Crypto Options Analytics, March 20th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$41,297

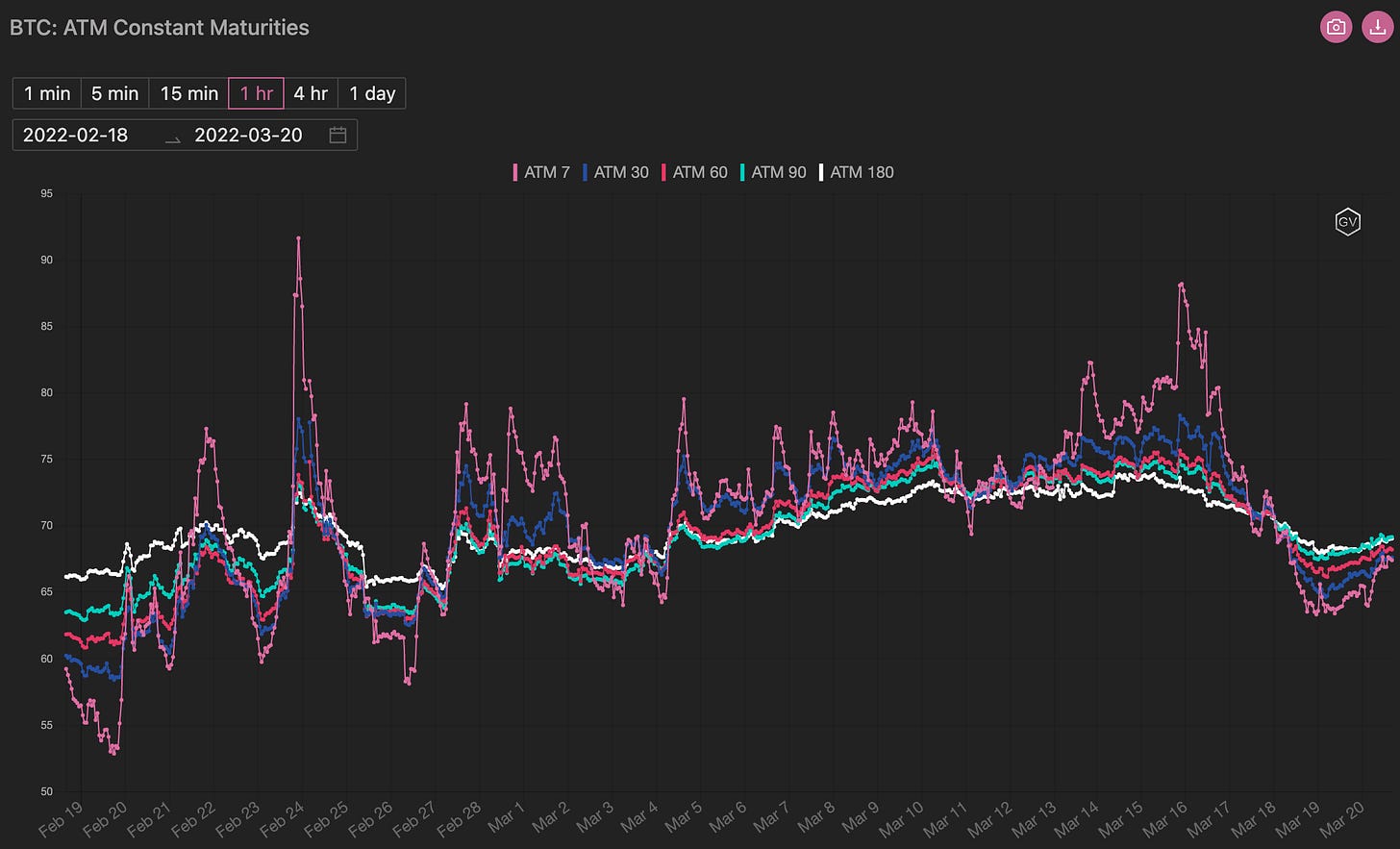

DVOL: Deribit’s volatility index

(1 month, hourly)

This week’s main event was the FOMC meeting.

The overall consensus from the FOMC meeting is that the Fed was hawkish but still relatively “behind the curve”, meaning its efforts will likely fall short of stopping inflation.

25bps ( (6x) 25bps hikes for the year) will not be enough in the face of 7.9% inflation prints.

