Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

Weekly Thinking - Pre-FOMC trade (long IV, short-delta) Post-FOMC long call-flies

This Wednesday at 2pm ET we’ll have the FOMC statement, projections and press conference.

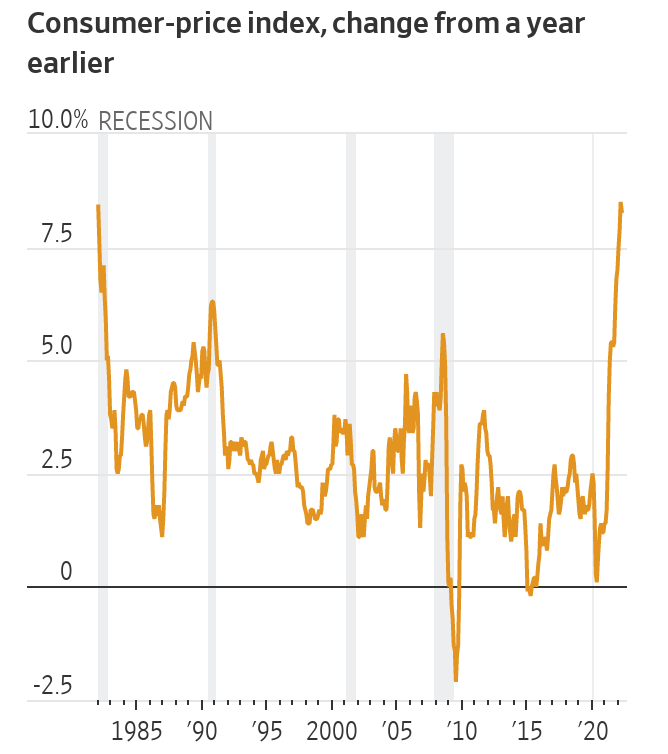

CPI numbers released on Friday were devastatingly high and caused the markets to drop lower as inflation will lead to central bank tightening.

(CPI Friday 8:30 ET - WSJ)

Peering into the minds of the Fed, I see FOMC playing out in the following ways:

First, the Fed has been using “forward guidance” as a tool to affect expectations and the long-end of the yield curve.

Instead of trying to “surprise” the market with larger than expected rate hikes, the Fed is using forward guidance to enable the market to anticipate steady rate hikes in a longer hiking cycle. Why?

This affects long-term rates more directly

Instead of “crashing” the market, the market will float lower, in a more controlled fashion.

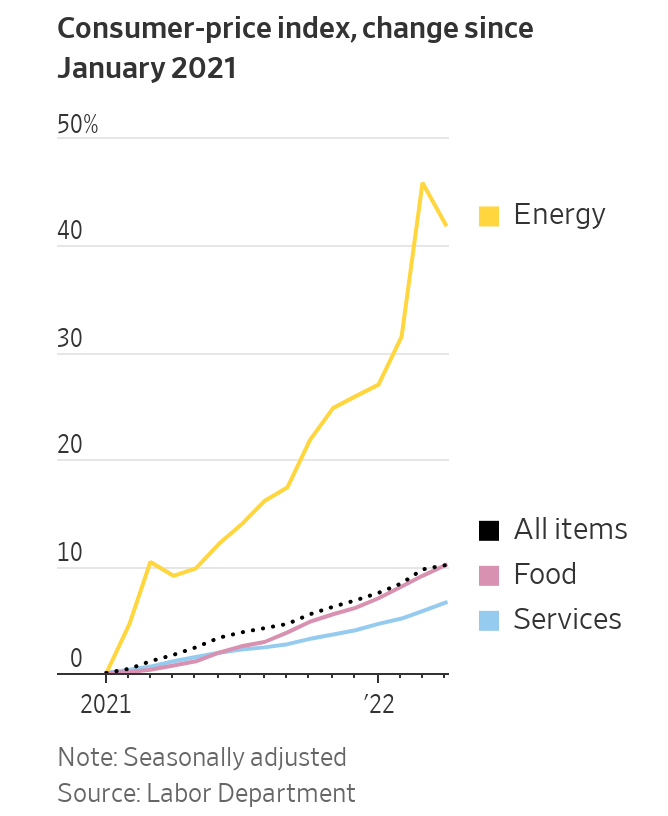

Point #2 might very well explain the massive drop in VVIX, and the VIX’s lack of explosiveness in recent market declines.

(VVIX - via TOS)

Given this background, I expect the FOMC to adjust language around rate hikes going forward, in response to the CPI’s massive reading Friday. The could lead to the Fed potentially projecting…

An openness towards 75bps hikes

An extension of the rate hike cycle

I think everyone knows something MUST be done… therefore, my bias is that the “risk” markets show weakness into FOMC.

Pre-FOMC

This allows us to buy down-side puts GOING into FOMC… IV will likely drift higher into the event, off-setting theta; short-delta is my bias and weekend price action has already shown its hand.

Long put-spreads.

Post-FOMC

POST-FOMC potentially reacts with a sell-off on the news… But I’m not convinced this will last. Here’s my thinking:

The Fed signaled willingness to do SOMETHING = selling reaction

Is that something ENOUGH…? (This will be debatable by definition).

Event passed, vol. lower, some think it isn’t enough, slow choppy recovery

Post-FOMC and post sell-off, call butterflies could become an interesting position.

Long call butterflies.

In the BIGGER picture:

I’m waiting for a panic set-up…

ETH in the hundreds.

BTC in the $10k handle.

Sol in the teens.

These prices would likely present massive opportunities in vol., spot and basis.

Quality NFT purchases in such an environment could also be interesting “option-like” instruments. And posting off-market bids for NFTs would provide the chance to capture a liquidity premium, should crypto markets panic.

