Crypto Options Analytics, March 13th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$38,797

DVOL: Deribit’s volatility index

(1 month, hourly)

Bitcoin implied volatility has lagged behind commodity asset classes since the start of the Ukraine invasion.

You’ll notice that equity IV, gold IV and oil IV have all managed to nearly double while BTC IV has only increased about 25%.

One could argue that BTC volatility wouldn’t be directly impacted by geopolitical developments in quite the same way as, say, oil.

We believe that there is the potential for BTC volatility due to risk asset correlation, gold like BTC value propositions and sanction evasion demand flows.

TERM STRUCTURE

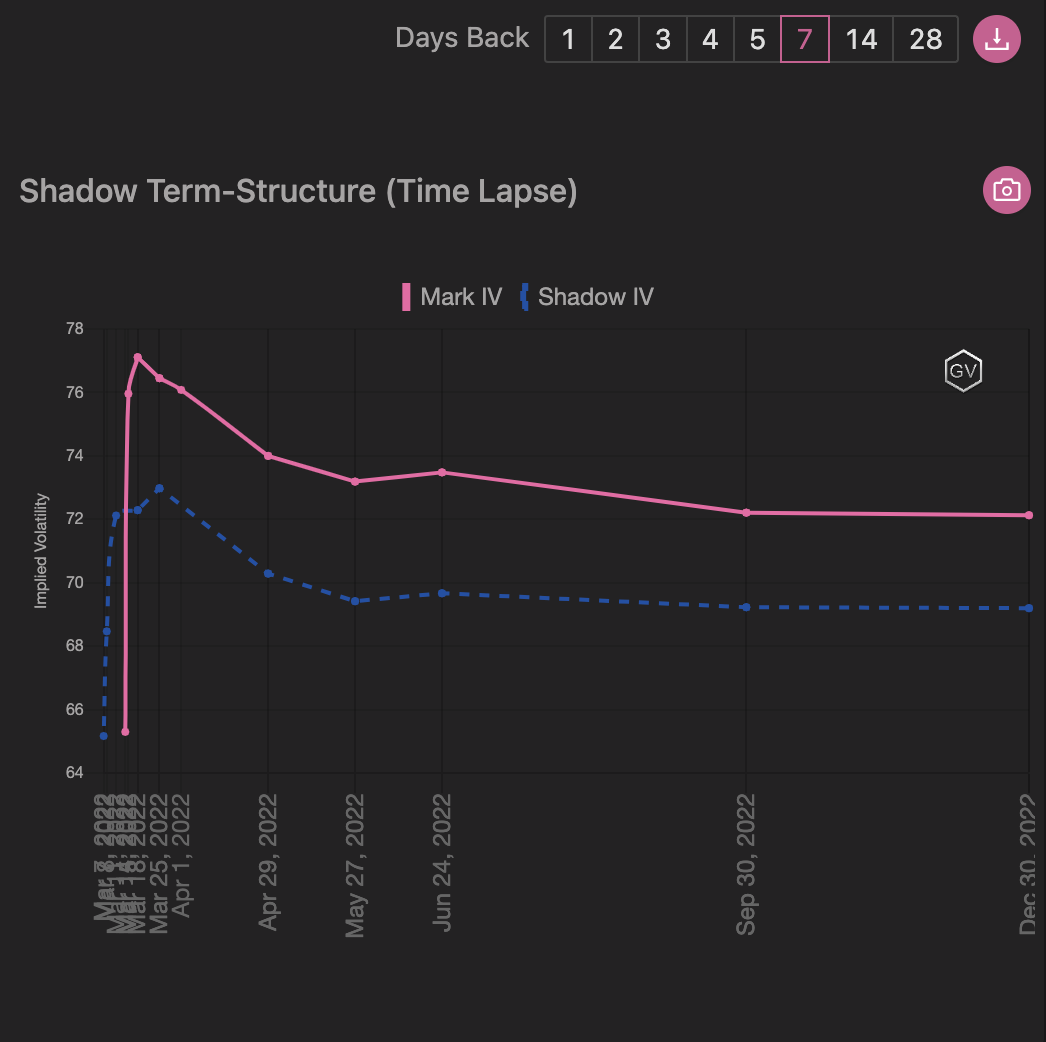

(March 13th, 2022 - BTC’s Term Structure - Deribit)

