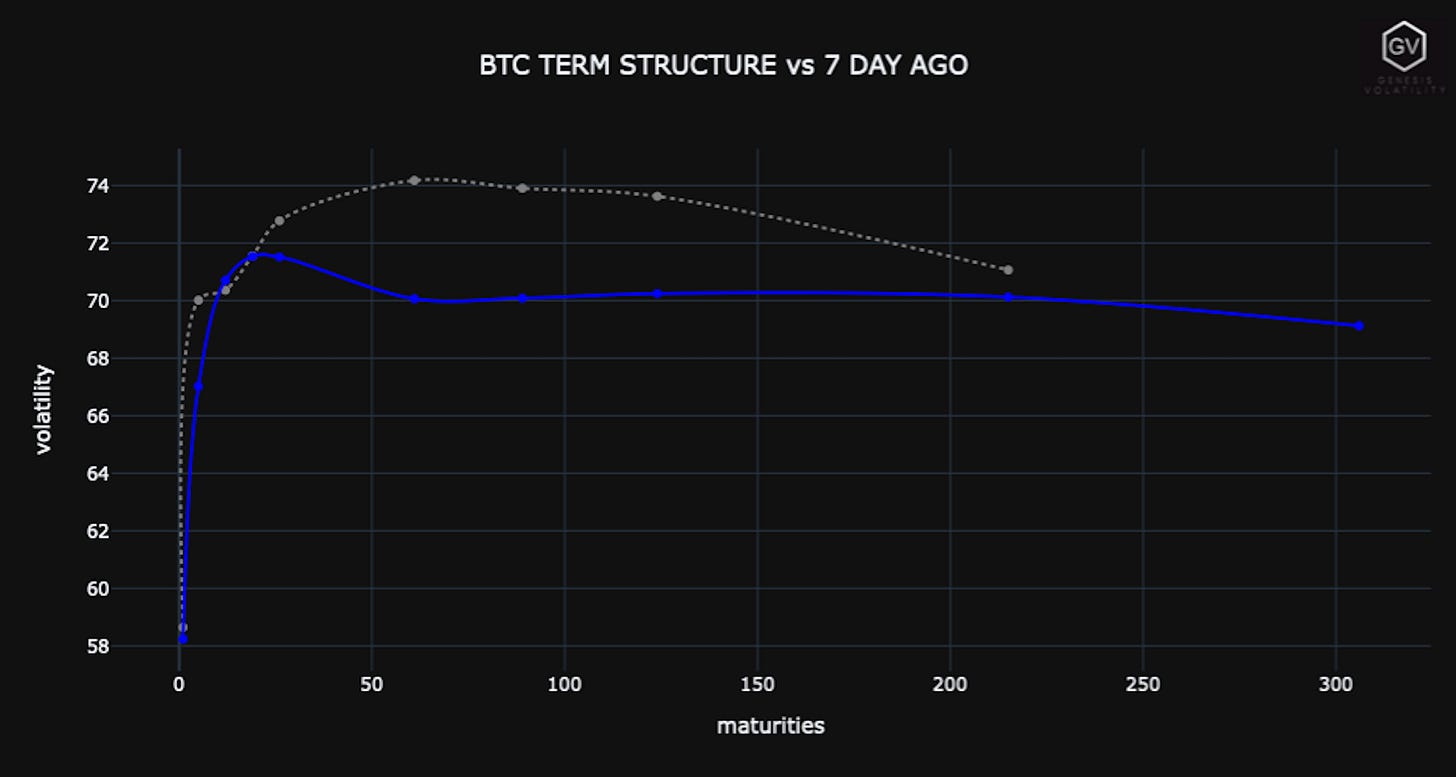

TERM STRUCTURE

(May 29th, 2022 - BTC’s Term Structure - Deribit)

(gvol API python module, pre-built notebook charts )

The term structure is a “mixed” shape.

The front is very steep and decidedly in Contango, with the back-end relatively flat.

30-day IV is on the cusp of both regimes and a GREAT short-vol. candidate.

Should spot prices retake $30k, we would be even more confident in the short-vol. thesis… This has been a very “well-defined” price level and a great trigger for measured-risk.

