Crypto Options Analytics, March 14th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

We are extremely pleased to collaborate with DeFi option-protocol Opyn.

GVol is providing CeFi option-analytics directly into the Opyn UI, for quick reference pricing for DeFi option traders.

Crypto Derivatives Roundtable

We were extremely happy to moderate the Crypto Derivates Roundtable. This was an awesome and informative event.

You can view the recorded version here.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Can’t stop, won’t stop!

The Bitcoin rally of magnificent proportions continues.

SKEWS

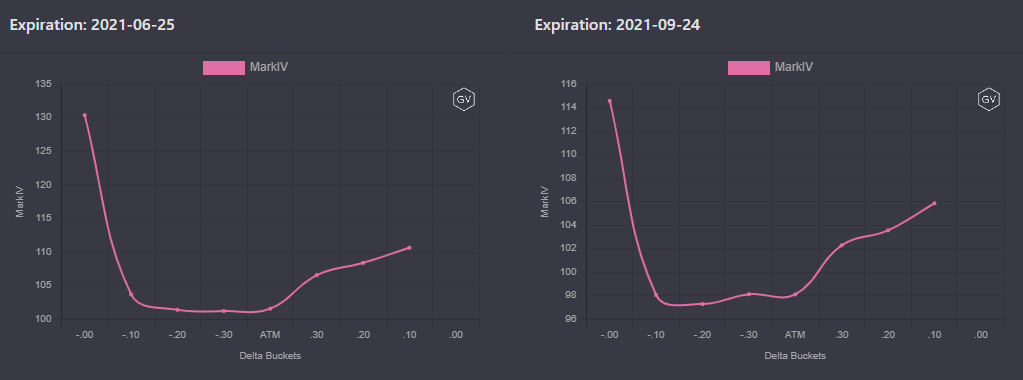

(March 14th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Skews have become much more positive as of late, as the Bitcoin rally entices traders to pay more for call-options versus put-options.

Short-term and medium-term options have nearly identical put and call “tails”, as measured by implied-volatilities. This indicates that the option markets are pricing extreme moves equally between higher prices and lower prices.

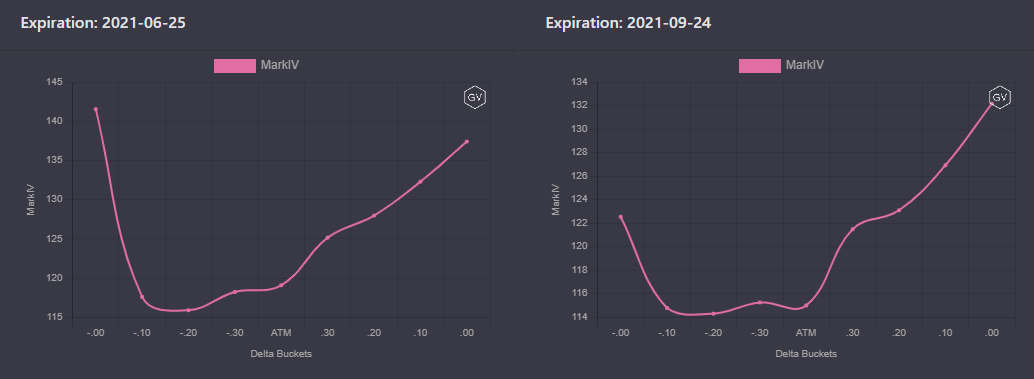

(March 14th, 2021 - Long-Dated BTC Skews - Deribit)

The longer-term-options have expensive put “tails”, although for long-dated options, the wings aren’t much more expensive than the belly.

TERM STRUCTURE

(March 14th, 2021 - BTC Term Structure - Deribit)

There has been absolutely NO CHANGE in the term structure.

Overall implied-volatility levels remain the same.

June-expiration continues to be the most expensive and the overall term structure carries a hump-shape as a side-effect.