All-in-all, this is a perfect storm for lower implied-volatility across assets.

TERM STRUCTURE

(March 20th, 2022 - BTC’s Term Structure - Deribit)

Notice that term structure overtime.

BTC implied have flipped from Backwardation pre-FOMC to Contango post-FOMC.

We’ve seen about a 10pts - 5 pts drop in IV, along the curve, week-over-week.

Given that other asset class volatility (oil, gold, stocks) are seeing a repricing lower, we think that short-term options will likely see a drop lower in IV.

Especially given the context of FOMC and executive orders being now behind us.

SKEWS

(March 20th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

As implied volatility dropped lower, puts saw the brunt of the vol. selling.

This has caused skew to re-price higher, finally honing in on the zero-line.

We now have an almost symmetric skew.

We continue to believe long-term options, especially calls, to be rather cheap and attractive.

Diagonal calls structures (long the otm far-dated, short the near money short-dated) are interesting in this environment.

(March 20th, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

The echo of last week's big trades were present in the open interest profile: the $34k-$42k strangle - unfortunately for the buyer - ended up worthless, with the settlement at $40.5k and a tough gamma scalping environment.

Except for the prize given out to $38k call holders, the week was pretty stingy.

(Mar 18th, 2022 - BTC Notional - Deribit)

(Mar 18th, 2022 - BTC Dollar premium - Deribit)

BIG TRADES IN THE FLOW

(Mar 14th-20th, 2022 - Options scanner BTC - Deribit)

The week of the FOMC meeting started off with a bang, with a put spread sold in the April 29th exp. with strikes of $34k-$30k. The trader hedged the position, neutralizing delta and betting on a softening of the volatility. Spot on!

The day of the meeting, gamma was bought relentlessly; but from 6pm on, something changed and the flow began to sell positions.

The calendar on strike $42k - which shortened the spread on March 18th-25th - was very smart.

In the following days, while the unloading of very short-term positions continued, the flow saw increasing exposures on April $42k and June $50k.

Also of note, above is a short butterfly that ended up trading 1000x.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 20th, 2022 - BTC Premium Traded - Deribit)

(March 20th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (14 Mar - 20 Mar)

The highest block-trading volume was on Thursday, 17 March with $544mil traded, a day after the FOMC meeting. Block trades accounted for 50.8% and 47.2% of exchange volume in BTC and ETH on that day!🔥 (https://paradigm.co/stats)

7-day ATM IV traded to a high of 88IV prior to FOMC, before trending lower to 63IV to end the week. Vols sold off after FOMC, and we could expect continued downward pressure as realized vol is still under-performing the implieds.

BTC options volumes were concentrated in the 29 Apr 30000 & 34000 puts (3137.5x & 3337.5x traded), and 40000 & 42000 Calls. 25 Mar and 1 Apr were the favored tenors in Calls.

