Crypto Options Analytics, May 22nd, 2022

The easy money is not getting “distracted” in nonsense low-conviction trades and missing the opportunity to capitalize on a massive “puke” event, if we get one.

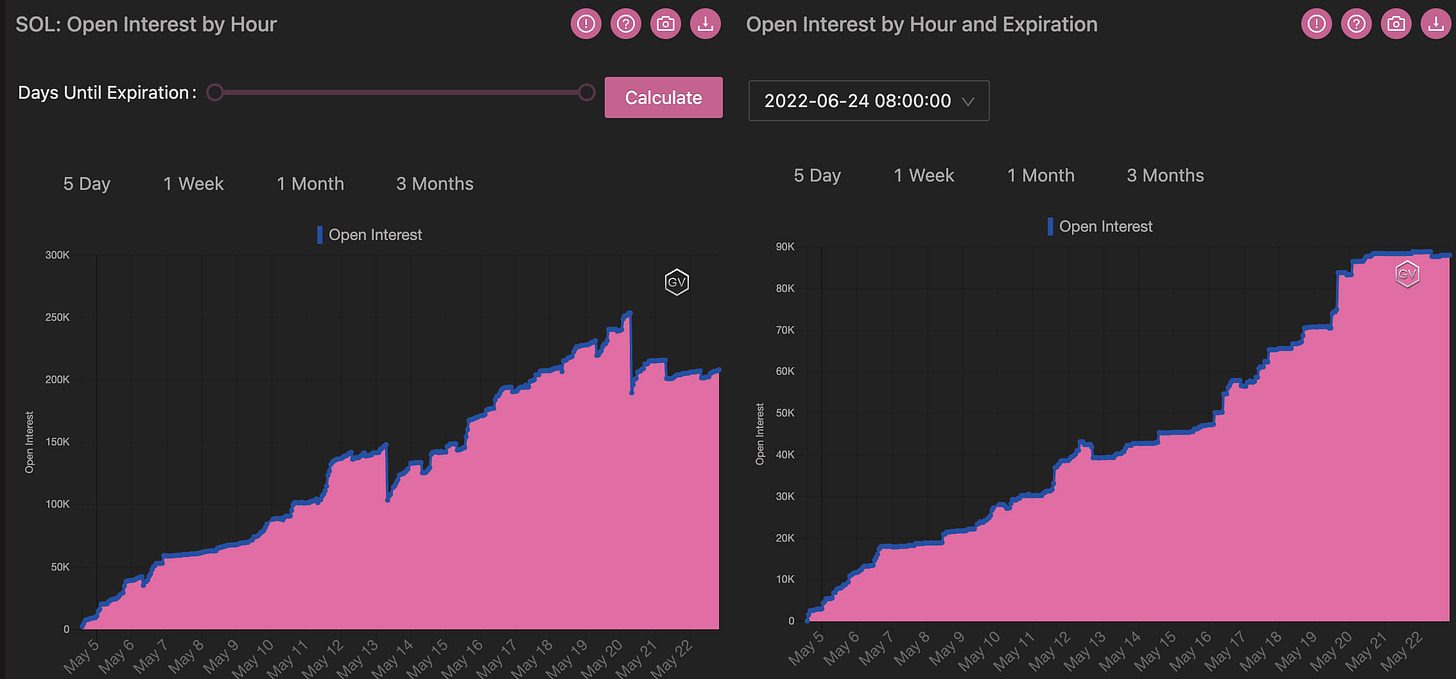

Deribit launches SOL options! Check here

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$29,959

DOV auctions [Ribbon, Friktion, Katana, Thetanuts, PsyFinance]

*note: Protocols have different auction times & calculated vols. are estimates

DVOL: Deribit’s volatility index

(1 month, hourly)

Bitcoin volatility softened this week.

We continue to expect 5/11 to be the medium-term volatility high, but Bitcoin spot prices aren’t bouncing with any conviction and seem unable to hold above $30k… This is bearish price action.

Combine this meager price action with weakness across traditional assets and we expect to see lower spot lows in the future for cryptos.

That said, in the short-term, a lot of bearish action has already occurred these past 2 weeks and a “pause” for spot-selling seems logical here, until bearish action resumes.