BTC: $28,119 -6.06%

ETH :$1,810 -16.24%

SOL: $39.63 -15.67%

DVOL: Deribit’s volatility index

BTC - (1 year w/ spot line chart)

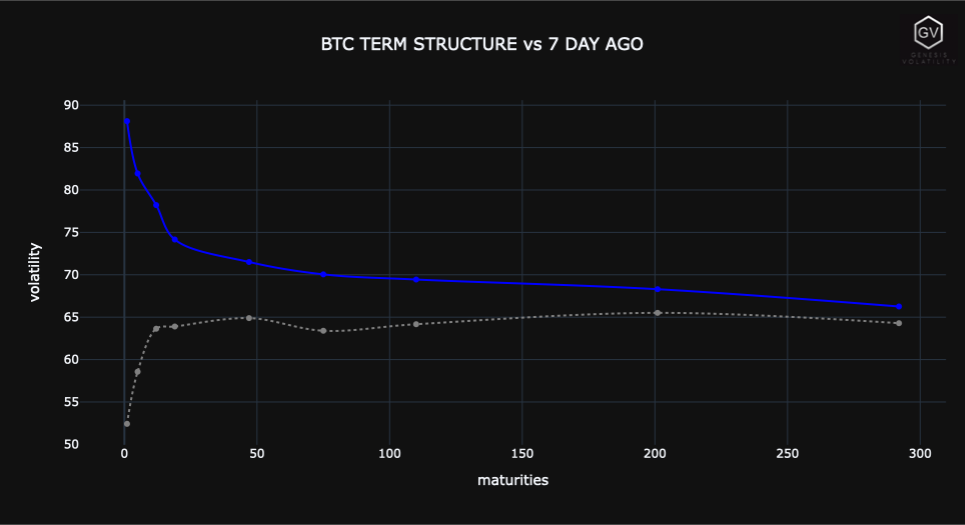

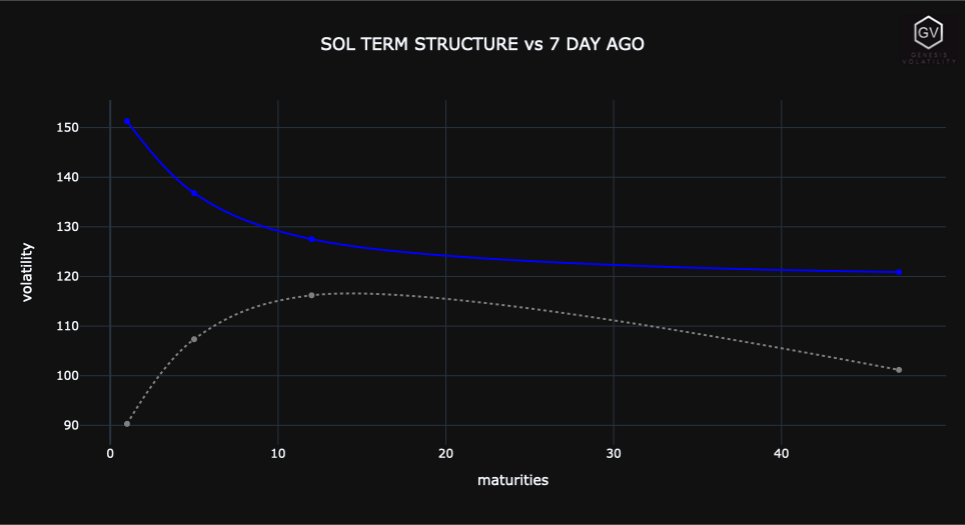

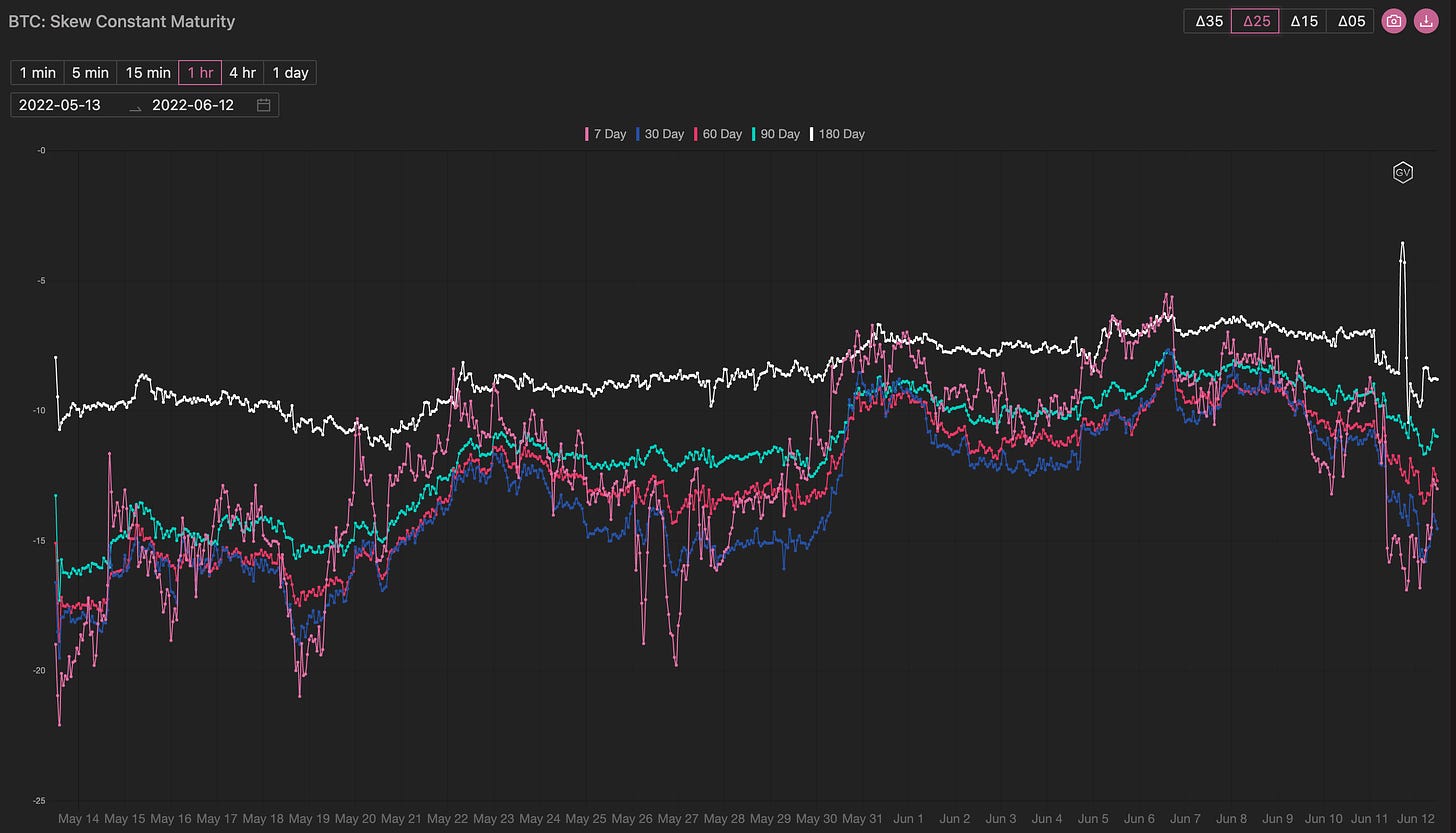

TERM STRUCTURE

(June 12th, 2022 - BTC’s Term Structure - Deribit)

