Crypto Options Analytics, May 15th, 2022

(https://twitter.com/cyounessi1)

Cyrus, my friend and my boss at DRW and later the head of risk at MakerDao and an analyst at Scalar Capital (Linda Xie’s fund) clearly saw the writing on the wall 4yrs ago.

Hat tip, sir!

Deribit launches SOL options! Check here

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$29,594

DVOL: Deribit’s volatility index

(1 month, hourly)

Welcome to hell week… A.K.A. crazy stuff environment!

Crypto vol. finally moved higher after a persistent grind lower in IV and RV YTD.

Options are like insurance and long-vol. trades are often frustrating in this sense…. They resemble an almost binary payout when correct…

Bleed, bleed, bleed, paid.

OR

Nothing, nothing, nothing, BOOM.

TERM STRUCTURE

(May 15th, 2022 - BTC’s Term Structure - Deribit)

(gvol API python module, pre-built notebook charts )

This week, the term structure massively inverted (no surprise) and IV hit nearly 200% for short-dated expirations.

What are the plays here?

First, spot prices aren’t really “bouncing” yet, we’re seeing a rather weak recovery… combine this price action with TradFi markets and the potential for the end of a 30+ year bond bull-run… There’s likely still pain in the medium term.

In the short-term, spot prices have likely bottomed out while option vol. likely peaked.

This is the time to fade vol. (at least statistically speaking).

Shorting put volatility, via June 24th 1x2s or broken-wing butterflies, seems rather interesting to me.

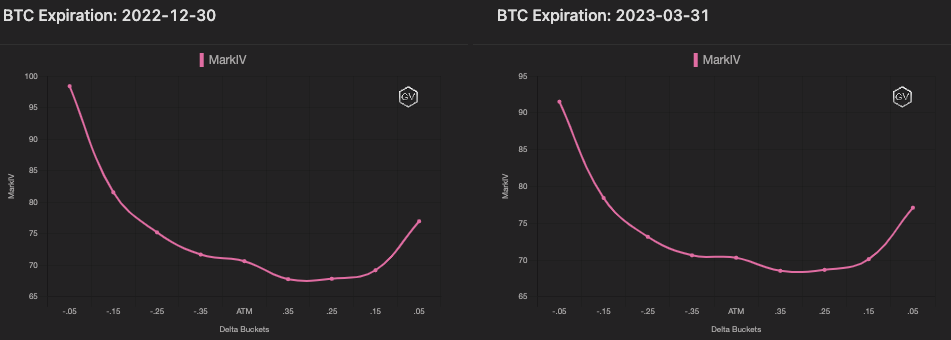

SKEWS

(May 15th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Option skew is also providing interesting opportunity.

Should prices find stability and bounce violently higher, fading the skew is a prime vol. trade.

TradFi markets tend to have sharp rallies in bear environments… I’d expect that psychology to be mirrored in crypto (although it has yet to be seen, it could still happen).

(May 15th, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

Looking back over the previous two weeks of trading that led to the recent open interest profile composition for the May 13 weekly expiration, we can find a common thread of caution and protection.

Except a naked long for over 1000x contracts in the $37k call and a 1x2 call ratio in $40k-$44k strikes with reduced premium and risk, all strike puts that rewarded the premium paid were mainly bought! Let’s just remember the trade mentioned last week with the purchase of $39k puts with the spot at $39.5k!

At settlement, the distributed premium was around $23M - equal to about 3.7% of the notional- while 63% of contracts expired worthless.

