Crypto Options Analytics, March 7th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Signup for the Crypto Derivatives Roundtable

https://www.eventbrite.sg/e/crypto-derivatives-roundtable-tickets-144598765801

To trade visit: Deribit, Bit.com, Okex, Delta.Exchange, Hegic, Opyn, Primitive

For Chinese, visit our partner: TokenInsight

For best execution with multiple counter-parties and anonymity visit: Paradigm

For crypto-options podcast content, visit: The Crypto Rundown

Last week, Bitcoin and other crypto currencies were range-bound.

Implied volatility eased over the week, especially since we had a large spike in IV the week before.

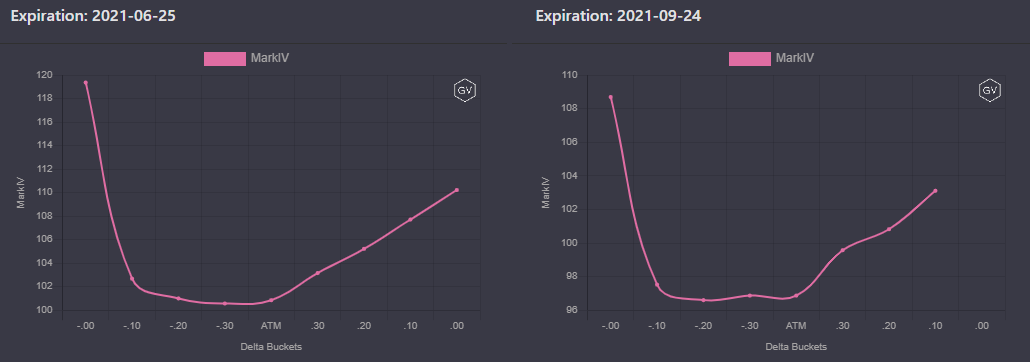

SKEWS

(March 7th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Skews in the .30 delta region have once again become positive in both short-term and medium-term options.

“Tail” hedges continue to be extremely expensive. Across all expirations, the -.10 delta bucket continues to be the most expensive optionality.

(March 7th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(March 7th, 2021 - BTC Term Structure - Deribit)

With implied volatility coming back down, we have seen the term structure come closer to a Contango structure once again.

June expiration remains an outlier of sorts, creating a hump.

Assuming the current term structure shape holds, June becomes a very attractive selling point in Vol., due to “roll down”.

ATM/SKEW

(March 7th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

Looking at ATM vol., we can see that IV has been unable to hold higher levels.

Despite bouncing off the 95%-100% range, IV is finally holding below 100%.

Without a resumption in the bull trend and new ATH’s, we’d expect IV to fail to hold above 100%.

Negative-option-skew did not last long. Now that the price correction has occurred, option traders are now back to paying a premium for calls compared to puts.

