Crypto Options Analytics: June 8th, 2025

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

Wednesday 8:30a- CPI

Thursday 8:30a - PPI

Friday 10a - Consumer Sentiment

MACRO

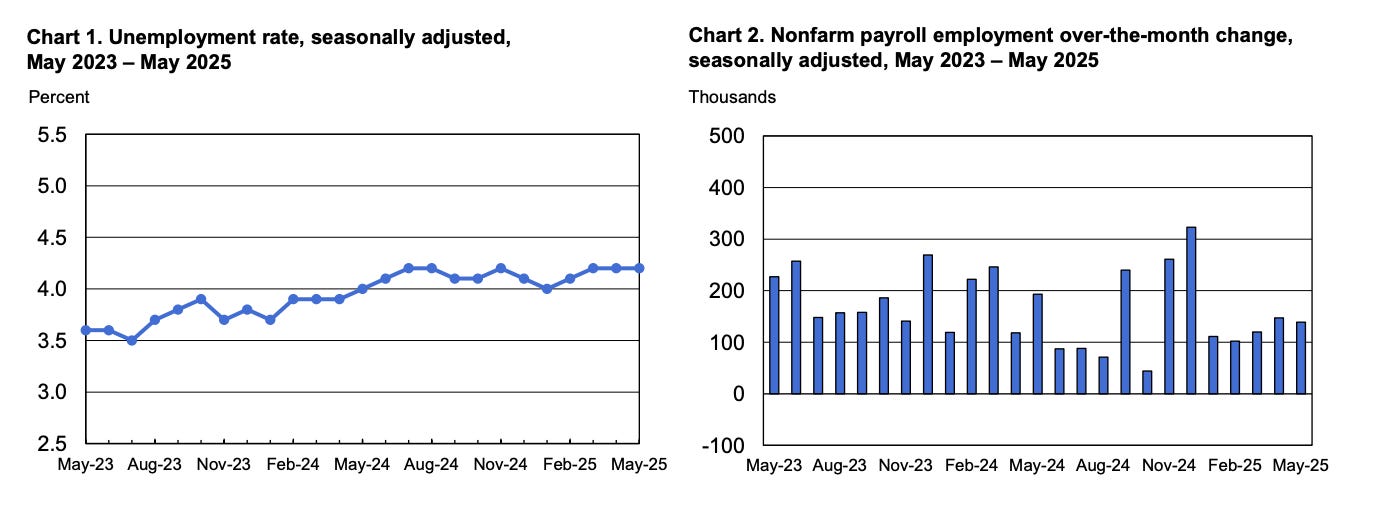

The big number last week was the NFP report released Friday. Jobs came in stronger than expected at +139k for May (vs +125 expected). Report here.

This was a decent surprise after Wednesday’s ADP jobs number (private payroll) was weaker than expected, the weakest in two years, coming in at +37k versus +110k expected.

Overall this was a bit of a mixed report for jobs, but helps guide the Fed to lean towards lower rates should inflation continue to remain tame.

Inflation has been tame for the most recent readings, another good inflation report this upcoming week (CPI Wednesday and PPI Thursday) could solidify the argument for rates to finally be brought down.

Another major event this week was the block-buster Circle (USDC) IPO. What a monster event! After being set to open at a $31 IPO price, the market didn’t start trading until $64 and closed Friday’s session at $107… Even $115 in after hours trading.

I can’t help but view the reaction to CRCL as very bullish for the space, especially from a regulatory point-of-view.

Right now, the US Treasury market is sorely in need of buyers as foreign money remains uncertain. CRCL’s business model is to issue USD Stable coins, backed one-to-one, and using the dollar collateral to invest in US Treasury paper.

There’s likely going to be collaborative treatment from the administration for this business model.

Outside of these macro events geopolitical risk, tariff wars and domestic turbulence (Thinking LA stuff, which could also spark a trade war negotiation spiff) remain hard to for-see wild cards.

BTC: $106,134 (+1.1% / 7-day)

ETH :$2,534 (+0.1% / 7-day)

SOL :$154.39 (—1.1% / 7-day)

Crypto

To me, the bullish Bitcoin trend remains un-damaged, despite the recent pull-back.

Volatility is under-performing, but I could see a slow (and consistent) grind higher in prices.

The fundamental picture remains strong in my mind. The high performing CRCL IPO, the USD trend lower (and continued downside risk) the collaborative regulatory backdrop. All are reasons for continued market participation into a steady bullish market.

I almost forgot to add the Coinbase Acquisition of Deribit (the biggest crypto acquisition to date) in the above list.

As the market environment continues to be friendly there’s an interesting trading opportunity coming up soon around the a “Spot ETH Staking ETF” (Solano too).