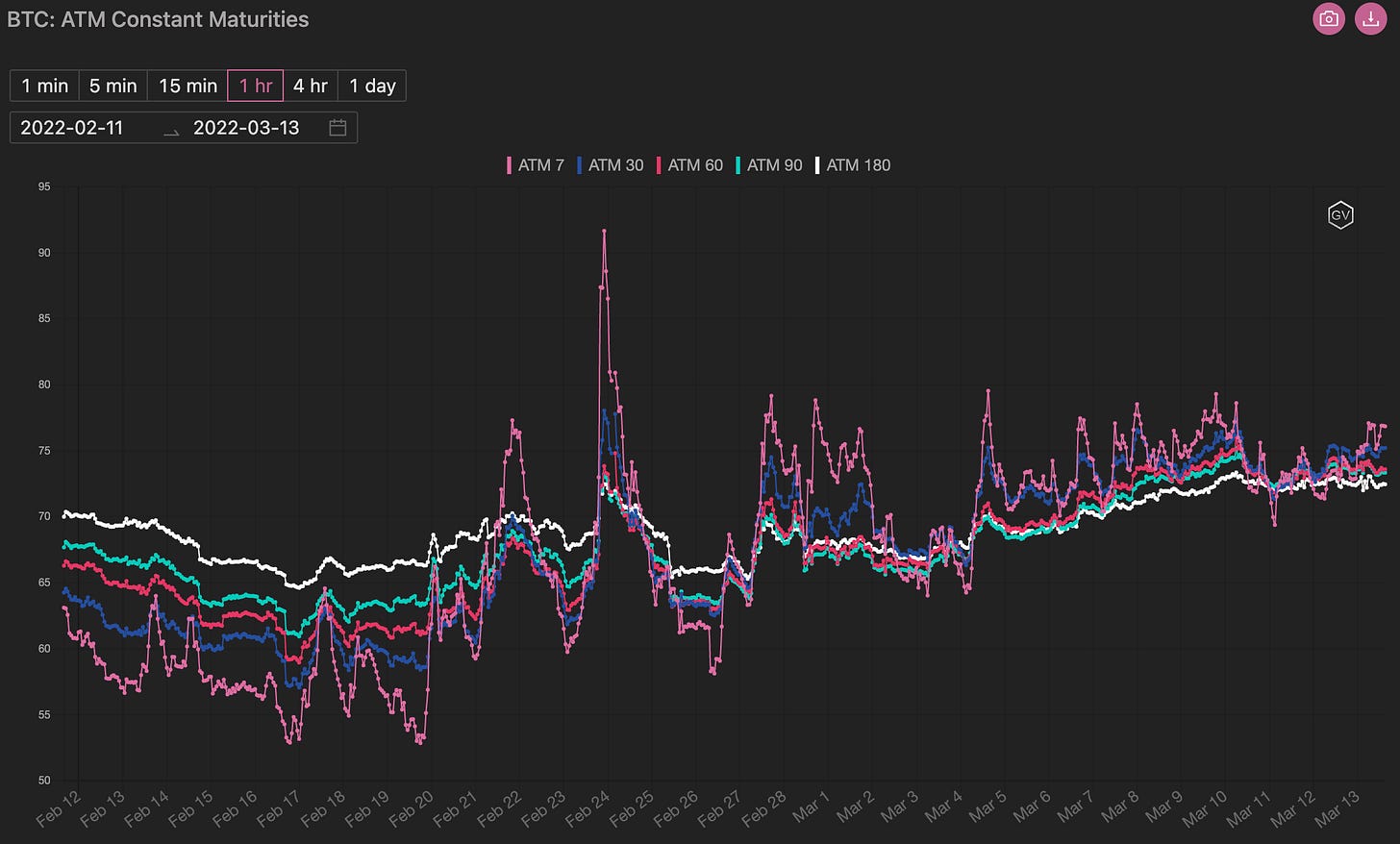

Although BTC IV is lagging TradFi counterparts, week-over-week, the term structure has managed to increase +5pts.

It’s also worth noting that there is a persistence in the term structure to remain flat or Backwardated in the last 30-days.

The type of term structure reflects strong demand for short-term options, as traders hedge immediate “surprise risk”.

SKEWS

(March 13th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Implied volatility skew had a modest rise higher - about +4pts- for short-term options, as the release of executive orders this week were received as bullish.

The administration showed a constructive approach to crypto-currencies, with a desire to keep the US as a market leader.

Notice the +5,000 point rally in BTC.

This type of activity, with a subsequent reversal, justifies the demand for short-term options. Gamma paid.

On another note, the quick fade of the BTC price rally doesn’t bode well for long BTC.

Should BTC break $35k, the next logical price support is around $30k.

(March 13th, 2022 - Long-Dated BTC Skews - Deribit)

Long-term skew has had a jump higher over the weekend.

Historically, 180-day skew (in white) is almost never negative; long-term bulls could take advantage of the cheap skew to pick-up BTC deltas, using a favorable IV structure.