BTC (gvol.io)

BTC (above - gvol API python module, pre-built notebook charts )

ETH (above - gvol API python module, pre-built notebook charts )

SOL (above - gvol API python module, pre-built notebook charts )

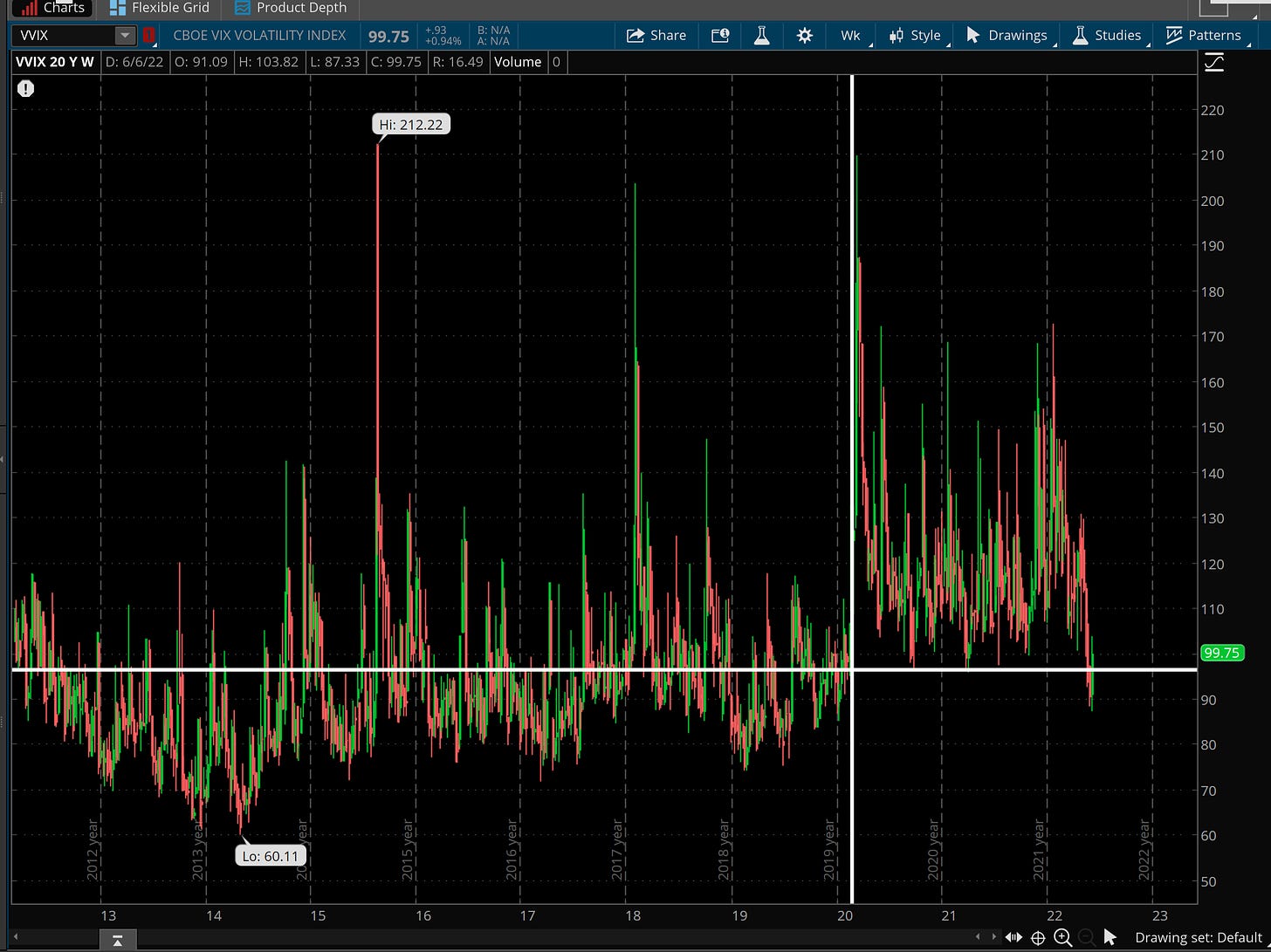

Spot vol. continue to remain inversely related.