(May 13th, 2022 - BTC Contracts - Deribit)

(May 13th, 2022 - BTC Dollar Premium - Deribit)

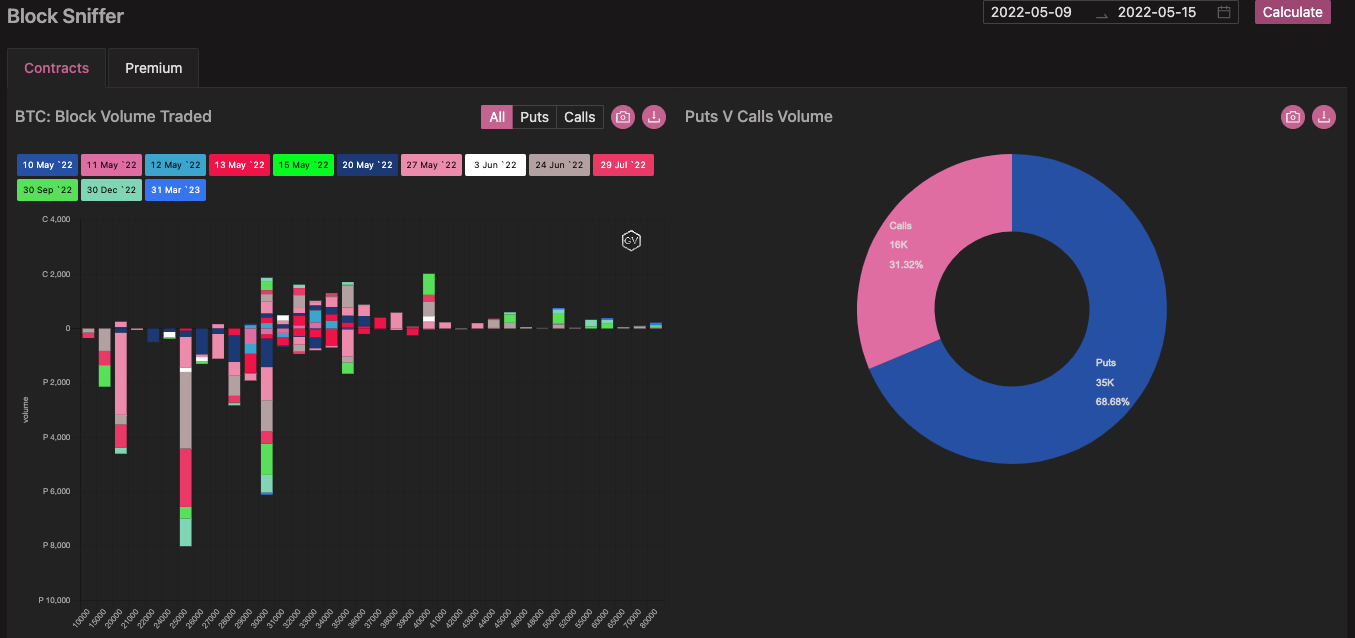

BIG TRADES IN THE FLOW

Very complex week to comment on, if you analyze the flow of trades. In weeks like this, it is a vain job to try to correctly evaluate the intentions of traders: very high volumes, profit-taking, positions rolled down and forward and some liquidations are variables that do not allow you to clearly read what is happening.

(9th - 15th May, 2022 - Options scanner BTC - Deribit)

But anyway, here are some interpretations:

Plausible profit taking of the $25k puts June/July with 50% premium reinvested in December expiry.

The same type of activity was also found for $25k puts -May/+Jun 500x.

A two-way interest in the $20k May27 with prevalence of on-screen purchases, and subsequent sales blocked during Friday’s peak volatility.

With the index returning to $30k, multiple trades on screen bought $32k calls on June 24th.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 15th, 2022 - BTC Premium Traded - Deribit)

(May 15th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (9 May - 15 May) BTC

Risk premia exploded due to the spot carnage and our tail hedging flows. BTC 1M 15-delta puts traded as high as 40v over 30D 15-delta calls, the highest differential on record. There were very few offers to sell deep downside earlier in the week.

While risk premia appears to be peaking, vol-of-vol remains extremely elevated as high spot/vol correlation led to large intraday swings in implied levels. Front-end vols collapsed 20-30v on Friday!

Encouraging that BTC and ETH perpetual funding rates have held up well, despite the spot selloff, respectively. On the other hand, alt perp funding rates remain negative, due to large alt selling pressure.