ATM/SKEW

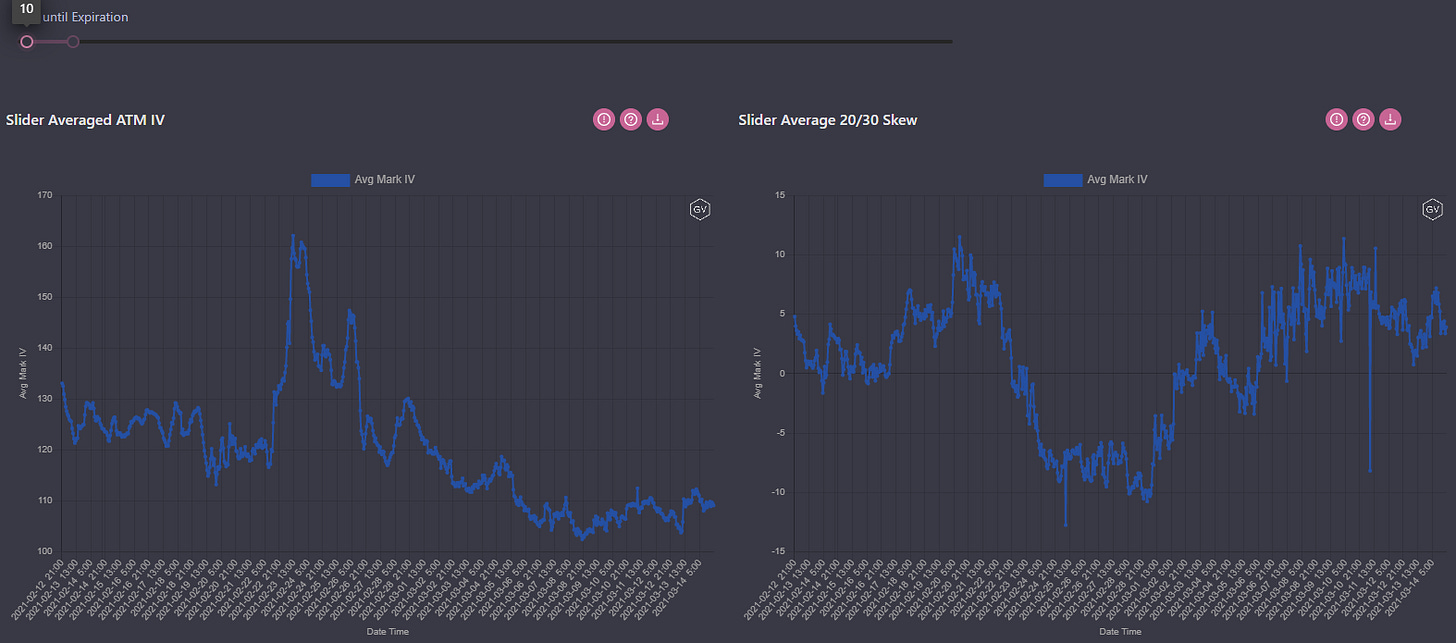

(March 14th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

Notice that ATM implied-volatilities continue to be bound in a tight range…

The only significant shift has been in the option skew. Call-options are being priced higher as traders continue to be enticed by higher Bitcoin spot-prices.