Last week, we saw a quiet market until the CPI prints came out, this then led to BTC testing $27.5k over the weekend, and ETH breaking below $1,500.

All the term structures are currently inverted, but overall levels are way below peaks seen in May.

I don’t expect these May peak vol. levels to be retested without a substantial catalyst such as the Luna peg-break or a surprise macro event.

Going into FOMC, if backwardation holds… we’ll get a nice IV “roll-up” with a likely higher overall IV level pre-announcement.

We’ve consistently seen crypto vol. reacting to FOMC events… We know Crypto Vol. traders follow FOMC.

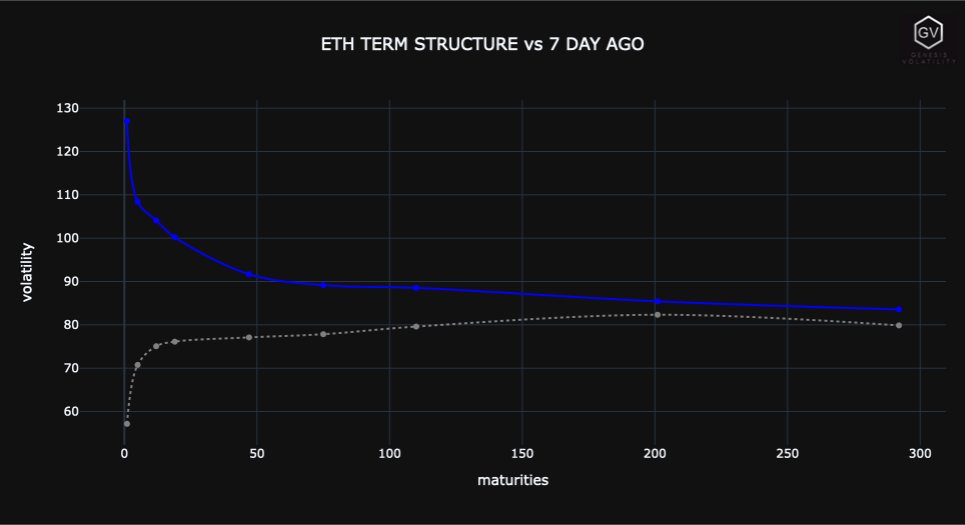

SKEWS

(June 12th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Short-term… there’s a skew “roll down” that will benefit us with the pre-FOMC trade…

Not only will IV roll up the term structure, but relatively speaking, IV favors puts as maturities shorten (seen in the skew chart above).

These combined factors go a long way to compensate put holders against theta, in vol. events like this.

Bigger picture

As Ben Moussa mentionned on the Gvol podcast two weeks ago, there are substantial changes in structural flows that are affecting the vol. surface.

DOV supply combined with institutional call-overwriting are likely going to persistently affect the long-term skew levels.

Having short-term and medium-term skew bid to the put side (Call IV - Put IV depicted above) does make sense given the current environment, but long-term skew was historically bid to the call side, as BTC would often FOMO higher.

At some point, I do think long-term skew could create great call-buying opportunities… not in anticipation of a change in structural flows affecting IV, but in anticipation of realized vol. returning to a FOMO market… (This is a “back-pocket” idea, as we wait for the bear environment to pass).

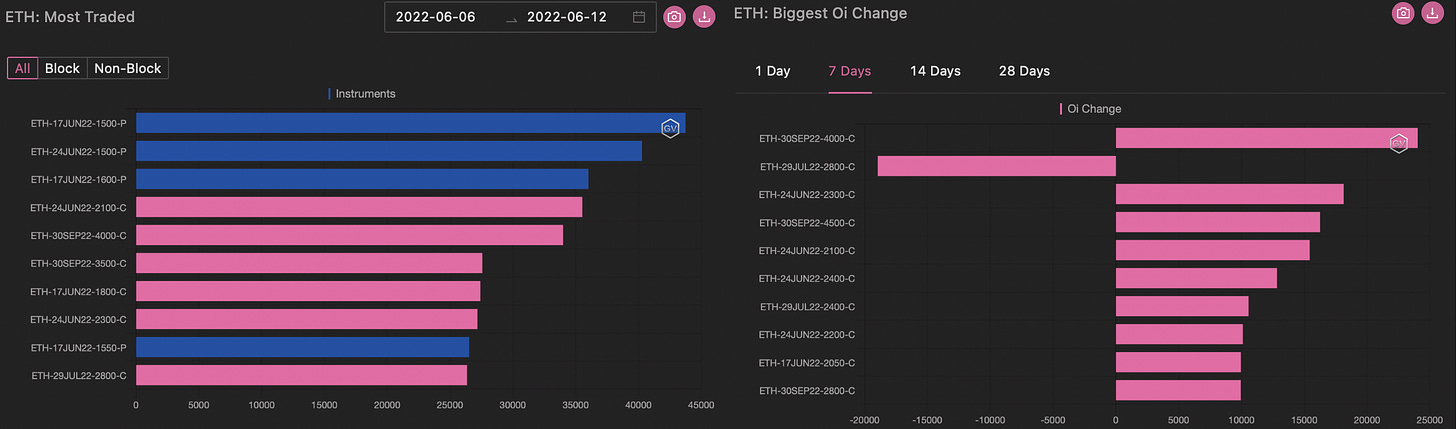

Open Interest - @fb_gravitysucks

WEEKLY EXPIRY

Second weekly of June is photocopy of the previous one for Bitcoin, with 25k contracts, of which 87% expired worthless. In the open interest profile stands the $32k call bought in the previous days.

