Crypto Options Analytics, May 1st, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$39,544

DOV auctions

*note: Protocols have different auction times & calculated vols. are estimates

DVOL: Deribit’s volatility index

(1 month, hourly)

Traditional risk assets are being dragged lower by rising rates. This week has important announcements to be aware of.

FOMC & Press conference on Wednesday

BOE rate hike on Thursday

Payroll on Friday

Taken together, it’s hard to imagine this week will be quiet, given the risk asset weakness and BTC/Nasdaq correlation seen in recent history.

TERM STRUCTURE

(May 1st, 2022 - BTC’s Term Structure - Deribit)

(gvol API python module, pre-built notebook chart )

The term structure is still in a Contango formation. Part of the reason for this is the lack of “sharp” movements lower in spot. So far, the weakness has seen a controlled movement.

That said, the term structure is on the lower-end of the percentile distribution.

Should things continue to get ugly, spot prices could test $35k → $30k and IV could march higher into the upper 75th percentile distribution.

SKEWS

(May 1st, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Option skew has been pricing-in downside volatility consistently for weeks.

We wrote a twitter thread, earlier this week, examining ways to hedge / short the market, given skew pricing.

We continue to think that buying long-term call options with short futures could provide interesting long-vol. entries here… in anticipation of lower prices and high IV.

(May 1st, 2022 - Long-Dated BTC Skews - Deribit)

