Crypto Options Analytics, March 6th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$38,309

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(March 6th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

This week saw a huge rally in BTC prices, up to $45k, and subsequent reversal into the weekend, ending the week almost unchanged.

Option skew remains nearly the same, week-over-week.

Despite the massive rally early in the week, all option expirations continue to price negative skew.

We believe BTC has shown the potential for bullish price action and significant upside remains possible.

That said, option volatility seems like a higher probability bet than directional trades.

(March 6th, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(March 6th, 2022 - BTC’s Term Structure - Deribit)

Short-term volatility has softened week-over-week causing the term structure to ease away from strong Backwardation, to something more “flat”.

Medium and long-term volatility has held still, week-over-week, despite the large realized volatility.

Medium and long-term volatility continues to be an enticing long.

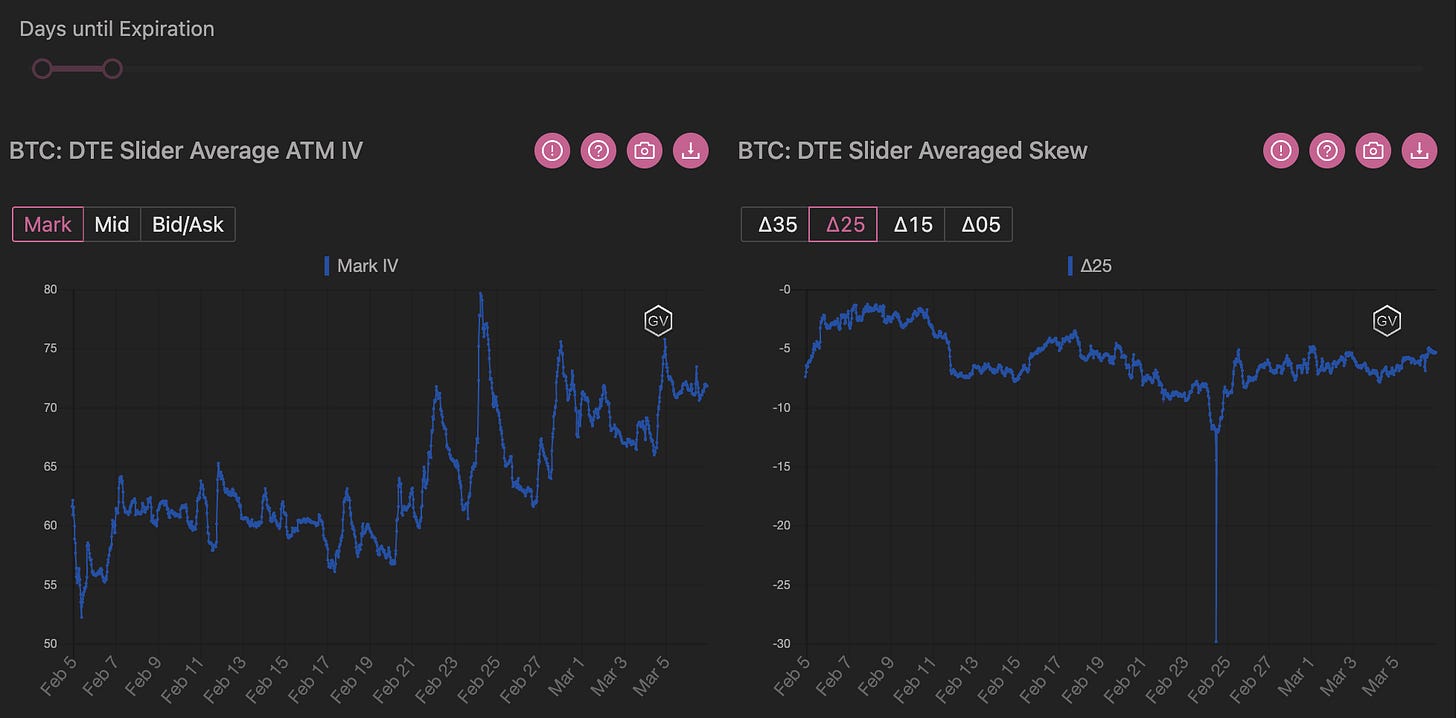

ATM/SKEW

(March 6th , 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

The volatility trend (left) is upward sloping with much gyration along the way.

Option skew remains rather stable, discounting the potential for upside volatility.

Remaining delta-neutral but long-volatility using call structures seems like a preferred trading idea here. The idea that volatility will diminish if prices “rally” doesn’t seem true to us and we would even argue the case for upside volatility being ever more present now, given the price action seen this week.