For Ethereum, 215k contracts of which 89% are worthless. The notional compared to Bitcoin, which reached parity a few months ago, fell sharply.

(June 10th, 2022 - BTC/ETH Notional - Deribit)

BIG TRADES IN THE FLOW

Mixed feelings without a clear dominant theme. As soon as the spot price raised its head a bit, we saw timid bullish trades (mainly call spreads); when the index fell, the focus shifted to short-term puts.

Early Sunday morning (European time) the index broke down all recent support levels. I think the tone of the coming days will be more unequivocal.

(6th - 12th Jun, 2022 - Options scanner - Volumes and OI change - Deribit)

(Options scanner - ETH 29 JUL 2800 CALL- Deribit)

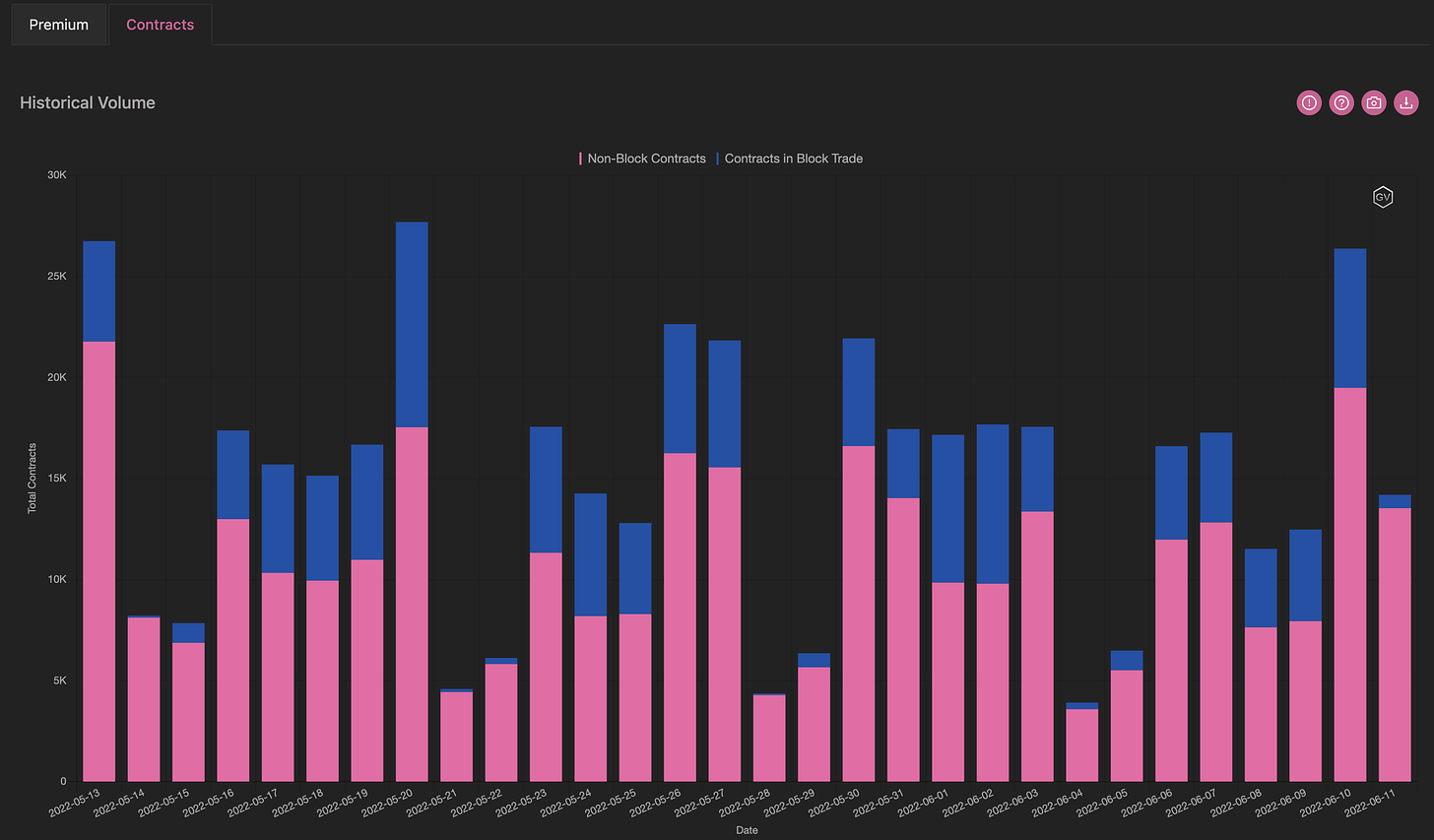

VOLUME

(June 12th, 2022 - BTC Premium Traded - Deribit)

(June 12th, 2022 - BTC’s Contracts Traded - Deribit)

