Crypto Options Analytics, June 20th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(June 20th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Crypto prices continue to test price ranges.

On Monday, BTC attempted to trade back above $40k only to be rejected.

Over the weekend, BTC attempted to trade below $35k; currently, the level seems to have held.

As BTC tests these ranges, short-term and medium-term skews have been quick to price accordingly. Meaning that skews became less negative as $40k was tested, only to turn around, and price puts even higher (skew going more negative), as $35k got tested.

In the bigger picture, skews are still slowly approaching symmetry as the May sell-off becomes something of the past.

(June 20th, 2021 - Long-Dated BTC Skews - Deribit)

Long-options, expirations with more than 180 days, are now priced with positive skew, meaning the calls are bid versus the puts.

TERM STRUCTURE

(June 20th, 2021 - BTC’s Term Structure - Deribit)

Going into the week, the term structure resembled this shape.

After FOMC, the term structure briefly fell into a Contango structure as volatility began to leak out of the market.

The weekend sell-off then brought the term structure right back to where we are now.

Most of this activity is being driven by very short-dated option purchases.

ATM/SKEW

(June 20th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is demonstrating the “touchy” volatility phenomenon described earlier…Price-range-testing is quickly met with option-panic-buying, causing IV to spike higher, only to fade back down once the range has proven itself to hold.

Option SKEW (right) is displaying the grind higher and compression near the 0 skew (symmetrical) level.

Right now, the deviations from symmetry correspond with volatility spikes.

VOLUME

(June 20th, 2021 - BTC Premium Traded - Deribit)

(June 20th, 2021 - BTC’s Contracts Traded - Deribit)

Total volume remains consistent, with no significant deviations from the norm.

This type of volume profile is steady and controlled.

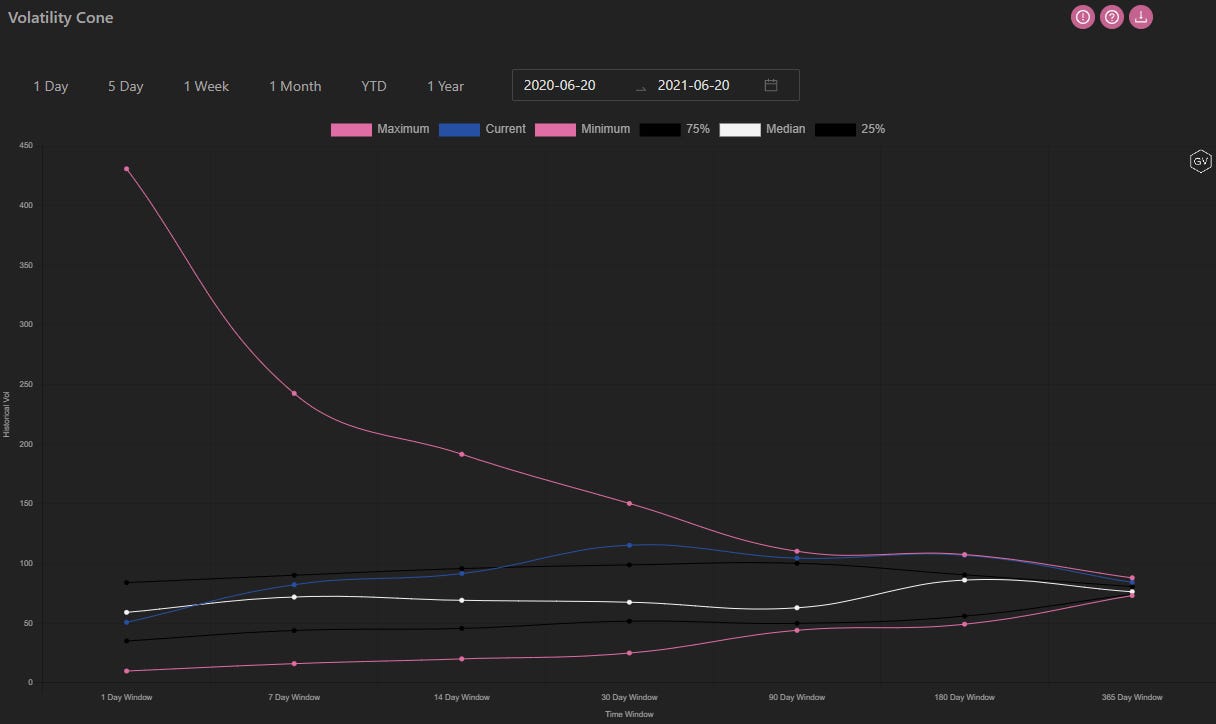

VOLATILITY CONE

(June 20th, 2021 - BTC’s Volatility Cone)

RV is now beginning to test the median for shorter measurement windows.

We continue to expect RV to head towards the median for longer-dated measurement windows as well.

REALIZED & IMPLIED

(June 20th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV and IV are trading on top of each other and seem to be in agreement, however remember that IV reflects future estimated RV.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(June 20th, 2021 - ETH’s Skews - Deribit)

ETH and BTC have been displaying similar phenomena in terms of skews this week.

Skew has been responding in accordance to directional spot prices - testing support and resistance levels accompanied by brief spikes in IV.

(June 20th, 2021 - ETH’s Skews - Deribit)

Long-term options - think +180 days - are also in positive territory, causing calls to be bid relative to puts.

TERM STRUCTURE

(June 20th, 2021 - ETH’s Term Structure - Deribit)

ETH’s term structure has a similar story to BTC’s.

Short-dated options are swinging around, causing the current term structure to be Backwardated in the very short expirations, but Contango for medium- and long-term options.

ATM/SKEW

(June 20th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is systematically floating down lower, with brief spurts of IV spikes, that are quickly faded back lower as well.

The SKEW (right) doesn’t seem as compressed near the symmetrical 0 line, as we see in BTC, but we expect symmetry to be found as consolidation and lower IV continues.

VOLUME

(June 20th, 2021 - ETH’s Premium Traded - Deribit)

(June 20th, 2021 - ETH’s Contracts Traded - Deribit)

Volumes in terms of $ premium traded continue to look dismal, although contracts traded (which are mostly OTM through deductive reasoning) have seen a nice jump higher in the past few days.

VOLATILITY CONE

(June 20th, 2021 - ETH’s Volatility Cone)

Realized volatility is near the median for even more measurement windows than the BTC volatility cone.

We expect this trend to continue.

REALIZED & IMPLIED

(June 20th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

Although the IV and RV relationship currently provides nothing surprising, the above chart does indeed confirm the steady grind lower in both RV and IV.