Open Interest - @fb_gravitysucks

BTC

The first week of the month started with fireworks: from a low of $37k to a high of $44k in a few days and with a retracement on expiry to $41.5k; clearly, the volatility was not lacking and it was evident that interest from traders materialized, given both the open interest profile and the volatility term structure.

In general, the positive trend has rewarded those who bought the dip during the last week.

(Mar 4th, 2022 - BTC Notional - Deribit)

(Mar 4th, 2022 - BTC Dollar premium - Deribit)

BIG TRADES IN THE FLOW

The positive momentum of the week's opening was anticipated by a large flow of 25 March $45k calls bought on Sunday afternoon with the spot $39k. About $2M of option premium was paid here.

Later in the afternoon, again on Sunday, an interesting 1x2 call ratio was bought. Good structure for an high volatility environment.

These trades had a great timing ahead of Monday’s pump.

During the day, the bullish sentiment continued with outright calls being bought in strikes between $42k-$45k for weekly expirations, and $50k on monthly expirations.

In two days, between March 2nd and 3rd, the June $45k-$60k call spread dominated the flow and was the largest bitcoin trade in recent weeks, with a net premium of over $4.5M (signs inverted in chart below).

The options scanner also shows significant interest in the $60k call in April. These contracts were bought on screen in clips of 25 contracts. Really unusual execution.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 6th, 2022 - BTC Premium Traded - Deribit)

(March 6th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Feb 28 to March 6)

As the world continues to witness the continued efforts by Ukraine to stave off Russian advances, spot remains content drifting lower paring gains from the previous week.

In keeping with the fact geo-political risks remain front and center, the term structure in BTC remains inverted with 1mo IV sitting circa 3 points higher than 6mo IV, alluding to the prevailing uncertainty. Front end risk in ETH’s term structure seems to be dissolving, although not completely - exhibiting a kink around mid-year and appearing hesitant as to whether normalcy will be resumed or whether further hikes in the near end will follow.

In BTC outright purchases of calls and call Spreads dominated flow with focus primarily around the 42k and 45k levels. Interestingly, Call spreads accounted for circa 35% of all blocked transactions in BTC with 74% of the week’s volume printed as calls.

(Feb 28 to March 6 - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(March 6th, 2022 - BTC’s Volatility Cone)

Realized volatility is strong now.

We’re clearly above the 75th percentile for the medium measurement windows.

We expect this trend to continue.

REALIZED & IMPLIED

(March 6th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Notice the IV/RV relationship currently being priced.

Again, long volatility continues to pay and remains the preferred structure.

There are also significant fundamental reasons for the increased RV and we don’t expect these to dissipate anytime soon.

$2,623

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(March 6th, 2022 - ETH’s Skews - Deribit)

ETH skew also remains negative but has repriced higher week-over-week.

Traders have been willing to bet that the potential for higher volatility is also possible from a price rally.

Option skews back to monthly highs.

(March 6th, 2022 - ETH’s Skews - Deribit)

TERM STRUCTURE

(March 6th, 2022 - ETH’s Term Structure - Deribit)

The ETH term structure has flattened due to short-term options weakening.

Medium and long-term options also saw a parallel shift lower in volatility.

The term structure currently remains in “no-man’s-land”.

Medium and long-term volatility seems like a safer buy, as short-term IV has the potential to disappoint due to bad timing.