In BTC, a scramble to cover short gamma positions and buy tail protection in 15k-25k strikes due to offside positioning. The put-call ratio traded 3:1 from Tuesday through Friday. Largest blocks: 1.6k 27May 20k puts, 1.5k Jun 25k puts, 1.5k Jul 25k puts, and 715x Sep 15k puts.

BTC

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 15th, 2022 - BTC’s Volatility Cone)

RV is between the max reading and the upper 75th percentile…

Vol. normally doesn’t stay at peak levels very long, and if you survived the vol. “event”, then selling vol. on the backside (aka as it’s coming down) typically ends up being a good trade.

We’re likely going to be back in the interquantile rather quickly… sometime next week.

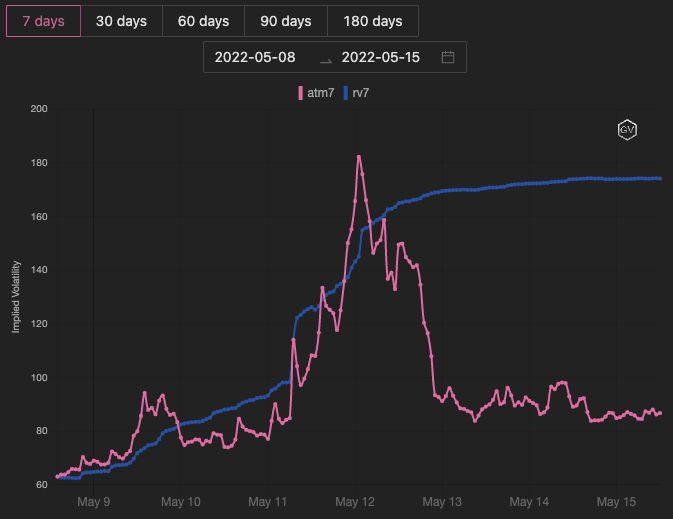

REALIZED & IMPLIED

(gvol API python module, pre-built notebook charts)

7-day IV is already discounting the RV.

Once the big days “drop-out” of the RV window, we should see weekly vol. below 80%.

$2,015

DVOL: Deribit’s volatility index

(1 month, hourly)

Squeeth IV hit 200%+

This instrument will be an interesting “bounce buy” when ETH does hit bottom (probably in the medium term).

Until then, Squeeth IV is rather high and the carry (in-kind funding) is expensive to hold.

TERM STRUCTURE

(May 15th, 2022 - ETH’s Term Structure - Deribit)

The term structure is still inverted, although IV has dropped massive weekly highs.

Ethereum vol. is still expensive but interesting events are happening in ETH that aren’t found in BTC.

We’ll be seeing ETH 2.0 testnet go live sometime in June… Should things go well, we could see a merge in August.

This will greatly change the economics of ETH and could create buying pressure on ETH.

Those are medium term events however, and likely overshadowed should macro events become hectic.

SKEWS

(May 15th, 2022 - ETH’s Skews - Deribit)

Skew is VERY EXTENDED…

We saw extreme levels during the week. These skews have recovered for short-dated options but longer maturities are still quite negative.

Like BTC, fading skew can be interesting around here.

(May 15th, 2022 - ETH’s Skews - Deribit)

