Crypto Options Analytics, June 5th, 2022

CPI Friday, FOMC in a couple weeks.... sideways while we wait...

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

Weekly Theme - SIDEWAYS but watch for CPI Friday 8:30 ET

Last week’s price action started strong, thin holiday markets likely helping, but the rally was quickly smashed back down.

This makes me believe we have a market “unwilling” to move higher, establishing well-defined boundaries to the upside and downside.

Think $28k-$32.5k; markets could “drift” to these levels.

A surprise FOMC action in a couple weeks could break the lower support, but without that surprise, it’s best to assume that spot prices remain sideways, while using the clear boundaries as levels.

(WSJ - NFP “Payrolls” 8:30 am ET)

Last week, on Friday, we had non-farm payrolls come in.

The 390k jobs added were less than the 500k (12-month average) but unemployment held strong at 3.6% DESPITE a 330k increase in labor force participation.

Nothing here is market moving.

The next rate hikes for FOMC are expected to be 50bps in June and July.

The “perfect” setup would be a drift lower in BTC to around $28k, IV rise pre-FOMC, 50bps hike… sell post FOMC IV…with the expectation that markets chill and drift back to the $30k zone.

Friday’s CPI number will likely be a non-surprise. Given that core-CPI has been driven mostly by housing (owner’s equivalent rent) and that last week’s house sales dropped… the housing prices are likely not going to surge to the upside (at least that’s my base-case scenario).

$29,934 + 2.6% $1,810 +0.89% $39.63 -10.84%

DVOL: Deribit’s volatility index

BTC - (1 year w/ spot line chart)

TERM STRUCTURE

(June 5th, 2022 - BTC’s Term Structure - Deribit)

BTC (gvol.io)

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

Although the relief rally was short-lived in spot prices last week, the associated drop in IV was there.

The term structure assumed an even more pronounced Contango shape, with the front-end options getting hit especially hard.

This week -being a “wait and see” week - is primed for vol. selling… the Contango “roll-down” will help Theta decay.

Clear “stop” boundaries are available with $28k as a price point.

SOL is an interesting coin here, given that SOL has continued to experience chain outages… The latest was a 4hr outage last week.

This is a very unique risk that keeps affecting Solana, undermining its dApp ecosystem. That said, I still like SOL.

In my experience, the death knell for a crypto isn’t code hiccups, which cause price spikes lower, but an “apathy” from developers and a slow fade away.

Luna and Bitconnect are examples of big prices spikes to zero (scam coins)… but many of the other coins, instead, slowly asymptote to $0 as people stop caring for them and working on them.

I don’t think these fates will be destined for SOL.

SKEWS

(June 5th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Put skew “relaxed” this week.

The early “relief rally” brought skew higher as traders sold puts, but the reversal in spot prices threw skew back lower only briefly.

I find this option activity encouraging for the “sideways” theme this week.

Instead of skew returning right back to last week’s levels as $30k spot failed to hold, the option market felt more confident, selling puts, and ended up closing the skew on weekly highs… despite a nearly unchanged week for spot.