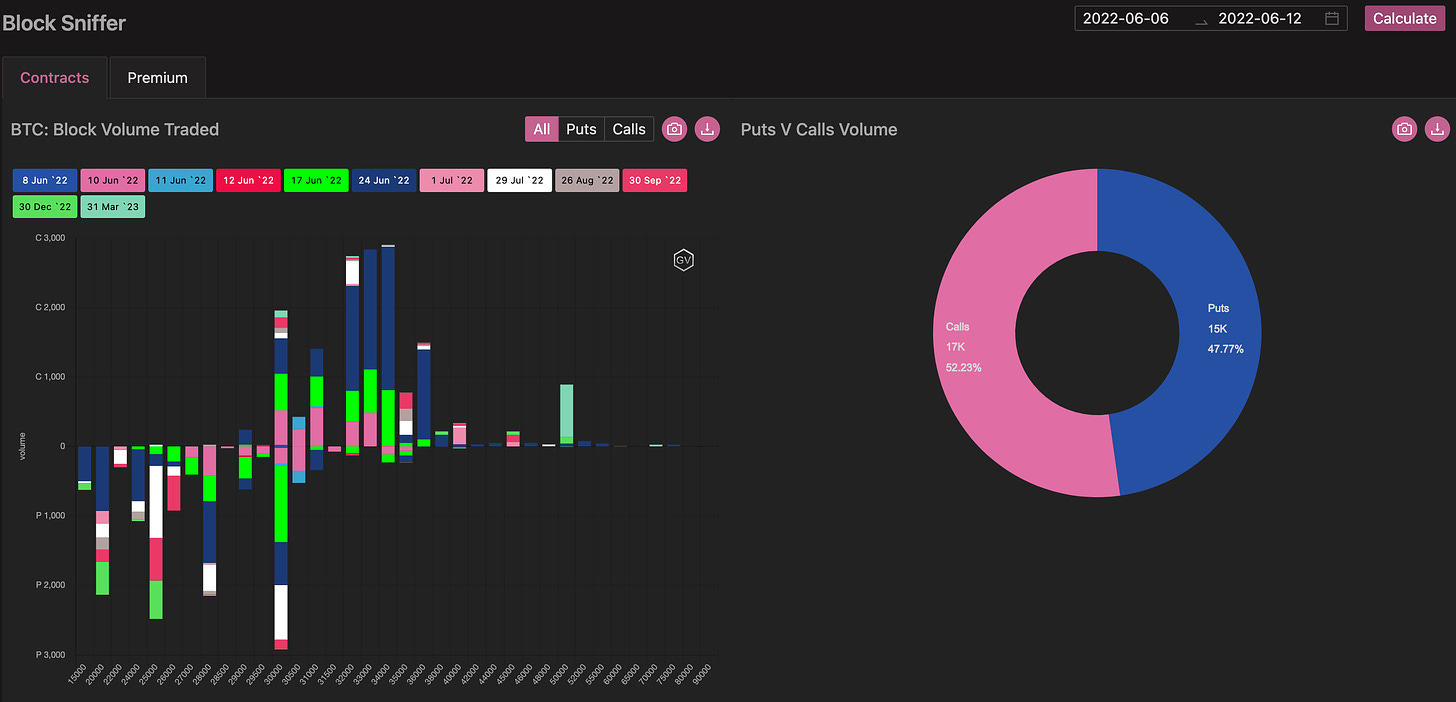

Paradigm Block Insights (06 June – 12 June)

Relentless downside bid lives on as increased macro headwinds and a lack of upside catalysts drag majors lower this week, with ETH taking the brunt of the selloff. Large size seen across Paradigm this week.