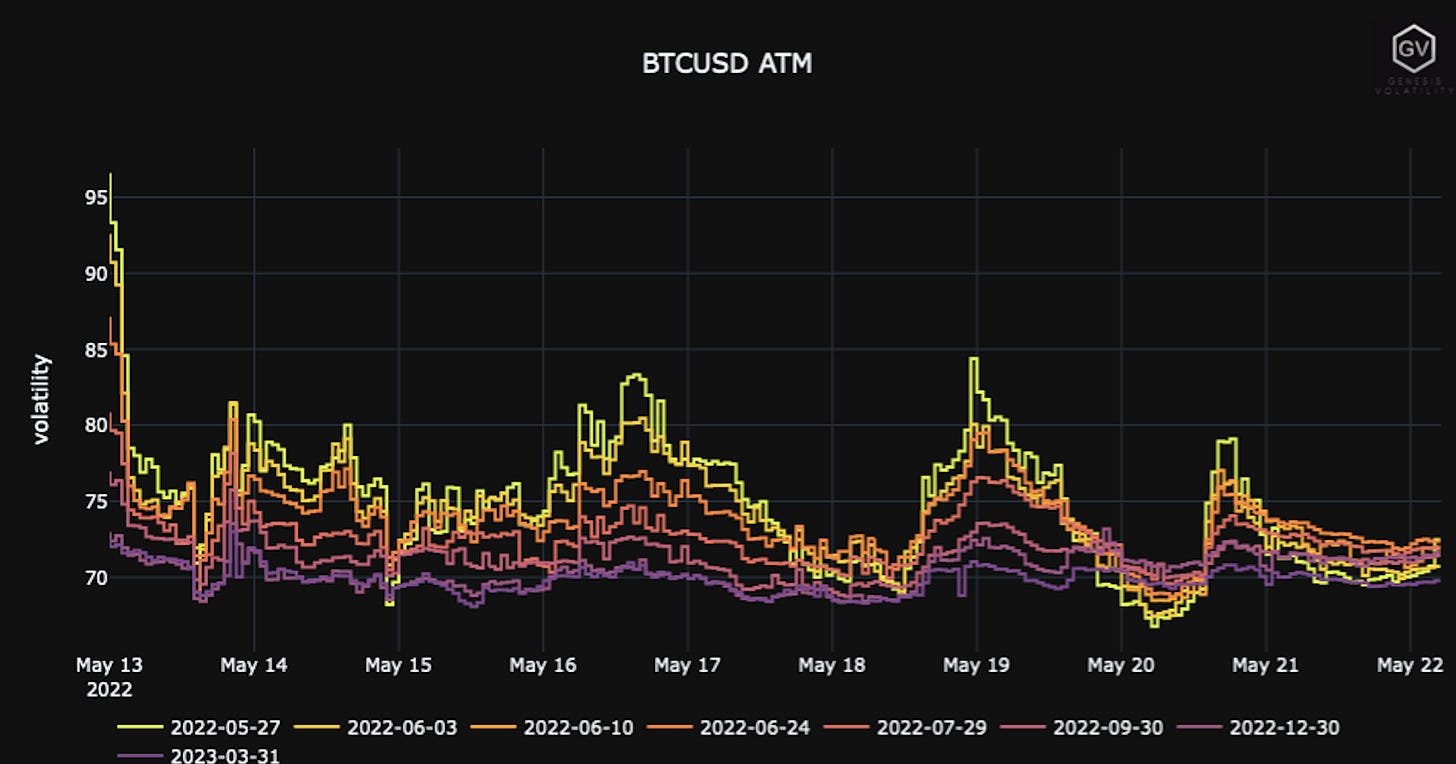

TERM STRUCTURE

(May 22nd, 2022 - BTC’s Term Structure - Deribit)

(gvol API python module, pre-built notebook charts )

The term-structure of IV is currently flat. This flatness represents “uncertainty” from the option market.

Overall IV levels are low compared to historical bearish environments and we’ve YET to seen a real “PUKE” in both Crypto and Traditional environments.

A Crypto and Tradfi “PUKE” will be REAL OPPORTUNITY.

Instead of anticipation, patience and reaction will be the professional way to capitalize on such a move…

Major “Pukes” are rare events and having free capital and a deployment plan will be essential.