VOLUME

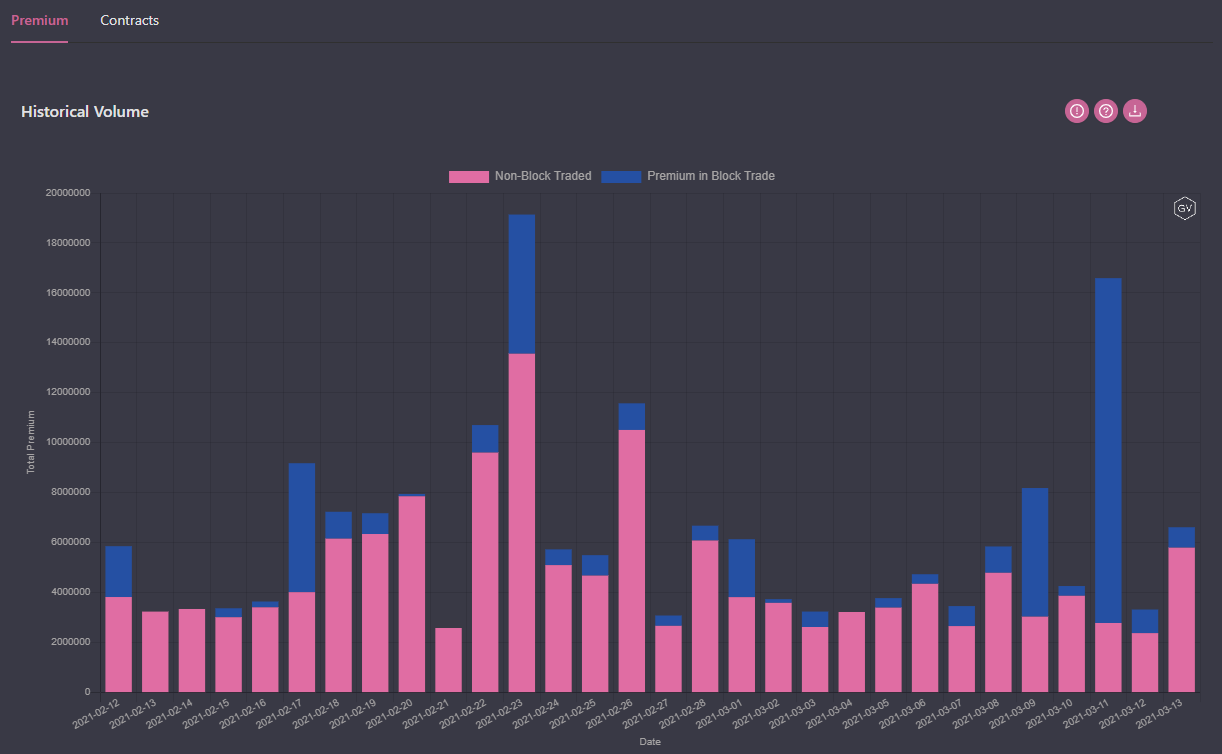

(March 14th, 2021 - BTC Premium Traded - Deribit)

(March 14th, 2021 - BTC Contracts Traded - Deribit)

Volumes — as measured by premiums traded — saw a significant uptick in the past week.

We are pleased to see option-market participation resume with new Bitcoin ATH’s.

Paradigm continues to see active block-trading-activity nearly everyday — accounting for a significant portion of the volume seen on Deribit.

VOLATILITY CONE

(March 14th, 2021 - BTC’s Volatility Cone)

Realized-volatility is holding firm.

We continue to hold above the 75th percentile across all the measurement windows.

REALIZED & IMPLIED

(March 14th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol. - Deribit)

Although it seems that RV and IV keep flipping between premiums and discounts to each other, overall it looks like volatility is currently in equilibrium.

As the market-rally becomes ever-more extended, traders are likely going to be willing to pay for optionality, given the prospect of sharp market corrections.

SKEWS

(March 14th, 2021 - ETH Skews - Deribit)

While Bitcoin skews became more positive for short-term and medium-term options, ETH skews have remained about the same.

Skews become more positive as expirations are extended, but the shorter-date options mirror a more symmetrical shape.

(March 14th, 2021 - ETH Skews - Deribit)

There is a strong call-appetite for long-dated expirations.

TERM STRUCTURE

(March 14th, 2021 - ETH Term Structure - Deribit)

The ETH term-structure has nearly the same shape as last week, with only a few points of IV being shaved off.

We see, here again, that June-expiration remains the most attractive options for selling, given the humped term-structure.

ATM/SKEW

(March 14th, 2021 - ETH ATM & Skews for options 10-60 days out - Deribit)

Notice that ATM IV and skew have been tightly range-bound over the past week.

We also notice that ETH spot-prices haven’t been exhibiting quite the same momentum as Bitcoin spot-prices.

VOLUME

(March 14th, 2021 - ETH Premium Traded - Deribit)

(March 14th, 2021 - ETH Contracts Traded - Deribit)

There was a large amount of block paper going through on 3/11.

This trading activity was due to deep ITM call-diagonals between June 320C and Dec 360C, likely a synthetic futures’ basis trade.

VOLATILITY CONE

(March 14th, 2021 - ETH Volatility Cone)

Like Bitcoin, we see a consistent realized-volatility above the 75th percentile for ETH realized-volatility.

REALIZED & IMPLIED

(March 14th, 2021 - ETH 10-day Realized -, and Trade-Weighted-, Implied-Vol. - Deribit)

Again, we believe overall volatility remains at equilibrium, despite the frequent IV/RV discount/premium flipping.