Crypto Options Analytics, March 27th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$44,909

DVOL: Deribit’s volatility index

(1 month, hourly)

Market swinging headlines being absent has allowed spot prices to follow an upward trend with lower realized volatility.

In response, option implied volatility is pricing itself lower and assuming a steeper “Contango” term structure.

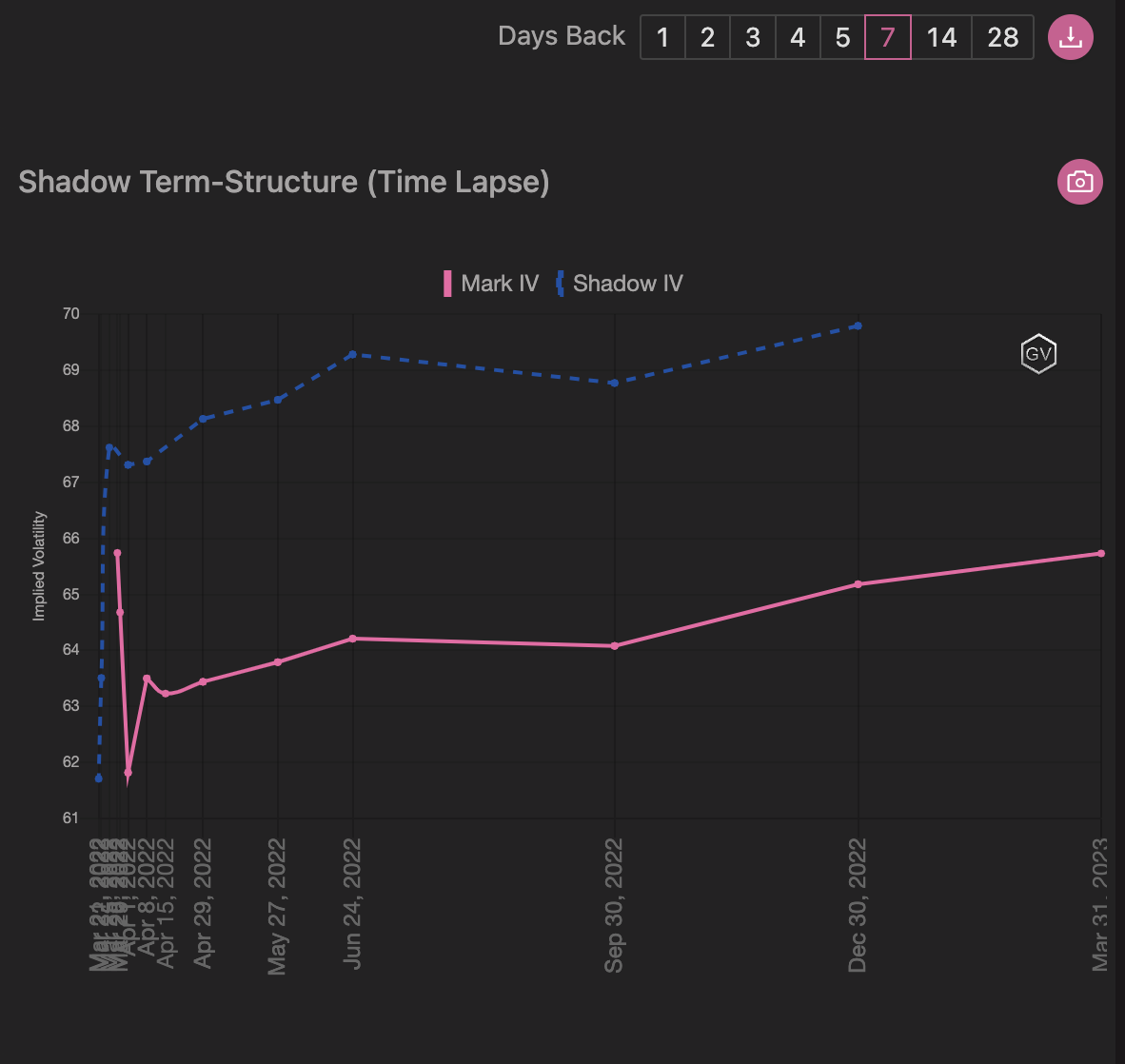

TERM STRUCTURE

(March 27th, 2022 - BTC’s Term Structure - Deribit)

The term structure dropped about -6pts across all expiration week-over-week.

For the backend of the term structure to reprice itself nearly as much as shorter expirations, is arguably excessive.

Who’s to say what the rest of 2022 is bringing, in terms of BTC volatility, based one week’s worth of data?

Should BTC spot prices break $45k → $50k and resume a bull-run… 180-day RV could resemble something similar to 2017 (93%) or 2021 (90%). 180-day options are currently pricing 65%.

SKEWS

(March 27th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

BTC option skew continues to believe volatility will come from downside spot prices as opposed to an upside breakout.

I do agree with these assumption in the medium-term.

However, upside volatility could materialize in short-term options should spot prices breakout above $45k and run straight to $50k.