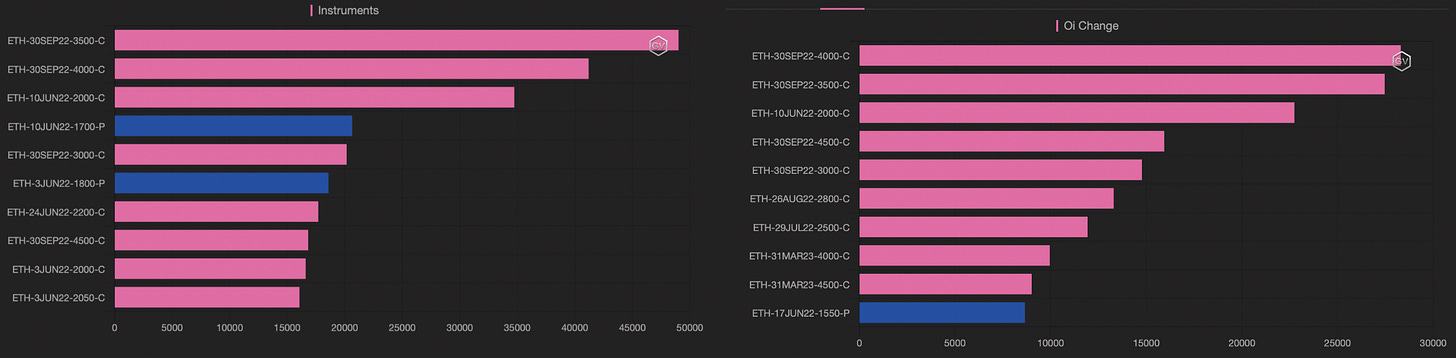

Open Interest - @fb_gravitysucks

WEEKLY EXPIRY

First weekly in June with 25k contracts, of which 87% expired worthless, for Bitcoin, and 270k contracts, of which 90% expired worthless, for Ethereum.

The open interest profile shows calls bought with index above $31k/$1.9k and the “defensive wall” of puts.

(June 3rd, 2022 - BTC/ETH Notional - Deribit)

BIG TRADES IN THE FLOW

The first week of June saw moderate volumes, questioning the expectations of the market on the resolution of index price action uncertainty in June.

(30th May- 5th Jun, 2022 - Options scanner - Volumes and OI change - Deribit)

Among the Bitcoin trades to report, buying $32k calls (at the average price of $30.3k), a call fly $36k/$38k/$40k and buying $30k put on July.

Ethereum, for its part, saw the usual narrow call spreads in September and the sale of $2k calls for June 10th.

VOLUME

(June 5th, 2022 - BTC Premium Traded - Deribit)

(June 5th, 2022 - BTC’s Contracts Traded - Deribit)