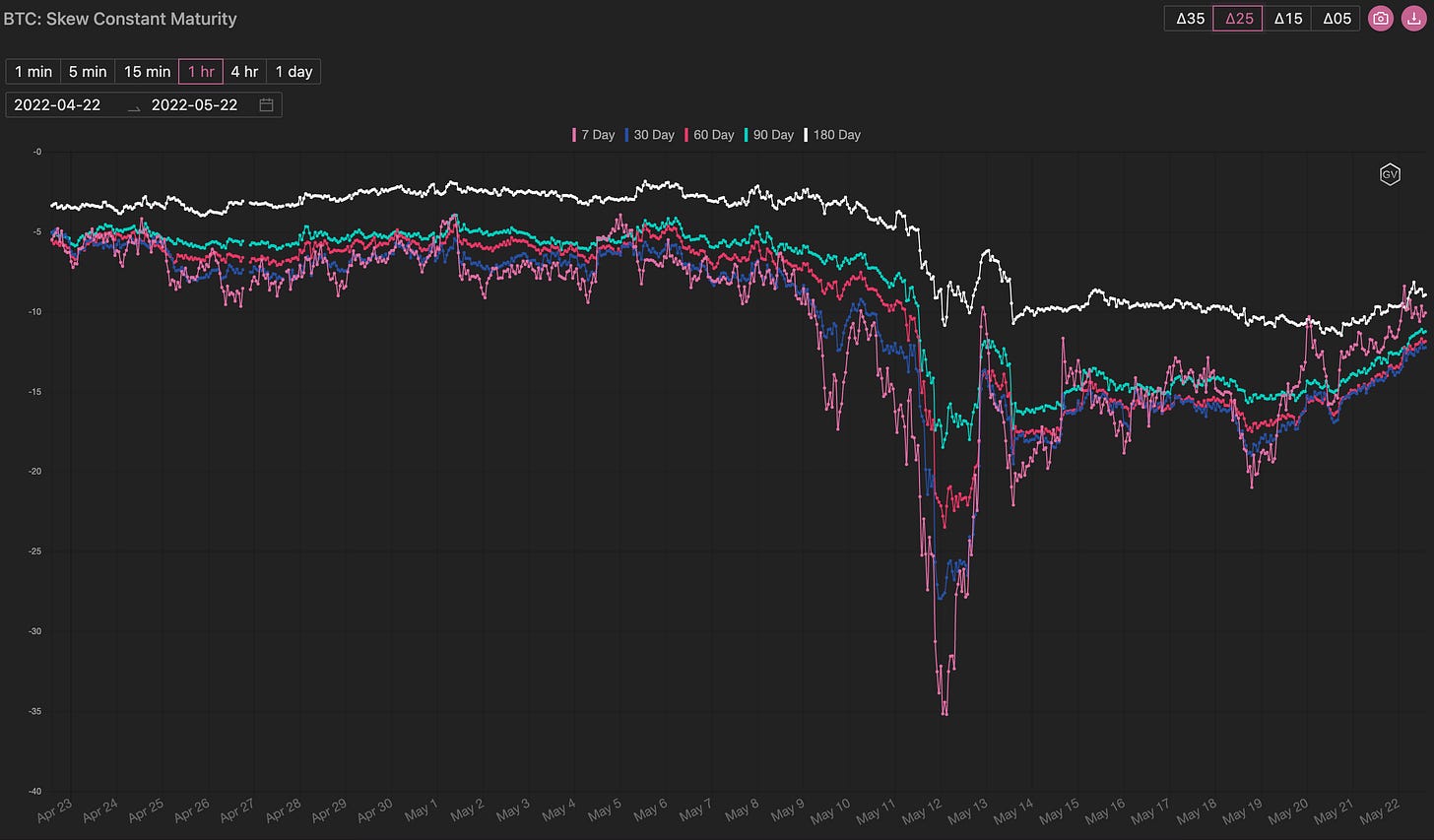

SKEWS

(May 22nd, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Speaking of anticipation, the bearish option skew seems to get “ahead of itself”.

We’re seeing extended skew anytime spot moves lower.

The skew reacts quickly and drastically, but without a puke to follow-through, traders are overpaying for OTM put protection… Traders are itchy for a downward “flush”, but it’s a wiser play to fade the rare event than to pay for it ahead of time.

Here’s what I mean: BTC prices could panic-sell down to <$10k, but it’s hard to predict that… It’s easier to have cash and a plan to buy <$10k (or fade extended vol.) if we actually get there… otherwise we risk consistently overpaying for tails protection that never materializes.

