Crypto Options Analytics, June 13th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(June 13th, 2021 - Short-term and Medium-Term BTC Skews - Deribit

We’ve seen a substantial drop in both RV and IV over the past week.

Option markets still maintain a negative skew for short-term and medium-term expirations, but not to the same extent as seen in mid-May.

As volatility drops and prices “settle” there could be opportunities found in selling the puts as long as BTC holds above $30k.

(June 13th, 2021 - Long-Dated BTC Skews - Deribit)

Long-term options are flirting with zero skew and slightly positive call skew.

Call buyers are being offered cheaper price tags due to the combined effects of lower forward prices and nearly symmetrical option skew, although IV still remains on the higher side, historically speaking.

TERM STRUCTURE

(June 13th, 2021 - BTC’s Term Structure - Deribit)

The term structure is back in the “flat” shape, after displaying large backwardation periods in the past month.

This structure is consistent with a transition back into lower volatility environments and the term structure could fall into Contango if the lower vol. trend continues.

ATM/SKEW

(June 13th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is now flirting with the lower range seen this month.

Spikes in IV were met with sharp drops in skew (right).

This shows that recent vol. events were dominated by put-buying as traders hedged spot price drops.

A continued decrease in IV will likely send skew back into positive territory as traders become optimistic about spot prices once again.

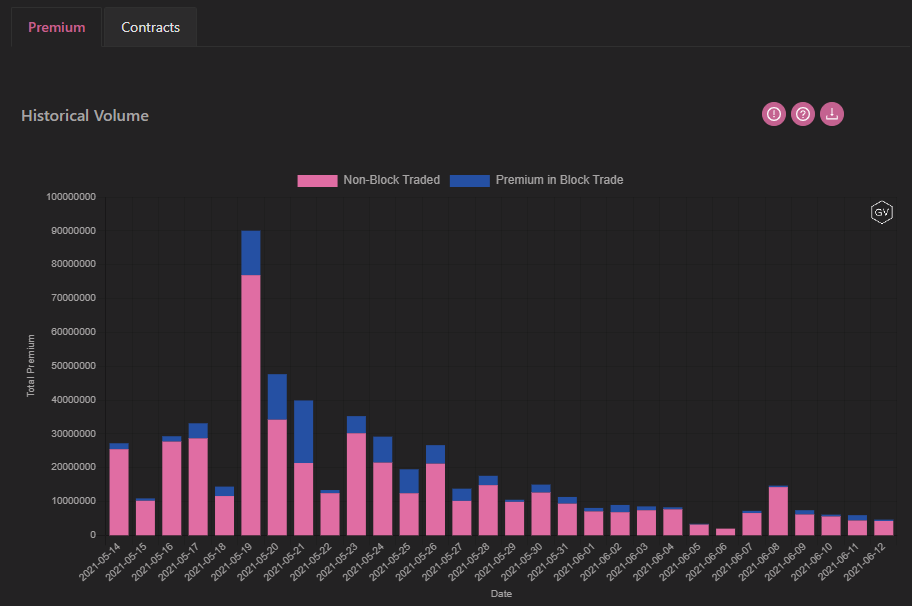

VOLUME

(June 13th, 2021 - BTC Premium Traded - Deribit)

(June 13th, 2021 - BTC’s Contracts Traded - Deribit)

Total volume have been very quiet over the past two weeks, especially in terms of dollar-premiums traded.

The lack of robust volume is congruent with a consolidation in spot prices and lower volatility going forward.

We don’t expect any increases in volume or volatility until BTC decidedly breaks out of the $30k-$40k range.

VOLATILITY CONE

(June 13th, 2021 - BTC’s Volatility Cone)

The realized volatility is still relatively high here, given that all measurement windows exceed the 75% percentile.

We expect RV to be back around the mean for the shorter measurement windows by next week.

REALIZED & IMPLIED

(June 13th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

A couple weeks ago, IV was heavily discounting RV: the option markets were proved right.

RV has now dropped significantly and joined IV in the 90% zone.

We expect both to head lower from here if spot price ranges hold.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(June 13th, 2021 - ETH’s Skews - Deribit)

Looking at Deribit’s ETH DVol index, we can see IV has dropped for ETH as well.

Skews still remain negative for the short- and medium- option expirations.

Option traders are still pricing in some downside risk.

(June 13th, 2021 - ETH’s Skews - Deribit)

Long-term options display more positive skew for ETH than they do for BTC.

There is a slightly higher appetite for ETH calls than BTC calls relatively speaking.

TERM STRUCTURE

(June 13th, 2021 - ETH’s Term Structure - Deribit)

ETH’s term structure is pricing in an interesting hump shape concentrated in September’s expiration.

We find this peculiar, given the EIP-1559 upgrade that is scheduled for July.

There could be interesting opportunities between July, Aug, and Sept. expiration months.

ATM/SKEW

(June 13th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV is slowly grinding lower, while at the same time ETH skew is moving higher.

The IV drop lower is consistent and doesn’t display the erratic behavior witnessed earlier in the month.

The low “Vol of Vol” likely means volatility heads lower from here in a controlled manner.

There are interesting short-volatility structures that could be executed here.

A spot price breakout beyond the $2k-$3k range would be a good “stop” price.

VOLUME

(June 13th, 2021 - ETH’s Premium Traded - Deribit)

(June 13th, 2021 - ETH’s Contracts Traded - Deribit)

For short-volatility traders, the option volume charts above feel encouraging.

This low volume feels like a lack of energy and excitement around ETH.

VOLATILITY CONE

(June 13th, 2021 - ETH’s Volatility Cone)

ETH is now breaking below the upper 75% percentile and headed towards the median RV.

Like BTC, we expect lower RV- as long as ETH respects the $2k-$3k spot price range.

REALIZED & IMPLIED

(June 13th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

The big IV to RV discount that ETH option traders were pricing also proved correct.

RV has dropped significantly and both IV and RV have now joined together.

Both are still historically high and could come down some more.