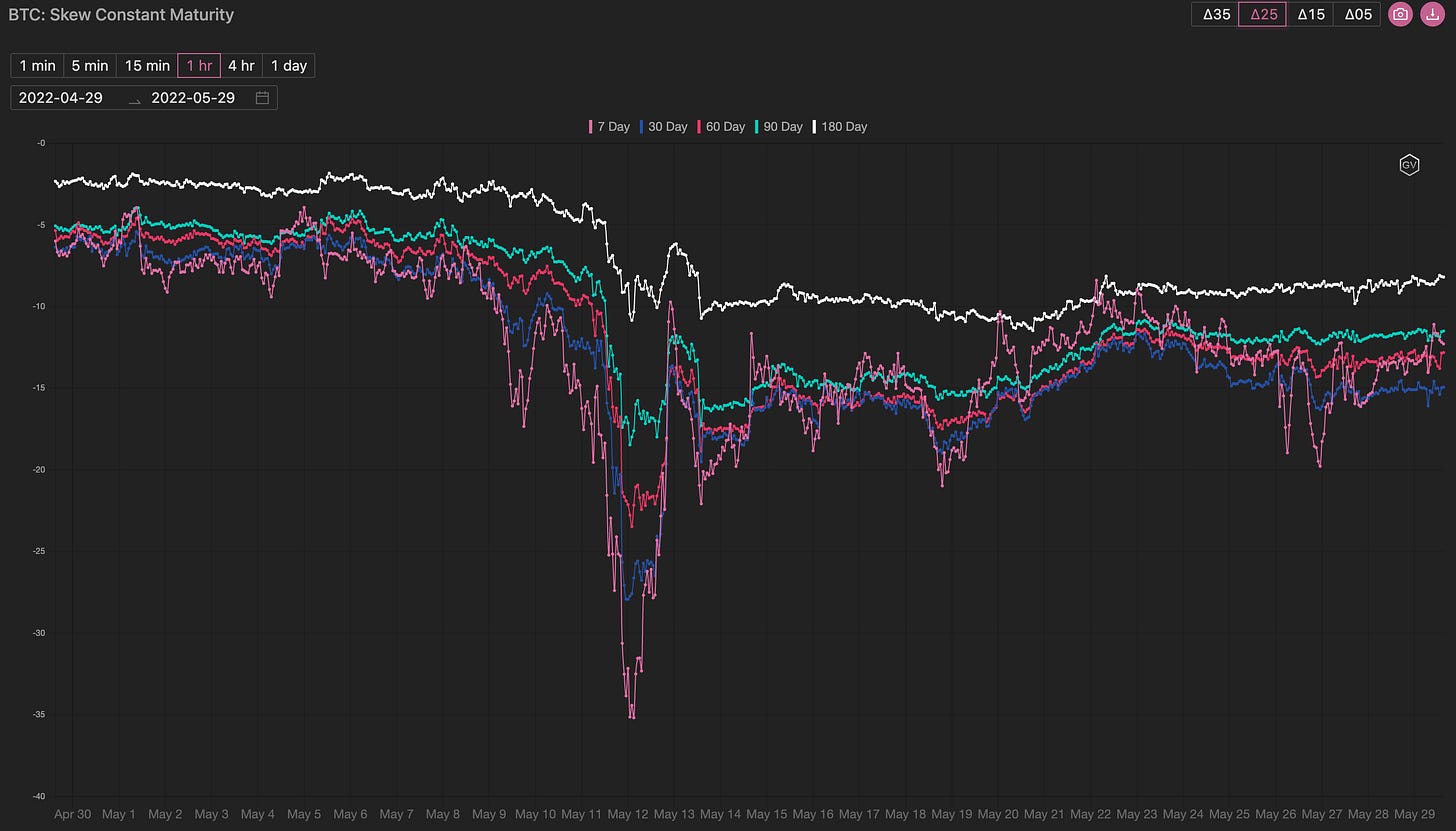

SKEWS

(May 29th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Put skew has persistently been bid.

Lower vol. makes short-put skew an especially interesting risk opportunity.

30-day put skew is also the most bid here, which would play nicely with the term structure shape for short-vol. traders.

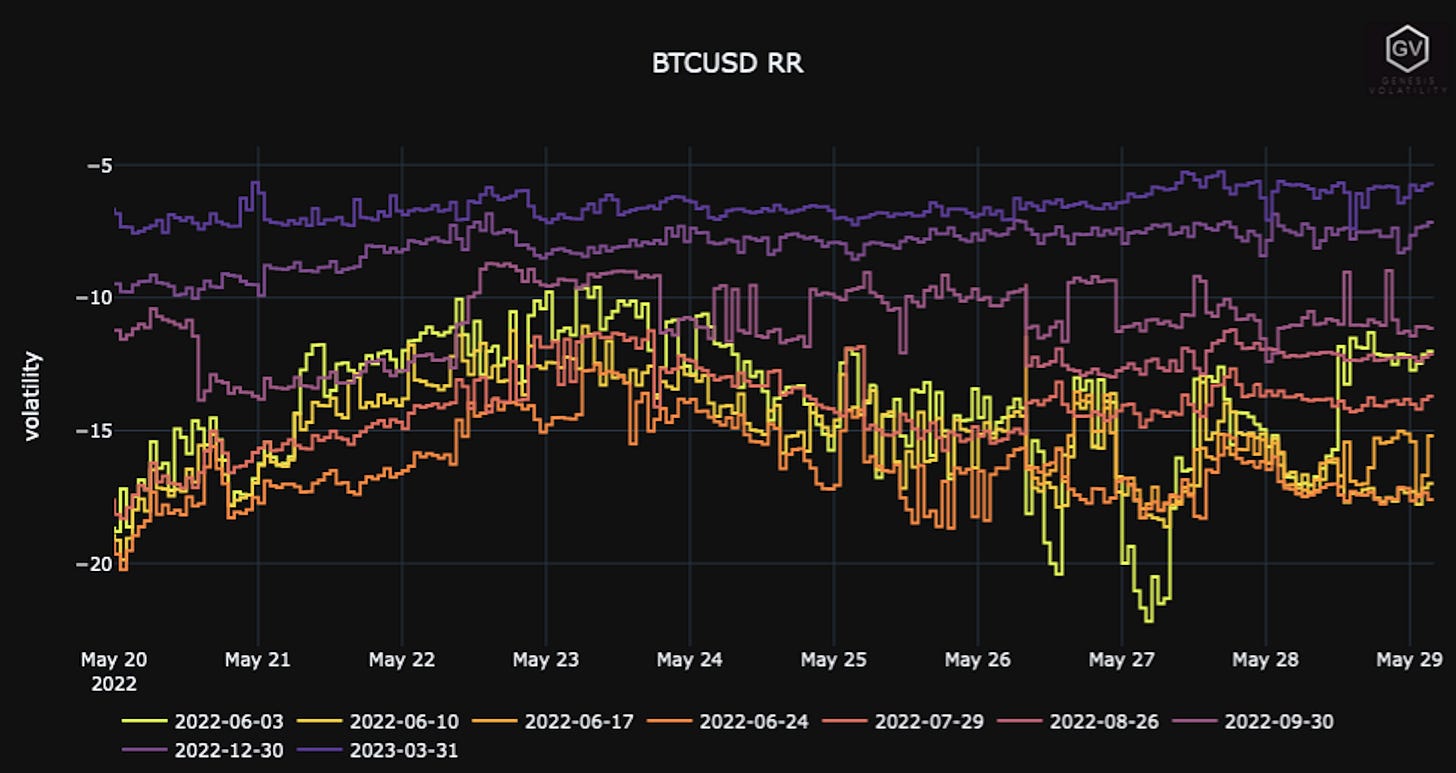

(May 29th, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

Over the past month, the index dropped from $40k to $29k, dictating the sentiment of traders.