(14 Mar - 20 Mar - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

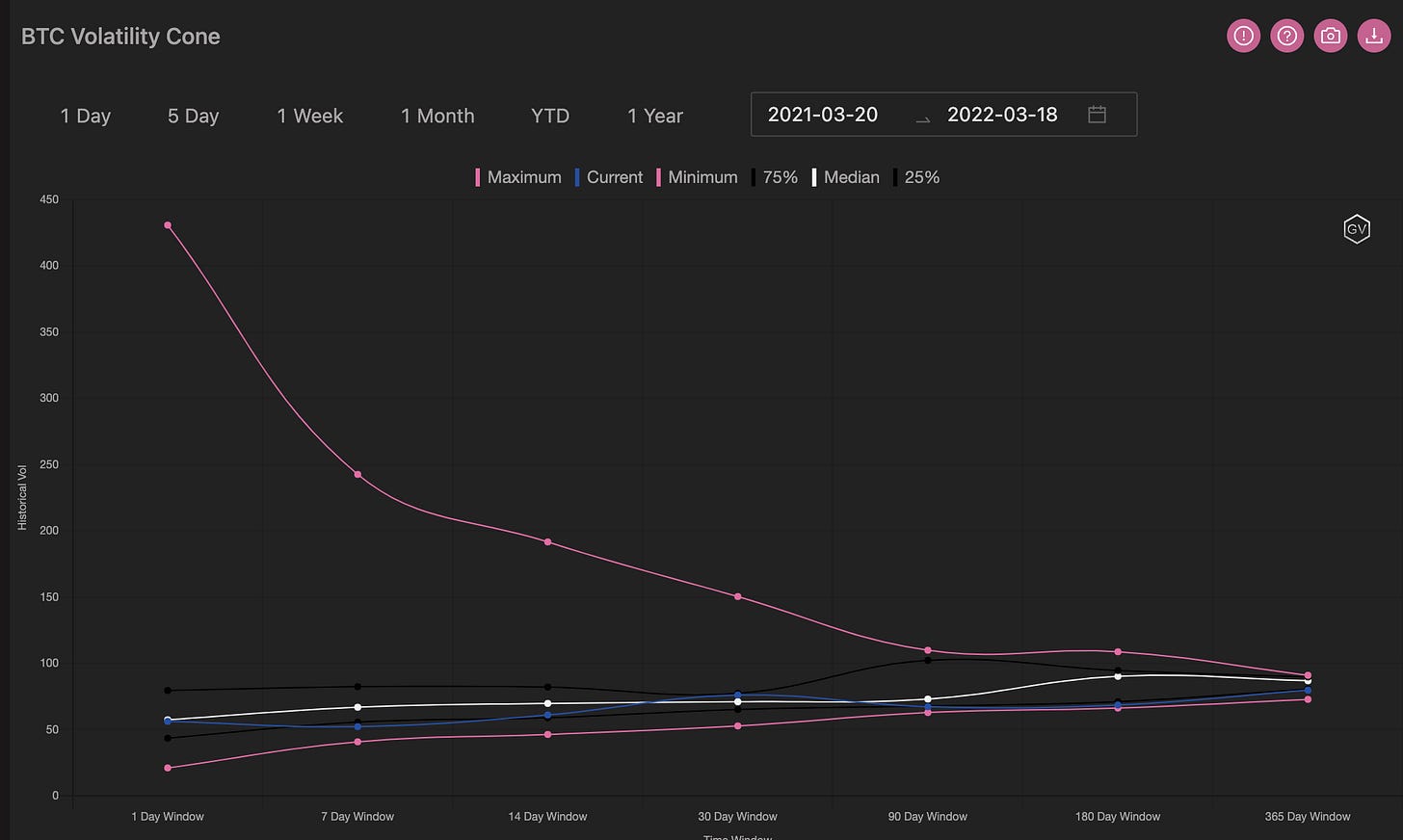

VOLATILITY CONE

(March 20th, 2022 - BTC’s Volatility Cone)

Realized volatility is now back near the lower 25th percentile for 7-day and 14-day measurements.

We expect RV to be rather quiet in the near term.

Even with the Russia/Ukraine context, the market is now kind of aware and less likely to be surprised into higher volatility.

Any positive developments around the Ukrainian invasion could, however, send volatility lower.

REALIZED & IMPLIED

(March 20th - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV and IV are about equal.

We expect both (in the short-term) to reprice lower around levels seen around mid-February.

$2,869

DVOL: Deribit’s volatility index

(1 month, hourly)

TERM STRUCTURE

(March 20th, 2022 - ETH’s Term Structure - Deribit)

ETH IV also dropped post-FOMC, but the term structure hit an even steeper Contango structure.

We can see that short-term IV dropped nearly 15pts week-over-week, while long-term IV dropped about 5pts.

Although we expect RV to quiet down in the near term, 65% 7-day IV is probably a good buy for Ethereum.

SKEWS

(March 20th, 2022 - ETH’s Skews - Deribit)

Options skew is holding a slightly more bearish tone compared to BTC.

Nearly all option skews are clustered around the -6pts mark, although they rallied nearly 10pts week-over-week as traders sold puts post-FOMC.

We’d expect skew to continue up to the zero line, especially if things continue to cool down.

(March 20th, 2022 - ETH’s Skews - Deribit)