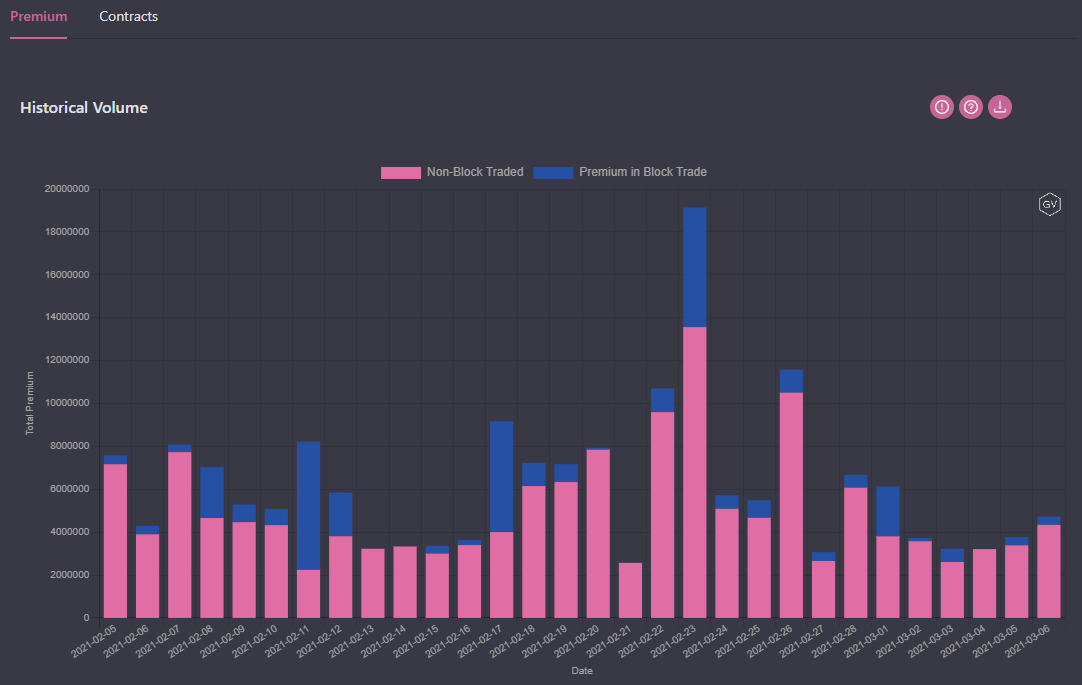

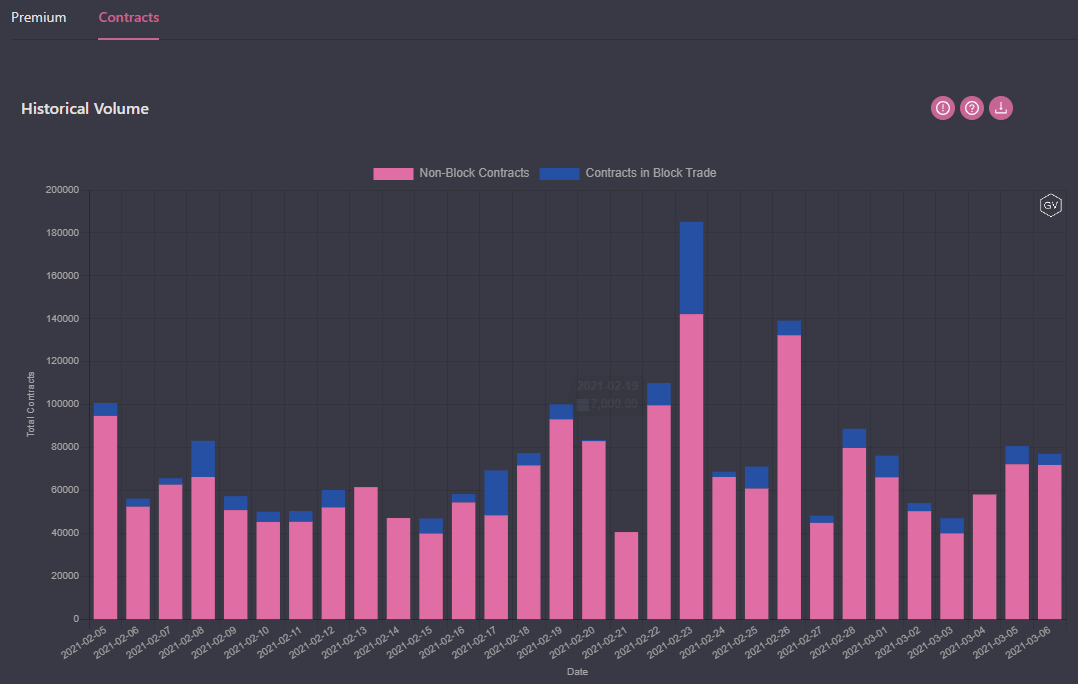

VOLUME

(March 7th, 2021 - BTC Premium Traded - Deribit)

(March 7th, 2021 - BTC Contracts Traded - Deribit)

Volumes are steady, without significant outliers over the past week.

Block volumes on Paradigm continue to contribute a significant amount of option flow on Deribit. Using our block trade sniffer “Block Trades Tied-Up”, traders can inspect block flow to mimic positioning.

VOLATILITY CONE

(March 7th, 2021 - BTC’s Volatility Cone)

Compared to last week, RV has come back down.

We continue to hold above the 75th percentile for many rolling windows. This trend has been present for many newsletters.

RV has not had the chance to truly calm down.

REALIZED & IMPLIED

(March 7th, 2021 - BTC’s 10-day Realized and Trade-Weighted Implied Vol - Deribit)

Implied volatility has held more steady than RV.

RV has traded at both a discount and premium to IV in a short period of time.

Volatility hasn’t been able to pick a direction and has therefore mostly held steady, given the market choppiness.

SKEWS

(March 7th, 2021 - ETH Skews - Deribit)

ETH’s skews last week were negative, with expensive put and call “Tails”.

Now .30 delta skew is back into positive territory.

What’s interesting is that unlike BTC’s, ETH’s “Tails” remain the most expensive on the call side. This picture is the inverse of BTC’s.

(March 7th, 2021 - ETH Skews - Deribit)

Long dated skew is heavily priced to the call side, creating an almost linear line.

TERM STRUCTURE

(March 7th, 2021 - ETH Term Structure - Deribit)

Like BTC’s, ETH’s term structure resumed a near Contango shape, with June again being an outlier in implied volatility.

ETH’s implied volatility is about 20 pts higher than BTC’s overall.

Like BTC’s, ETH’s June expiration provides a sweet spot for vol. sellers, who can enjoy a volatility “roll down” along with Theta collection.

ATM/SKEW

(March 7th, 2021 - ETH ATM & Skews for options 10-60 days out - Deribit)

ATM IV finally found some downward momentum.

Despite the drop in IV, Skew was able to find its footing again and flip into positive territory once more.

VOLUME

(March 7th, 2021 - ETH Premium Traded - Deribit)

(March 7th, 2021 - ETH Contracts Traded - Deribit)

ETH’s volumes have been steady.

Scanning ETH’s volumes for large outliers could be very telling and merits the consistent inspection.

VOLATILITY CONE

(March 7th, 2021 - ETH Volatility Cone)

Again, we see a consistent realized volatility above the 75th percentile.

REALIZED & IMPLIED

(March 7th, 2021 - ETH 10-day Realized and Trade-Weighted Implied Vol - Deribit)

Even more so than BTC’s, ETH’s realized volatility has chopped around a lot, flipping around from large IV/RV premium, to IV/RV discount.