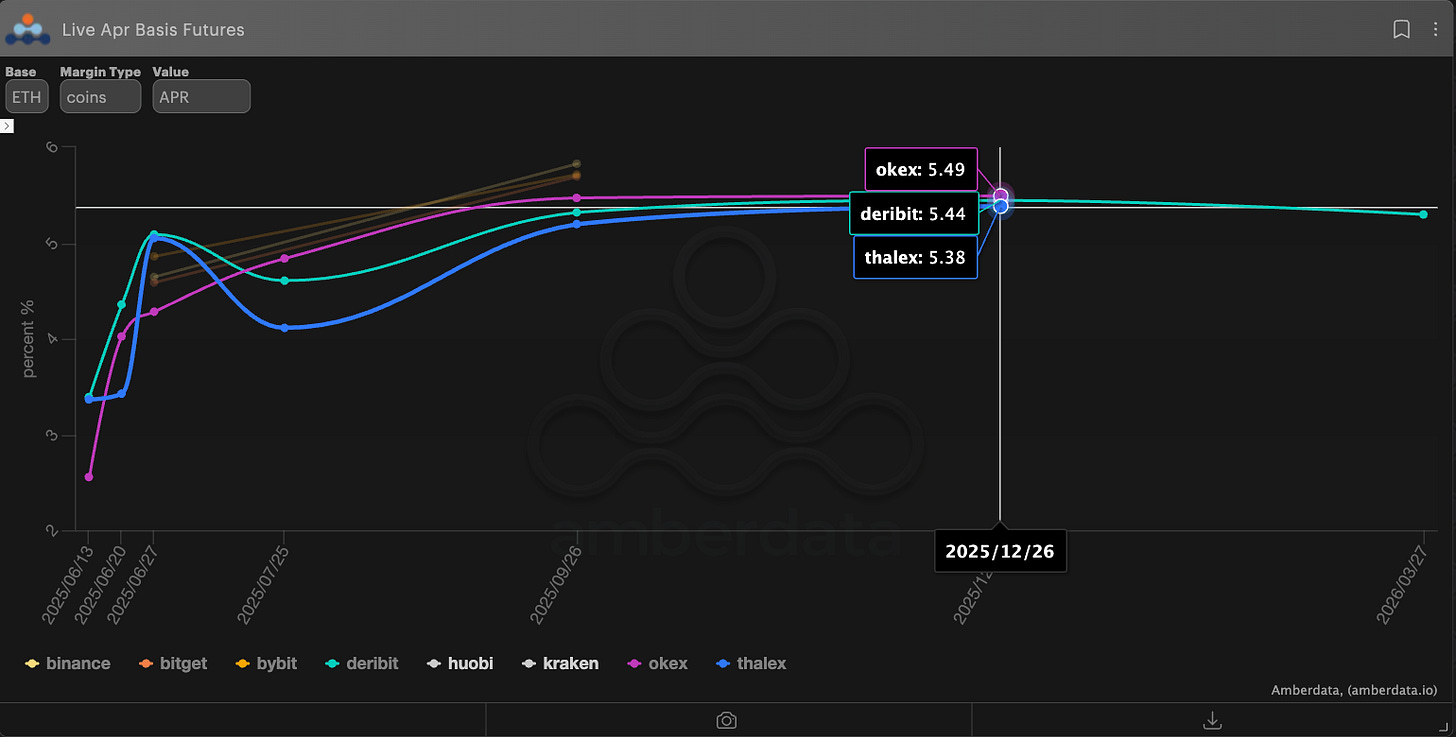

Not only would staking rewards appear as an interesting catalyst for institutional investors to “buy-hold” the assets, but the futures market is currently pricing a nearly identical futures basis between ETH and BTC.

Currently the basis differential sits around 1%, but ETH staking rewards are about 3%.

In an efficient world, I’d expect the delta-neutral basis trade for both to be equal after staking rewards (meaning the ETH futures basis seems high) if traders can simply buy the Spot ETF and sell CME futures against their delta exposure.

We can already see this truth being priced into the perpetual markets on Deribit between BTC and ETH.

YTD, total funding costs for BTC positions is about 2% more than ETH total funding costs (or 4% annualized).

This creates an intersting trade in the fixed-for-floating space as well. Sell the ETH Future, buy the ETH-Perp.

(https://www.rho.trading/ has these types of markets on-chain)

These are my thoughts and ideas for now, beyond delta exposure.

BTC

ETH

Derive Pro set to go live Thursday this week!

Borrow rate on Derive now 4%, one of the lowest in DeFi

BTC OI remains heavily skewed to calls as traders buy up cheap leverage with vol at yearly lows! Similarly, traders are buying up cheap ETH calls!

Skew remains positive for both ETH and BTC as a consequence, possibly indicating a bullish start to Q3.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.