Crypto Options Analytics, June 26th, 2022

Congrats to Deribit launching their “test” version of combo trades!

Click here, to visit!

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE: Panic Relief

Goldman Sachs is raising funds to purchase Celsius assets.

FTX bailed out BlockFi.

TradFi assets are seeing a rally on the back of Powell’s testimony to the House Financial Services Committee last week.

According to Powell, should economic activity drop and unemployment rise, even if inflation was still high, the fight against inflation would be considered successful (by some measures), but he would be reluctant to cut rates again, (therefore at least cease raising?).

Maybe this rhetoric is showing some restraint against the inflation fight and some support, economically speaking.

On the crypto side of things, the bailout of BlockFi and the buying interest for Celsius assets does provide relief against the fear of complete contagion.

As expressed last week, time merely going by seemed like a bit of relief from full contagion fears… the rational being that “bank runs” typically don’t take a pause when things are truly broken.

These are my big picture thoughts this week but my conviction is at best “medium”.

I think contagion fears and volatility is likely at a local high and going to get better from here… but I don’t think we’ve seen the ultimate spot price lows either.

Here’s a chart of the 2018 BTC bear market versus 2022.

I think we’re at the consolidation period.

BTC: $21,263 +8.43%

ETH :$1,224 +12%

SOL: $40.51 +19.71%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

We might see some fund redemption related selling this week causing BTC spot prices to retest slightly below $20k again, but the panic seems to have left the market.

DVOL has a clear logical IV level… which is the June 6th level.

My thinking is that the May 9th to June 6th peak-to-trough ratio is likely a good model for our current descent.

TERM STRUCTURE

(June 26th, 2022 - BTC’s Term Structure - Deribit)

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

SOL (gvol API python module, pre-built notebook charts )

Solana has been showing relative spot strength compared to BTC and ETH.

We’re happy to see more expirations listed as well.

BTC and ETH still have relatively flat term-structures.

Assuming we’re in for a consolidation period, a shift back Contango seems very probable.

Vega weighted calendar positions?

SKEWS

(June 26th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Although RR skew remains negative (C-P), we’re seeing a nice move higher, led by short-term options.

7-day is at the local high, while 30-day skew is at the local low.

Typically, the 7-day and 30-day have a close relationship and this divergence is atypical.

Given my previous assumptions, I believe the 30-day RR skew is lagging and will likely catch up this week.

This creates an interesting opportunity to capture the extended 30-day skew… Not only do I think these curves move higher, but should they remain constant, time passage alone will converge today’s 30-day into a 7-day later.

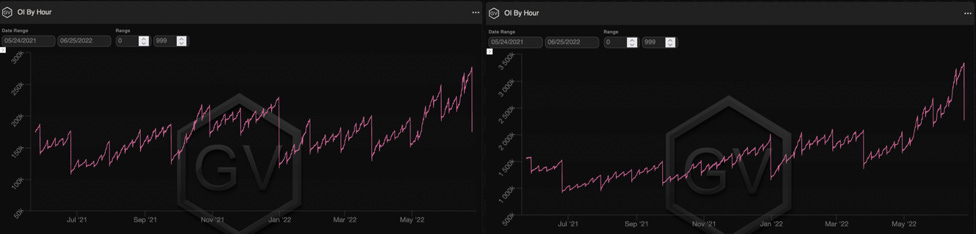

Open Interest - @fb_gravitysucks

WEEKLY EXPIRY

The last week of trading for 24th June expiry saw the important closing of open interest of $20k puts (two-way interest but unloading MMs inventory) and the purchase of $10k/$15k. Same goes for Ethereum in $1k/$0.8k strikes.

On Friday, the total open interest reduced by 40% on Bitcoin and 35% on Ethereum.

Many were expecting some action after the close of over $3.2B notional, but for the moment it is calm. The fact that there are still seven trading days on June may have delayed trader’s activity. Let’s wait for the beginning of July…

(June 24th, 2022 - BTC - ETH Notional - Deribit)

(June 24th, 2022 - BTC - ETH Open interest - Deribit)

BIG TRADES IN THE FLOW

The mixed sentiment from markets’ participants continues, so important trades with a “resolute character” are currently missing.