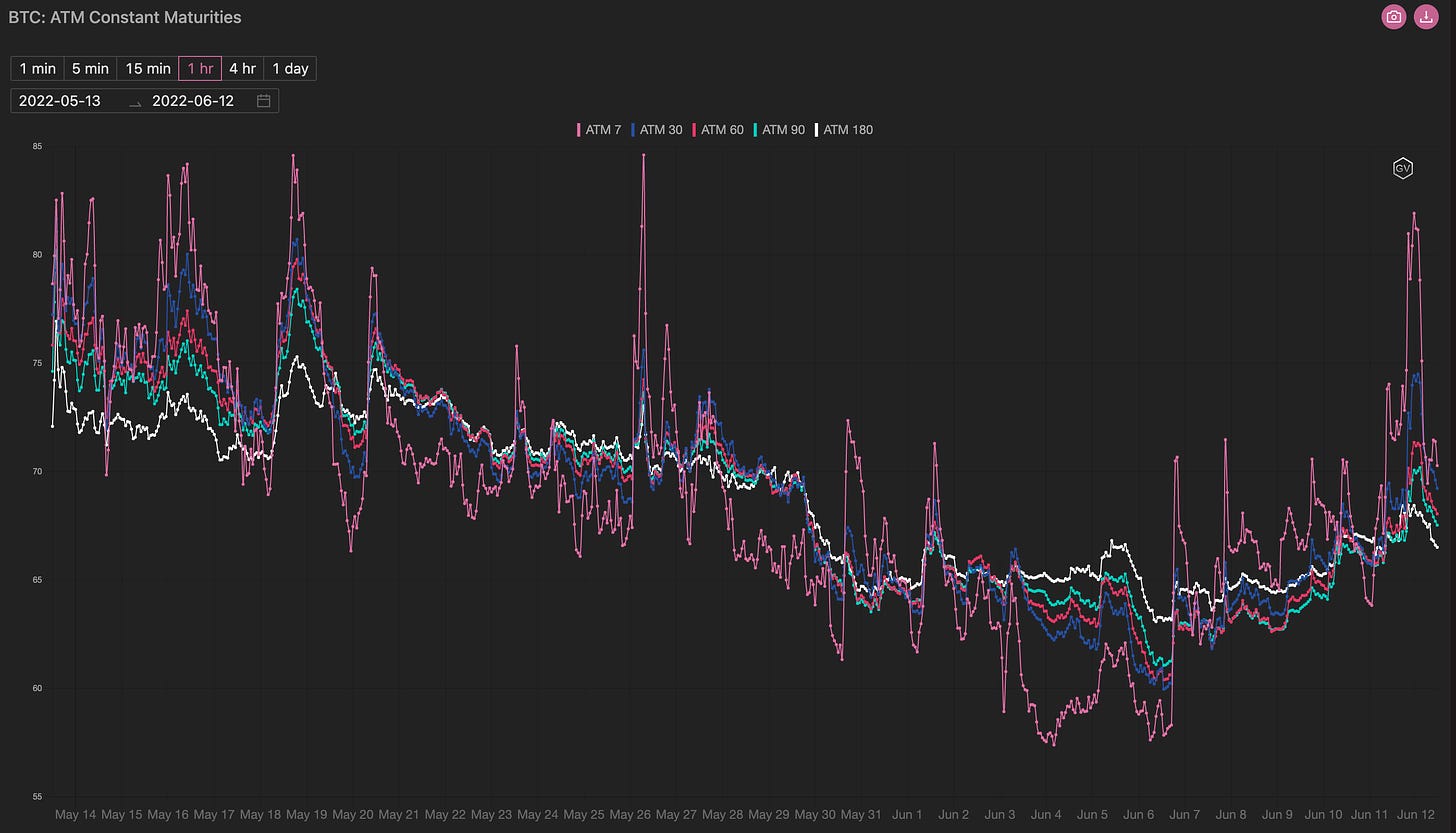

Vols continue to richen as spot moves lower. Long gamma trade that we have been recommending is paying off. We recommend holding this position, at least until the FOMC next week. BTC ATM vols by expiry: 13Jun: 81v, 17Jun: 77.4v, 1Jul: 72.3v Aug: 69.7v.

Notable Weekly BTC Flows:

730x Jun 33k/36k call spread bought

600x Jul 30k put bought

500x Sep 26k put sold

465x 24Jun 22 32k/34k call spread sold

405x Jun 32k/34k call spread bought

300x 2x1 Jul/Dec 25k put calendar sold

300x Dec 20k puts bought

Notable Weekly ETH Flows

16,000x Sep 3500/4000/4500 call fly bought

15,000x Jun 2100/2300 call spread bought

5,000x Jul 2300 / 26 Aug 22 2400 call calendar bought

4,000x Jun 2400 call bought

3,000x Dec 4k call sold

Makers continued to provide competitive pricing and better than screen. Total Vega traded in outright options was 325K, but the net flow for our Makers was a sell of 10K.

Calls were being offered, with makers buying Dec ‘22 calls (▲ 10-40) for a total of +25K Vega, while selling July/Aug ATM calls. Overall call Vega flow being +5K.

Puts were bought 🛒. Makers sold near-term (June 10 & 17) puts in the ▲15 - 35 range, as well as ▲50 puts in July 29 (-27K Vega). They bought longer-term puts, mostly ▲ 25-35 puts in Sep and Dec. (+28K Vega). Overall put flow was -15K.

Third SUCCESSFUL week of @ribbonfinance auctions on @tradeparadigm. @GenesisTrading wins the WBTC auction at 32bps - a whopping 7bps better than screen (28% better price for vault owners)!! The FIRST ever AAVE auction was won by @QCPCapital. Congrats both!

