Crypto Options Analytics, June 27th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$32,875

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(June 27th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

BTC spot prices failed to hold $35k throughout the week and tested below $30k.

This price action sent short-term option IV soaring as trader’s grappled with spot prices testing lower ground.

Short-term and medium-term options skews continue to be firmly negative as a result but the level of skew was only modestly affected.

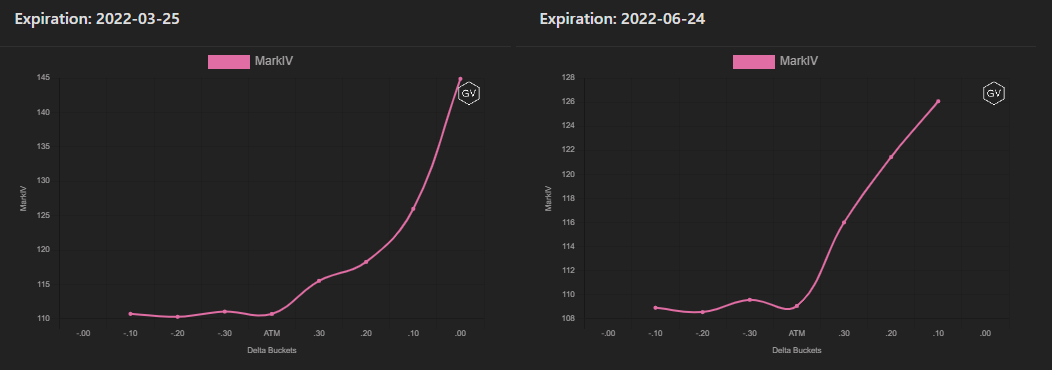

(June 27th, 2021 - Long-Dated BTC Skews - Deribit)

Deribit listed a new option expiration, the 6/24/22 contract.

Looking at the two longest dated contracts we can see that option skews are positive.

Given these skews, we can see the market is still willing to pay a premium for long-term calls over long-term puts.

The current uncertainty isn’t bleeding into the longer-term view for BTC.

TERM STRUCTURE

(June 27th, 2021 - BTC’s Term Structure - Deribit)

Although short-dated options are the most expensive in terms of IV, the overall term structure is nearly flat.

The range of IV values is tightly bound between 94% and 101%.

ATM/SKEW

(June 27th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) saw a spike given the spot price range break.

However, what’s interesting to note is the stability that option skews currently exhibit.

Notice the SKEW (right) being much more volatile earlier in the month.

This current skew stability exhibits a market that isn’t caught off-guard due to the recent spot activity even though the market does expect more volatility if the consolidation range does indeed fail to hold.

There isn’t panic.

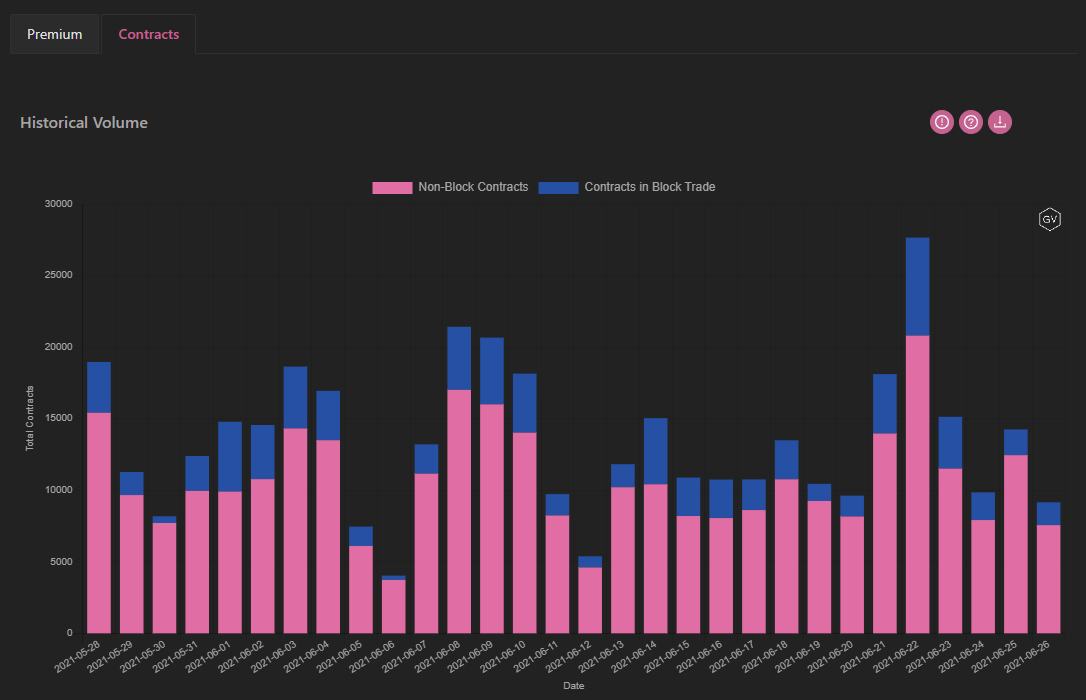

VOLUME

(June 27th, 2021 - BTC Premium Traded - Deribit)

(June 27th, 2021 - BTC’s Contracts Traded - Deribit)

Volumes saw a nice spike on June 22nd as BTC spot prices traded below $30k.