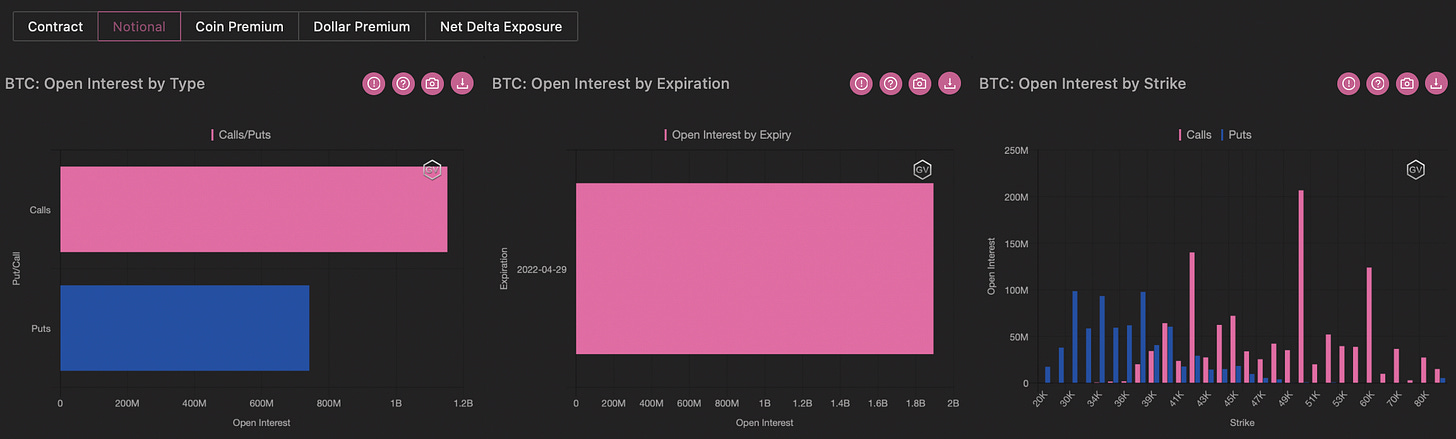

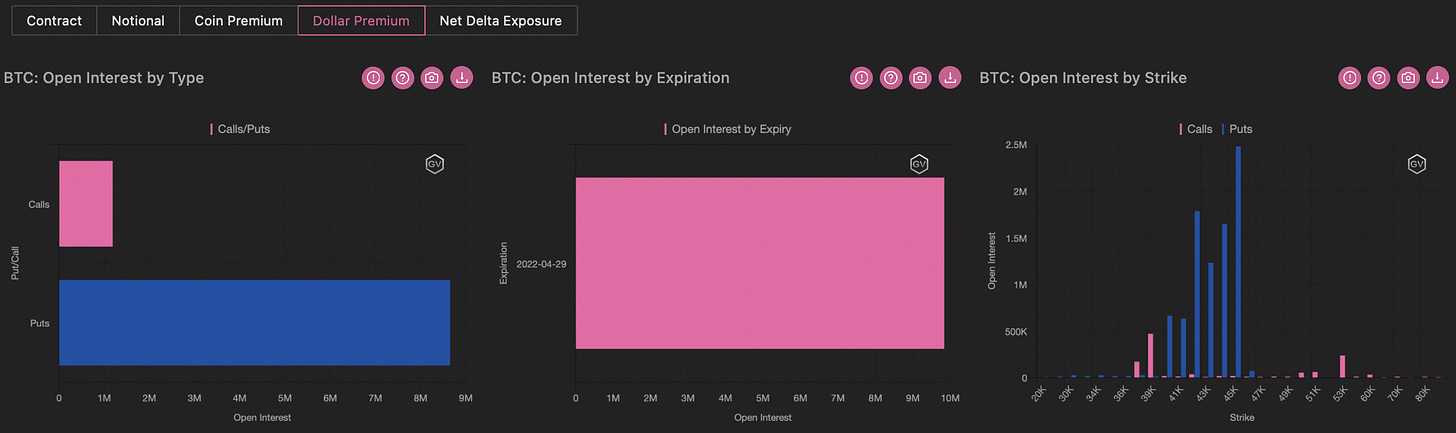

Open Interest - @fb_gravitysucks

BTC

The monthly expiration contract for April had 48k contracts and $1.8B of notional value. These values are below historical averages. Recall that the price since this expiry was opened has basically gone nowhere, remaining in the $38k-$48k range. Factors that certainly did not help directional traders to take strong positions.

The open interest profile is interesting, with a clear imbalance in favor of calls. The OI profile shows a strong resistance level of $42k and the April “expected target” of the $50k. Completely disappointing all expectations, the settlement of $39.5k saw 87% of contracts expiring worthless: an out-of-scale value for a maturity of this magnitude.

(Apr 29th, 2022 - BTC Notional - Deribit)

(Apr 29th, 2022 - BTC Dollar Premium - Deribit)