The puts accumulated throughout the period between $35k and $30k and the timid bullish trades with call ratio 1x2, are evident in reading the open interest profile. Noteworthy are the $26k/$20k strikes sold, resulting in a positive gamma exposure by MMs to act as support.

With nearly $1.8B of notional, the deadline was the second highest in the whole 2022 by number of contracts (about 60k of which 80% expired worthless).

(May 27th, 2022 - BTC Notional - Deribit)

(May 27th, 2022 - BTC Dollar Premium - Deribit)

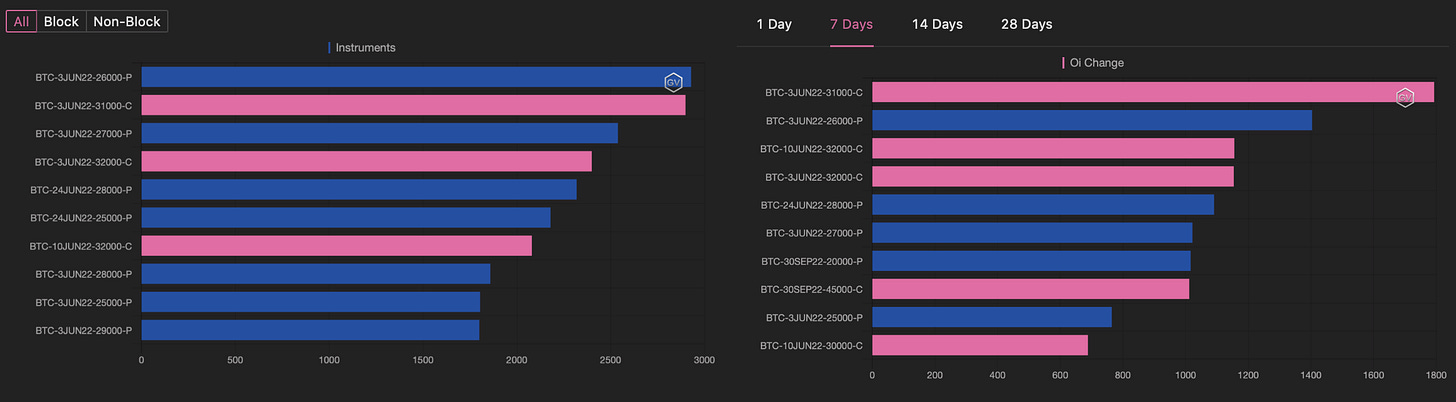

BIG TRADES IN THE FLOW

The lowest week in May, considering both contracts and notional, and one of the most subdued in all of 2022.

(Global volumes BTC - Deribit)

(23rd - 29th May, 2022 - Options scanner BTC - Deribit)

On Friday, we reported the purchase of calls $31k for June 3rd and $32k for June 10th; bet on a short-term relief rally.

Among the most “heavy” trades in terms of premium paid, on the other hand, we point out the purchase of over 1000x $28k June 24th put contracts for about $2M.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 29th, 2022 - BTC Premium Traded - Deribit)

(May 29th, 2022 - BTC’s Contracts Traded - Deribit)

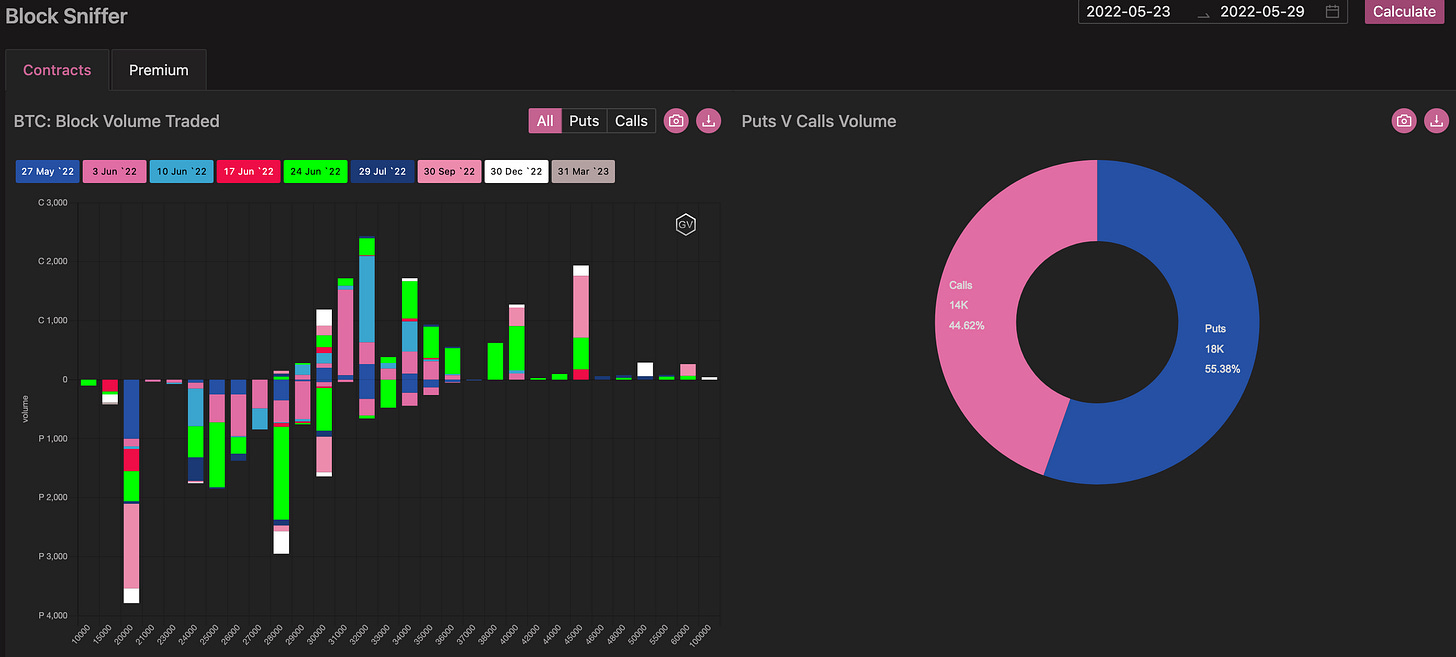

Paradigm Block Insights (23 May - 29 May) BTC

The market is struggling to see the upside catalyst in crypto majors at the moment. Equity markets received a relief rally after the Fed’s dovish hint but inflows did not trickle into crypto markets.

