Crypto Options Analytics, March 28th, 2021

"Volatility finally melts. ETH's term structure is in a STEEP Contango."

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Stop and breathe!

Bitcoin and other cryptos are finally consolidating.

SKEWS

(March 28th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

As crypto currency volatility finally starts dropping lower, skews have taken a more normal shape.

25 Delta skews are now positive but are not extended to extreme levels.

We are seeing a more controlled and stable skew level.

(March 28th, 2021 - Long-Dated BTC Skews - Deribit)

Longer-term options have a more notable positive skew with call options retaining a premium over put options.

This type of structure is said to be “business as usual”

TERM STRUCTURE

(March 28th, 2021 - BTC’s Term Structure - Deribit)

It’s safe to say that the option volatility term structure is now mostly in Contango.

This type of term structure is congruent with lower volatility environments.

Note that the June expiration volatility premium has now been traded away.

For many of the past newsletters, we noted that June options were abnormally expensive versus the rest of the curve, and provided an attractive yield for vol. sellers. This opportunity has now come to fruition.

ATM/SKEW

(March 28th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM implied vols. have seen a consistent slope lower.

Any sharp rally in ATM vol. has been quickly smashed lower.

Skew ranges have held a nice healthy level around +5pts. The range of skew trading has also been relatively stable.

The option markets are behaving in a healthy and controlled manner.

VOLUME

(March 28th, 2021 - BTC Premium Traded - Deribit)

(March 28th, 2021 - BTC’s Contracts Traded - Deribit)

Option premiums traded are now consistently below $40m. This range is lower than previous newsletters, which saw some daily volumes exceed $60m.

Contract volumes are consistently below 20k units daily, whereas previous volumes could easily exceed 25k units.

Taken together, this all reflects a lower uncertainty in the market and a pause in crypto price action.

VOLATILITY CONE

(March 28th, 2021 - BTC’s Volatility Cone)

Realized volatility consistently held the upper 75th percentile for the longest time.

RV is finally floating back down towards the median…

If spot-prices continue to consolidate around the highs without any sharp sell-offs, expect RV to drop below the median and, potentially, test the lower 25th percentile.

REALIZED & IMPLIED

(March 28th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol. - Deribit)

The large pull-back, or retracement, in volatility is apparent.

No IV/RV discount/premium is seen here.

SKEWS

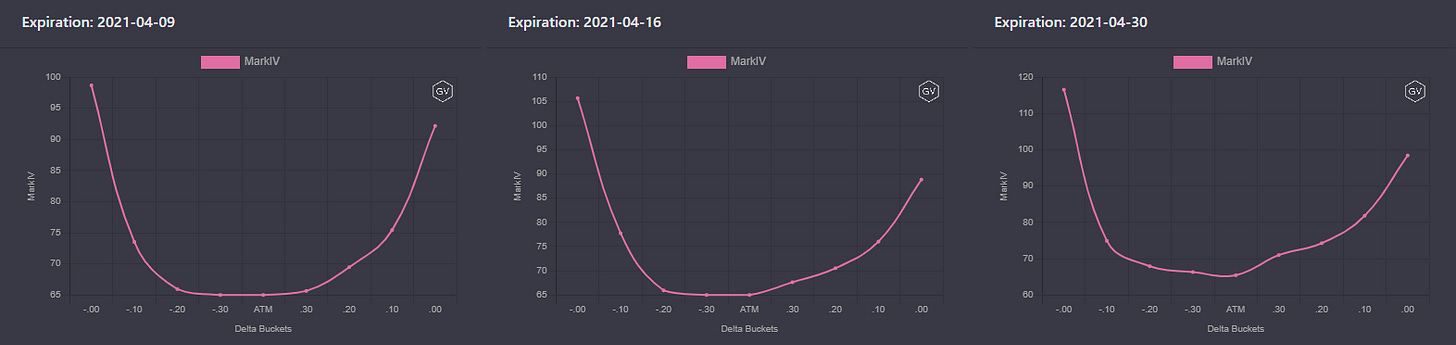

(March 28th, 2021 - ETH’s Skews - Deribit)

ETH is displaying even skews for very short-dated options.

As we extend expirations for ETH options, skews become more and more positive, displaying the natural volatility premium bestowed on call options versus put options.

(March 28th, 2021 - ETH’s Skews - Deribit)

There is a strong call-appetite for long-dated expirations.