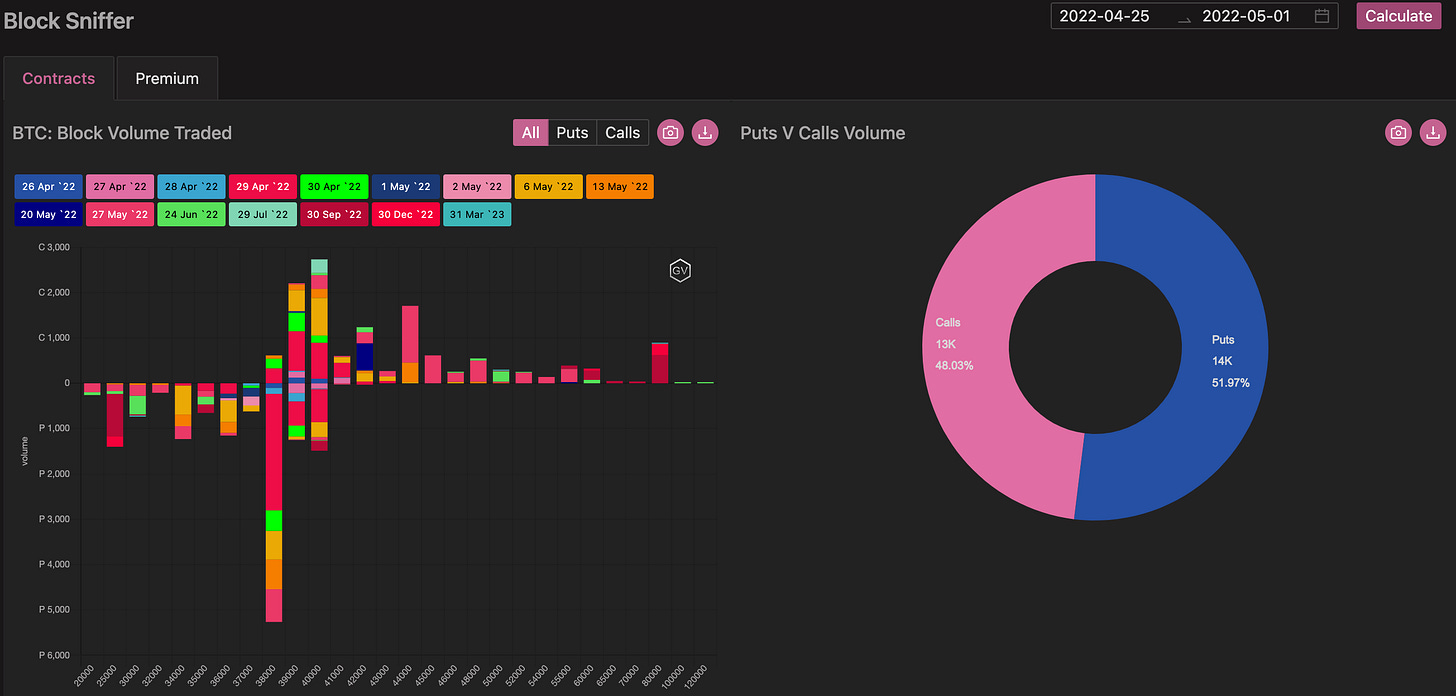

BIG TRADES IN THE FLOW

With the loss of key $40k support, sentiment is veered on seeking protection with short-term gamma buying and tails buying on longer maturities.

(25th Apr - 1st May, 2022 - Options scanner BTC - Deribit)

The week began with an on-screen purchase of September $55k call for over $2M in net premium paid, one of the few bullish trades of the week. With the spot at $38k, cunning traders rolled positions forward and down between $38k and $34k; along with the usual volatility selling trades composed of strangles $38k-$44k, the latter strike heavily sold in the monthly expiration of May .

An interesting pattern to report is the use of combo ratios “selling the body and buying the wings”: $35k-$25k put ratio 1x4 and $60k-$80k call ratio 1x3, both on September.

Finally, on Friday the most refined trade of the week: a diagonal ratio call 1x2 20May/29July +$42k/-$40k, opened delta neutral, gamma long, short vega, with a really impressive gamma/theta ratio.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 1st, 2022 - BTC Premium Traded - Deribit)

(May 1st, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (25 April - 1 May) BTC

Crypto winter persists as BTC recorded the worst April performance in its history, ~-15% MoM and -3.8% WoW. April’s median BTC spot return is +20%, the highest of any other month. ETH followed suit finishing -4.9% WoW.

BTC 1M ATM IV ended at 56v, in-line with last week despite continued spot weakness. 7-day realized picked up to 56v, crossing the 7D ATM IV of 53.6v.

The most notable BTC blocks were on the upside, despite a balanced put-call ratio. Two-way flow in 6May/27May topside, and buying of Sep/Dec 80k calls via call ratios and outright.

BTC

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 1st, 2022 - BTC’s Volatility Cone)

RV lifted higher this week.

Overall, RV is still in a meager state, hanging out around the lower 25th percentile.

Should spot-prices continue lower, median volatility seems like an immediately logical target.