WTD: NDX +6.3% vs BTC -2.6% and ETH -10.6%.

A mid-week sell volume spike following Fed minutes led to a reset in BTC IV. 7d ATM IV high 78 drifted down to 69. BTC 7Day 25delta skews hit a weekly high of 23%. We saw continued putspread and downside put buying in our flows.

BTC Flows were mainly rolling vol exposure and long-dated downside protection. Notable flows included: 2000x Bear Risky Sep 20k/45k, 1575x Jun 28k Put, 1100x 25k Jun 24 Put, 1463x 10Jun 32k Call, 1450x 3Jun 31k Call

BTC

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

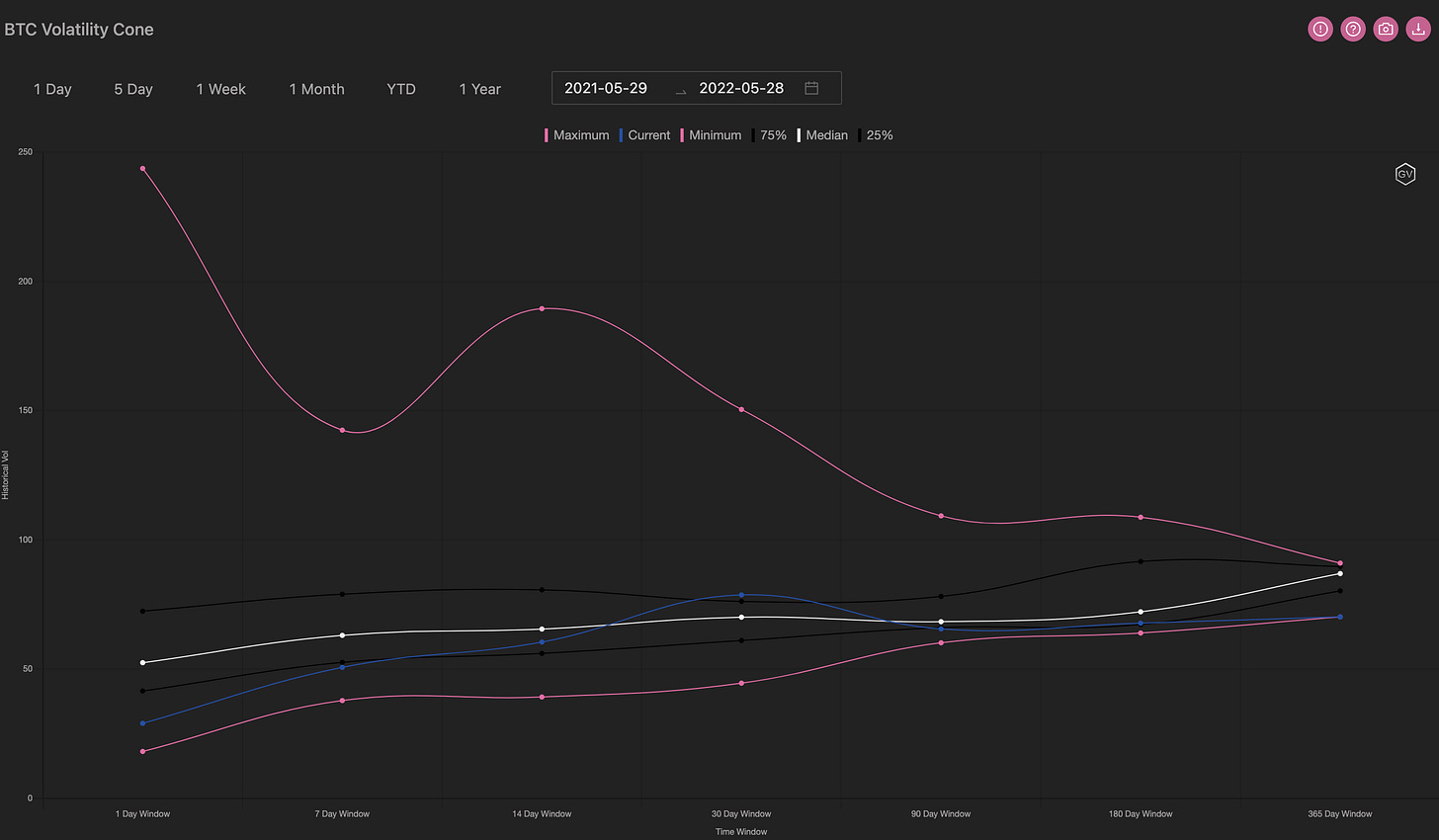

VOLATILITY CONE

(May 29th 2022 - BTC’s Volatility Cone)

Realized vol. has “come-in” significantly these past few weeks, ever since the Luna madness has been behind us.

Again, we don’t think new crypto highs and a persistently low RV regime are here for the long-term… but in the short-term, it looks like we’re in relief rally territory.

REALIZED & IMPLIED

(gvol API python module, pre-built notebook charts)

Notice that IV is now above RV… Option traders are pricing a hike higher in short-term IV.