Long-term option skew is also an outlier historically speaking.

Since April 2019, 180-day option skew has almost always maintained a positive reading since BTC exhibits a “FOMO” market. This FOMO is further compounded by an often exploding futures basis as traders will pay anything for leveraged long exposure.

Due to this, we believe the 180-day call options are again, attractive buys.

Those options could be financed by selling medium-term calls to package the whole position into a diagonal.

(March 27th, 2022 - Long-Dated BTC Skews - Deribit)

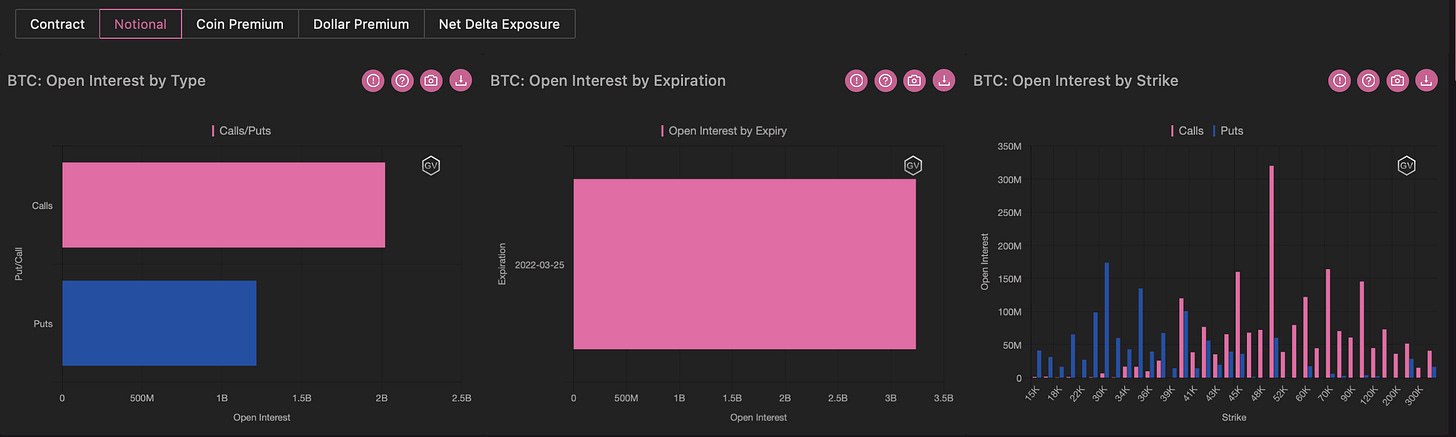

Open Interest - @fb_gravitysucks

BTC

This week we witnessed the first quarterly close of 2022 with over $3B of open notional, one of the highest values since August 2021.

The strike $50k soars above the others, symbolically defining the level that separates caution from euphoria.

Thursday's jump from the "maxpain" level of $42k, confirms that this theory is just a superstition.

80% of the contracts have expired worthless.

(Mar 25th, 2022 - BTC Notional - Deribit)

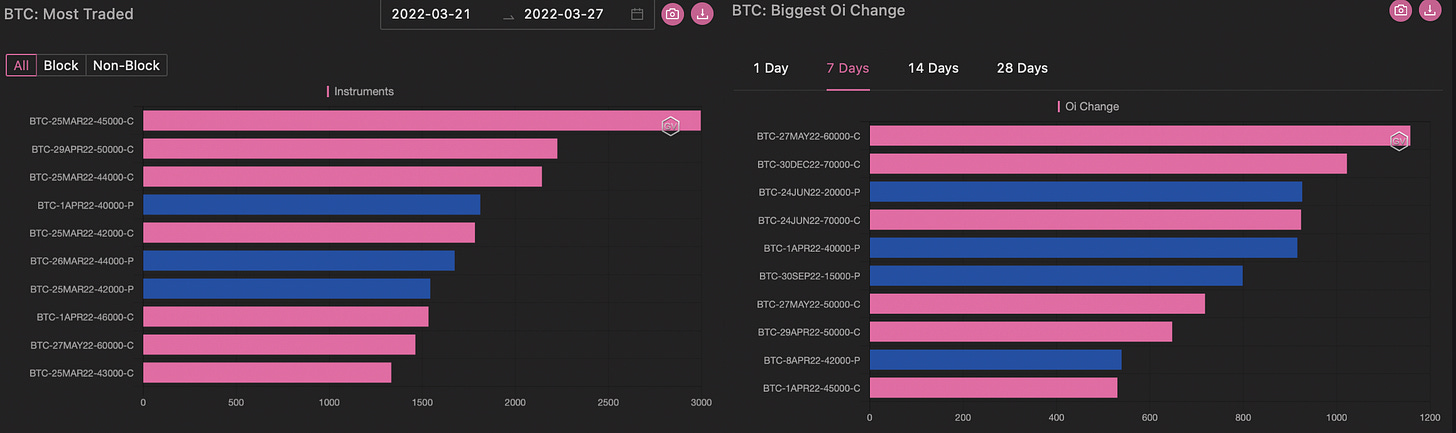

BIG TRADES IN THE FLOW

Unfortunately, this past week did not register any significant trades.