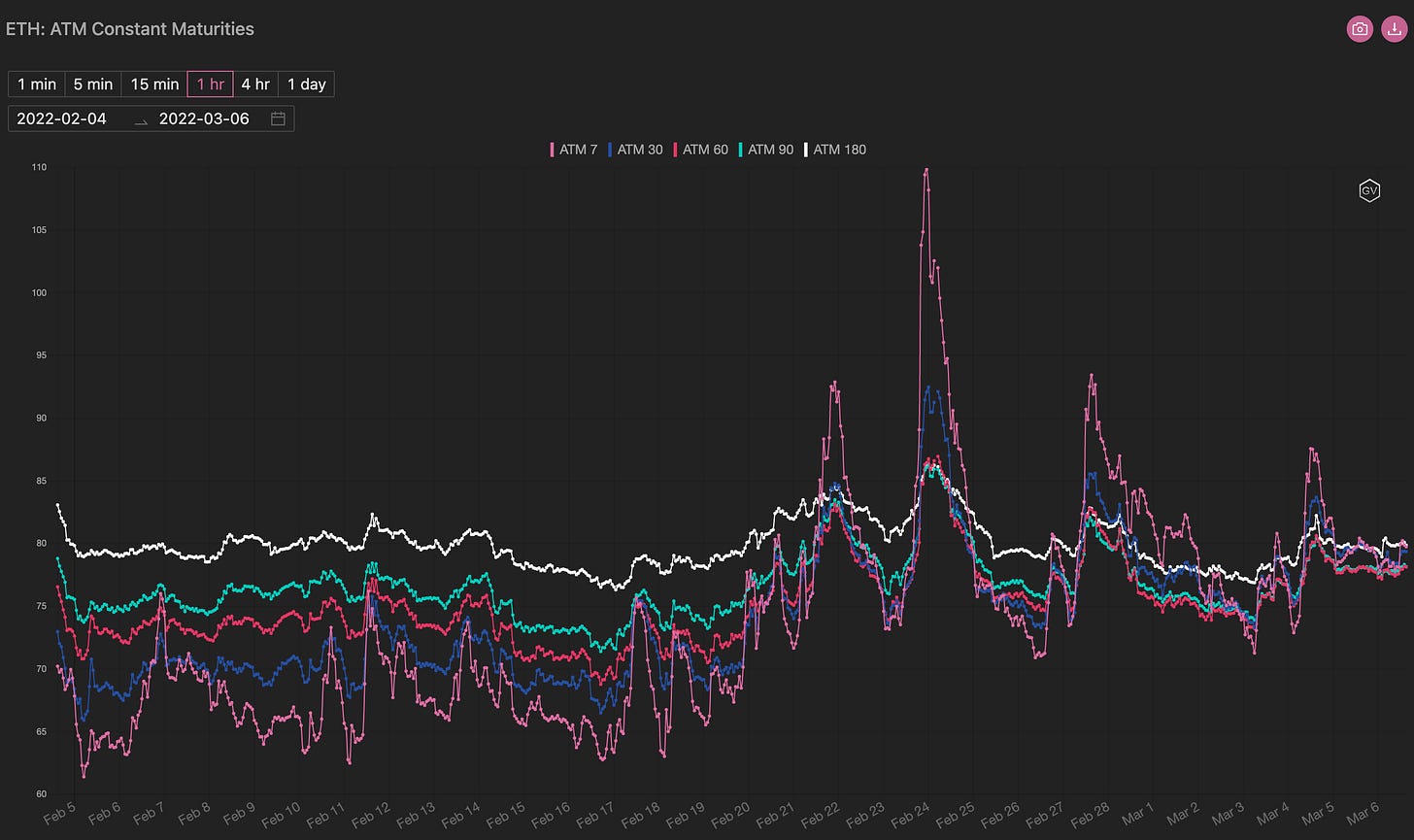

ATM/SKEW

(March 6th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

IV is in the monthly mid-range, with the potential to increase nearly +20pts should the world become even more crazy.

Option skew is clearly having a come-back and approaching par again.

Open Interest - @fb_gravitysucks

ETH

A quiet week for Ethereum, which is living in the shadow of Bitcoin. The influence of DOV in the open interest profile seems to prevail; with a P/C ratio oriented towards the downside, the $3.0k-$3.1k strikes received considerable attention, but after the first leg-up on Bitcoin, they expired worthless nonetheless.

(Mar 4th, 2022 - ETH Notional - Deribit)

(Mar 4th, 2022 - ETH Dollar premium - Deribit)

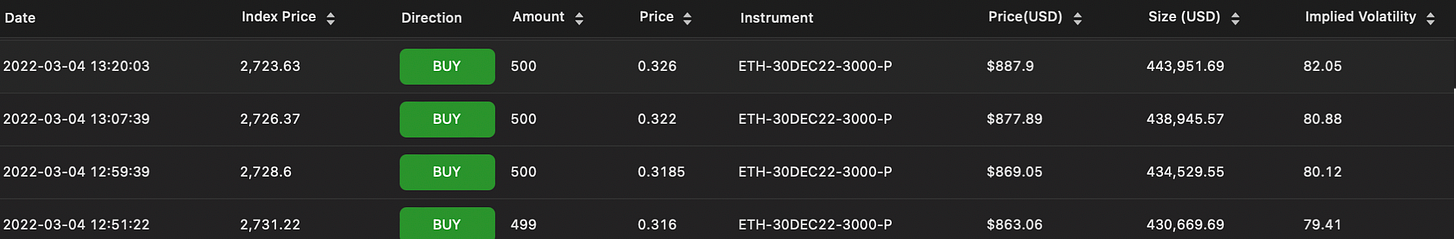

BIG TRADES IN THE FLOW

As for Bitcoin, ETH’s week started early on Sunday, with particular interest in short-term calls: 4March $3k and 18March $3.2k.

On Monday, in the wake of Bitcoin's first move up, an on-screen purchase of 8,500 contracts for May $4k hinted that the desire for upward exposures could continue.

In following days, however, with indications that Bitcoin, in the macro context, had more thrust, the flow slowed down and saw less significant trades.