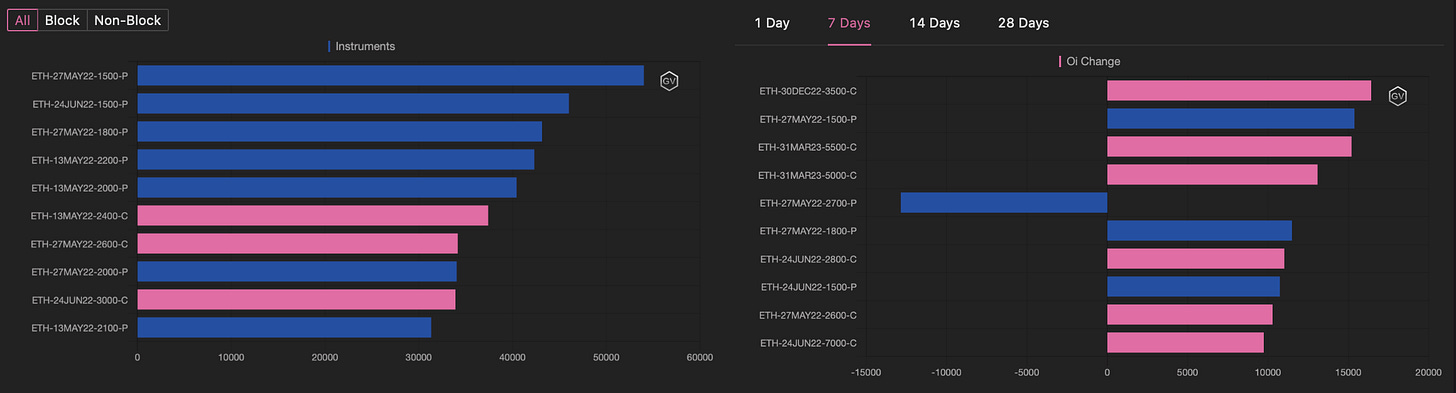

Open Interest - @fb_gravitysucks

ETH

Weekly expiration saw a very high total contracts and high distributed premium for Ethereum, thanks to the large number of puts bought last week in the $2.4k strike. Often, it was an on-screen purchase, and some positions rolled down from $2.8k/$2.6k.

With a notional just below that of bitcoin, the distributed premium was an amazing 7.4% and contracts expired worthless with an historical min of 54% (almost half of the contracts have finished ITM!).

(May 13th, 2022 - ETH Contracts - Deribit)

(May 13th, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

The same considerations made above also apply to Ethereum.

(9th - 15th May, 2022 - Options scanner ETH - Deribit)

Earlier this week, with the index at $2.4k, an on-screen trader sold over $4M of $3.5k calls in December.

The significant closing of open interest on the $2.7k put on May 27 with index around $2.3k suggests a profit taking.

Finally, we should note the substantial activity often in conjunction with other contracts/expiries in $1.5k/$1.8k strikes, which, even without giving us unique indications on directionality, reveal the levels of support that traders are observing.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(May 15th, 2022 - ETH’s Premium Traded - Deribit)

(May 15th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (9 May - May 15) ETH

In ETH, wingy puts also a theme, but more two-way flow compared to BTC’s buying interest. 14k Sep 1k puts sold and May 1900 / Jun 1500 put calendar traded 11k. On the upside, 7k Dec 4000 calls and 5k Mar 5000/5500 call spreads.

Paradigm saw net buyers of BTC/ETH vega on Monday. Vega flipped better to sell later in the week, as the spot drawdown accelerated, and hedges were monetized.

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(May 15th, 2022 - ETH’s Volatility Cone)

BTC and ETH RVs were almost identical recently.

This vol. event likely returns relative vol. towards their historical norms… Although ETH RV will drop, it likely won’t match the BTC RV again…

That is mostly a hunch, but I think the RV complacency is likely gone for the time being.

REALIZED & IMPLIED

(Gvol API python module, pre-built notebook charts)

7-day IV significantly discounting the RV-by nearly 100%…

That “may” be a little excessive, but I’d also would not be very interested in buying IV now either.