The $30k prices enticed traders to rebalance option hedges causing option trading volumes to rise.

VOLATILITY CONE

(June 27th, 2021 - BTC’s Volatility Cone)

As $35k failed to hold, realized volatility came back into the market.

We are now back in a higher volatility environment with all measurement windows above the 75th percentile.

REALIZED & IMPLIED

(June 27th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV and IV continue trading relatively close to each other, although IV is trading at a small discount to RV.

$1,898

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(June 27th, 2021 - ETH’s Skews - Deribit)

ETH skews continue holding negative levels for short-term and medium-term option expirations.

ETH is experiencing similar phenomenon to BTC as spot prices test price ranges.

(June 27th, 2021 - ETH’s Skews - Deribit)

Long-term options are also in positive territory for ETH.

The silver-lining here is that despite the current uncertainty, things still bode well for the long-term big picture in ETH and BTC.

TERM STRUCTURE

(June 27th, 2021 - ETH’s Term Structure - Deribit)

ETH’s term structure is also relatively flat.

The IV range is bound between 108% - 116%.

This is a flat term structure given that the option expirations now span one year.

ATM/SKEW

(June 27th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) was displaying a strong downward trend before last week’s spike.

Spot prices sent IV higher but SKEW (right) was able to remain strong.

The current skew levels are still approaching the zero line.

Keeping an eye on skew is a good gauge for option market sentiment.

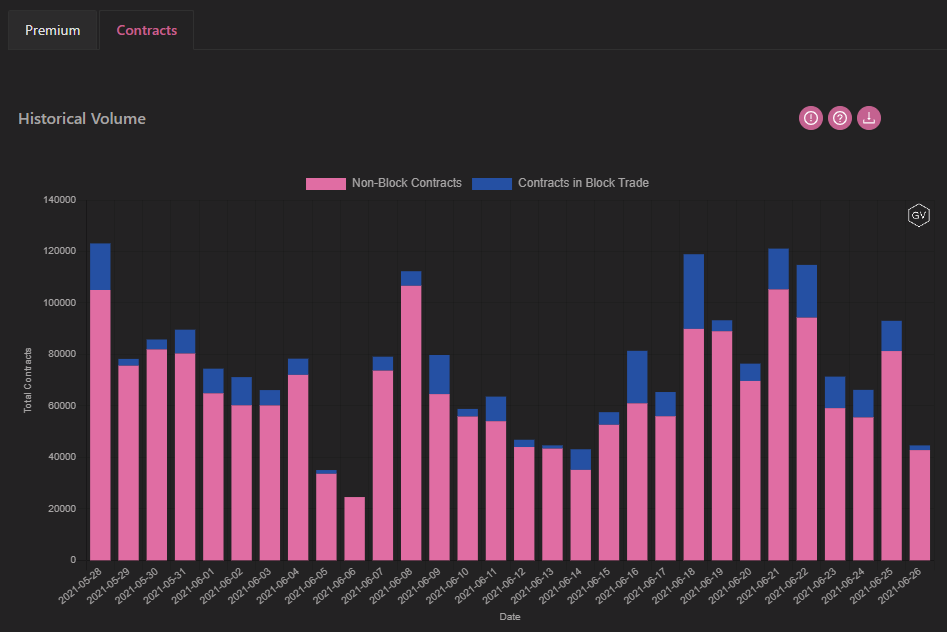

VOLUME

(June 27th, 2021 - ETH’s Premium Traded - Deribit)

(June 27th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes picked up nicely throughout nearly all of last week.

There seems to be a return towards option appetite, which could invite higher IV levels along with it, especially if the downward price trend resumes and consolidation fails to hold.

VOLATILITY CONE

(June 27th, 2021 - ETH’s Volatility Cone)

Realized volatility picked up versus last week.

We are now back above the 75th percentile for nearly all the measurement windows.

The consolidation theory may not hold.

REALIZED & IMPLIED

(June 27th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RV continue to be tightly bound despite the large changes seen last week.