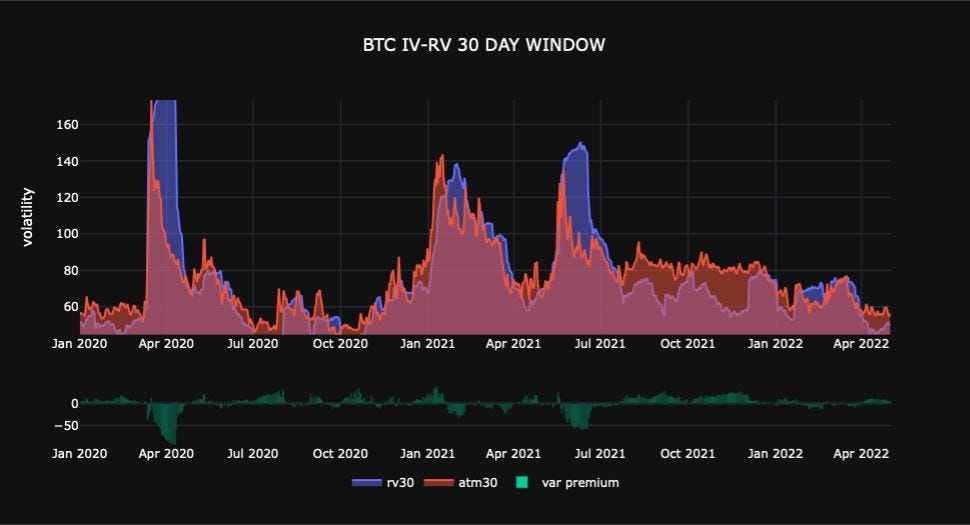

REALIZED & IMPLIED

(gvol API python module, pre-built notebook chart)

Short-term 30-day IV continues to display a slight var. premium, but that has narrowed week-over-week.

90-day IV trades around 90-day RV.

$2,952

DOV auctions

*note: Protocols have different auction times & calculated vols. are estimates.

DVOL: Deribit’s volatility index

(1 month, hourly)

DVol is in the 70-handle for ETH, as ETH continues to hang around the lower levels seen in the past 12-months.

Squeeth traders have recently sold IV down to comparable levels, but opportunities abound.

Often, Squeeth IV float above the 100% mark… This instrument is worth keeping on your dashboard… Hopefully a wBTC Squeeth will be launched soon too.

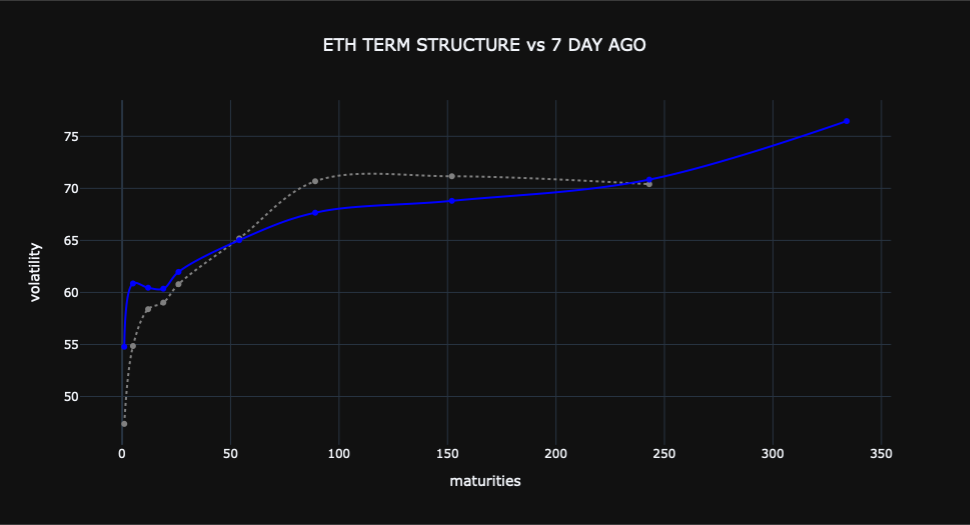

TERM STRUCTURE

(May 1st, 2022 - ETH’s Term Structure - Deribit)

The term structure remains in Contango with individual readings low on the percentile distribution charts.

ETH upside volatility might also materialize given that ETH 2.0’s PoS consensus shift is set to occur later this year.

