Crypto Options Analytics, May 16th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(May 16th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

For the past few weeks, we’ve written about the divergences between ETH and BTC option skew.

Although ETH experienced a strong rally to higher spot prices, BTC option skew seemed to be relatively bearish.

This past week, we finally witnessed a catalyst to send BTC spot prices lower, which proved options skews to be right.

Short-term and medium-term option skews continue to be very bid to the puts, reflecting a potential move towards even lower BTC spot prices or at least more downside volatility.

(May 16th, 2021 - Long-Dated BTC Skews - Deribit)

Long-dated options still have a positive skew, although not extended to typical levels.

TERM STRUCTURE

(May 16th, 2021 - BTC’s Term Structure - Deribit)

The BTC ATM term structure is strongly in Backwardation.

This signifies panic as option traders scramble to buy short-term options to hedge the current spot prices.

Over the last week, we witnessed a large divergence between the ETH and BTC term structures… Relative vol. traders had interesting opportunities to bet on convergence due to bearish spot price moves… it seemed like the term structures were only pricing bullish vol. relationships.

ATM/SKEW

(May 16th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

The volatility profile is congruent with a genuine fear over spot price action.

ATM implied volatility is climbing towards monthly highs and option skew is near monthly lows.

This is evidence of strong put demand as traders hedge lower prices.

VOLUME

(May 16th, 2021 - BTC Premium Traded - Deribit)

(May 16th, 2021 - BTC’s Contracts Traded - Deribit)

The past week had higher volume spikes; although we do find these to be modest, given the large moves in implied volatility, the change in term structure, and skews becoming very negative.

VOLATILITY CONE

(May 16th, 2021 - BTC’s Volatility Cone)

It’s no surprise to see realized volatility higher than the 75th percentile for almost all measurement windows.

Although realized volatility is high, notice there is more room to go historically speaking.

REALIZED & IMPLIED

(May 16th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV and IV are trading the same levels.

Nothing notable stands out here.

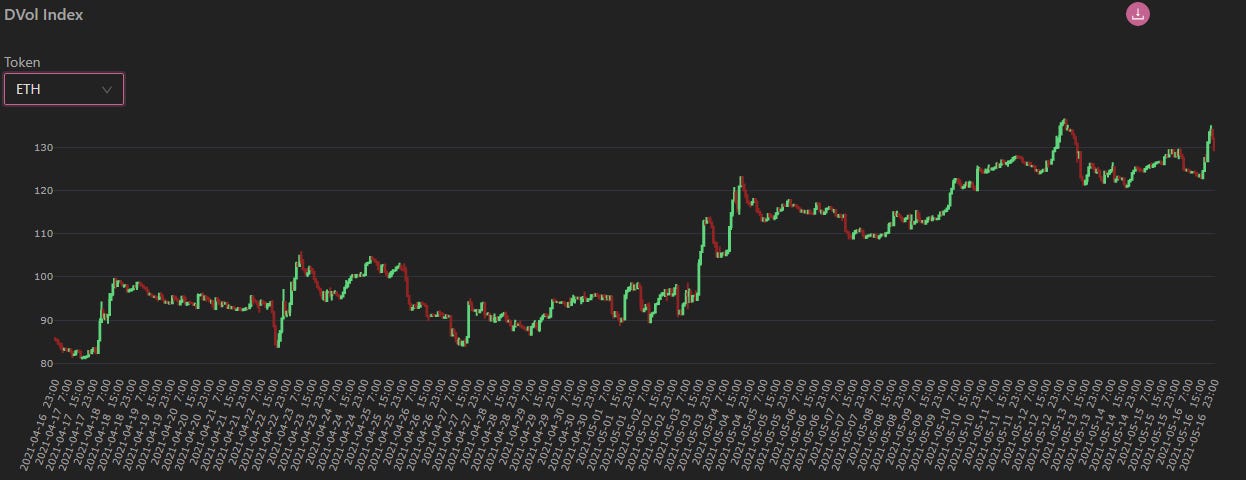

DVOL: Deribit’s volatility index

(1 month, hourly)

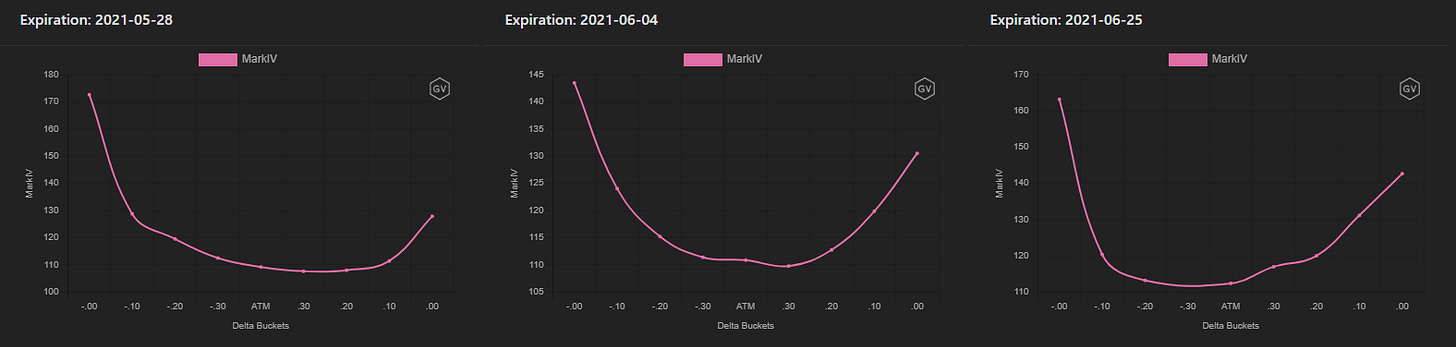

SKEWS

(May 16th, 2021 - ETH’s Skews - Deribit)