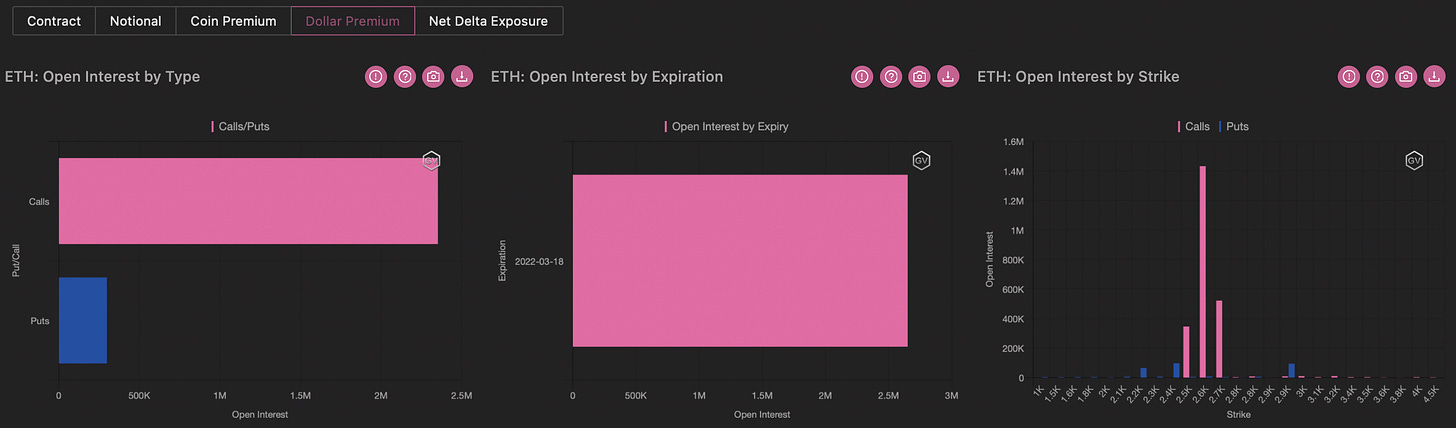

Open Interest - @fb_gravitysucks

ETH

For Ethereum, the puts purchased at the beginning of last week marked the open interest profile.

The strike $2.2k outclassed all other ones, expiring worthless and leaving the prize distributed at a handful of dollars in calls at strikes $2.5k-$2.7k

(Mar 18th, 2022 - ETH Notional - Deribit)

(Mar 18th, 2022 - ETH Dollar premium - Deribit)

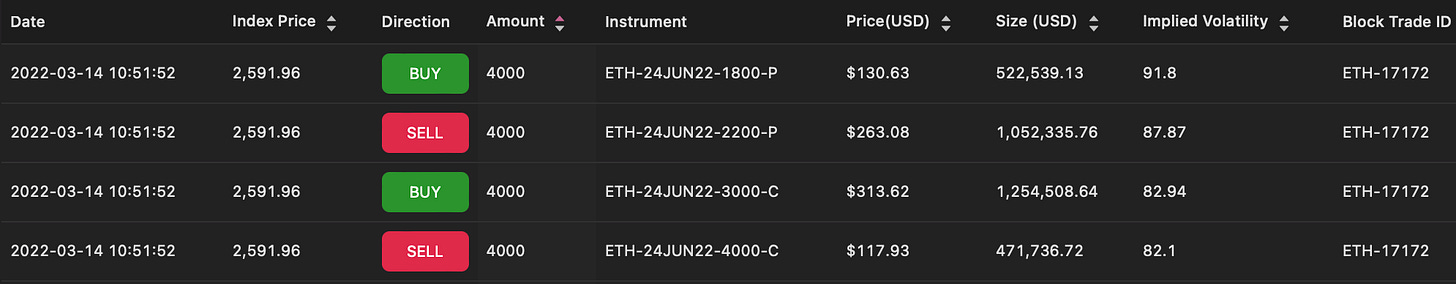

BIG TRADES IN THE FLOW

(Mar 14th-20th, 2022 - Options scanner ETH - Deribit)

On Monday, a buyer bought a call spread for June $3k-$4k financed by a sale of a put spread. However, it should be emphasized that these multi-leg strategies could partially close existing positions, thus giving only a partial reading of the trader's true intentions.

Also, on Thursday, another 4-leg trade was noticed, this time an iron condor. Here too, the same considerations as above apply.