We think this is wrong, given our relief rally theme, and look at this IV/RV spread as a significant profit opportunity this week.

There’s a large IV premium, skew premium and we expect RV to hold or even head LOWER.

$1,794

DVOL: Deribit’s volatility index

(1 month, hourly)

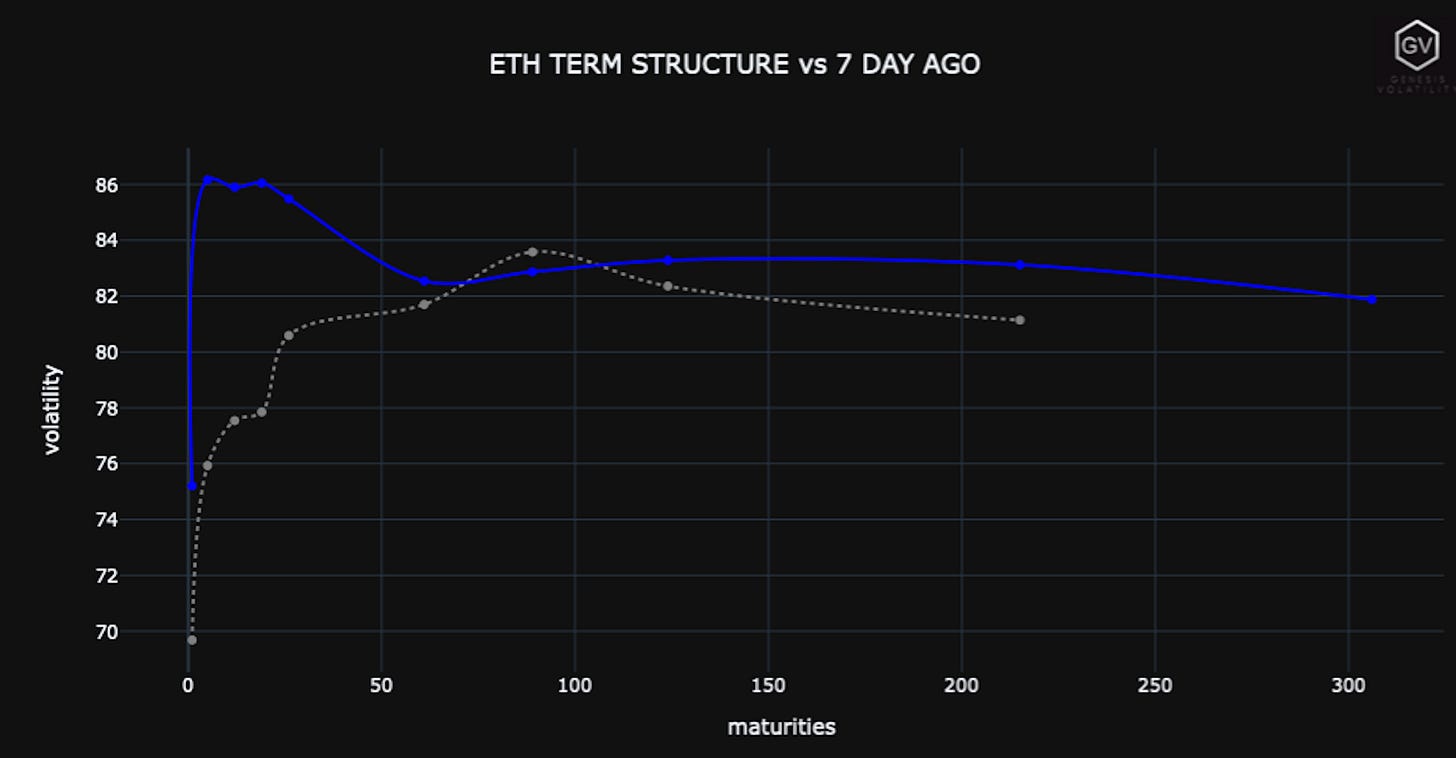

TERM STRUCTURE

(May 29th, 2022 - ETH’s Term Structure - Deribit)

ETH IV is seeing a lot of “jumps” as ETH spot prices are unable to keep an advantage over BTC. Instead ETH is showing relative weakness. The ratio got priced substantially lower.

SKEWS

(May 29th, 2022 - ETH’s Skews - Deribit)

The higher IV jumps + the lower ETH/BTC ratio and now the skew bid to the puts makes ETH vol. a GREAT candidate for a relief rally week.

ETH put vol. is likely to get smoked this week and ETH could easily head back to +$2k

(May 29th, 2022 - ETH’s Skews - Deribit)

(Pre-built notebooks using the gvol Python module)

Open Interest - @fb_gravitysucks

ETH

Unlike Bitcoin, for Ethereum the puts stand out, albeit slightly in the total, with an interesting concentration between $1.8k/$1.7k/$1.6k.

The majority of these contracts were opened last week, often in put-spread combination. The two-way interest shown by traders in these strikes suggests mild support in terms of gamma.

With nearly $1B of notional, the deadline was the second highest in all of 2022 by number of contracts (about 550k, of which 67% expired worthless).