TERM STRUCTURE

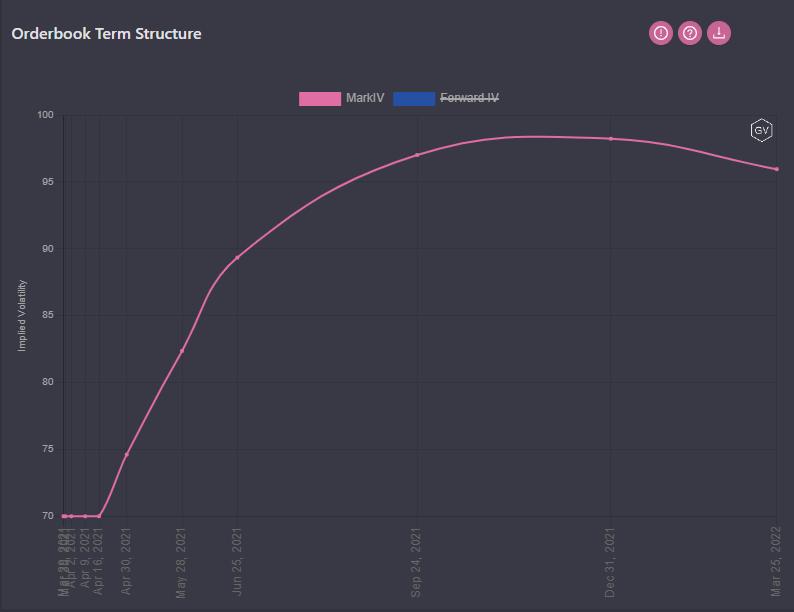

(March 28th, 2021 - ETH’s Term Structure - Deribit)

We have a very nice Contango term structure seen in ETH.

Notice how steep the volatility curve is: 20pts between spot vol and June 25th expiration. BTC’s steepness is about 8pts for similar expirations.

ETH’s implied volatility has an expensive “Roll-down” given the current term structure.

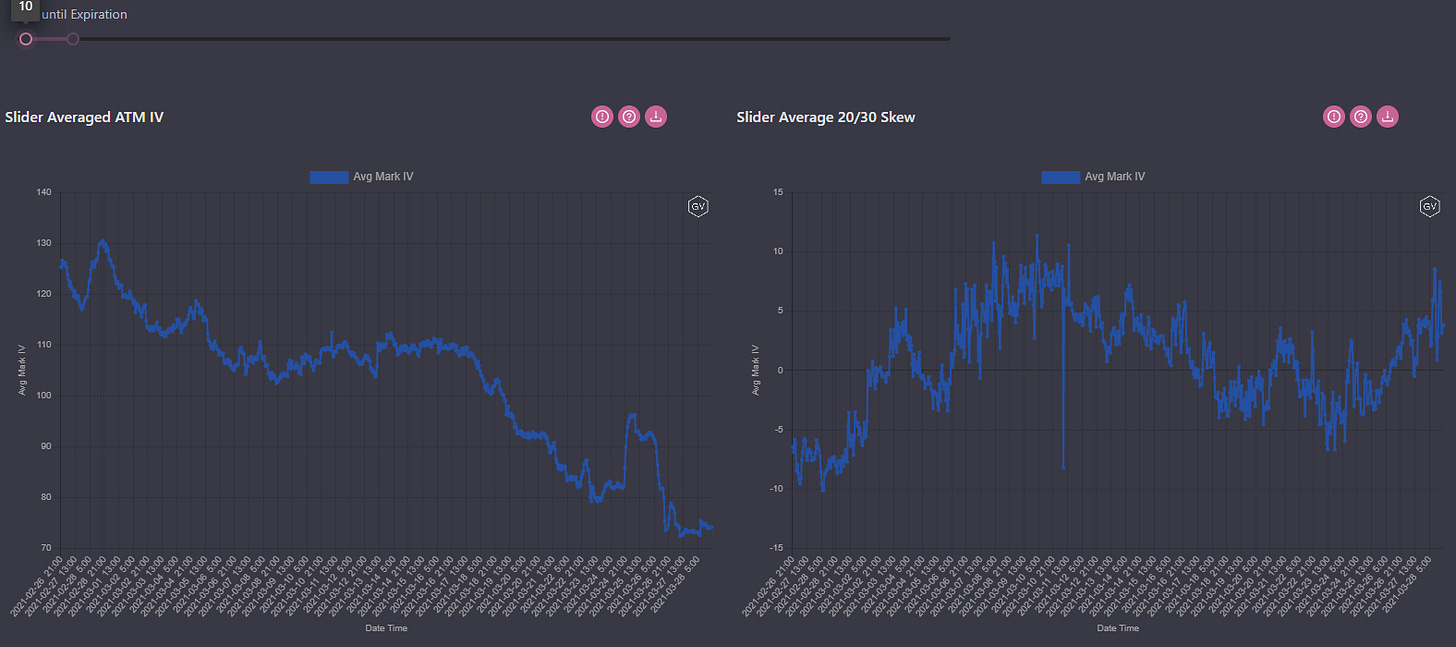

ATM/SKEW

(March 28th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Similar to the BTC charts above, ETH’s ATM IV is relentlessly dropping lower, while option skew holds tight.

VOLUME

(March 28th, 2021 - ETH’s Premium Traded - Deribit)

(March 28th, 2021 - ETH’s Contracts Traded - Deribit)

ETH’s option volumes haven’t seen the same relative drop lower as BTC’s.

Overall, volumes remain similar to those seen in the last few newsletter issues.

VOLATILITY CONE

(March 28th, 2021 - ETH’s Volatility Cone)

ETH’s realized volatility is now back on the median for most volatility measurement windows.

We can say that realized volatility is near equilibrium here.

As long as ETH’s RV holds these levels, volatility sellers will benefit from vol-selling and the steep Contango term structure “roll-down”.

REALIZED & IMPLIED

(March 28th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol. - Deribit)

RV and IV are back around the longer-term averages seen over the past year.

IV/RV is showing no discount/premium.