The remainder of the post-FOMC week saw a substantial drain of $3k call positions on March 25th and a renewal of protection with flow of puts bought in strikes $2.1k- $2.2k-$2.4k for April 29 and 18000x $2.6k for April 8th.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

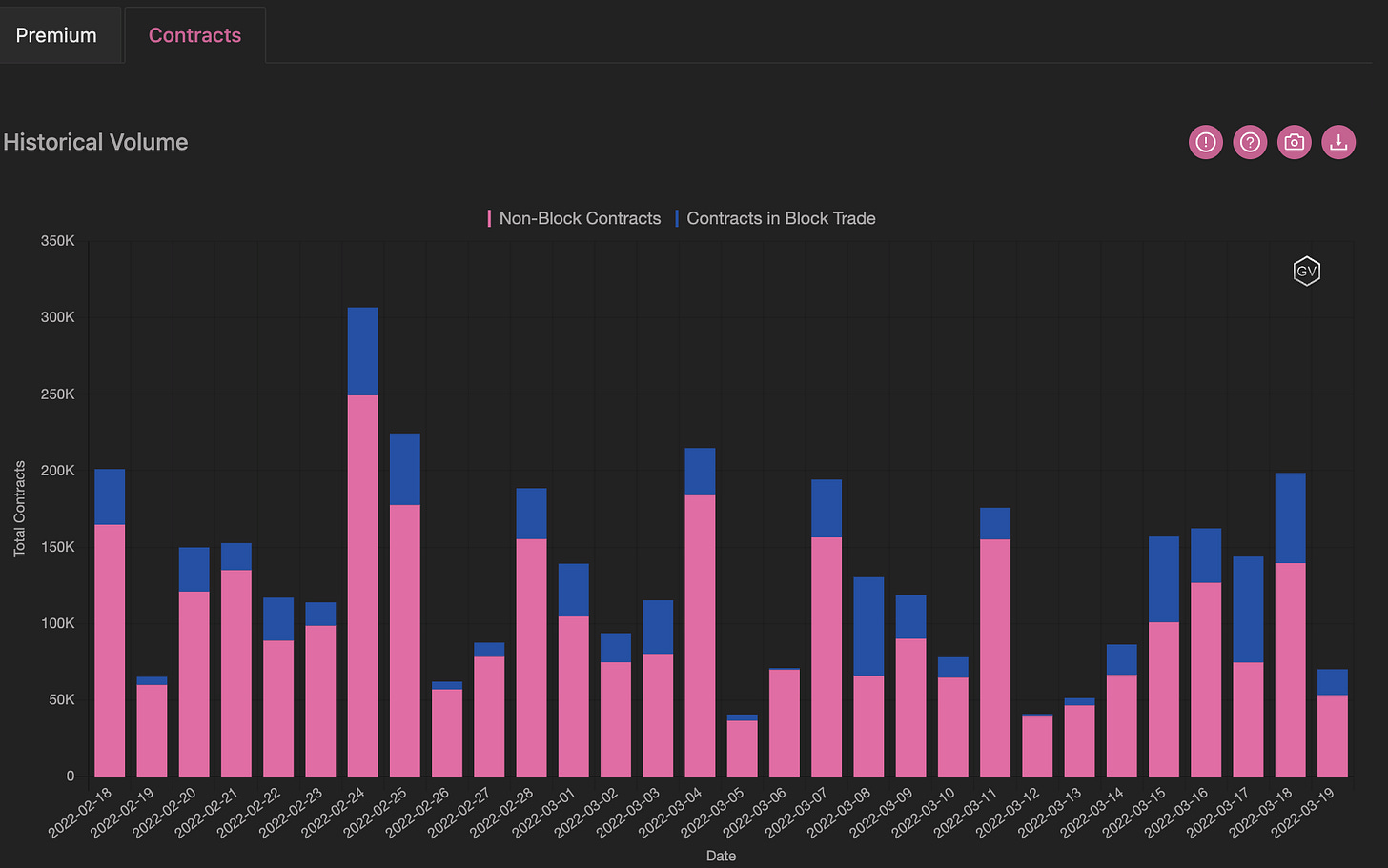

VOLUME

(March 20th, 2022 - ETH’s Premium Traded - Deribit)

(March 20th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (14 Mar - 20 Mar)

ETH IVs also fell from 90 to 70 levels after FOMC on risk-on sentiments. Skews in both BTC and ETH are telling a consistent story this week, as both traded higher (albeit still at negative levels) after FOMC.

Put-call ratio in ETH is 0.94, where we saw hedging activities in Puts. Puts interest were well spread-out across 1500 to 2600 strikes. Volumes in Calls were more concentrated in the 3000 (~46k contracts traded) and 4000 strikes (~29k contracts).

