Crypto Options Analytics, May 23rd, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Crypto markets have had one of the largest volatility spikes recorded in the past few years, exceeded only by March 2020 during the Covid related selling.

There are two notable differences between now and March 2020:

1) Crypto markets have substantially larger market caps today than in March 2020, which makes the extent of this selling more significant and surprising.

2) Crypto markets are crashing on their own. We aren’t seeing large equity price crashes or crude oil crashes.

These points are important to keep in mind.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 23rd, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Skews are extended to very negative levels.

Both short-term and medium-term BTC option skews are the most negative all year, by large margins.

There is a lack of put-option sellers and put-option buying has become crowded.

Something to keep in mind when selling crypto puts in coin-denominated accounts:

As spot prices approach zero, put-selling losses (even put spreads) reach infinity coin denominated payouts…

This makes put-selling uniquely difficult and a risk that must be expertly managed.

(May 23rd, 2021 - Long-Dated BTC Skews - Deribit)

Long-term option expirations are displaying opportunity here…

Note that September’s expiration is negatively skewed while December is more positively skewed. There is interesting calendar/diagonal opportunities to be found here.

TERM STRUCTURE

(May 23rd, 2021 - BTC’s Term Structure - Deribit)

BTC’s term structure is in extreme Backwardation.

Volatility has doubled from last week.

There is still a lot of gamma risk in short-dated options as realized volatility continues to be high.

There remains significant risk of volatility remaining high, even if prices RALLY back.

Relative volatility opportunities in ATM volatility between expirations seem less clear-cut than those found on the options skews.

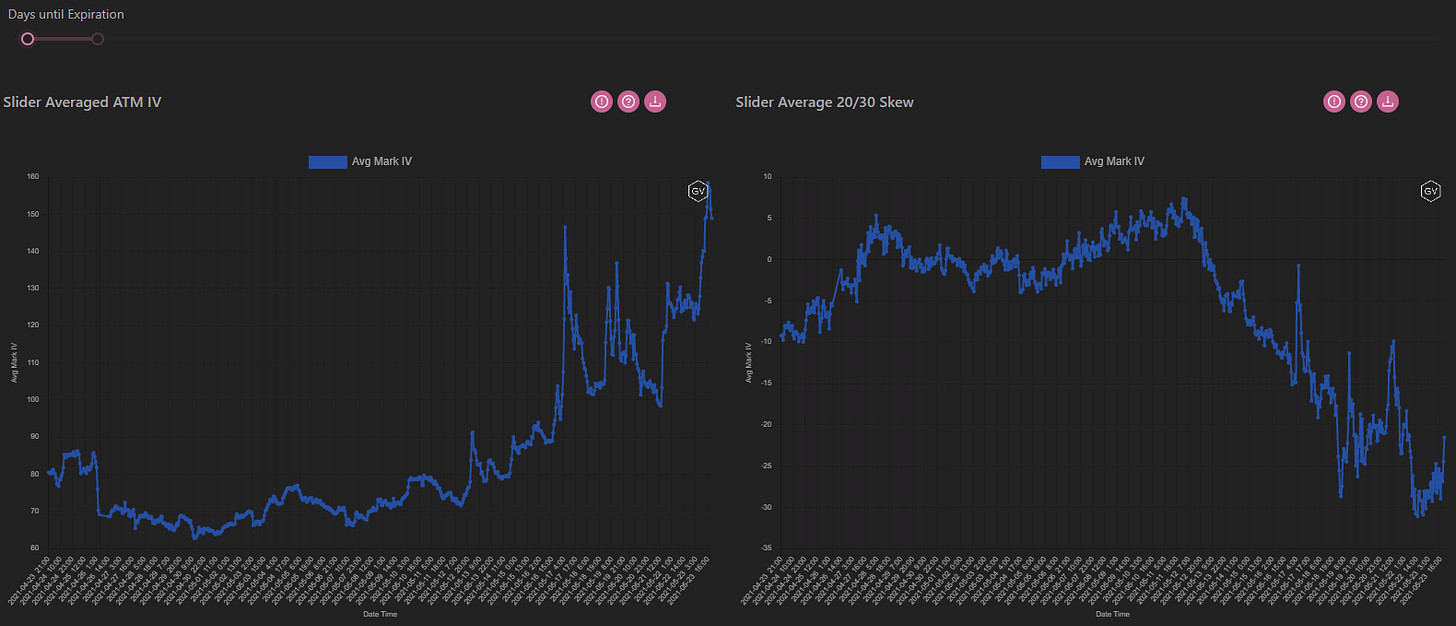

ATM/SKEW

(May 23rd, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM implied volatility has been erratic.

We noted on twitter that the variance of implied volatility is quite high.

Option traders are selling volatility to find themselves only buying it back as spot markets continue to have trouble finding their footing.

Skews are insanely negative… Again, selling puts in coin-denominated markets presents unique risk but currently there is A LOT of opportunity structuring put skew trades appropriately.

VOLUME

(May 23rd, 2021 - BTC Premium Traded - Deribit)

(May 23rd, 2021 - BTC’s Contracts Traded - Deribit)

May 17th and May 19th stick out as days of significant option volume.. That is no surprise.

We expect option volumes to be high over the coming week as volatility markets currently provide awesome opportunity.

Flies and spreads are great trade structures.

We’re proud to see our partners at Paradigm navigate the turbulence with impeccable uptime, allowing market makers and traders to capitalize on futures spreads and option trades with efficient execution during these FAST markets.

VOLATILITY CONE

(May 23rd, 2021 - BTC’s Volatility Cone)

Realized volatility is at the MAX seen all year.

There is opportunity to be had here but trade short vol structures prudently.

Again, we maintain that flies could be very interesting at these levels…

Think 35k-40k-45k butterflies or broken-wing put butterflies, those types of structures.

REALIZED & IMPLIED

(May 23rd, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV is at a large premium to IV but this is to be expected… Implied volatility is discounting future RV because volatility will mean revert lower at some point… The guessing game isn’t “IF” but “WHEN”.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 23rd, 2021 - ETH’s Skews - Deribit)

Deribit’s DVOL index steadily moves higher, with puts leading the way.

Put skew is sharply more negative for all option expirations, but more so for short-term and medium-term options.

(May 23rd, 2021 - ETH’s Skews - Deribit)

December options are still able to eek out a positive skew but everything shorter term than that is negative.

TERM STRUCTURE

(May 23rd, 2021 - ETH’s Term Structure - Deribit)

ETH implied volatility is very high, some of the highest levels seen on record.

The term structure is in Backwardation as the markets discount future volatility lower.

ATM/SKEW

(May 23rd, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM implied volatility has been less erratic in ETH than in BTC.

ETH’s climb higher is more steady and even handed.

Skew levels are DEEPLY negative and opportunity is hidden in these very negative skews.

VOLUME

(May 23rd, 2021 - ETH’s Premium Traded - Deribit)

(May 23rd, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are not displaying significant outliers for May 17th and May 19th, the volumes have been rather consistent throughout the month.

VOLATILITY CONE

(May 23rd, 2021 - ETH’s Volatility Cone)

ETH realized volatility is at a maximum.

Don’t discount the potential for a violent snap back in spot…

REALIZED & IMPLIED

(May 23rd, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

Like we’ve seen in BTC, ETH RV is trading at a large premium to IV due to IV discounting future RV lower.

RV is very high here… Things can still move.