Crypto Options Analytics, June 19th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE!

There’s A LOT going on right now (we will touch on crypto in a second).

The FOMC raised rates +75bps this week and expect it to raise rates another +75 OR +50 at their next meeting.

Powell says the Fed is targeting a 2% inflation rate “WHILE” (key word) the labor market remains in full-employment.

(CPI - WSJ)

We’re far from 2% inflation, which means the Fed is going to keep hiking UNTIL something breaks.

Asset prices NEED to go down basically. Think energy and food.

THEN WHAT?

Once the economy hits a recession and employment begins to drop, THEN the Fed will need to start making decisions.

Fight inflation OR support the economy.

When there’s inflation, assets become a source of safety for preserving wealth.

The combination of the Fed RAISING rates to break asset prices… then stopping/reversing course to support the economy and employment, creates a MASSIVE opportunity.

Unless inflation is “fixed” for good, those who SURVIVE the “tightening” cycle will be afforded the opportunity to buy wealth-preserving assets, at a discount!

It’s important to recognize a 2022-2023 recession from raising rates IS NOT like the 2008 and 2020 recession and pandemic.

One is “manufactured” while the other two were scary external crises without clear solutions!

CRYPTO

Blockchains are working.

DeFi is working.

Smart-contract code is executing.

Nothing is BROKEN in crypto… What’s occurring is deleveraging.

Luna, Celcius, 3AC and whoever is next are getting liquidated. This is making prices drop today, but it’s also cleaning the market of froth.

Those who survive and make it to the other-side will be stronger.

Markets will consolidate for protocols, OTC desks and lenders will be rid of systematically risky counter-parties and leverage ratios for traders will be at all time lows.

Lastly, prices will be low.

Your only job right now is to SURVIVE.

Get to the other-side and you’ll enjoy massive buying opportunities… this has happened many times in crypto.

As mentioned last week…

ETH in the hundreds.

BTC in the $10k handle.

Sol in the teens.

These prices would likely present massive opportunities in vol., spot and basis.

Quality NFT purchases in such an environment could also be interesting “option-like” instruments. And posting off-market bids for NFTs would provide the chance to capture a liquidity premium, should crypto markets panic.

As for vol. in such an environment?

Think about fully collateralized strategies… cash-secured puts and covered calls.

Vertical spreads to partially trade away high IV.

BTC: $19,609 -30.03%

ETH :$1,093 -39.61%

SOL: $33.83 -14.71%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

I thought the LUNA event set the highs for IV but we touched those highs again this week.

With contagion risk, crypto holders become FORCED to sell at any price to meet margin requirements… this creates a feedback loop which causes EVEN more selling…

Liquidations cause forced selling → leads to lower prices → leads to more liquidations.

This extends prices ranges (aka creates vol.)

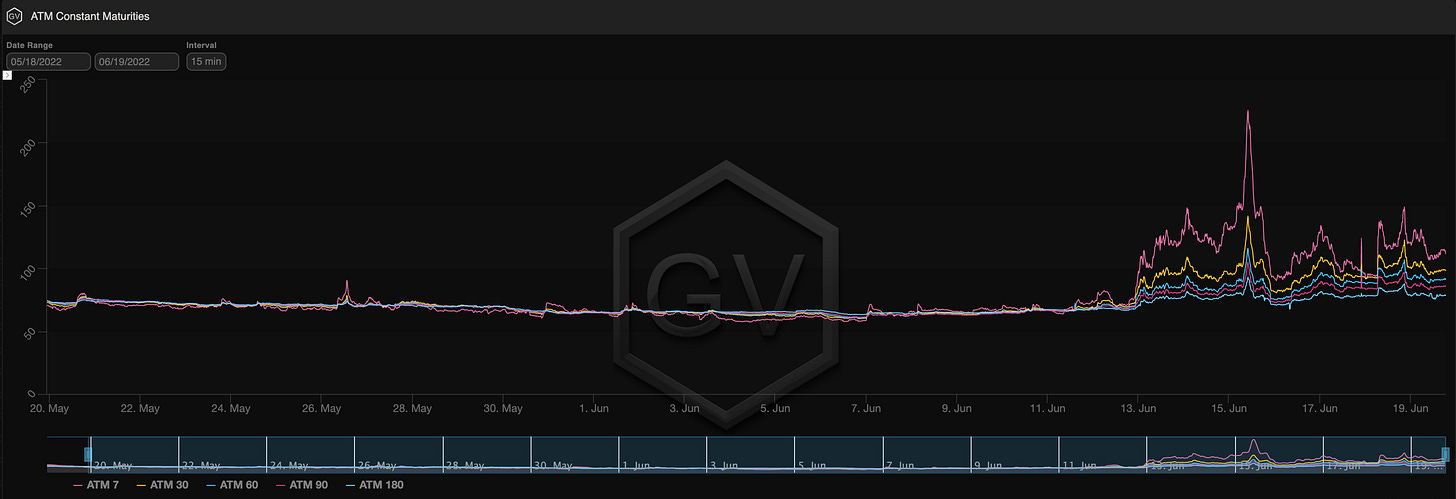

TERM STRUCTURE

(June 19th, 2022 - BTC’s Term Structure - Deribit)

BTC (gvol.io)

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

SOL (gvol API python module, pre-built notebook charts )

The term structure is highly backwardated right now, which is DEFINITELY justified.