Anyway, among the main trades of the week we point out:

(19th - 26th Jun, 2022 - BTC/ETH Options scanner - Volumes and OI change - Deribit)

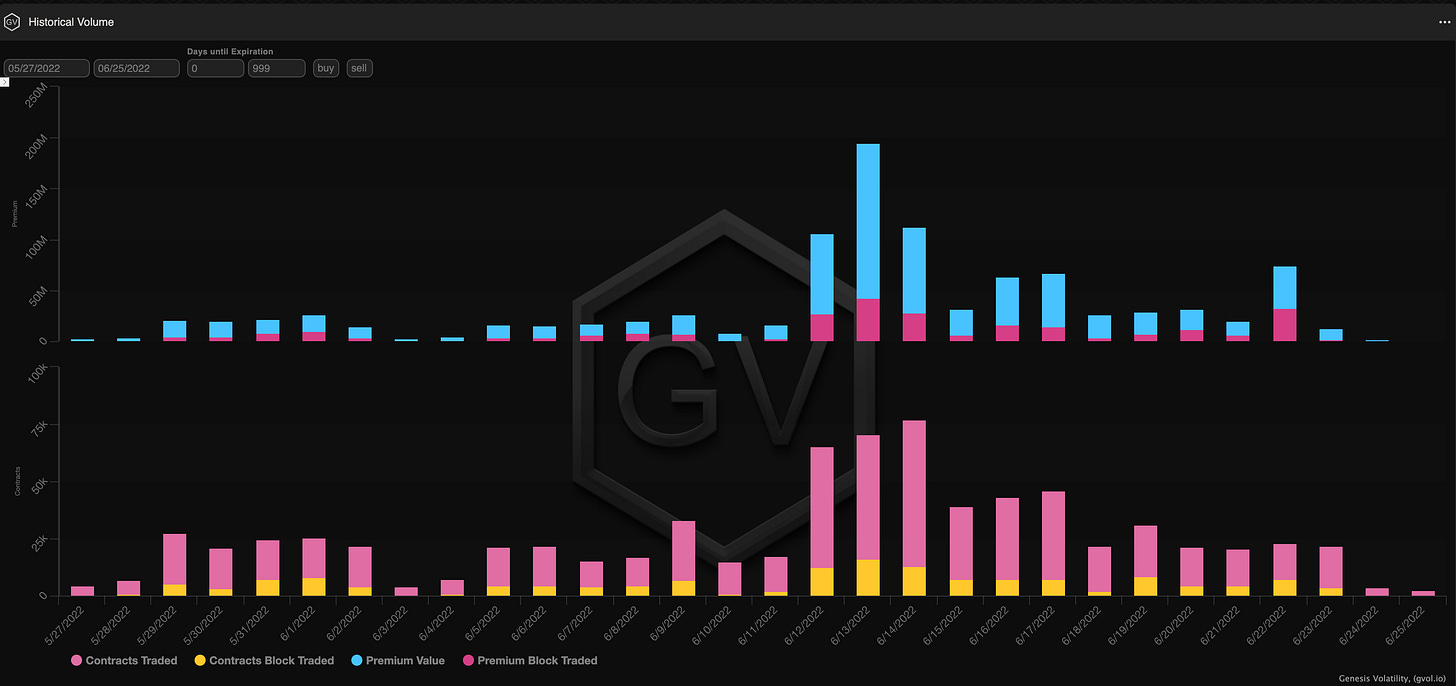

VOLUME

(June 26th, 2022 - BTC Premium/Contracts Traded - Deribit)

Paradigm Block Insights (20 June – 26 June)

Crypto majors finally in the green as US equities cracked a 3-week losing streak and systemic lending concerns slightly moderated on news of potential lender bailouts.

BTC +3.7% / ETH +8.3% / SOL +18.7%

BTC vols significantly compressed on the small spot rally, with the front-end of the term structure back to upward sloping and most of the curve trading in the high 70s.

1Jul: 77.9v

8Jul: 80.4v

15Jul: 79.4v

Aug: 77.5v

Sep: 75.8v

Dec: 75v

While the worst forced liquidations seem behind us, we lean towards owning downside, given high macro uncertainty and recessionary pressures..

We like 29Jul put spreads to reduce some carry, given high implieds and to take advantage of rich skew. 1M 25-delta skew is 13v (puts over).