(May 27th, 2022 - ETH Contracts - Deribit)

(May 27th, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

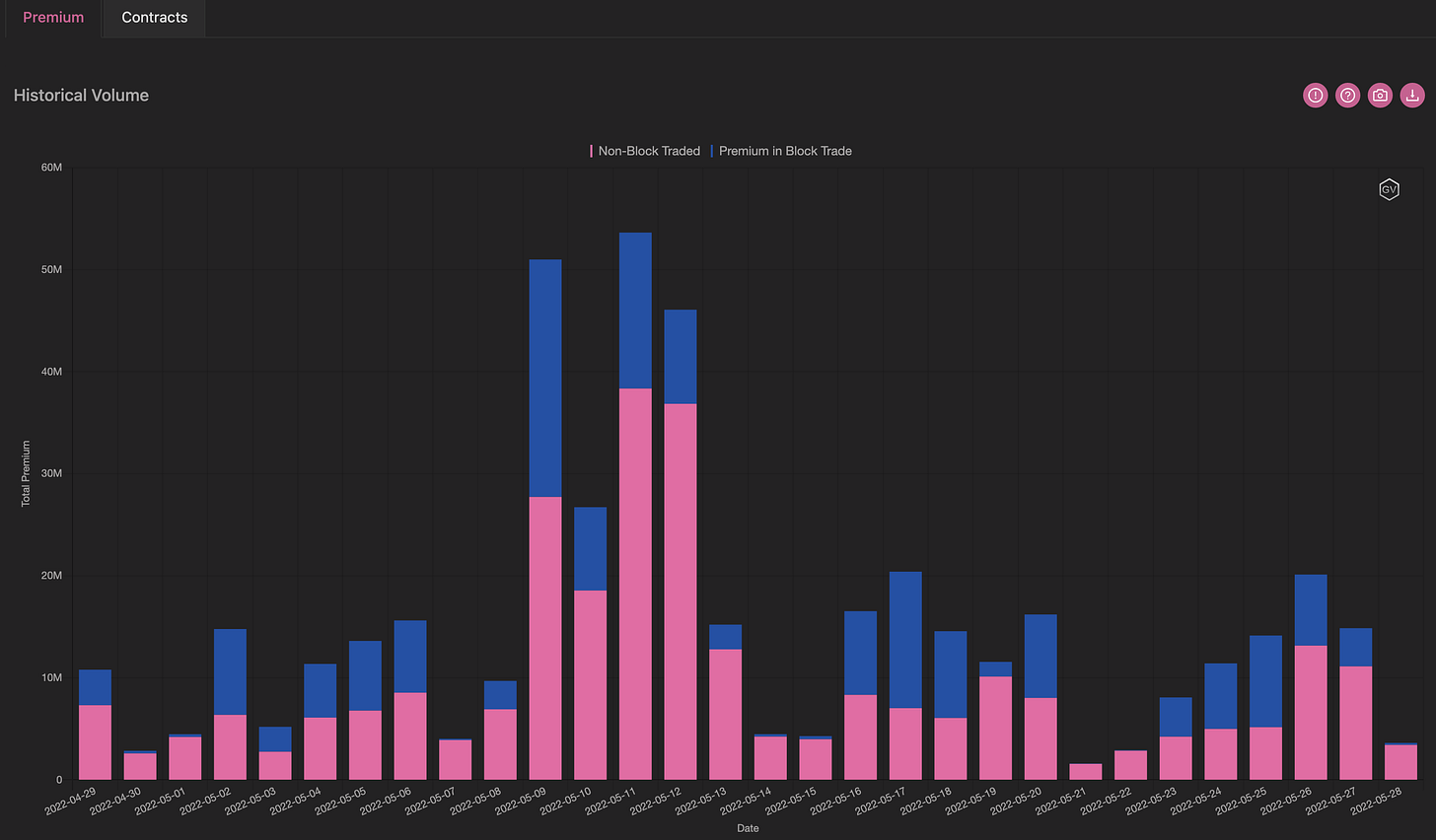

Also for Ethereum volumes were down compared to recent weeks, with puts taking the biggest part of the trades.

(23rd - 29th May, 2022 - Options scanner ETH - Deribit)

Of note is the continuation of call spreads in December $3.5k/$4k and $4k/$4.5k, trades that we have already talked about in past newsletters.

However, the most traded strikes of the week were $1.7k and $1.6k (puts) and the buying of $2k calls on 3rd June.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 29th, 2022 - ETH’s Premium Traded - Deribit)

(May 29th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (23 May - 29 May) ETH

Similar to BTC Flows, ETH flows were mainly by downside protection via outrights, put rolls and low delta call spreads. 18k 24Jun 1400 Put, 15k Dec 3500/4000 Call Spread, 15k 3Jun 1700 Put, 14k 3Jun 1600 Put.

🎀 Ribbon Finance - Paradigm completed our first DOV Auction with Ribbon Finance on Friday 5/27, 542x 3Jun 33k Calls were sold @ 0.0026, this was 6 bps better than Deribit screen price at the time of the auction. Please contact us to get active!

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 29th 2022 - ETH’s Volatility Cone)

Median RV across the board, as ETH RV is propped up from relatively weak spot activity.

We think RV will head lower and ETH relative spot weakness will cease as 2.0 merge news and headlines hit the wire, combined with the relief rally.