(May 22nd, 2022 - Long-Dated BTC Skews - Deribit)

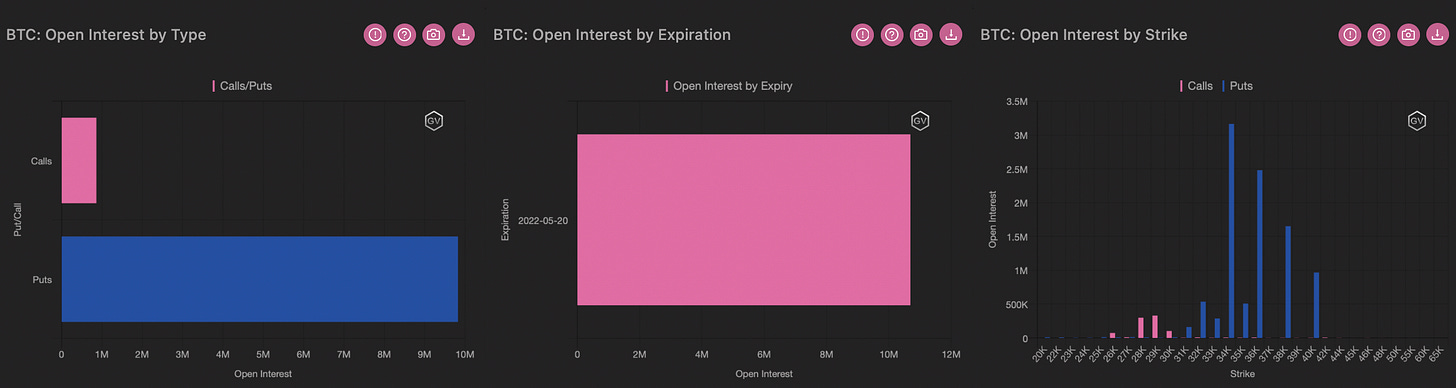

Open Interest - @fb_gravitysucks

BTC

This weekly deadline slipped away without too much attention. With the index in tight range (between $29k and $30.5k) and a delivery price in line with the previous week, it’s no surprise that the value distributed to buyers was very low, with 83% of worthless expired contracts.

To underline, the P/C ratio is very much in favor of puts, a very unusual case for Bitcoin but consistent with what has happened in the last two weeks.

(May 20th, 2022 - BTC Contracts - Deribit)

(May 20th, 2022 - BTC Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

A week of “quiet” after the storm, with trades executed in modest quantities.

(16th - 22nd May, 2022 - Options scanner BTC - Deribit)

Among the contracts with the most open interest, the (prevalent) purchase of $32k calls for May 27th - a purchase flow that we noticed from mid-week onwards, with multiple trades.

As for puts trades, the picture is more colorful and it is difficult to find a common theme given the different opinions expressed - often even of the opposite sign.

Definitely worth noting are: the 1x2 put ratio June 24th $30k/$25k; a $26k put calendar -27MAY/+24JUN; and the outright purchase of $30k put on July and September.

Short-term strikes sold at $25k/$26k make us assume positive gamma exposure from MMs, resulting in a plausible level of support.

Lastly, on the end of the week the long straddle $27k/$33k on June 10th, and the purchase of 500x $15k put for March 2023.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 22nd, 2022 - BTC Premium Traded - Deribit)

(May 22nd, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (16 May - 22 May) BTC

The extent of this week’s vol reset has surprised us, given the proximity of the UST/Luna shock. 7-day realized has collapsed to 65v, and implieds have followed with 1M ATMs falling from 80v to 70v.

BTC and ETH skew trades rich despite the extent of the vol reset, with BTC 1M 25-delta at -15v. Demand for puts remains high following last week’s rush to cover short downside positions.

1x2 put ratios screen well, given elevated vol/skew. BTC Jun 20000/26000 1x2 put ratio is .017 offer (10-delta, ref 29870, 12x max payout-to-cost). However, they screen well for a reason…You need to believe spot grinds lower for the trade to perform.

BTC

Composition of Block Trades

In BTC, flows share the view that realized will increase, with the largest blocks being gamma buying and near-term protection. A busy calendar ahead, with ECB (9Jun), US CPIs (10Jun), and FOMC (15Jun).

1k 27May 32k call

815 10Jun 27k/33k strangle

710 20May 25k/27k put spread

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 22nd, 2022 - BTC’s Volatility Cone)

I’m torn here.

We’re clearly in a “crazy” environment where RV can make new annual highs… But we’re also already half-way there…

It’s too easy to have bad timing and pick the wrong direction and see RV move in the opposite direction.

My bias remains lower RV in the near term, but new annual highs later…

The easy money, again, is not getting “distracted” in nonsense low-conviction trades and missing the opportunity to capitalize on a massive “puke” event, if we get one.