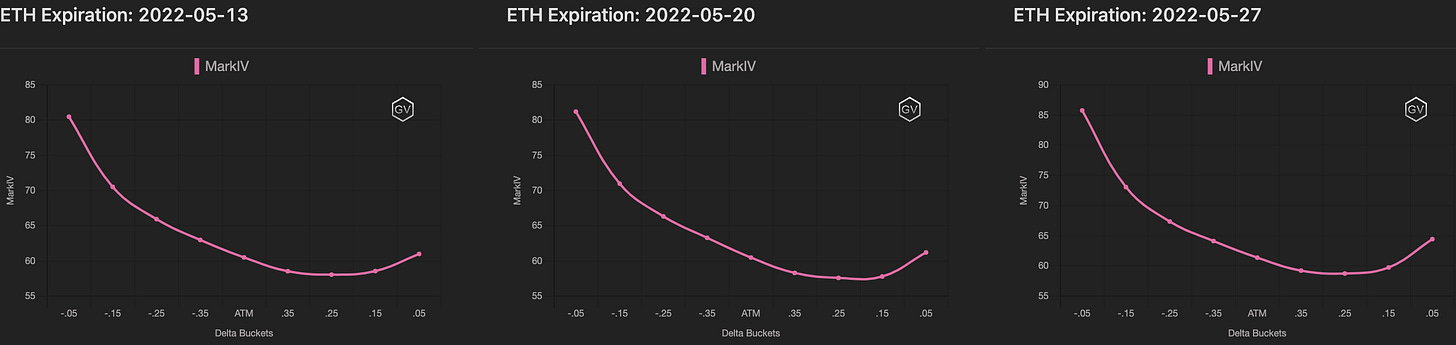

SKEWS

(May 1st, 2022 - ETH’s Skews - Deribit)

Similar to BTC, ETH skew is negative across expirations with 30-day skew leading lower.

The ETH/BTC price chart has seen an uptrend since Jan. 2020, and some trades utilizing skew could make sense.

Like BTC, we think ETH long-term calls in the ∆25 range, combined with short futures could be a good trade construction.

(May 1st, 2022 - ETH’s Skews - Deribit)

Open Interest - @fb_gravitysucks

ETH

For Ethereum, the monthly expiration had 400k contracts and notional value of $1.2B, which was well below the historical values. Here, too, the same considerations made on bitcoin about taking directional positions and boring price action apply.

The open interest profile, on the other hand, differs in several respects, above all the structural put/call balance, which confirms the interest shown by traders in recent months towards puts (see the latest newsletters). The higher volumes on Ethereum (4 to 1 vs Bitcoin) from DOV are certainly helping to change the reading. It is an interesting dynamic and to be kept monitored.

With a settlement of $2.9k, 89% of contracts expired worthless! If we add to this number the irrelevant premium distributed, being naked long on options right now is more of a leap of faith than a probabilistic bet.

(Apr 29th, 2022 - ETH Notional - Deribit)

(Apr 29th, 2022 - ETH Dollar Premium - Deribit)