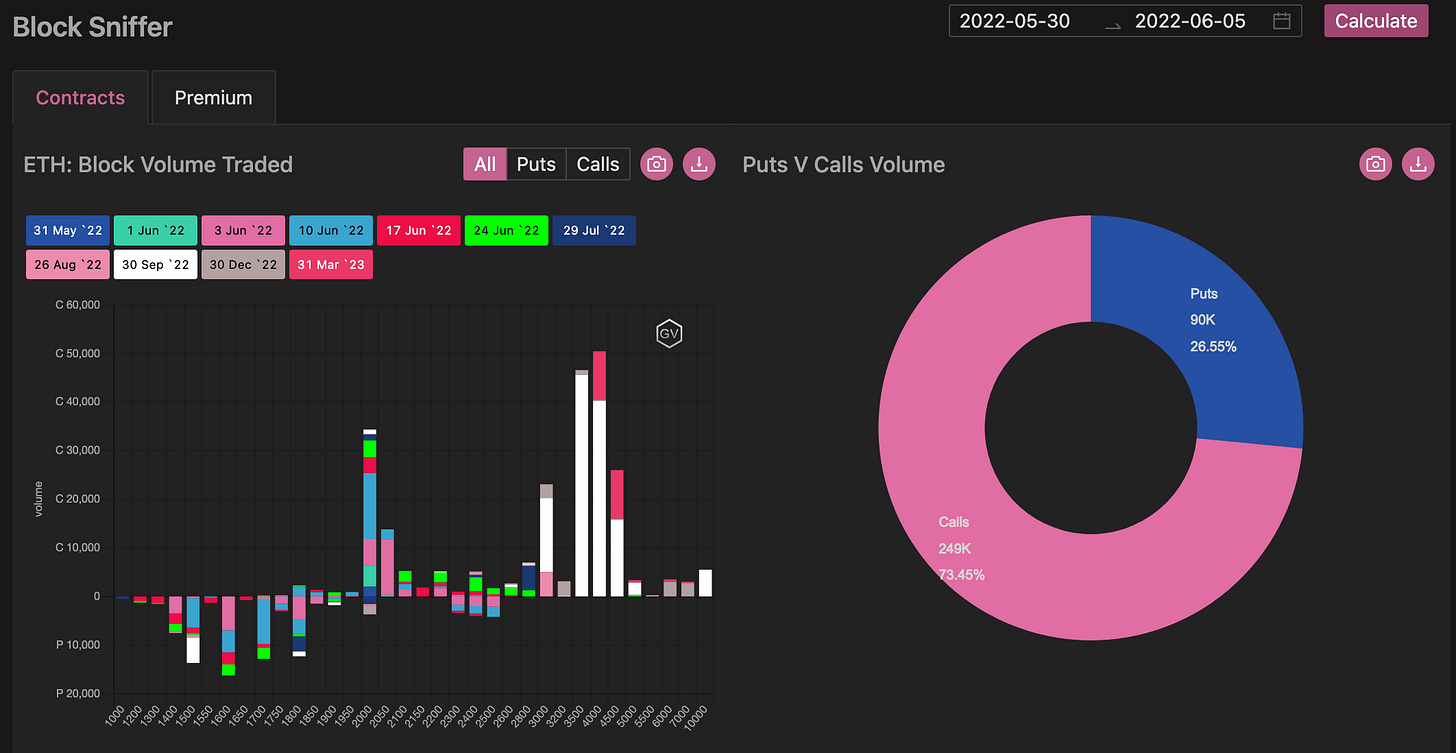

Paradigm Block Insights (30 May – 05 June) BTC

Serious FOMO flows on Paradigm on Mon/Tues, as BTC finally broke through 30k to 32k. With implieds in the low 60s, a strong flurry of short-dated BTC/ETH upside played for a short-gamma squeeze. Calls outpaced puts 3:1 670x 1Jun 32.5k calls bought, 555x 3Jun 32k calls bought, 11.2k 3Jun 2050 calls bought.

As BTC slid back towards 30k on Wed, BTC flows turned significantly bearish on Paradigm, with strong demand to buy downside vol. 850x Put 29Jul 30000 bought, 750x Put 30Dec 15000 bought, 550x RRPut 29Jul 26000/38000 bought.

We like owning BTC or ETH 17Jun vols, as strong ATM selling flow in this maturity after Friday’s DOV auctions cratered implieds from 68v to 61v. 388x 17Jun 30k straddles sold, 210x 17Jun 29k calls sold, 50x 17Jun 27k/33k strangles sold.

We prefer owning ETH 17Jun over BTC, given the Ropsten testnet merger on 8Jun and its higher correlation to NDX ahead of important macro catalysts: ECB (9Jun), US CPI (10Jun), and FOMC (15Jun). ETH 17Jun 1800 straddle for ~77v. For more on Ropsten merger as a source of volatility, see here from @DRW

We had another MEGA successful @ribbonfinance BTC auction 🔥Congratulations @QCPCapital on winning! Vault holders received a bid of 0.0041...6 bps better than the @DeribitExchange price!🎉 That's a 💥17%💥 improvement in the absolute premium from selling the call! Please contact us to get active!