The random trade that I like “while waiting for the puke” is selling coin for USD, and capitalizing on extended put skew structures in a cash-secured manner.

REALIZED & IMPLIED

(gvol API python module, pre-built notebook charts)

Short-term IV was quick to discount 7-day RV last week and option traders were then proven correct.

$2,009

DOV auctions [Ribbon, Friktion, Katana, Thetanuts, PsyFinance]

*note: Protocols have different auction times & calculated vols. are estimates

DVOL: Deribit’s volatility index

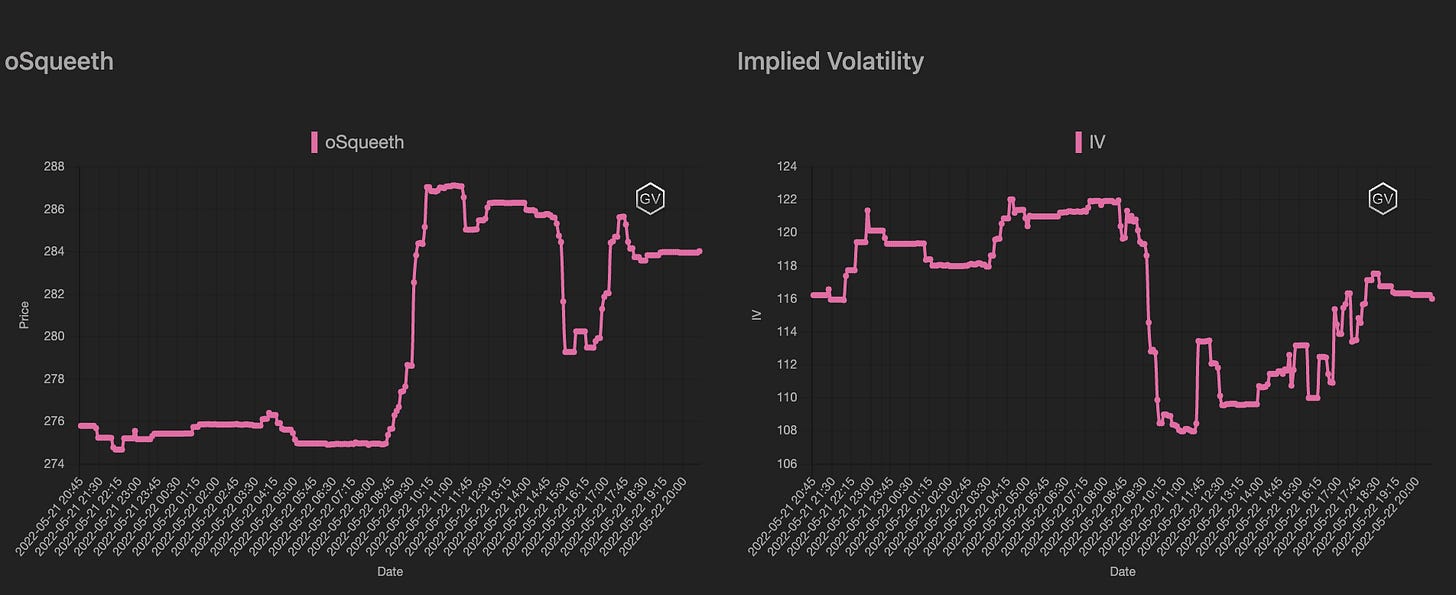

(1 month, hourly)

Squeeth will likely be an interesting and efficient instrument to capitalize on an extended spot selling move.

We’ll need to keep an eye on Squeeth plays.