(14 Mar - 20 Mar - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

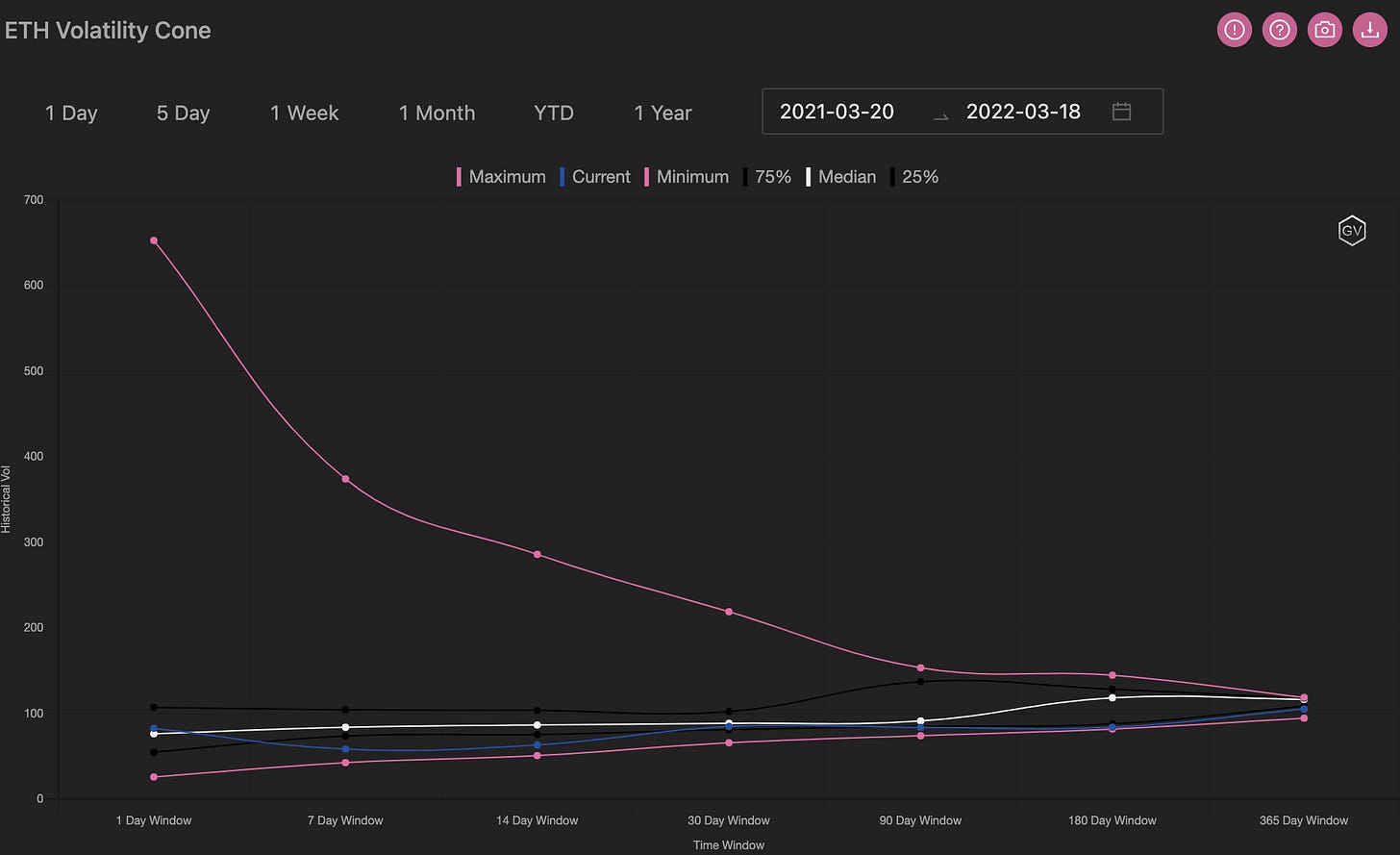

VOLATILITY CONE

(March 20th, 2022 - ETH’s Volatility Cone)

Realized Volatility has softened significantly.

The 7-day and 14-day measurement windows are now “BELOW” the 25th percentile and near the minimum line.

Due to volatility clustering and the passage of significant events, we’d expect RV to remain low for the next few weeks.

REALIZED & IMPLIED

(March 20th, ‘22 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

RV has a slight lead on IV as both head lower.

We are torn between short-term volatility and long-term volatility.

We expect short-term IV to drop while long-term IV is likely too cheap, especially for ∆25 calls.