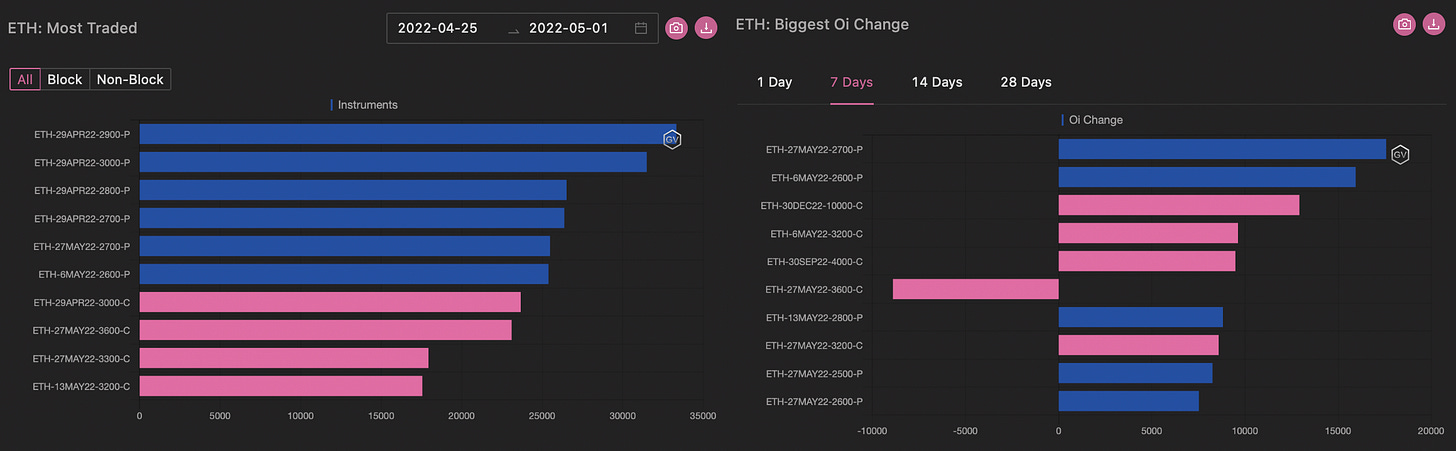

BIG TRADES IN THE FLOW

A purely conservative trading week for Ethereum, with the now usual activity on puts (albeit two-way) and the largest trades executed with ratios.

(25th Apr - 1st May, 2022 - Options scanner ETH - Deribit)

Over the past two weeks we have noticed the prevalence of ratios 1x2/1x3. The most important trades were made in the December deadline and the prevalence was to “sell the body and buy the wings”: -6k/+10k 1x3, -5k/+8k 1x3, -3k/+7k 1x2. Our thesis in this regard is that these structures could substitutes for spot positions, maintaining upside exposure in the event of a rise but not suffering price stagnation. It's just a guess but it's definitely something to consider.

Other trades include an on-screen sale of $4k calls in September for about $1.4M premium, and another substantial call sale on July $3.2k.

In general, the flow was more conservative than that of Bitcoin, which, itself, had not been particularly bright.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