Until then, Squeeth vol. premium seems persistent…

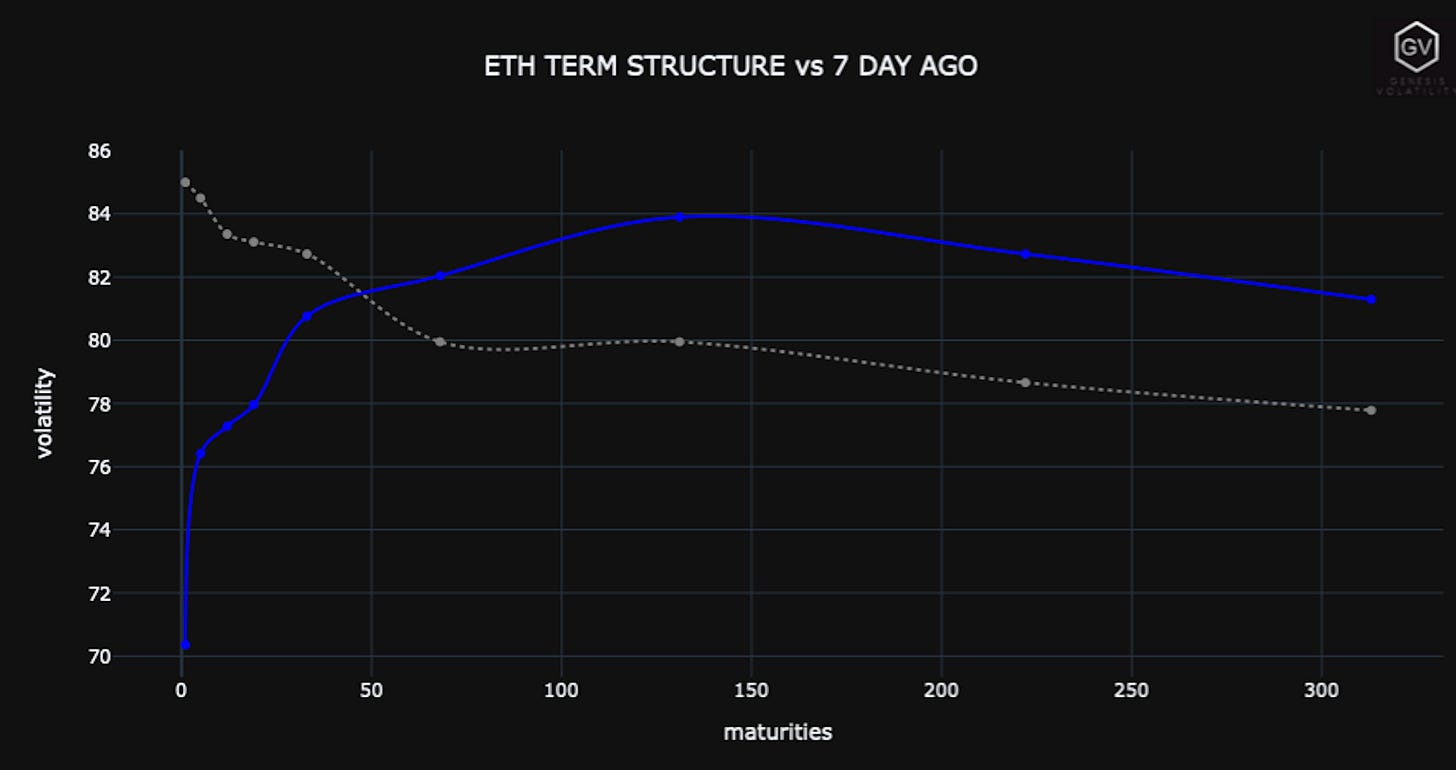

TERM STRUCTURE

(May 22nd, 2022 - ETH’s Term Structure - Deribit)

ETH’s term structure is mostly flat.

On the monthly chart, we see a similar shape as 30-days ago but just “shifted” higher on a parallel basis… Same dynamics but higher vol. regime.

80% IV isn’t high for ETH, historically speaking, however.

“No-mans-land”… I’m not interested in betting on outright ETH IV in either direction.

Even spot price levels are “meh”… $2k ETH? I’d rather buy ETH for hundreds of dollars in a bear market… or buy ETH above $3,500 on a successful PoS merge and trending market.