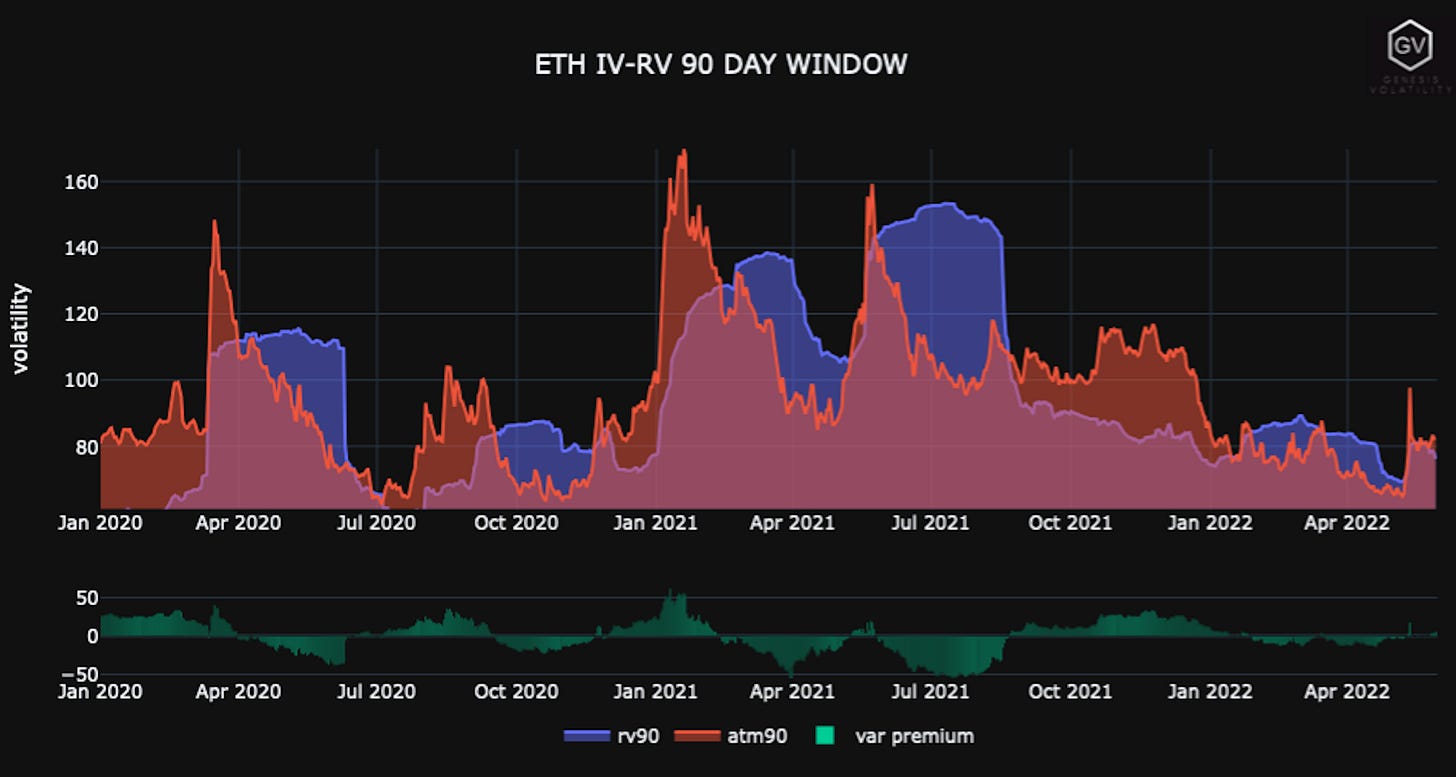

REALIZED & IMPLIED

(Gvol API python module, pre-built notebook charts)

ETH IV/RV is kissing, likely due to the higher RV.

Instead of ETH IV pricing a premium, short-vol. sellers will likely benefit from a drop in RV.

$44.45

DVOL: Deribit’s volatility index

(1 month, hourly)

TERM STRUCTURE

(May 29th, 2022 - SOL’s Term Structure - Deribit)

Nice big “hump” structure in SOL IV.

I’m very weary of short-IV positions in SOL because I think the spot-vol relationship is less predictable.

I’d rather be short-skew in SOL… I think SOL could easily hit $90 again in “no-time”, which makes RV explode higher on the long side.