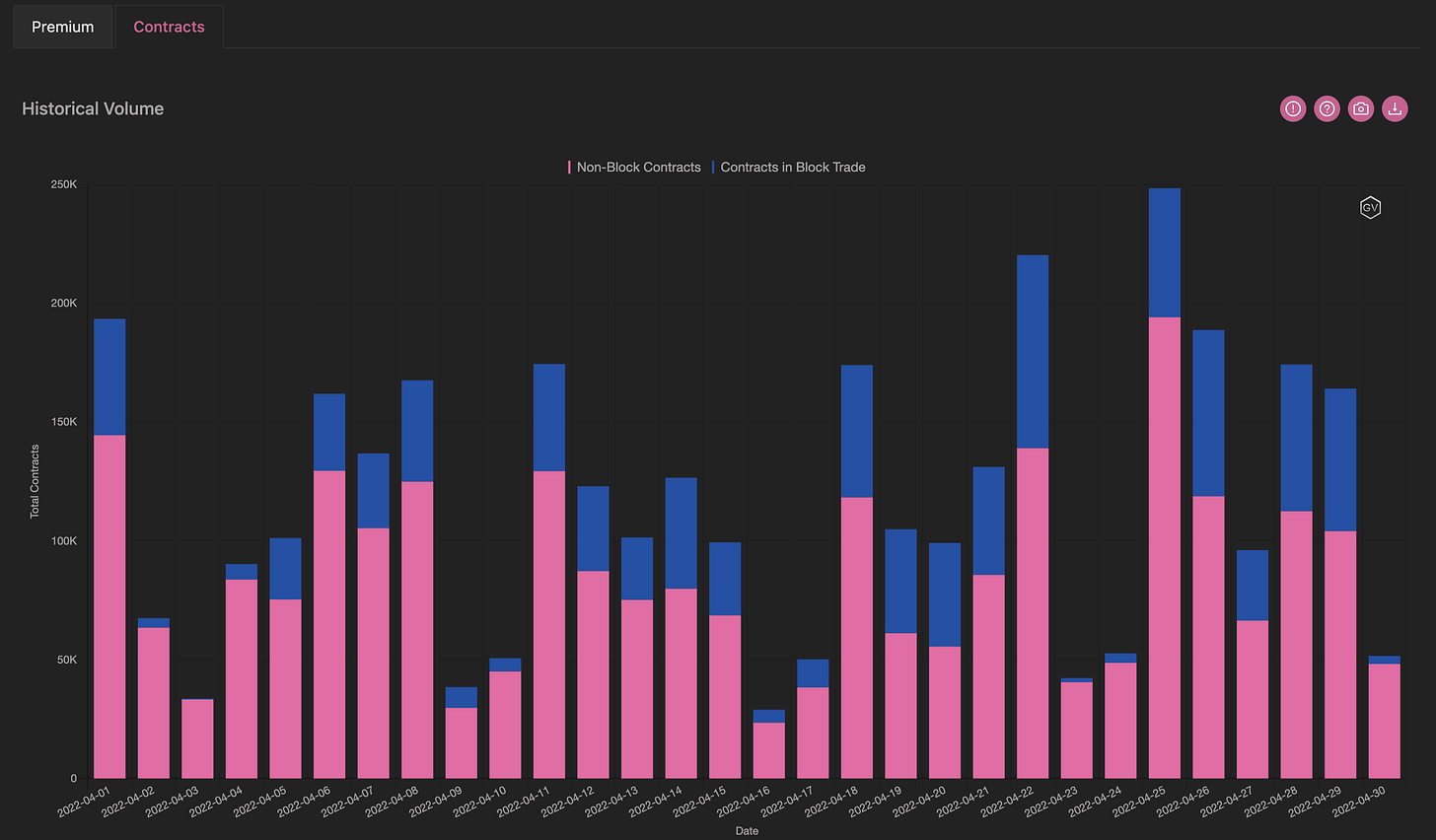

VOLUME

(May 1st, 2022 - ETH’s Premium Traded - Deribit)

(May 1st, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (25 April - 1 May) BTC

ETH 1M ATM IV ended the week at 62v and 30-day realized at 55v. The 7-day realized vol in ETH increased as well, and crossed the 7-day implied vol.

The largest ETH flows were front-end systematic vol sellers and buyers of longer-dated wingy upside structures: Sept outright calls, Dec call ratios, and Mar call spreads.

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 1st, 2022 - ETH’s Volatility Cone)

RV moved slightly higher for short-term measurement windows.

Long-term measurements are still rather dismal for ETH. Downside volatility is the most likely higher vol. scenario for now.

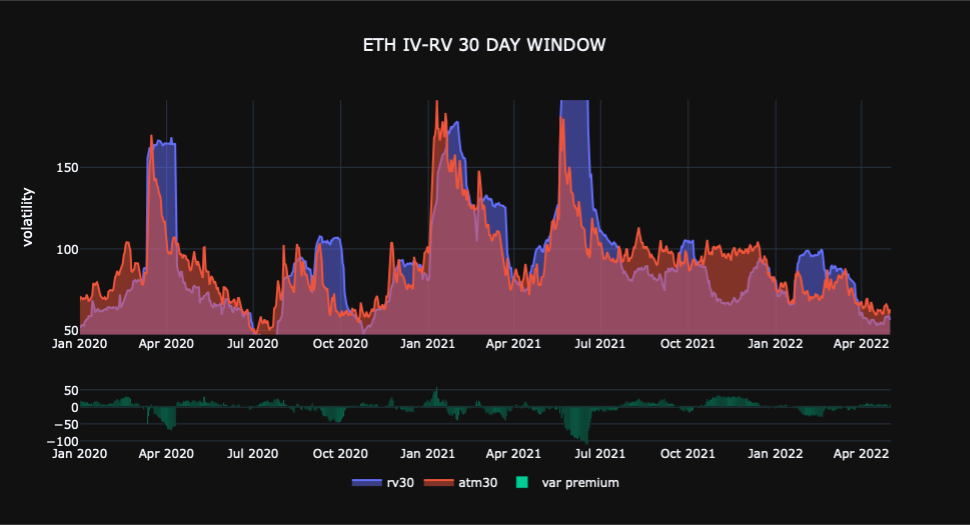

REALIZED & IMPLIED

(Gvol API python module, pre-built notebook chart)

90-day IV/RV is still at a discount, although narrowing, while 30-day IV/RV is pretty much at par.