ETH option skews, like spot prices, have been lead lower by BTC.

We can see that short-term option skews are negative, yet medium-term and long-term skews are positive.

This bodes well for ETH’s relative strength compared to BTC.

(May 16th, 2021 - ETH’s Skews - Deribit)

ETH’s long-term options continue to display HEAVY positive skew, nearly unfazed by the recent spot price action, only dropping about 5pts.

TERM STRUCTURE

(May 16th, 2021 - ETH’s Term Structure - Deribit)

Backwardation is present in the ETH term structure as well.

Although the bearish price action did send volatility higher, IV was already high, given the bullish rally of the previous weeks.

We wouldn’t be surprised to see ETH have a volatile recovery rally higher, keeping IV’s nearly constant.

ATM/SKEW

(May 16th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV is back to the monthly highs, while skew is near the monthly lows…

ETH skew lows are not nearly as deep as BTC skew lows.

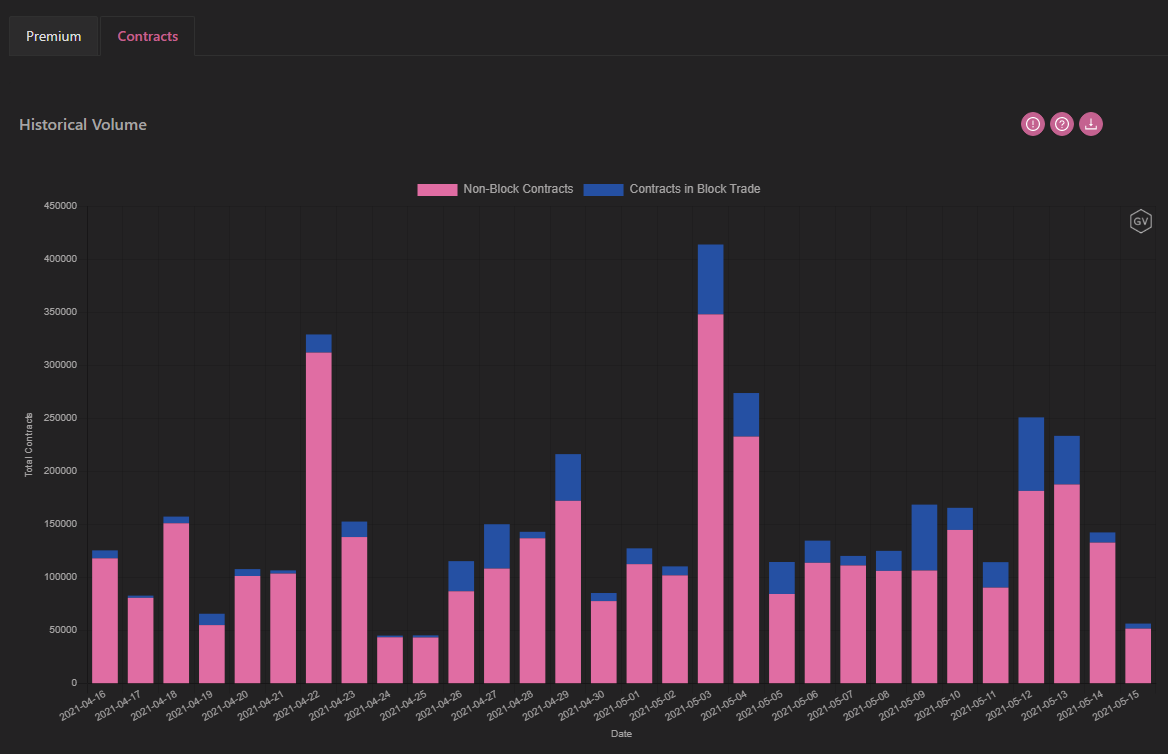

VOLUME

(May 16th, 2021 - ETH’s Premium Traded - Deribit)

(May 16th, 2021 - ETH’s Contracts Traded - Deribit)

ETH saw heavy option volume throughout the week, especially when measured in terms of premium traded.

VOLATILITY CONE

(May 16th, 2021 - ETH’s Volatility Cone)

Realized Volatility continues to move higher.

ETH is now around the 75th percentile for all measurement windows.

REALIZED & IMPLIED

(May 16th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is currently trading at a slight discount to RV.

ETH call options could be interesting here… Especially because we don’t expect a relief rally to send ETH volatility lower.