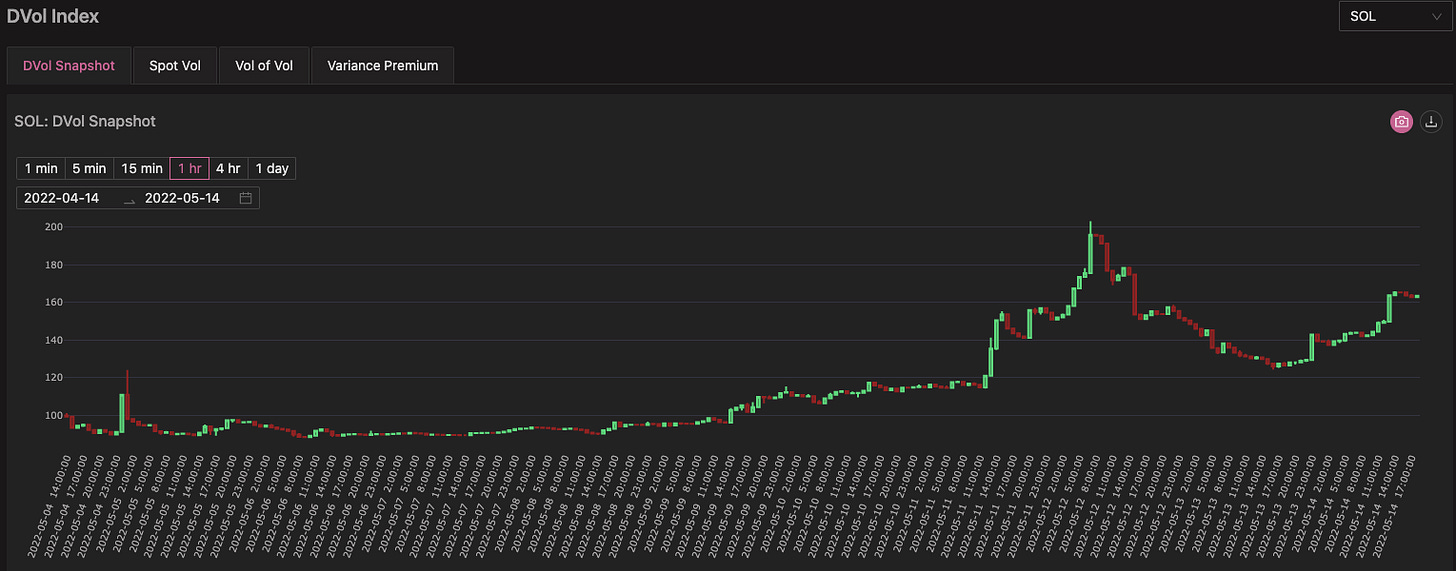

$49.26

DVOL: Deribit’s volatility index

(Hourly DVol Chart)

TERM STRUCTURE

(May 15th, 2022 - SOL’s Term Structure - Deribit)

Compared to BTC and ETH, Solana options have a lot of IV…

The markets will likely be moving with a lot of correlation; selling collateralized puts in Sol. might be the most interesting - as these have more “juice” - but won’t necessarily hold a higher Beta should prices go lower, because the market cap is already much smaller.

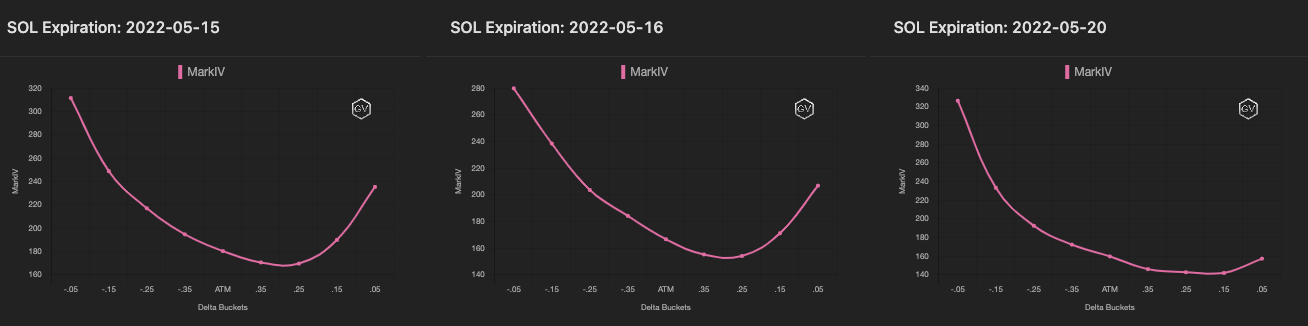

SKEWS

(May 15th, 2022 - Short-term and Medium-term SOL Skews - Deribit)

Along with my previous thinking, the SOL option skew is also extended… The combination of extended skew, higher IV, and already small market cap… could prove good for selling puts.