29Jul expiry captures global inflation data and the next FOMC meeting, the next largest catalysts for risk assets. The below structure breaks even at 19k.

BTC 29Jul 16k / 20k put spread for .0465 (ref 21300, 22d, ~4x max payout-to-cost)

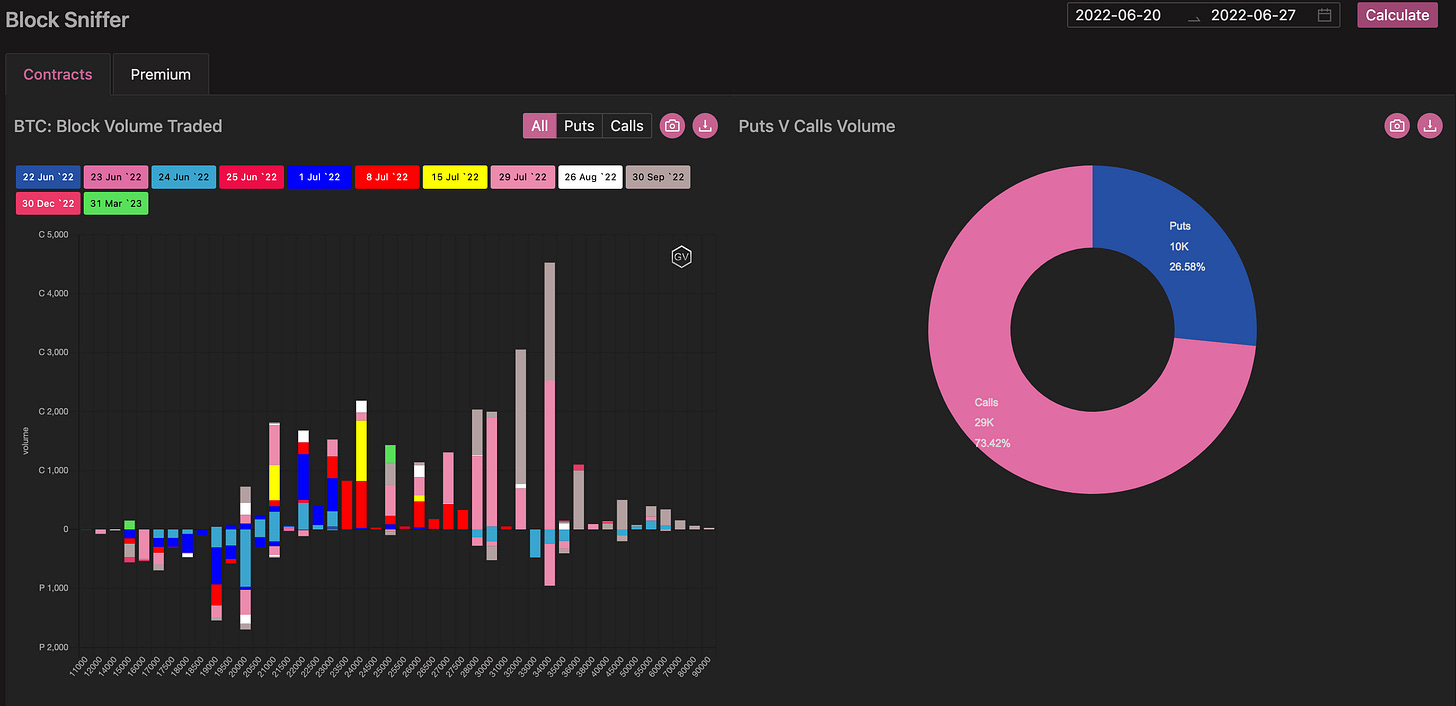

Composition of Block Trades

In BTC, the theme was large call butterfly activity throughout the week. These trades achieve a max payout if spot trades at the middle strike at expiry.

If spot trades to the upper strike, you make nothing, but do not lose anymore than the premium paid.