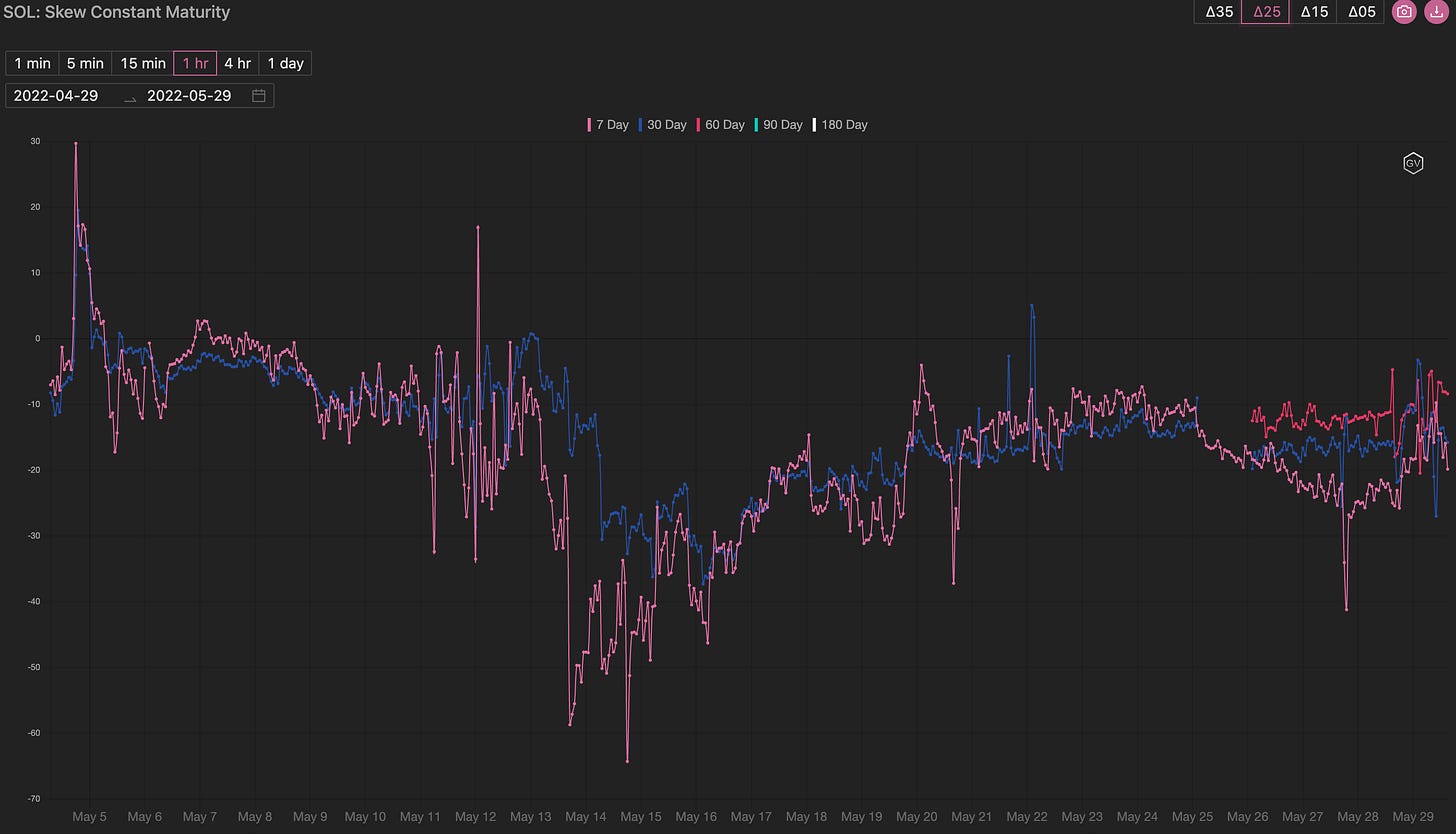

SKEWS

(May 29th, 2022 - Short-term and Medium-term SOL Skews - Deribit)

Vol. neutral skew trades are interesting here.

SOL has a small market cap. and a sharp rally could definitely happen in SOL.

The skew is still quite negative, so fading skew is my preferred trade here.

(May 29th, 2022 - Long-Dated SOL Skews - Deribit)

VOLUME & OI

(May 29th, 2022 - SOL OI Profile - Deribit)

Big June quarterly expiration concentration.

Put/Call ratio favoring puts.

Concentration of low delta put OI too.

(May 29th, 2022 - SOL Premium Traded - Deribit)

(May 29th, 2022 - SOL’s Contracts Traded - Deribit)

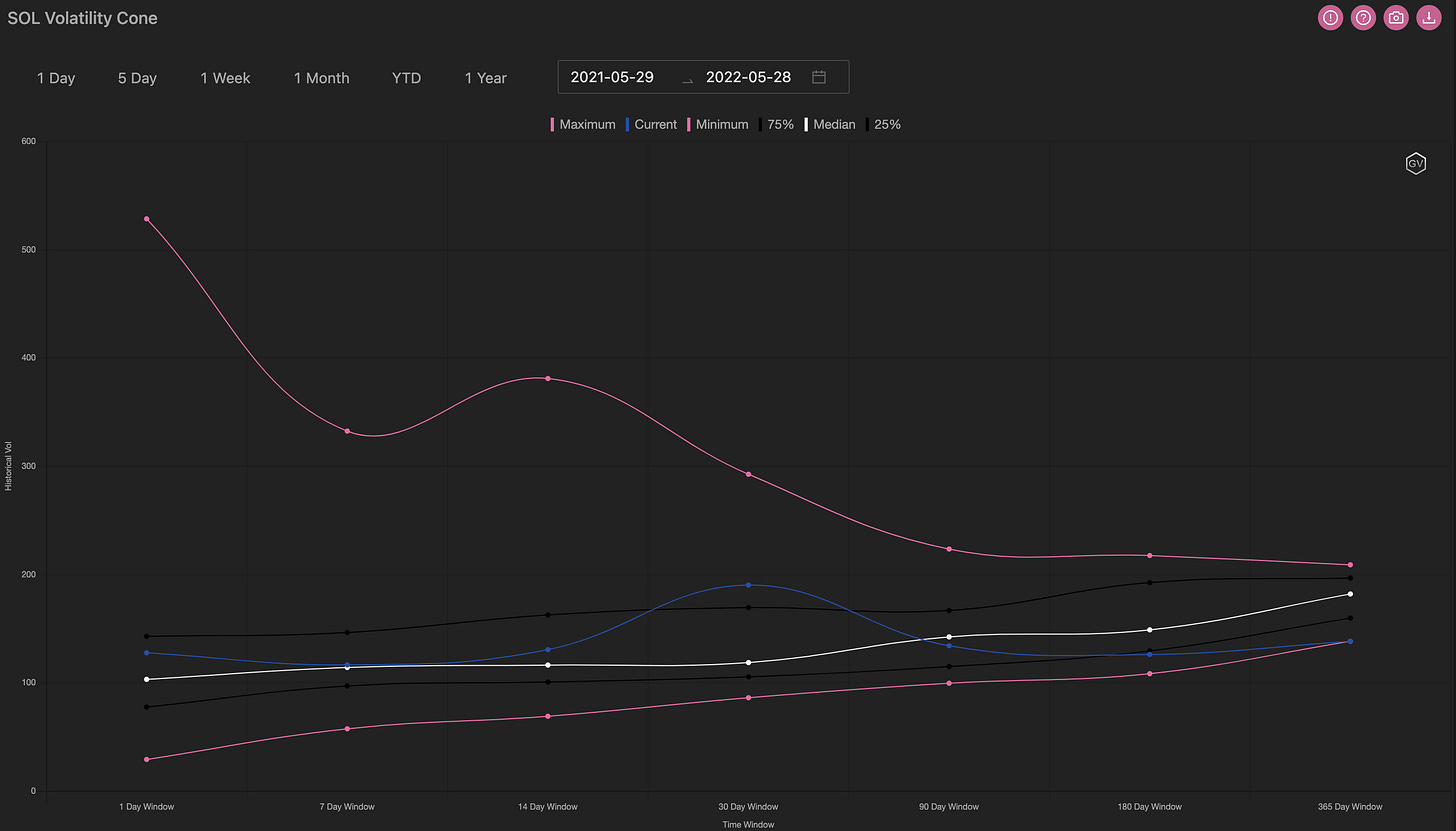

VOLATILITY CONE

(May 29th, 2022 - SOL’s Volatility Cone)

SOL RV is still high!

Interesting to note: smaller cap RV is still way above the median, while BTC is around the 25th percentile.