Should prices rally, however, I do think SOL will maintain a higher Beta.. which makes the classic skew trade interesting in SOL too.

(May 15th, 2022 - Long-Dated SOL Skews - Deribit)

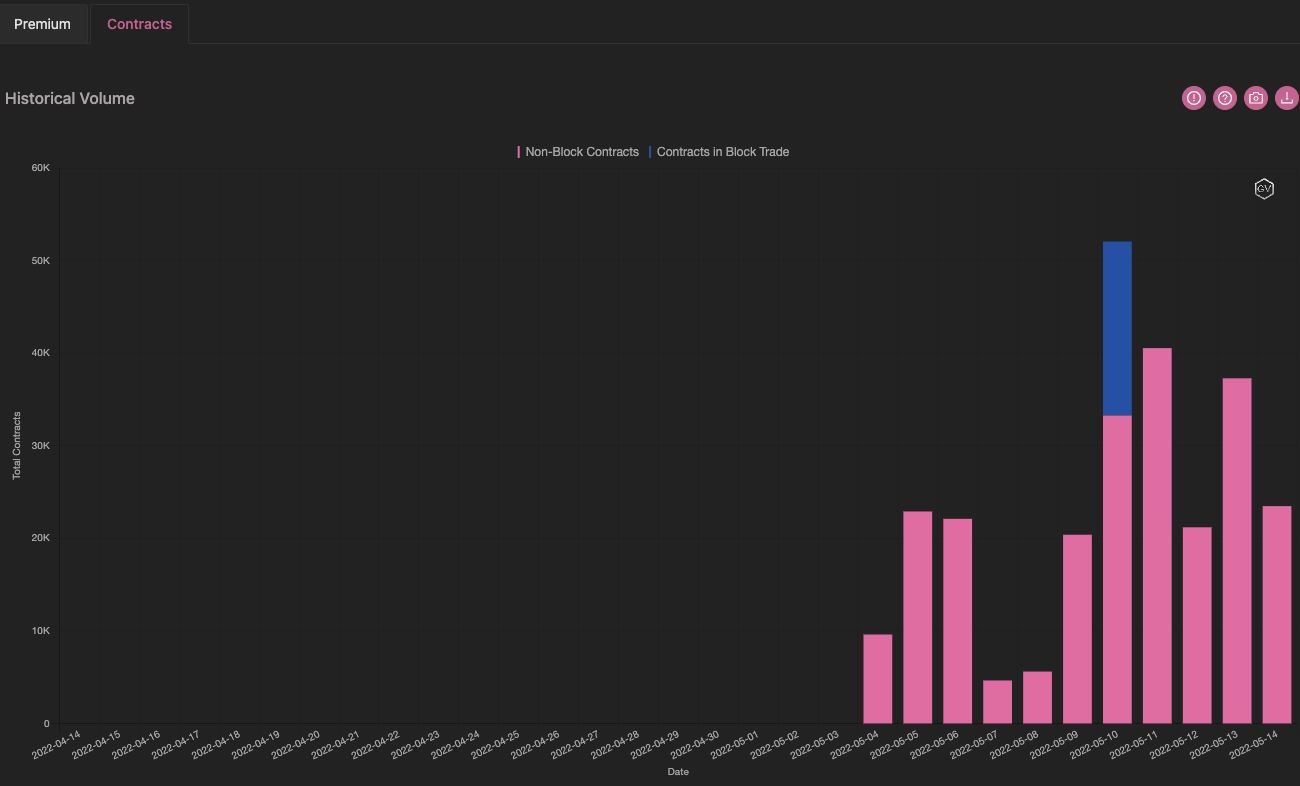

VOLUME & OI

(May 15th, 2022 - SOL OI Profile - Deribit)

(May 15th, 2022 - SOL Premium Traded - Deribit)

(May 15th, 2022 - SOL’s Contracts Traded - Deribit)

VOLATILITY CONE

(May 15th, 2022 - SOL’s Volatility Cone)

RV is still very close to the annual PEAK.

We’re likely going to see some strong mean-reversion in SOL RV over the next week or two, as prices find stability.