4000x 30Sep 32k/34k/36k CFly bot

2600x 29Jul 28k/30k/32k CFly bot

2000x 30Sep 28k/32k/45k CFly bot

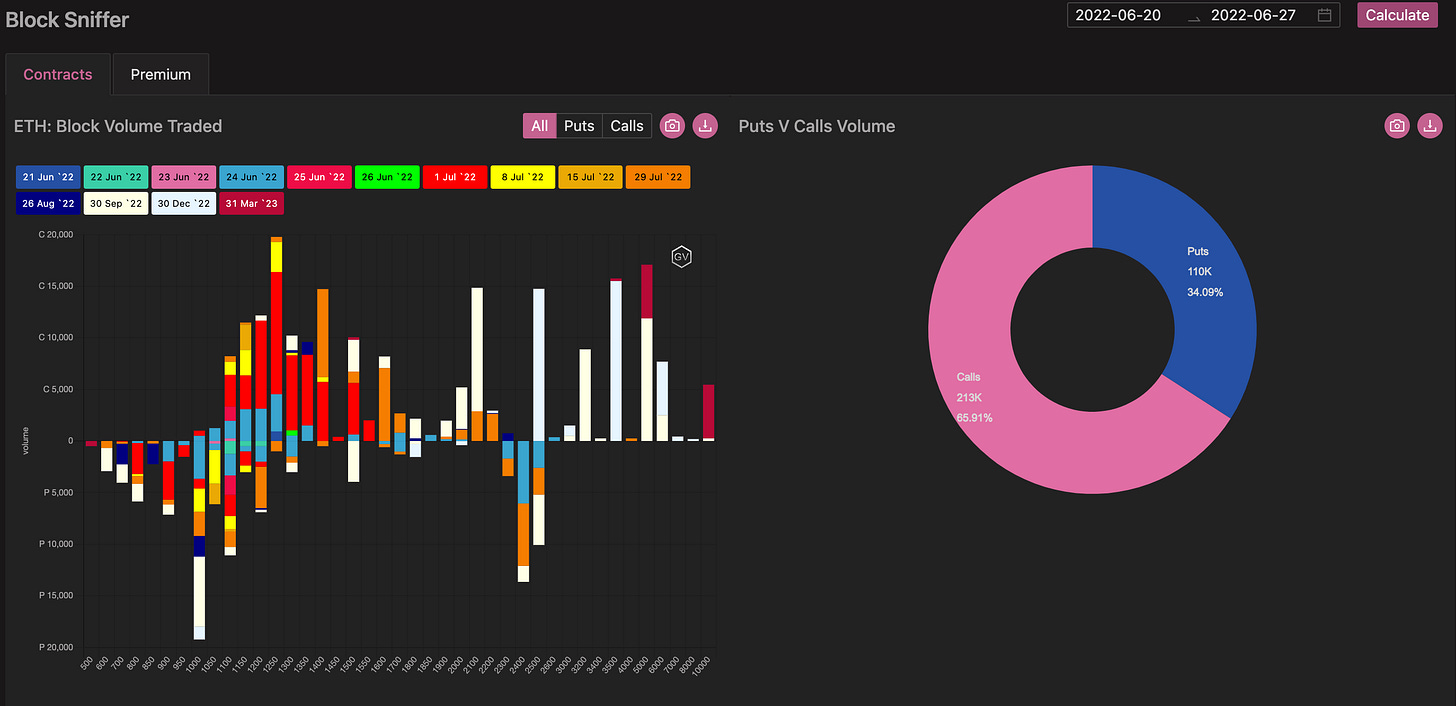

In ETH, call/put ratio 2:1 on Paradigm, with very strong topside interest via outright calls. Similar to BTC, very little downside interest given the amount of hedging activity we saw in the past two weeks.

7250x Jul 1400 calls bot

3.5k 1Jul 1200 and 1250 calls bot

3.5k Dec 2500 calls bot

In SOL, options have begun printing on Paradigm, with market makers now auto-streaming quotes in GRFQ! On 6/23 we saw over 50% of Deribit SOL volume!

We saw strong topside interest ahead of the Solana mobile phone announcement at NFT NYC.

40k 29Jul 50 call bot

6.4k 24Jun 35 put sold

33.75 29Jul 40 straddle sold

BTC

ETH

SOL

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(June 26th 2022 - BTC’s Volatility Cone)

(June 26th 2022 - BTC IV-RV)

IV was quick to discount RV lower (no surprise, given mean-reversion properties).

Should our big picture theme hold true, the median RV levels will be logical targets.

Before June 13th, RV was around median according to the Volatility cone above.

We’re likely going to see RV lead the way back down to these levels and IV/RV return to VRP.