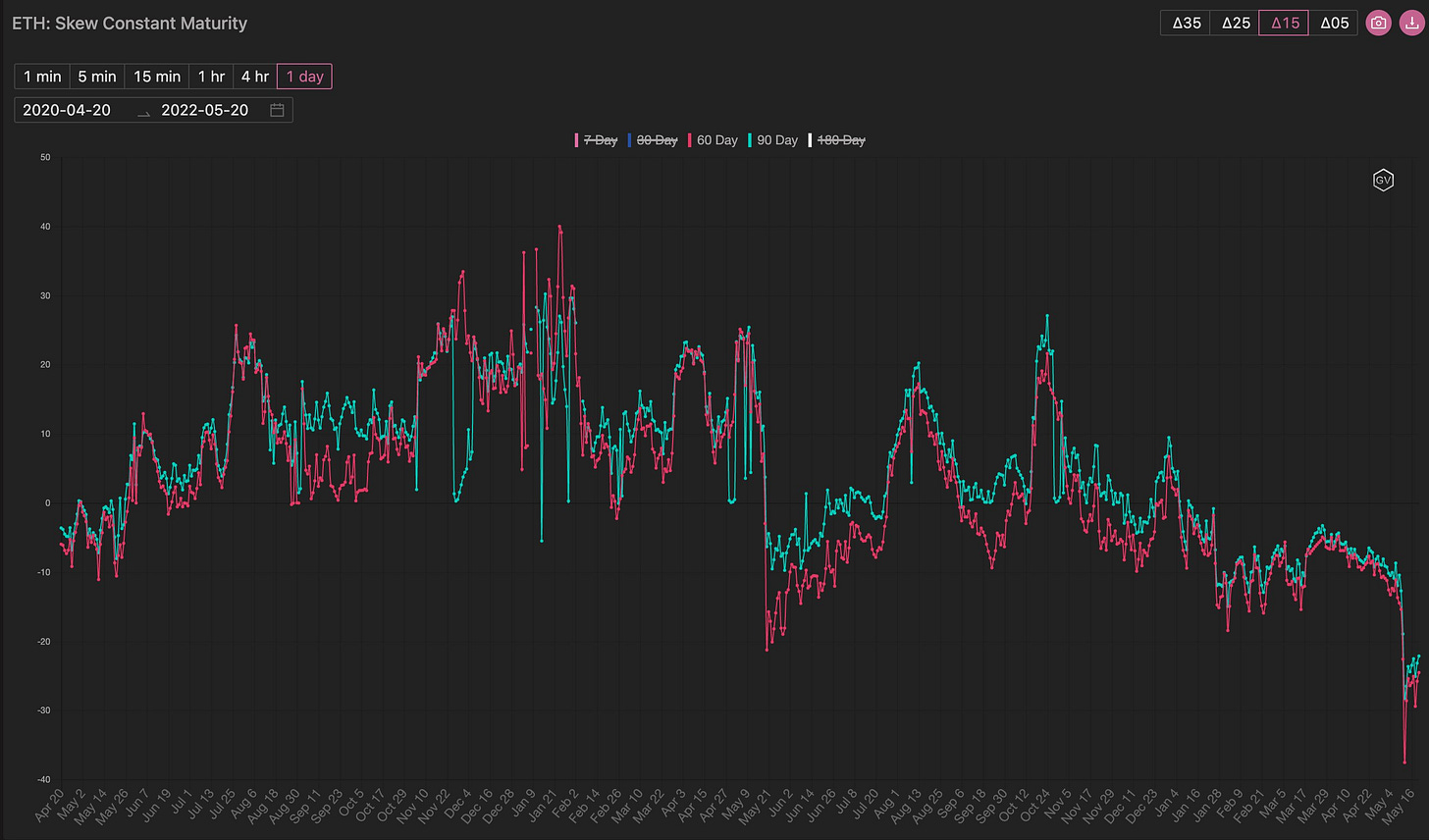

SKEWS

(May 22nd, 2022 - ETH’s Skews - Deribit)

Speaking of buying ETH for “hundreds” of dollars, doing “cash-secured” put structures in this extended skew environment seems interesting.

+1x $1400 ETH JULY PUT = $93 -2x $1000 ETH JULY PUT = ($78)

This is the kind of trade that’s decent while we wait for “more information”.

If you’re going to do a 1x2 trade on a leveraged basis… buy an extra short-dated put… to cover open-ended risk.

+1x $1400 ETH JULY PUT = $93 -2x $1000 ETH JULY PUT = ($78)

+1x $500 ETH June 10th Put = ($1.5)

Then roll it on expiration, or revisit the entire trade.

(May 22nd, 2022 - ETH’s Skews - Deribit)

(Pre-built notebooks using the gvol Python module)

Open Interest - @fb_gravitysucks

ETH

Even for Ethereum the weekly was subdued, albeit with some distinctions.

Although the total notional open was -30% (420M vs 600M) compared to Bitcoin, the distributed premium was almost +100% (20M vs 10M) with “only” 75% of contracts expiring worthless.

(May 20th, 2022 - ETH Contracts - Deribit)

(May 20th, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

Week of call trades for Ethereum - not necessarily bullish, though.

(16th - 22nd May, 2022 - Options scanner ETH - Deribit)

On Monday, we witnessed the incessant on-screen sales execution of $2.8k calls in July, with a total executed for over 10,000 contracts.

Also on Monday, an interesting put fly on June 3 $1.8k/$1.6k/$1.4k - a position to be allowed to expire without adjustments for the final payout profile.