Lastly, a purchase for about $2M made onscreen for long-dated puts.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 6th, 2022 - ETH’s Premium Traded - Deribit)

(March 6th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (Feb 28 to March 6)

ETH was less homogeneous, showing a clear bias in exposure towards the upside but with more balanced flow overall. In ETH 3k Jun topside exposure proved to be the proverbial flame to the moth.

(Feb 28 to March 6th - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

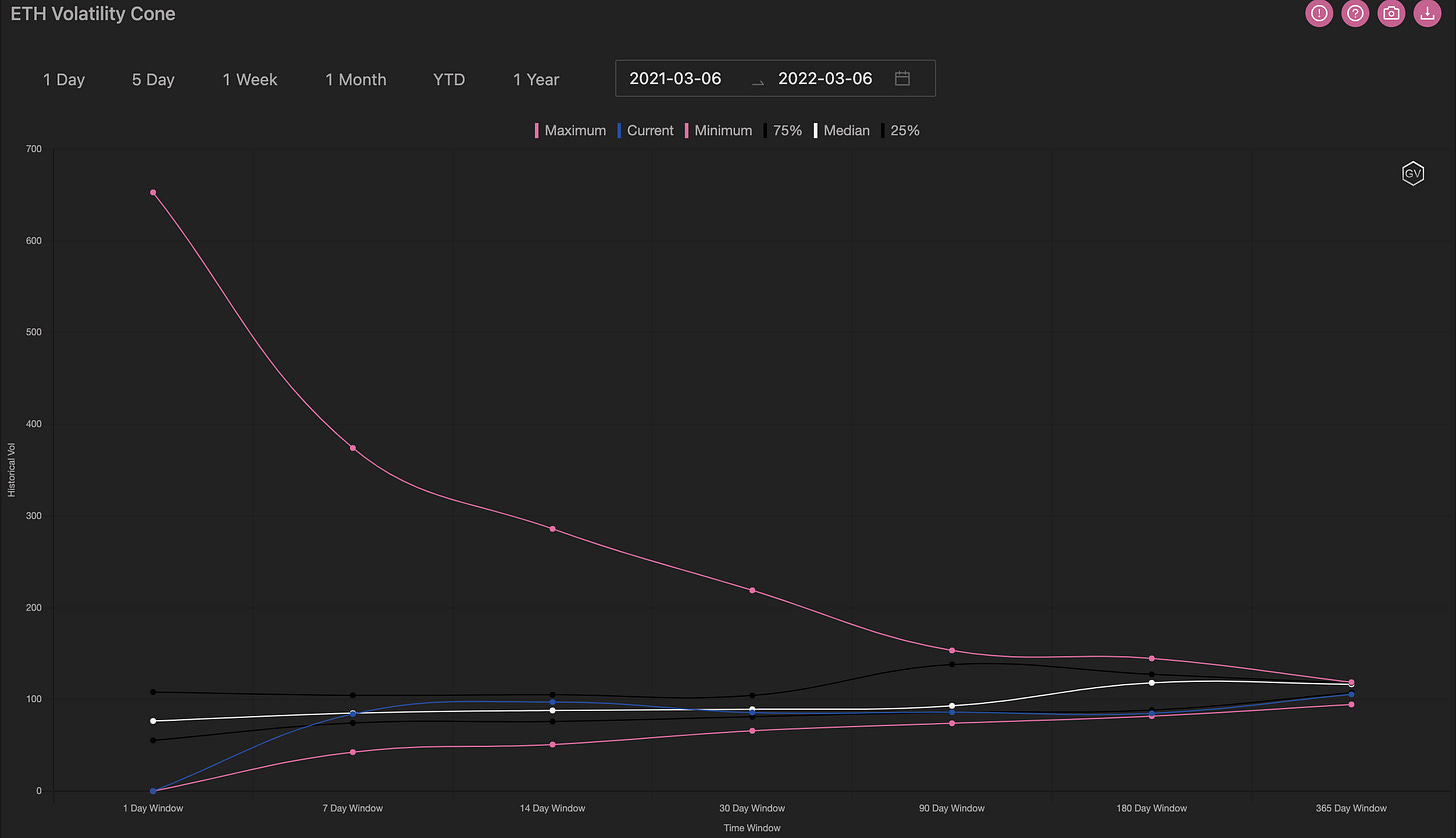

VOLATILITY CONE

(March 6th, 2022 - ETH’s Volatility Cone)

ETH RV is rather tame compared to the BTC volatility cone.

ETH RV isn’t above the 75th percentile for any measurement windows, confirming that BTC is seeing “relatively” more attention, given the backdrop of a new international currency standard debated.

REALIZED & IMPLIED

(March 6th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Like BTC, ETH is displaying a favorable IV/RV relationship for volatility buyers.

We believe this chart is yet another reason to continue recommending volatility longs.