For context, this week had the lowest number of traded contracts in 2022 and the second worst in terms of traded premium.

The only trades worthy of note, added exposure in the $60K-$70K strikes for the May-June-December maturities.

With the start of the new quarter, we expect renewed interest.

(Mar 21st-27th, 2022 - Options scanner BTC - Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 27th, 2022 - BTC Premium Traded - Deribit)

(March 27th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (21 Mar - 27 Mar)

The highlight of this week was the quarter-end expiry on 25 March. Volume was mainly driven by rolling of positions post-expiration. Exchange volume of BTC and ETH was almost $1.1b and $800mil respectively, and ~30% was done as block trades on Paradigm.

Futures Spread volume also picked up after we launched our Futures Spread Dashboard. Prior to expiry (21-24 Mar), we traded a volume of 50mil per day on futures spreads. These stats can be found on https://www.paradigm.co/stats

In BTC, interest across strikes resembled a bell-curve, with 70k calls the outlier, where we saw almost 2500x traded, of which 1000x traded in each of Jun and Dec expiries. 15-25k puts also saw more interest in Jun and Sep tenors.

(21 Mar - 27 Mar - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(March 27th, 2022 - BTC’s Volatility Cone)

Realized volatility is now at an annual minimum for short-term measurements.

180-day RV is also at a low for the year.

We think global macro developments and domestic attitudes towards crypto remain rather bullish enough to ignite a bull-run in the longer-term, but medium term RV can remain low for a while.

REALIZED & IMPLIED

(March 27th - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV is leading the way lower, presenting a profitable IV/RV gap for medium term options.

We continue to view diagonal trades the preferred structure in this environment.

$3,175

DVOL: Deribit’s volatility index

(1 month, hourly)

TERM STRUCTURE

(March 27th, 2022 - ETH’s Term Structure - Deribit)

ETH’s term structure is very steep and unlike BTC could be providing good vol. buying opportunities across all the expirations tenors, although diagonals with medium/long expirations are favored.

Ethereum has had a higher beta historically speaking but also has more developments in the pipeline.

Beacon chain deposits, L2 developments, EVM compatible chains coming online and DeFi protocol innovations are all potential sparks to an ETH bull-run.

SKEWS

(March 27th, 2022 - ETH’s Skews - Deribit)

Long-term option skew for ETH is now at the 0-line but this levels is likely too cheap too.

Buying long-term ETH calls at parity, and given the low IV levels, provides nice upside given the potential for significant ETH 2.0 developments.

Medium-term volatility can be a good hedge for any long vol. position via calendar positions.

(March 27th, 2022 - ETH’s Skews - Deribit)

Open Interest - @fb_gravitysucks

ETH

This was an important maturity for Ethereum, with notional over $2B, the highest exposure value since June 2021.

This confirms the interest of traders in ether options which has gained market share versus Bitcoin.

The strike of $15k ("the Raoul Pal strike") stands tall above all the others, reminding us how little it takes in the crypto market to influence the behavior of the participants.

90% of the contracts have expired worthless.

(Mar 25th, 2022 - ETH Notional - Deribit)

BIG TRADES IN THE FLOW

For ether too, the week was very quiet.

Only the usual activity was found; short-term puts with two-way interest.

(Mar 21st-27th, 2022 - Options scanner ETH - Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 27th, 2022 - ETH’s Premium Traded - Deribit)

(March 27th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (21 Mar - 27 Mar)

In ETH, interest was spread rather evenly across strikes, with greater emphasis on Jun and Sep contracts in put wings, while Calls saw more interest in 4/1, 4/8 and especially 4/29 contracts. Put-call ratio was 0.93.

After the expiry, we first saw selling flows in both BTC and ETH, mainly in 29Apr topsides. This drove IV lower by about 3-5vols across tenors, but we turned to see more buying into the weekend after the sell-off subsided.

We are seeing a divergence in Skew between BTC and ETH. 180-day skew in ETH has traded above par, while BTC skew remains below par and 7-day skew fell by 2vols.

IV remains under pressure from the drag of realized vols, where spot remains within the 2-month range, while the 10-day rolling historical volatility drifted to near all-time lows (BTC at ~40 HV, and ETH at ~50 HV).

(21 Mar - 27 Mar - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(March 27th, 2022 - ETH’s Volatility Cone)

Realized Volatility near minimums for all measurement windows.

This bodes well for volatility sellers, although IV is already near matching levels.

Again, we think long time-horizons contain the potential for upside surprises, while medium-term is volatility is more predictable.

Short-term IV is already cheap and a squeezing potential is more present.

Therefor we continue to prefer the medium-term/long-term diagonal strategy here.

REALIZED & IMPLIED

(March 27th, ‘22 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Both RV and IV are headed lower, although RV is leading the term.