If the liquidation cascade is going to occur, it will occur NOW.

IV needs to be high NOW, because the contagion uncertainty is NOW.

Merely, having time go by, is bullish.

Once the 3AC situation has passed, we’ll likely be through the worst of it.

Crypto prices will take a while to recover however… This isn’t a crypto specific event… this is part of a bigger macro deleveraging.

I don’t expect BTC prices to get about $35k anytime soon.

SKEWS

(June 19th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Skew is extreme.

Realistically, cascading price drops could make crypto touch extremely low prices in a “flash crash”-like event.

Where “flash crashes” occur will be exchange specific.

Tail put will be very profitable in such a scenario, and a similar scenario for calls isn’t likely right now.

Hence the insane put skew.

These extended ranges can be tempting but it’s better to wait until contagion de-risking is more “certain” and be first to sell extended skew as then, even if prices aren’t as good.

As noted before… BTC RV has some seasonality to it and summer months are relatively quiet.

July will likely provide more contagion risk “certainty”, in time for a lower RV seasonal shift.

Something to keep in mind.

Open Interest - @fb_gravitysucks

WEEKLY EXPIRY

To find a weekly with higher volumes we have to go back to September 2021. The extended bearish movement, while long overdue, has inflamed traders’ activity.

Bitcoin: 35k contracts, notional $735M, $40M distributed premium and 70% of expired options worthless.

Ethereum: 318k contracts, notional $350M, $10M distributed premium and 69% of options expired worthless

(June 17th, 2022 - BTC/ETH Notional - Deribit)

BIG TRADES IN THE FLOW

These are the phases of the market where a large number of volumes traded - such as those seen this week- do not correspond to an equivalent of new contracts opened.

Before the weekend with the index on the $20k/$1k media all the focus was on puts: massive profit-takings ($35k/$25k), some partially rolled down in the strikes $15k-$10k, and hectic volumes in strikes $20k/$15k for Bitcoin and $1k/$0.8k for Ethereum.

(13th - 19th Jun, 2022 - BTC/ETH Options scanner - Volumes and OI change - Deribit)

Next week there will be the monthly deadline with over $3B of notional combined.

The open interest profile shows that we are in “uncharted territory” in terms of potential market pins. The net positive gamma $20k strike could provide some hook if index is near expiration.

VOLUME

(June 19th, 2022 - BTC Premium/Contracts Traded - Deribit)

Paradigm Block Insights (12 June – 19 June)

A nasty week for crypto as the market digests mounting lending concerns and a painful macro environment for risk assets, with central banks well behind the curve. BTC: -31% / ETH -32% / SOL -6%

Why the WoW underperformance of BTC/ETH relative to SOL and other alts?

1. Lending collateral mostly denominated in BTC/ETH. Lenders forced to liquidate as borrowers failed to meet margin calls.

2. Steep alt drawdowns prior to this week. 6M return: SOL -81% vs. BTC -58%.

ATM implied vols significantly rallied this week as spot moved up the skew, 7d realized vol spiked to 148v, and fixed strikes reset higher given the extreme bid for protection on Paradigm.

BTC ATM Implieds 24Jun:113, 29Jul: 97, 26Aug:90, 30Sep:84, 30Dec:78.

Put rolling activity has created an extreme bid for downside vol & skew. The activity did not relent over the weekend, given Saturday’s spot move. BTC 1M 25-delta skew trades at -32v (25d call - 25d put) vs ETH at -25v, reaching the most extreme levels on record this week.

🌊BTC downside flows on Paradigm drove the skew bid, as spot sold off.

2370x 16Jun 18k put bot

1500x Jun & July 25k put sold

780x Jun 20k put bot

We did not see the same put demand for ETH (we rarely do in calm markets). Perhaps it helps explain the BTC/ETH skew differential.

🌊 Notable ETH flows continue to focus on the upside, with strong activity in call flies and ratios: Shocking to see Paradigm ETH call-put ratio 2:1 with spot -32% WoW.

10k Sep 2200/2800/3400 call fly bot

10k Sep 3500/500 1x2 call ratio bot

9.5k 1Jul 1300 calls sold

👉 Update on our futures spreads offering: June is on track to be the largest volume month on record, largely driven by symmetric fees now on Deribit-cleared futures. Last week’s volume was larger than the previous 4 weeks combined!! 🔥🔥

If you have rolls to do, our market is deep and tight on our dashboard!