Open Interest - @fb_gravitysucks

BTC

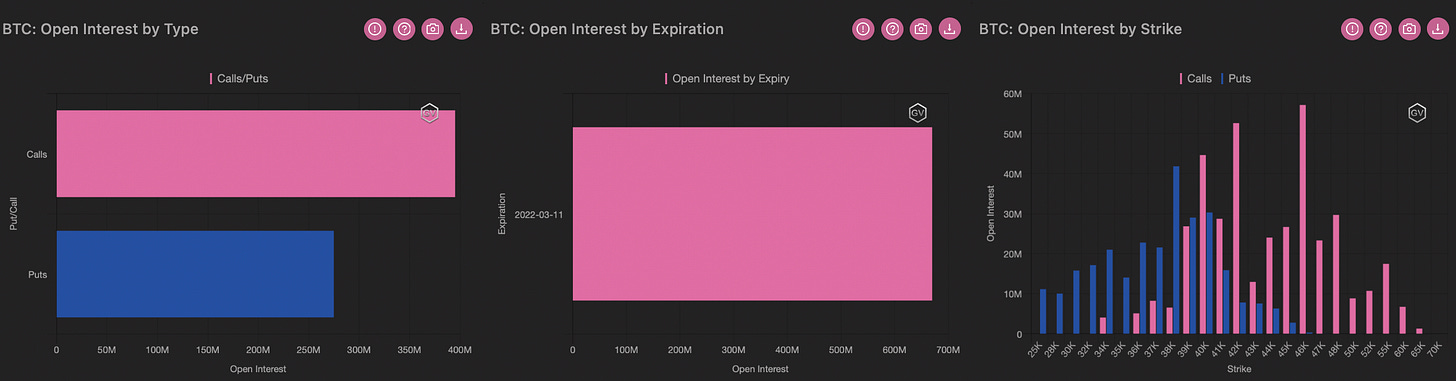

With a distributed premium of only ~$6M from $650M notional, the weekly deadline passed without much fanfare. A lower range price and market uncertainty did the rest.

The open interest profile highlights, if ever there was a need, which are the levels followed by the traders: $38k support and $46 resistance.

(Mar 11th, 2022 - BTC Notional - Deribit)

(Mar 11th, 2022 - BTC Dollar premium - Deribit)

BIG TRADES IN THE FLOW

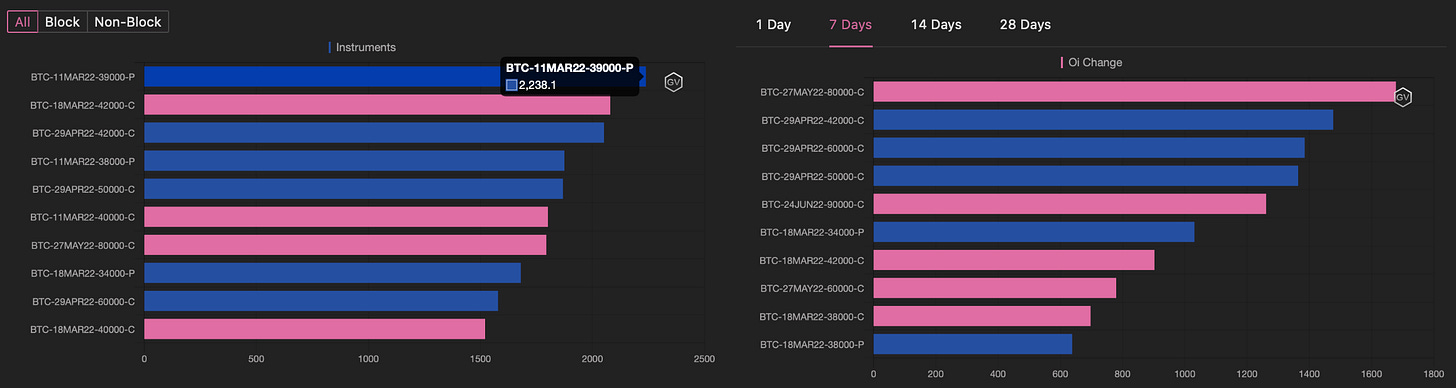

(Mar 7th-13th, 2022 - Options scanner BTC - Deribit)

The first few days of the week saw a gamma load on the March 18th maturity. Straddles around $38k and strangles around $34k-$42k were bought from traders speculating in short-term realized volatility.

In the mid-week, a more upward-oriented flow saw call spreads $42k-$50k in April and a diagonal calendar $60k-$80k April/May. The composition is bullish, with lightened premium and reduced theta/vega exposure. More nuanced trade of the week.

For the rest of the week, the tape was muted; a sign that uncertainty still prevails and is awaiting the meeting this Wednesday where the Fed is expected to announce a first hike in many years.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 13th, 2022 - BTC Premium Traded - Deribit)

(March 13th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (7 Mar - 13 Mar)

The early week run up to 42k in BTC was driven by the Executive Order, which demonstrates the USA's interest in fostering the innovation of digital assets. Inflation and war remain the key drivers of broader markets.