BTC

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

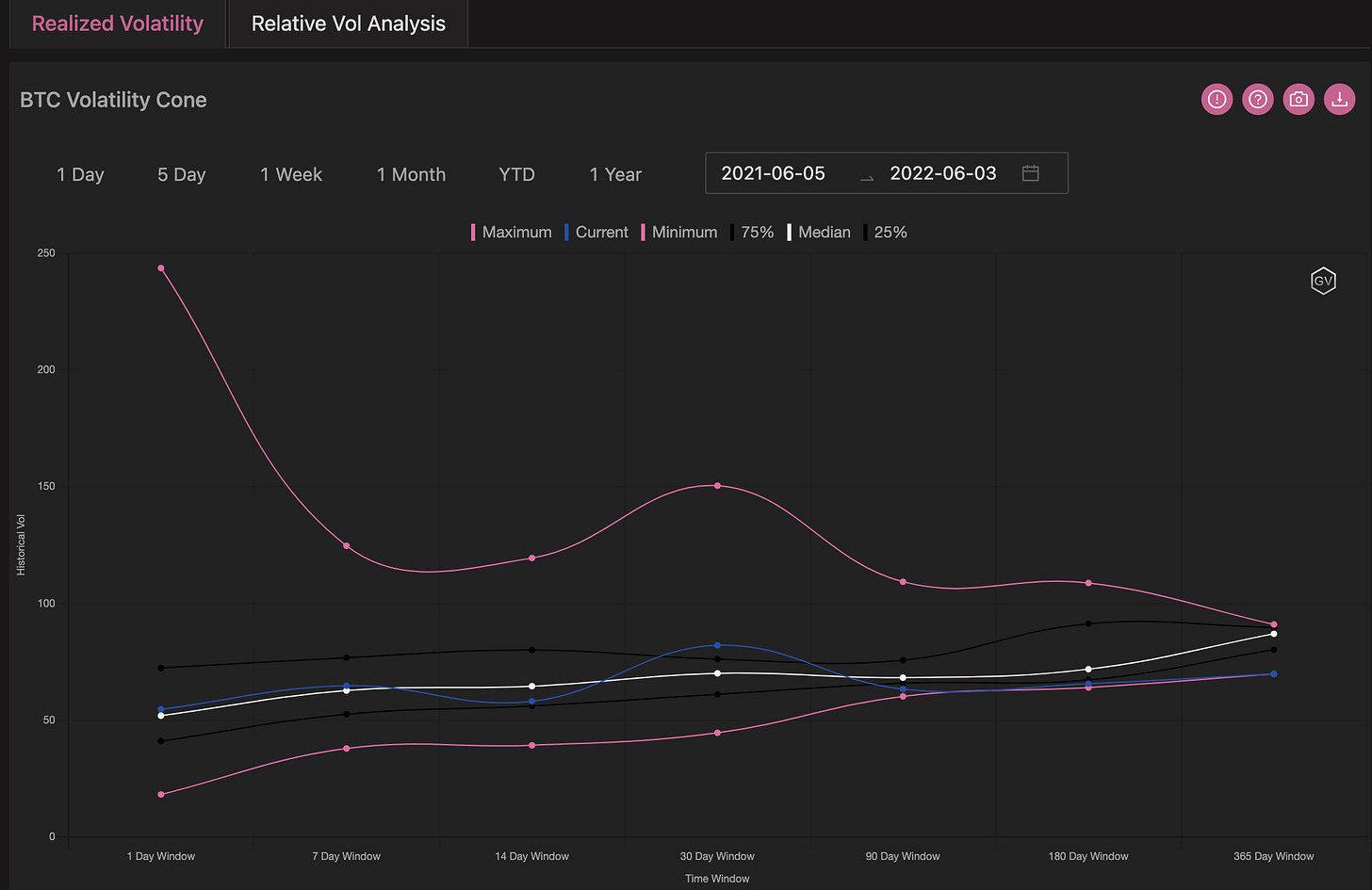

VOLATILITY CONE

(June 5th 2022 - BTC’s Volatility Cone)

RV is along the median lines.

Without any catalysts, we’re expecting RV to be below the median in this next week.

REALIZED & IMPLIED

(June 5th 2022 - BTC IV-RV)

IV RV premium still good for vol. sellers; we aren’t expecting a rise in RV here.

The markets are likely going to sit-and-wait for the time being until FOMC week… and even then, assuming rate hikes are in-line, markets things will likely chill again.

That said, spot markets are definitely NOT strong, last week’s relief rally was clearly “rejected”.