BTC

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

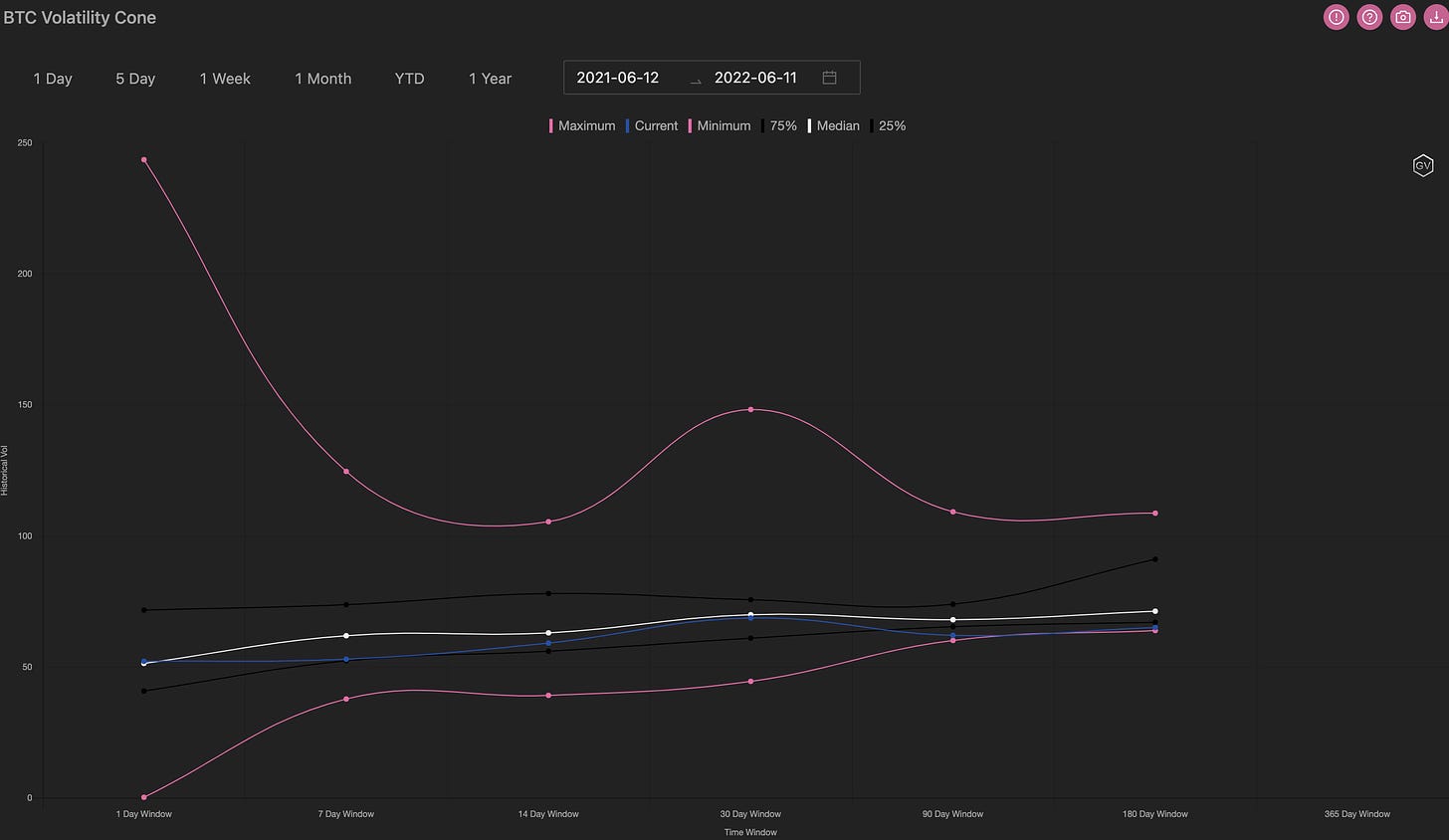

VOLATILITY CONE

(June 12th 2022 - BTC’s Volatility Cone)

Short-term realized volatility could definitely move higher… aiming for the 75th percentile.

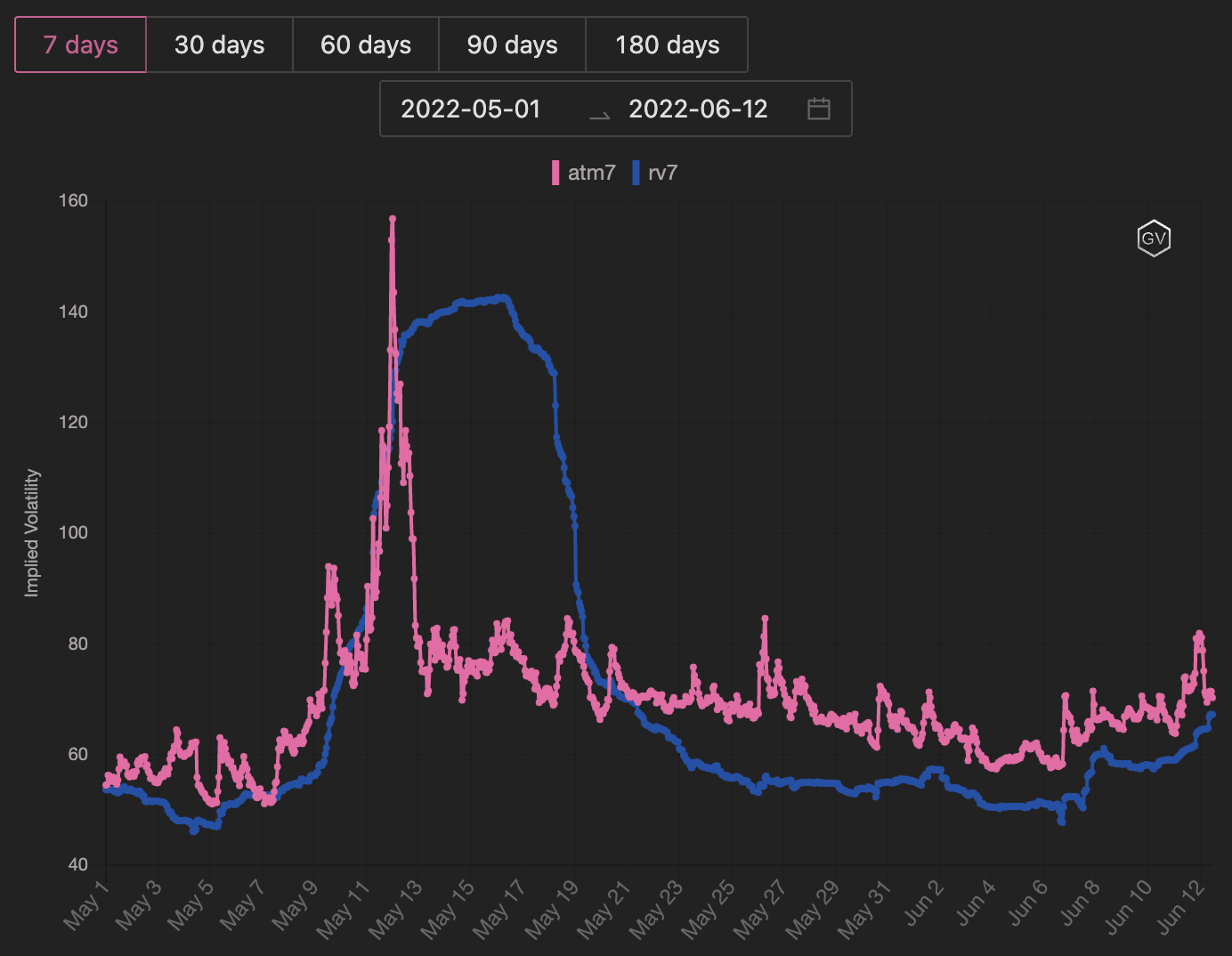

REALIZED & IMPLIED

(June 12th 2022 - BTC IV-RV)

IV/RV premium still holding, although the gap has slightly narrowed.

VRP isn’t cheap and we’ll need an IV drift higher for the pre-FOMC idea.

Post-FOMC, call-flies will benefit from decay and VRP, if spot is able to recover to levels near the butterfly belly.

(Sorry for anyone new to options, I realize talking about “butterfly bellies” sounds like bunch of gibberish)