Feb CPI printed at 7.9% as expected, and the risk-aversion seeped into crypto as well. BTC couldn’t sustain the rally and retraced back below 40k by the end of the week. ETH underperformed and was rejected at 2700 levels as well.

Composition of block trades was exceptionally high on 8th March (BTC 43.3%, ETH 49.2%) and 9th March (BTC 48.6%, ETH 23.5%). We averaged daily volume of $480million!🔥 (https://paradigm.co/stats)

In BTC, Calls dominated the volume, as 67.7% of the options traded were Calls (20k contracts), with the majority traded at 40k strike, mainly in March expiries. However, the single highest volume was the 29Apr 42k Calls with 1880x traded.

BTC IV remained range-bound between 71-79 levels for the 7d ATMs, while the longer-ends traded tightly at 72 handle. 180d skew, however, ticked higher despite not seeing much trading volume, possibly due to weekend illiquidity.

(7 Mar - 13 Mar - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(March 13th, 2022 - BTC’s Volatility Cone)

Realized volatility is currently hovering above the median and near the upper 75th percentile for medium measurement windows.

This is not suprising, given the macro events seen this week:

+7.9% CPI print on Thursday

Biden EO

Russian Invasion developments

Next week, we expect crypto to remain calm until the FOMC announcement scheduled for 2pm ET on Wednesday.

REALIZED & IMPLIED

(March 13th - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV and IV are currently priced around 80% for 10-day windows.

Given the potential for ceasefire & aggressive (or lack of) rate hikes in the coming week, we are watching $35k and $45k as important levels, followed by $30k and $50k

$2,559

DVOL: Deribit’s volatility index

(1 month, hourly)

TERM STRUCTURE

(March 13th, 2022 - ETH’s Term Structure - Deribit)

ETH IV has gained +5pts this week and maintains a nearly flat term structure.

That said, 7-day IV saw a drop lower later in the week, possibly related to DOV auction supply.

We believe the vol. path for ETH differs from Bitcoin.

The value propositions from ETH seem less attractive in the current environment (geopolitical hedge and alternative currency), which could cap. “risk-haven” gains. Meaning that BTC seems like the gold-alternative, more-so than ETH.

SKEWS

(March 13th, 2022 - ETH’s Skews - Deribit)

(March 13th, 2022 - ETH’s Skews - Deribit)

A significant skew spread exists for ETH, not seen in BTC.

A short of skew Contango… Where short-term option skew is most negative, while long-date skew is less negative.

This could be related to potential ETH 2.0 and scaling solution optimism.

Open Interest - @fb_gravitysucks

ETH

If the expiration of Bitcoin was subdued, that of Ethereum was even more.

With a distributed premium of around $2.7M out of an open notional of $450M, it must have been a disappointing week for net buyers of the this expiration.

The most traded strikes were $2.4k and $3.1k, clearly defining the price range between support and resistance.

(Mar 11th, 2022 - ETH Notional - Deribit)

(Mar 11th, 2022 - ETH Dollar premium - Deribit)

BIG TRADES IN THE FLOW

(Mar 7th-13th, 2022 - Options scanner ETH - Deribit)

The week began and ended with "same" trade: on-screen purchases of puts in $2.2k strike. Monday focused on 18th March, and Saturday on 1st April expirations.

It should be emphasized that the latter - due to the low market volumes and the type of execution-led to a lifting of the entire curve and a simultaneous impact on the other maturities. Beyond this, the $3k calls for March 25th had decent volume.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(March 13th, 2022 - ETH’s Premium Traded - Deribit)

(March 13th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (7 Mar - 13 Mar)

The Put-Call ratio was more evenly distributed in ETH at 0.69 (59% traded were Calls). Interest in ETH was more concentrated in specific strikes, with 18Mar 2200p trading 23,750x, and 25Mar 3000c trading 22,824x.

ETH ATM IVs traded lower as well, from 90 levels at the start of the week, to lows of 78 IVs. 25delta skew across tenors traded lower from -2 to -5 too. This divergence in skew between BTC and ETH is mainly driven by the 18Mar 2200p activity, and suggests greater protection buying.

(7 Mar - 13 Mar - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(March 13th, 2022 - ETH’s Volatility Cone)

ETH realized volatility is lack-luster.

We’re seeing measurements between the median and lower 25th percentile.

Due to the importance of macro in the current trading regime, ETH is taking a backseat to BTC.

REALIZED & IMPLIED

(March 13th, ‘22 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Both IV and RV are headed lower on the week.

RV is leading IV lower by a small margin.

Again, macro flows will likely be focused around BTC rather than ETH, especially for upside “gold-like” demand.