BTC

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

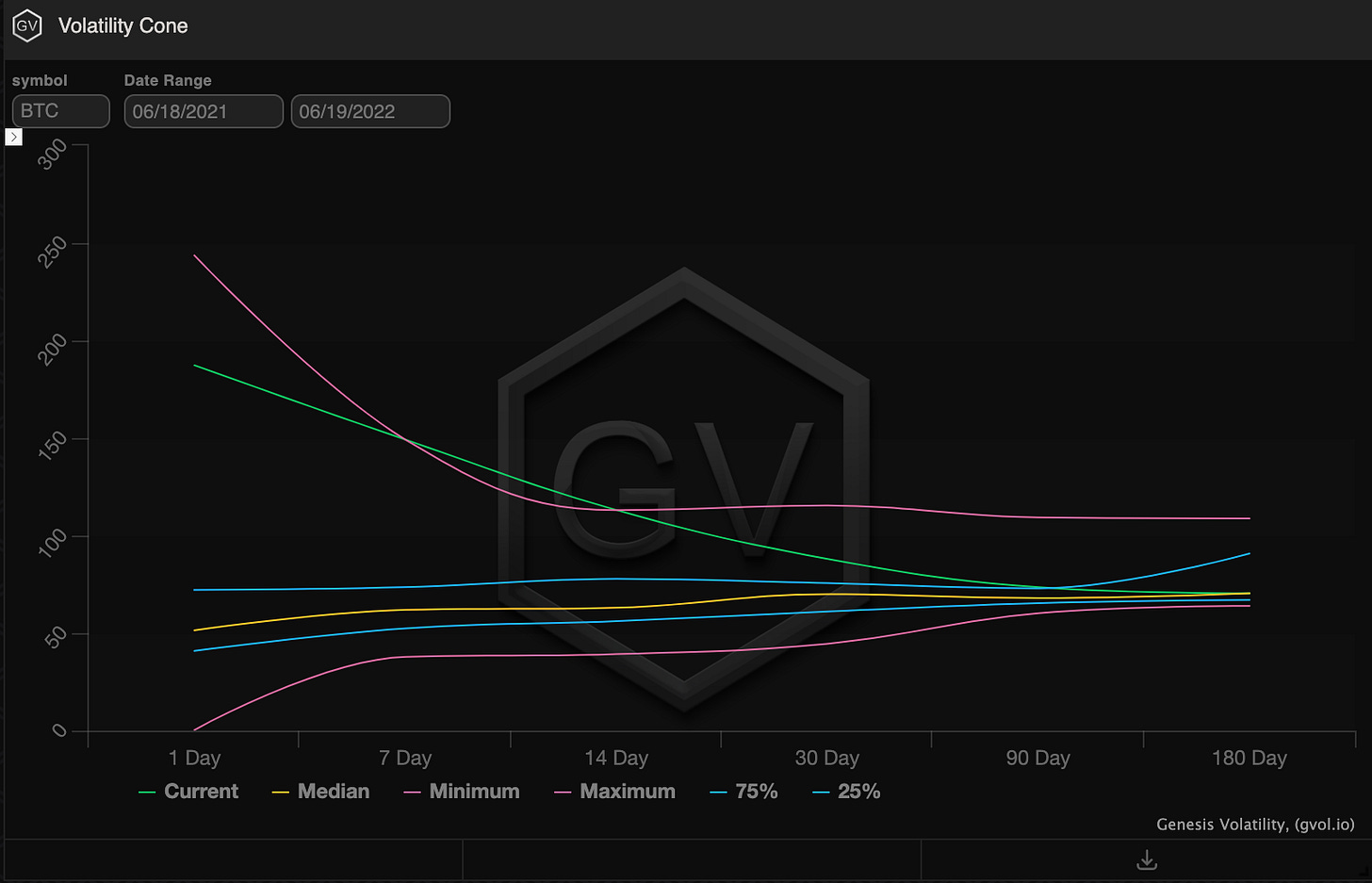

VOLATILITY CONE

(June 19th 2022 - BTC’s Volatility Cone)

RV is peaking on the year, no surprise there.

Contextualizing the current environment versus proceeding with bearish panics would make sense.

Users can view BTC RV back to Jan 2012.

REALIZED & IMPLIED

(June 19th 2022 - BTC IV-RV)

IV/RV is currently discounting RV.

This is a typical relationship in a high volatility environment, due to mean-reversion pricing.

Traders are betting that the worst is behind us and things will begin to calm down.

I wouldn’t buy vol. here but I wouldn’t sell vol. here either.

Fundamentals MATTER a lot right now. This next week will be extremely telling…

We need more information on the extent of the contagion or prices hit more attractive levels.

$10k was a long-term price point for BTC and that’s still 50% away.