But it’s about long-term deadlines that we’ve seen the biggest trades. Call spread in March 2023 in strikes $5k/$5.5k and $5.5k/$6k (for a total of 60000 blocked contracts) and December $4k/$4.5k (30000 contracts).

Although big size, the tightness of the spread results in very limited net exposure to Greeks, and the premium-paid/max-payoff ratio suggests a lottery ticket bet.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 22nd, 2022 - ETH’s Premium Traded - Deribit)

(May 22nd, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (16 May - 22 May) ETH

In ETH, a sharp contrast vs. BTC, with large call spreads trading. These structures are perhaps upside hedges, given their winginess … the Dec is a 4-delta spread.

40k Mar 5500/6000 call spread bot

35k Dec 4000/4500 call spread bot

20k Mar 5000/5500 call spread bot

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 22nd, 2022 - ETH’s Volatility Cone)

IV is basically priced along the median RV line right now, at ~80%.

Like BTC, there isn’t much to do here without a crystal ball.

REALIZED & IMPLIED

(Gvol API python module, pre-built notebook charts)

30-day RV and IV are clustered together nicely, same with the 7-day.

90-day RV is being discounted down to the 80% handle.

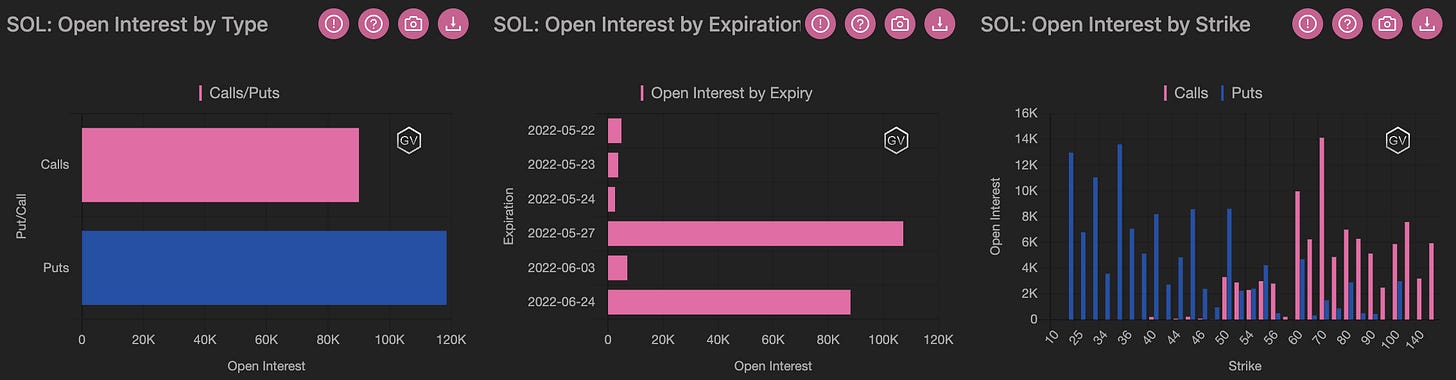

$51.45

DVOL: Deribit’s volatility index

(1 month, hourly)

Solana Vol. is in a league of its own.

It’s nearly 1.7x higher than BTC vol.

I continue to think that in a bear market SOL doesn’t hold a higher beta all the way to zero. There’s likely a fundamental buying floor at some point, and the downward “steam” slows as prices head lower.

I don’t really know, it’s just a theory.

It’ll take less money to create a “buying wall” and we know FTX and other big players are likely going to step in, should we drop another -80%.

TERM STRUCTURE

(May 22nd, 2022 - SOL’s Term Structure - Deribit)

IV is about 140 right now… but can obviously go much higher.

SKEWS

(May 22nd, 2022 - Short-term and Medium-term SOL Skews - Deribit)

The option skew is pretty negative here… As mentioned before, I don’t completely agree with the downside vol. premium.

A lot of the higher SOL vol. came from the long side in the past… SOL rallied from $1.5 to $250 in 24months before… We could see 100% rally again.

(May 22nd, 2022 - Long-Dated SOL Skews - Deribit)

VOLUME & OI

(May 22nd, 2022 - SOL OI Profile - Deribit)

(May 22nd, 2022 - SOL Premium Traded - Deribit)

(May 22nd, 2022 - SOL’s Contracts Traded - Deribit)

VOLATILITY CONE

(May 22nd, 2022 - SOL’s Volatility Cone)

Given everything mentioned before… SOL is also a good candidate for the “cash-secured” put structures capitalizing on put skew.